What is the full cycle of accounts payable process?

The accounts payable process is a key function of your business, as it involves making sure that you are on top of all your payments.

Without the complete accounts payable process, you can easily fall behind on bills and can potentially end up with late payments that incur late fees.

To mitigate this, you have to understand the full cycle of accounts payable to be able to pick out areas in the process that need improvement.

What is accounts payable?

At its core, accounts payable refers to the money a company owes to its suppliers or vendors for goods and services received but not yet paid for. It's essentially the opposite of accounts receivable (AR), where a company awaits payment from its customers.

Accounts payable plays a pivotal role in maintaining the financial equilibrium of a business by managing its outstanding obligations.

The accounts payable cycle begins when a good or service is procured and ends when it is paid for. If a company’s accounts payable are paid on time, then it helps other operations across different teams run smoothly without any hiccups. This makes it a vital function in any organization’s finance department.

What is the full cycle of accounts payable?

Broadly speaking, accounts payable processes are about taking care of money your business owes. It involves creating orders, receiving orders, and then paying for those orders.

However, full cycle accounts payable duties are not limited to just the payment process. Reviewing, matching, and reconciliation are also part of the complete accounts payable process.

To put it simply, a full cycle of accounts payable encompasses the full scope of the accounts payable process.

What is the importance of accounts payable?

1. Cash flow management

Effective accounts payable management ensures that a company maintains optimal cash flow.

By paying bills strategically and on time, businesses can allocate resources more efficiently and seize opportunities for growth.

Holding off on payments until the due date can sometimes help a business earn interest on its liquid funds and increase its cash in hand.

Suggested read: Ultimate guide on cash flow management

2. Financial reporting

Financial statements such as the balance sheet, profit and loss statement, and cash flow statement are important indicators of business success for any organization.

Accurate and timely recording of accounts payable transactions is crucial for generating precise financial statements. It provides stakeholders with a clear view of a company's financial health, aiding in informed decision-making.

Suggested read: Paperless expense reporting to streamline expense management

3. Budgeting and planning

Accounts payable data is invaluable for budgeting and financial planning. It helps companies predict their short-term and long-term financial obligations, allowing for better resource allocation.

The finance team of an organization will be able to draft more accurate budgets if records of accounts payables are maintained properly.

4. Audit preparedness

An audit is conducted to ensure that a company is following and adhering to all legal standards and practices of financial management.

Well-maintained accounts payable records simplify the audit process. Auditors can swiftly assess financial transactions, reducing the time and effort required for compliance checks.

5. Operational efficiency

Streamlining accounts payable processes improves overall operational efficiency. It reduces manual tasks, minimizes errors, and frees up resources for more strategic activities.

Payments due are verified and paid faster thanks to automation that helps in fulfilling operational duties on time.

6. Compliance and risk management

Adhering to regulatory and compliance requirements is paramount. Accounts payable ensures that a company meets its obligations, minimizing legal and financial risks.

Boost financial efficiency with AP automation

Full cycle accounts payable process flow

The full cycle of the AP process runs from procurement identifying the goods or services required, to accounts payable issuing payment for goods or services.

Here is a breakdown of the complete cycle from start to finish with details for each step:

1. Beginning of the cycle: Determination of goods

The accounts payable cycle commences with the identification of goods or services required by a company to support its operations. This can include anything from raw materials, leasing or renting of land or office space, and other expenses to help in business operations.

2. The purchase department starts the procurement

The purchase department initiates the procurement process by assessing the organization's needs and determining how to fulfill them effectively.

This activity involves finding vendors and suppliers for all the organization’s needs and narrowing down on a few of them to choose the best suitable provider.

3. Search for suppliers

The search for reliable suppliers is essential. This involves researching potential vendors, considering their reputation, and assessing their ability to meet your requirements.

After searching, a list is created to reach out to the potential suppliers.

4. Request for proposal

Companies often request proposals from potential suppliers to compare offerings and make informed decisions.

A request for proposal is a formal outreach that specifies a company's requirements and asks the vendor or supplier to get back with a quote that outlines the pricing for the requirement.

