How to reconcile accounts payable transactions for your business?

Accounts payable is an essential accounting function that helps extract the information related to the company’s dues to the suppliers.

To get to the particulars of the payments, there is a long process of accounts payable reconciliation that requires checking invoices, purchase orders, accounting sheets, and more.

In order to reach the correct payable amount, it is important to perfect the process and eliminate any and all errors. All this comes under Basic Business 101, which means that every business must thoroughly know the subject.

What is account payable reconciliation?

Account payable reconciliation is the process where the invoice sent by the supplier is compared and matched to the accounting sheet and the purchase order details created by the business.

Other documents which can be used for reconciliation are bank statements and any other transaction details. The reconciliation is successful when the invoice and the company’s documents of the order match.

An unsuccessful reconciliation would show unmatched balances and call for rework on the process to spot any discrepancies or wrong entries.

Why is it important to reconcile accounts payable?

The accounts payable reconciliation process is important to get the data of the exact money spent and to calculate the profits and expenses at the end of every business year.

Reconciliation shows data on important business spending. Account payable reconciliation is an opportunity for companies to scrutinize their spending and cut down on any unnecessary purchases.

If a company does not perform the accounts payable reconciliation process at appropriate intervals, there can be huge gaps between the bank statements or purchase orders and the vendor’s invoice.

There can also be missing entries and double entries unrecognized entries as well. All this causes a mismatch of payments and orders, for which the company has to bear losses.

There might be times when your vendor might send you invoices with higher payment amounts and hidden costs; if you don’t have an account payable reconciliation system in place.

Then you would never know what you were charged extra for, and you would end up blindly paying for it. Hence, it is always smart to conduct account payable reconciliation before making any payments.

Steps to reconcile accounts payable transactions

1. Obtain the accounts payable balance

To start the accounts payable reconciliation process, you need first to get the AP balance sheet. Each company has its own way of dividing the balance sheet into various trial balances based on their type of vendor type.

2. Obtain accounts payable aging report

An account payable aging report is an essential document that summarizes the due invoices and bills. This report is also usually categorized on the basis of vendor type, due date, and amount.

This report helps you organize all the payments and visualize the payment stream. You can easily track and timely payments to your vendors through this. Ultimately you can sidestep any late payment charges or fines.

3. Compare the total balance of both reports and other documents as well

This is an extremely crucial step where you must check that the aging report and the AP balance sheet amounts must match.

Along with this, the invoice sent from the supplier’s side must also match these and other related documents like bank statements.

4. Investigate variance

If any mismatch is found, the accounts payable team must determine the cause of the discrepancies and work on correcting them.

Anything like missing credit notes, double entries, missing transactions, and doubtful calculations all need to be identified and corrected in this step.

5. Review the AP’s general ledger

If you get to an unmatched number, but the beginning balance is correct, then you are required to look through the accounts payable general ledger.

This document shows the current liability of the business and gives a more detailed view of the dues, whereby the error can be spotted.

6. Complete the final process

To complete the process, you will have to tally the debit and credit sides of the accounts payable ledger.

The credit side would contain the bills and invoices amount of the credit purchases made by the company and that amount which needs to be paid to the vendor.

The debit section would show those invoices and amounts which the business has already paid. So, ultimately the credit balance of the AP general ledger would be the summarization of those invoice amounts which are due.

Related read: How to reconcile expense reports?

Take control of your finances

What are the best practices for successful AP reconciliation?

1. Implement automation

The traditional method of accounts payable reconciliation which includes manual processes can be inefficient and prone to many errors.

By implementing AP automation tools, businesses can automate accounts payable reconciliation, streamlining the process, reducing manual errors, and enhancing efficiency. Automation can match invoices with purchase orders and receipts, accelerating the reconciliation process.

2. Regular and timely reconciliation

Regular and timely reconciliation is crucial to identifying discrepancies promptly. Monthly or quarterly reconciliation can prevent long-standing errors from accumulating.

If things go unchecked for a long period, then errors or discrepancies might be hard to fix after a while.

3. Segregation of duties

Separating duties among employees involved in the AP process helps prevent fraud and errors. Ensure that those authorizing, processing, and reconciling transactions are distinct individuals.

This will help stop individuals from committing fraud as there will be other members of the team checking transactions along the way.

4. Employee training

Invest in training for your finance team. A well-trained team is more equipped to spot discrepancies and perform accurate reconciliations.

