What is travel and expense report and why automate it?

In the business world nowadays we get to hear a lot about travel and expense reports whenever employee travel and expenses are the topics of discussion. T&E expenses are mostly used to explain the company’s operational costs related to business travel from T&E fraud to policies, everything has a cost. The business travel industry is a $1.28 billion industry.

Your business may be located anywhere in the world, chances are your company’s top three largest expenses consist of T&E as one among salaries and SaaS. A travel and expense report provides better employee spending transparency and helps you reimburse the employees quickly and effortlessly. However, you must be wondering what exactly is T&E expense?

What does T&E mean?

T&E stands for “travel and expense” or “travel and entertainment.” This term is used to describe business expenses that employees incur either from their pocket or through a company card for business purposes. These T&E expenses are then reimbursed directly or the credit card bill is paid after the employees submit the genuine and appropriate paperwork.

T&E is a category that includes a large variety of business expenses such as dinner with clients, business travel stay and related expenses, etc. It consists of particulars such as meals, lodgings, air travel, local transportation, and incidentals.

Importance of T&E reports

Travel and expense reports are significant for various major reasons that matter to an association, whether a small organization or a global corporation.

Fraud reduction

Unluckily, employee fraud is an unwanted element of travel reimbursement. However, you can lower your association’s subjection to these frauds by following a proper procedure.

Tax preparation

In most countries across the globe, travel is completely nontaxable, in a case where it justifies business motives. The purpose may include recruitment, sales, on-site client assistance, professional development, procurement, and more. Well, you need to present an invoice or a receipt as proof to deduct your tax legally with the IRS or related government entity.

Business intelligence

Reporting not only serves for the tax branch of the governments whose countries you carry your business in. Analyzing travel expenses is significant for your organization as well. To elaborate, with proper knowledge relating to travel spending, you can make progressive decisions to design your T&E budget. With the monthly and quarterly travel and expense reports, you can find out teams or projects that are overspending.

What types of expenses come under T&E?

Travel and expense (T&E) management involves tracking and reimbursing employees for costs incurred while conducting business on behalf of the company.

These expenses can vary widely depending on the nature of the business and the travel involved. Below are the main types of expenses typically covered under T&E.

Travel expenses

Travel expenses encompass the costs associated with the physical movement of employees from one location to another for business purposes. This includes airfare, train tickets, car rentals, and mileage reimbursements for personal vehicle use when traveling to meetings, conferences, or client sites.

These expenses are essential for enabling employees to perform their duties outside of their regular workplace. Companies often have specific policies that govern the types of travel expenses that are reimbursable and may require pre-approval for certain expenditures.

Lodging expenses

Lodging expenses cover the costs of accommodation when employees are required to stay overnight away from their home base. This typically includes hotel stays, but may also cover alternative accommodations such as serviced apartments or short-term rentals.

The goal is to provide a comfortable and safe environment for employees while they are on business trips. Companies often set guidelines or limits on lodging expenses to control costs, and some may have agreements with specific hotel chains to receive discounted rates.

Meal and entertainment expenses

Meal and entertainment expenses are incurred when employees need to dine or entertain clients, partners, or colleagues as part of their business activities. This can include costs for meals, drinks, and event tickets during business dinners, networking events, or other official gatherings.

While these expenses are necessary for building relationships and conducting business, they are often subject to strict company policies and limits to prevent excessive spending. Receipts and detailed explanations may be required to justify these expenses.

Client expenses

Client expenses refer to the costs incurred when hosting or entertaining clients to facilitate business relationships and negotiations. This can include taking clients out for meals, providing them with transportation, or covering the costs of activities like golf outings or theater tickets.

These expenses are crucial for maintaining strong client relationships and are often seen as an investment in the company’s growth. However, companies typically enforce specific guidelines to ensure that client-related spending is reasonable and aligned with business objectives.

Miscellaneous travel expenses

Miscellaneous travel expenses cover various other costs that don’t fall neatly into the above categories but are necessary for the successful completion of business travel. These may include fees for baggage, parking, tolls, internet access, and service tips.

