10 common invoice processing errors you can easily avoid

Let’s face it, invoice processing might sound like a straightforward process but it’s often far from being so. Invoice processing errors can become a nightmare for your Accounts team if not handled carefully enough.

To explain briefly, invoice processing is the system via which an accounts department carries out several tasks to process invoices; starting from receiving them from vendors or suppliers to payment, and the subsequent recording of the same in a general ledger.

Given the number of steps and the manual processes involved, mistakes in this procedure are not only common, but they’re also pretty much inevitable. So, it makes sense to take a closer look at what exactly are the things that could (and do) go wrong and how you could deal with them.

Common challenges in invoice processing

Missing invoices

Misplaced or missing invoices can delay payments and hurt your company’s cash flow. If your company is using Net 30 end-of-the-month (EOM) payment terms you might not even find out until a month or more. These problems are aggravated even further if you are forced to start the invoicing process all over again.

Confusing invoices

Invoices are not always created in a universally understandable manner and this can lead to confusion and subsequent challenges in invoice processing. Your customers, vendors, and suppliers might not always view invoices in the same way as you do. This problem is especially pressing for enterprises selling a large product variety to various customers, therefore having to invoice them repeatedly.

Missing data

Inaccurate invoices are another major reason behind invoice processing problems. The more accurate your invoices are, the faster they are likely to be processed and the lesser chances there are of them being pushed to the back of the line until someone figures out how to rectify or recover the missing particulars.

Errors in the invoice

Alongside missing data, errors in the invoice itself can also be a cause behind inaccurate invoices and further challenges in invoice processing. Whether it is because of a small calculation error or a misplaced decimal point, mistakes are bound to happen. These mistakes, if left unchecked, also become a big reason behind delayed remittances and other challenges.

Recurring invoice mistakes

Repetitive errors are never a good sign, no matter which department they are made in. Be it incorrect math, inaccurate data, missing invoice email, or missing particulars; repeating errors in invoicing can not only lead to significant delays and hurdles for both you and your client but can also have a detrimental effect on your relationship with your clients. It can also play a part in damaging your credibility in the market.

Too many standalone systems

The separate systems that Accounts departments have for each way that suppliers submit invoices can prove to be a hassle. Taking a fragmented approach to accounts payable automation can result in a confusing web of systems that complicate the user experience, difficulty accessing critical information, and added expenses. The lack of an integrated system means processes have to be manually maintained while at the same time ensuring all errors in invoice processing are handled.

Missing contact information

Missing or incorrect contact information on your invoices is a direct cause for processing delays and errors. Especially if your payments are due to be received 30 days after invoicing you lose out on a minimum of a month before the problem is even identified.

Lots of supplier inquiries

A common obstacle that all Accounts departments have to cope with regularly is a large number of follow-up calls from suppliers enquiring about the status of their invoices. For companies using manual invoicing processes, suppliers are usually in the dark until the payments are made. This can lead to a high degree of uncertainty and confusion.

No scalability

Manual invoice processing requires manual labor. As a result, companies following manual procedures have to resort to vetting, hiring, and training new staff whenever invoice volume increases. Compulsive hiring is never a go-to for any manager and should be avoided to maintain a particular level of personnel quality.

Poor visibility

With traditional invoice processing, it is next to impossible to get real-time updates on the status of the process. When relying on paper processes and emails for updates it is difficult to be sure of where things stand. As a result, it becomes increasingly challenging to manage cash flow, time, operations, and risks without regular updates.

How to eliminate inaccuracies with accounts payable automation?

Business experts, academics, and accounts departments all over the world have begun to realize the potential of automation. However, a large number of Accounts departments continue to follow inefficient, inaccurate, and cumbersome manual processes.

This is quite unfortunate as there are several ways in which Accounts Payable Automation can help your Finance department eliminate inaccuracies and improve overall efficiency. For instance:

