How to streamline business expense reporting process?

As your business grows so will your employee size, operation scale and, consequently, also your expenses. And, as your expenses increase so will the pressure that falls on your finance teams to process expense reports. Expense reporting is an integral part of any business’s everyday operations. It helps track expenditure, guide budgeting, manage reimbursement and so much more.

Traditionally, expense reporting would have been a lengthy manual process. It would take hours, if not days, of hard labour to process expense reports of a decently sized company. Now, however, things are quite different. The world around us is evolving and so is business.

Expense reporting has also benefited from the technological evolutions and revolutions our world is seeing. With the help of automation, AI and highly advanced software the process of expense reporting has never been made to be any easier.

How to set up expense reporting process?

Verify reported expenses

After employees submit their expense claims make sure to include a step where you verify each expense claim. Vet these submissions to ensure that the claims made are without errors or mistakes, have all the information required to process expense reports and are free from any other discrepancies.

Design easy-to-follow expense reporting template

Design an employee expense report template that your workforce can use as a blueprint for recording expenses. If you’re not using expense management software you’re probably going to create a log sheet or a template document to serve this purpose. Ensure this template is easy to understand and all your employees have access to it.

Streamline receipt handling

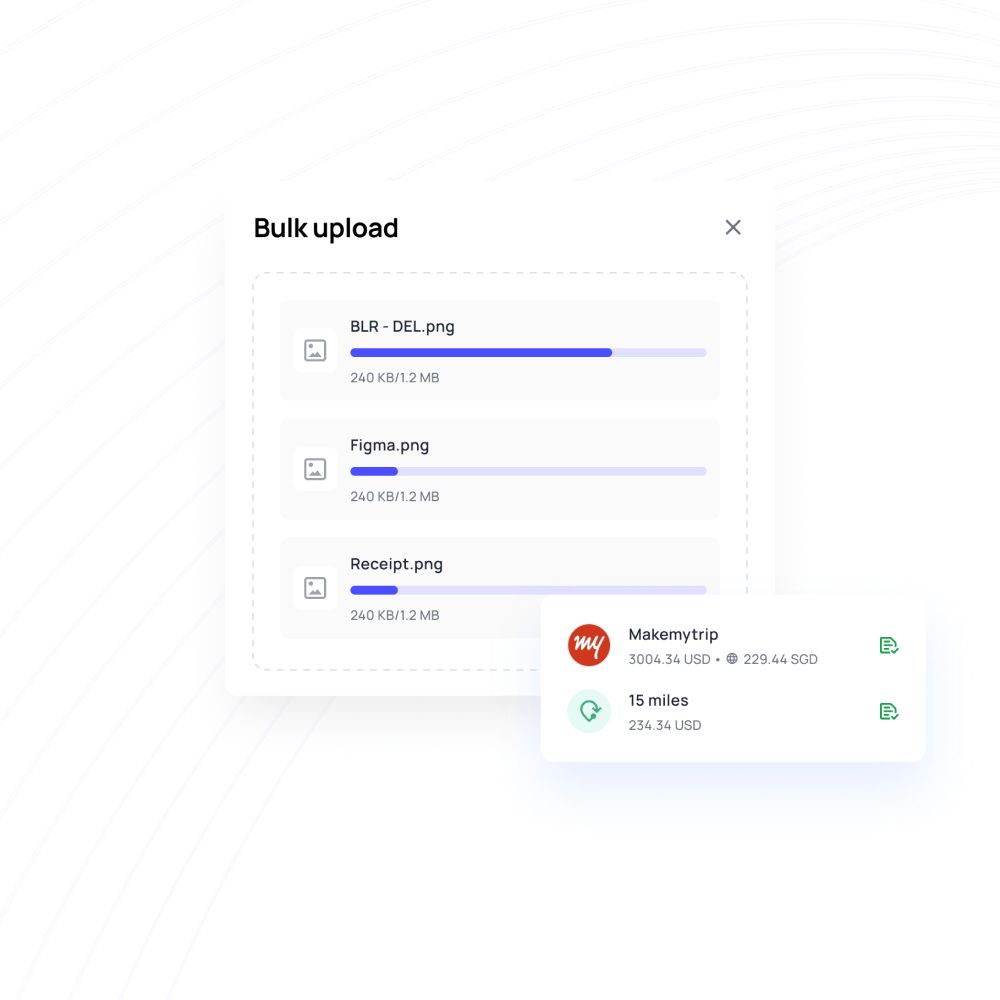

Receipts are notorious for being an important part of the expense reporting process that is also the cause behind most delays. Receipts are very easy to misplace or damage. To avoid this include a receipt management strategy in your expense report process. Enforce this strategy by incentivizing timely submissions and, or, educating your employees about the importance of receipts. Of course, you can always use a company expense report software where your employees can upload snapshots of receipts and never worry about it again.

Establish business expense policy

A company expense policy is essentially a document that outlines all the guidelines your employees have to follow when requesting, making or reporting a purchase. It should include directions regarding allowable expenses, reimbursement timeline, per diem travel amounts, an upper limit for purchases, and mileage reimbursements. The first step to setting up an expense report process is to establish a business expense policy that is easy to understand and easy to access. Employees going through the expense claim process must first be able to get their hands on and then understand the rules they are expected to follow.

Reconcile expenses

Once you’ve verified the expense claims the step that follows involves reconciling your expenses. You must match expenses recorded in your general ledger against card and account statements. The total of expenses submitted should be equal to the receipts submitted by your employees. In case the totals don’t add up you must locate missing receipts and investigate the cause behind the discrepancy to avoid succumbing to fraudulent activities.