Types of T&E reporting processes

Managing business travel and expenses (T&E) is crucial for maintaining accurate financial records and ensuring compliance. A travel and expense report is a document used by employees to list and submit their travel-related expenses for reimbursement.

This process helps organizations track spending, manage budgets, and maintain transparency. Companies typically manage T&E reports either manually or through automated systems, with each approach offering different advantages and challenges.

Manual reporting

Manual reporting involves employees filling out expense reports by hand or using basic spreadsheet software.

This method requires employees to collect receipts, log expenses, and manually input data, which can then be submitted to the finance department for approval and reimbursement.

While manual reporting offers a straightforward approach, it is time-consuming and prone to human error.

Automated expense reporting

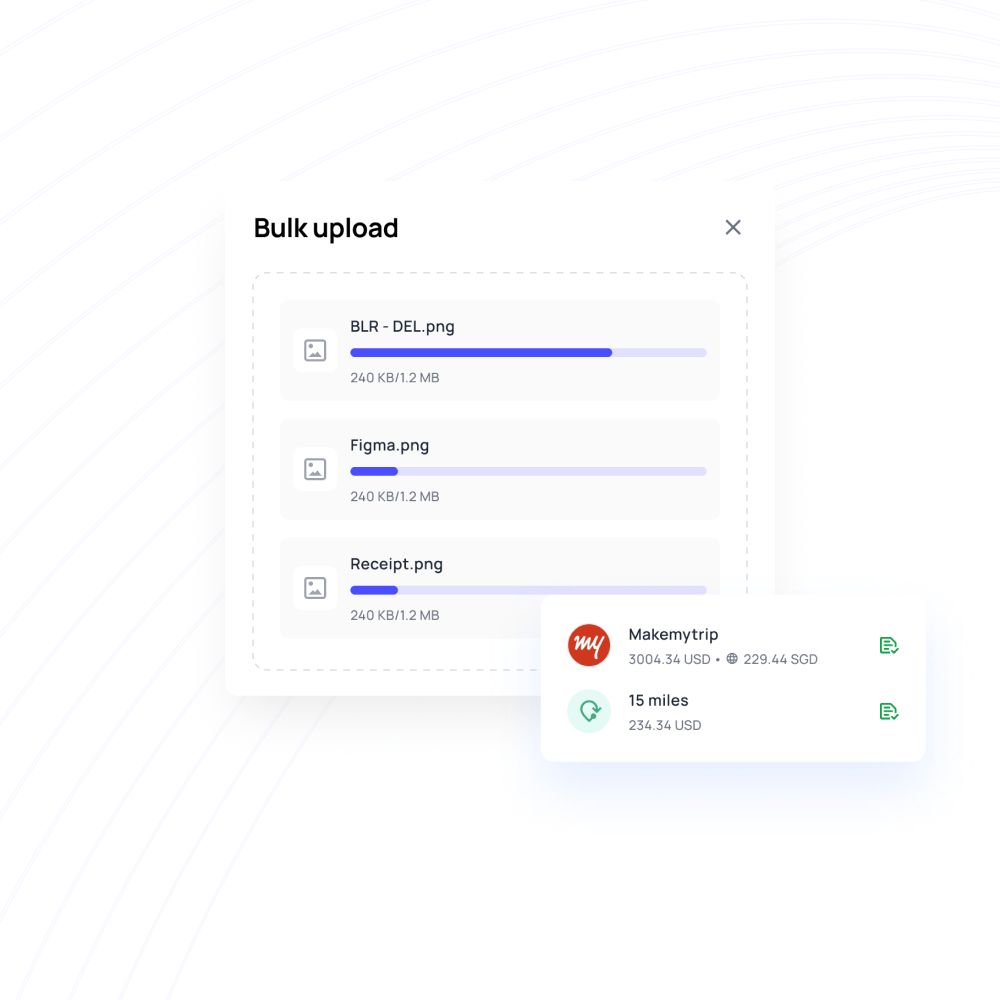

Automated expense reporting systems streamline the T&E process by integrating digital tools that automatically capture, categorize, and submit expenses.

