Volopay corporate card for modern businesses

Say goodbye to complicated expense tracking and slow payment methods. Introduce Volopay’s corporate expense card feature to your business for easier payments.

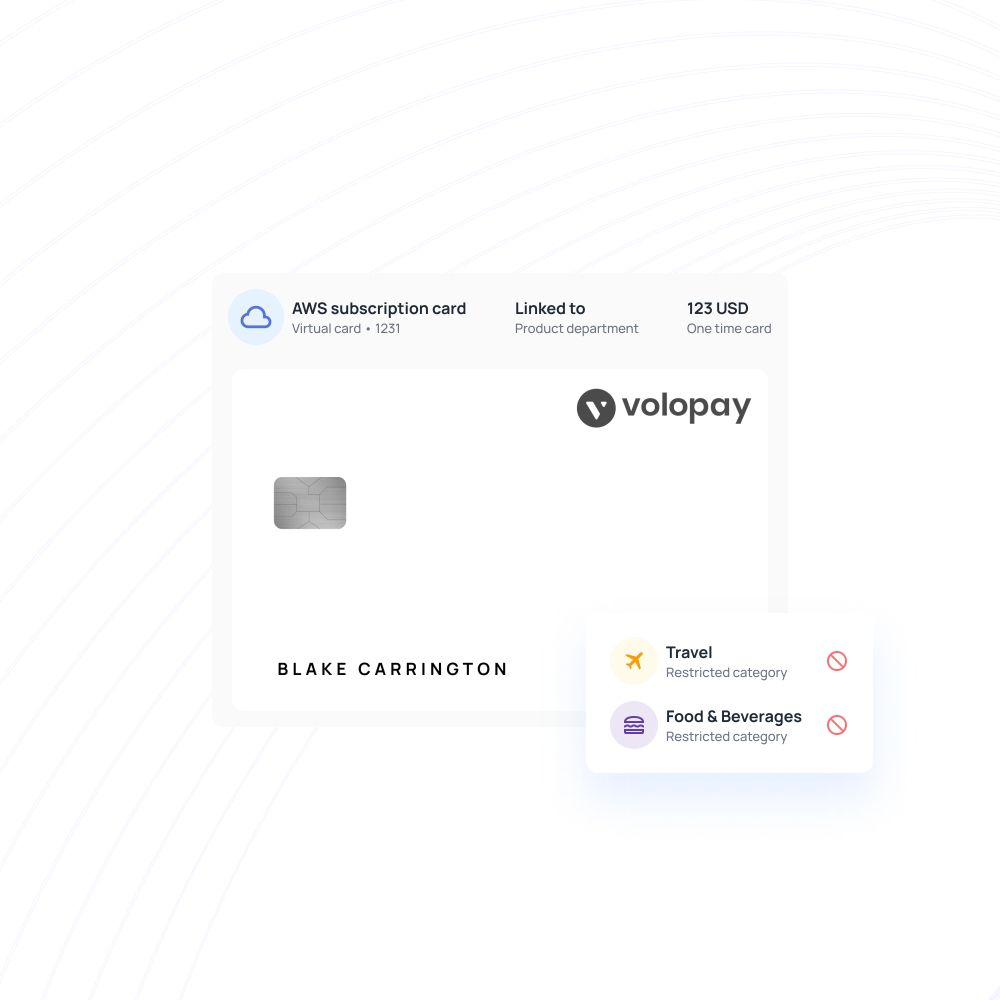

Get customizable spend limits, automated expense reporting, real-time tracking, and better budgeting with corporate cards. A combination of physical and virtual cards will take care of all your expenses—whether they are for business travel, subscriptions, online shopping, and so much more.

