Top 6 accounts payable automation benefits

There isn’t a single business in the world that doesn’t have an accounts payable process. With a sudden rise in the number of businesses opting for an automated accounts payable process. After the shift to complete digitization of workplaces, there was a notable rise in faulty AP systems.

Aside from the tedium of piled-up paperwork and a tangled approval line, manual AP also proved to be a glaring security flaw and payment frauds. With regards to business integrity, accounts payable automation is more than just a convenience. It is becoming a necessity.

Choosing the right accounts payable software is no easy task, though. But we’ve definitely made it easier for you to understand how accounts payable automation works, and the benefit of accounts payable automation for your business. Let’s dive in!

Scrap the manual labour behind AP

The manual AP process might not feel like a very long one, at first glance. Unfortunately, it can quickly become one of those things that you don’t realize are difficult until you find yourself buried under piles of receipts, paperwork, due payments, and lost records. How is that possible? Well, consider all the elements that are part of accounts payable process.

There is receiving invoices, sorting and assigning them, manually entering them into the accounting software you use. It doesn’t end there. These invoices then need to be tracked for timely payments, and approved by a designated team member. They are also stored for any future reference or paper trail. A sizable amount of time and effort can go into AP, especially if your business is scaling.

As more vendors and payments get added to a cycle, the higher the chances of human error. It also increases the number of people involved in the web. To mitigate these issues, it's essential to automate accounts payable reconciliation, streamlining the entire workflow and reducing the risk of mistakes.

Automate your AP process with Volopay

What are the potential pitfalls of manual accounts payable processes?

1. Manual labour

The cost of manual labour is a steep one (sometimes as high as 60%, according to multiple studies). Not only is this inefficient and expensive, it also creates a long list of work. Invoice entries can easily be missed, or accidentally duplicated.

Oftentimes, approval processes can take long hours, even days and weeks. Manual data entry also results in lost work hours and a high risk of information loss.

2. Improper management

Management mistakes can take place on an object level (invoices, purchase orders, payment receipts, payment errors) and on a human level (multiple parties involved in handling the same information).

Mismanagement of accounting data has not only caused businesses to lose track of their entire AP process but also prevented them from efficiently closing gaps before they become wider.

3. Security & monetary losses

We’ve mentioned fraud and theft risks earlier. Those are given with an AP system that involves follow-ups and error-riddled bookkeeping. Manual AP has also significantly harmed the scalability of businesses.

With large budgets and labour hours going into account management, businesses are unable to allocate budgets towards growth and team expansions. Efficiency is hitting an all-time low as businesses remain away from accounts payable automation.

Accounts payable automation is your desired solution!

The advancement in fintech, and the level of customization to business needs, allow accounts payable software to cater to the very specific and unique needs of different businesses. Integrated suites like Volopay are purpose-built spend management tools that eliminate the painful administrative work that goes into AP.

Accounts payable automation for small businesses can benefit from such systems, which bring together all the tools required for a business to make payments. These can range from petty cash and corporate credit cards to vendor payments and credit lines.

The all-in-one platform allows an end to end automation of accounts payable. There is visibility and transparency behind all payments. Approval processes are instant, as are budget allocations. Moreover, the digitization of invoice management makes manual labor the bare minimum.

Top 6 benefits of accounts payable automation

The benefits of accounts payable automation are numerous. Attempting to explain them in one blog post can be arduous - but we’ll try our best so that you can understand the revolutionary solution that is at your fingertips.

We’ve established that electronic accounts payable system has the ability to eliminate manual labour and bring in cost efficiency. But how exactly does that happen? Let’s take a look.

Cost reduction

Cost reductions associated with switching to automation come in the form of eliminating labour costs, and binning costs of physical office products. Paperless accounts records have become an expectation for sustainable initiatives in 2021.

But the savings on switching to paperless and automated expense systems can be as high as 60-70%. By adopting AP automation for retail businesses, as well as other industries like manufacturing, healthcare, and logistics, these issues can be resolved efficiently, leading to faster processes, increased productivity, and enhanced decision-making.