These systems use features like receipt scanning, credit card integration, and mobile apps to minimize the administrative burden on employees.

Automated systems reduce errors, speed up reimbursement cycles, and provide real-time insights into spending.

Importance of travel and expenses (T&E) reports

A travel and expense report is a vital tool for businesses to maintain financial transparency and operational efficiency.

By systematically tracking and managing travel-related expenditures, companies can better control costs, enforce policies, and ensure compliance with tax regulations.

Below are key reasons why T&E reports are essential.

To track employee travel expenses

Tracking employee travel expenses through T&E reporting allows businesses to maintain accurate records of the costs incurred during business trips. This information is crucial for reimbursing employees promptly and ensuring that all expenditures are in line with company policies.

By systematically capturing and organizing these expenses, companies can gain insights into travel spending patterns, identify opportunities for cost savings, and monitor adherence to established travel guidelines. Effective tracking also helps prevent discrepancies and ensures transparency.

Essential for budget control and cost management

Travel and expense reports play a crucial role in budget control and cost management by providing a detailed overview of travel-related expenditures.

These reports enable businesses to compare actual spending against budgeted amounts, helping to identify areas where costs may be exceeding expectations.

By analyzing T&E data, companies can make informed decisions about future travel budgets, negotiate better rates with vendors, and implement cost-saving measures. This proactive approach to managing travel expenses supports overall financial health and sustainability.

Reducing excess costs

By regularly reviewing travel and expense reports, companies can identify and address instances of excessive spending.

Whether it’s through tighter enforcement of travel policies, setting clearer guidelines, or offering employees more cost-effective travel options, these reports provide the data needed to curb unnecessary expenses.

Reducing excess costs not only improves the company’s bottom line but also encourages a culture of financial responsibility among employees. Regular audits and spend analysis of T&E data can help highlight areas for improvement and ensure that resources are used efficiently.

Detecting fraudulent activities

T&E reports are an essential tool for detecting and preventing fraudulent activities within a company.

By carefully reviewing expense reports, businesses can identify unusual patterns or inconsistencies that may indicate fraudulent behavior, such as inflated receipts, duplicate claims, or expenses that fall outside of company policy.

Implementing automated expense reporting systems can further enhance fraud detection by flagging suspicious transactions in real time. Proactively addressing potential fraud helps protect the company’s financial integrity and maintains a culture of trust and accountability.

Important for ensuring tax compliance

Ensuring tax compliance is another critical reason for maintaining accurate T&E reports. Many travel and entertainment expenses are tax-deductible, but they must be properly documented and justified to meet regulatory requirements.

T&E reports provide the necessary records to substantiate these deductions and support compliance during tax audits. Accurate reporting of T&E expenses helps businesses avoid penalties, ensures adherence to tax laws, and maximizes allowable deductions.

Proper documentation through detailed T&E reports simplifies the tax filing process and mitigates the risk of non-compliance.

How can you report T&E expenses?

Expense reporting software supporting policy compliance is an additional benefit for associations planning to scale. It can easily identify policy-restricted expenses which makes it convenient for approvers to trace violated T&E expenses.

Employing an expense report template for tracking expenses

Initially, several organizations began their T&E expense tracking process on Microsoft excel sheets. Well, in the long run, this method becomes inconvenient. The expense reporting process is still carried out manually, which implies employees have to hold their invoices or receipts for a long duration. Plus, every communication is carried on through phone calls and emails, which serves to delay. Tracking the audit trail becomes complicated when expense reporting is a paper process.

Using travel & expense management software

Travel expense management software aids in simplifying the process of expense reports for business travel. It allows your employees to submit expense reports for business travel conveniently with the use of a mobile app. With the introduction of OCR technology, employees can now click expenses directly from invoices. It eliminates the requirement of holding paper receipts for a long time. Once the employee submits the T&E expense report, approvers get notified. They can approve or disapprove expenses within a few clicks.

