8 step guide to create an expense report

Keeping up with expenses is a tough job for most businesses. Tracking, recording, and evaluation of all incurred expenses come under the basic responsibility of the financial business management department. However, businesses can avoid the risks of financial damages and troubles by maintaining an efficient small business expense report.

By keeping a track of all operational expenses, businesses can prepare effective plans for themselves, foresee any barriers that may arise in cash flow, and make sure that significant expenses such as vendor payments and payroll are initiated on time.

What are small business expense reports?

A small business expense report is often described as a document that keeps a track of all your operational expenses. The interrogations such as why, when, how, and by whom for all the expenses, along with proof in the form of receipts are a part of small business expense reports.

It makes easy for you to assemble a record of all the payments that your employees initiate, which assists your business in filing expense deductions.

Typically, an employee submits an expense report with attached receipts after making business purchases. If it meets per diem and other criteria, the business compensates the employee later.

Types of expense reports for business

Expense reports are essential tools for businesses to track, manage, and control spending. Whether you run a small business or manage a large corporation, understanding the types of business expense reports can streamline your financial processes and ensure transparency.

Here’s a guide to the different types of expense reports and how to create them efficiently.

One-time expense reports

One-time expense reports are used for individual, non-recurring expenses. These could be related to a specific project, event, or business trip.

The simplicity of these reports makes them ideal for capturing unique expenses without cluttering your regular accounting processes. Typically, you’ll include details like the date, amount, purpose, and receipts, making it easy to verify and process the expense quickly.

Monthly expense reports

Monthly expense reports are designed to capture all expenses incurred within a specific month. These reports are crucial for businesses that need to track and analyze their spending patterns over time.

By summarizing daily or weekly expenses into a monthly report, businesses can identify trends, control costs, and make informed budgeting decisions. Consistency in format and detail helps streamline monthly reporting and enhances financial planning.

Long-term expense reports

Long-term business expense reports are tailored for extended projects or initiatives that span several months or even years.

These reports provide a comprehensive overview of cumulative expenses, helping businesses track ongoing costs and ensure that budgets are adhered to over the long term. Detailed tracking and regular updates are key to maintaining the accuracy and relevance of long-term expense reports, which are critical for strategic planning and financial forecasting.

Recurring expense reports

Recurring expense reports are used to manage expenses that occur regularly, such as subscriptions, rent, or utilities. These reports help businesses automate and simplify the tracking of ongoing costs, ensuring that recurring payments are accounted for without unnecessary manual input.

By categorizing these expenses separately, businesses can easily monitor and control their fixed overheads, improving financial management and forecasting accuracy.

Departmental expense reports

Departmental business expense reports focus on the expenditures of specific departments within a business, such as marketing, HR, or IT. These reports are essential for understanding how different areas of the business are utilizing their budgets.

By isolating department-specific costs, businesses can assess the efficiency and effectiveness of spending, enabling better resource allocation and internal financial accountability. Regular departmental reporting also aids in cross-departmental financial comparisons and overall business performance evaluations.

Expense reports assist you with two objectives

Expense reports are more than just a record-keeping tool; they serve crucial roles in managing your business’s financial health and ensuring smooth operations. By organizing and categorizing expenditures, business expense reports help businesses achieve specific objectives that are vital for sustainability and growth.

Here’s how they assist in two key areas.

Financial tracking and control

Expense reports play a pivotal role in financial tracking and control by providing a detailed overview of all business expenditures. This visibility enables businesses to monitor spending patterns, identify areas where costs can be reduced, and ensure that budgets are being adhered to.

Regularly reviewing these reports helps prevent financial discrepancies and fosters a culture of accountability, ultimately leading to more informed and effective financial decision-making.

Reimbursement of employees

Expense reports are essential for managing the reimbursement of employees who incur costs on behalf of the business. By submitting detailed reports, employees can be reimbursed accurately and promptly, ensuring that their out-of-pocket expenses are handled fairly.

Clear guidelines on what can be claimed and proper documentation streamline the reimbursement process, minimize errors, and ensure compliance with company policies.