1. Reduced invoicing costs

2. Reduced time-taken for invoice processing

3. Reduced discrepancies in invoice recording

4. Easier and more secure touchless processing

5. Decreased departmental workload

6. Invoice data can be pre-populated into internal systems

7. Increased rate of success for extracting data from invoices

8. Eradication of manual or human errors in invoice processing

9. Protect against fraud, prevent invoice duplication, avail early benefits or discounts and avoid late payment fees

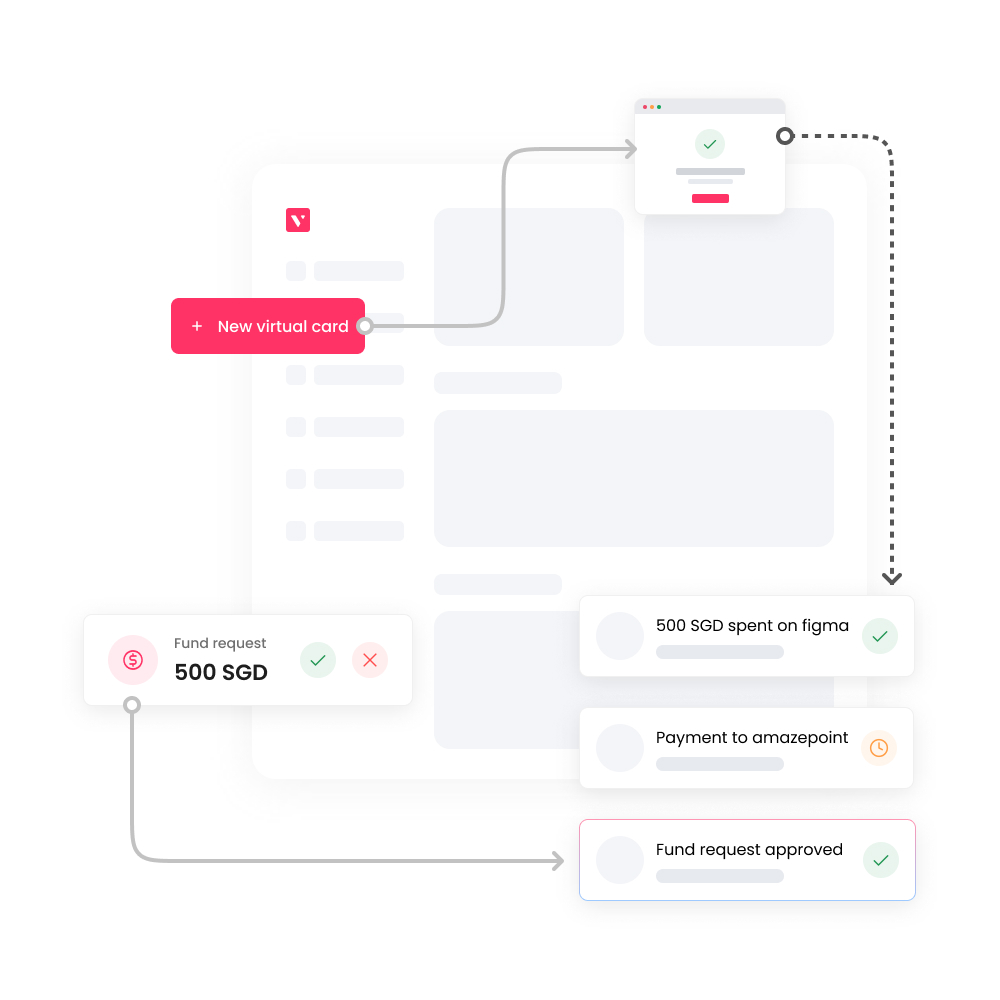

10. Direct invoices through structured and customizable approval workflows

11. Improve visibility, enforce compliance and control via pay and report

Want to eliminate inaccuracies with accounts payable automation?

Best practices to eliminate manual invoice processing

Reducing manual intervention can drastically reduce invoice processing errors. For too long now Finance departments have had to suffer because of the mammoth amount of data entry, verification, double-checking, and follow-ups. This degree of labor that comes with manual invoice processing is the root cause behind most of the challenges faced.

The number of manual steps in such systems is greater—and each step takes longer—than in a system with even a slight degree of automation. Some of the best practices and solutions to reduce this manual process can be brought forth via automation.

Deploying an integrated accounts payable automation system is a one-way ticket to getting rid of manual invoicing challenges. With automation, you can improve the invoicing process, reduce human error and save costs.

1. Identify KPIs in accounts payable

2. Implement or improve three-way matching

3. Automate record keeping

4. Reduce average payment cycle time

5. Cut cost per invoice

6. Delegate non-essential tasks to software

Invoice processing - KPIs to consider

Determining the right KPIs to help identify errors in invoice processing can be a daunting task, given the number of variables at play. However, they are extremely useful in identifying recurring bottlenecks or delays.

Time taken to pay an invoice

Time taken to verify and approve an invoice

Cost to process an invoice

Late payments

Early payment discounts

Duplicate payments

How can Volopay help in tackling errors in invoice processing?

Looking for a one-stop solution that combats all the challenges that come with invoice processing? We’ve got you.

Automate your accounts payable processes

Not only your invoice processing, but Volopay helps you automate the whole of accounting and streamline all your accounts payable processes, eradicating complex financial workflows in your business.