5. Review receiving quotes

Quotes from suppliers are evaluated to choose the most suitable option based on factors like cost, quality, and delivery time. Depending on the stage of your business, you might prioritize different factors as the most important.

For a business in its infant stages with low funds, a supplier with the lowest cost might seem like the ideal option to go with.

6. Negotiation process

Negotiations with the selected supplier may take place to establish mutually agreeable terms and conditions.

As a business, you may also negotiate different terms from what was quoted by the supplier to see whether they would be ready to accommodate your deal.

7. Create a purchase order

Once a mutually agreed deal has been closed, your organization can generate a purchase order (PO) specifying the quantity, price, and delivery details.

This document serves as a legal agreement between the company and the supplier and outlines all the terms and conditions that have been agreed upon.

8. Supplier confirmation

Once the supplier receives your purchase order, they will confirm the purchase order, acknowledging their commitment to fulfill the requested goods or services.

This may or may not take a lot of time depending on the communication process and the levels of checks carried out before approval.

9. Delivery of goods

Goods are delivered as per the purchase order's terms, and a receiving report may be generated to document the receipt of goods.

This receipt of goods is an important document to keep handy and is used to verify the legitimacy of invoices later on in the process.

10. Invoice receipt

● In the accounts payable cycle, the arrival of supplier invoices marks a critical phase. An invoice is usually sent along with the goods delivered or at a later date as agreed by both the supplier and the buyer.

● Invoices can be received in various formats, including paper invoices, electronic invoices (e-invoices), Electronic Data Interchange (EDI), or multiple methods at the same time. Having a digital copy of the invoice helps with scanning and verifying it with supporting documents.

11. Invoice verification and approval

● Verification involves cross-checking invoices against purchase orders and receiving reports to ensure accuracy and legitimacy. This can be done manually or through the use of automation software. AP automation software helps in completing this step faster, especially when dealing with multiple invoices and suppliers.

● Approval workflows are established to review and authorize invoices, ensuring that only valid invoices move forward for payment. Once the invoice has been approved, only after that can it be moved forward for payment processing.

12. Payment authorization

Once invoices are verified and approved, payment authorization is granted to proceed with the payment process. This authorization is done by the accounts payable department which is responsible for processing the payments for each invoice that the organization receives.

13. Payment processing

Payments are processed following the company's established payment methods and schedules.

A payment might also be scheduled for a later date as per the terms and conditions agreed upon by a vendor rather than being paid immediately.

14. Document management

● Effective organization and storage of invoices, receipts, and related documents are essential for audit trails and compliance. Companies can choose to store these documents in physical paper format and also have digital copies that can be accessed more easily through online cloud storage services.

● Digitization and centralized storage of documents enhance accessibility and security. You can also create multiple backups of your important documents online in different storage services so that you don’t lose them even if there is some problem with one of the services.

15. Supplier communication

Maintaining open and transparent communication with suppliers fosters strong business relationships and resolves any potential issues promptly.

In case there are any issues with the invoices that you received or with the goods or services supplied, having a quick and easy way to communicate can resolve issues faster.

16. Reconciliation and reporting

Reconciliation of accounts payable balances with financial records ensures accuracy, and regular reporting provides insights into the company's financial health.

Suggested read: What is account reconciliation, its types, and best practices

Transform your AP cycle with complete automation

What are the main areas in a cycle of accounts payable?

1. Purchase order

The purchase order is a central part of the full cycle of accounts payable because it acts as a contract between your business and the vendor from which you are purchasing supplies.

It includes information about the quantity of the product, the type of service if you are purchasing services, the delivery deadline, as well the price agreed on by both parties.

The vendor is responsible for delivering their product according to the purchase order, while your business is responsible for making payment accordingly.

2. Receiving reports

Once your business has received the product from the supplier, your team will turn the receipts of your purchase into a receiving report.

The receiving report is a document detailing the examination of the product received, comparing it with its respective purchase order.

It’s also where you make notes of any damages, or if there are any discrepancies between the purchase order and the product received.

This is to ensure that all requested items have arrived in the appropriate and agreed-upon conditions.

3. Vendor invoice

After the items received have been cross-referenced with the purchase order, your vendor will then submit an invoice for you to process payment.

