6 ways to automate expense reports and approvals

Every business runs on one simple rule — to make money, you have to spend money. Hence every organization incurs different expenses like salaries, vendor payments, interest payments, travel costs, etc. Although, you must be thinking that expense requests and approvals must be a simple process. No, it is an extremely time-intensive task. This is significant because many businesses still depend on a manual expense report and approval system which involves extensively running around the office to get things done.

You may argue that your company is comfortable with the manual expense reporting process, but using paper receipts or letting unknown expenses happen will only affect your company’s growth, your team’s productivity and also make the company more vulnerable to fraud. A smart decision, in this case, would be to opt for expense management automation. Expense automation will help you save a significant amount of time and money in the small business expense report and management automation process.

Why are expense reports still used in business?

Simplifies tax deductions

Numerous business activities happening in your company are eligible to be termed as tax-deductible. But how would you claim such expenses until you have them properly filed and recorded with proof? One technique many businesses use is taking expenses statements from their corporate card statements or bank accounts. However, all business expenses are not reflected in these statements. On the other hand, expense reports can make your life much easier by simply recording all and every expense made by the business.

Base factor of budget creation

A budget is an essential tool to manage your business’s money effectively. While creating a financial year plan, a detailed and dense expense report will help with better money allocation and structuring of the company’s goals for its future ventures. You will be able to give every team its necessary requirements for undertaking different projects. Along with this, if you want to closely monitor the actions of every department, like whether the team is working according to the budget or what advantages are being seen from each project, an extensive expense report will help you a lot.

Facilitates precise reimbursement

We see many instances where employees pay for certain business expenses out of their pockets and fairly reimbursing those expenses is a mandatory duty. However, while reimbursing the employees, you will of course want to make sure that all the requests are legit and genuine.

With employee expense reporting you can put together a standardized process through which your employees are informed about the expense policies. It is also a quicker way to determine if a reimbursement claim is legitimate or not. A well-formed expense report has receipts attached to each expense, which is solid proof of how much money was spent and at which places, and does it align with the company’s expense policies.

Boost expense tracking and cost control

With the help of an expense report, you get the key to control your company’s costs and review all the expenses. Regular tracking of company expenses helps is building a clear picture of the amount of the money that is being spent and also show clear results of where is the money going.

Tracking your company’s expenses from time to time gives you a clear picture of how much money is being spent and for what purposes. Along with this, you can also see the amount your employees spend on different expense categories and then analyze which factor is bringing in money and which aren’t. Also, through expense reports, you can also see the loopholes in your company’s expense policy, which you can eventually rectify.

Problem with manual expense approval process

Expense reporting and expense approval workflow is an extensively cumbersome, difficult, and monotonous process, no one wishes to deal with, especially if the whole process is manual.

1. Employees have to track and keep a record of all their expenses with proof like receipts, credit card bills and this takes numerous hours to document.

2. The manager has to put in infinite hours in approving all the team’s expenses.

3. The accountant is responsible to ensure all reimbursement requests and expenses given by the company employees are backed up with valid proof of purchase and then has to manually the whole data into a spreadsheet and also align all the books with it.

4. The CFO has to manage and organize a budget with the given expense report, but there are significant expenses not mentioned many times and so many other errors.

It is fact that paper receipts and manual data entry are extremely expensive and time-consuming, however, all these problems can be avoided with just one solution. Automated expense reporting. In simple terms, expense automation gives your business the facility to conduct processes in a less time-consuming and more efficient way.

Expense management automation will help all the people included in this process from employees to CFO. the long-term advantage of this is that your business will now be able to save hundreds and thousands of dollars and hours.

Still using spreadsheets to manage your business expenses?

Why automate expense reporting?

Faster reporting

An expense approval software can profitably eliminate all the paperwork from the expense report approval process. Even if you assume that all the manually created expense reports are perfect, still the creation of these reports takes an insane number of hours.

In order to correctly do this, they must have all the purchase receipts, then make triple sure that all the details filled in are correct, and then forward the sheet to the concerned person. Although, the main factor to consider is that no one from the company wants to willingly participate in the expense approval workflow.