What are the steps for reporting T&E expenses?

The first step in reporting T&E expenses is to decide whether to use a manual method or expense management software. Manual methods typically involve filling out spreadsheets or paper forms, which can be time-consuming and prone to errors.

On the other hand, expense management software streamlines the process by automating data entry, categorizing expenses, and integrating with other financial systems. Choosing the right method depends on the company’s size, budget, and complexity of travel activities.

Collecting receipts is essential for documenting and validating the purchases mentioned in a travel and expense report. Employees should gather all relevant receipts, including those for travel, lodging, meals, and any miscellaneous expenses incurred during business trips.

Keeping digital or physical copies of receipts is important for accurate reporting and compliance with company policies. Some companies also use mobile apps that allow employees to scan and upload receipts on the go, simplifying the collection process and reducing the risk of lost documents.

Once all receipts are collected, the next step is to organize expenses by category, such as transportation, accommodation, meals, and entertainment. Proper organization ensures that each expense is accurately recorded and categorized according to company policies.

This step also helps in identifying any discrepancies or items that may require further clarification. Organizing expenses is crucial for preparing a comprehensive and accurate expense report, making it easier for both employees and approvers to review the submitted information.

After organizing the expenses, employees need to prepare the expense report. This involves entering all relevant details, including dates, amounts, expense categories, and descriptions of the business purpose for each expense.

If using expense management software, this process may be partially automated, with the system automatically populating data from uploaded receipts. A well-prepared expense report is clear, and concise, and includes all necessary information to facilitate a smooth approval process.

Attaching supporting documentation, such as receipts and invoices, is a crucial step in the T&E reporting process. This documentation provides evidence of the expenses incurred and is often required for compliance and audit purposes.

Whether submitting reports manually or through software, employees should ensure that all necessary documents are attached and properly labeled. Incomplete documentation can lead to delays in approval and reimbursement, so it’s important to be thorough in this step.

Once the expense report is prepared and documentation attached, the report is submitted for approval. This typically involves routing the report to a manager or finance team member who reviews the details for accuracy and compliance with company policies.

The approval process can vary depending on the company’s workflow, with some organizations requiring multiple levels of review. Using expense management software can streamline this step by automating approval workflows and providing real-time status updates.

If the report is flagged for any discrepancies or issues, the employee may be required to review and revise the submission. This step involves addressing any feedback from the approvers, correcting errors, or providing additional documentation as needed.

It’s important for employees to promptly respond to requests for revisions to avoid delays in the reimbursement process. Thoroughly reviewing the report before submission can minimize the likelihood of needing revisions.

After the expense report is approved, the next step is to submit it for reimbursement. This involves sending the approved report to the finance department for processing. The finance team will then arrange for the reimbursement to be made to the employee’s account.

Timely submission of the approved report ensures that employees are reimbursed quickly, maintaining their cash flow and satisfaction with the company’s expense management process.

Finally, maintaining records of T&E expenses is important for both the employee and the company. Employees should keep copies of their submitted reports and supporting documents in case of future queries or audits.

For companies, maintaining a well-organized archive of T&E reports is essential for financial reporting, compliance, and analysis. Proper record-keeping ensures transparency and helps in addressing any discrepancies or disputes that may arise later.

Manage all your company travel expenses with ease

Common challenges of managing T&E

Managing travel and expense (T&E) processes can be complex and time-consuming, often leading to inefficiencies and increased costs.

Businesses face several challenges in ensuring that T&E management is accurate, compliant, and streamlined. Below are some of the most common challenges encountered.

Lack of real-time analytics

One of the significant challenges in managing T&E is the lack of real-time analytics and spending insights.

Without access to up-to-date data, companies struggle to monitor and control travel expenses effectively.

This lack of visibility can result in overspending, delayed responses to budget deviations, and missed opportunities for cost optimization.

Real-time analytics are essential for identifying trends, adjusting travel policies, and making informed decisions that align with the company’s financial goals.

