Expense reconciliation: How to reconcile expenses faster

Whether it’s to help keep track of revenue or to keep your books in order and prepared for external audits, expense reconciliation is an inescapable part of accounting. Finance teams across companies and industries lose so much time and sleep at the end of every month trying to balance books, manage incomes and expenditures ensuring that, for example, closing bank balance equals income minus spending.

These processes might seem fairly straightforward but can be far from being so. The ways we go about expense reconciliation have been in play for a long time and have been tedious and mind-numbing for just as long. Now, however, with accounting automation, accounting software, etc. this scenario is changing. There are now concrete tools using which you can work around the difficulties that come when you reconcile expense reports.

What is expense reconciliation?

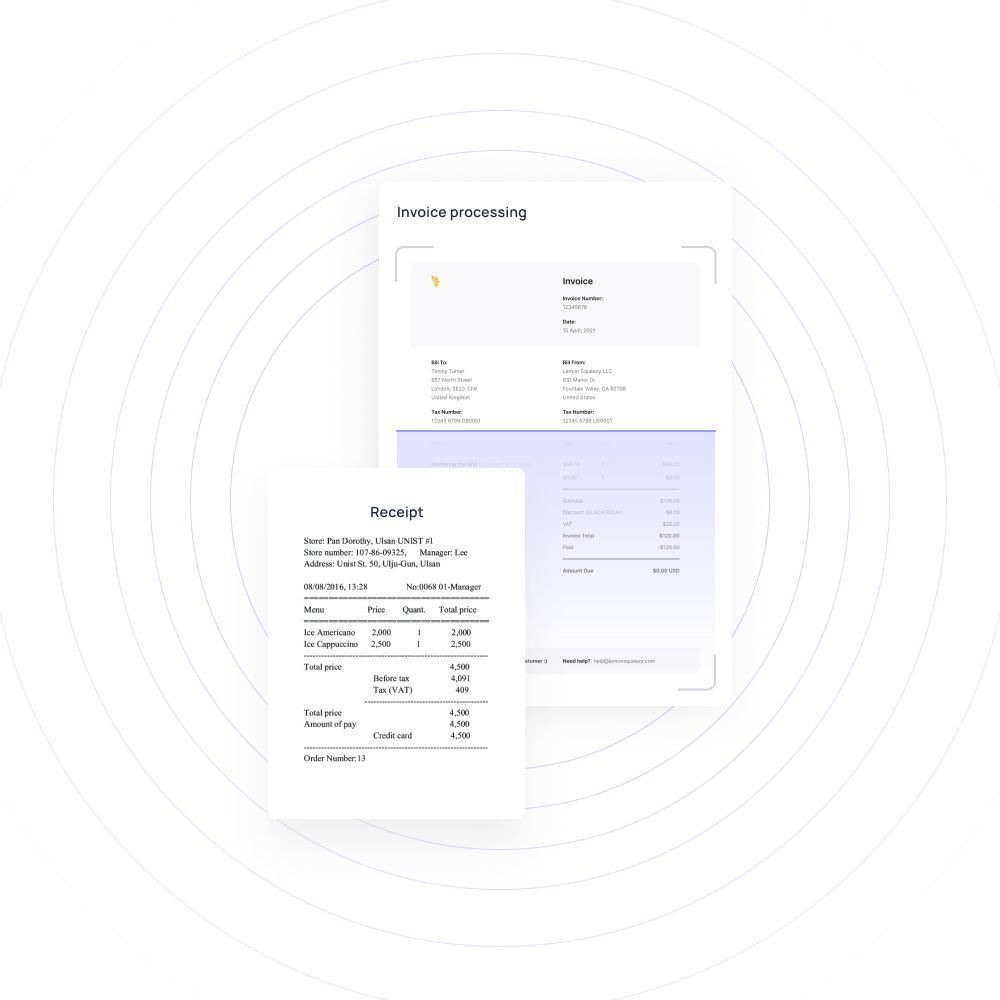

Simply put, expense reconciliation is the overarching process a company carries out in order to balance its books and keep track of where its cash is going. Accountants and finance teams work together to carry out a series of record checks to match entries in its general ledger with actual expenses. They compare and compile essential documents like receipts, invoices, etc., and match them with expense claims and transaction records. Expense report reconciliation helps companies check for approvals, confirmations, and receipt records of every payment the organization has made.