Even if you have automated accounts payable reconciliation software, having a well-trained team that knows the process in and out will help in resolving issues faster if there are any.

5. Documentation and record-keeping

Maintain organized records of invoices, purchase orders, and receipts. Proper documentation simplifies the reconciliation process and supports audits.

Without important documents such as the invoice, purchase order, and the goods received report, verifying and reconciliation are not possible.

6. Standardize procedures

Create standardized procedures for AP reconciliation, ensuring consistency and reducing the likelihood of errors. This establishes a clear framework for the reconciliation process.

Part of standardizing the process can include implementing automation software that supports your AP team’s work and improves the overall efficiency of the system.

7. Matching purchase orders and invoices

Matching POs with invoices is a fundamental step in AP reconciliation. Ensure that all details align, including quantities, prices, and terms.

While the matching process can be done manually, it is more efficient to let software do the heavy lifting and have it double-checked by AP team members for safety.

8. Vendor communication

Effective communication with vendors is essential. When your AP software or AP team member spots any error in an invoice, then make sure to communicate this to the vendor immediately.

Clarify any discrepancies promptly and maintain good relationships with your suppliers.

9. Three-way matching

Implement a three-way matching system that reconciles the PO, invoice, and receiving report. This thorough approach minimizes errors.

Making sure that the details on an invoice you have received match with the other two documents ensures that it is legitimate.

10. Duplicate invoice checks

Develop a process to identify and eliminate duplicate invoices to prevent overpayment. When dealing with multiple vendors on a recurring basis, similar invoices tend to recur.

But your AP team needs to ensure that they are legitimately new invoices that are similar to previous ones rather than being exact duplicates of invoices that have already been paid.

11. Review outstanding payments

Regularly review outstanding payments to identify and address overdue invoices. This helps maintain strong vendor relationships.

Some accounts payable reconciliation software will also let you schedule payments in advance. This way you won’t have to deal with any late payment penalties.

12. Reconciliation reports

Generate reconciliation reports to track progress and identify recurring issues. These reports provide valuable insights into your AP process.

If you use an accounts payable management software, you can easily generate these reports from it.

13. Auditing and internal controls

Conduct regular internal audits to ensure compliance with reconciliation procedures and internal controls. Identify weaknesses and address them proactively.

If you find any loopholes in certain processes, then make sure you update them to enhance the security and safety of AP payments.

14. Vendor relationship management

You can use software to streamline payment and communication processes with your vendors. Effective vendor relationship management goes beyond just vendor payment reconciliation.

Building strong partnerships with your suppliers can lead to better payment terms and discounts.

How often should you reconcile accounts payable?

Many companies perform an annual account payable reconciliation process, which is at the end of every financial year. However, annual reconciliation is the least you can do; it is highly suggested to reconcile more often.

It would be best for businesses to conduct daily reconciliation, but we understand that is difficult to achieve, at least not with manual accounts payable reconciliation.

Monthly reconciliation is the most feasible option, as you can make timely payments to your vendors and also keep regular track of your expenses.

Reimagine your reconciliation process!

What is the issue with the manual reconciliation process?

1. Chaotic and slow process

With regular incoming invoices, accounts payable reconciliation becomes extremely chaotic.

Along with this, manual reconciliation means the employees would have to check all documents, rectify errors and correct them without any automation, and this makes the process slow.

There is a certain capacity to which an employee can work, and with numerous invoices being received every now and then, the possibilities of delayed work increase, as they would have to go back and forth to get documents, get signoffs, go to the particular POC for any error details and more.

2. Error-prone in data entry

Manual account payable reconciliation is highly prone to errors as each entry is physically entered into the system by the employees and shared between different systems and documents.

The more processing steps, the more the possibility of errors. This results in inaccurate accounting data or missing entries, or double entries.

Many companies still use Excel sheets which are highly incompatible with such a task as they lack any features for spotting any minor discrepancies and errors in data, which would cost the company huge sums of money.

3. Expensive processing

Accounts payable reconciliation can be colossally expensive when done manually because it includes numerous costs. These costs are employee salary, price of paper documents, processing requirements, fees of sending payments, etc.

When all of the above is added up, the company is costed a fortune for just the accounts payable reconciliation process.

4. Lack of transparency and control

A centric database with all accurate financing information is the need of the hour for any business.

Spreadsheets don’t quite fulfill the purpose of providing a centric database that would allow complete transparency and more managerial control over the business's financial matters.

