Articles

Get insights on the latest happenings from the world of finance.

Explore our guide to know the process, essential strategies, tips, approach and best practices for IT budgeting.

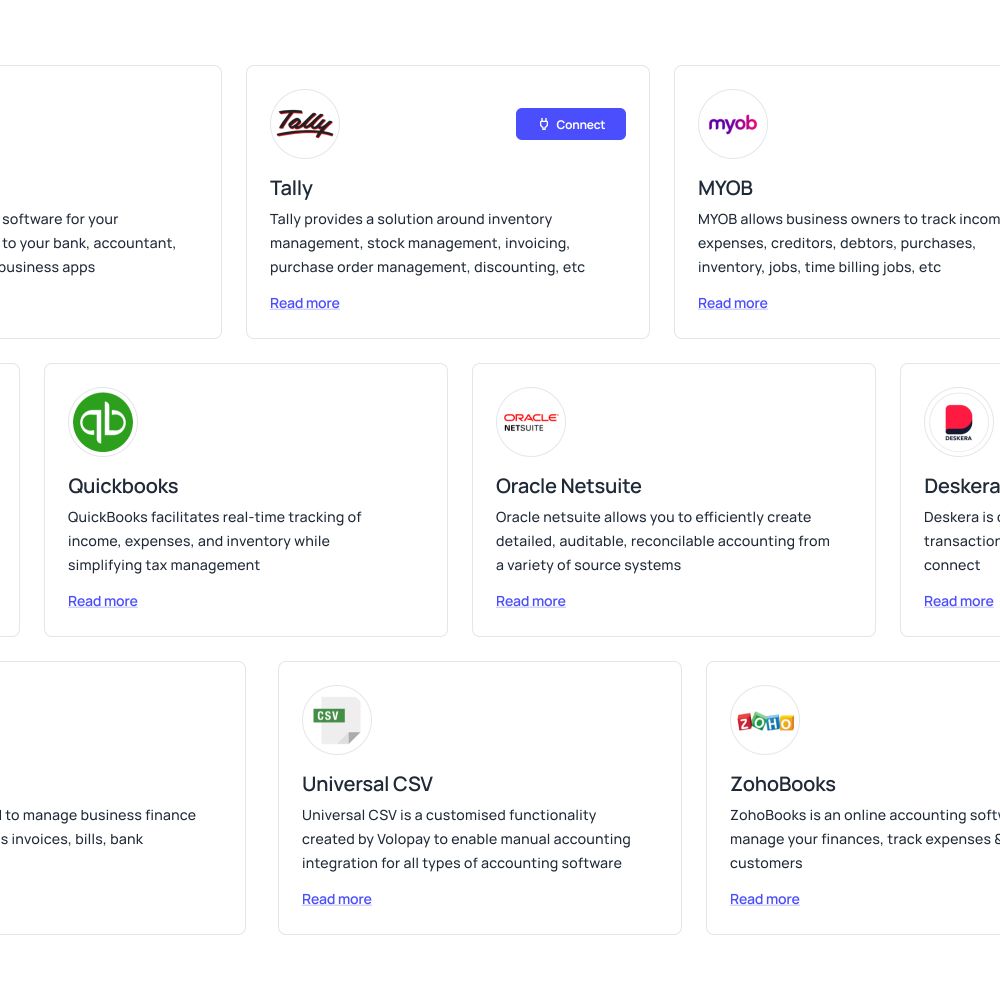

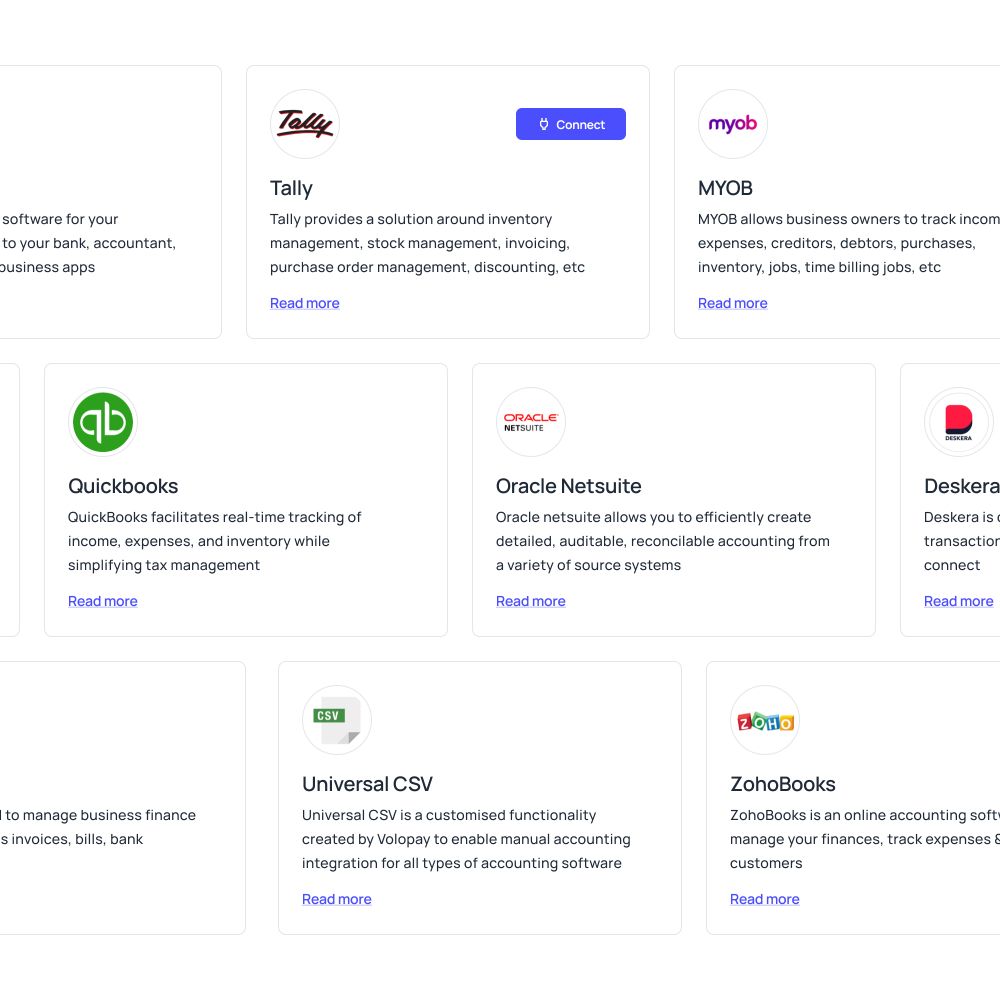

Discover what an integrated accounting system is, its key features, and how it can streamline your financial processes.