Different ways to reconcile expenses

If you are reconciling financial data of a small business and, or, most of your data is stored in hardcopy you can use paper records as your means of expense reconciliation. Paper records entail maintaining a physical ledger of your transactions.

In a traditional system, paper records have been used for a long time yet are highly susceptible to human errors, damage, loss, etc. They’re an option but not exactly the best one if you’re planning to scale your business.

Using spreadsheets on excel to manage expense reconciliation, or rather any other accounting process is not very new. Even though it’s still quite widely used amongst smaller, emerging companies, spreadsheets are also a very inefficient means of financial reconciliation.

Data loss, manual entry errors, and visibility issues are common. Moreover, spreadsheets are infamously tedious and offer little in terms of in-depth analytics.

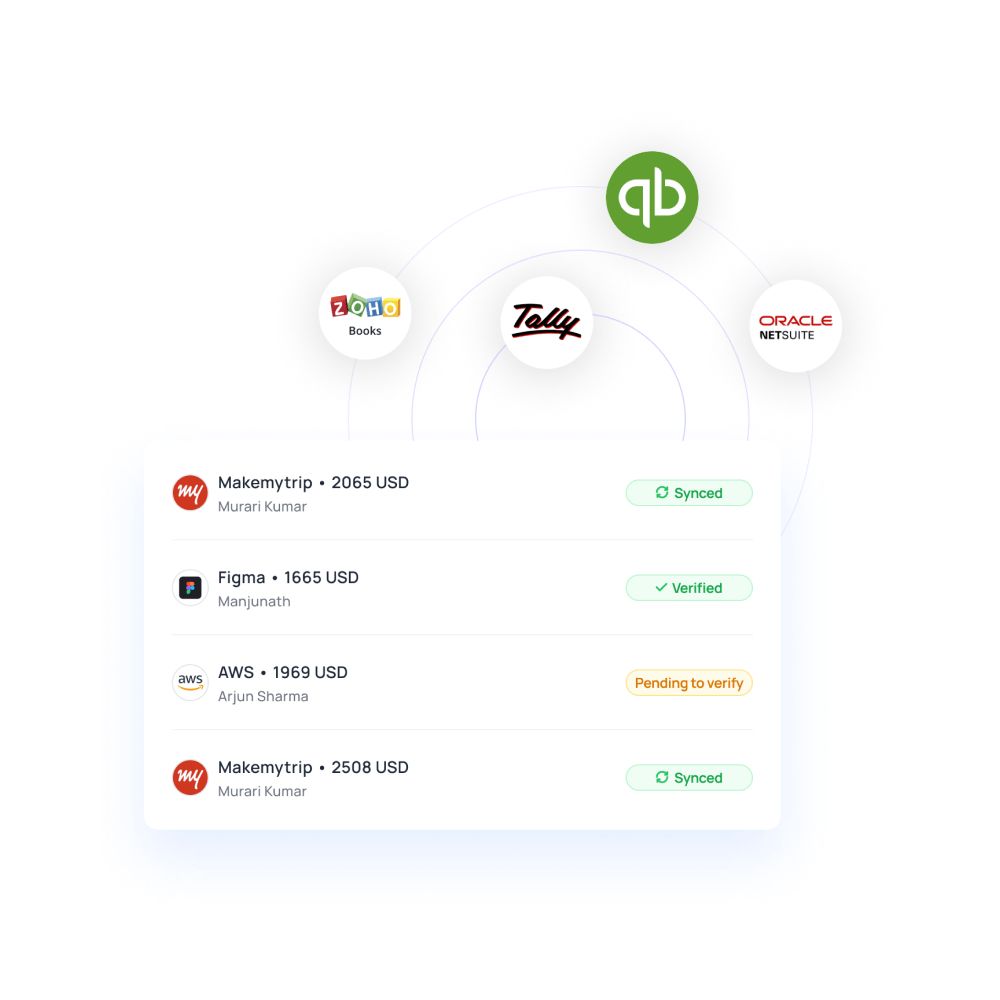

Nowadays, however, the use of paper records and spreadsheets is being widely replaced by accounting software that can do the same job in a fraction of the time with little to no effort required. Platforms like Xero, Quickbooks, etc. can help you reconcile expenses with the click of a few buttons.

These are systems that come equipped with features that record and process your transactions in real-time so that your finance teams do not have to wait till the end of the month before reconciling financial data.