Without this, the decisions making abilities and long-term strategizing plans of the company can be seriously compromised.

Scrolling through different sheets for different information and then making decisions is not only a long process but also invaluable for business growth and reputation.

5. Inability to detect fraud

Accounts payable reconciliation, when done manually, can be unsecured and highly vulnerable to fraudulent entries.

As there are numerous sheets and not ecstasy ideal detailed visibility into the data, there is a high chance that anyone from the company can easily fill in fraud entries or hide any fraudulent transactions.

The complexity of the process and the time it takes to complete it is more inviting to unauthorized activity.

Related read: Eliminate manual data entry challenges with automation

Benefits of using automation software for AP reconciliation

1. Increased efficiency

Depending on the volume of work that your AP department has to complete there might be a lot of data entry that needs to be completed.

AP automation streamlines manual tasks, enabling your finance team to focus on more strategic activities. Automated data entry, matching, and approval workflows reduce time spent on repetitive tasks.

2. Reduced errors

The more workload there is, the more the chances of errors occurring when it comes to manual processes.

Automation significantly lowers the risk of human error in data entry and reconciliation. This accuracy is vital for maintaining the integrity of your financial records.

3. Cost savings

By minimizing manual labor and errors, AP automation can lead to cost savings as fewer people can now do the same amount of tasks in a reduced amount of time.

Additionally, it can help you take advantage of early payment discounts and avoid late payment penalties.

4. Enhanced visibility

Automation provides real-time visibility into your AP processes. You can track invoices, approvals, and payments at any stage, ensuring transparency and control. This will ensure that no payment due goes unnoticed and cause any problems later on.

5. Improved compliance

Automation helps enforce compliance with company policies and regulatory requirements. It ensures that invoices go through the necessary approval processes by the correct managers or supervisors before a payment is made and reduces compliance risks.

6. Faster approval workflows

Automated approval workflows speed up the processing of invoices, allowing for quicker payments and happier vendors.

If employees were to follow the traditional method of manually emailing and contacting a senior for approval, then it would end up taking a lot of time and may even be missed by a manager in their long list of emails.

7. Vendor relationships

Efficient AP processes, facilitated by automation, enhance relationships with suppliers. On-time payments and accurate records contribute to trust and collaboration.

Software to manage AP gives a strong foundation for ensuring all the basic tasks are taken care of so that employees can focus on strategic activities and build their relationships with the vendors.

8. Data security

AP automation software often includes robust security features, safeguarding sensitive financial data from breaches and unauthorized access.

Ensuring that your money is safe and your vendor’s important data is not leaked is crucial for business continuity.

9. Scalability

As your business grows, AP automation can scale with you. It adapts to increased transaction volumes and complexity, ensuring continued efficiency. This is a tough thing to achieve if you solely rely on manual processes without the use of software.

10. Time savings

Automation saves valuable time for your finance team, allowing them to focus on strategic tasks rather than manual data entry and reconciliation.

With the time that the finance team has saved, they can allocate it to forecasting more accurate future budget needs according to existing and past records of the company.

11. Integration capabilities

Many AP automation solutions integrate seamlessly with other financial and accounting software, streamlining your entire financial ecosystem.

You will be able to sync and export your AP data onto your accounting platform.

12. Improved decision-making

Access to real-time data and analytics through automation empowers you to make informed financial decisions quickly and confidently.

You no longer have to wait for a long time for an accountant to generate a report manually as you have access to the analytics at all times.

Maximize these benefits by choosing the right automation tools. Explore our guide to the Best Accounts Payable Software in the US to enhance your AP processes.

Elevate your reconciliation game

Best accounts payable reconciliation software

There are many accounts payable reconciliation software available in the market you can choose from. To get the best one for your business, you must understand what each one of them offers:

