Secure prepaid business cards for employees in the US

Say goodbye to out-of-pocket expenses and poor spend visibility. Equip your employees with business prepaid card or a prepaid business debit card to make business purchases easier, faster, and safer.

Spend smarter with built-in controls and customizable limits. Load your prepaid business cards according to your budgets and assign them to employees. Manage your expenses, online purchases, procurement, and many more.

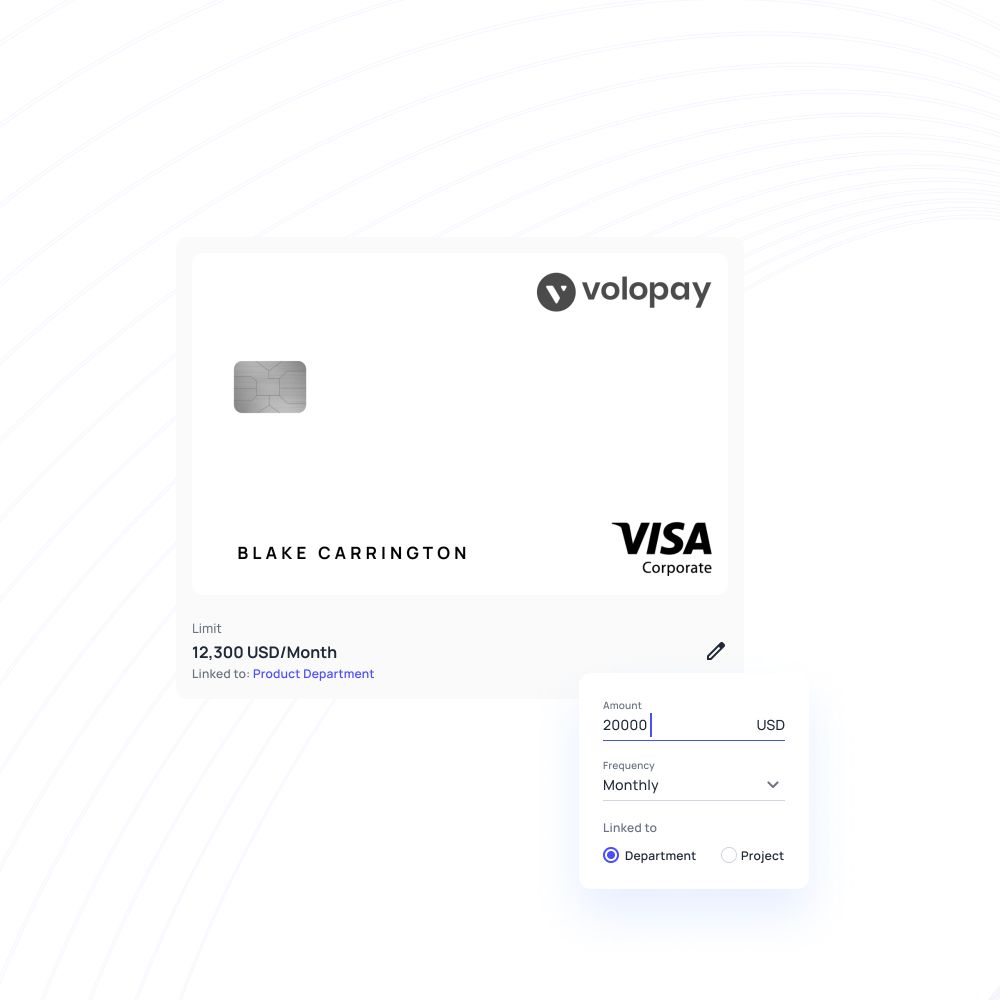

Business prepaid cards with built-in spend limits

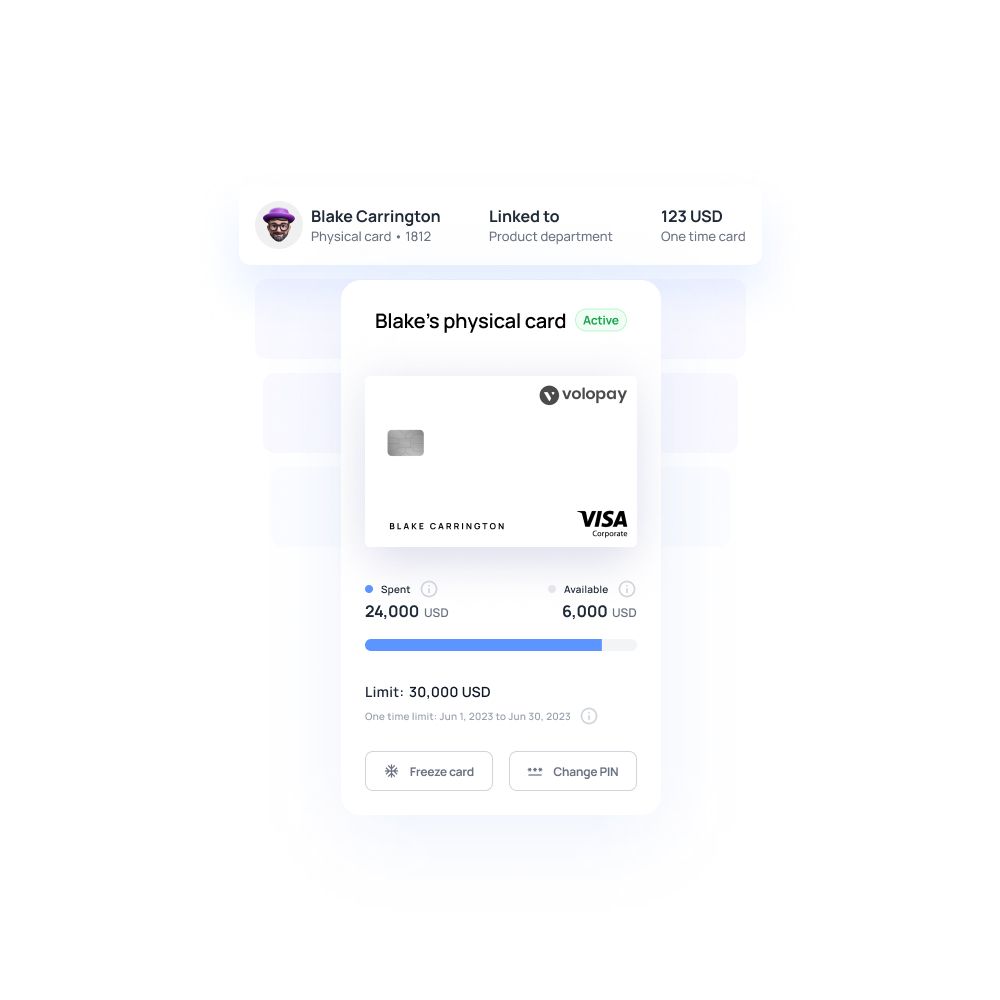

Top up your business prepaid cards or prepaid business debit card as you see fit to avoid overspending. Each physical prepaid card or employee