Get to know the common NetSuite implementation mistakes to ensure a seamless integration of NetSuite with your business operations.

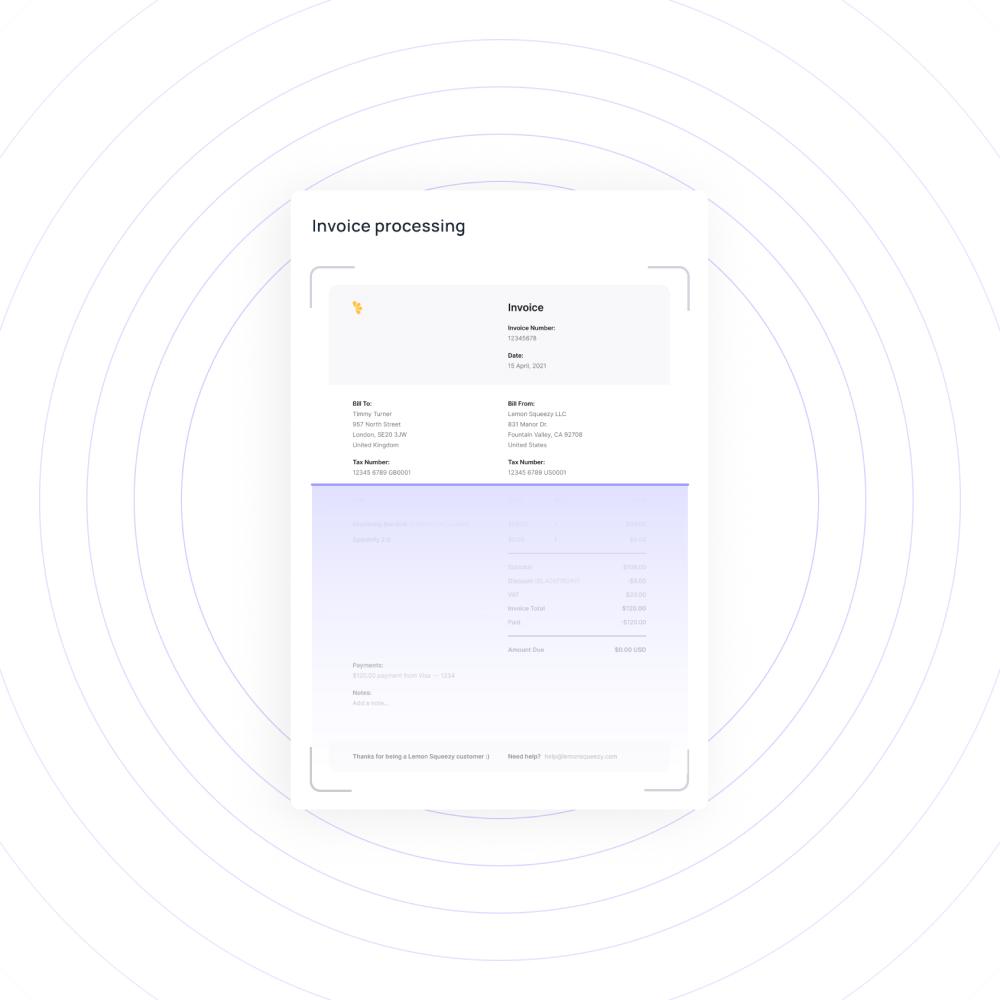

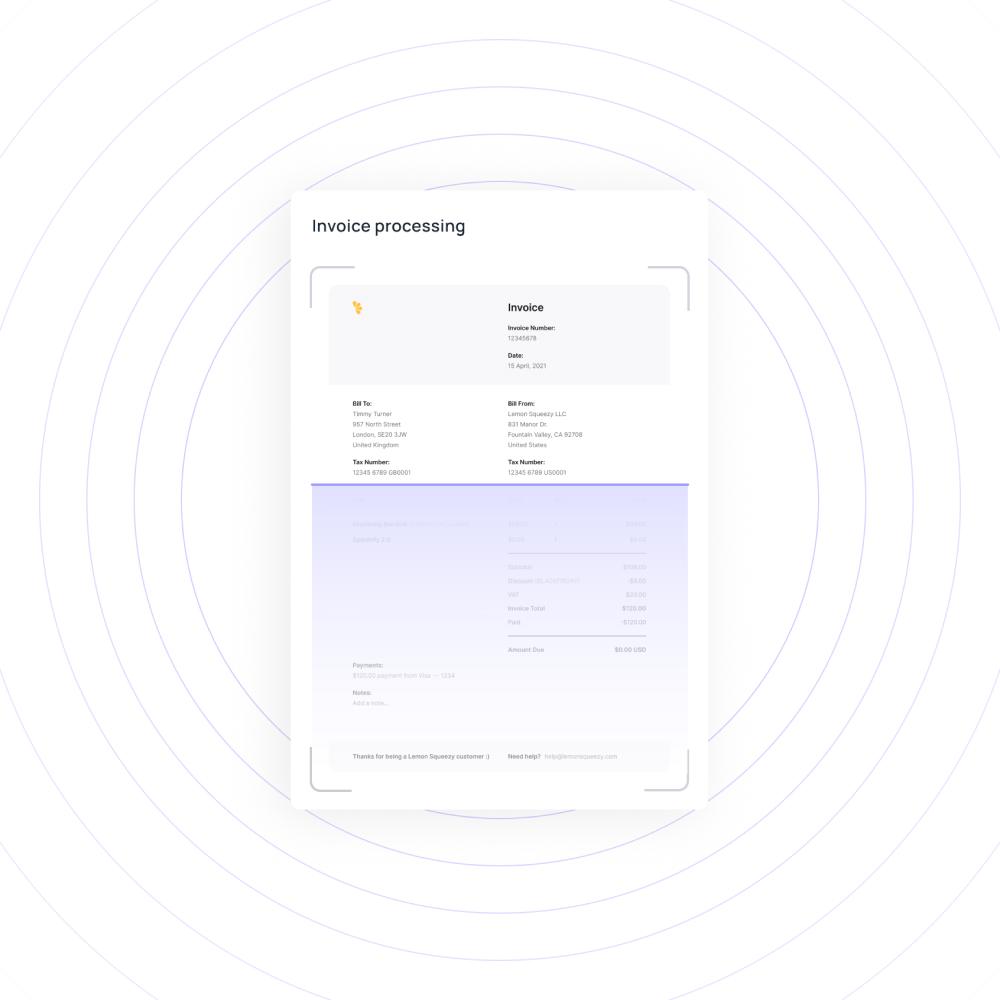

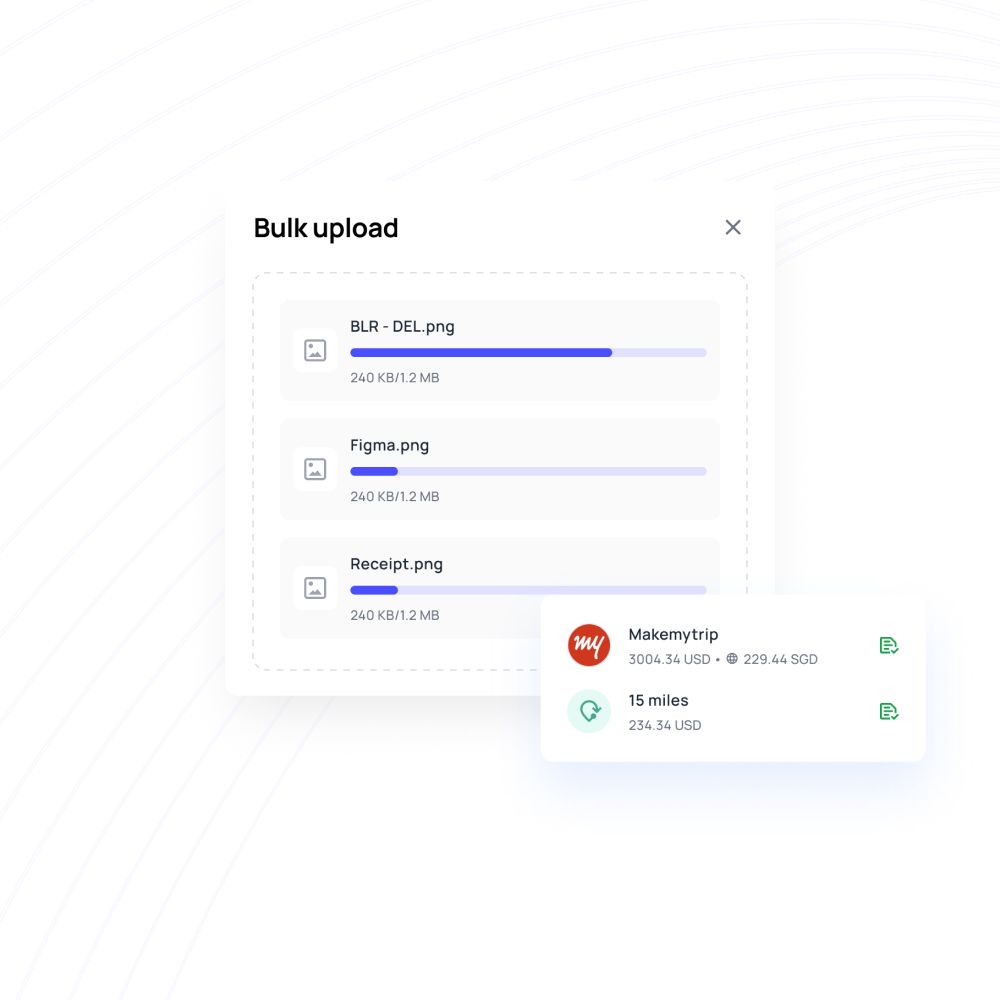

Learn about the problems of manual invoice matching and how automated solutions can streamline invoice process and improve accuracy.

Discover the common accounts payable challenges, from processing delays to human errors and learn how to overcome these challenges with automation.

Explore our guide on accounting automation to understand its benefits, implementation strategies, and how to streamline your financial process.

Understand the benefits of NetSuite API integration and discover the best practices for smooth and easy integration process.