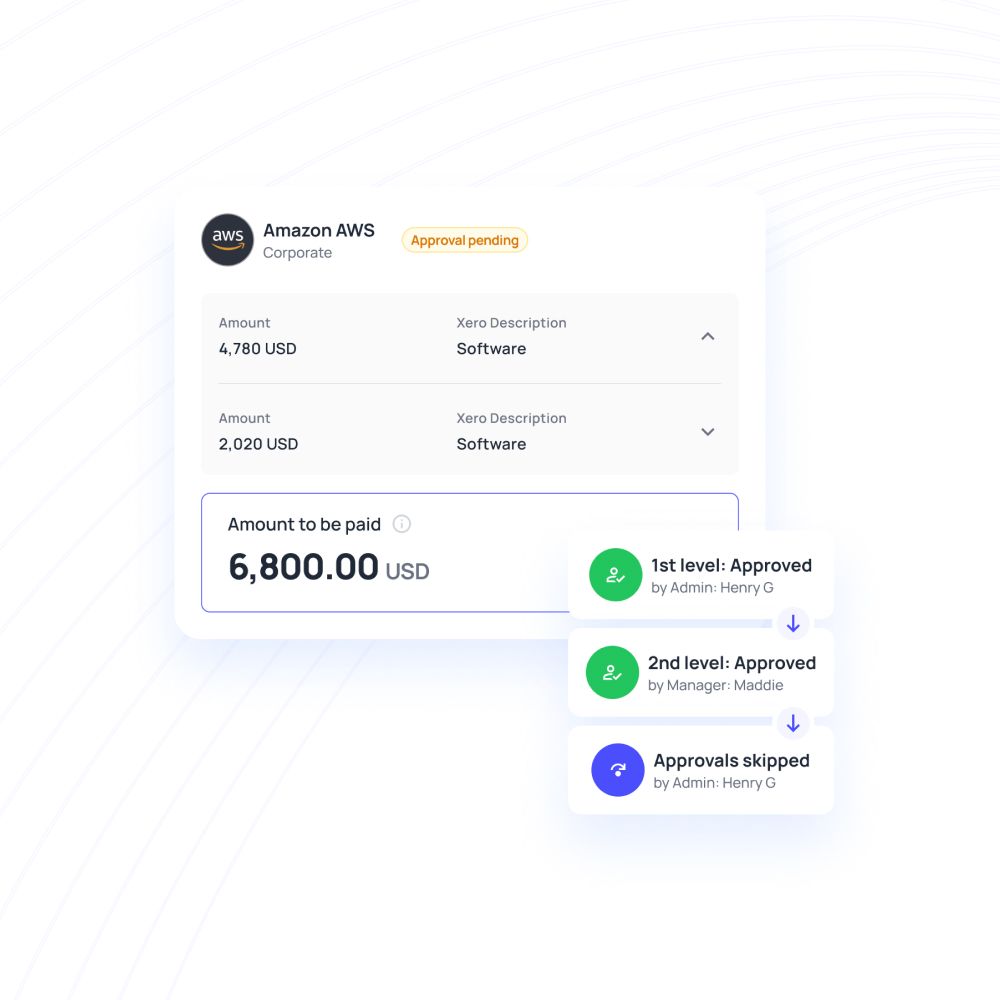

Smarter spending with approvals

No need to worry about going over your budget when you use corporate expense cards. Volopay’s corporate card for startups allows you to implement your approval workflows for better accountability.

All expenses made with corporate expense cards will be automatically reflected on your platform. Quickly fill expense reports through a mobile app. With automated non-compliant expense flagging, robust card management features, and the ability to start discussion threads, every expense is guaranteed to be accounted for.

Easy and faster payments

All it takes is a swipe of your card to make payments when you use a Volopay corporate card. There’s no need to play the waiting game with approval delays with pre-approved spending limits built into the corporate expense cards you issue.

Get expense alerts whenever a transaction is made. Say goodbye to complicated reimbursement processes and allow your employees to make business expenses without all the hassle.