debit card that you assign to an employee can have its own custom spend limit. You’ll be automatically prevented from spending over the allocated budget.

Set up controls to block specific merchants or only allow payments to specific vendors. With advanced control options for prepaid business cards, you can even decide if a card’s spend limits can be automatically refreshed, and how often it happens.

Easy-to-load and use prepaid business cards

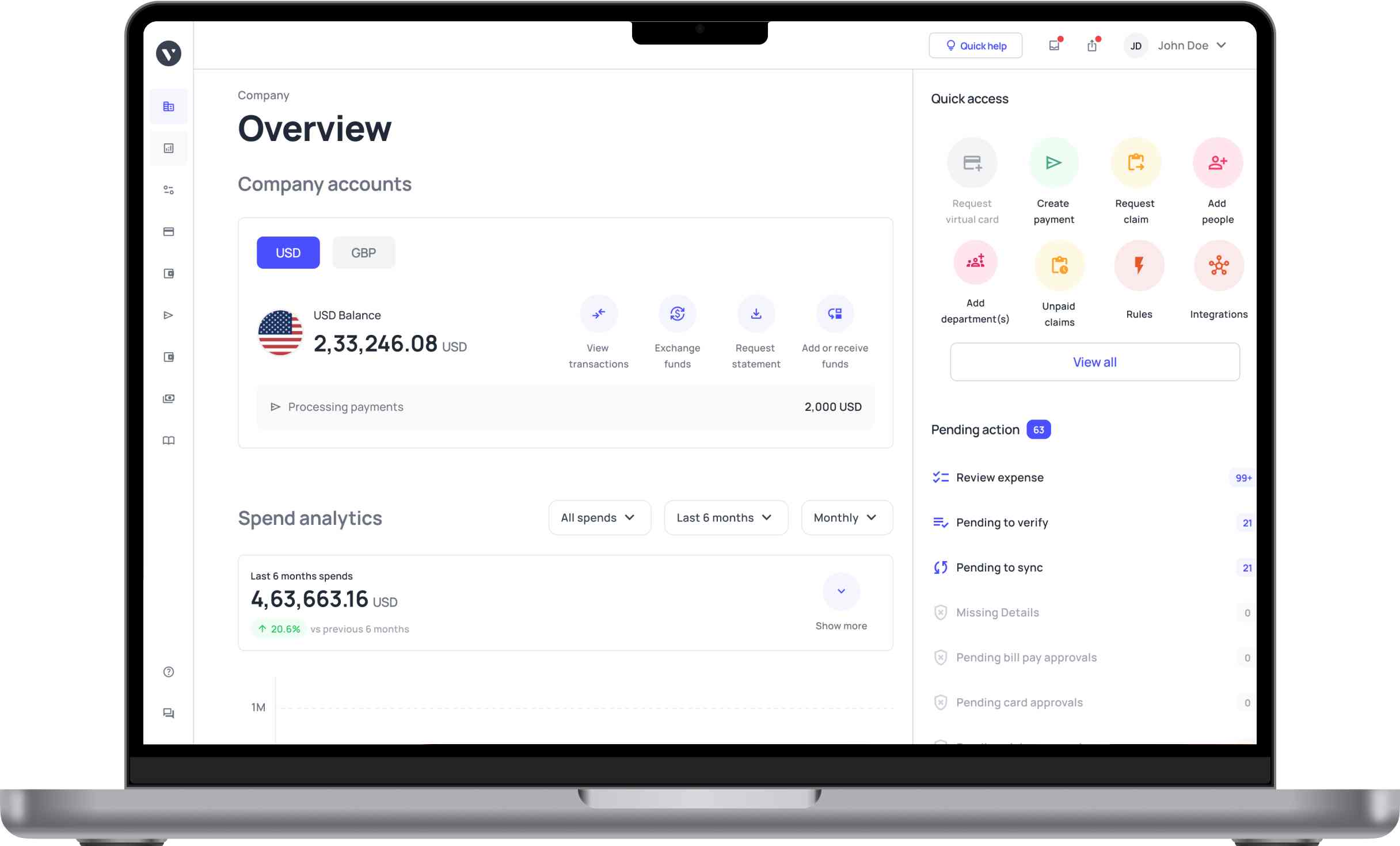

There’s no hassle associated with Volopay's business prepaid cards or prepaid business debit card. With a card management dashboard that can be accessed from anywhere with internet access, you can load your cards easily online. No need to go to the bank!