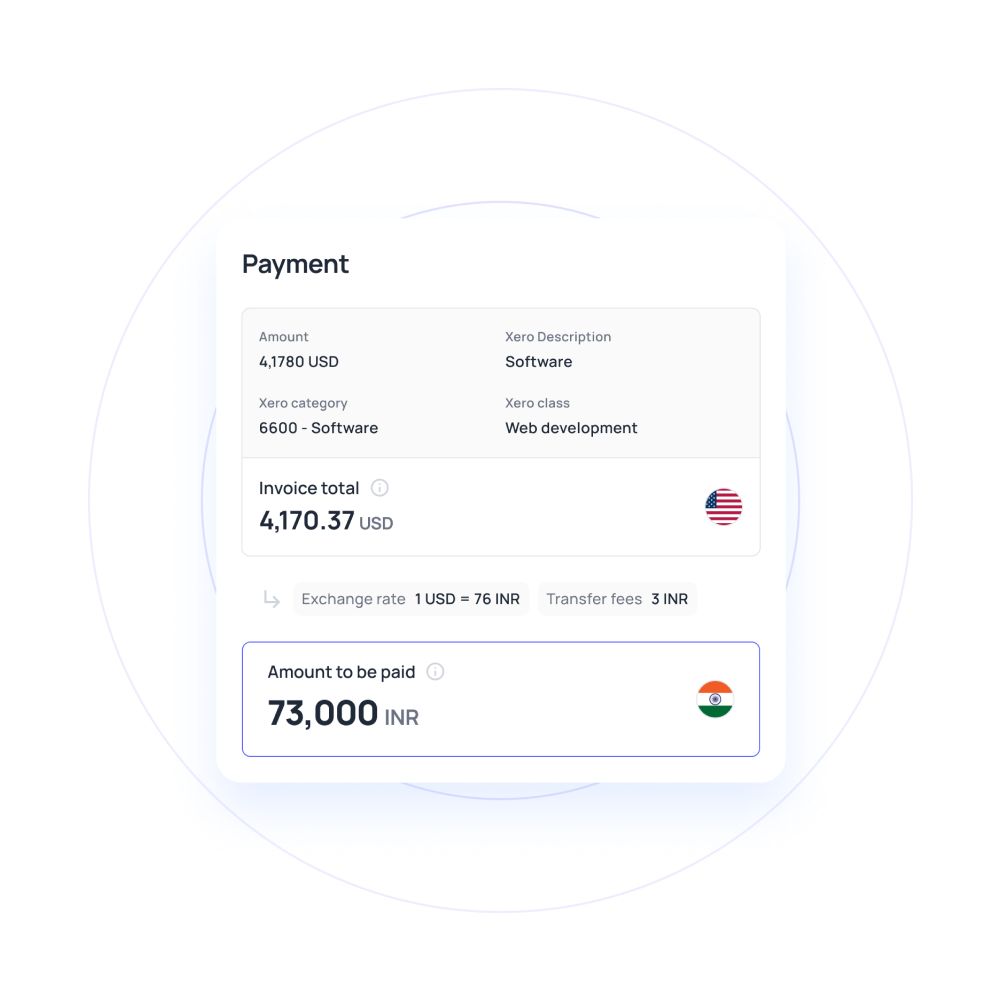

Get to know the fundamentals of remittance transfer and how companies can send and receive international payments through remit wire transfer.