What does expense report have?

Employee and administrator name

The contrast between who is bearing costs for the organization's benefit and who they're answering to should be clarified. A bookkeeper can check repayment costs and assume they request the employee to go for a specific explanation.

Name of the division

Direct recognizable proof of the division in which you work ought to be thought of regardless of whether you have the enrolled administrator's name and the ID number. Whenever required, this can likewise succeed a worker ID piece of the cost report.

Employee ID number

The representative ID number confirms who's documenting the report and assumes that the number is related to any of the affiliation's areas of expertise. Small businesses are more averse to producing a worker ID number, yet they are expected to have an arrangement that perceives the division where a representative offers administrations.

Purpose of the excursion

Record the specific motivation behind why operational expenses require spending. Purposes, for example, business gatherings, client gatherings, purchasing supplies for organization use, and so forth, are thought of. Make certain to be essentially as sure as conceivable in portraying the point of your excursion.

Timeframe for business costs

Notice the timetable in which you went for business purposes. Outlay rates modify per annum, so referencing the year gives a careful depiction of the amount you ought to spend in a specific period.

Company card data

While building costs, write down the name of the organization card you utilized. An advanced record offers simplicity to a worker for following instalments and referencing them progressively.

Description of the cost

Notice what points of interest you bought and where you bought them from. To give a striking portrayal, attempt to refer to the total location of the store you purchased an item from. As such, the affiliation finds how far you went for business.

Category of the cost

Underline assuming that this use relates to inadvertent charges or housing and suppers. It's smarter to be pretty much as coherent as attainable in getting what each expense falls under. Ask your administrator on the off chance that you have any inquiries while finishing up this piece of the expense report.

Total costs

Notice all costs from an affiliation trip, keep up with receipts for each cost, and pass it to your bookkeeper for endorsement. Without a trace of documentation, your costs can't be repaid. In this way, saving receipts are a warning and ought to be referenced independently in the private company expense report.

Signature

A mark from a bookkeeper and a worker is the best answer for claiming the precision of costs to be repaid. In straightforward terms, the mark is last except if changes should be done inside the report. A director generally guarantees the precision of things bought, the cost, and the purchase area by cross-checking a cost report.

Payment method

The payment method section of a business expense report specifies how the expense was paid—whether by cash, company credit card, or personal funds. Recording this information is crucial for accounting purposes, as it helps reconcile payments and track the flow of funds within the business.

Merchant or vendor details

Including merchant or vendor details in an expense report is essential for identifying where and to whom the payment was made. This section typically records the name of the merchant, the type of service or product purchased, and the date of the transaction.

Supporting documentation

Supporting documentation, such as receipts or invoices, is a critical component of an expense report. These documents provide proof of purchase and are necessary for validating the legitimacy of the expense. By attaching supporting documentation, businesses can ensure transparency and accountability in their financial reporting.

Policy acknowledgment

An expense report often includes a section for compliance and policy acknowledgment, where employees confirm that their submitted expenses adhere to the company’s policies. This acknowledgment helps maintain consistency in expense reporting and ensures that all claims are within the allowable limits set by the business.

Eliminate paperwork with advanced expense reporting software

How to create an expense report?

Creating a business expense report is a straightforward process that can be made even easier with the right tools and a systematic approach. Whether you're doing this manually or using software, following these steps ensures accuracy and compliance with your business's financial practices.

Here's how to create an expense report efficiently.

1. Choose a template or expense management software

The first step in creating an expense report is selecting a suitable template or expense management software. Templates can be found in spreadsheet programs like Excel or Google Sheets, while specialized software offers more features, such as automation and integration with accounting systems.

Choosing the right tool depends on your business’s needs, but the goal is to simplify the process and ensure consistency in reporting.

2. Gather information and receipts

Before filling out an expense report, gather all necessary information and receipts. This includes transaction dates, amounts, payment methods, and any other relevant details.

Keeping receipts organized and readily available ensures that all expenses can be accurately documented and verified. This step is crucial for maintaining transparency and supporting the legitimacy of the expenses reported, particularly during audits or reviews.