Manual expense reporting

Manual expense reporting is often fraught with inefficiencies, errors, and delays as employees are required to collect receipts, fill out forms, and submit reports for approval.

Manual processes also increase the risk of inaccurate data entry, lost receipts, and miscalculations.

This not only complicates the reimbursement process but also hampers the finance team’s ability to gain a clear and timely view of the company’s travel spending.

This ultimately affects financial accuracy and the decision-making process.

Receipt management and documentation

Managing receipts and documentation is another common challenge in T&E management. Employees often misplace or fail to submit receipts, leading to incomplete or inaccurate expense reports.

The manual tracking and storage of physical receipts can also be cumbersome, making it difficult to maintain organized records.

Inadequate documentation can result in reimbursement delays, compliance issues, and challenges during audits.

Streamlining receipt management with digital tools is essential for improving efficiency and ensuring that all expenses are properly documented.

Complexities of multiple currencies

For businesses operating globally, managing T&E expenses in multiple currencies adds another layer of complexity.

Currency conversion rates fluctuate, making it difficult to accurately calculate and reconcile expenses.

Additionally, employees may face challenges when submitting expenses in foreign currencies, leading to inconsistencies in reporting.

Companies must also ensure compliance with varying tax regulations across different countries to ensure accuracy, consistency, and adherence to international financial standards.

Slow reimbursement process

A slow reimbursement process can lead to employee dissatisfaction and frustration. When employees are not reimbursed promptly for their out-of-pocket expenses, it can affect their cash flow and morale.

Delays often occur due to inefficient approval workflows, manual processing, or missing documentation.

This can strain employee relations and reduce the overall efficiency of T&E management.

Streamlining the reimbursement process through automation & clear policies can significantly improve the speed & accuracy of reimbursements, leading to higher employee satisfaction.

Limited automation options

A lack of integration and automation possibilities in T&E management systems can create silos of information, leading to inefficiencies and data inconsistencies.

Without integrated systems, data must be manually transferred between platforms, increasing the risk of errors and delays.

The absence of automation also means that repetitive tasks, such as data entry and report generation, consume valuable time and resources.

Integrating T&E management with other financial systems and automating key processes can enhance efficiency, reduce errors, and provide a unified view of expenses.

T&E reporting best practices

In the growing technological world, a T&E expense report is not a physical form anymore. Expense reporting should be unified with your business travel software. Also, the expense report for business travel process should be digital. How to simplify your T&E expense reports with invoice unification, reimbursement request reduction, and receipt scanning. Have a look at these do’s and don’ts:

Implement the right software

DO employ T&E software with automation facilities: Implement T&E expense management software that provides receipt scanning. It automatically imports the expense report form data.

DON’T manually store receipts and T&E expense reports: Avoid the use of a paper expense report template. This will only lead to manual work for your managers and travelers. Rather, your expense policy should brief how to employ your T&E software.

Book travel in one place

DO book business trips with travel and expense report management software: By motivating employees to book business trips with verified business travel and expense report management software, you can have a better command over their spending and simplify expenses into one monthly invoice. This brings down the requirement for expense reporting.

DON’T book business travel on consumer websites: The business-related expenses distribute all over the place, requiring T&E expense reports, in a scenario where your employees book business travel on consumer sites (employed by vacationers).

Integrate your tech

DO integrate your T&E software with your T&E expense management software: To compile all of your nontaxable travel expenses in a single location, you are advised to consolidate your expense management software with your business travel platform.

DON’T rely solely on a T&E software: Even if travel and expense report management software is beneficial for every kind of expense, it doesn’t assist you to spend money. It only reflects what you spent after the fact. You require a business travel platform for invoice integration and submerge T&E policies.

Use corporate cards to your benefit

DO provide business credit cards to frequent travelers: A corporate card may not save time as several associations still demand employees to prepare a travel and expense report even if they employ the provided corporate card. The latest T&E expense management software conciliates T&E expense reports with credit card transactions, so your finance team is free from the additional work.