You want to make sure that you have a streamlined invoice process and that you follow the process for every invoice you receive. The complete accounts payable process maintains that there are no invoice frauds that happen to your business.

4. Three-way match

Payment for an invoice should not happen automatically until the invoice gets matched against the corresponding purchase order and receiving report documents.

Doing three-way matching whenever you receive an invoice prevents fraud and detects errors in invoices.

5. Review, approve, and process payments

When scheduling payment for an invoice, you should also have an approval workflow set up in your business.

Those who are the designated approvers of invoices will be in charge of making sure that invoices of any scale have been checked for approval.

Once everything has been approved, the accounts payable team will then process the payment. The full cycle of accounts payable will come to a close when the payment has been received and reconciled.

Key challenges faced in the full cycle of accounts payable

There are many challenges that you may encounter in the full cycle of accounts payable. Some common ones that your business might face include:

1. Lack of planning

There is a lot of planning involved in the steps of the full cycle of accounts payable. However, when you are processing a lot of orders, it will be near impossible to plan out every single detail for every part of the accounts payable process

2. Outdated equipment

Without the help of accounts payable automation software, you will have to manually enter invoice data, three-way match every invoice, and chase down approvers one by one for every single invoice you have.

This is inefficient and lengthens the full cycle of accounts payable.

3. Limited staff

When you are processing hundreds of invoices every month, having a small team of accounts payable staff might not be enough.

Having limited staff will result in huge workloads that can be overwhelming, and in the worst-case scenario, your staff might start getting behind on the complete accounts payable process.

4. Duplicate payments

When processing invoices manually, there is a chance that you could accidentally pay for the same invoice twice. If these errors are detected, you can then ask for a refund from your vendors, although it might be a tedious process.

But if duplicate payments don’t get detected, it’ll lead to a leak in your cash flow.

5. Manual bottlenecks

Manual work in the full cycle of accounts payable will cost you, as they are time-consuming and often can lead to results that are riddled with errors. Invoice data entry, for example, can slow you down when the process is done manually.

6. Lost/missing paperwork

Your documents will likely have to cross many desks in the full cycle of accounts payable. It’s easy to lose track of which document should be on which desk. This could then lead to missing paperwork, which will leave you with incomplete data.

7. Diluted approval process

It’s difficult to track down every approver for every single invoice. This could lead to a diluted approval process, where your invoices may not go through every level of approval or could even be processed without authorization and the necessary approvals.

8. Inaccurate balance sheet

Data getting misplaced or lost in the full cycle of accounts payable can lead to inaccuracies in your month-end reports, such as your balance sheet.

When you have an inaccurate balance sheet, you won’t be able to accurately detect where your business is leaking money and therefore can’t fix it.

9. Late payments and late fees

If your business has a slow invoice turnover time, this could lead to an inability to pay your invoices on time.

When you are riddled with late payments, late fees from vendors could easily add up and end up costing you a lot of money that you could otherwise save.

What is the role of automation in streamlining the accounts payable cycle?

Invoice processing

In the traditional way of invoice processing, a human would have to sit and go through each detail and then manually enter it into a system to make the payment.

Automated invoice processing drastically reduces manual data entry. Optical Character Recognition (OCR) technology extracts information from invoices, minimizing errors and accelerating processing times.

Approval workflows

Automation streamlines approval workflows by routing invoices to the relevant stakeholders electronically.

Rather than having to manually email someone, wait for them to check it, and then get their reply, automation software streamlines the process by notifying individuals in real time. This ensures swift reviews and approvals, eliminating bottlenecks.

Invoice matching

The manual method of matching an invoice with its supporting documents is time-consuming and prone to errors. This leads to added administrative costs and the chance of losing a lot of money.

Automation software seamlessly matches invoices with purchase orders and goods received reports. Any discrepancies are flagged for human intervention, enhancing accuracy and compliance.

Payment scheduling

If software tools did not exist, it would be very difficult and time-consuming to schedule payments.

Automated payment scheduling through accounts payable software ensure that payments are made on time, optimizing cash flow management and preventing any late payment penalties.

Document management

Automation centralizes document storage, enabling quick retrieval and reducing the risk of document loss. If you were to store physical documents, there is a chance of losing them to theft, fire, or some other natural disaster.