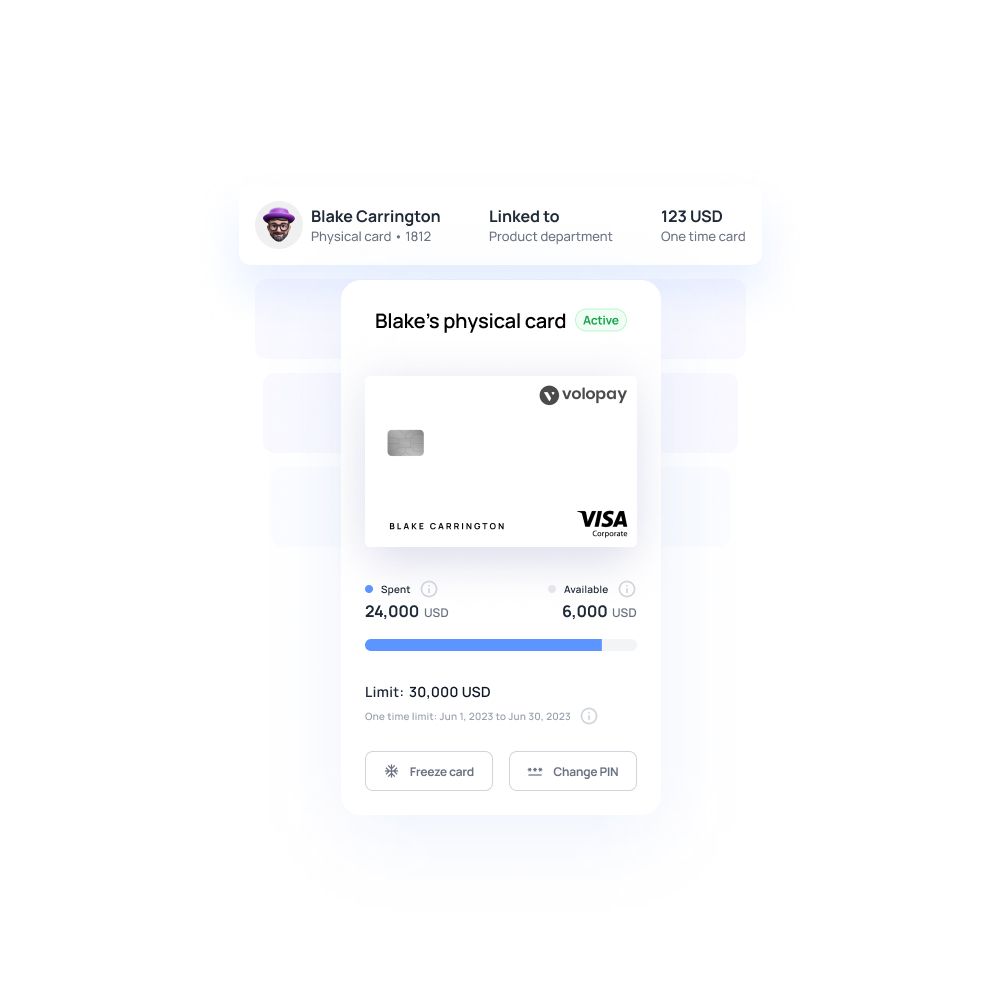

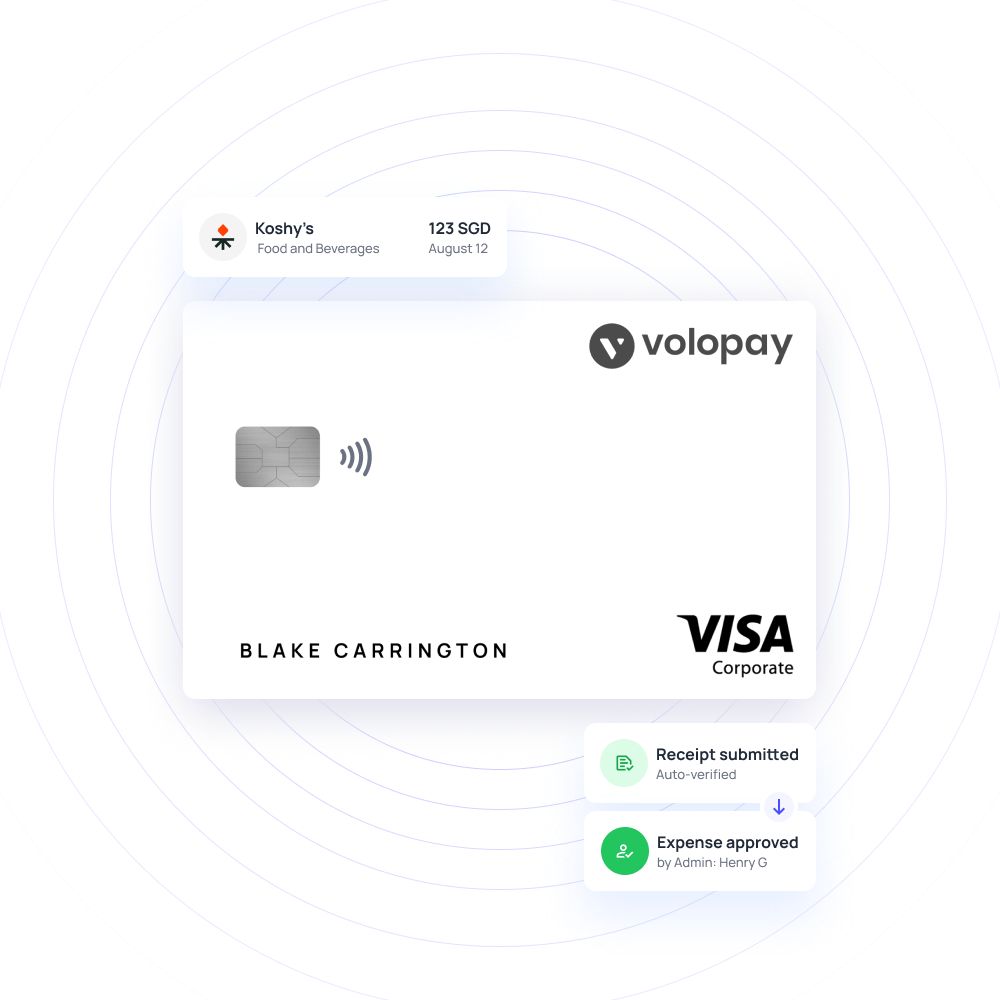

Explore how a purchasing card can simplify procurement process, enhance control and improve efficiency in business spending.

Get to know the difference between a business credit card and a debit card and discover which option best suits your business needs.

Get to know how paperless invoice processing system works and the benefits of implementing one in your organization.

Explore the benefits, features and functionalities of a global business account and learn how they are different from traditional bank accounts.

Unveil the concept of recurring payment, associated challenges and effective solution to overcome these challenges.

Learn how automation helps streamline process, enhance accuracy, and provide valuable insights that help leaders take strategic decisions.