DON’T require travelers to constantly demand reimbursements: Employees avoid making payments with their fund and then files a request for expense reimbursements. The introduction of a corporate card eliminates this system. Having fewer expense reports for business travel saves time for managers and travelers.

Digitize your travel policies

DO include your T&E policy in your travel and expense report management software: One cause why business T&E software is so significant is the capability to digitize policies. These T&E policies play a vital role during trip planning and booking, so they control expenses.

DON’T rely on a policy document to assist you to handle spending: Employees don’t usually go through T&E policy documents. If your T&E policy is only a part of a document, it might be convenient to educate employees on how to scan invoices, but it won’t control your business T&E expenses.

Related page: Why should businesses have travel request approval workflow

How can automation make T&E expense reporting easier for your business?

Automating travel and expense reporting can significantly streamline the management of business expenses, reducing administrative burdens and enhancing accuracy.

By leveraging automation, businesses can simplify the entire T&E process, from data entry to reimbursement, leading to improved efficiency and cost control. Here's how automation can help:

Elimination of paperwork

Automation eliminates the need for cumbersome paperwork by digitizing the entire T&E reporting process. Employees no longer need to fill out manual forms or store physical receipts.

Instead, they can upload receipts and enter expenses via mobile apps or online platforms. This not only saves time but also reduces the risk of lost documents and errors in data entry.

By moving away from paper-based processes, businesses can create a more organized and efficient expense management system.

A quick insight into spending patterns

Automated T&E systems provide real-time insights into spending patterns, allowing businesses to monitor and analyze travel expenses more effectively.

With instant access to detailed reports and dashboards, management can easily identify trends, track budget adherence, and spot potential areas for cost savings.

This quick access to data enables more informed decision-making and helps businesses stay on top of their financial goals. Automation also facilitates better forecasting and planning for future travel budgets.

Faster approval process

Automation accelerates the approval process by streamlining workflows and reducing manual intervention. Expense reports can be automatically routed to the appropriate approvers, who can review and approve them with just a few clicks.

Automated systems also offer customizable approval hierarchies and notifications, ensuring that reports move quickly through the process without delays.

This leads to faster turnaround times and ensures that employees receive timely reimbursements, improving overall satisfaction and productivity.

Improved reimbursement process

The reimbursement process is significantly improved with automation, as it allows for quicker and more accurate processing of expense reports. Automated systems can directly integrate with payroll or accounts payable systems, ensuring that approved expenses are reimbursed promptly.

This reduces the administrative burden on finance teams and minimizes the risk of errors that can occur with manual calculations. Automation also provides employees with transparency into the status of their reimbursement, leading to greater trust in the system.

Automatic policy compliance

Automated T&E systems help enforce policy compliance by automatically flagging expenses that fall outside of company guidelines. These systems can be programmed to check for policy adherence in real time, ensuring that only eligible expenses are submitted and approved.

This reduces the risk of non-compliance and minimizes the need for manual oversight. By maintaining strict control over expenses, businesses can avoid unnecessary costs, reduce the risk of fraud, and ensure adherence to internal and regulatory standards.

Related page: Automate your travel and expense management process

Why choose Volopay for T&E management?

Volopay offers a comprehensive solution for managing travel and expense (T&E) processes, making it an ideal choice for businesses looking to streamline their financial operations.

With its integration capabilities, user-friendly interface, and robust features, Volopay simplifies expense management, enforces expense policies, and provides real-time reporting.

Its advanced tools allow companies to gain better control over spending, improve efficiency, and ensure compliance, all while offering an intuitive experience for employees and finance teams alike.

Improved visibility into spending

Volopay provides enhanced visibility into company spending by offering real-time access to expense data through its centralized platform.

This feature allows businesses to monitor T&E expenses as they occur, helping to identify trends, control costs, and enforce budgetary limits more effectively.

With detailed reporting and analytics, management can gain deeper insights into travel expenses, ensuring that spending aligns with company objectives. This improved visibility helps businesses stay on top of their financial health and make data-driven decisions.

