What is spend analysis and how to conduct it in 8 steps?

When you're going through your quarterly or year-end profit reports and see that the final numbers on the sheet are way lower than your initial targets. You only get two guesses to know the cause behind this. Your first guess for this anomaly would be a calculation error. But the accounting team has done a stellar job and the ledgers are crystal clear.

Your second guess is more likely to be embezzlement. You run these numbers through a fine-toothed comb. Still, no change. The numbers stand firm and the team loyalty is higher than ever. Then what’s the answer?

It’s guess number three - Inadequate spend analysis. While focusing on optimizing revenue channels that make you money while you sleep, you must also look at your spending to eliminate those processes that cost you money as well as your sleep.

What is spend analysis?

By identifying expense categories and collecting expenditure data, you can reduce procurement costs and enforce financial control. This process, known as spend analysis, is key to maintaining financial hygiene.

Spend analysis management helps maintain cash flow, create effective budgets, and ensure spending transparency by consolidating apps and removing unnecessary subscriptions.

Spend analysis can look like a daunting process as a whole, especially when you are doing the financial pruning for the entire company. But breaking it down into easy, actionable steps can put you on the right track.

Importance of spend analysis

What is spend analysis? Spend analysis is the systematic process of collecting, cleansing, classifying, and analyzing expenditure data to reduce procurement costs, improve efficiency, and ensure compliance.

The importance of the spend analysis process lies in its ability to help businesses identify cost-saving opportunities. By examining spending data, companies can pinpoint areas where expenses can be reduced through better negotiation with suppliers, bulk purchasing, or exploring alternative sourcing strategies.

Additionally, taking spend analysis steps enhances supplier relationships by allowing businesses to understand their spending patterns and identify key suppliers. This understanding fosters stronger, more collaborative relationships, leading to better terms and improved service.

Furthermore, the spend analysis process is crucial for enhancing financial management. It aids in more accurate budgeting and forecasting, ensuring that financial resources are allocated effectively and in alignment with business goals.

By leveraging spend analysis, organizations can optimize their financial strategies, leading to greater efficiency, cost savings, and overall business success.

What are direct spend and indirect spend in spend analysis?

Direct spend

Direct spending refers to expenses directly related to the production of goods and services, including raw materials and components.

These costs are essential to the manufacturing process and have a direct impact on the cost of goods sold (COGS), making them crucial for determining profitability and pricing strategies.

Efficient management of direct spending is vital for optimizing production costs and maintaining a competitive edge.

Indirect spend

Indirect spending includes all expenses not directly tied to production, such as office supplies, marketing, and maintenance services.

While these costs don't affect the production process directly, managing them efficiently can result in substantial cost savings and improved operational efficiency.

Effective oversight of indirect spending is essential for optimizing overall business performance and reducing unnecessary expenditures.

Optimize your finances with spend management

How does spend analysis work?

In order to understand what is spend analysis, it’s crucial to understand how the spend analysis process works.

Spend analysis steps are essential for optimizing financial management. They begin with data collection, where expenditure data is gathered from various sources, including invoices, purchase orders, and contracts.

Next is data cleansing, which ensures accuracy by removing duplicates, correcting errors, and standardizing formats. Following this, the data categorization process classifies spending data into specific categories and subcategories for more detailed analysis.

Once categorized, data analysis is conducted using analytical tools to identify spending patterns, trends, and opportunities for cost savings and efficiency improvements.

Finally, reporting generates comprehensive reports that provide insights into spending behaviors and highlight actionable opportunities, empowering businesses to make informed, strategic decisions for better financial outcomes.

How to conduct spend analysis for business in 8 steps?

Identify your goals

To conduct an effective spend analysis, you must first determine the exact goals for the process. Really think about what you want to achieve from applying these methods. The universal goal is visibility i.e. the ability to see the who, what, when, why, and how of every expense made via company money.

The data is usually available for us to access, but it is stored in such a haphazard manner, that it becomes almost impossible to have a starting point to these spend analysis methods. Therefore it is crucial that you list out the kind of data you want to retrieve from the chaotic horde of spreadsheets and folders.

Identify data sources

To effectively conduct the spend analysis process, start by identifying all relevant data sources. These may include financial systems, procurement platforms, invoices, purchase orders, contracts, and supplier records.

Ensuring comprehensive data collection from various departments and systems is crucial for a thorough analysis. Accurate and complete data sources are the foundation for meaningful insights and actionable recommendations in spend analysis.