Using digital automation software to store and back up data in different places, you can be sure that you always have access to important information even if you lose it in one place. This enhances audit readiness and compliance.

Reconciliation and reporting

Automated reconciliation compares AP data with financial records in real time. This not only minimizes errors but also provides up-to-the-minute insights into the financial health of a company.

If a finance professional were to do this manually, it would take a lot of time and they might miss out on some errors as well.

Compliance and auditing

Automation enforces compliance by applying predefined rules to invoices. Certain software systems can be catered in a way so that an invoice cannot be paid before it is verified and approved by a member. This reduces the risk of fraudulent or non-compliant payments and facilitates auditing.

Data analytics

Automated AP systems generate valuable data that can be analyzed for insights into vendor performance, spending trends, and cost-saving opportunities.

Automation software can also filter data as per your needs and present it in a manner that gives you unique and custom insights regarding your AP spending.

As the future of accounts payable unfolds, data analytics will become even more powerful, offering deeper insights into financial operations.

How can Volopay better manage the full cycle of accounts payable?

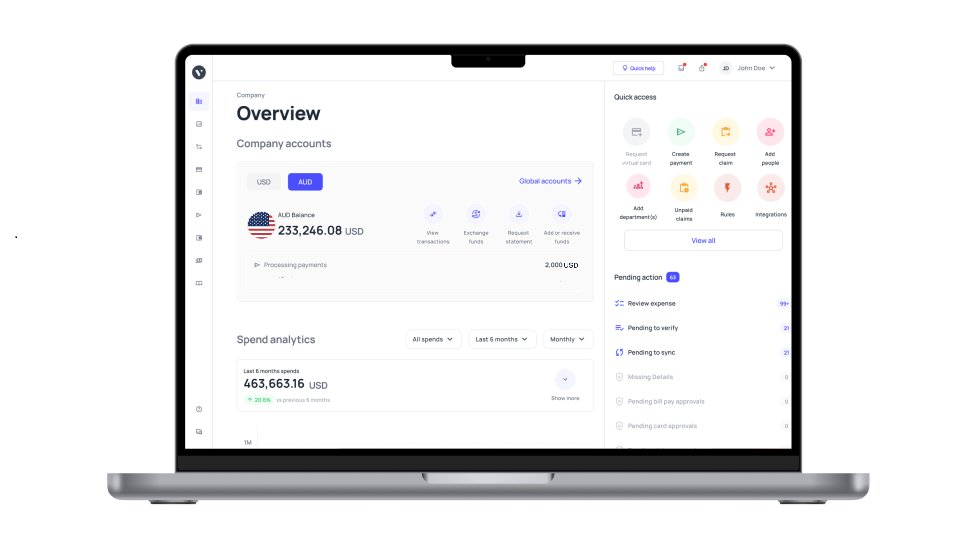

With Volopay’s accounts payable automation, you can automate areas of invoice processing such as data extraction and approval workflows.

You no longer have to manually extract data from each invoice, saving time and avoiding errors.

Invoices that have been entered into the system will automatically be routed to their designated approvers, who can view these invoices and approve them in real time.

With Volopay you get to speed up your complete accounts payable process and get better visibility into the full cycle of accounts payable.

Automate your AP cycle end-to-end with Volopay!

FAQ's

The Procure to Pay or P2P cycle is the full cycle of accounts payable, involving placing an order, purchasing goods or services, and making payments to suppliers.

PO invoices have purchase orders attached to them and usually involve vendor purchases. Non-PO invoices, on the other hand, don’t have purchase orders attached to them and are typically not pre-approved. Reimbursements of employees or service invoices are usually of the non-PO invoice type.

The 5 steps in the end-to-end process of accounts payable start with invoice capture, followed by invoice approval, payment authorization, payment execution, and finally analytics. It begins when you receive an invoice and ends not after you pay it, but rather after you analyze and review the process.

The 3 types of reconciliation are bank reconciliation, customer reconciliation, and vendor reconciliation. While bank reconciliation is reconciling with the transactions in your bank account, customer and vendor reconciliation is about reconciling your books with your vendors’ or customers’.