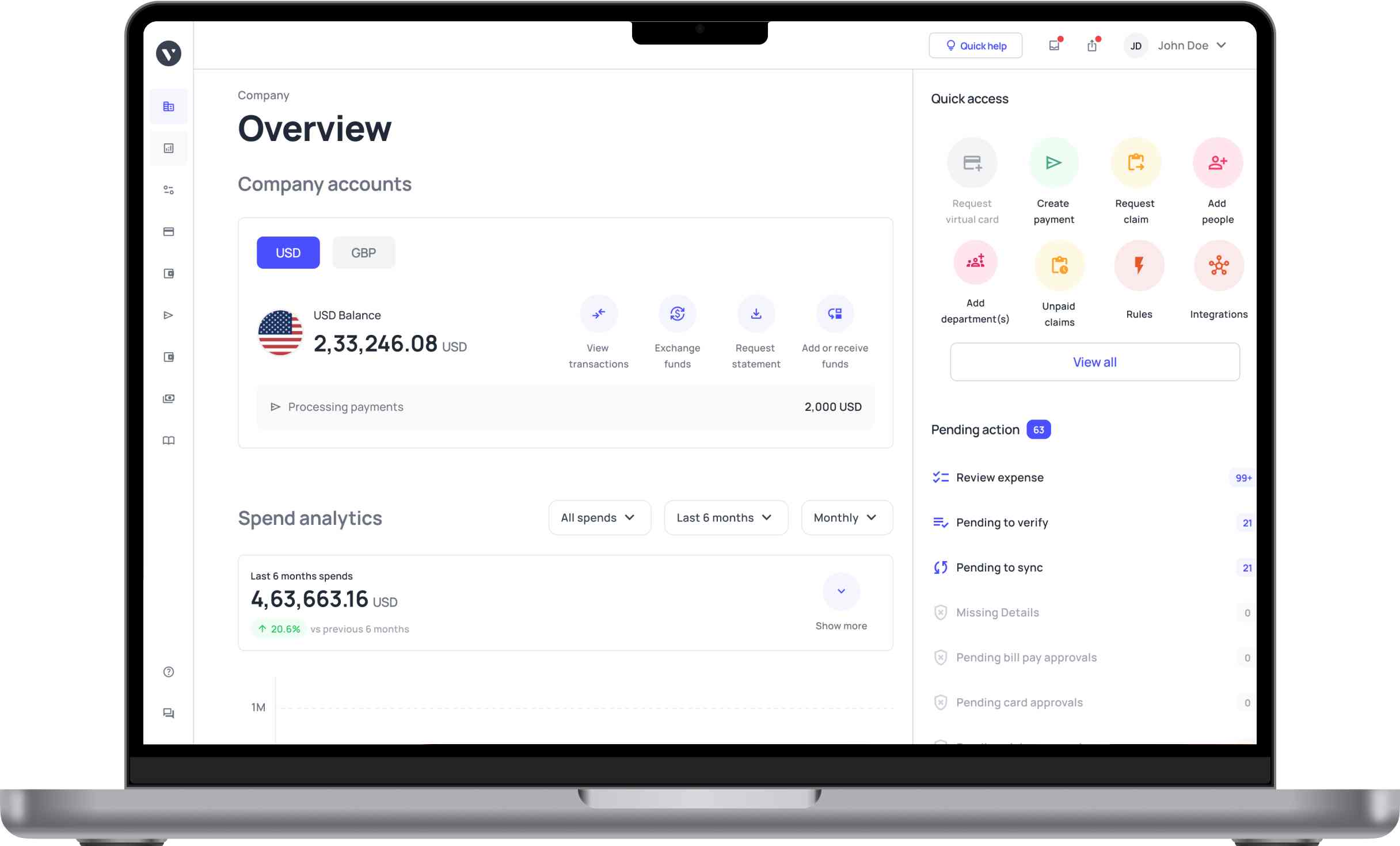

Track expenses in real-time

Worried about a lack of expense visibility? Using a corporate card for startups will fix that. All expenses made on a corporate card will be automatically reflected in your Volopay dashboard.

Expenses can also be auto-approved when they’re made at particular merchants and comply with all preexisting policies. Link cards with the appropriate department or project. Unexpected or unauthorized purchases are no longer a problem when employee expenses have transparency and accountability.