3. Fill out the report

● Employee information

Start by entering the employee information into the report. This includes the employee’s name, department, and contact information. This ensures that the expense is correctly attributed and processed. It also creates a point of contact if any follow-ups are required.

● Expense details

List each expense in the report. Listing expenses is not as simple as adding the amount—it needs to include the date, amount, payment method, and description. Providing detailed information helps in accurate accounting and budgeting, and creates a clear paper trail of expenses.

● Attach receipts

Attach all relevant receipts to substantiate the expenses listed. Ensure they are legible and match the corresponding entries in the report. Receipts act as proof of payment and are also a verifiable record of any expenses made by employees in case there are any discrepancies to rectify later.

4. Handle currency conversion and international expenses

If your expenses involve foreign currencies, accurately convert these amounts into your business's primary currency. Use the exchange rate applicable at the time of the transaction and document it clearly in the report.

Handling international expenses correctly is vital to ensure financial accuracy and compliance, especially in businesses that frequently deal with cross-border transactions.

5. Ensure compliance and adhere to policies

Review your company’s expense policies to ensure that all reported expenses are compliant. This includes checking for allowable limits, required documentation, and approved types of expenses.

Adhering to these policies not only simplifies the approval process but also reduces the risk of claims being rejected. It’s essential to remain consistent with these guidelines to maintain ethical and transparent financial practices.

6. Calculate totals and subtotals

Once all expenses have been entered, calculate the totals and subtotals. This step involves summing up individual expenses and categorizing them if necessary (e.g., travel, meals, office supplies).

Clear categorization helps in better budget tracking and financial analysis. Double-check these calculations to ensure accuracy before submitting the report, as errors can lead to delays in processing or approval.

7. Add relevant notes

Adding notes to your expense report can provide context for certain expenses, clarify unusual charges, or offer explanations for policy deviations. These notes help reviewers understand the nature of each expense and can preemptively address any questions or concerns.

Including relevant details in this section contributes to a smoother review and approval process, particularly for higher or atypical expenses.

8. Review and submit

Finally, thoroughly review your expense report for errors, missing information, or discrepancies. Ensure all fields are completed, receipts are attached, and totals are accurate.

After ensuring everything is in order, submit the report through the appropriate channels for approval. A well-prepared expense report speeds up the reimbursement process and minimizes the need for corrections or follow-up inquiries.

Why do businesses need expense reports?

Expense reports are vital tools for businesses, serving multiple purposes that contribute to effective financial management and operational efficiency. They provide a structured way to monitor spending, ensure compliance, and streamline various financial processes.

Here’s why businesses rely on expense reports and the key benefits they offer.

1. Ensures accurate financial tracking

Expense reports play a crucial role in ensuring accurate financial tracking by systematically recording all business-related expenses.

This comprehensive tracking helps businesses monitor their spending patterns, allocate budgets appropriately, and identify areas where cost control is needed. Accurate financial tracking not only supports day-to-day operations but also provides essential data for long-term financial planning and decision-making.

2. Facilitates reimbursement process

Expense reports streamline the reimbursement process for employees who incur business expenses. By documenting each expense with details and receipts, employees can be reimbursed promptly and accurately.

This is true for large or small business expense reports. It not only helps maintain employee satisfaction but also ensures that all expenses are accounted for in the company’s financial records. A well-organized reimbursement process helps maintain smooth financial operations, processing expense reports faster and ensuring timely reimbursements.

3. Ensures policy compliance

One of the key functions of expense reports is to ensure that all expenses adhere to the company’s policies. By requiring employees to detail their expenditures and provide supporting documentation, businesses can verify that all claims are within the guidelines.

This helps prevent unauthorized spending, reduces the risk of fraud, and ensures that financial practices align with internal controls and regulatory requirements.

4. Enhances financial reporting and auditing

Expense reports are essential for enhancing the accuracy and thoroughness of financial reporting and auditing. They provide a clear and documented trail of expenses, which is invaluable during audits and financial reviews.