Gather data

Now that you have a fair idea of the data you want to collect, it is time to figure out places where the data exists. The number one problem in this process is the lack of data hygiene. Data isn’t organized or stored in a centralized location that is accessible to whoever needs it.

Some departments manage their budgets and streamline their expense reporting process, some don’t. This can easily lead to money being leached off your company through unnecessary purchases and routine subscriptions. To find this data, you might have to look in various places.

They might be procurement tools, invoice processing systems, spreadsheets, payroll, company credit cards, business bank account transactions, and lots more. This process might be time-consuming, especially when you do not have a centralized database to streamline the accounts payable process. Once the data is identified, the next steps become relatively easier.

Clean the data

It’s time to turn confusion into clarity! Sort out the data you’ve gathered onto one database so that there is one singular platform to access all your expenses.

This would be a great time to find a single spend analysis software that brings together all your spend data to one location and acts as your north star for any spend analysis in the future.

Remember to invest in an automated spend analysis platform that assimilates all your data and keeps your spend history up-to-date. This data might be available to you in different currencies, timezones, and formats, so ensure that you have clarity of action if and when these issues arise.

Create supplier list

The only thing as important as your spending data is your supplier data. Having a list of all your suppliers handy is a neat way to organize payments to the respective vendor. Doing this will have a twofold effect. First, it will help you see the frequency with which you pay your vendors.

This is particularly helpful if you have international suppliers, where frequent payment can lead to unnecessary FX charges, and therefore you can club these payments to save yourself money. Second, an organized supplier list with total spending will also establish a purchasing trend for each vendor. You can clearly determine quarters of peak orders and adjust your costs accordingly.

Categorize them

The next step after creating a supplier list is to categorize the expenses as per their expense categories for easier analysis. You might need tabs, columns, or different sheets or pages in the database you choose to store this data categorically.

You can do this by marking down departments, spending categories such as travel, meals, office supplies, etc., or based on payment frequency one-time, monthly, annual, etc.

This categorization not only streamlines the tracking and management of your organization’s expenditures but also plays a crucial role in creating a comprehensive travel and expense report that can reveal insights into spending patterns and highlight areas for potential cost savings.

Analyze your data

Now you posses a clear, organized, and accessible database of spend data that is now ready to be analyzed. The spend analysis might defer according to your goals. However, if one of your goals is to reduce unnecessary expenses, here are a few key things to consider:

● Wasteful subscriptions

Subscriptions can be wasteful in two ways. Either you or your employees have subscribed to services that do not serve the purpose wholly or partially, or you are unknowingly paying for duplicate apps used in different departments that serve the same purpose.

Both of these types of subscriptions are extremely wasteful and slowly burning a hole in your company’s pockets.

● Costly renewals

Did you know that some SaaS-based platforms offer bulk or enterprise-level discounts for companies of varying sizes? Since your team managers are usually responsible for their teams, they do not take advantage of these cost-effective options and rob you of these opportunities.

Therefore, seek out these platforms and keep your team leaders up-to-date regarding the renewal date. That way, the managers can negotiate a better deal before the renewal cycle for the new month begins.

● Large one-time payments

Payments like taxes and other important fees can make a nice dent in your cash flow if not prepared for in advance.

Doing an end-to-end spend analysis can inform the high-level executives regarding these big expenses and make budgets accordingly.

● Miscellaneous expenses

If you have been casually ignoring the snack stock maintenance in your office kitchen, then it’s high time you start paying attention.

Snacks for your whole team alone can cost you a couple of hundred dollars every week, thereby costing you thousands of dollars every year! Other miscellaneous spends need to be reported and their relevance questioned in your spend analysis reports.

Repeat the process

The best part about the entire spend analysis process is the sheer knowledge it imparts regarding a company’s spending patterns, trends, and highlights cost-saving areas.

For this reason alone, spend analysis should not be a one-time process. The database has to be constantly updated, the spending trends have to be analyzed regularly to ensure no oversight and 100% transparency in the process. Doing so regularly can optimize your business spending, reduce cash outflow, and retain higher profits.

However, doing so regularly manually on an outdated platform such as spreadsheets is a surefire way to end up with improper data management. So switch to automation, and you will gain better control over your indirect spending.

Example of spend analysis

Imagine a mid-sized technology company looking to reduce its operational costs. The company conducts the spend analysis steps to understand its expenditure patterns better.

First, they collect data from invoices, purchase orders, and supplier contracts. After cleansing and categorizing the data, they find that a significant portion of their indirect spending is on IT services sourced from multiple vendors.