Time saving

Manual accounting is a time consuming process, not just because of the actual time taken for making records (although that is definitely a huge chunk of it).

A significant amount of time is also wasted in long approval times. Invoices can get lost. Payment orders can get stuck in a loop of finance and management approvals. Budget allocation and fund requests can remain pending. All of these waiting games are roadblocks to efficient accounting.

With automation, they can all be removed, and increase speed as well as productivity hours.

Control over expenses

Automating your accounts payable process brings in total control over approvals and financial policies. You can generate physical and virtual cards, set limits on them, and attach them to budgets of your choice.

Funds for cards and budgets have real-time approvals, aided by the presence of the web and mobile app (as well as email integrations). Every purchase order and transaction is visible on admin dashboards to allow for a seamless audit trail.

Improved accuracy

Margins of human error exist with any manual process. However, automation helps catch these errors in time. Since there is no need for manual inputs, things like invoice labels, transaction details, and line-item data can be screened and automatically transferred across platforms.

Automation also prevents duplication of payments to vendors. The secure processes of automation software also protect the company from fraudulent entries, missing entries, or data loss.

To explore the best AP automation solutions that reduce errors and protect your business from fraud, visit our page on the Best accounts payable automation software in the US for 2025.

Ease in auditing

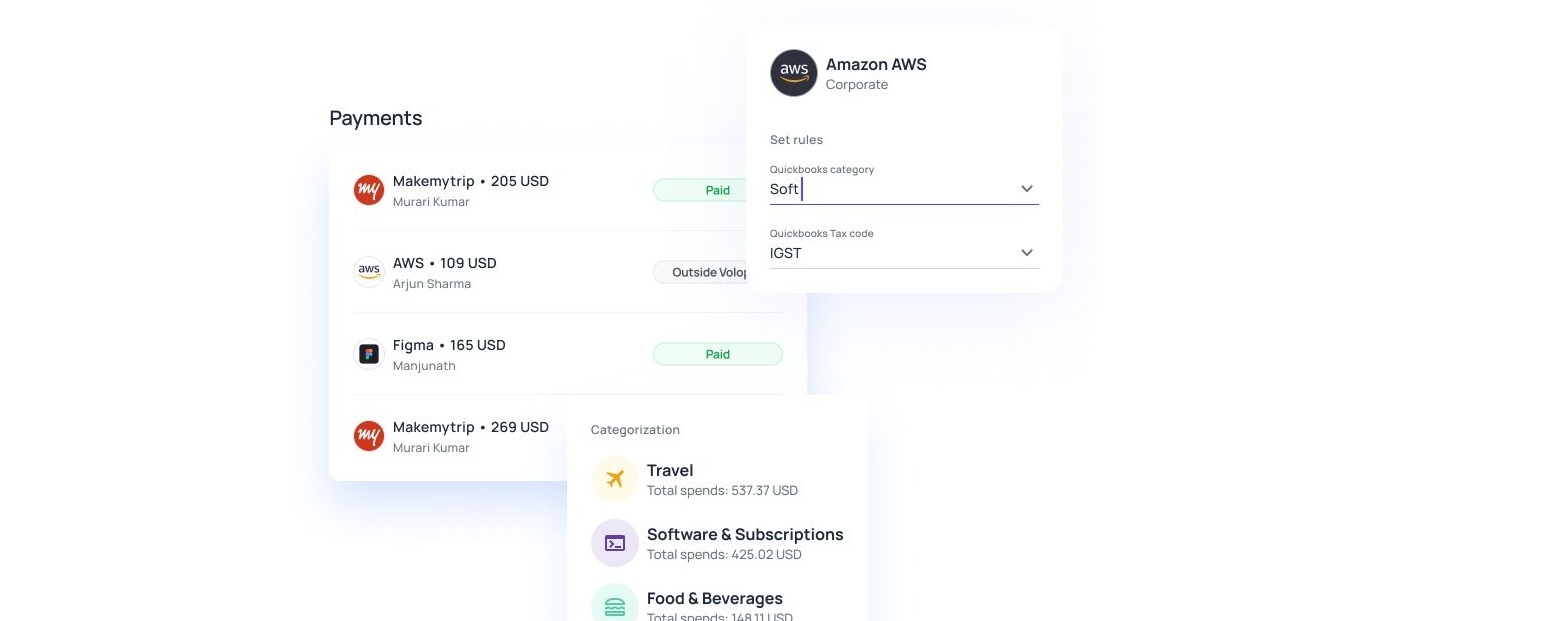

One of the largest benefits of accounts payable automation is the integration of accounting software's with your AP software. Integration of systems removes the burden of manual coding and labelling of transactions.

Instead, systems like Volopay’s allow you to directly transfer your transaction records and receipts to accounting software like Xero, Netsuite and Quickbooks. This makes auditing transparent and rapid, and also makes cross-platform verification easier.

Discounts on early payments

Although not universal with all automated accounts payable, Volopay’s management system offers unique awards for timely payments. Opportunities for cashback with our supplier network can help boost your income by earning returns in exchange for early payments. This automated setup prevents you from worrying about payments in the future.

These top benefits only scratch the surface of AP automation's potential. Dive deeper with our blog, AP Automation Unlocked: A CFO’s Guide to Efficiency, for strategies tailored to CFOs.

Get an account payable software for your business

Experience easy vendor management with Volopay

The presence of unlimited virtual cards also makes accounts payable easier, especially if you’re looking at AP automation for small businesses.

With physical card allocation being limited, Volopay’s virtual cards can help pay vendors for fixed vendors (such as Amazon Web Services, Google Ads, G-Suite, MailChimp, etc.)