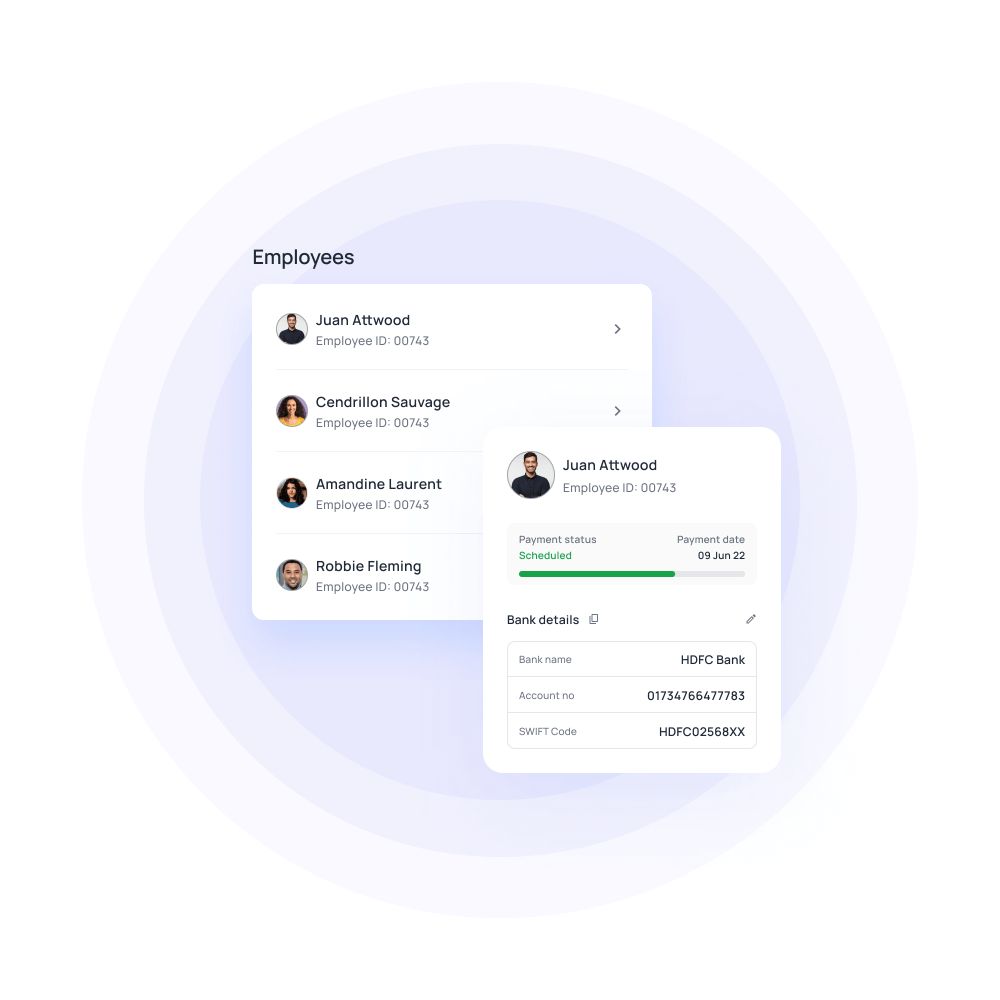

Roll out reimbursements

After you’ve verified all expense claims the step that comes next includes rolling out reimbursements for these claims made. Employees love working in a company that respects their employees’ personal finance. Approve employee expense reports, process and roll out reimbursements promptly to avoid delays and drop in overall employee satisfaction levels. By using reimbursement management software you can automates the entire process.

Risks of manually filing expense reports

There are two approaches companies can take in managing their employee expense report process - the traditional, manual approach or the new, software-driven approach. While the software-driven approach is rapidly gaining popularity there are still many companies that use the traditional approach of manually filing expense reports via spreadsheets or worse, by pen and paper.

Filing expense reports manually can lead to a number of obstacles in the process. Some of the common risks associated with manual expense reporting include:

1. Data entry errors made by employees when processing expense reports.

2. Calculation errors made by employees in the reconciliation step can negatively impact company revenue and cashflow.

3. Reimbursements rolled out for duplicate or spurious expense claims.

4. Huge requirements of company resources in manual processing tends to draw efforts away from value-producing tasks.

5. Time and labour intensive steps involved in manual expense processing often lead to a drop in employee productivity levels and burnouts.

6. Misplaced receipts, delayed report submissions, delayed approvals and reimbursements, revenue leakage due to incorrect processing can also lead to a dip in overall company morale.