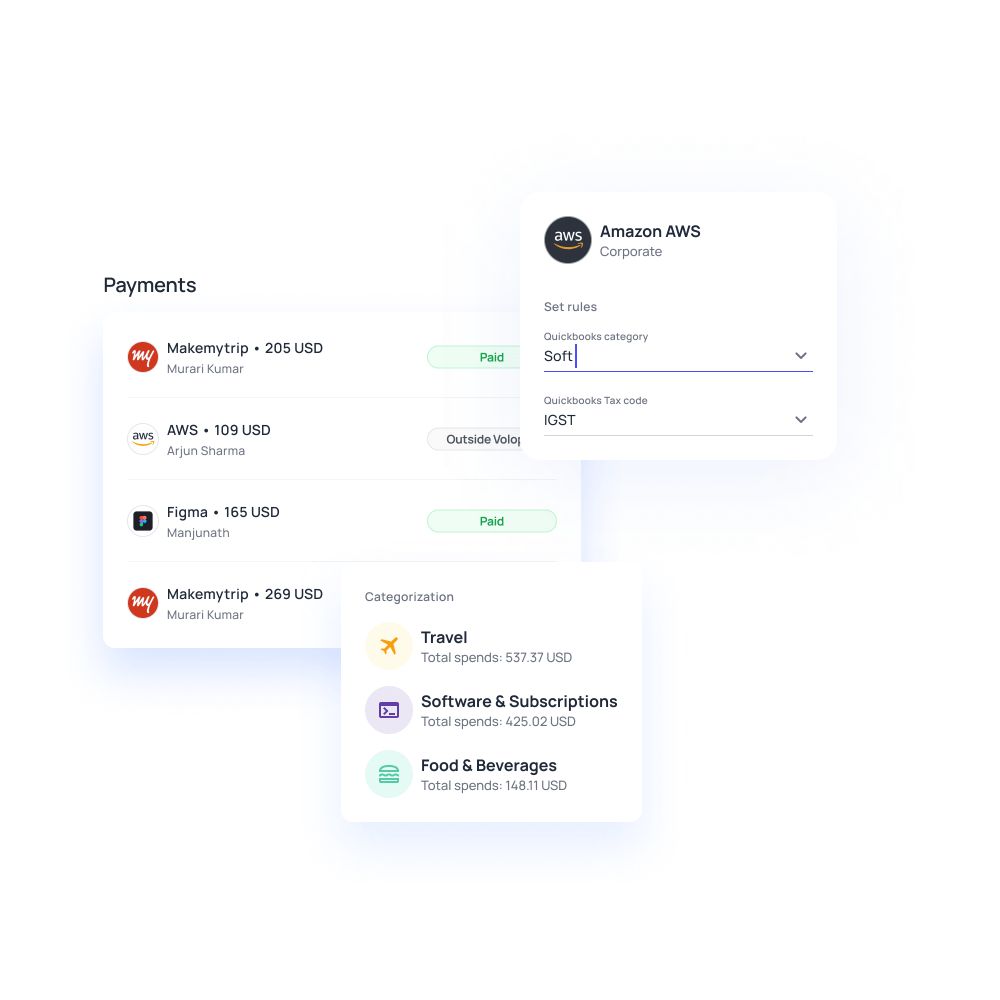

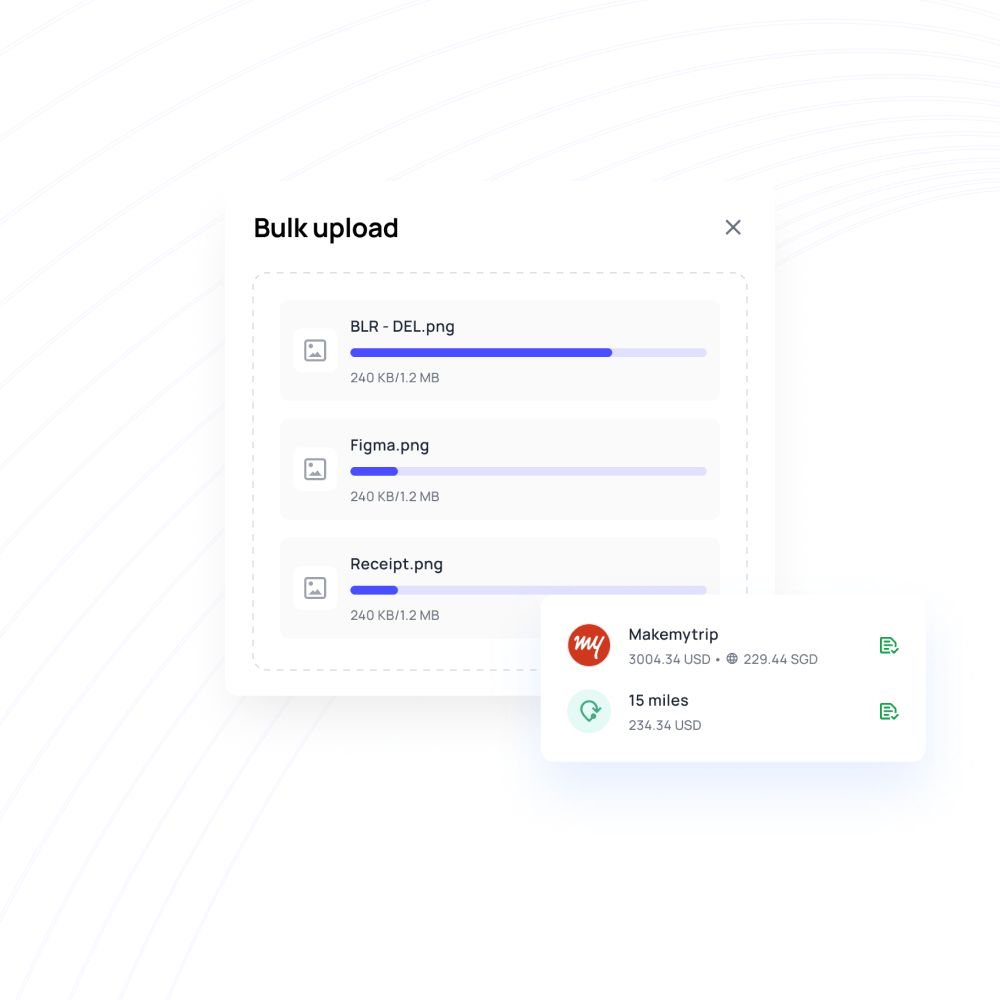

However, with expense automation, the employees simply have to note every expense the time it happens by taking a snapshot of the receipt and uploading it on the software. It potentially removes all the paper and unnecessary spreadsheets from the process. Every claim is accurately recorded in the system and can be easily approved or disapproved by the head.

Reduced errors

Statistically, over 20% of expense reports are filed inaccurately. Once all these errors start piling up, the end of the year accounting can become one hell of a task by draining all your time and efforts, assuming that you are able to identify and rectify all the errors.

However, with automated expense reporting, it is almost impossible for any error to pass by because while making an expense request or claim the employee is taken through the whole process step by step. Along with this technological features like OCR make your life much easier by scanning and reading all the receipts and matching it with the claims.