By analyzing this data, the company realizes that consolidating these services under one vendor could lead to substantial cost savings and streamlined operations. They negotiate better terms with a preferred supplier, reducing costs by 15%. Additionally, the spend analysis process uncovers that bulk purchasing of office supplies could save an additional 10% annually.

As a result, the company not only cuts expenses but also improves vendor relationships and operational efficiency, demonstrating the value of spend analysis in strategic decision-making.

Simplify operations, and boost profitability with automated spend management

What are the benefits of spend analysis?

Spend analysis is a powerful tool that provides businesses with crucial insights into their expenditure patterns, helping them optimize financial management and drive strategic decisions.

By analyzing spending data, companies can uncover opportunities for cost savings, improve supplier relationships, and enhance overall operational efficiency. The benefits of spend analysis extend across various aspects of business operations, leading to a more competitive and profitable organization.

Cost savings

Spend analysis is instrumental in achieving cost savings by identifying areas of overspending and opportunities for cost reduction.

By analyzing expenditure data, businesses can implement strategies like bulk purchasing, supplier consolidation, and negotiating better terms.

These actions lead to significant savings that directly enhance the bottom line.

The saved money can then be reinvested into other vital areas of the business, driving growth and improving overall financial health.

Optimal resource allocation

Spend analysis enhances operational efficiency by revealing inefficiencies in procurement processes.

By thoroughly analyzing spending data, companies can streamline workflows, eliminate redundant spending, and optimize their supply chain.

This increased efficiency leads to reduced costs and improves the organization’s overall speed and responsiveness.

Streamlined operations enable businesses to adapt more quickly to changes and enhance their ability to meet market demands effectively.

Enhanced budgeting and forecasting

Spend analysis offers detailed insights into spending trends, which enhances the accuracy of budgeting and forecasting.

By leveraging this data, companies can create more informed financial projections, ensuring that budgets are realistic and aligned with actual spending patterns.

This proactive approach to financial planning helps businesses allocate resources more effectively, avoid budget overruns, and maintain financial stability, ultimately leading to better decision-making and improved financial outcomes.

Improved supplier relationships

Spend analysis provides businesses with clear visibility into spending patterns, helping them better understand their relationships with suppliers.

This insight allows companies to identify their most strategic suppliers and focus on fostering stronger, more collaborative partnerships.

Improved supplier relationships often result in better pricing, more favorable terms, and enhanced service quality from suppliers, all of which contribute to the overall success and increased competitiveness of the business.

Informed strategic decision making

Spend analysis is crucial for data-driven decision-making, which is central to successful business strategies.

It provides companies with the insights needed to make informed decisions about procurement, supplier management, and resource allocation.

By relying on accurate data rather than assumptions, businesses can develop more effective strategies that align with their goals.

This approach not only drives sustainable growth but also ensures that resources are optimally utilized, enhancing overall business performance and competitiveness.

Increased compliance and control

Spend analysis is vital for ensuring compliance with procurement policies and maintaining control over spending.

It provides businesses visibility into spending behaviors, highlighting areas where policies might be breached.

This enhanced oversight reduces the risk of financial mismanagement and ensures all expenditures align with the company’s strategic objectives.

By enforcing compliance, businesses safeguard their financial health and maintain alignment between spending and long-term goals.

Better negotiation leverage

Detailed spend data provides businesses with significantly enhanced leverage during important supplier negotiations.

By understanding the volume and frequency of their purchases, companies can negotiate more favorable terms, such as discounts for bulk buying or extended payment terms.

This improved position in negotiations often results in significant cost savings and more advantageous contracts, ultimately benefiting the company’s bottom line and contributing to more efficient procurement practices.

Risk mitigation

Spend analysis provides detailed insights into spending trends, enhancing the accuracy of budgeting and forecasting.

Companies can leverage this data to create more informed financial projections, ensuring that budgets are both realistic and aligned with actual spending patterns.

This proactive approach to financial planning enables businesses to allocate resources more effectively, avoid budget overruns, and maintain financial stability, leading to more strategic and successful financial management.

Operational efficiency

Spend analysis boosts operational efficiency by pinpointing inefficiencies in procurement processes.

Analyzing spending data helps companies streamline procurement workflows, eliminate redundant spending, and optimize their supply chain.

This enhanced efficiency not only cuts costs but also accelerates the organization’s speed and responsiveness.