Why reconcile expense reports?

Expense reconciliation is an essential cog in the wheel that keeps your business running. You must reconcile expense reports not only for cash flow management purposes, but also because it helps with:

1. Fraud prevention

Going through your financial records and card statements when reconciling financial data can be a useful practice in identifying suspicious transactions.

It can help you highlight and take steps against any transfers that were not appropriately authorized, duplicate charges, or missing deposits from your bank account before they can have any negative impact on your finances.

Related read: How to identify and prevent expense reimbursement fraud?

2. Company finance assessment

Reconciliation in accounting can also be a useful tool in helping you assess your company’s financial status.

When you balance your books you get a good view of your incomes and expenditures and a consequent understanding of where your cash flow could be headed. This can help you set or tweak budgeting and estimate a forecast for future funding requirements.

3. Error prevention

The visibility you get over your expenses and incomes when balancing books lets you identify any errors that might have crept in.

The presence of multiple entries, incorrect entries, or missing information can add up to larger problems over time. Catching them before they do so can help you sustain the future of your company.

Suggested read: How to streamline business expense reporting process?

Why is reconciliation such a challenging process?

Expense reconciliation is both inescapable and challenging. While the steps involved might seem straightforward enough the carrying out of the same is far from being so. Now, before you can streamline your expense reconciliation systems it is important to have a better understanding of what are the challenges they come with first:

Multiple sources of data

The financial data that your finance teams have to reconcile can arise from a variety of sources. Purchase orders or requests, invoices and proofs of purchase, company card statements, approval forms are just some examples of the diverse ranges of data sources that your accountants have to work with. The problem is that each of these sources is designed independently and so contains data in different forms. Your finance teams have to painstakingly match each of these transactions with their records, ensuring that all is in order.

Data formatting issues

With expense reconciliation it’s not just the multiple sources of data that’s the problem, it is also the format in which this data comes. Just getting the data accurately and entering it into accounting systems can itself be a tedious task, ensuring the right GL codes and expense accounts is another headache.

Credit card statements, vendor invoices, purchase requests all come with their information mentioned in different formats. Data has to be carefully extracted from each of them and formatted to fit your accounts.

Transaction delays

The diverse range of data sources that expense reconciliation deals with also comes with equally diverse timeframes. Each of these transactions and their sources work within their own workflows, and usually, most of these workflows don’t match with each other.

Your company card statements might arrive at one time while expense reports might come later, you cannot close your books until and unless all these transactions have closed and necessary documents have been attained.

Moreover, the time taken to close these processes gets prolonged even further when someone makes an error.

Lack of context

Difficulties arise especially when transactions are recorded without any context or documentation. This is particularly difficult when there are a lot of individuals in your organization with the authority to execute transactions. Your finance team will then have to do a lot of running around to reconcile these expenses.

Similar read: How to do petty cash reconciliation?

How to reconcile expense reports faster

Your expense accounting and reconciliation can benefit significantly from taking a three-pronged approach where your main focus should be on automating, digitizing, and decentralizing your entire automated accounting system.

Automation is the way of the world right now and the faster you get on board the sooner you’ll be able to keep up with the industry. Matching expense or transaction logs with documentation is actually a very convenient task to automate. Machines and AI hold the ability to sift through and check mountains of data with a great deal of ease and efficiency.

Digitization comes along with automation. The two work hand-in-hand to make expense reconciliation much more efficient. You can incorporate features such as e-receipts, digital invoicing, automated expense reimbursement and so much more to make your company’s expense report reconciliation systems much faster.

Nobody likes being micromanaged, you hire people because of their expertise in a particular field. The same goes for your accounts team. Decentralizing expense reconciliation can remove bottlenecks and help your accountants do their jobs with much fewer hurdles. You can incorporate modern payment methods, decentralized spend policies, remote-friendly tools, and real-time access to help make your accounting processes decentralized.

These principles, however, are far easier to write about than to implement. In light of this, let’s also take a look at a few concrete processes you can incorporate into your systems to speed up the way you reconcile expense reports:

Modern payment methods

You can incorporate new, more efficient payment methods for your company to make accounting easier. A good example of this is a corporate credit card or a company card. These cards come fitted with features that give you instant access to credit lines, tracking, and recording tools that help you manage expense reconciliations and do much of the heavy lifting and mundane tasks for you.