Spending on business purchases is as easy. Employees won’t need to make out-of-pocket expenses when a transaction can be completed with just a swipe of the business prepaid card.

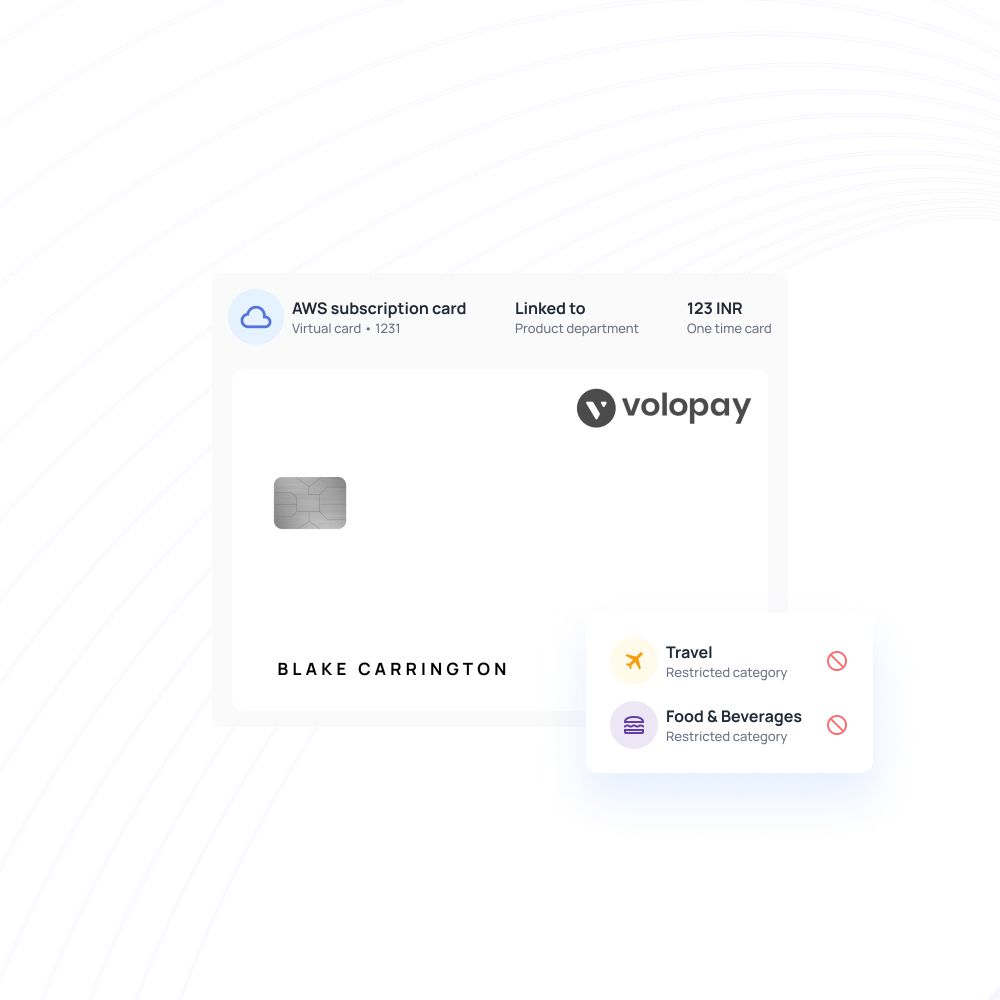

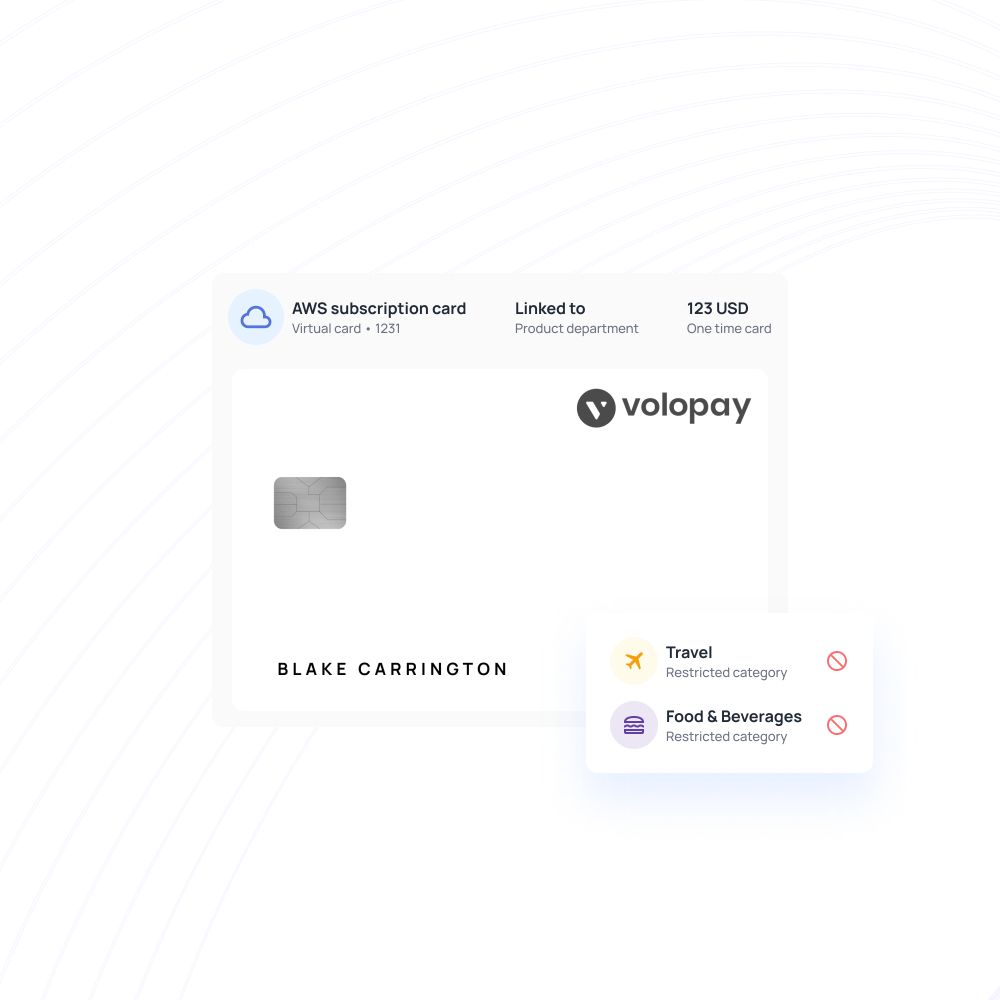

Create vendor-specific business prepaid cards

Unlike a personal credit card used for business purposes, you don’t need to be stuck with one shared employee debit card for expenses from multiple departments. Volopay allows you to create multiple business prepaid cards or prepaid business debit cards to manage your vendors better.

Different prepaid business cards can be used for different vendors, making it easier to track your vendor payments. Streamline your payments and get better visibility with Volopay's business prepaid cards.

Get the perfect prepaid business cards for your business!