Detailed expense reporting ensures that all expenditures are transparent and can be easily verified, reducing the risk of discrepancies. This documentation is critical for maintaining credibility with stakeholders and regulatory bodies.

5. Improves expense management efficiency

By using structured expense reports, businesses can significantly improve their expense management efficiency. These reports allow for easier categorization, tracking, and analysis of expenses, helping businesses identify trends and make informed decisions.

Automation and software solutions further enhance efficiency by reducing manual errors and speeding up the approval and reimbursement processes. Overall, efficient expense management contributes to better financial control and resource allocation.

Streamline your expense reporting process with Volopay

Best practices for creating effective expense reports

Creating effective business expense reports is essential for maintaining accurate financial records and ensuring smooth business operations. Adhering to best practices not only simplifies the expense reporting process but also helps in minimizing errors and improving compliance.

Here are key practices to follow when preparing expense reports.

1. Attach all necessary receipts & documents

Always attach all required receipts and supporting documents to your expense report. These documents serve as proof of purchase and are essential for validating the expenses.

Ensure that the receipts are legible and properly organized. Attaching complete documentation helps prevent delays in processing and facilitates smoother reimbursement and approval processes.

2. Accurately categorize expenses

Properly categorizing expenses is crucial for accurate financial reporting. Group similar expenses under appropriate categories, such as travel, meals, or office supplies.

Accurate categorization makes it easier to analyze spending patterns and track budget allocation. It also simplifies the approval process, as reviewers can quickly understand the nature of each expense.

3. Provide detailed descriptions

Including detailed descriptions for each expense adds clarity and context to your report. Clearly explain the purpose of the expense, who was involved, and how it relates to business activities.

Detailed descriptions help approvers understand the necessity of the expense and can reduce the likelihood of queries or rejections during the review process.

4. Adhere to company policies

Ensure that all expenses reported comply with your company’s policies. Familiarize yourself with the guidelines on allowable expenses, documentation requirements, and reimbursement limits.

Adhering to these policies not only streamlines the approval process but also demonstrates responsibility and alignment with company standards, reducing the risk of expense report rejections.

5. Convert foreign currencies accurately

If your business expense report includes transactions in foreign currencies, ensure accurate conversion into your company’s primary currency.

Use the exchange rate applicable at the time of the transaction and document the rate used. Accurate currency conversion is crucial for maintaining consistency in financial records and avoiding discrepancies in expense reporting.

6. Double-check totals and calculations

Before submitting your expense report, double-check all totals and calculations for accuracy. This includes verifying individual expense amounts, subtotals, and overall totals.

Correct calculations ensure that the report reflects true costs and prevents delays caused by errors. Taking the time to review your figures can also prevent potential misunderstandings or disputes.

7. Submit reports promptly

Timely submission of expense reports is important for ensuring that expenses are recorded and reimbursed promptly. Delays in submission can disrupt financial planning and budgeting processes.

By submitting reports promptly, you also help maintain cash flow consistency for both the business and employees awaiting reimbursement, ensuring smoother financial operations.

8. Review for completeness and accuracy

Thoroughly review your expense report for completeness and accuracy before submission. Ensure that all required fields are filled, receipts are attached, and no details are missing.

Reviewing your report carefully helps catch any errors or omissions that could otherwise lead to delays in approval or require corrections later on.

9. Secure necessary approvals

Ensure that your business expense report is routed through the correct approval channels. Depending on the company’s policies, this might involve departmental managers, finance teams, or executives.

Securing the necessary approvals is critical to finalizing the report and facilitating reimbursement or budget adjustments, ensuring smooth and compliant financial processes.

10. Automate where possible

Leverage automation tools and expense management software to simplify the creation and submission of expense reports.

Automation reduces manual data entry, minimizes errors, and speeds up the entire process. By automating routine tasks, you can focus on more strategic financial management and improve the overall efficiency of your expense reporting workflow.

Related read: Why does your business need automated expense reporting?

How does automation improve expense reporting for your business?

