Expense management software made easy, fast and safe

Digitalize and automate your financial processes with Volopay's software for expense management, giving you control over your business expenses while freeing your teams to do their best!

Smart corporate cards

Stop wasting hours trying to approve expense claims. Use Volopay cards instead. The employee swipes the card and the expense is fully coded and synced into the accounting system.

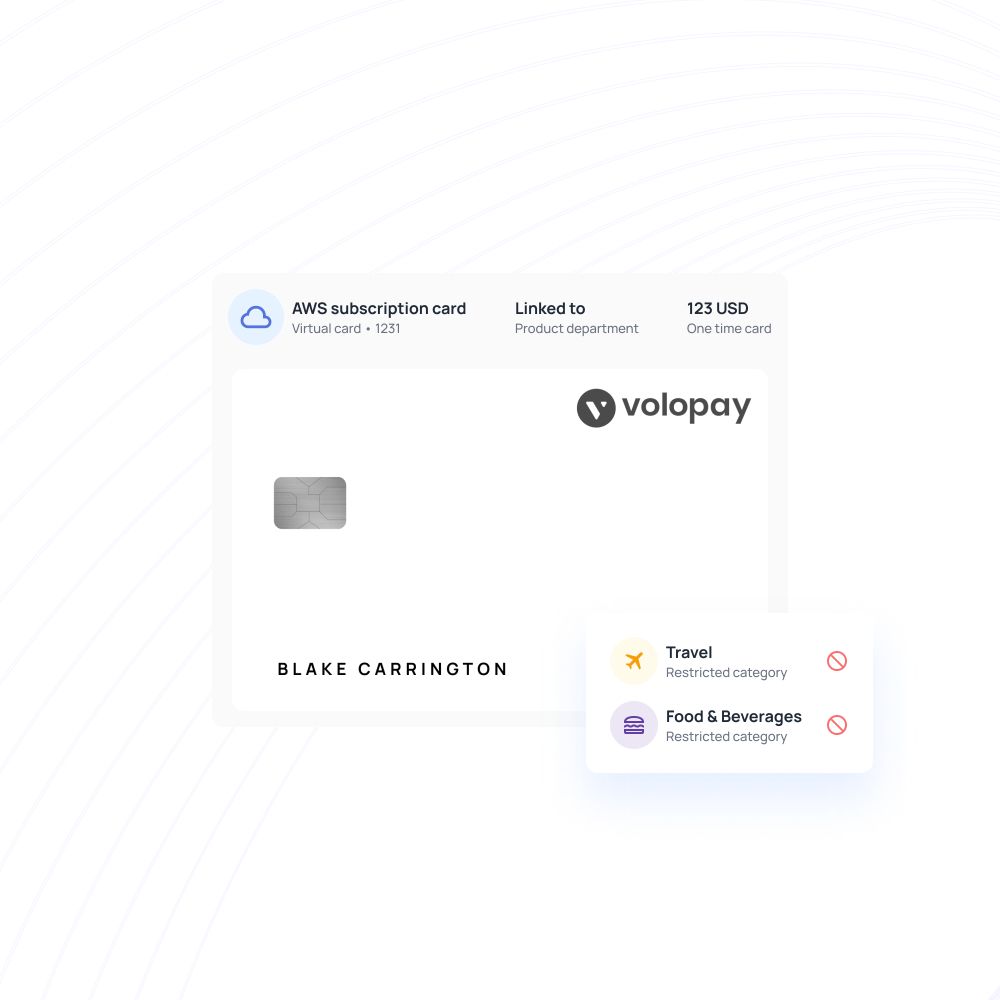

Instant virtual cards

Create virtual cards with unique numbers to use for online payments. Create a separate card for each subscription/online payment, set a limit on each card, and freeze or block cards at your convenience.

Physical cards

Issue customized physical cards to your traveling employees. With built-in expenditure rules, you can keep track of every payment, limit specific merchants and amounts, and link spends to any department or project.