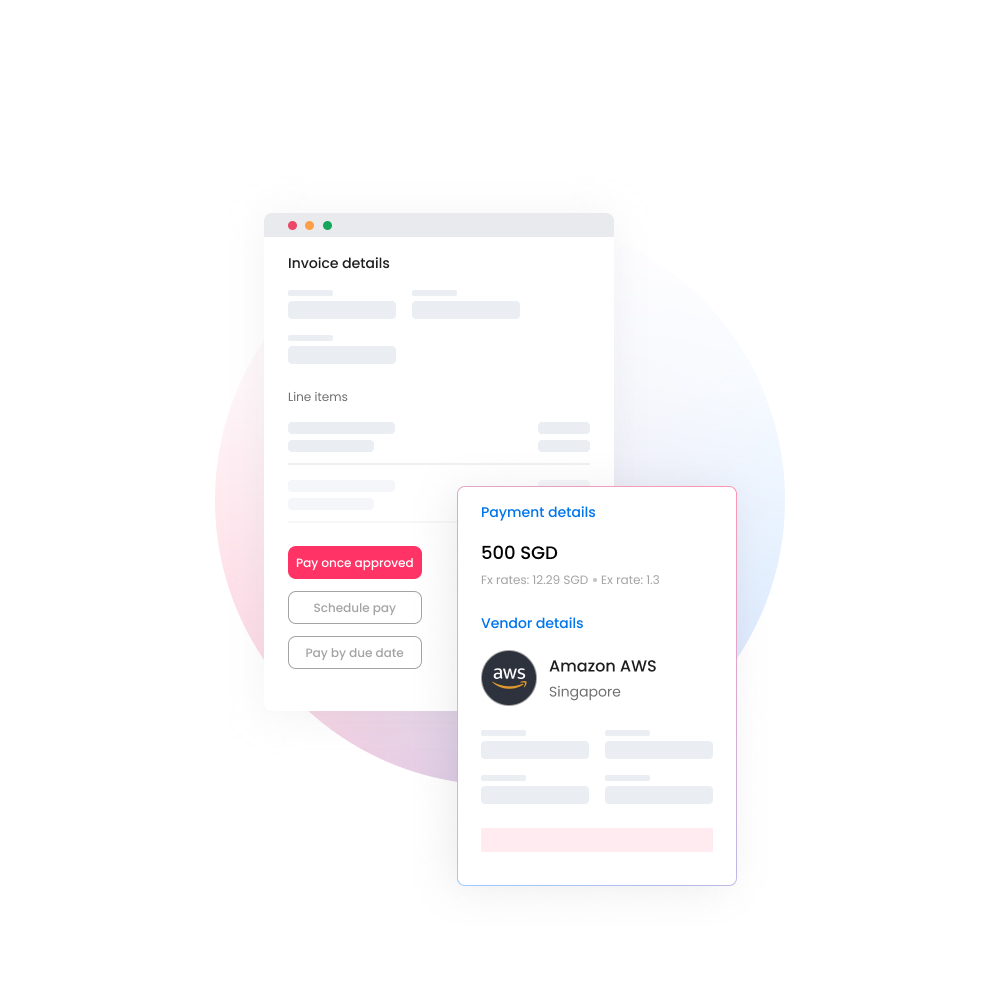

Eliminate manual check runs and save cost

WIth Volopay you can now leave multiple responsibilities that would have otherwise been done manually to an air-tight AI-run software. Thus, allowing to save costs on the invoicing process, resource usage, and hiring. Need to issue invoices? Just click a button or schedule it on the platform.

Reconcile all expenses in real-time

Volopay integrates beautifully with the accounting software you use. With just one click all your expenses, card, or vendor payments, can be fit seamlessly into your accounting software, thus saving you from those month-end nightmares.

FAQs

Automated invoice processing is the process of seamlessly extracting data from invoices entering your system, automating all the steps in between, and pushing it into your ERP so that processing payment can be done with just a few clicks.

Volopay is your best bet when it comes to automating invoice processing because it is much more than your everyday Accounts Payable Automation system. It gives you the ability to track all your expenses in real-time.

Invoice processing is used for managing vendor or supplier invoices from receipt to payment, and recording in the general ledger.

Invoice processing involves the complete cycle of receiving a supplier invoice, approving it, establishing a remittance date, paying the invoice, and then recording it in the general ledger.

Trusted by finance teams at startups to enterprises.

Get started with Volopay to automate invoice processing

Related pages

Faster invoice approvals, avoiding duplicate payments & detailed spend visibility, are some of the advantages of invoice approval automation.

Better relationships with vendors, eliminating errors & saving time, are some of the benefits of streamlining your invoice management process.

Automating with OCR, having invoices in one place & getting a vendor PO number, are some of the steps to avoid duplicate invoice payments.