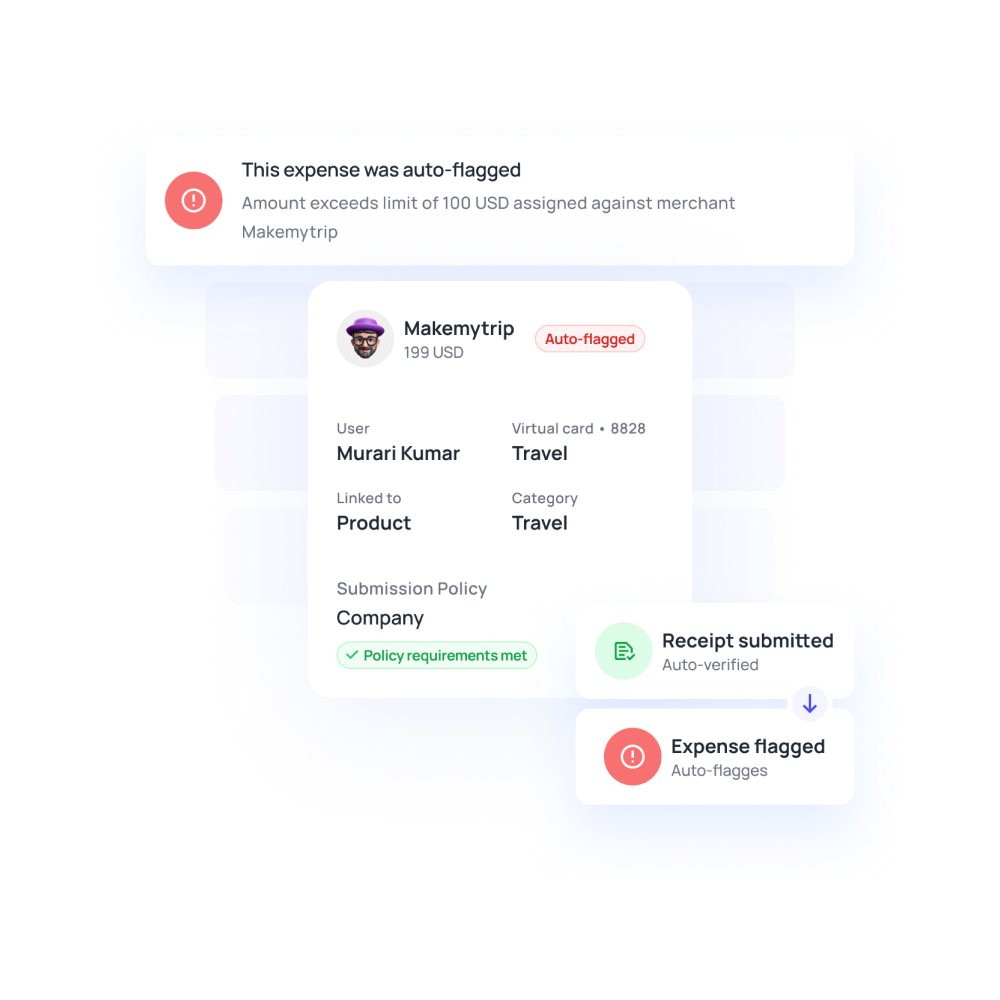

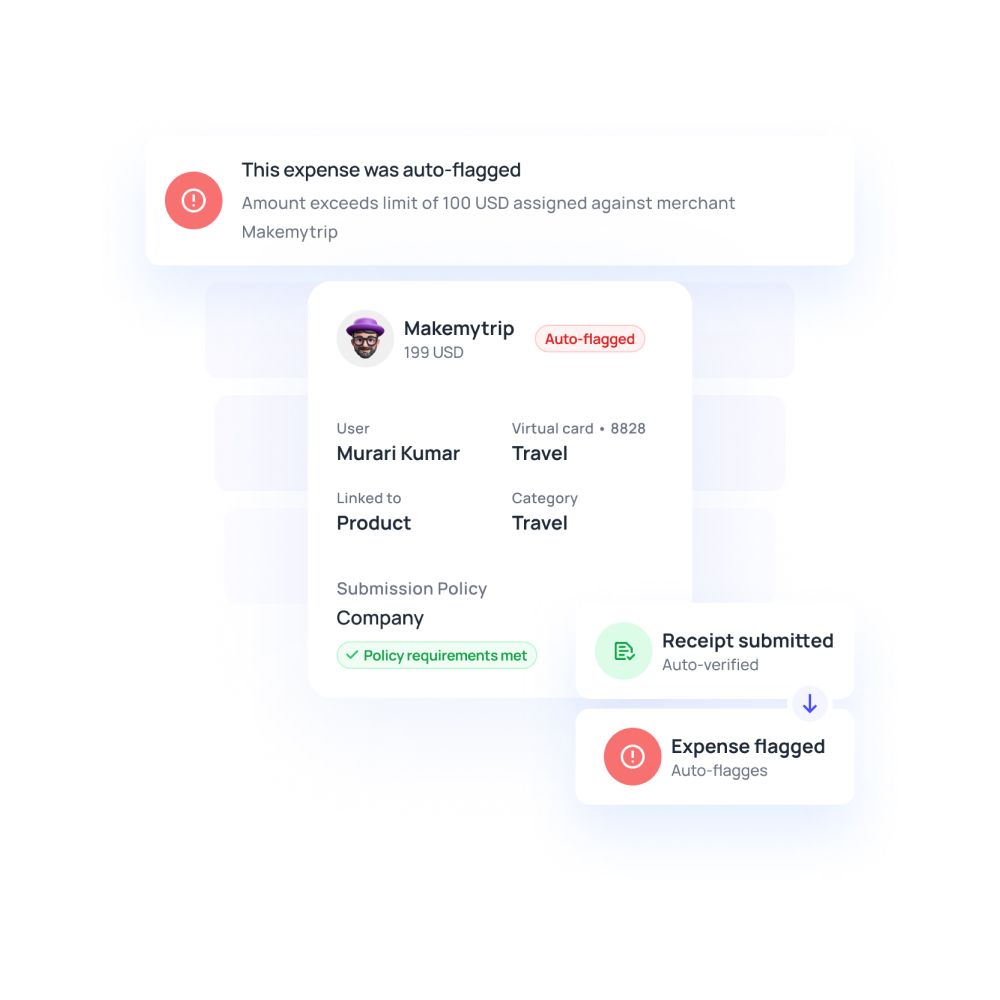

Automated expense reporting

No need to worry about missed expenses—every transaction you make with your business prepaid cards will be automatically recorded. The Volopay dashboard supports automatic updates for you and your employees.

For every transaction made using prepaid business debit card or employee debit card, employees will be reminded to complete the expense record with additional information. Customize required fields and allow employees to submit expense reports from anywhere with the help of our mobile application.

