How to make accounts payable more efficient for a business?

Accounts payable essentially means the process by which businesses pay their bills and invoices. For all businesses, irrespective of size, the accounts payable process is an integral part of cash flow management.

Without an efficient accounts payable department it will be difficult to make sure your bills are being paid accurately and on time.

If your business is unable to pay bills efficiently the repercussions can be quite far-reaching. Vendor relationships, cash flow management, and accounting processes will all be hampered.

To avoid this you need to adopt certain strategies on how to make accounts payable more efficient.

Key strategies to modernize your accounts payable department

Given below are some strategies you can enforce to ensure your business is right up there with the best in terms of accounts payable management:

1. Centralize your invoice payments and database

It is crucial to centralize payments when processing supplier or vendor invoices. It is a lot easier to get a clear overview of every dollar leaving the company if all company payments come from a single, common account.

You should especially strive to avoid ad hoc basis invoice payments, or paying with multiple different credit cards or accounts.

When you split bill payments it not only opens your finances up to the risk of expense fraud but also makes it much harder to get control over the amount of money your company is having to pay every month.

The best approach you can take to address this issue is to use a centralized invoice payment and database system, like Volopay.

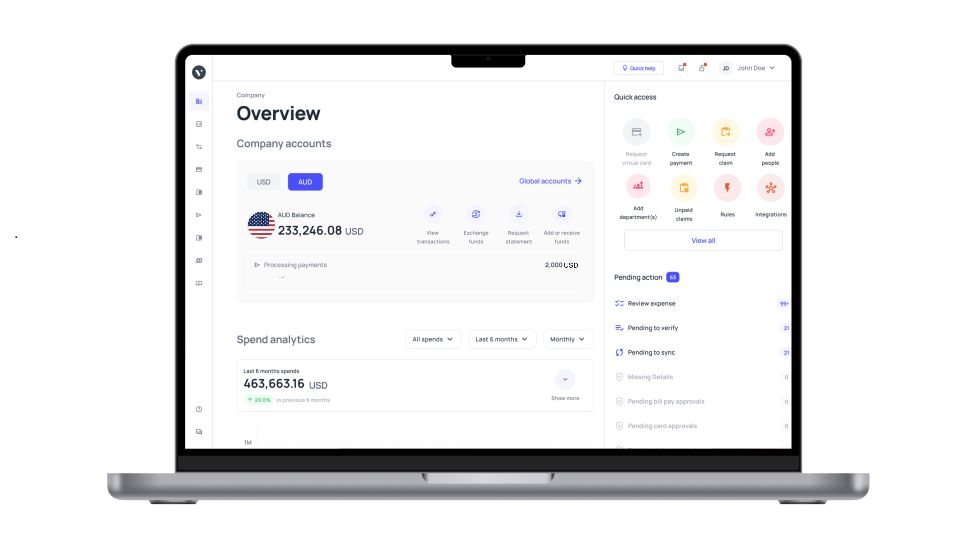

You can use Volopay’s comprehensive spend management system to make a host of business payments, like travel spending, office expenses, and vendor payments, all from one uniform platform.

The best part is that you can even automate these payments to happen without any manual intervention required.

2. Focus on accuracy - Reduced chance of data entry errors

When it comes to accounts payable process improvement you must put special emphasis on accuracy.

When your accounts payable department processes bills and invoices using manual systems there can be countless invoice errors and problems related to the accuracy of data entry.

Manual data entry errors, duplicate invoices, or mismatching invoices with POs are common for companies that are still using spreadsheets or excel to do their accounts payables.

Use accounts payable automation systems like Volopay to radically reduce the number of errors in accounts payable.

With an automated system, you can delegate functions like invoice processing, expense reporting, and accounting reconciliation to software.

This software is designed to perform all these functions with zero errors and at a fraction of the time, it would otherwise require.

By using systems like Volopay you can not only reduce the frequency of errors but also the amount of time and money you have to invest in accounts payable process improvement.

3. Increase transparency in AP processes

Transparency and collaboration in the process can be a considerable pain point in the accounts payable system. Getting all stakeholders to get on the same page to approve and process invoices can be a difficult task to do.

Companies often have to deal with and run around multiple levels of approvers to get invoices processed. This can severely slow down the process and reduce the degree of transparency you have over the process.

Communication and collaboration are also required with vendors and suppliers in case invoices have incorrect details attached. All this can make your accounts payable process inefficient, especially when done manually.

However, this does not mean that the level of collaboration between stakeholders cannot be improved. All you need to do is use accounts payable platform that comes equipped with an effective communications system.

Volopay, for instance, instantly notifies approvers when the need for approvals arises. On Volopay’s platform approvers, employees, and vendors all come together in the same place. This allows increased collaboration and therefore transparency in the process.

4. Work with an AI-supported AP process

Artificial intelligence is one the best things to have happened to accounts payable in recent years. AI can be a powerful tool that can significantly boost your accounts payable department’s efforts.

It’s a well-known fact that managing processes manually can be the cause of great concern for the accounts payable department.

Related read: Machine learning and AI in finance - Overview & benefits

Time is valuable and a lot of it can be wasted on processing invoices, decoding and locating the required information, and making the actual payment.

Instead of following this inefficient process, you can simply upgrade to an AI-supported accounts payable system. Artificial intelligence-powered platforms like Volopay can automatically process invoices with minimum fuss.

With Volopay all you need to do is sit back and let the platform take care of invoice processing. As soon as an invoice is received the system automatically extracts the required information.

The platform also reaches out to required approvers and gets approvals done automatically.

With multiple, highly customizable controls in place, you can let Volopay’s AI take care of vendor payments. Additionally, all this is done with zero errors and at lightening fast speed.

How to make accounts payable more efficient with Volopay

Gone are the days when businesses would have to depend on slow, inefficient paper-based processes to manage accounts payable.

Now, with Volopay’s accounts payable software, you get access to a multi-currency business account, the ability to make and schedule domestic and international money transfers, invoice management, vendor management, and automated processes for these.

Here’s how to make accounts payable more efficient with Volopay:

1. Invoice management can help you reduce manual work and process invoices much faster for quicker payments

2. Volopay’s vendor management platform can help you get better insights into your spending patterns at a vendor level.

3. It is very simple to schedule international payments on Volopay. You get full information about the charges associated with the payment for full transparency.

4. You can set up recurring payments to improve the Customer/Vendor Relationship as this can ensure timely payments.

5. You can schedule payments depending on your needs and get benefits of early payment discounts or offers.

6. USD 0 Transfer Fee and competitive FX rates can help you save a lot of money on international transfers.

7. Monitor all your future payments from a unified dashboard and receive real-time notifications and email alerts whenever a bill is due or processed.

Finally, it is clear by now that the best way to approach the “how to make accounts payable more efficient” dilemma is to simply get accounts payable automation system. And in this context, Volopay is one of the best options out there.

Volopay’s comprehensive accounts payable software manages your complete AP needs without the struggle that comes with manual processes.