Future of accounts payable: What does it look like?

In the modern era, it’s no longer uncommon to see accounts payable staff seated in front of a computer instead of routing invoices for approval from desk to desk.

The fact is that accounts payable teams in many companies are beginning to tap into new technology and its impact on accounts payable processes.

Your accounts payable team will likely be able to access all the data they need to perform their tasks on a single platform with the help of artificial intelligence. The future of accounts payable has already started.

Overview of the accounts payable market outlook 2023 - 2032

Accounts payable is an integral function of any company. With the shift towards remote and hybrid working environments and a need to reduce paper invoices.

Automation has started becoming the answer to many issues faced by accounts payable departments across industries.

It should be no surprise that the global valuation of the accounts payable automation market in 2021 was at US$ 2.3 billion.

This valuation is expected to grow at a compound annual growth rate of 10%, reaching US$ 2.6 billion in 2022 and all the way to US$ 6.7 billion by 2032.

Reasons for the demand

Digital payments now seem to be the future of payment. Industry giants and other professionals have moved towards digitalization and automation.

You no longer have to be in the same physical location as someone else to process payments. Accounts payable automation helps the procure-to-pay process go smoother and faster.

There is also a need to reduce the number of paper invoices, especially when the volume of bills in many growing companies is going up.

With an increase in volume and a demand for speed when it comes to payment processes, accounts payable automation is growing increasingly more popular, oftentimes even necessary.

Payment fraud is also a big reason for the demand in the accounts payable automation market. Automation can help reduce risks and is therefore a key aspect for many businesses when considering the future of accounts payable.

Contributing factors

Moving into an era that has popularized remote and hybrid working environments accounts payable automation becomes a must for many businesses.

It becomes increasingly more difficult to perform accounts payable tasks traditionally when your employees may not work from the same location.

The future of accounts payable is also driven by the fact that accounts payable teams in every business want better visibility of their processes.

Starting from the moment you receive an invoice all the way to when your payment is received by the vendor. With real-time access to all of the data, accounts payable teams allow businesses to make more well-informed decisions.

There are fewer errors in the process and better strategies made surrounding it.

Automate your accounts payable process with ease

What does the future of accounts payables look like?

1. Artificial intelligence

For the future of accounts payable, artificial intelligence will be able to help through many features.

For instance, AI in accounts payable can streamline the data entry process by automating invoice data capture, significantly speeding up this task.

Once your invoices go through for approvals, artificial intelligence can also help with sending automatic approval reminders to their respective approvers.

You’ll be able to process your invoices faster with machine learning technology.

2. Challenging security threats

One of the big concerns that have propelled the technology into the future of payment industry is security threats. Payment frauds remain a concern for many businesses.

But accounts payable automation can reduce security threats and fraud attempts. Your data will be stored in a remote server surrounded by a firewall, making it difficult for any external factors to harm your data.

While an accounts payable software allows you to add employees as you see fit, you can also limit the access each employee has to your data.

With software that is the future of accounts payable, you can ensure that only authorized personnel has access to sensitive and confidential information.

Having full visibility of the accounts payable process also means that issues are more easily noticeable and can be nipped in the bud before they become a massive concern.

With the help of technology like automatic bank reconciliation, you can now perform bank reconciliations daily to make sure that nothing is amiss.

3. Advisory role

The future of accounts payable will see your accounts payable team playing a more advisory role.

With the heavy lifting of administrative work taken care of by automation, the accounts payable team can turn their attention to interpreting the data available to them and communicating it to stakeholders.

Collaborating with stakeholders like the procurement or finance department will allow your accounts payable team to strategize with them.

4. Eliminating manual data entry

Gone are the days of having to do manual data entry. The future of accounts payable means that data from your invoices can now be extracted and entered directly and automatically into your accounts payable automation software.

Not only does it speed up the process, but it also reduces errors that would otherwise have been made manually. Automated data entry eliminates typos in vendor information or mistakes like misplaced decimal points.