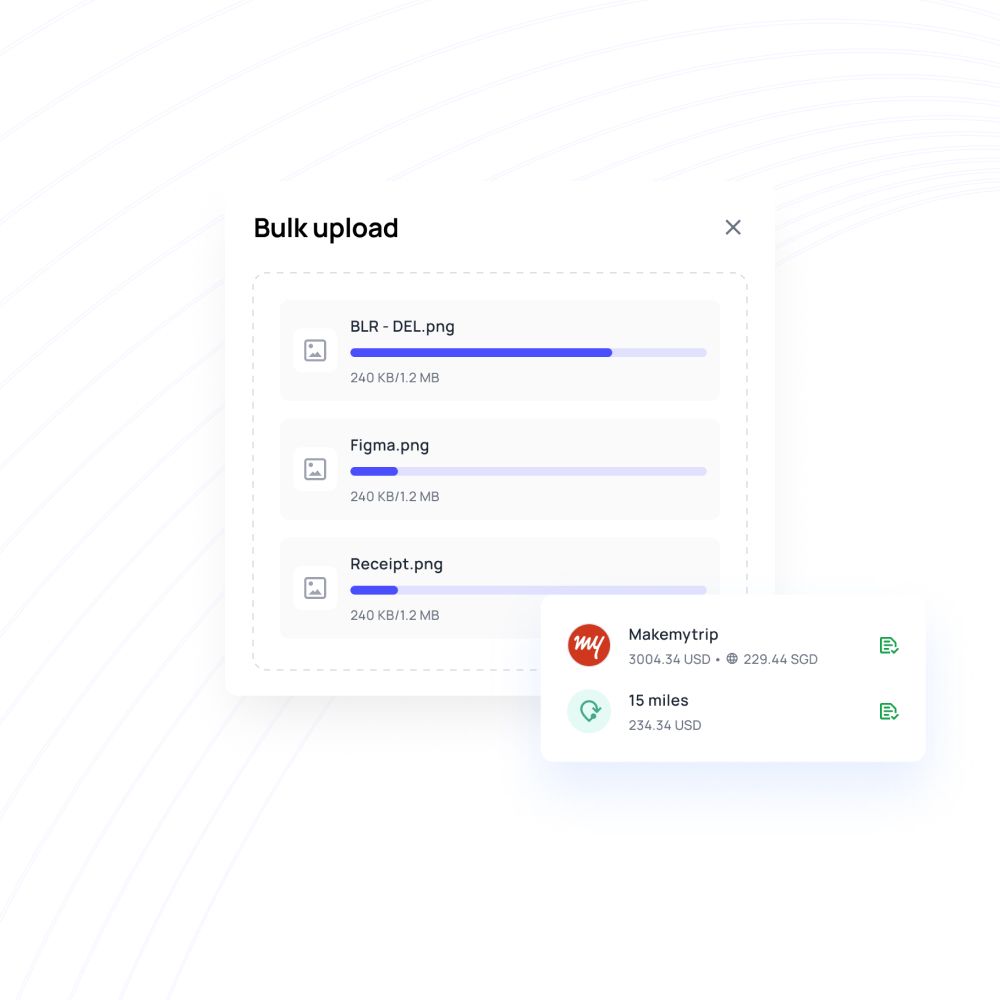

Out-of-pocket expenses

Had to make a business payment from your own pocket? Manage reimbursements efficiently through Volopay's employee expense management software. Submit reimbursement claims for incidentals, cash, mileage—any business expense that didn't make it onto a Volopay card—in seconds.

Attach receipts, clarify expenses using the comments section, and streamline approvals. Reimburse your employees directly to their bank account with a single click.

Virtual cards for subscriptions

Generate instant virtual cards for secure online payments, and eliminate risks by using virtual corporate cards that aren’t linked to your company’s bank account.

Create burner cards for one-time payments and recurring cards to manage all your online subscriptions from a single dashboard. Keep track of SaaS payments to avoid forgotten subscriptions and double payments from multiple teams.