Real time visibility

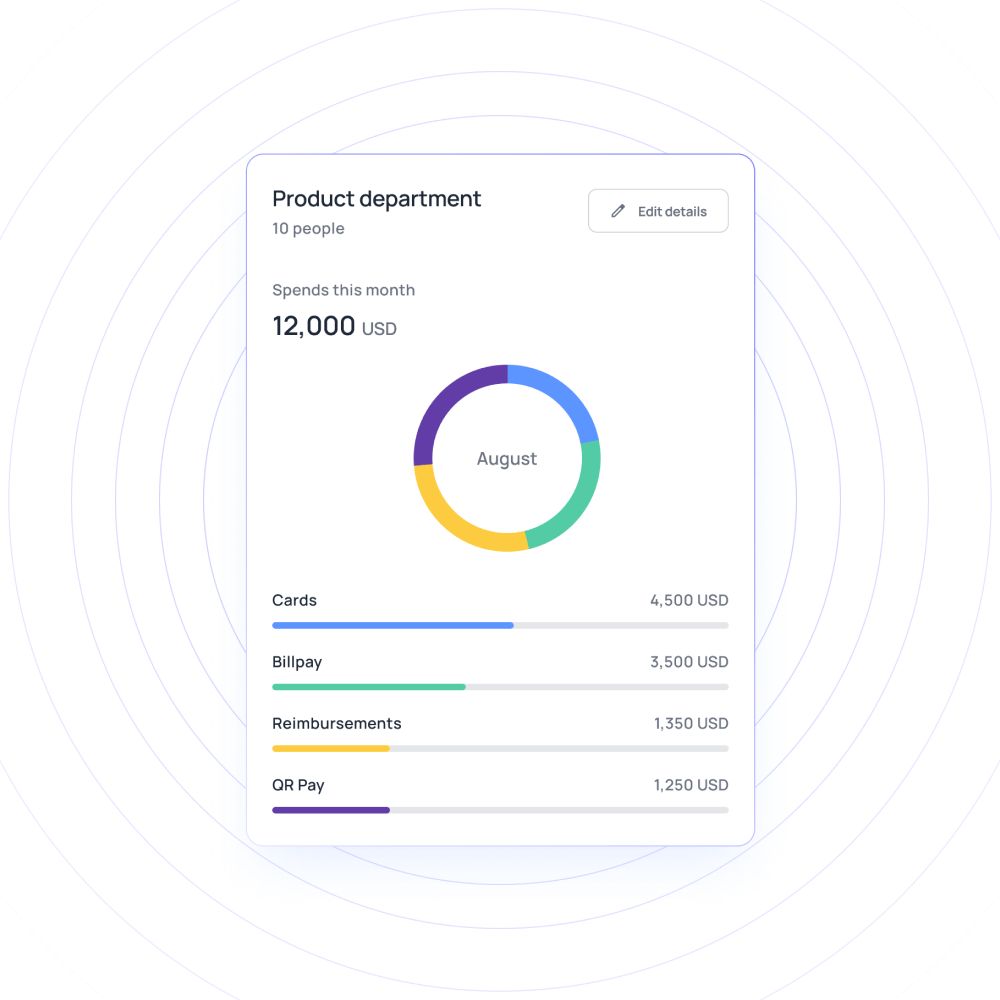

Visibility is one of the main issues that company CFOs and finance leaders struggle with because it is crucial to understand what is being spent. Statistically, 57% of businesses running in the market face this problem.

But if you opt for expense management automation, it will allow all the employees to submit their receipts in real-time and the finance team will always have a record of all the company spending immediately. This whole real-time feature makes budgeting and forecasting more precise.

How to implement automated expense approval system for your business?

Determine your automation needs

The first towards automation is identifying the area of your business operations that need to be automated. By looking at processes that consume the most time and effort, it could be the creation and manual data entry of each and every expense in a spreadsheet or maybe the receipt matching process.

Once you list out the business processes that require automation, imagine all those paper-free and completely digitized and forecast the potential benefits your business will reap from it.

Rethink your policy

Any company would naturally choose to follow a pretty loose expense policy if the whole expense reporting process is done manually. However, you must always take care that every point of your business’s expense policy must be written down clearly so that the employees can easily comprehend it.

Along with this, your policy should be flexible to incorporate changes during emergencies or unique situations. The policy needs to clearly state the person incharge to take the final approval decisions and also lay down the best course of action for everyone to easily follow the policy.

Check your workflow

The best way to check your workflow is by setting up a meeting with your team and then discussing who all are required to be a part of the expense report approval process and also rule the people who are not as important. Furthermore, ask every team member which responsibility would suit them the best. By gathering all their responses, make a workflow and see that everyone agrees with it.

Pick your tools

There are different software or apps available for tracking different expenses and at the same time, there are all-in-one platforms that take care of everything. Look for apps that would make your employees’ life easier or ask the team about their preferences.

There are many platforms that give you a demo of the working process of their expense approval software. You can take these demonstrations and explore your options. Just keep in mind that the platform you choose should transform the expense reporting process into an effortless one.

Customize the software

Once you decide which platforms you want to use for expense automation, spend a significant amount of time to get yourself and your team familiar with this automation tool. The more you invest in browsing and looking through every feature the more comfortable you will be with inducing the tool into the process. Reap benefits from the training videos and sessions conducted for your employees.

Upgrade with time

New tools and features can be exciting, we understand. However, a better option would be to enhance the tools you already have and regularly optimize the expense approval workflow. Grow steadily with time and smartly analyze your needs.

Why automate expense reports with Volopay?

Using different automation systems for the different business processes can become extremely hectic to handle, so why not, make a smart move and choose an all-in-one platform. Volopay is your one-stop shop for travel expense management, receipt scanning, expense approval, accounting integration and so many more processes related to automated expense reporting.

Trusted by finance teams at startups to enterprises.