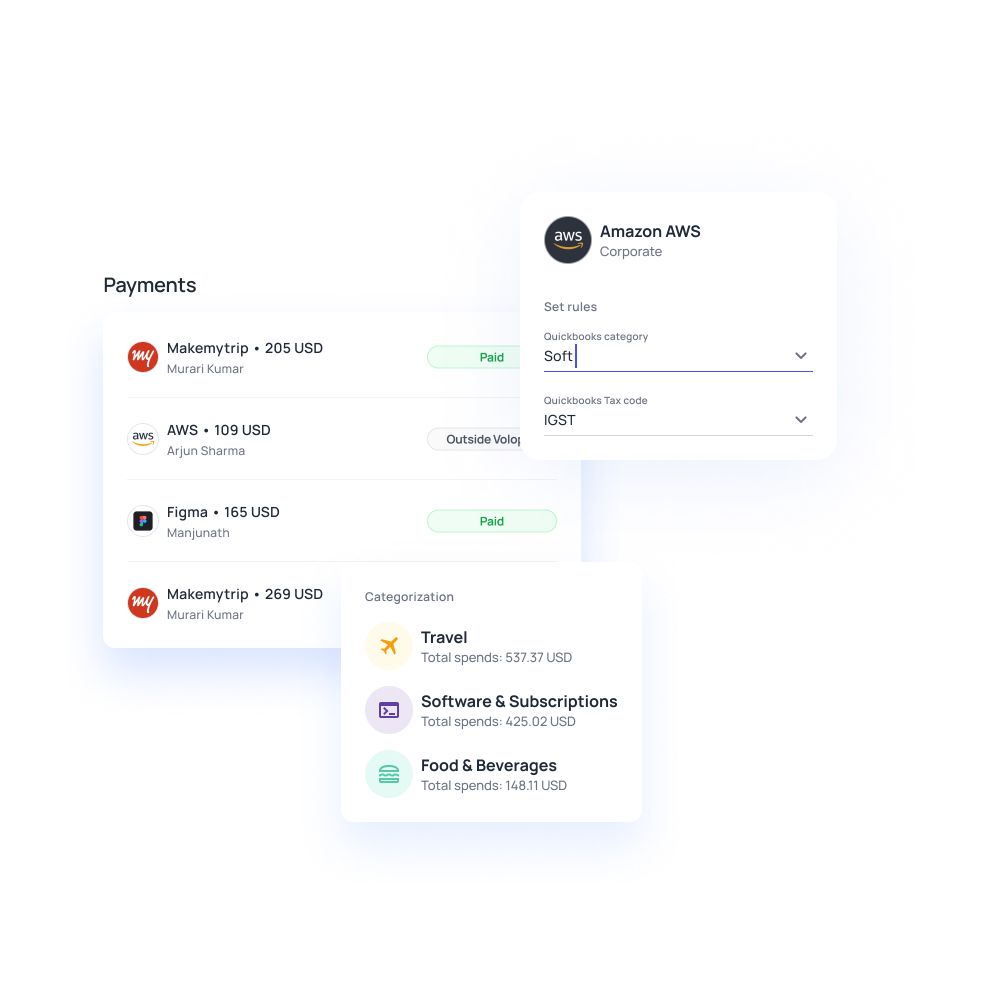

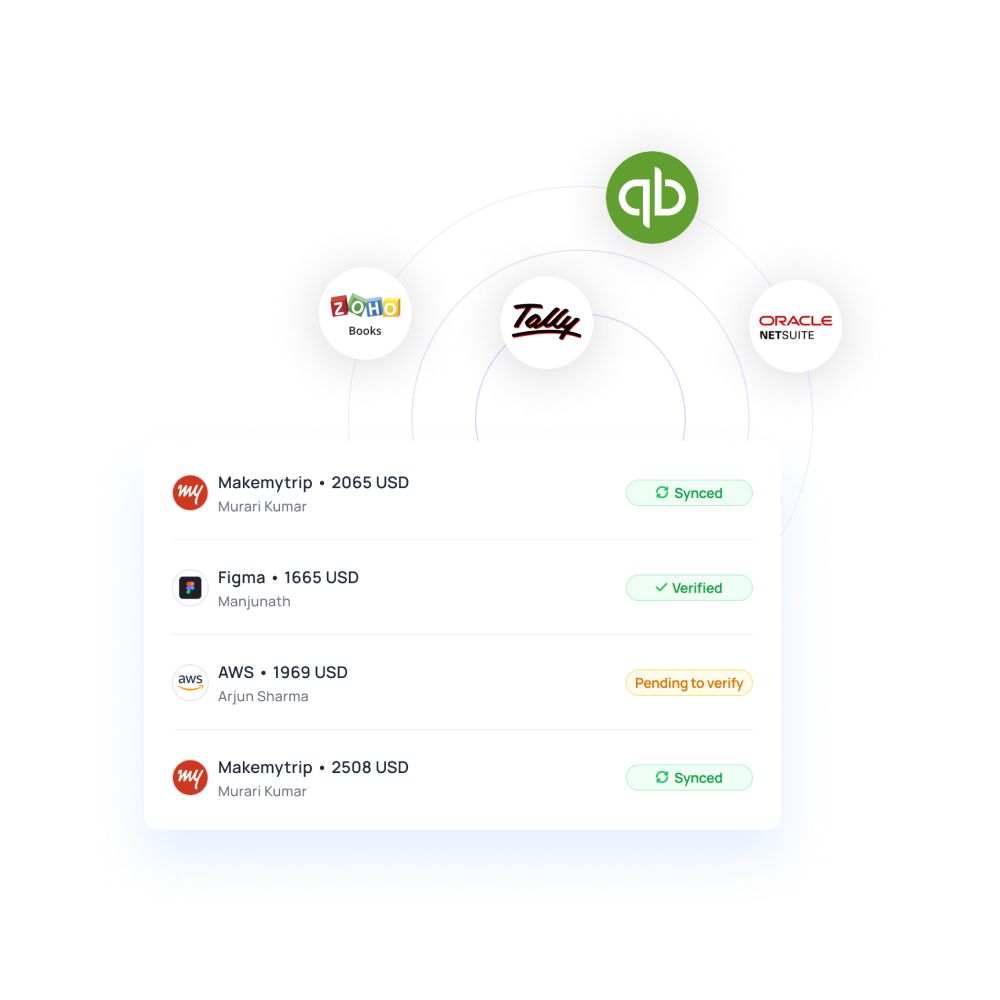

Easy integration with accounting systems

Card expense accounting doesn’t need to be difficult or time-consuming. Integrate your business prepaid cards or prepaid business debit card with existing accounting systems via Volopay. This allows your data to be automatically and accurately synced across multiple platforms.

Our team will happily help you set up your integrations to allow you to utilize the direct sync feature for a more streamlined financial workflow.

Enhanced security and fraud protection

Avoid carrying large amounts of cash to make business transactions. With business prepaid cards, you can load them as needed. It also makes it easier to prevent fraud and theft, since all transactions with your prepaid business debit card are updated on the ledger as soon as they occur.

Volopay’s industry-standard certifications and security measures ensure that your data is safe with us. If an employee debit card unfortunately gets lost, stolen, or compromised, the freeze and block features offer extra protection against fraud.