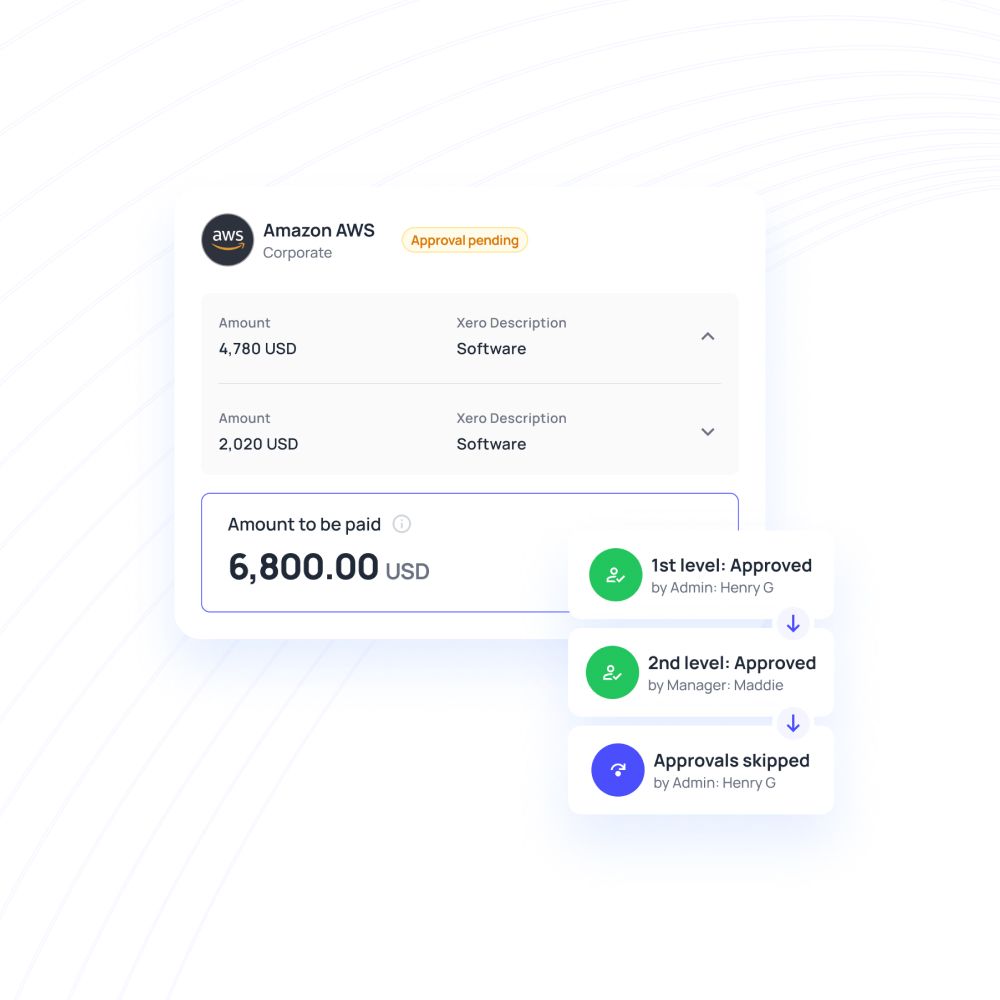

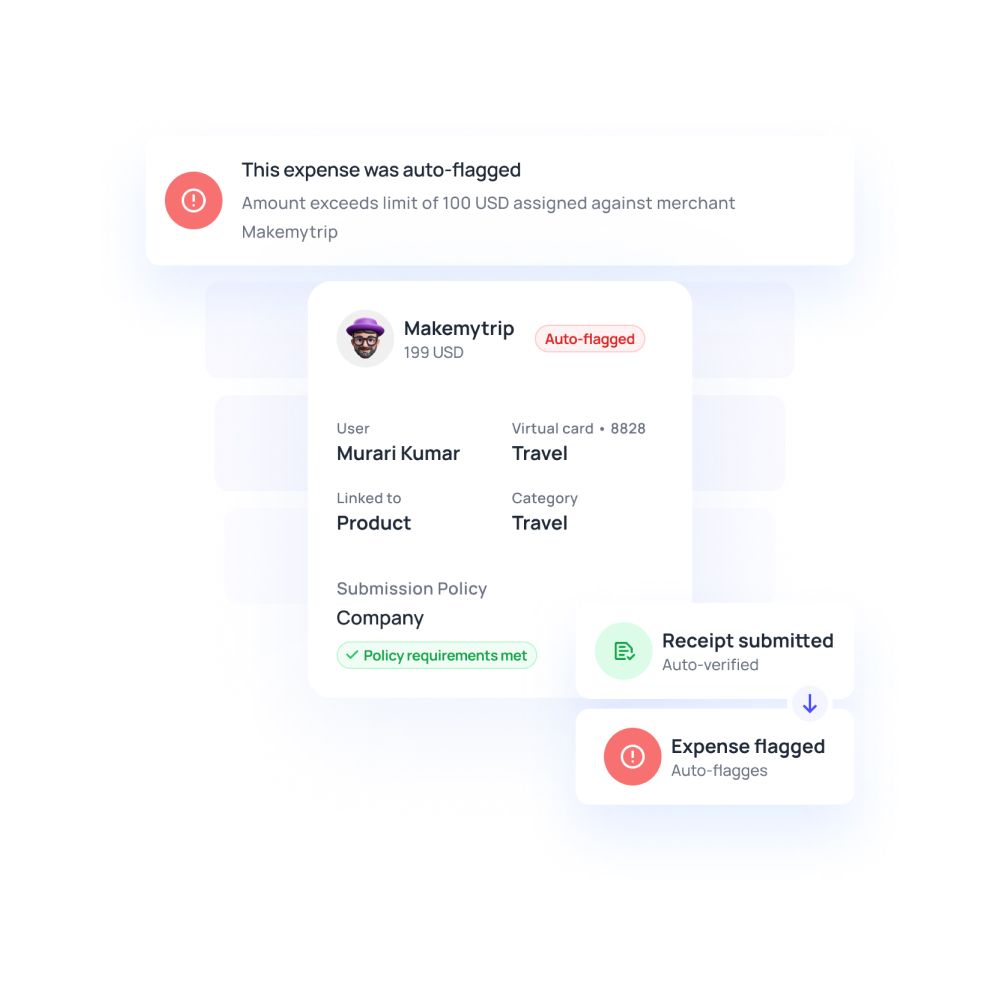

Set advanced multi-level approvals

Easily design custom approval workflows using Volopay's software for expense management to automatically route them to one or more approvers in any order. Approval workflows allow certain merchants to be auto-blocked and let you set payment thresholds to control overspending.

Create department- and project-specific policy flows. When decision-makers are absent, create workflows that automatically move to next-in-line.

Effortless expense management at your fingertips!

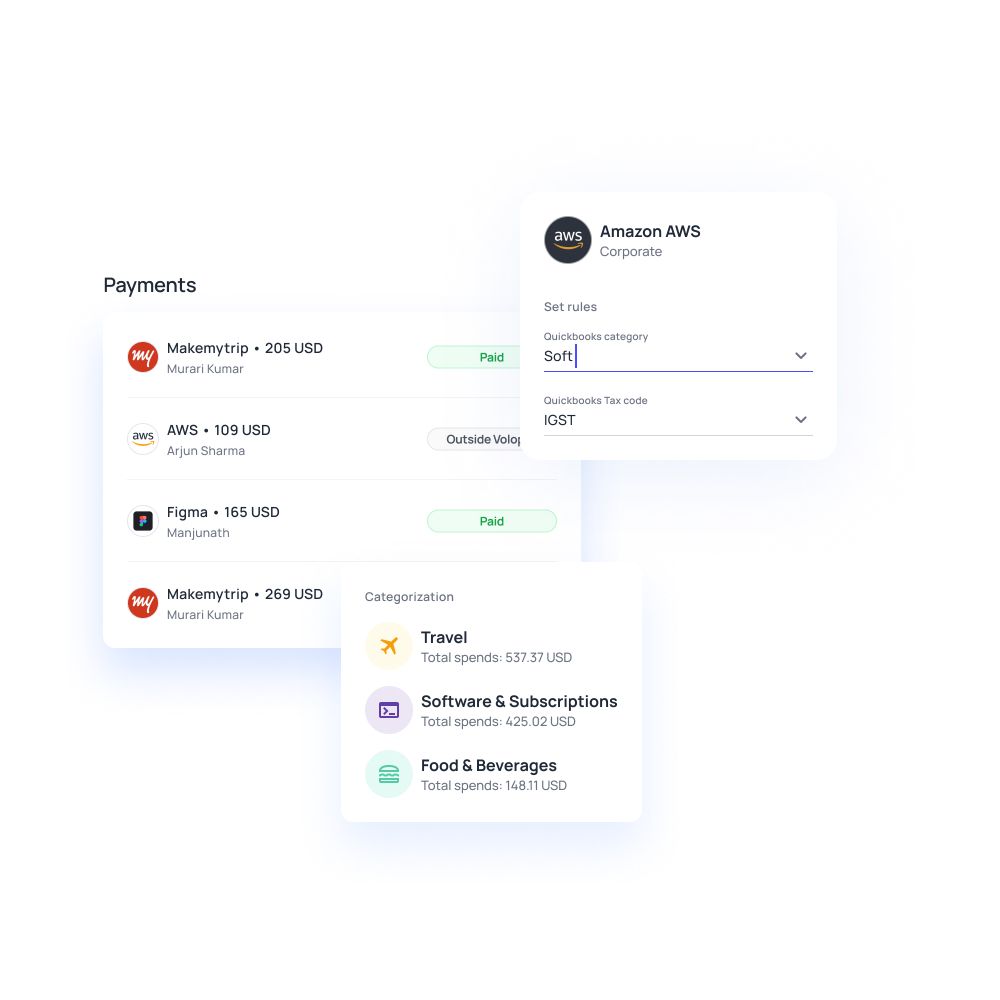

Track spending in real-time

For every transaction that happens, you get to know the where, when, and why of the spend. This introduces a whole new level of spend transparency in your business.