By improving procurement processes, businesses can operate more smoothly and effectively, leading to better performance and a more agile response to market demands.

Competitive advantage

Spend analysis offers a significant competitive advantage by effectively optimizing overall spending management.

Companies that leverage detailed spending data can provide more competitive pricing, invest in innovation, and swiftly adapt to evolving market changes.

This agility and cost-effectiveness allow businesses to outperform competitors and capture a larger market share.

By effectively managing expenses and reallocating resources strategically, businesses can achieve sustained success and strengthen their position in the marketplace.

What are the best practices in spend analysis for business?

To maximize the benefits of spend analysis, businesses should adhere to best practices that ensure comprehensive and effective evaluation of expenditure data. Implementing these practices helps organizations gain valuable insights, improve financial management, and drive strategic decision-making.

Here are some essential best practices for successful spend analysis.

1. Conduct spend analysis regularly

Conducting spend analysis regularly is essential for keeping insights into spending patterns current.

Frequent analysis enables businesses to monitor expenditure changes, uncover new cost-saving opportunities, and adjust strategies accordingly.

Regular reviews ensure that spending aligns with business goals and adapts to evolving market conditions, helping organizations stay agile and responsive.

Consistent analysis not only supports better financial management but also helps detect expense report frauds, enhancing strategic decision-making by providing ongoing visibility into expenditure trends.

2. Evaluate current spend management practices

Regularly evaluating your current spending management practices is key to identifying areas for improvement.

By assessing procurement processes, supplier relationships, and spending patterns, businesses can detect inefficiencies and find opportunities for optimization.

This evaluation helps refine spending management approaches, leading to better cost control and enhanced financial performance.

Understanding the effectiveness of existing practices allows for targeted improvements, ensuring that spending aligns with organizational goals and drives better overall financial outcomes.

3. Use advanced analytical tools

Leverage advanced analytical tools to significantly enhance the depth and accuracy of your spend analysis.

Tools such as data visualization software, predictive analytics, and machine learning algorithms provide valuable insights into spending patterns and trends that might not be apparent through basic analysis.

These technologies enable businesses to uncover hidden opportunities for cost savings, improve forecasting accuracy, and support more informed decision-making.

By integrating advanced tools into your spending analysis process, you can achieve a more comprehensive understanding of expenditure and drive more strategic financial planning.

4. Monitor vendor performance

Continuously monitoring vendor performance is critical to ensuring that suppliers meet their contractual obligations and deliver the expected value.

Regular assessments of vendor performance help identify areas for improvement, such as enhancing service quality or achieving better cost-effectiveness.

This practice is essential for effective supplier management, fostering stronger relationships, and ensuring that vendors contribute positively to your overall spending strategy.

By staying vigilant about vendor performance, businesses can optimize their supply chain and secure better terms, ultimately supporting their financial goals.

5. Ensure data accuracy and consistency

Maintaining data accuracy and consistency is crucial for conducting reliable spend analysis.

Ensure that expenditure data is gathered from trustworthy sources, is free of errors, and adheres to standardized formats.

Accurate and consistent data forms the backbone of effective spending analysis, enabling meaningful insights and strategic decision-making.

By prioritizing data integrity, businesses can achieve more effective cost management, enhance financial expense reporting with automation, and make better-informed decisions, ultimately leading to improved financial performance and strategic outcomes.

Optimize your expenses with our expense management solution

Volopay makes spend analysis easier

With Volopay's spend management software, you can easily digitalize and automate your financial processes, and get your business expenses under your control, freeing your teams to do what they do best!