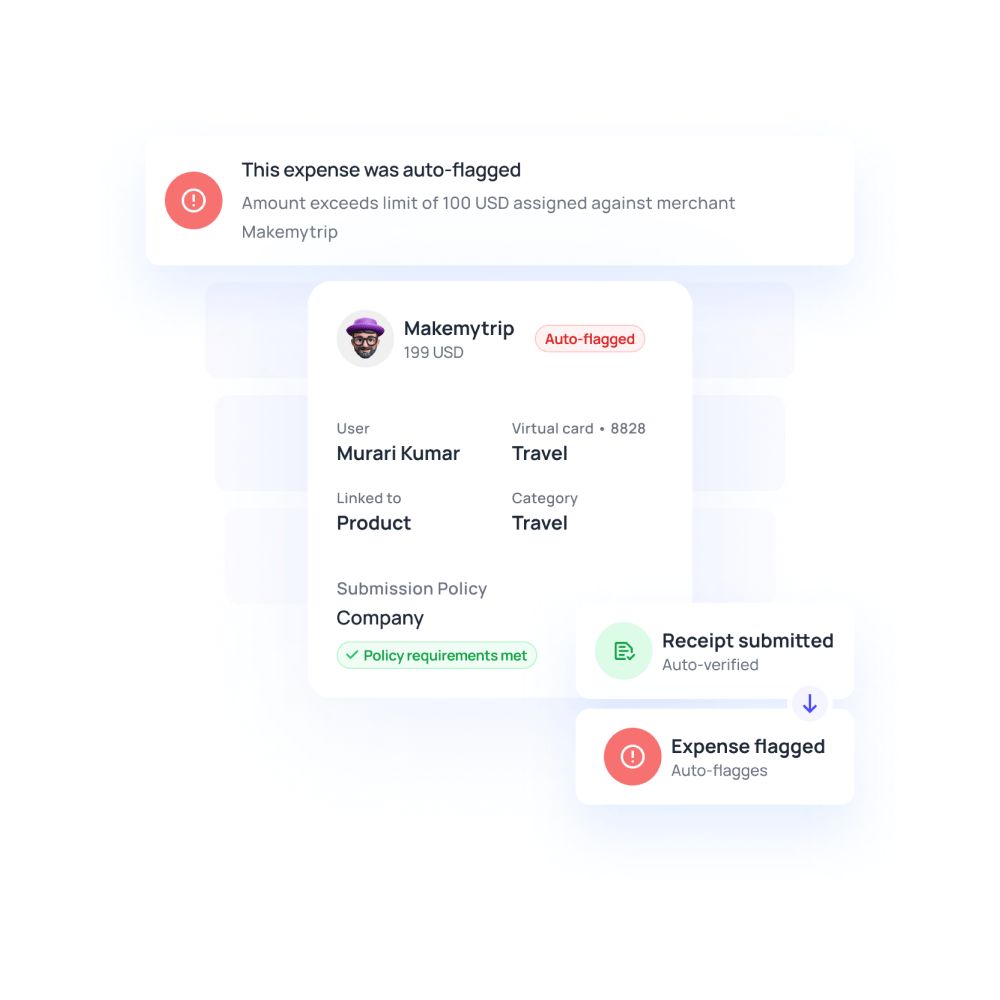

7. Identifying out-of-policy violations or expense fraud via manual checks can be extremely tedious and inefficient. Minor errors and discrepancies often evade manual checks.

6 ways to streamline expense reporting process

Leverage automation

Expense management platforms have made it extremely easy to streamline expenses. You can leverage the power of automation to cut down on all the time, resources and labour that would’ve otherwise been required. Everything, from recording the expense to reimbursement and reconciliation, can be handled by this software.

Receipt scanning, invoice processing, reconciliation etc. are all done automatically. This software also flags discrepancies and notify responsible parties automatically. You’ll still have to review a few expenses here and there but it’ll only take a fraction of the resources that manual processes would require.

Automation can greatly enhance the process, but it all starts with a solid foundation. Learn the basics of expense report creation in our blog on how to create an expense report for your business easily.

Eradicate out-of-pocket expenses

By eradicating out-of-pocket expenses you can cut out your expense reporting woes at their root. To do this you can use expense reporting software that also provides corporate credit cards. You can issue these cards to employees who need to make purchases. The best part of these cards is that they're very easy to issue, track and control.

You can fund them with only the amount that particular purchases require, automate payments made via these cards and maintain visibility over their usage. All transactions made using these cards are recorded and reported automatically by SaaS platforms.

Incentivize responsible behaviour

The best way to motivate any kind of behaviour is to incentivize it. The same goes for getting your employees to follow company expense policy guidelines and protocols. You can provide special rewards or perks for employees who regularly submit expense claims on time, always provide receipts, make error-free submissions etc. This can help motivate employees to follow protocol and ultimately make life easier for your accounts department trying to streamline expenses.