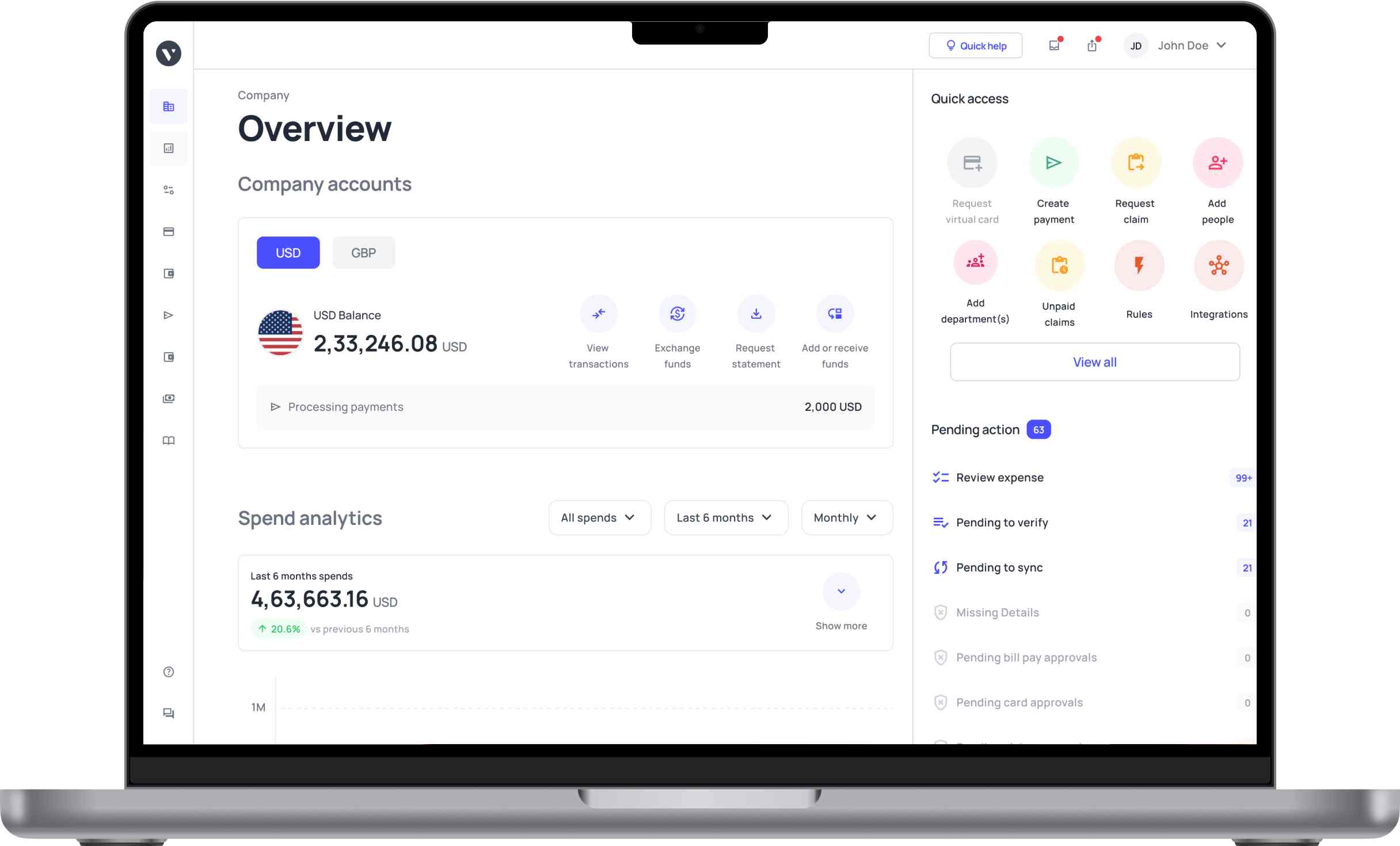

1. Volopay

● Overview

Volopay is a comprehensive expense management and accounts payable platform designed to streamline the financial operations of an organization. It offers features for expense tracking, approvals, and seamless reconciliation.

● Features

Volopay provides expense tracking, corporate cards, automated approvals, and real-time expense reporting. You can create and manage vendor accounts on the platform and pay them easily through the platform’s money transfer feature. Whether you have vendors in your country or abroad, you can make domestic and international payments. It also integrates with popular accounting software to ensure uniformity of expense data across platforms.

● Pros

Users praise Volopay for its intuitive interface, robust expense tracking capabilities, and efficient reconciliation processes.

● Reviews & ratings

With a high user rating, Volopay stands out for its user-friendly design and efficient expense management features.

2. QuickBooks

● Overview

QuickBooks Online is a well-established accounting software that includes accounts payable features. It's known for its user-friendly interface and comprehensive financial tools.

● Features

QuickBooks Online offers a comprehensive way to manage all your accounts payable needs such as expense tracking, invoicing, and making payments to the necessary vendors. The platform also has integrations with various other business tools that makes it a great choice for managing accounts payables.

● Pros

Users appreciate QuickBooks Online for its ease of use, wide range of features, and strong reputation in the accounting software industry.