5. Automatic alerts

When an invoice has been sent for approval, accounts payable automation software can alert admins that approval needs to be made. This cuts down your processing time.

You can also get alerts in the form of notifications flagging down any potential issues. This way, you can catch them early even without hundreds of invoices to work through.

6. Proactive vs reactive

Allow your accounts payable team to have a proactive approach by pinpointing challenges and addressing them early. Rather than react to issues or wait around for invoices to land on their desks.

The future of accounts payable will see them analyzing data on the accounts payable software dashboard and noticing things before they become an issue, such as unwanted changes in the cash flow.

7. Accounts payable will play a strategic role

In the future, accounts payable management will play a strategic role. Trends show that the future of accounts payable involves technological advances that will speed up tasks otherwise done manually and streamline your processes.

This, however, does not remove the need for an accounts payable team. What it does instead is shifting your accounts payable team’s role and allow them to spend more time analyzing data and looking for new opportunities.

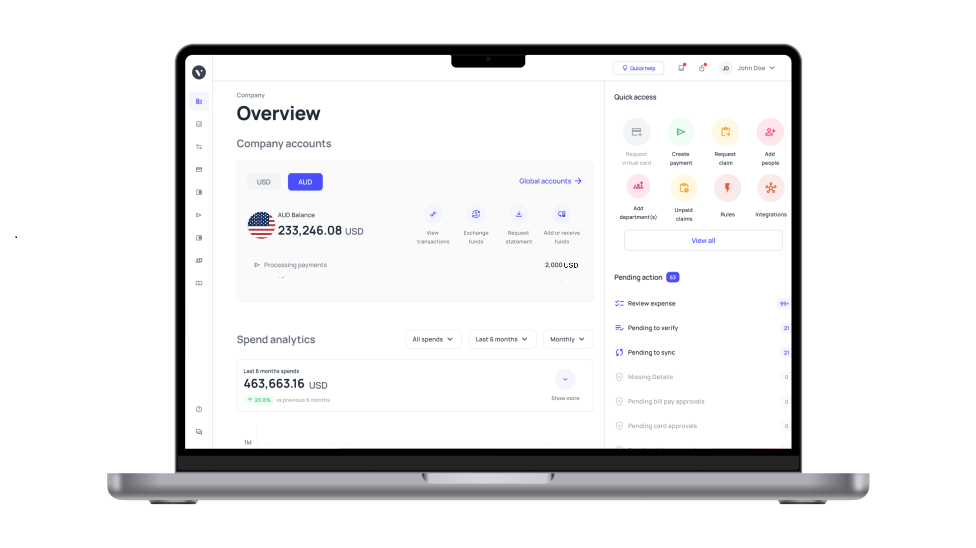

Accounts payable automation for your business with Volopay

The fact is that the future of accounts payable is already here. For many businesses, shifting to an automated approach when it comes to accounts payable is a need. Streamline your accounts payable processes with Volopay.

Process your invoices faster, reduce errors and fraud risks in the process, and build better relationships with your vendors by ensuring that all your payments are made on time.

FAQ’s

The accounts payable team is in charge of making payments to suppliers and other creditors, ensuring that your company is on top of all your outstanding bills and vendor invoices, and recording company short-term debts. They are also responsible for viewing and analyzing your payment data.

The world is moving towards electronic payments. To support the digitalization of payments, digitalization of the whole process must happen so that accounts payable teams can keep up. The future of accounts payable demands automation. Paired with the fact that this is a time when many businesses are seeing shifts in their work environment to a hybrid or even remote work model, accounts payable automation is often the answer for many businesses.

B2B payments are complex and require a lot of attention, with processes such as invoice data entry and payment approvals. Accounts payable ensures that the process goes smoothly with the help of automation. Along with the shift towards digital payments, B2B payments can see a decrease in fraud risks and processing time.