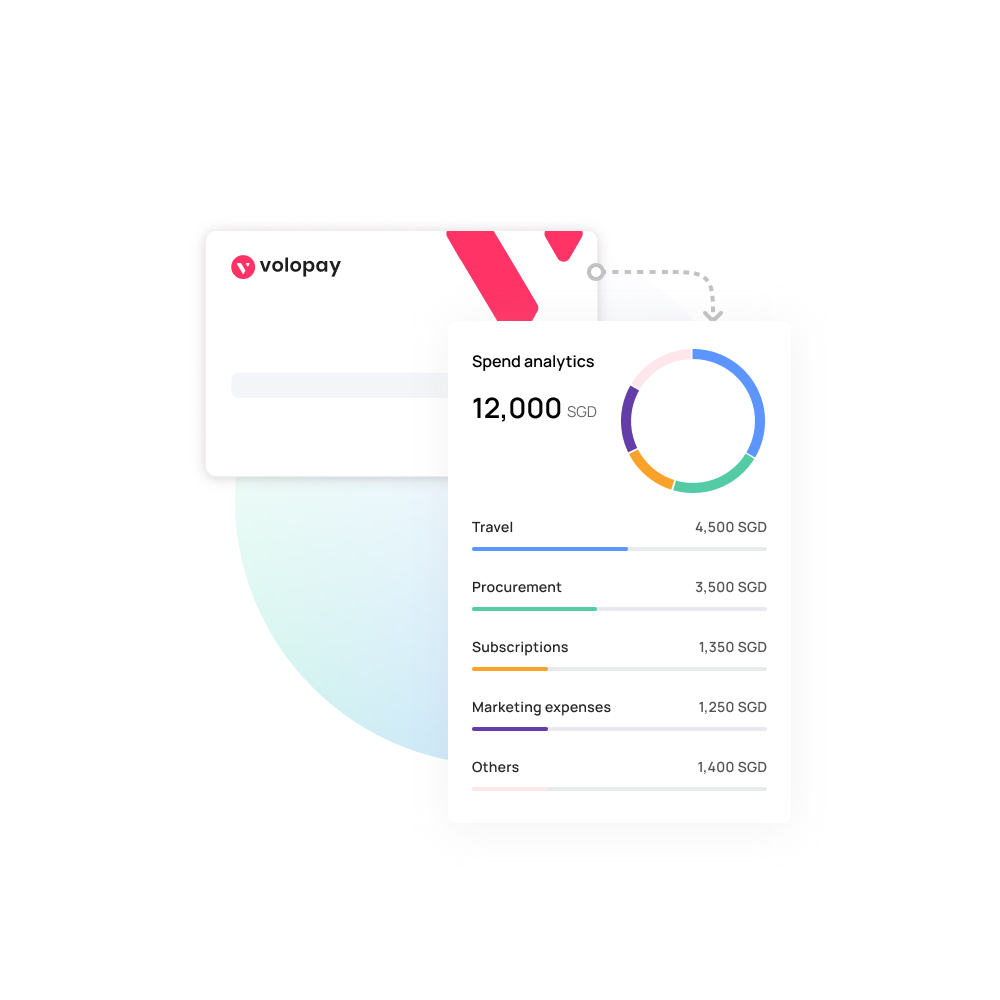

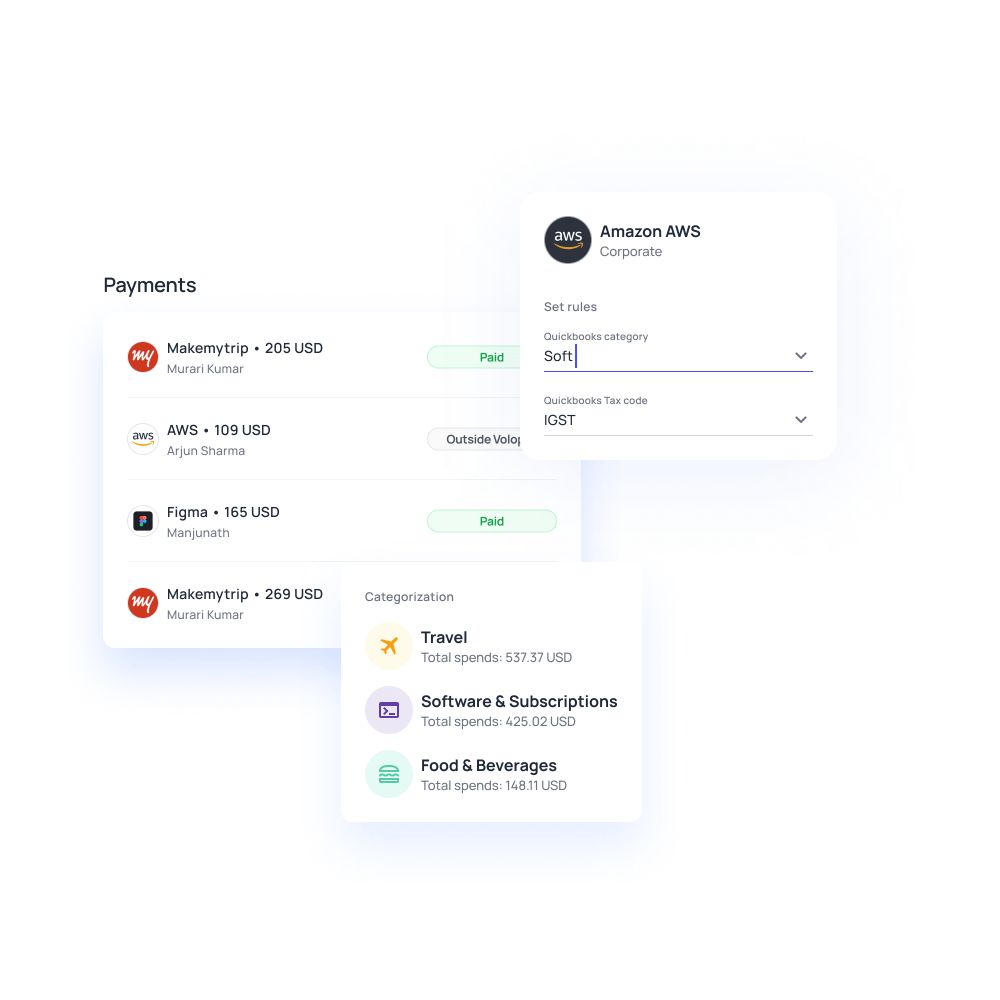

Utilize the power of analytics and insights

Analyzing past behavior and understanding what went wrong is crucial for securing the future of your expense management systems. Streamline expenses by identifying key areas for improvement in your expense reporting process through spend analysis. While you can manually chart historical data and analyze it, using expense management software equipped with analytics and insight-building features can significantly enhance this process.