Perfect corporate card solution for your business!

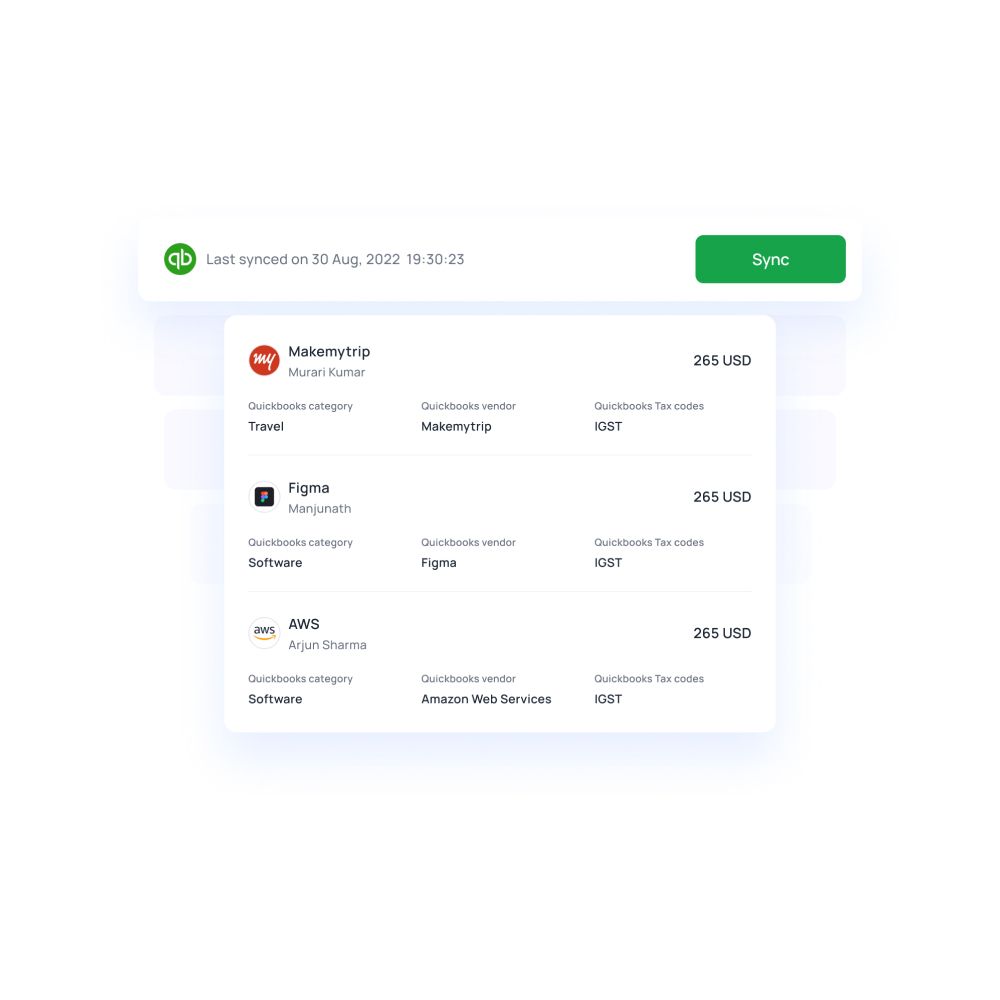

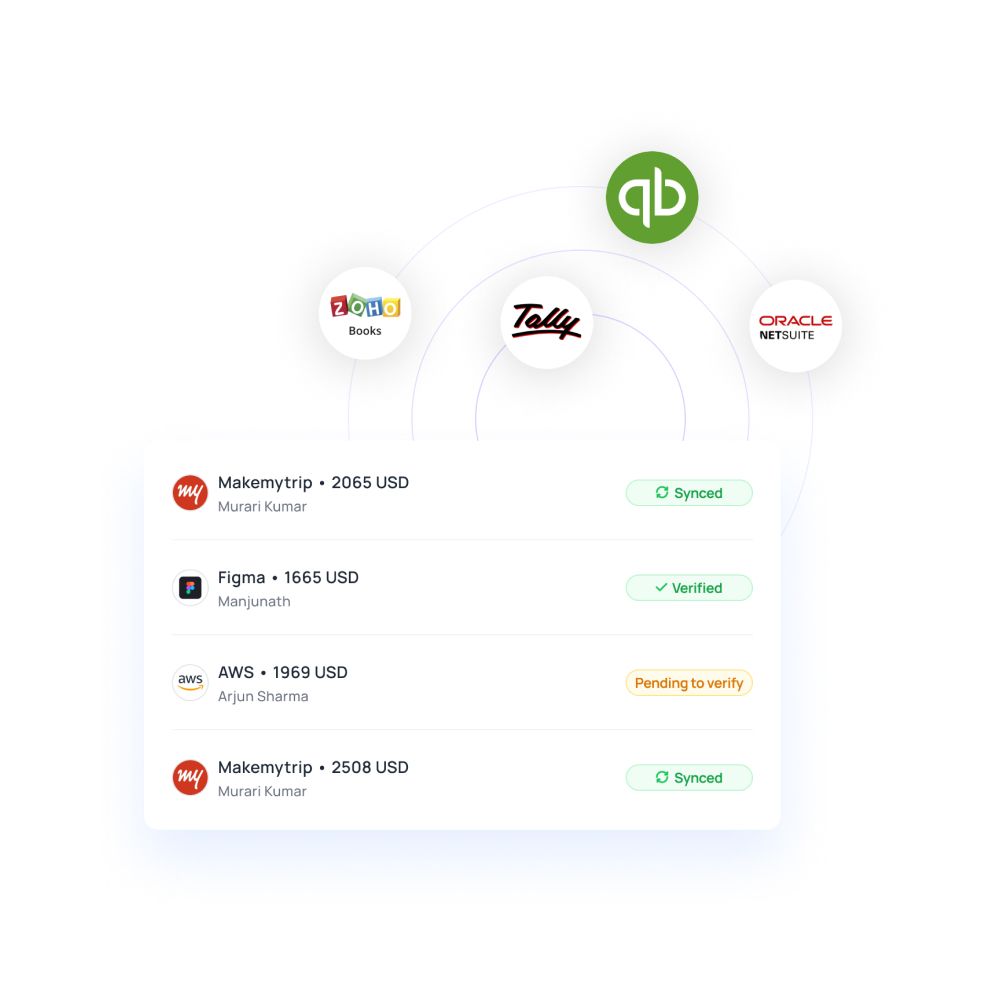

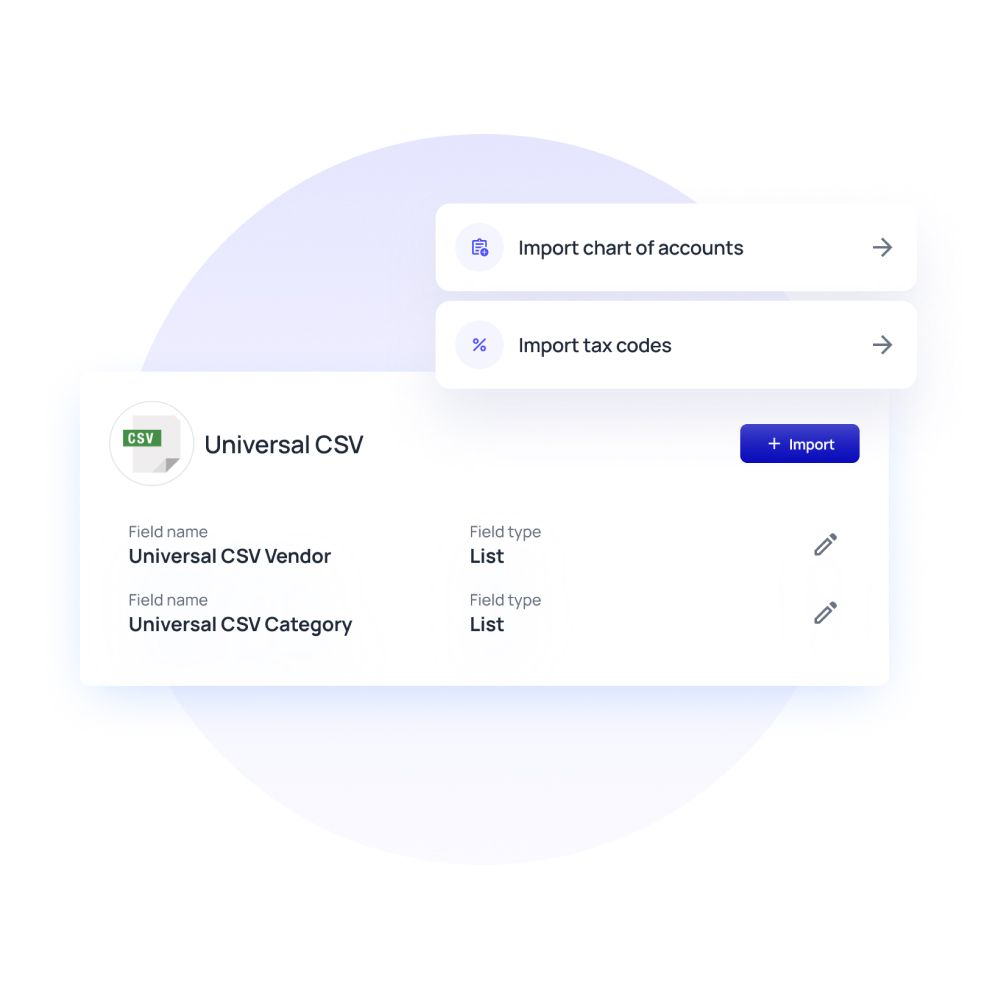

Easy accounting system integration

Streamline your financial management by integrating your corporate cards with accounting systems. No more stressing over time-consuming manual data entry processes.

Ensure that your accounting records are error-free. With integration capabilities, you can get enhanced accuracy and streamlined reconciliations, complete with card expenses split into multiple line items. Expenses can be directly synced between your platforms with ease.