Push notifications alert users and managers of transactions made, and payments can be approved and scheduled in advance. Use the mobile app to scan and upload receipts or invoices on the go.

Control spend before it happens

Leverage precise controls to eliminate out-of-policy expenses with corporate expense management software. Create default company-wide policies, as well as customizable policies for specific departments and budgets. Set spending rules so that your smart corporate cards automatically decline any transactions that don't follow them.

Create approval workflows so that some merchants can be blocked, or so that only some merchants are allowed. Even set thresholds and policies for reimbursement claims to manage employee expenses.

Spend smarter with proactive control

Secure your company funds by enabling a multi-level approval policy over every card that you issue to your employees, utilizing employee expense management software. Employees can request funds on the go and approvers can approve or deny them immediately with a click of a button.

Vendor payments made through the wallet can also be monitored through a thorough maker-checker policy for complete compliance.

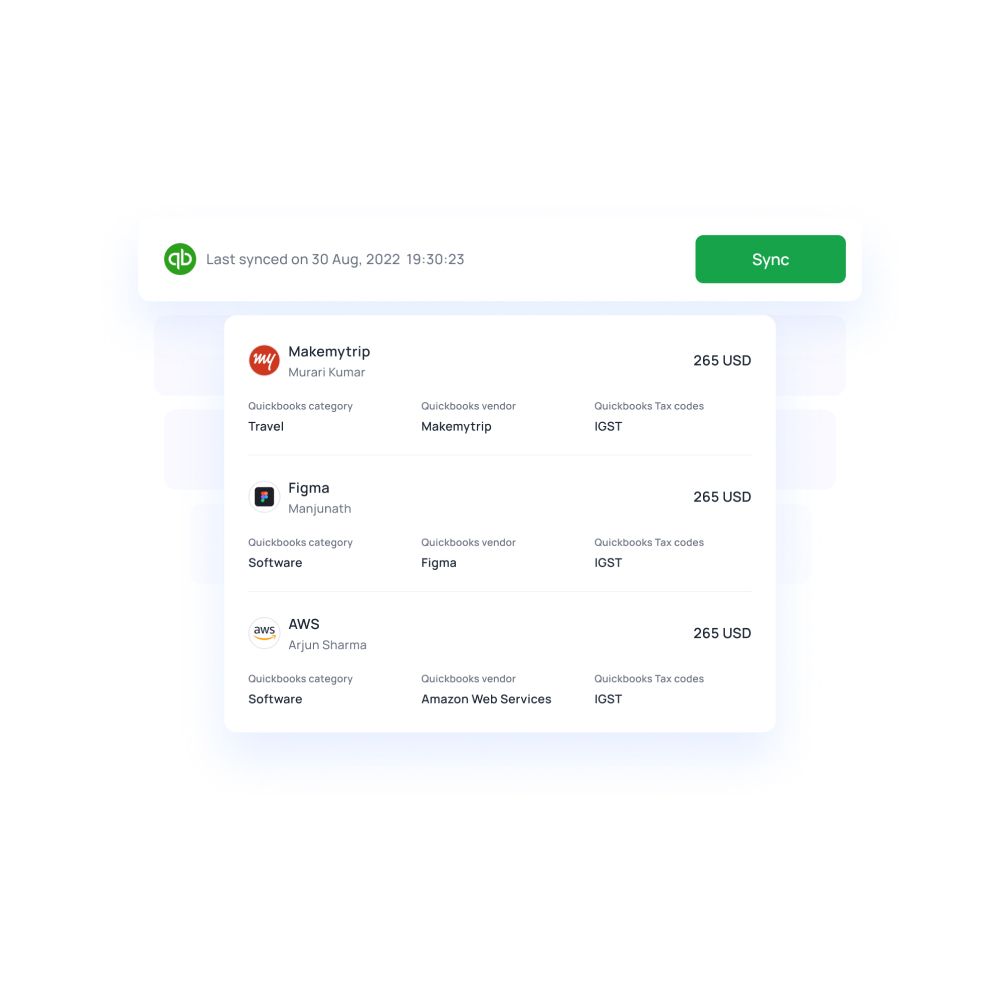

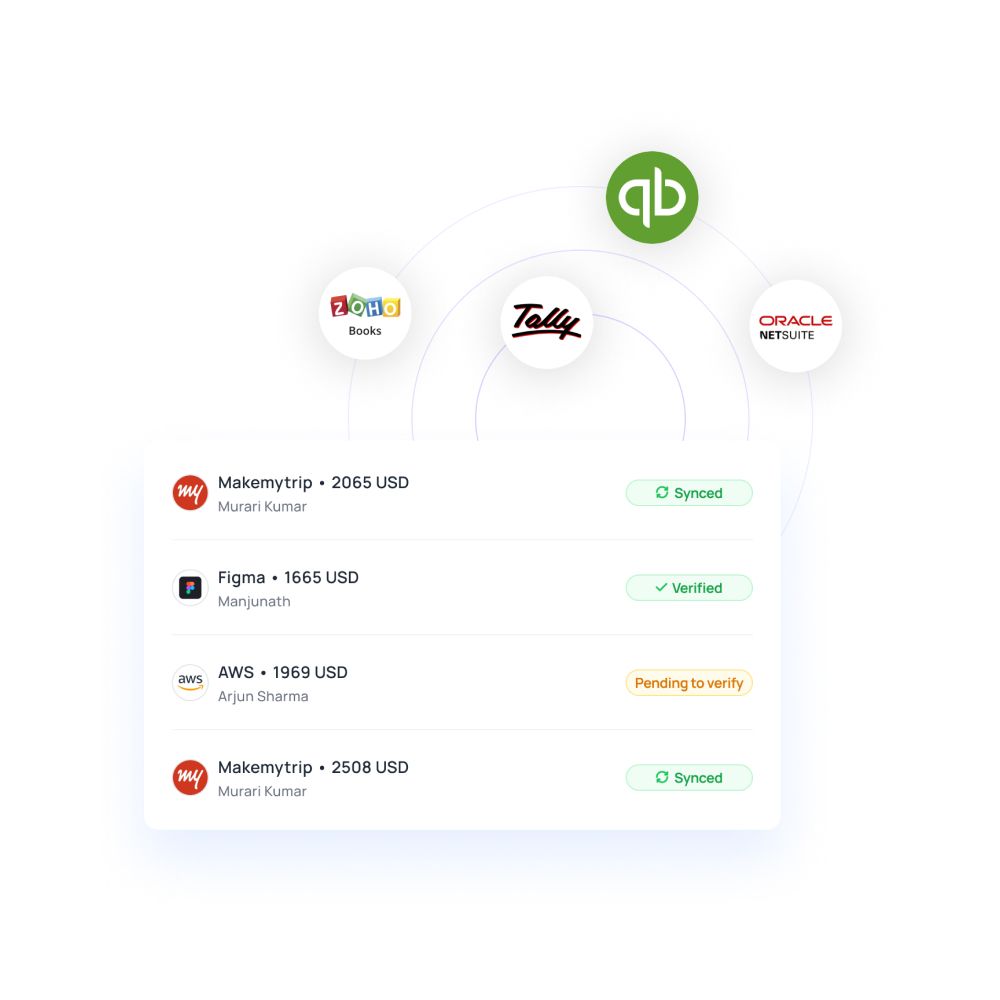

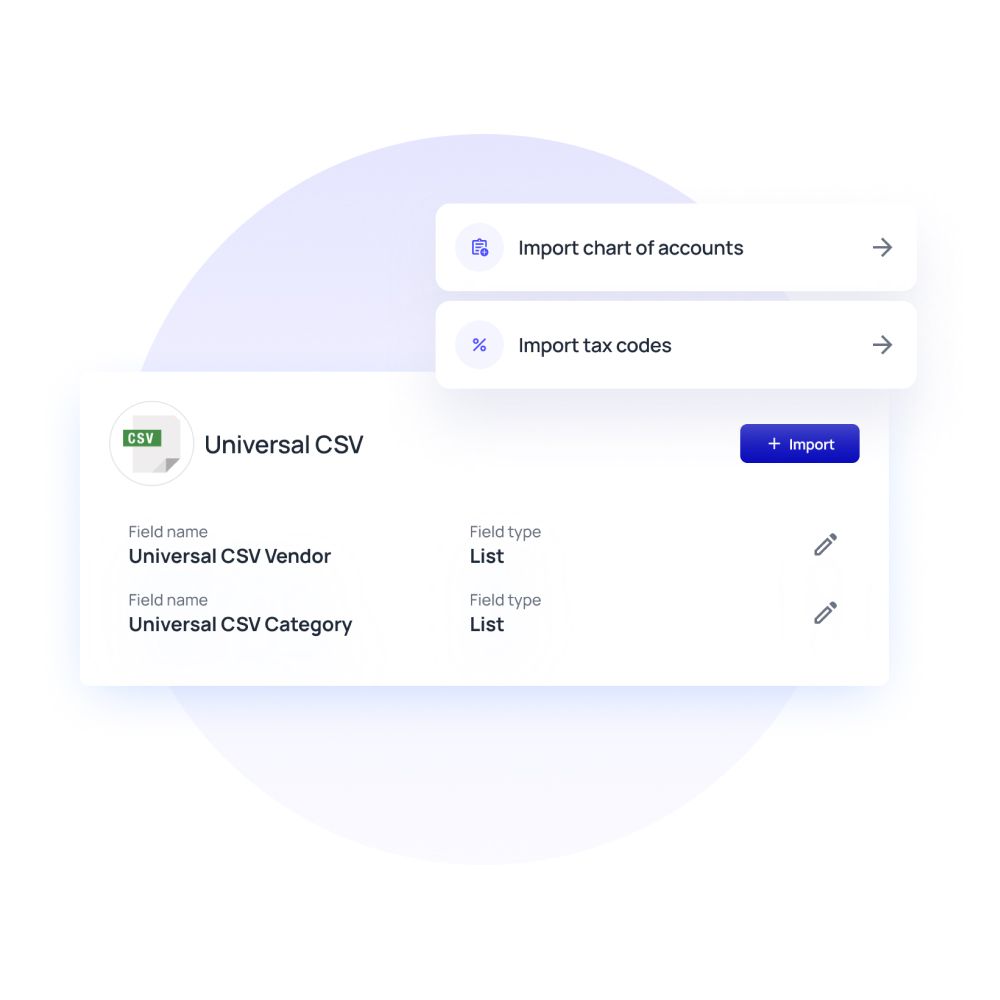

Seamless accounting software integration

Volopay’s corporate expense management software enables hassle-free integration with leading accounting software. With real-time data synchronization, this connection removes the need for manual entries, lowering the chances of errors.

By automating the flow of financial information, you can keep your records up to date with minimal effort. It’s a simple way to streamline your accounting processes while maintaining accurate financial data across systems.

Automate your business expense management with Volopay

Automated reconciliation for financial accuracy

Achieve unparalleled financial accuracy with our automated reconciliation feature. Volopay’s expense management system ensures that every expense is matched against bank statements and receipts, providing you with instant visibility into discrepancies.

This corporate expense management automation not only saves time but also reduces the likelihood of financial errors, giving you peace of mind. With accurate reconciliations, you can make informed decisions based on reliable financial data.