Eliminates paperwork and error-ridden reports

Managing the expense report spreadsheets manually is a tough part of the job for your employees and the finance department. The paper receipts are to be stored by your employees to file their expenses. On the other hand, the finance team spends a lot of time on the verification of paper receipts and passing approval of expense reports for reimbursements. Also, manual work is associated with unexpected errors.

Imagine a situation where your employee submits the exact expense report, but your finance department enters the wrong data while manually transferring the reports from the spreadsheet to the accounting system. Automation of the expense report process eliminates the risk of human errors. The finance department just needs to click a picture of the receipts and upload them directly to the portal with expense report software.

The finance department can gather the report once the accumulation of expenses is fruitful. It takes out feverish assignments and diminishes wellsprings of mistakes. Regardless of whether mistakes continue, your finance manager can undoubtedly follow them, which is normally troublesome with paper records.

Improves policy compliance rates

Keeping up with consistency and presenting travel expense policies turns into an imposing undertaking without a trace of a legitimate expense report app. It's intense for the finance team to follow and guarantee consistency for exchanges being moved into a spreadsheet when numerous costs appear together. This requires manual exchange of every cost against the travel expense policies.

Manual use handling can likewise intend that out-of-strategy charges show up out of the blue, and your finance team winds up discounting your laborers for policy violation. To improve travel policy compliance, your cost report programming can be modified according to your association's travel arrangements.

The framework is intended to automate flag and banner costs that are against the travel regulations. The approvers would be notified in case of policy violation as and when they appear. This further adds to the simplicity of your finance team. They can inspect the consistency of the costs continuously and acknowledge or object to them in a couple of snaps.

Prevents expense fraud

Expense reports are prone to theft when the employees submit them manually. The manual cost process adds to the turmoil, which offers the ideal setting for deceitful practices, for example, gathering together mileage charges and presenting a similar receipt two times. Controlling these fake exercises is a difficult situation as you should distinguish suspected asserts and circle back to the related employee to redress the issue.

Automation presented by the expense report app is a straightforward method for stopping such cost misrepresentation. It can precisely follow where the copy sections showed up and inform the submitter (and their approver) to either correct or eliminate the cost. Also, an upgraded work process adds to straightforwardness by permitting a twofold audit process. After the approver's review, it gives an extra audit before reimbursing the costs.

Speeds up approval and reimbursement

Without proficient expense report programming, the finance team and superiors invest a great deal of energy checking every representative's expense report manually and moving tasks starting with one approver then onto the next. It prompts a postponement in the reimbursement process. Suppose, a group of representatives has quite recently gotten back from an excursion supported for business purposes.

Before long, your finance department will have a greater part of receipts to set up a cost of doing business reports. They'll need to check the fitness of every cost referenced in the receipts by matching it against the approach. Assuming they skirt a receipt erroneously or put off an envelope for certain days, there goes the employee's expense report for repayment. The manual intercession can be decreased by introducing an expense report application and redesigning the endorsement work processes.

With an approver's endorsement of a report, the assignment is consequently moved to the following approver in line. It advises them to satisfy their job in the endorsement interaction. When every one of the endorsements is gotten, the finance manager can review and pass the expense report for repayment with a couple of snaps.

Increases visibility

Employee expense reports when prepared manually confine the continuous visibility of costs- the insight that you accumulate after drawing out data from a few sources could be extremely old. To screen when and where the association's abundance is being utilized, the finance department of your affiliation would expect essentially seven days to dissect the records and accumulate a precise operational expense report.

You ought to be fit for examining and seeing information as the occasions happen to make rushed, informed choices. Manual administration of costs influences information exactness and limits your visibility into your affiliation's income. Most expense report programming offers broad reports on trips, costs, repayments, strategy infringement, and a few others. You can utilize the policy violations report to figure out the top strategy violators in your organization inside a couple of snaps.

In addition, you can depend on the monthly expenses reports investigating your employees' spending behavior. Aside from settling on speedy choices, these reports help your travel and finance unit to work together to shortlist the ideal vendors for inn networks and aircraft transporters. Together, they can arrange the best arrangements and deals from the sellers. Finally, you can monitor your income and screen your affiliation's monetary exhibition.