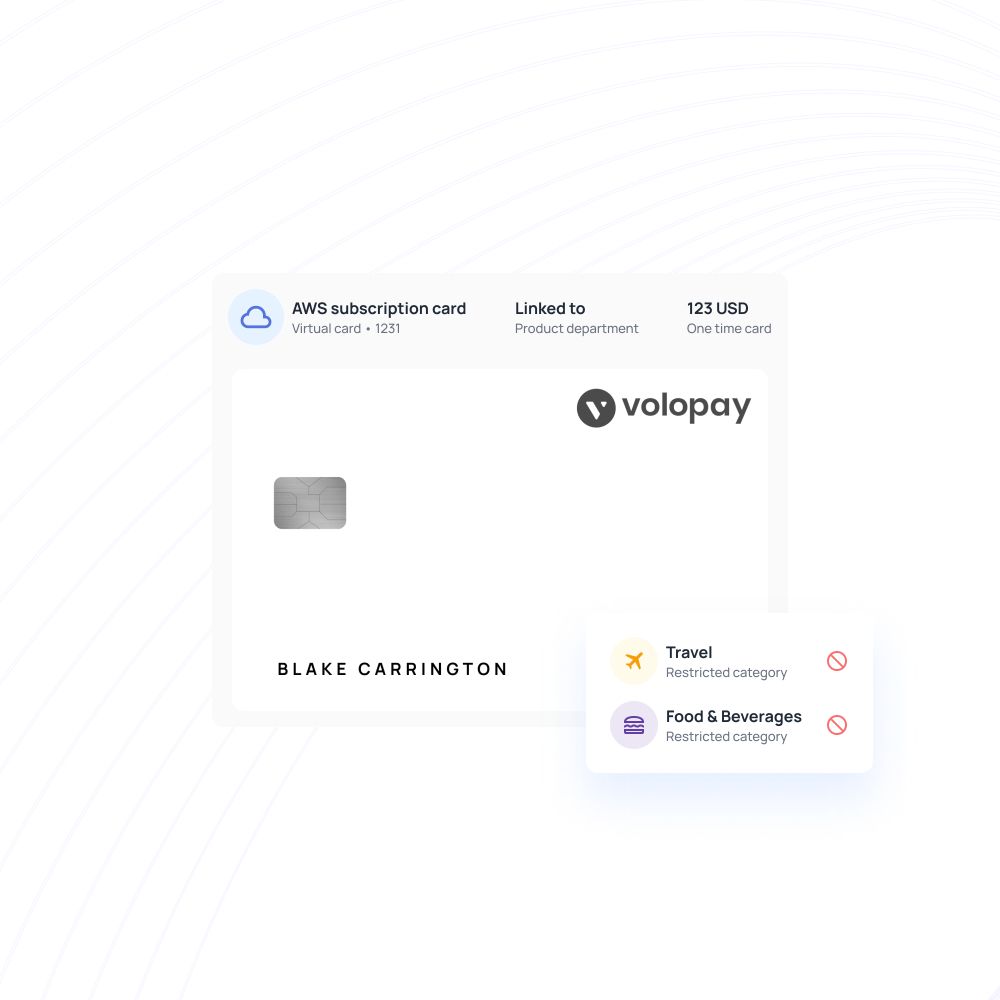

Issue multiple cards to employees

Issue cards to all your employees with ease by using Volopay corporate expense cards. You can activate, block, freeze, and replace cards in just a few clicks. Easily request repayments from cardholders for non-compliant and inappropriate transactions.

Avoid card sharing, which will create payment and tracking complications. Volopay allows each of your employees to have their own cards. Between physical and virtual cards, you can assign each card to a specific employee or purpose.

Automated expense categorization

You don’t want to waste time categorizing expenses manually, especially when you need to make multiple business expenses on each card. Get automated expense categorization with Volopay to make viewing and managing your spending easier.

All expenses made on your corporate card can be automatically categorized with customizable advanced rules. When filing expense reports through the Volopay app or platform, employees can also select the relevant categories with a click.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

See how Volopay cards can benefit your business

Simplified reimbursement

Ever felt like that pile of reimbursement claims is never-ending? Make the swap from out-of-pocket employee expenses to corporate cards to simplify and even reduce the need for reimbursements.

Equip employees with corporate cards to empower their purchases. Setting limits helps prevent employee overspending.

Improved cash flow

Having good cash flow begins with managing your expenses well. Use corporate card limits to ensure that you’re spending within your budget, which will help you guarantee positive cash flow.

No more surprise bills at the end of the month. Curb overspending and improve your cash flow by making use of a corporate card for startups.

Protect finances as you build business credit

Business credit, which is separate from personal credit, can make or break your company. Carefully controlled spending and transparent transaction records ensure you can manage your finances without harming your business credit.

Volopay’s corporate card for startups helps protect your financial habits, allowing you to focus on building business credit and ensuring your credit score for the future.

Simplified real-time expense tracking

End-of-month expense report surprises are a thing of the past. With a comprehensive card management platform like Volopay’s, you’ll receive real-time updates on all your card spends.

Every time any of your employees use a corporate card for a transaction, it will be automatically reflected on your card management platform. You can easily track every single penny spent by your business with ease.

Increased convenience

Instead of relying on the owner’s credit card to do business transactions, empower your employees by equipping each of them with a corporate card for startups.

Every employee will be able to easily make business expenses whenever needed. No more card-sharing hassles and chasing each other down just to make a quick payment!

Improved vendor relationships

Nobody wants to make late payments to their vendors; it’ll lead to late fees, complications, and distrust. Avoid these issues by using corporate expense cards for your business.

Pay your vendors faster and more efficiently with features like a comprehensive expense management system, unlimited virtual cards, and pre-approved payment limits.