● Reviews & ratings

QuickBooks Online enjoys consistently positive reviews and high ratings, making it a trusted choice for businesses of all sizes.

3. Zoho Books

Overview

Zoho Books is a cloud-based accounting software solution with a dedicated module for accounts payable. It caters to businesses of various sizes.

Features

Zoho Books provides accounts payable management, expense tracking in real-time to keep track of all AP expenses, automated workflows including expense reporting & approvals, and integration with other Zoho apps.

Pros

Users find Zoho Books easy to navigate, and they appreciate its affordability and integration capabilities with other Zoho software.

Reviews & ratings

Zoho Books receives favorable reviews for its simplicity and affordability, making it an attractive option for small to medium-sized businesses.

4. ProfitBooks

● Overview

ProfitBooks is an accounting and inventory management software that includes accounts payable features. It's suitable for small businesses and startups.

● Features

ProfitBooks offers accounts payable management, expense tracking, invoicing, and inventory management. This makes it a great software for managing AP, especially for businesses that deal with a lot of logistics. Being able to manage inventory along with its payment makes it an ideal choice for manufacturing companies.

● Pros

Users highlight ProfitBooks' user-friendly interface, affordability, and helpful customer support.

● Reviews & ratings

ProfitBooks receives positive feedback for its simplicity and cost-effectiveness, making it a valuable choice for small businesses.

5. Xero

● Overview

Xero is a popular cloud-based accounting software known for its robust features and scalability. It includes accounts payable functionality.

● Features

It is a very well-known and widely used accounting software that packs many more features than just accounting functions. Xero provides accounts payable management, expense tracking, invoicing, and a wide range of integrations with third-party apps.

● Pros

Users commend Xero for its feature-rich platform, scalability, and strong accounting capabilities.

● Reviews & ratings

Xero consistently receives high ratings and positive reviews, positioning it as a top choice for businesses seeking comprehensive accounting solutions.

Reconcile your accounts payable transactions seamlessly with Volopay

All the delay and sluggishness caused by manual accounts payable reconciliation can easily be eliminated by Volopay's accounts payable reconciliation automation. Here are the benefits of automating with Volopay.

OCR scanning and email attachment recognition system

Using this, you won’t have to manually enter the data from each invoice. The system automatically picks out the required information from the invoice and fills it into your database.

This way, you won’t lose your invoices, and data determination would be just a matter of a few keyword searches in the document.

More visibility and control

Volopay allows you to have easy access to the data of the whole process as every transaction is recorded in real-time, and all the process details are entered into a centric database.

So you can instantly look into any delays and also see who is responsible for the same. Plus, you can always customize the data according to the vendor and requirements.

Streamlined Accounts payable reconciliation process

The various steps involved in the reconciliation process all get streamlined with Volopay’s accounts payable reconciliation automation. Any error or wrong entry would be flagged and can be corrected immediately.

Plus, payments can be made through virtual cards and vendor accounts, so you don’t have to deliver payments in person or pay any processing fee.

Direct accounting integration

All the information processed while reconciliation is received directly from the accounting software, and once the process is complete, the updated information automatically gets updated into the accounting system.

Then you will not have to invest resources in manually entering the updated numbers into the accounting sheets.

Simplify processes and reduce errors

Yes, Volopay automated transaction reconciliation is done in real-time with a multiple-approval system, where every transaction has to be approved by the department head, and the approval screen displays all required information like the name of requesting employee, amount, purpose, etc.

AP automation uses the OCR scanning technology to scan invoices; by using this, you do not have to manually enter any data. All the scanned information is auto-filled by the system into your business database.

An automated reconciliation system refers to the automatic matching of different expense and transaction documents to verify all payments going out of the company and all the earnings of the business.

No, bank reconciliation is a separate financial process that involves comparing a company's bank statement with its internal accounting records to ensure they match.

Accounts payable reconciliation specifically focuses on reconciling vendor invoices, purchase orders, and payments.

Volopay automates accounts payable reconciliations by providing tools for expense tracking, approvals, and real-time reporting.

It streamlines the reconciliation process, reducing manual work and errors while ensuring compliance with company policies.

Businesses often choose Volopay as their first choice for AP reconciliation due to its user-friendly interface, robust expense management features, seamless integration capabilities, and positive user reviews.

Volopay offers a comprehensive solution for expense and AP management, making it a top pick for many organizations.