Take control of your business expenses with Volopay

How does Volopay help in expense reporting?

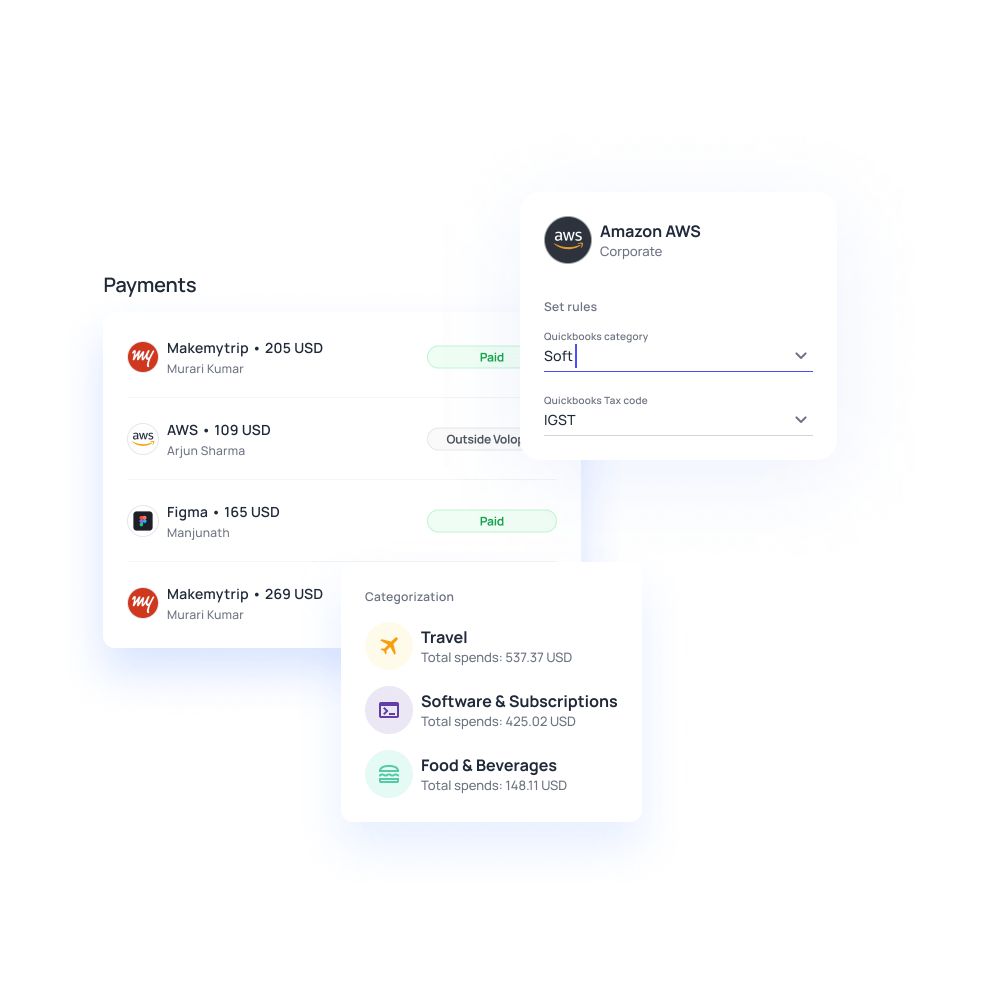

Volopay simplifies and enhances expense reporting for businesses with its comprehensive expense management system. By offering features like real-time tracking, automated report generation, and seamless integration with other financial tools, Volopay streamlines the entire expense reporting process.

Businesses benefit from reduced manual work, faster approvals, and more accurate financial data. These features not only improve efficiency but also provide better control over company spending, making Volopay a valuable tool for modern expense management.

Automation of expense reporting

Volopay automates the entire expense reporting process, eliminating the need for manual data entry and reducing the risk of errors.

With automated receipt capture and real-time data syncing, employees can easily submit expenses on the go, and finance teams can quickly review and approve reports. This automation saves time and ensures that business expense reports are accurate, consistent, and compliant with company policies.