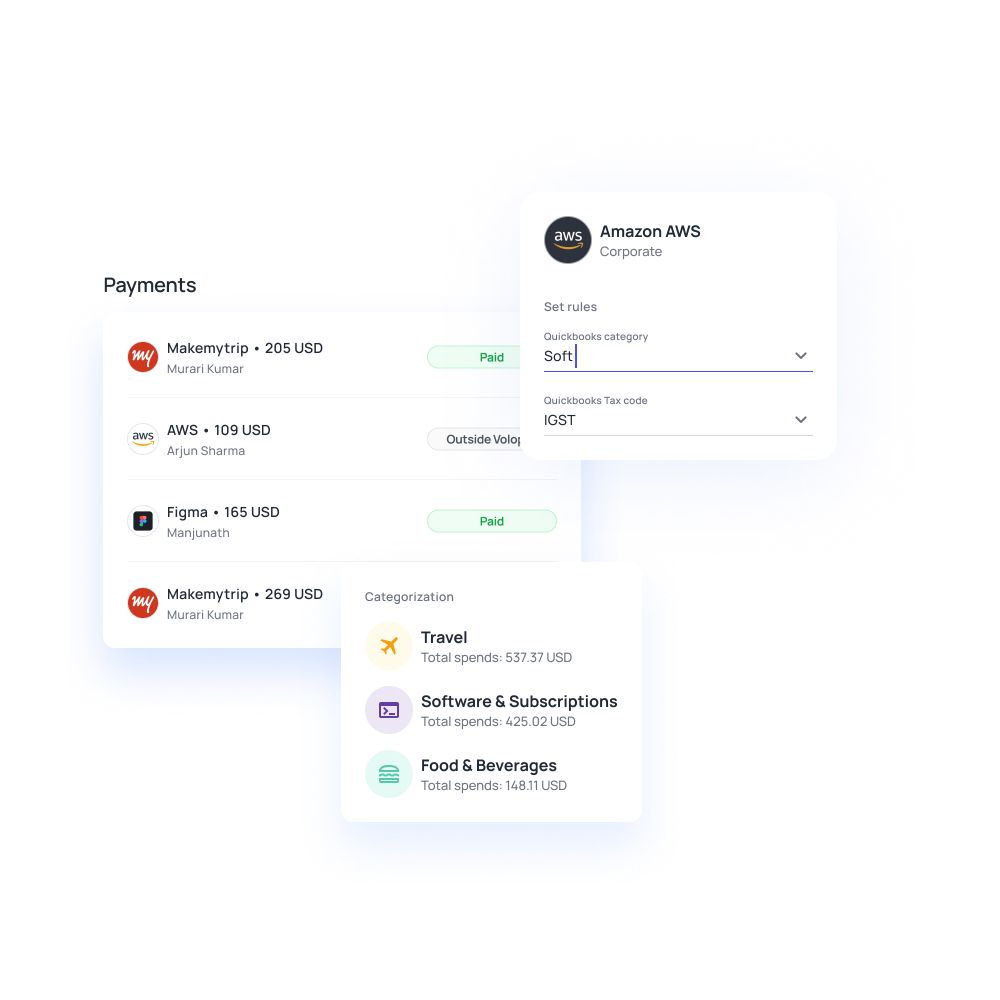

Volopay combines approvals, corporate cards, bill payments, expense reimbursements, and accounting automation into one single platform. No more going through different tools and systems to look for purchase orders and invoices.

Make expense reimbursement hassle-free

Your employees can use Volopay to submit a digital version of their work-related expenses which get automatically categorized, thanks to our innovative technology.

Want to eliminate the reimbursement process and streamline spend analysis? Then go ahead and empower your employees with our premium physical and virtual corporate cards with built-in limits and approval workflow, so you never have to go over budget ever again.