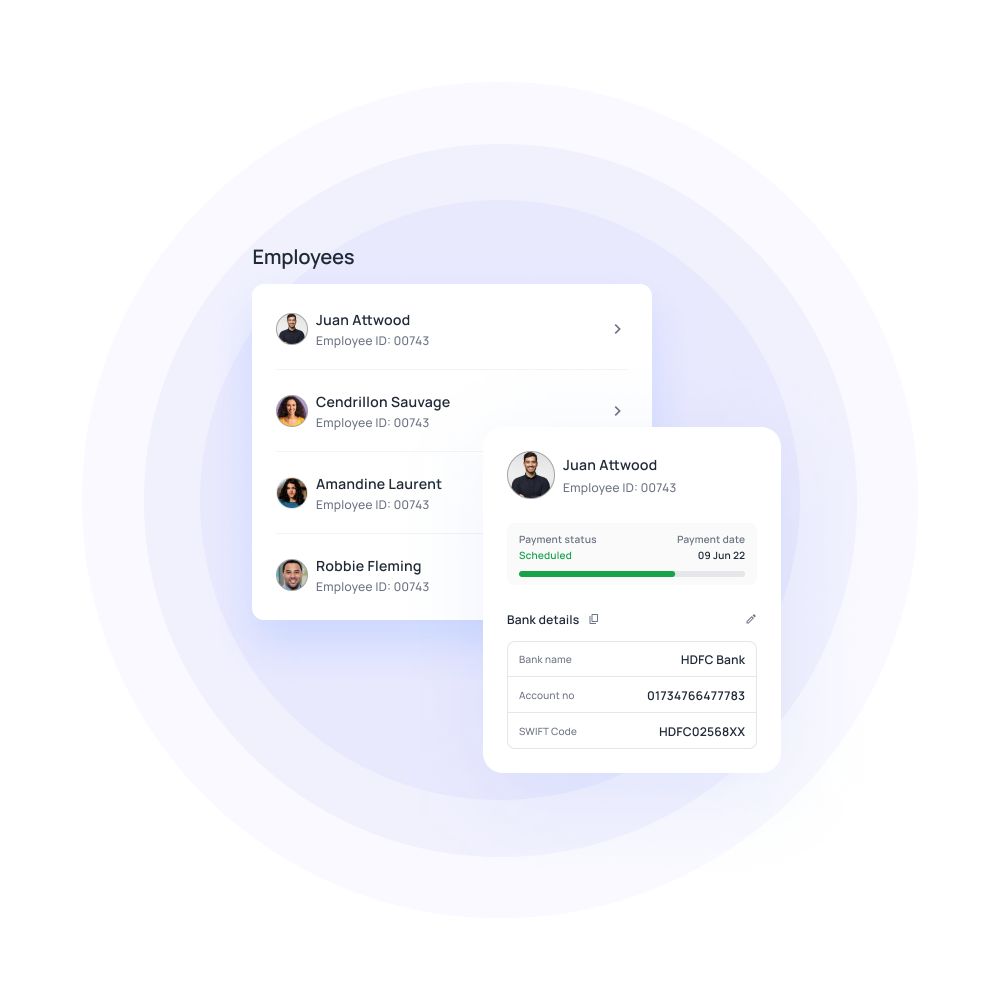

Simplified payroll management

Volopay's corporate expense management software simplifies payroll management by automating the tracking of employee expenses, ensuring accurate and prompt payroll execution.

The system's integration of expense data into the payroll process guarantees compliance and lightens administrative tasks. This streamlining allows your team to dedicate more time to strategic activities that drive business expansion.

