How to implement paperless invoice processing and its benefits

The traditional formats of business operations are evolving every day and handling supplier invoices is one such area.

More and more companies are letting go of the need to have physical paper invoices and are instead shifting to a paperless invoice processing system.

The benefits of a paperless accounts payable process far outweigh the traditional way of processing invoices.

Payments are processed faster, it is easier to store, match documents, verify the details and ensure that duplicate payments are not being made.

How does the paperless invoice process work?

A paperless invoice process looks similar to a traditional one but is much faster and easier to process.

Since an invoice will be sent digitally via email as a PDF or an e-invoice, the time it takes for a physical copy of an invoice to reach the buyer from the seller is cut out.

Moreover, the chances of losing an invoice or it getting lost within a stack of other documents are also negated since it is digitally present on your email or any other system that you are using. You can simply search for it by typing and it will automatically pop up.

Many companies also use AP automation systems that allow them to quickly match and verify invoices with supporting documents without coordinating with other team members and waiting for their responses.

Once verified, the AP team member or the accountant can schedule the payment for a future date so that they don’t have to worry about missing out on the payment.

Since all these processes occur digitally, they can easily be tracked without needing a physical paper trail.

How can you implement paperless invoice processing?

1. Drafting a plan of action

This is the first step to going paperless for your invoicing system. Your accounting team must identify where they currently stand with their AP processes and how they can be improved through automation and a paperless system.

2. Digitizing the invoices & handling the process

Once your plan is ready, you must get all your existing invoices onto your digital platform of choice. This will be a time-intensive task but once it is done, it will help streamline the entire process.

3. Automating the accounts payable

The automation platform you choose for your accounts payable should be capable of helping you set up invoice approval workflows or systems, manage all your vendors & invoices, and make payments to them easily.

4. Configuring the system & training users

The last step to having a paperless accounts payable process is to make sure that the accounting team is trained properly and is up to speed with the new system and how it works.

Benefits of implementing a paperless invoice processing system

1. Saves money and resources

The cost of processing an invoice can be measured depending on the time and effort it takes to process it. A paperless invoicing system enables you to automate many tedious manual tasks to save money and resources.

2. Increases productivity

A paperless invoice approval system along with other automation features such as data capture, three-way invoice matching, recurring payments, and scheduling tools increase the accounting team's productivity by taking out repetitive manual tasks that take a lot of time.

3. Digitizes the business

Moving to a digital way of processing invoices improves speed and reduces the need to store physical copies of invoices. It also improves the accessibility of data whenever required if you use a cloud expense management system.

4. Receive payments faster

When invoices are processed faster, it means your suppliers and vendors receive their payments quicker. This improves your business relationships and can also enable early payment discounts to save more money.

5. Reduced data entry errors

A paperless invoice process involves many automated systems that reduce the need for manual data entry and thus decrease the chances of errors. Automation technology also helps to spot errors and rectify them.

6. Contributes to helping the environment

A paperless invoice processing system also helps the environment by eliminating the use of paper and reducing the overall paper waste that is produced by a company.

Suggested read: Benefits of accounts payable automation for your business

How can Volopay help with the paperless invoice processing?