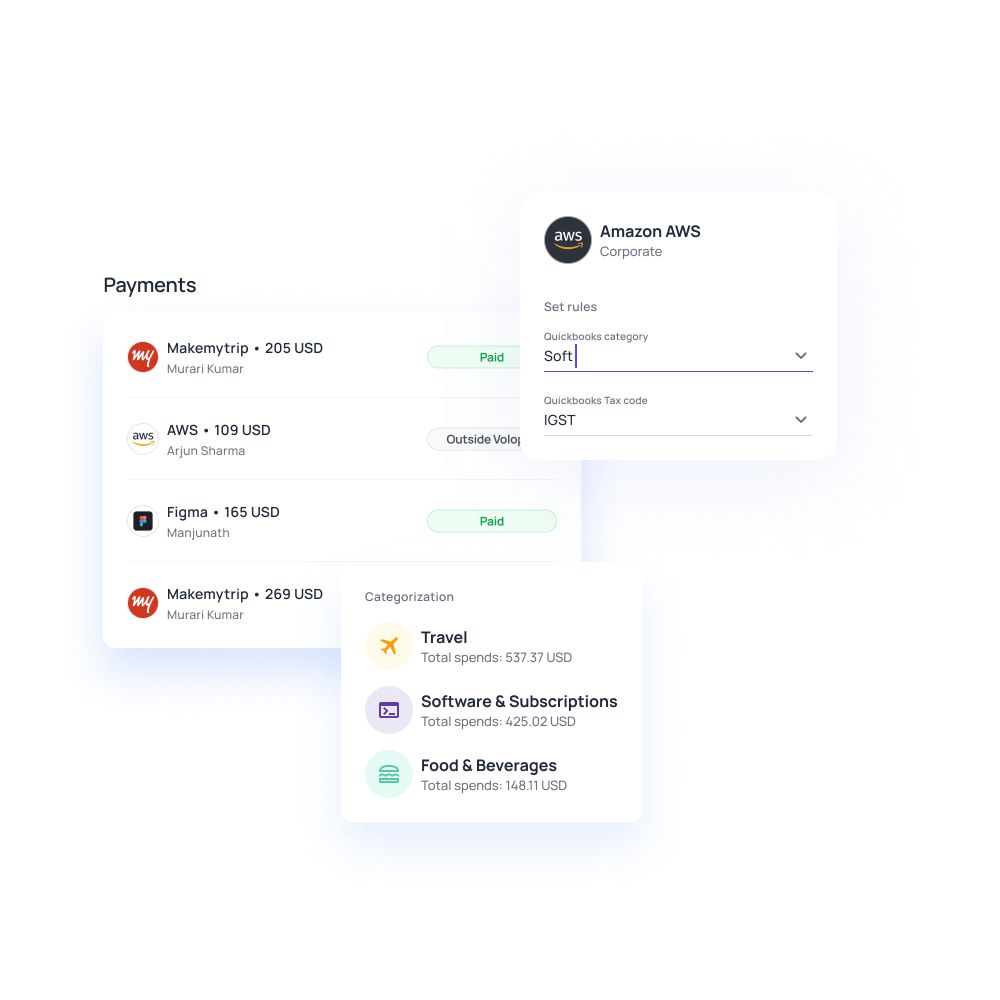

Integrate expense management

Expense management platforms that offer integrated accounting services have come as a boon to the finance industry. These apps offer a one-stop-shop for all your accounting woes including expense reports, reimbursements, approval workflows, physical and virtual cards, and, of course, expense reconciliation. These platforms are especially helpful in overcoming the issues that come with diverse data sources.

Automate reconciliation

These steps, including the three overarching principles, are best summed up by automated reconciliation platforms. A system that can record transactions, conduct approval checks, and then corroborate transactions with documents itself can basically reconcile expenses within seconds using a fraction of the labor that would otherwise be required. These platforms are capable of handling the entire expense reconciliation process while all you have to do is keep an eye out for any glaring errors and focus on working on insights and recommendations for the future of your company.

Digitize documentation

Tracking and verifying documents is an important part of expense reconciliation but also one of the more tedious steps involved. Using digitized means of document management, like mobile scanning apps or PDF readers, can help cut down the effort required to record and store documents.

