How to identify and prevent expense reimbursement fraud?

Have you ever reviewed an employee expenses claim that was so bizarre and beyond the expense claim policy that it almost made you wonder why oh why an employee would think these are legitimate claim expenses? If you are stuck in a whirlpool of ridiculous claim expenses, you are not alone.

More than half of the world’s leading companies finance teams have reported receiving falsifying expenses by employees which are inappropriate, to say the least. If you too are struggling with a mountain of expense claims and a set of ridiculous company policies that need to be reigned in.

What are inappropriate expense claims?

When employees request reimbursement by claiming business expenses that are blatantly out of the company’s budget or submitting false expense reports that seem to be way too expensive than their real worth, it can be known as inappropriate expense claims.

While these expenses might look audacious to even laughable, they are a growing concern for businesses as they rack up a company’s claim expenses very quickly. Some of these expensive expenses could look like five-star restaurant dinners, $500 luxury cab rides, reimbursement for non-work-related entertainment, and lots more.

How businesses process expense claims

When companies rely on paper-based or text-based employee expense reimbursement claims, disaster is bound to strike. Here’s what a regular, run-of-the-mill employee expenses claim process looks like:

Step 1. An employee makes a purchase and pays out of their pocket. At this very first step, companies have a half-baked hope that the employee has an idea of what constitutes legitimate claim expenses and will therefore not make an inappropriate purchase.

Step 2. The employee saves the receipt. Again, this could be an issue if they forget to keep a track of reimbursable employee expenses or loses the paper receipts in an unfortunate laundry incident.

Step 3. They save these receipts up until the end of the week or month to file these claims. A lot can happen to paper receipts in 30 days. Therefore the employee has to exercise extra caution ensuring that the receipts are safe.

Step 4. The employee files an expense claim form. The claim is forwarded to the finance department. Again this is done over email or some work management application, where the message gets buried under a digital barrage of emails and work texts. Alternatively, a physical paper-based claim is filed which adds to a literal heap of expense claims

Step 5. The finance team runs the claim expenses through managers to approve them. This means that the finance department is running from office to office, confirming the expenses manually.

Step 6. Once the claim is approved, the dedicated finance employee in charge of reimbursement claims enters the details of the expense manually and schedules reimbursement.

Step 7. Yet again, the same details are entered into the accounting software.

Step 8. Once the employee who made the claim receives a confirmation, they receive the reimbursed value in the upcoming payslip. This whole process typically takes months according to company size and the levels of manual checks the finance department has to go through for a single expense claim.

How to prevent false expense claims?

Create clear and precise expense claim policy

A staff claim policy that doesn’t beat around the bush and specifies reimbursable and non-reimbursable expenses is the best way to eliminate any falsifying expenses by employees. Lay down a clear line of communication with your employees about what does and doesn’t constitute in the expense claim policy can refresh their memory regarding the same. You can do this by circulating company newsletters, staff emails, etc. You can also help your employees get real-time assistance by assigning an HR representative to assuage their expense claims doubts.

Address inappropriate expense claims as and when they arise

Ridiculous claims can be requested by different kinds of employees - some who are simply confused about the expense claim policy, some who have had a genuine lapse in judgment, while others are those who like to push the boundaries of what’s acceptable and what is not. No matter what kind of intention exists behind an expense claim, any exorbitant claim can jeopardize the company’s cash flow. That’s why it is prudent to address the unsuitable employee expenses claims as and when they arise to set clear expectations with all your employees.

Keep close eye on employees with extravagant claims in the past

While working on resolving expense claims, it would be a smart idea to closely inspect claims requested by those employees who have reported quite expensive or downright ridiculous claims in the past. This isn’t to say that these employees will repeat their past mistakes, but it’s wise to closely follow their requests in case of any relapse.