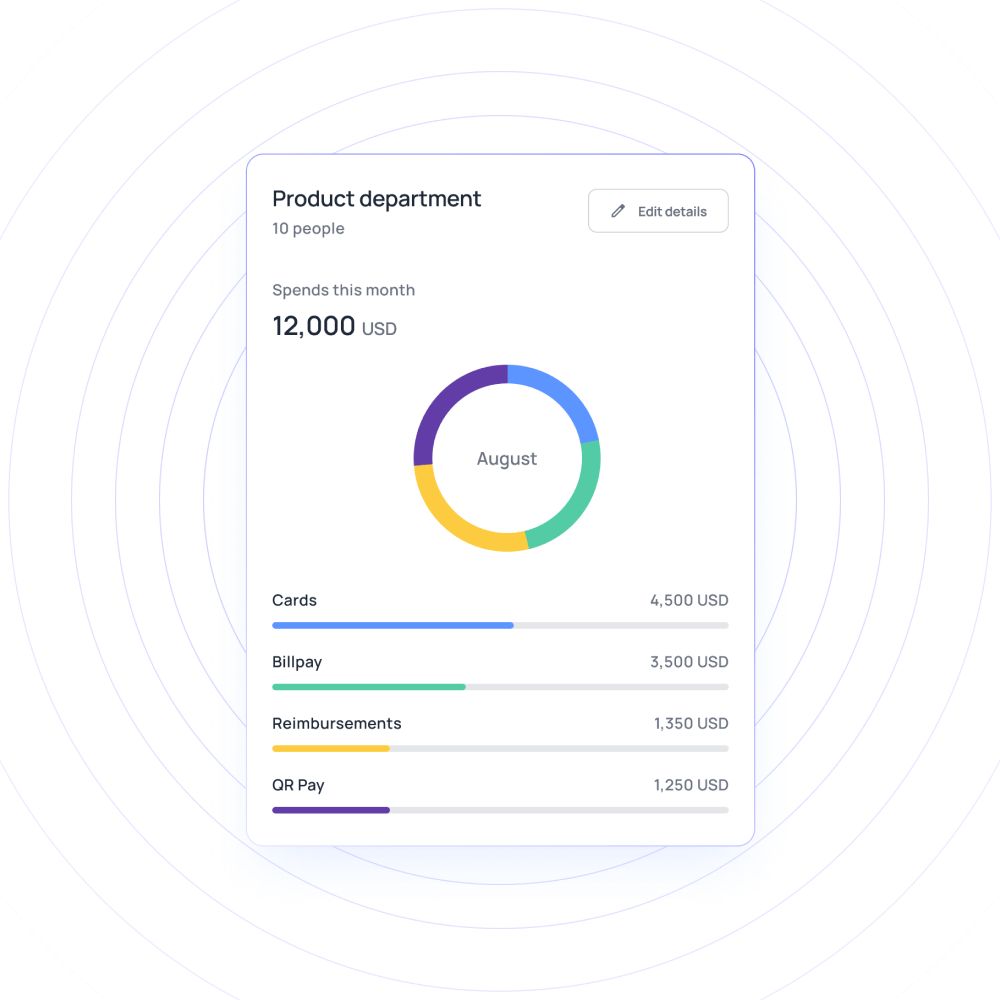

Real time visibility

Volopay gives you real-time visibility over all your spending on the platform with notifications for any spending made by you or your team on your card and bill payments.

Stop paying for unwanted subscriptions, and see all your vendors at one place with full control over subscriptions, with insights on overspending, cost-saving ideas, duplicate subscriptions, and so on. See a comprehensive view of your spend dashboard with real-time updates.

Set budgets with ease

You can set budgets for every department, employee and project. Take the guesswork out of “who paid what?” — Volopay's business budgeting software gives you a precise picture of who, what, why, when, and how of your organization’s expenditure.

You can even set these budgets as one-time or recurring based on the kind of subscription model you’ve chosen.

3-way matching

Volopay helps you do 3-way matching with your purchase orders, invoices and receipts so you never have to lose another spreadsheet or paper-based receipts again.

Simply upload your necessary documents on a single transaction and let Volopay take care of the rest!

FAQs

Expense management streamlines the tracking and categorization of expenditures, making spend analysis more effective. It ensures accurate data collection, which is essential for identifying cost-saving opportunities and improving financial oversight.

Manual spend analysis involves manual data entry and review, which is time-consuming and prone to errors. Automated spend analysis uses software to efficiently gather, process, and analyze data, providing faster and more accurate insights.

Businesses can measure ROI by comparing the cost of spending analysis initiatives against the financial savings and benefits achieved. Key metrics include cost reductions, efficiency gains, and improved supplier terms resulting from the analysis.

Businesses should conduct spend analysis regularly, such as quarterly or annually, to keep up with changing expenditure patterns and market conditions. Frequent analysis helps maintain up-to-date insights and supports timely decision-making.

Cost analysis focuses on the detailed examination of individual costs to understand their nature and impact. Spend analysis, however, provides a broader view of overall expenditure patterns and trends, helping businesses manage and optimize spending.

Businesses can manage and categorize spend data by using robust data management systems, creating standardized categories, and regularly updating data. Effective categorization involves grouping expenditures into meaningful categories for better analysis and decision-making.

The three core areas of spend analysis are data collection, data categorization, and data analysis. These areas involve gathering expenditure data, classifying it into relevant categories, and analyzing it to identify patterns and opportunities.

The primary objective of spend analysis is to provide a clear understanding of expenditure patterns to identify cost-saving opportunities, optimize procurement processes, and improve overall financial management.

Key performance indicators (KPIs) to track include cost savings achieved, percentage of spend under management, compliance with procurement policies, and improvements in supplier performance. These KPIs help assess the impact and effectiveness of spend analysis initiatives.

Spend analysis aligns with overall business strategy by providing insights that support strategic decision-making. It helps in optimizing resource allocation, improving financial efficiency, and ensuring that expenditures align with business objectives and long-term goals.

Trusted by finance teams at startups to enterprises.