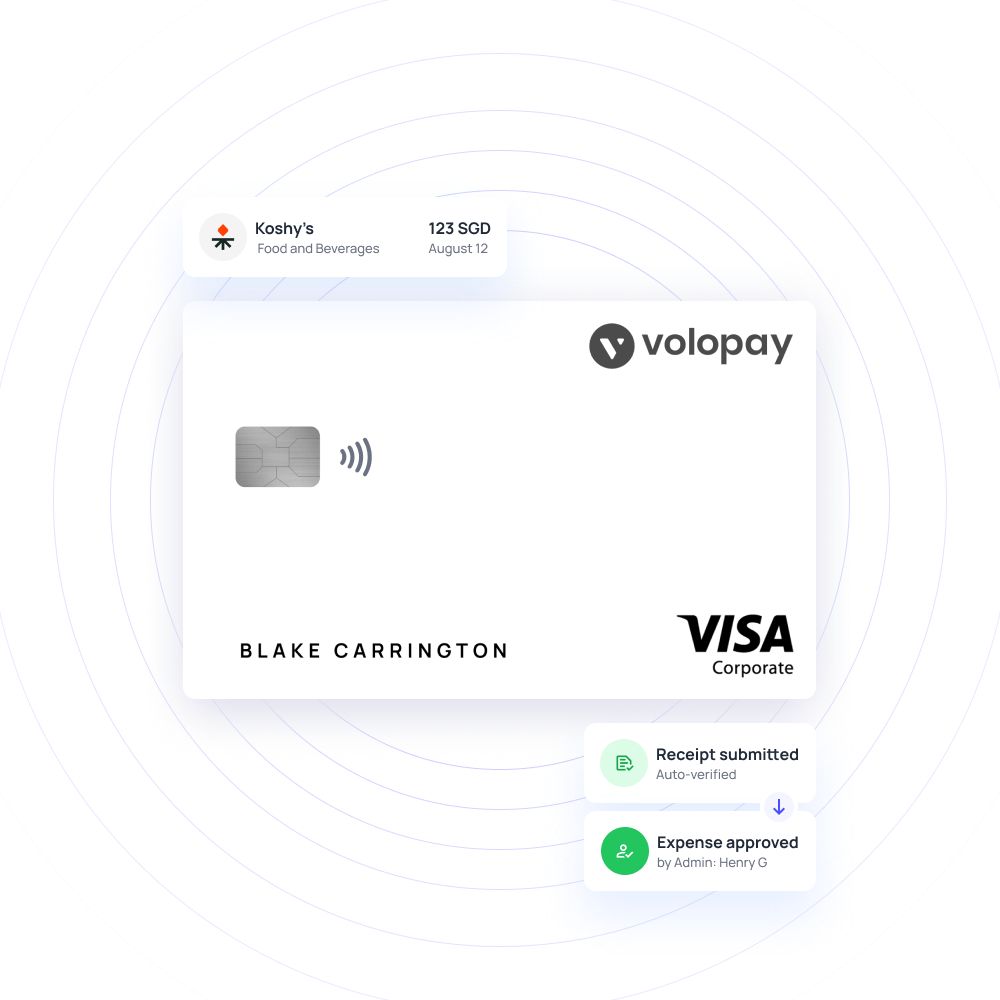

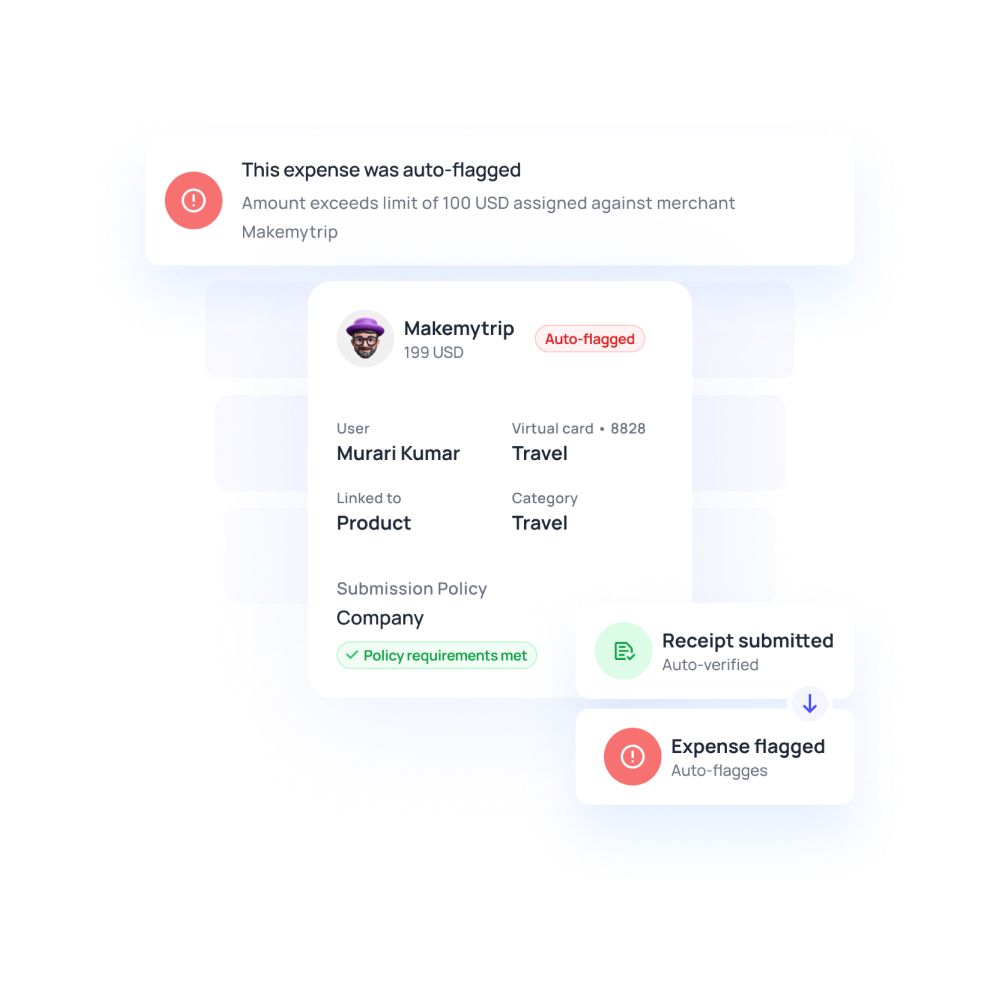

Learn how to identify and prevent fraudulent activities in expense reporting and safeguard your company's finances.

Learn how pre-spend expense approvals can help enhance control over travel expenses, improve budget management and streamline reimbursement process.