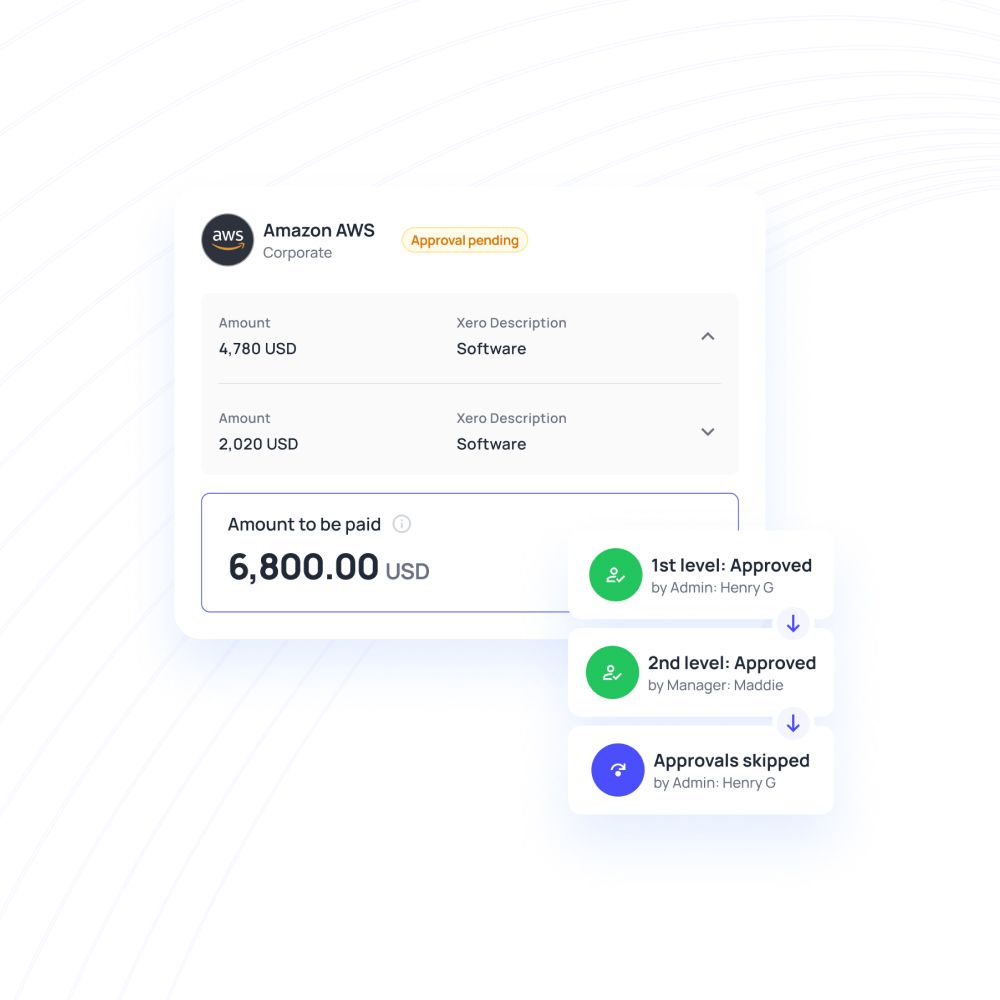

Multi-level approval workflows

With business prepaid cards, you can set pre-approved spending limits to enforce tighter spend controls. Block specific merchants from the platform, or alternatively, only allow certain merchant payments with your prepaid business debit card.

Employees can file expense reports for each card transaction using Volopay's employee debit cards, and the comment section lets approvers clarify details within the platform. Reports are automatically sent to approvers for review.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Diverse use cases for business prepaid cards

Travel expenses

Equip employees with business prepaid cards for business trips.

There’s no need for out-of-pocket spends—employees can manage travel expenses using a dedicated prepaid business debit card.

With pre-approved budgets, they can spend accordingly on airfare, hotel, rental cars, and other travel expenses.

Employee expenses

Out-of-pocket employee expenses are a hassle to your employees and the finance team.

Manage food, entertainment, and other employee expenses by equipping employees with business prepaid cards.

You can set pre-approved spending limits by loading your cards accordingly to effectively control how much money is spent.

Petty cash

Petty cash seems like a good idea until you realize it’s difficult to track how company funds are being used.

Replace petty cash with individual physical business prepaid cards for your employees.

It promotes transparency and visibility into how every penny is spent.

Purchasing and procurement

Procure materials and services easily using business prepaid cards.

The procurement team can set budgets and enforce them by loading your prepaid business cards according to the amount budgeted.

Card payments are also much faster, so business operations are guaranteed to go smoothly!

Online purchases

You won’t be able to swipe your card online, but you can enter your business prepaid card details to settle the transaction in just a minute or two.

Subscription providers, e-commerce sites, and marketing ad wallets generally have cards as the preferred payment method.

One-time purchases

Instead of sending cash or setting up bank transfers for one-time vendor and contractor purchases, use your Volopay business prepaid card to make payments easy.

No need to get your vendor’s account details—pay through a vendor portal with your card!