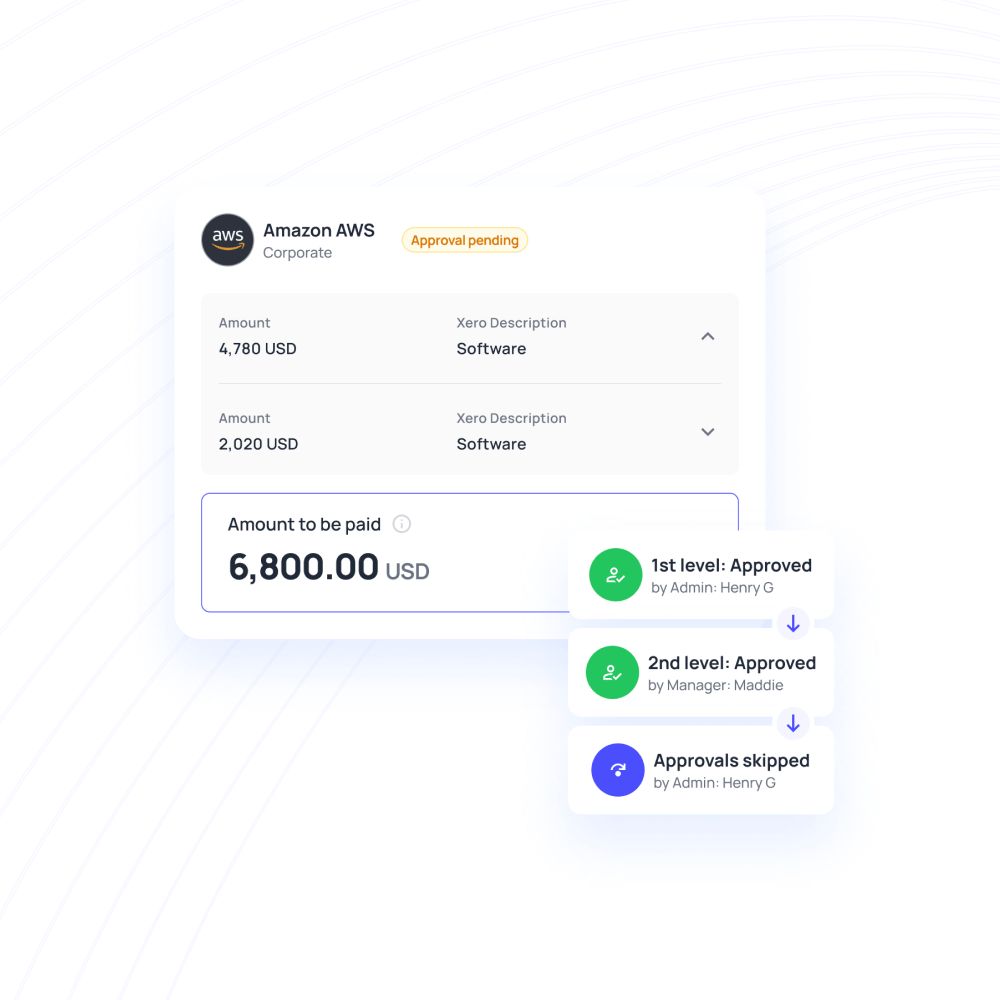

Set up approval systems

Submitting a purchase request is only the first step. To get approvals for the same responsible gatekeepers needs to validate these requests. If they do it on time there’s no problem, but if they don’t there’s going to be a lot of delays and running around your finance teams will have to do. Instead, use software that is capable of automating approvals.

You can set up auto-approval parameters for recurring expenses or even for low-value ones. In case manual approval has required this software also notify required individuals automatically.

Regularly update and revise policies

As the world around us continues to evolve so will the practices and processes associated with the business. Expense reporting already has evolved and there’s no guarantee that it won’t develop any further in the future. To ensure your policies are in tune with current trends conduct periodic reviews of your company expense policies and revise or update them as and when required.

Does your company's expense reporting process need automation?

Everything, from overall productivity to the company's bottom line, can be hampered by manual expense processing. By automating your expense reporting systems you can bid farewell to the most taxing and resource-draining aspects of expense reporting. Software that can streamline expenses, save time and money and do most of the heavy lifting.

Moreover, with expense management software at your disposal, you no longer have to fear inaccurate or scrupulous expense reporting. Few reasons why both your employees and your finance teams need automated expense reporting:

- Increased control and visibility over operations.

- Automated reconciliation of expense receipts and reports.

- No need for manual verification of expense claim submissions.