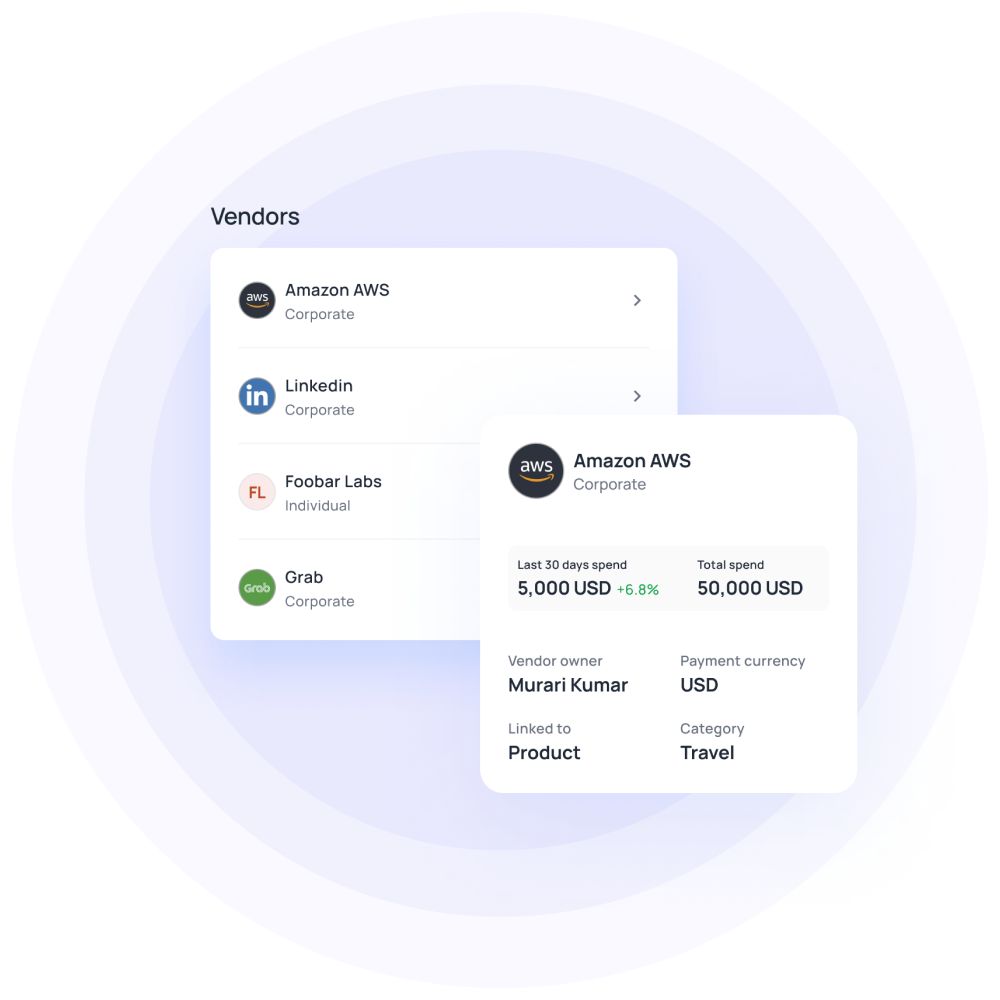

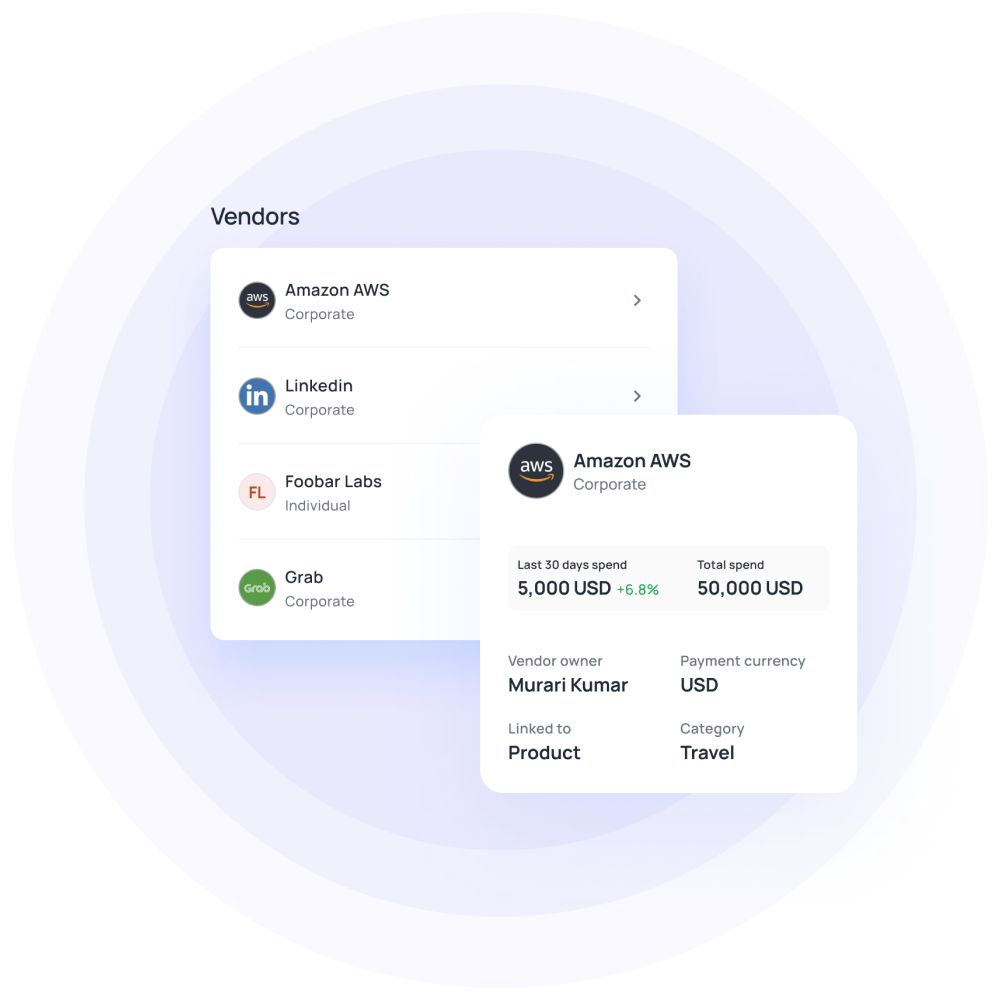

Discover common vendor management challenges related to vendor selection, performance monitoring, relationship management and their solution.

Explore how a bulk payment system can help businesses with easy salary dispersal, paying out dividends, and issue multiple refunds.

Closing accounting books is one of the most demanding tasks at the end of every year. This article can help you close books faster.

Explore in detail how a multi-level approval process can help businesses in reducing the time spent on manually settling reimbursements.