Your expertise, your card, your perks: Customized for every professional

CFOs

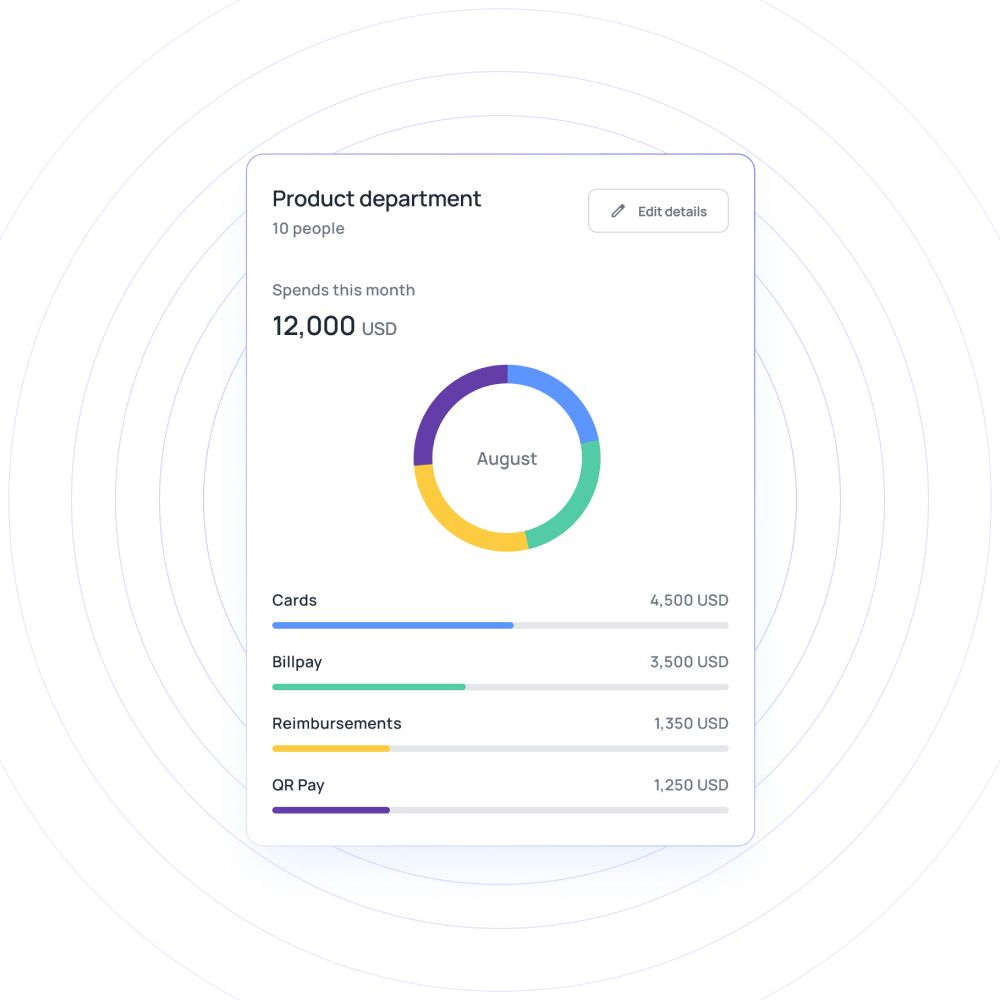

Volopay’s business prepaid cards provide CFOs with real-time visibility into company expenses, enhancing overall financial oversight.

Automated expense reporting simplifies reconciliation processes, saving valuable time on manual accounting tasks.

CFOs can set custom spending limits on each prepaid business debit card, ensuring controlled and efficient cash flow management.

CTOs

Prepaid business cards give CTOs centralized control over software subscriptions and technology-related purchases.

Instant transaction notifications help track team expenditures on essential IT tools and services.

Volopay’s prepaid business cards allow for customizable spending limits, offering CTOs increased flexibility in managing dynamic project budgets and adapting to changing financial needs.

Accountants

Prepaid business debit cards integrate seamlessly with existing accounting systems, automating the data entry process.

Accountants benefit from real-time expense tracking, ensuring accurate and up-to-date financial records. Thereby, reducing manual errors and processes.

By using prepaid business cards, streamlined reconciliation processes accelerate overall financial reporting, thereby boosting efficiency.

Marketing managers

Volopay’s prepaid business cards simplify managing campaign budgets, vendor payments, and advertising expenses.

Real-time insights enable quick adjustments to marketing spend for better optimization.

Marketing managers can easily assign individual employee debit cards to each team member, maintaining control over campaign-specific budgets and ensuring spending aligns with marketing strategies.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Volopay prepaid cards: fueling growth from startups to enterprises

Volopay’s prepaid business cards empower startups by providing real-time visibility and automated expense tracking.

With flexible spending limits and instant employee debit card issuance, startups can effectively maintain tight control over their cash flow while focusing on scaling their operations and pursuing new growth opportunities.

Small businesses benefit from Volopay’s prepaid business debit card, which simplifies daily expense management.

The business prepaid cards offer streamlined approvals and seamless accounting integrations, reducing manual processes and improving operational efficiency, allowing small businesses to focus more on core activities.

For large enterprises, Volopay’s business prepaid cards provide advanced spend control and multi-level approval workflows.

Comprehensive analytics and custom reporting features make managing complex financial operations easier and more efficient. Thereby, helping enterprises make informed decisions and optimize budget allocation.

