10 accounts payable best practices for businesses

In many organizations, streamlining accounts payable management is often seen as a back-office task. Due to this negligence, organizations become unaware of their obligations towards suppliers and third-party stakeholders.

This leads to damaged relationships with suppliers, missed early-payment discounts, reduced chances of securing new orders, and overall harm to the company’s reputation.

Timely payment of invoices is crucial to any organization. A proper mechanism for handling invoice processing goes a long way in improving the financial-worthiness of an organization.

What is accounts payable automation?

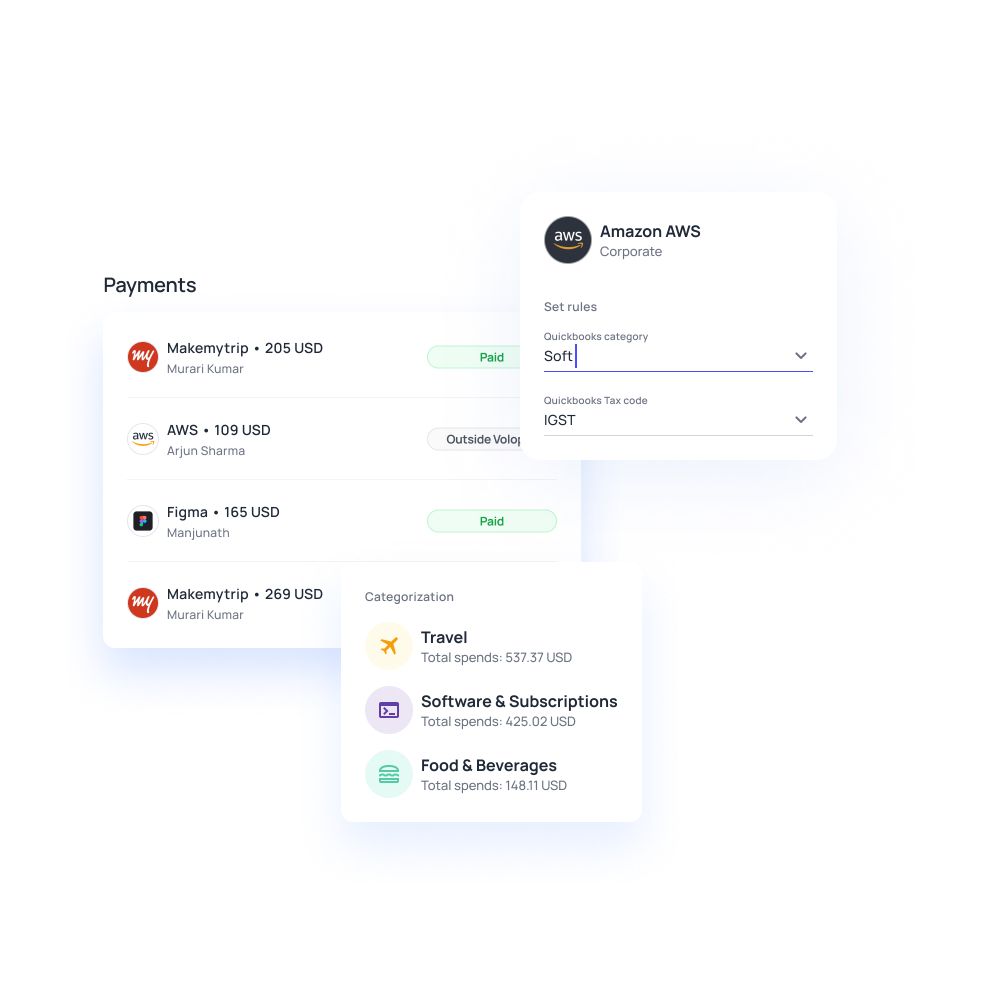

Accounts payable automation is your one-stop solution for managing your decluttered AP process. Through automation, companies can leverage the benefits of vendor management, invoice automation, and cost-cutting through supply chain management. An optimized AP process is one where there is adequate working capital, improved profitability, and reliable compliance reports.

Managing your accounts payable is a back-breaking process. Therefore, handling all its affairs is critical to efficient vendor management and robust workflow.

Best practices to improve accounts payable process

Prioritize invoices

Some invoices can be due on the same date but with different invoice totals. The finance team needs to prioritize invoices not just according to the due dates and amount but also according to the importance of payment. E.g., Bank interest, EMI, and credit card payments should be the top priority.

Moreover, paying invoices as they immediately come up might not be a life savior, as many consider it to be. The invoices have a payment period of up to 15 days, 30 days, or even 45 days in some cases. This period is a breathing time for the finance department to line up the outstanding payment according to their importance. Instant payment of invoices can cause a cash crunch with the finance team, and funds will be insufficient for any unforeseen circumstances. Therefore, the finance team must develop a strategy to sort the payments according to importance in a manner that does not affect the company’s working capital requirements.

Check cash payments

Companies rely heavily on the digital modes of payments available. Payment of funds and receipt of funds is directly displayed in the company's bank statement. Therefore, the burden of reconciliation is eased. But when cash is used as a mode of payment or receipt, financier controllers often fail to mark its entry into the system. This way, the payment completion entry is missed, leading to duplicate payment for the same invoice.