Cross-border payments, as well as domestic ones, can be collectively managed via the Volopay spend management platform. B2B payment is supported in 130+ countries, with the lowest possible processing cost.

Volopay’s Bill Pay feature helps you handle transactions in multiple currencies across cards and accounts.

Approval lines are also easy to manage on Volopay. Budget allocations and requests for fund additions go directly to assigned managers. They can approve within minutes, either through the web platform or even on their phones.

Your employees never have to find themselves stuck without funds, or unable to make vendor payments.

Our invoice management system helps you collect and pay invoices, with each record completely trackable.

The clean user interface makes it easy to maneuver without requiring in-depth technical knowledge or computer expertise.

Related reads

Volopay's AP automation platform gives you the best features to manage AP such as approvals, vendor onboarding, accounting integrations much more.

Understand what is AP and AR automation, its key differences and how Volopay can help you with AP automation and streamline your AP process.

Wondering whether to automate or outsource AP? Check our blog to explore the pros, cons, and differences to determine the best approach.

Get an account payable software for your business

FAQs

Volopay can extract data from your invoice and transaction history, and also collect raw data from receipts and documents. This data (such as vendor names, dates, the amount paid) is collated in a single place for you to notice any anomalies. To prevent duplicate payments, you can also set up recurring payments for repeat vendors/subscriptions.

Your invoices are all saved in one spot, along with an easy-to-access ledger. Any creation of invoices is easy to track, as well as the history of payment approvals.

Volopay is ideal for accounts payable automation for small businesses. The demo calls can help determine your expected expense patterns, with the best pricing plan recommended for you.

Vendor payments can seem cumbersome and confusing for a small business, especially with every man-hour valuable. There are also a limited number of bank accounts and cards. Volopay’s platform processes payments with unique details for every purchase, none of which are linked directly to your account. The dashboard allows for easy tracking of budgets and transactions, as well as subscriptions.

Extremely. Your account will have admins, as well as delegated approvers for every budget. As a result, any generated payment will have to go through the line of approvers before it can occur. You can assign multi-level approvers, as well, so that one level of approval can be verified by a different one. All these approvals can be done on the go and in real-time, making the process efficient and transparent.

With a single click! Schedule a demo with the Volopay team for a personalized orientation. It will take you through a tour of the accounts payable software features and its interface, how to manage it, and how to work with cards. The demo is also ideal for Volopay to determine which pricing plan works best for your needs.