Recognized as a leader in financial management

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our business prepaid cards

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Real-time expense reporting

Design your expense reporting system so that you get to know where, when, and why of every spend.

Multi-level approvals

Rewrite your company's spending policy and establish precise approval workflows to handle staff spending, payments, and fund requests.

Accounting automation

Safeguard your accounting structure—from card swipe to closed books—with world's fastest accounting integrations with direct integrations and real-time sync.

Explore more about business prepaid cards

Learn how corporate cards simplify expenses and boost financial control for businesses.

Discover how virtual corporate cards streamline payments and enhance security for your business.

Find out how corporate credit cards simplify expense tracking and improve overall business efficiency.

Bring Volopay to your business

Get started now

FAQs on prepaid cards

Yes. Prepaid cards work similarly to a business debit card, allowing you to withdraw funds at an ATM when needed.

If your business is registered as a limited liability company, you’ll be able to sign up and start using the Volopay platform. The application process only requires a few documents and has a short waiting period.

Once you’ve been onboarded, you can easily order your prepaid cards.

We take your data security very seriously. Volopay has industry-standard certifications and security measures to protect your information.

If a card is compromised, you can immediately freeze and block it to prevent misuse.

We are transparent with our fees. There are no hidden fees associated with your Volopay prepaid cards. Any charges that may incur in the future will be communicated to you.

Yes, Volopay’s prepaid business cards can be used globally, supporting international transactions and purchases while offering real-time expense tracking in multiple currencies.

Yes, you can manage your prepaid business cards on the go with Volopay’s mobile app, which offers full functionality for tracking expenses, loading funds, and more.

Yes, you can link and manage multiple prepaid business debit cards under one Volopay account, simplifying expense management across your entire team or department.

Volopay’s business prepaid cards are intended for direct business expenses rather than employee reimbursements, offering real-time spending control and transaction tracking.

Funds can be easily reloaded onto your business prepaid debit card through the Volopay platform, either manually or via scheduled transfers from linked accounts.

Volopay offers 24/7 customer support for businesses using prepaid business cards, along with dedicated account managers and comprehensive online resources for troubleshooting and assistance.