Empower your team with smart corporate cards

Managers

With Volopay’s corporate expense cards, managers can streamline approval workflows, track team spending in real time, and set custom spending limits.

This simplifies expense management processes and enables better decision-making, all while ensuring complete policy compliance.

Employees

Volopay’s corporate cards, like any corporate credit cards, allow employees to handle expenses without delays, reducing the hassle of reimbursement.

They can easily manage their transactions effortlessly via user-friendly mobile apps, eliminating the need for personal funds while ensuring complete transparency.

Finance teams

Corporate cards from Volopay enable finance teams to gain real-time visibility into company-wide spending.

Automated expense reporting significantly reduces manual work and improves cash flow management, allowing the entire team to focus on important strategic initiatives.

Accounting teams

Volopay’s corporate cards integrate smoothly with accounting systems, automating reconciliation processes.

This reduces errors, speeds up month-end closings, and enhances financial accuracy, ensuring that accounting teams maintain complete control over expenses.

One card, endless benefits: Volopay corporate cards for every business

Volopay’s corporate card for startups simplifies expense management by offering real-time insights and automated expense reporting, allowing founders to focus on growth rather than financial admin tasks.

This powerful tool helps new businesses maintain cash flow control while scaling quickly and efficiently, ensuring they remain agile and competitive in today’s fast-paced market.

With Volopay’s corporate expense card, small businesses can efficiently manage daily expenses and gain full transparency into team spending.

By carefully controlling budgets and automating approvals, these businesses can maintain operational agility, minimize unnecessary administrative overhead, and allocate resources more effectively.

For large enterprises, Volopay’s corporate card provides comprehensive spending control (just like a corporate credit card) through advanced analytics and dynamic spending limits.

With custom reporting and multi-level approvals, this solution empowers teams to manage complex financial workflows seamlessly, ensuring compliance and efficiency across departments.

Consistently rated at the top

Volopay takes pride in being consistently recognized as a top performer on G2. Our G2 badges are a testament to the outstanding value and satisfaction we deliver to our users.

These recognition demonstrates our commitment to offering cutting-edge financial solutions and outstanding customer support, which positions us as a reliable option for companies all around the world.

Learn more about Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Physical cards

Volopay’s physical prepaid corporate cards enable employees to manage business expenses effortlessly. These cards provide spending control, and real-time tracking, and eliminate the need for reimbursements.

Virtual cards

Volopay’s virtual prepaid corporate cards offer enhanced convenience for online purchases, subscriptions, and vendor payments. They ensure secure transactions while simplifying expense management and budget allocation.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Bring Volopay to your business

Get started now

FAQs on corporate cards

Corporate business cards, or corporate expense cards, are cards used for corporate payments and designed specifically with business needs in mind. It helps you keep personal and business expenses separate.

Corporate cards can be used for a variety of expenses. Business travel is a main use case, enabling your employees to make purchases on behalf of your organization during business trips easily.

You can also use it to manage other expenses, such as subscriptions, office supplies, online orders, and many more.

Yes. In fact, using a corporate card will make managing business travel easier. You don’t need to worry about employee reimbursements when they can control spending with corporate cards.

Yes. You can use Volopay corporate cards internationally as long as the merchant accepts card payments.

Yes, you can easily make cross-border payments with Volopay corporate expense cards. It makes both online and in-store purchases much more convenient.

Your business needs to be a registered company for it to qualify for a corporate card. Different card providers will have different requirements, so be sure you check with each one before you apply.

No. Corporate cards have entirely separate credit scores when compared to your personal credit score.

Volopay corporate cards provide robust security with features like multi-factor authentication, instant transaction notifications, and customizable spend limits, ensuring secure transactions for your business.

Volopay’s corporate expense card captures transaction data automatically in real time, providing detailed insights and automated reports, which integrate seamlessly with your accounting system.

If your Volopay corporate card is lost or stolen, immediately block the card via the mobile app or web platform to prevent unauthorized transactions and request a replacement for it.