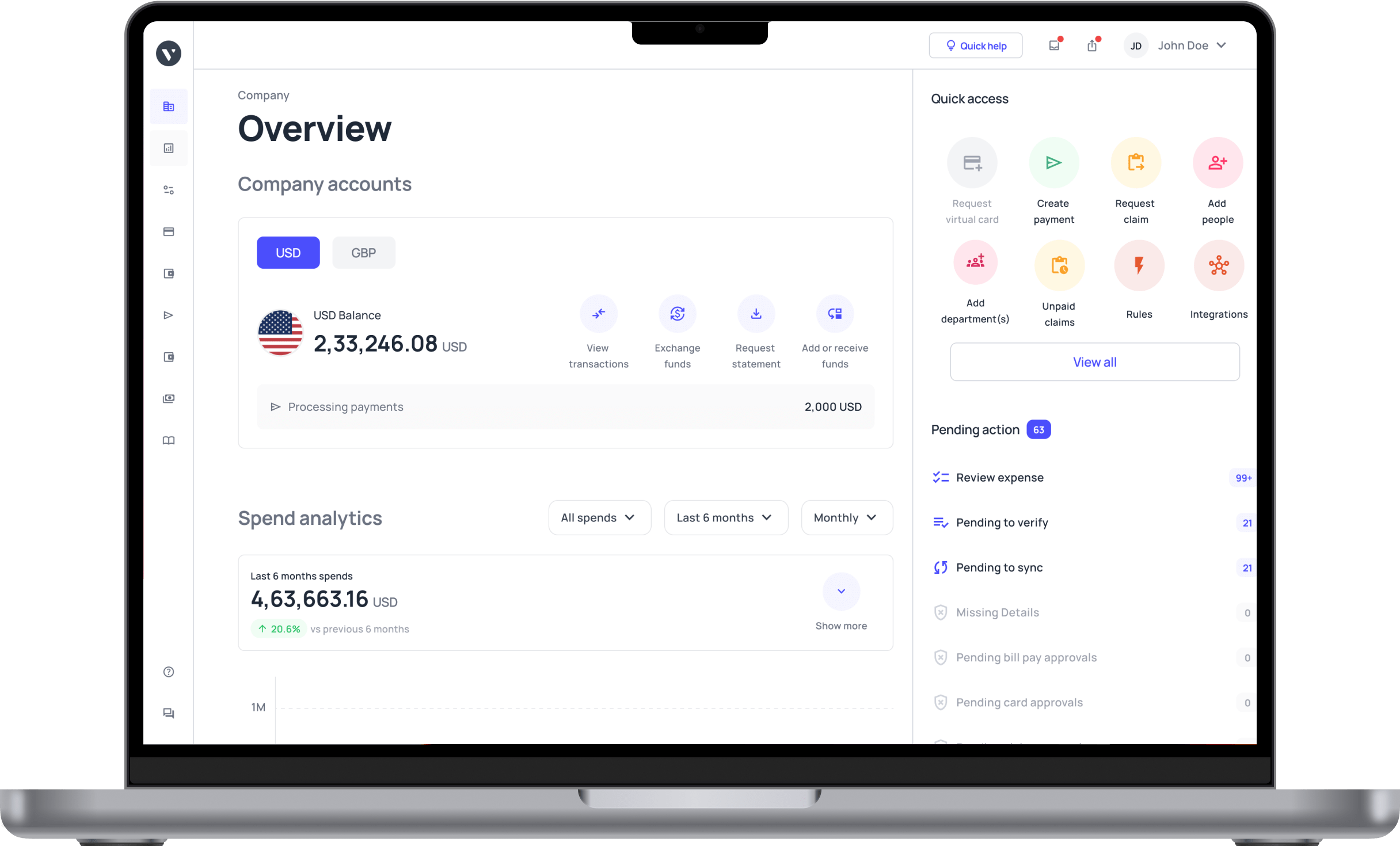

Volopay is an all-in-one expense management system that helps companies track, manage, and control all their expenses. Accounts payable automation is one of the many benefits of implementing a solution like Volopay.

Our accounts payable automation platform lets you create and manage an entire database of vendors with all their relevant information so that you don’t have to enter their details each time you want to make a payment.

Be it an individual or corporate vendor, you make both domestic and international payments to them. Thanks to our multi-currency wallet feature, you don’t have to worry about creating separate bank accounts to pay international vendors.

A built-in approval system also ensures that payments are made only after invoices have been approved by the relevant approvers. Hence making it a seamless paperless invoice processing system

You get to create custom approval workflows with up to 5 levels of approvers ensuring that payments of all magnitudes are under the control and supervision of the respective manager.

Cut down on paper-based invoice processes and go digital with Volopay

Yes, it is cost-effective to process invoices without a paper trail. Even if you use a digital system to process invoices, you can easily track all activities through it. The digital trail is more efficient than a paper trail.

Yes, data entry errors are reduced through the paperless invoice process. Many AP automation software systems have automatic data capture of the information on an invoice through a technology called OCR (optical character recognition).

The only aspect that can be considered a drawback is that paperless invoicing and AP automation systems usually require an internet connection to function. But in the digital world we live in, this won’t be an issue for 99.99% of businesses most of them have some degree of internet requirement for other business processes.