Streamline expense reporting with tools that truly work

The number one reason why some of these ridiculous claims either get approved by mistake or take months to be addressed is the poor employee expense reporting process. When the majority of your employees still rely on outdated methods of saving receipts such as safekeeping their paper-based versions or emailing them to the finance department’s already burdened email account, it is no wonder then that your company is at a serious disadvantage.

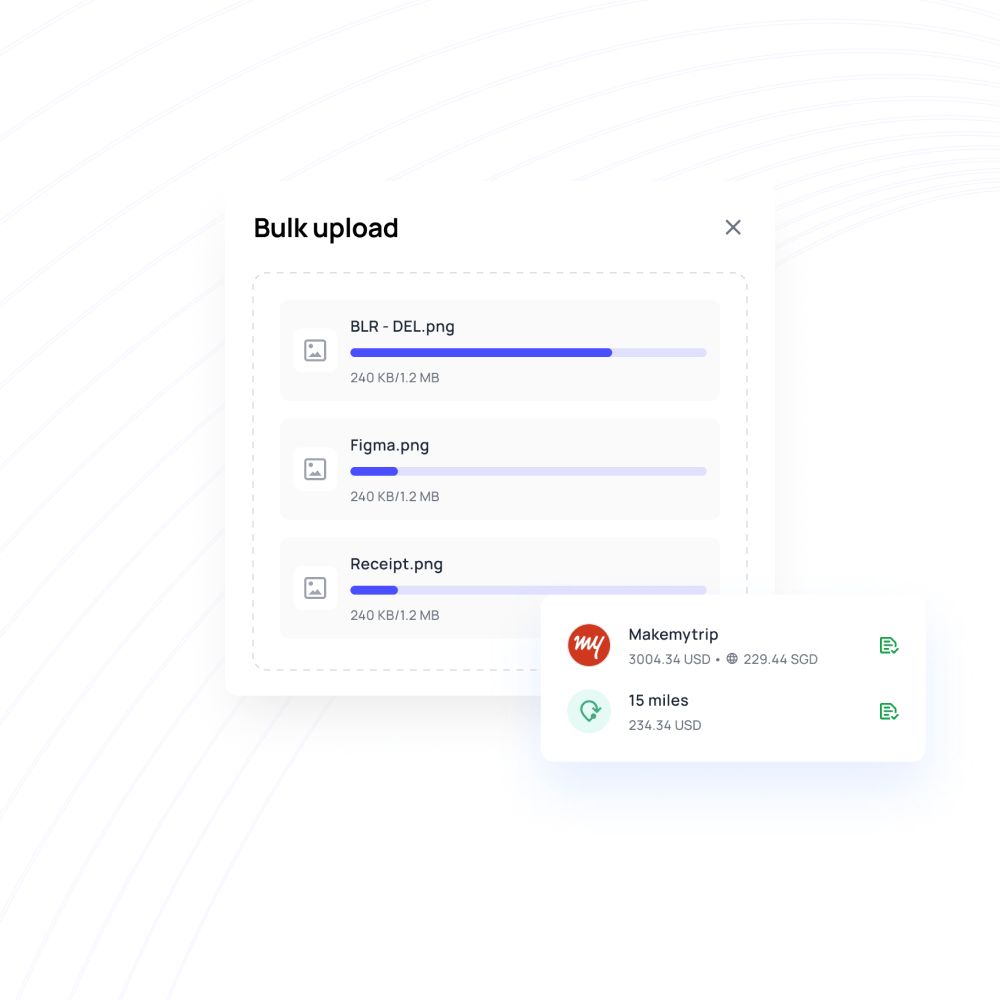

Investing in a spend management platform like Volopay lets your employees enjoy hassle-free expense report submission, using innovative OCR technology to digitally capture your receipts. Your employees simply take a picture of the paper receipt or upload the receipt document against their claim and that’s all! Your finance team, on the other hand, can track reimbursements for incidentals, cash, mileage, etc. against departmental budgets with real-time expense updates.

Related page: What is expense management software and how to choose one?

Trusted by finance teams at startups to enterprises.