Reconcile expense reports faster

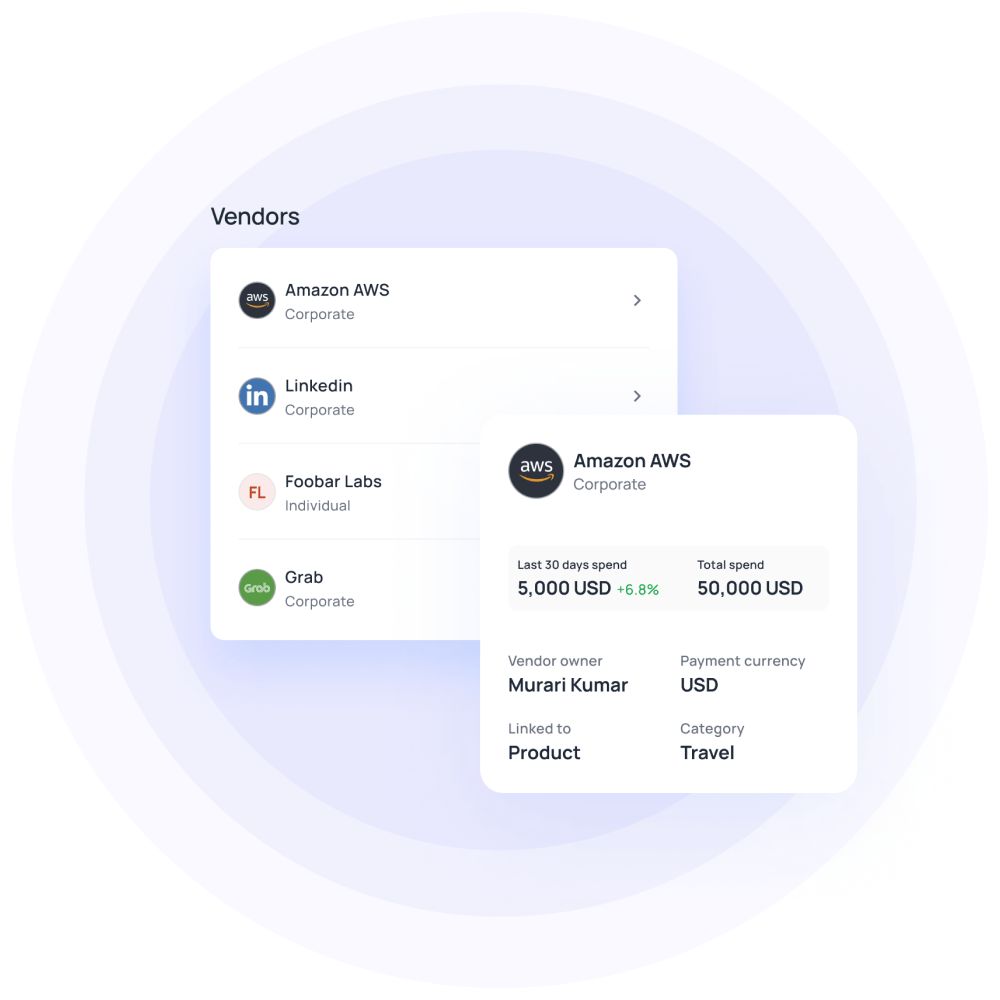

Volopay offers a comprehensive solution that comes fitted with all the necessary features a company might need to have a state-of-the-art expense reconciliation system.

An excellent example of the kind of expense management platform we have been discussing is Volopay. Volopay is essentially an expense management SaaS that offers an all-in-one platform for managing pretty much all the accounting processes that your company handles.

Our automated expense management accounting system is an especially powerful tool that you can use to make your finance teams’ lives so much easier. The software can record an expense, log it, notify the necessary individuals in case of approval requirements, store documents, and process transactions all in real-time.

The platform also comes with analytical tools that can provide valuable insights on the status of your books, all you need to do to obtain these reports is click a few buttons and wait for the software to work its magic.

FAQs

No, this is not possible because your books need to be balanced at the end of every month. If not, discrepancies might arise which might then have negative consequences for your cashflow. Other legal or audit issues may also come up.

Yes, it is possible to reconcile outstanding balances. You can carry it over to the balance of the next period to be calculated, usually the next month.

Yes, this would be possible but you would first have to convert the manual journal entries into digital format. This can be done manually or you can use document scanning services.

Yes, Volopay is well equipped to reconcile multi-currency account transactions.

Expense reconciliation processes are recommended to be carried out at least once a month.