- Little to no manual efforts are required to process expense reports.

- Streamline expenses with advanced analytic reports & insights on data.

- Automated receipt management eliminates the issues of physical receipts.

- Automated expense approval process no longer need for manual intervention.

Why should businesses choose Volopay?

Far too many companies talk about encouraging employee autonomy, trusting the workforce, promoting healthy spending etc. Only a small percentage actually act on this perspective. If you are a part of this percentage, if you want to encourage healthy spending then try Volopay's automated expense management software for your business.

Before Volopay employees would either have to share or borrow company cards to make expenses or just pay out-of-pocket. Ask any employee out there and they’ll tell you how tedious this can be. Messy expense reporting procedures, complicated protocols and a general lack of visibility over expenditures further aggravated expense reporting systems.

On the other hand, with Volopay, you not only advocate employee autonomy but actually enforce it. You can issue individual cards to every employee needing to make purchases. Employees can use these cards without the hassle and freely spend on the job. All spending is tracked in real-time so that you don’t have to worry about overspending or fraud.

Volopay offers one of the best prepaid business cards, making it easy to manage company expenses and ensure control over employee spending.

FAQs

Expenses are super easy to review with Volopay. Just navigate to the cards section on your dashboard, click on expenses and you can review all the expenses shown under “Review”. From here you can verify expense details and mark the expense as “Okay” or “Not Okay”, as required.