Customizable approval workflows

Volopay offers customizable approval workflows that align with your company’s specific expense policies and organizational structure.

You can set up multi-level approvals, define spending limits, and ensure that every expense report goes through the necessary checks before final approval. This flexibility not only enhances compliance but also streamlines the approval process, reducing bottlenecks and ensuring timely reimbursements.

Corporate cards with tailored controls

Volopay provides corporate cards that come with tailored spending controls, allowing businesses to set limits and track expenses in real time.

These controls ensure that spending aligns with company policies and budgets, and provide visibility into employee expenses as they occur. The integration of corporate cards with Volopay’s expense management system further simplifies the reporting process by automatically categorizing transactions and attaching receipts.

Real-time expense tracking

With Volopay, businesses can track expenses in real time, providing immediate visibility into spending patterns and cash flow.

This real-time tracking helps companies monitor budgets, identify potential overspending, and make informed financial decisions. The ability to see expenses as they happen ensures that there are no surprises at the end of the month, and it keeps financial data up-to-date and actionable.

Seamless integration with accounting software

Volopay seamlessly integrates with popular accounting software like Xero, QuickBooks, and Netsuite, allowing for effortless synchronization of financial data.

This integration ensures that expense reports are automatically reflected in your accounting system, reducing manual data entry and minimizing the risk of errors. The streamlined flow of information between systems simplifies reconciliation processes and enhances overall financial management efficiency.

User-friendly interface

Volopay’s user-friendly interface makes it easy for employees and finance teams to manage expenses, submit reports, and approve requests.

The intuitive design ensures that even those unfamiliar with complex financial tools can navigate the system effortlessly. A straightforward interface reduces the learning curve, encourages adoption across the organization, and enhances productivity by simplifying the expense reporting process.

Cost efficiency

Volopay’s expense management system contributes to cost efficiency by reducing the time and resources needed to process and manage expenses.

Automated processes, real-time tracking, and seamless integration cut down on administrative tasks and minimize errors, leading to significant savings. Additionally, the ability to monitor expenses closely helps businesses control spending and make more strategic financial decisions, improving overall cost management.

Bring Volopay to your business

Get started now

FAQs

Expense reports ought to frequently be submitted either month to month or quarterly. A month-to-month expense report helps track all the spending an affiliation has made inside that phase. It recognizes regions where the organizations can slice to boost benefits.

The government offers tax refunds to its citizens if the situation of over-taxation arises. It implies that reimbursement also occurs in the form of tax refunds. Unlike any other reimbursements, taxes are not implied on expense reports.

● Admin users: They can prepare and make changes in expense reports.

● Expense approvers: On behalf of the employers, expense approvers can prepare an expense report.

● Basic users: Employees are exposed to the chance of preparing expense reports for their reimbursement purposes. Well, the employers must turn on the expense reports toggle to avail this opportunity.

Receipts are considered quite significant while preparing expense reports because they serve as proof for the expense report excel. The employees are suggested to pin the receipts in the expense report for reimbursements.

You should submit a business expense report according to your company’s policy, which is typically monthly. However, for frequent travelers or large projects, weekly submissions might be preferred to ensure timely processing.

If you lose a receipt, check if your company allows for a missing receipt affidavit or a written explanation. Provide as much detail as possible about the expense to ensure it’s processed.

To ensure compliance, familiarize yourself with your company’s expense policy guidelines. Double-check that all expenses fall within the allowed limits, are necessary, and have proper documentation attached before submission.

Common mistakes include failing to attach receipts, miscategorizing expenses, entering incorrect amounts, and submitting reports late. To avoid these errors, review your report carefully before submitting it for approval.

Yes, many companies now accept or prefer digital submissions of expense reports. Using expense management software, you can easily submit reports electronically, complete with attached digital receipts, for faster processing.

Volopay simplifies business expense reporting by automating receipt capture, categorizing expenses, and allowing real-time tracking. It also integrates with accounting software, streamlining the entire submission and approval process for greater efficiency.