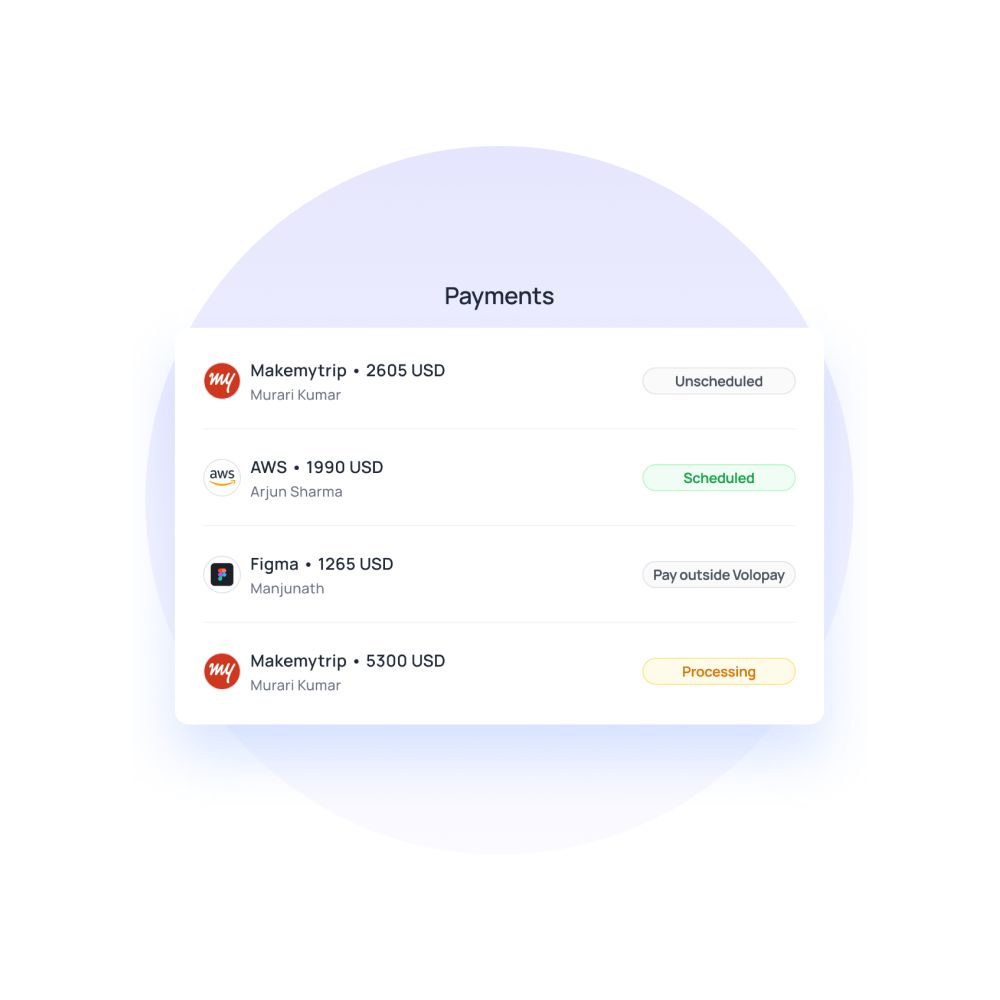

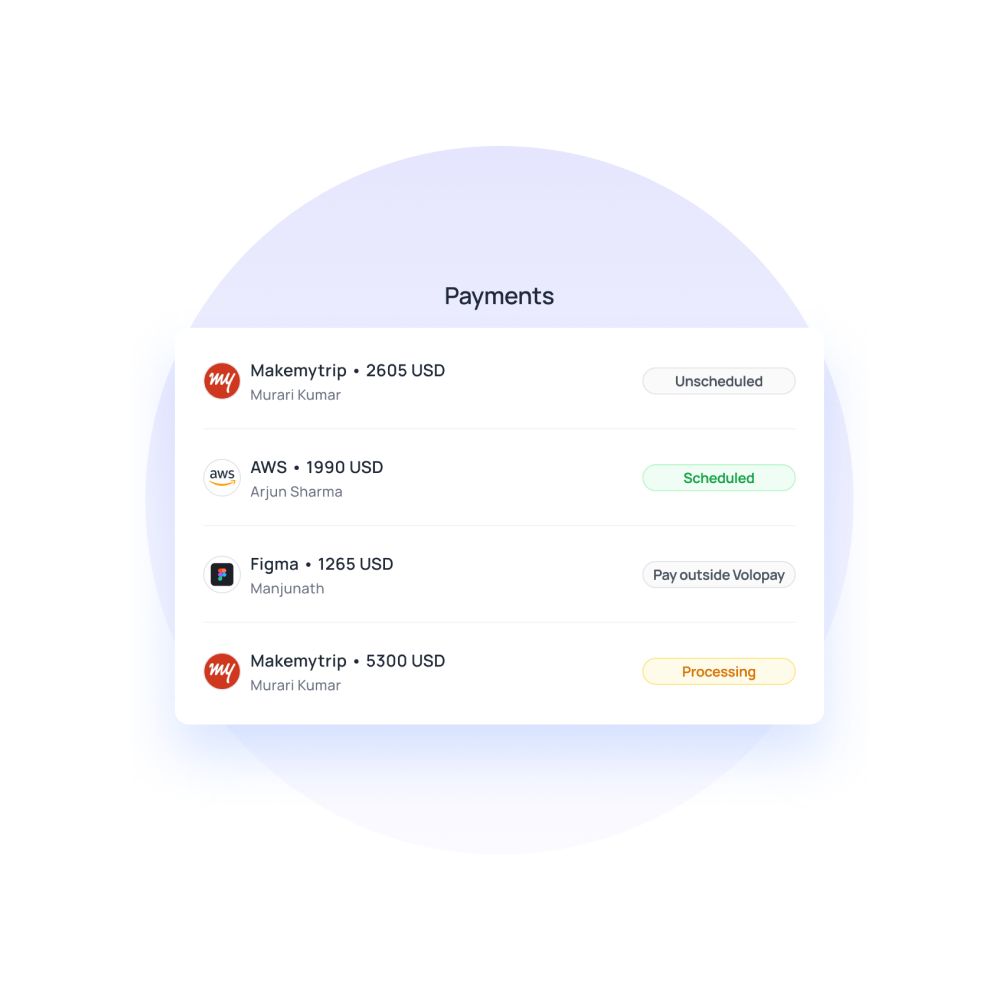

Learn how modernizing payment process can enhance efficiency, scalability, and financial performance, driving success in today's economy.