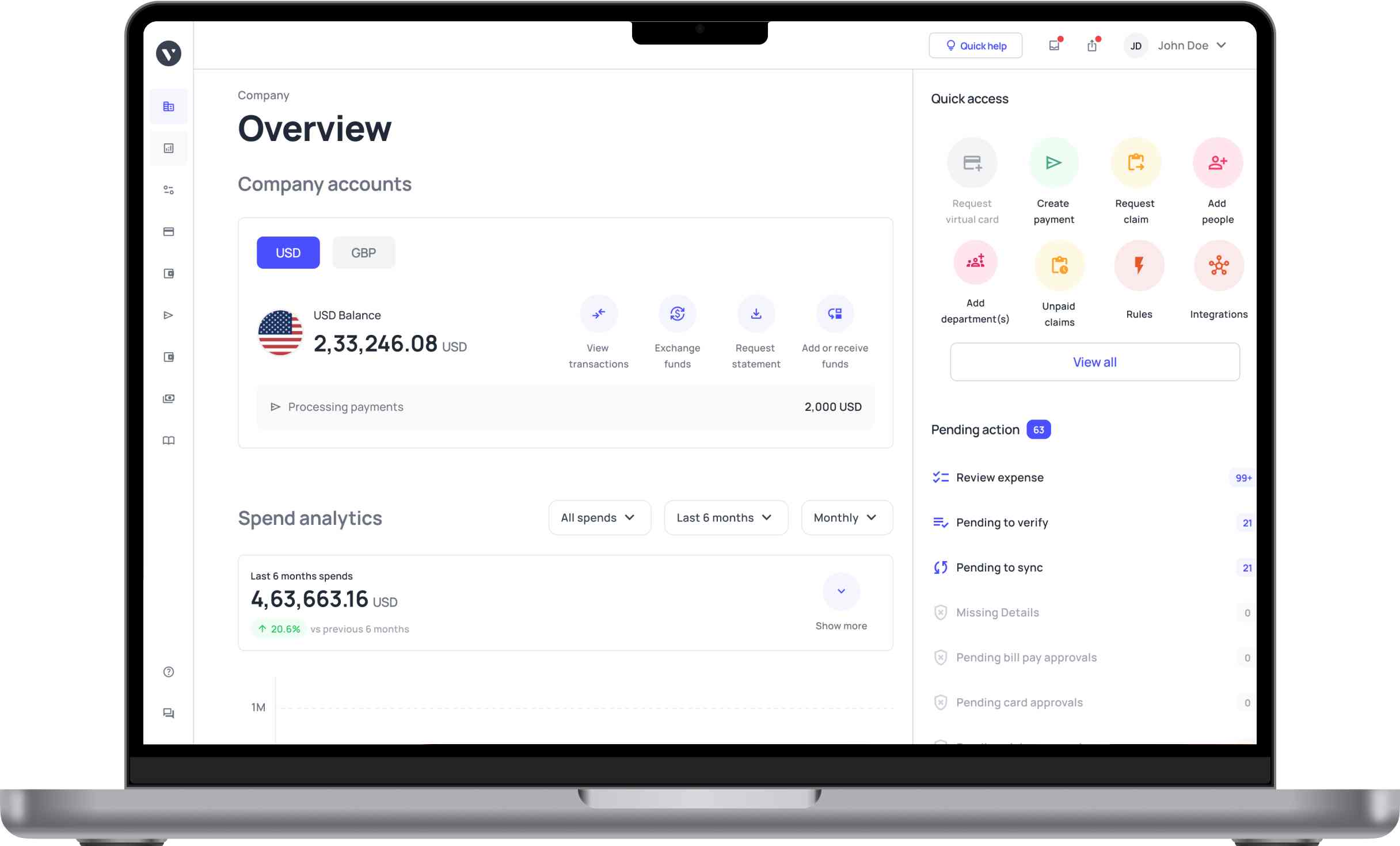

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

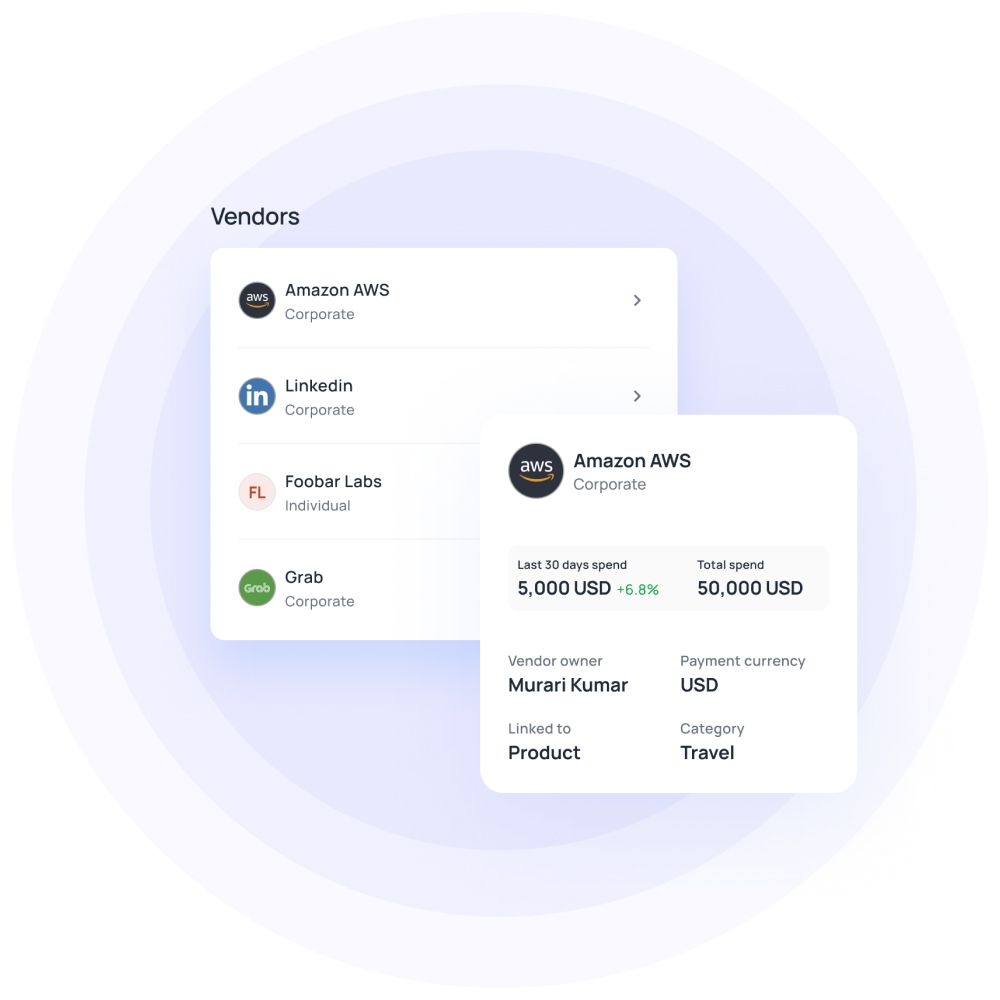

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Flexible expense management solutions for every business size

For startups, Volopay's expense management system greatly simplifies expense tracking and budgeting, allowing founders to maintain better control over their limited resources and finances.

Our automated systems help eliminate tedious manual work, thereby freeing up valuable time for teams to focus on sustainable growth and strategic initiatives.

With expense management software for small businesses, companies can streamline approval workflows and gain real-time visibility into spending.

Volopay’s user-friendly business expense management software interface ensures that teams can effectively manage expenses without needing complex setups, helping them reduce costs and improve cash flow.

Large enterprises can benefit from advanced features offered by corporate expense management software, including multi-level approval systems, seamless integration with accounting tools, and detailed analytics for comprehensive financial insights.

Volopay supports global teams with customizable policies, ensuring compliance and financial control across departments.

Real-time expense tracking for complete financial transparency

Track expenses instantly across teams

Track expenses instantly across teams with an expense management system.

Whether it’s a small team or a large organization, Volopay provides immediate and comprehensive visibility into all expenses, ensuring that every transaction is captured the moment it happens.

Instant expense alerts for every transaction

Stay on top of your finances with instant alerts for every transaction.

Volopay promptly notifies you in real time whenever a team member makes an expense, giving you immediate insights into spending patterns and effectively preventing any unauthorized or unexpected charges.

Budget control with live data

Manage your budgets more effectively with live financial data.