Instead of requiring physical receipts, on Volopay you just have to upload a photo of your receipt. Navigate to the cards section then click on expenses, locate the particular expense, click on it and upload your receipt to the required details section.

Yes, with Volopay you can sort, customize and categorize all your expenses according to a number of parameters like timeframe, expense category, approval status etc.

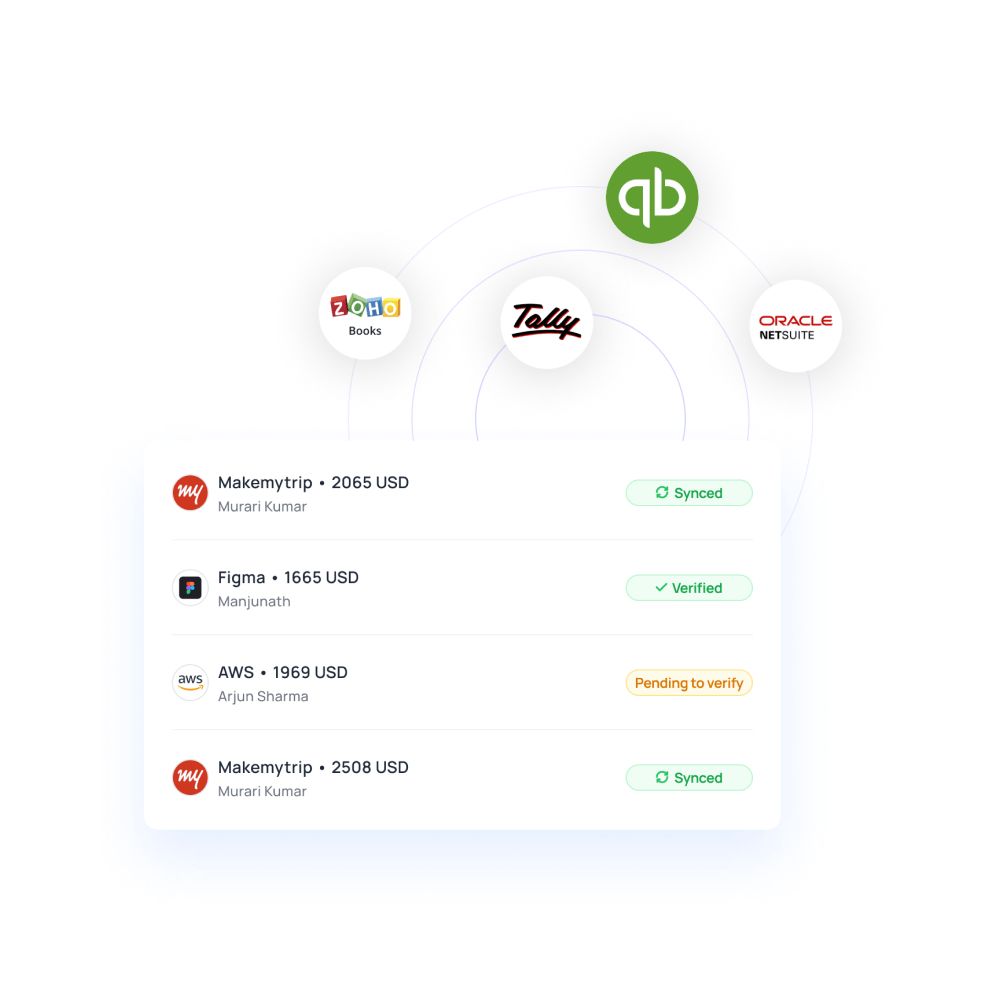

For you to sync expense reports with accounting software your expense management software needs to be API enabled. With Volopay you can seamlessly sync your expense reports with much popular accounting software like Netsuite, Quickbooks, Xero, Deskera, MYOB, Zoho, and Tally. and with your HRM software with the click of a few buttons.

Trusted by finance teams at startups to enterprises.