The same goes with cheque payments; suppliers might encash the cheque when other expenses are lined up or when there are insufficient funds in the account. Hence, communicating and coordinating with them is also a significant way to save organizations from last-minute haphazard.

Automation is the key

Contemporary businesses try to leverage the benefits of automation in almost every aspect of accounting and financing. This saves the time and energy of the workforce and helps companies attain higher profits with minimal effort.

Accounts payable automation is an intelligent way to make accounts payable process more efficient. Through the implementation of automation, minimum human intervention is called for. Companies can save millions of dollars by reducing paper documents and printing costs. Moreover, physical receipts and documents take up a lot of storage space and involve maintenance charges.

Therefore, adopting a paperless AP automation software helps make the processes more vigorous and helps in reducing costs. Looking ahead to the future of accounts payable, automation will continue to evolve, further enhancing efficiency, accuracy, and cost savings.

Reconciliation is a must

Keeping a record of all the accounts payable and accounts receivable is not the only task. Matching these against the invoices into the accounting system with correct details is time-consuming. Reconciliation on a daily basis is a must for every accounting team. This rectifies any wrong entry, errors, or missed payments immediately rather than waiting for month-end to change these figures, which causes vast discrepancies in the ledgers. In addition to this, reconciliation helps get the estimated amount spent behind each expense category.

Choose alternatives to cash

Making or receiving payments via electronic means is the safest way to ensure reconciliation. Since payments via these methods are linked to the bank accounts of the supplier and the company, any deposits or withdrawals made are straightway reflected into the bank system. These entries can be reconciled seamlessly with the accounts payable software. On the flip side, selecting cash as the mode of payment involves risk as the finance team might slip to whom the payment was made, against which invoice the payment was made, or any other reason.

Moreover, if there’s no receipt issued from the supplier, the company might get into trouble for not making payments or even have to issue a duplicate payment. Hence, e-payment platforms are the most secure and reliable method for giving and receiving payments.

Create a supplier portal

Large corporations have their supplier platforms where all vendor information is stored. This platform lets suppliers send or receive purchase orders (PO) to know the order status, order details, payment initiation, and other related information. There’s no risk of disparity between the parties' records through supplier portals. This system clears out the bottlenecks of communication and creates transparency.

Any query raised by any party can be immediately adhered to. Alongside, the tax filing status can also be viewed through the platform. It helps in understanding how well parties are performing their regulatory activities.

Accounting integration

Integrating the accounts payable software with the accounting software is a win-win situation for the organization. Accounts person cannot pass separate entries in the two software. The finance team saves time and mitigates the risk of duplicate entries by integrating the two systems.

Transparency

Maintaining a transparent system of information empowers employees in their position in the organization. Allowing employees to understand the system of processes enables them to comply better with its rules and guidelines. However, every employee in the organization need not be given the same level of access as the top management. Some crucial information should not be communicated with them, considering the fragility of the data. The details, like vendor information, invoices, payment status, etc., can be shared depending on the company.

Communicate the accounts payable workflow

Management should carefully devise an information workflow and communicate it to the employees. Employees need to know the concerned person for each activity. Different individuals are designated with other tasks in the manual method, but in the modern process, all the tasks can be carried out by a single person only. But the centralization of power puts the company in a position of great uncertainty. A single individual's knowledge of the entire process might result in slower processing of other functions.

Accounts payable fraud

Running checks for any fraudulent activity is vital. Before entering an invoice into the system, its authenticity needs to be analyzed. Checking the background of new vendors is critical to a company's safety. Therefore, implementing policies to check unauthorized invoices, unique vendors, or suspicion payment needs to be addressed.

What are the benefits of the accounts payable process?

By adopting invoice automation, companies can significantly reduce the costs of printing invoices, maintaining multiple records, storing piles of document files, etc. Also, the paper method exposes companies to the risk of catching fire or getting misplaced.

By implementing the above-mentioned best practices, companies can get hold of their accounts payable systems. With established accountability of employees as well as the admin, questions like these can be quickly answered, like who initiated the payment, invoices are paid and unpaid for each vendor, which employee was the person of contact with the vendor current cash position and working capital ratio and more.

With the timely payment of invoices, vendors give the purchaser an early-payment discount or some perks in the discount coupons (like holiday packages). Having healthy relationships with suppliers and stakeholders goes a long way in boosting a company's goodwill and worthiness.

Establishing a systematic workflow allows processes to function smoother with fewer hurdles. Employees should be made aware of the things concerned with their work environment and leave no scope of doubt.

Trusting an accounts payable software your company’s financials should ensure management about its utmost security and prevention from any form of a data breach.

Automate accounts payables with ease

Accounts payable software is the need of the moment. Not only does it help businesses in managing their accounts better, but it also helps in scaling the company to a more digital-savvy workspace. Using Volopay’s intuitive accounts payable software can give you a seamless experience of accounting aligned with fast invoice processing and on-the-go vendor management.