Volopay’s corporate expense management software offers up-to-date insights into how much of your allocated budget has been spent, allowing you to adjust spending plans and avoid overshooting financial limits.

Approval policies to simplify reimbursement and expense approval

Pre-approval expense policy

Implement a pre-approval policy to guarantee that expenses are sanctioned before being incurred. Employees can forward expense requests, and managers have the authority to approve these requests beforehand, confirming that expenditures are consistent with company budgets and policies.

Auto-approval expense policy

For smaller or recurring expenses, Volopay’s auto-approval policy allows certain transactions to be automatically approved based on predefined criteria. This saves time by removing the need for manual intervention for low-value or routine expenses, while still maintaining control over spending limits.

Multi-level approval policy

Large organizations can benefit from a multi-level approval process, where expenses pass through several levels of authorization based on the company’s hierarchy. This ensures that large or critical expenses receive appropriate scrutiny from higher-level decision-makers, promoting accountability at every stage. Utilizing effective software for expense management enhances this process, ensuring comprehensive oversight and control.

Maker-checker policy

The maker-checker policy ensures that no single person has full control over an expense. One employee (the maker) submits the expense, and another (the checker) verifies and approves it, safeguarding against errors and fraudulent activity.

Seamless expense management at your fingertips!

Why choose Volopay’s corporate expense management software?

Faster reimbursements with minimal manual effort

Volopay speeds up the reimbursement process by automating expense submission and approvals. Employees can submit receipts and track reimbursements in real time, while finance teams process claims quickly with minimal manual input.

This automation significantly reduces paperwork and completely eliminates delays, ensuring your employees get reimbursed much faster.

Expense management tailored for global operations

For businesses with international operations, Volopay’s platform is built to handle multi-currency transactions, cross-border payments, and regional tax regulations.

No matter where your teams are based, you can effortlessly track and manage global expenses seamlessly, keeping all your financial data consolidated securely in one place.

Dedicated support for smooth onboarding experience

Volopay offers personalized onboarding support to ensure a smooth transition to the platform.

Our dedicated team assists with setup, training, and ongoing support to help your business make the most of its expense management solution.

Simplified expense reporting for smarter decisions

Generate detailed reports with just a few clicks. Volopay’s corporate expense management software delivers insightful analytics, helping you track spending trends and make data-driven financial decisions. Simplified reporting also improves compliance and reduces audit risks.

Custom approval policies tailored to your needs

Volopay's business expense management software allows businesses to customize approval workflows to fit their internal processes.

Whether you need pre-approval, multi-level approvals, or auto-approvals for specific transactions, Volopay ensures that every expense aligns with your company’s policy.

Full control over corporate spend in one dashboard

Volopay’s corporate expense management software provides complete visibility over your company’s expenses in real-time.

You can effortlessly monitor spending patterns, set budgets, and enforce strict spending limits, ensuring full control over corporate expenses across all teams and departments.

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Multi-level approvals

With Volopay’s customizable multi-level approval system, you can ensure that expenses are properly vetted. This feature allows you to set up multiple layers of approval based on expense value, department, or specific team members, ensuring accountability and compliance at every level.

Employee reimbursement

Volopay simplifies employee reimbursements by automating the entire process. Employees can easily submit expenses through the platform, while managers can approve or reject them with a single click. This reduces manual effort and ensures that reimbursements are processed quickly and accurately.

Subscription management

Keep track of all your business subscriptions in one place with Volopay’s subscription management feature. You can monitor recurring payments, avoid unnecessary charges, and ensure that all subscriptions are aligned with your company’s budget.

Real-time visibility

Volopay provides real-time visibility into your corporate spending, allowing you to monitor transactions as they happen. With instant access to expense data, you can make informed financial decisions and avoid overspending.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

ParallelDots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Bring Volopay to your business

Get started now

FAQs

Volopay provides real-time data and analytics, allowing businesses to monitor spending trends and forecast future expenses. With customizable budgets and instant insights, companies can allocate funds efficiently and make data-driven decisions to maintain financial health.

Yes, Volopay supports multi-currency transactions and cross-border payments, making it easy to manage international expenses. Its corporate expense management software accommodates different currencies and tax regulations, ensuring seamless global expense management for businesses operating in multiple regions.

Volopay provides strong security measures such as two-factor authentication, encryption of data storage, and access controls based on permissions. These safeguards protect sensitive financial information, ensuring access is limited to authorized individuals and upholding stringent security and compliance standards.

Yes, Volopay provides real-time tracking of employee expenses, giving managers immediate visibility into spending. This allows businesses to monitor transactions as they occur, ensuring accurate financial control and preventing any unauthorized or unapproved expenses.

Volopay enables companies to set custom approval workflows, spending limits, and expense categories, ensuring every transaction aligns with corporate policies. Automated alerts and real-time tracking further enhance compliance, reducing the risk of policy violations or overspending.

Volopay simplifies vendor payments by enabling businesses to pay suppliers directly from the platform. With automated payment schedules and integration with accounting systems, it ensures timely, accurate payments while tracking all transactions for easy reconciliation.

Volopay’s expense management software allows businesses to customize approval workflows, including pre-approvals, multi-level approvals, auto-approvals for specific transactions, and maker-checker systems. This flexibility ensures that expenses go through the appropriate channels before being approved or reimbursed.

Yes, Volopay offers a user-friendly mobile app, allowing employees to submit expenses, upload receipts, and track spending on the go. Managers can also approve or reject expenses in real-time, ensuring smooth expense management from anywhere.

Employees can receive reimbursements quickly through Volopay's employee expense management software, which features an automated approval process and instant expense submission. Once approved, reimbursements are processed efficiently, reducing delays and ensuring employees are reimbursed in a timely manner.

Volopay's business expense management software offers a straightforward setup process, supported by a dedicated onboarding team. The platform provides seamless integration with current systems and user-friendly interfaces, ensuring that businesses can adopt it with minimal technical difficulties.