Streamlined expense reporting

Volopay streamlines the expense reporting process by automating data entry and approval workflows. Employees can easily submit expenses through the platform, which automatically categorizes and routes them for approval.

This eliminates the need for manual processing, reduces errors, and speeds up the overall reporting process. Volopay’s intuitive interface makes it simple for users to navigate, ensuring that expense reports are completed accurately and efficiently.

Streamlined expense reporting not only saves time but also enhances productivity and compliance.

Effortless receipt management

With Volopay, managing receipts becomes effortless thanks to its integrated receipt capture and storage capabilities. Employees can snap photos of receipts using their mobile devices and upload them directly to the platform, where they are automatically attached to corresponding expenses.

This digital approach reduces the hassle of keeping track of physical receipts and ensures that all necessary documentation is readily available for audits and reimbursements. Effortless receipt management improves accuracy and simplifies the expense tracking process.

Simplified multi-currency management

Volopay simplifies multi-currency management by automatically converting foreign currency expenses into the company’s base currency.

This feature is particularly beneficial for businesses with international operations, as it removes the complexity of manual currency conversions and ensures consistency across reports.

The platform also allows users to manage expenses in multiple currencies simultaneously, providing accurate and up-to-date conversion rates. Simplified multi-currency management helps businesses maintain financial accuracy and comply with international accounting standards.

Real-time analytics and insights

Volopay offers real-time analytics and insights that empower businesses to make informed financial decisions. The platform provides comprehensive dashboards and reports that display current spending trends, budget usage, and policy compliance.

These real-time insights allow businesses to react quickly to changes, optimize their travel and expense policies, and improve cost management. The ability to access and analyze data in real time is crucial for maintaining financial control and achieving business objectives.

Faster reimbursements

Volopay accelerates the reimbursement process by automating key steps from expense submission to approval and payment. Employees can submit their expenses through the platform, which are then quickly reviewed and processed by the finance team.

The integration with payroll systems enables prompt disbursement of funds, ensuring that employees are reimbursed without unnecessary delays. Faster reimbursements improve employee satisfaction and reduce administrative workload, making T&E management more efficient.

Integration with an accounting system

Volopay seamlessly integrates with various accounting systems, allowing businesses to synchronize their T&E data with their broader financial operations.

This integration eliminates the need for manual data transfers and ensures that expense information is accurately reflected in the company’s financial records.

The platform supports integrations with popular accounting software, providing a unified solution for managing expenses, budgets, and financial reporting.

Integration with an accounting system enhances accuracy, reduces redundancy, and simplifies the overall financial management process.

Bring Volopay to your business

Get started now

FAQs

T&E expense reports specifically track costs related to business travel and entertainment, such as airfare, lodging, and meals. Regular expense reports cover a broader range of expenses, including office supplies and utilities.

Automated T&E systems use real-time exchange rates or mid-market rates (middle point/average of the two currencies) to convert foreign currency expenses into the company’s base currency. This ensures accurate financial reporting and simplifies multi-currency expense management.

Yes, T&E automation software often integrates with various business systems such as accounting, ERP, and payroll systems. This integration streamlines data flow and ensures consistency across financial records.

Automated T&E systems use algorithms to detect anomalies, such as duplicate claims or expenses outside policy limits. These systems can flag suspicious activities for further review, helping prevent fraudulent claims.

T&E automation apps usually offer features like receipt capture, expense reporting, real-time notifications, and expense tracking. These mobile capabilities enable employees to manage expenses efficiently while on the go.

Automated T&E solutions support remote or hybrid work environments by providing cloud-based access to expense management tools. Employees can submit and approve expenses from anywhere, ensuring seamless operations regardless of location.

Automated T&E systems include security features such as data encryption, secure user authentication, and role-based access controls. These measures protect sensitive financial information and ensure compliance with data privacy regulations.

T&E policies should be reviewed and updated at least annually or when significant changes occur in business operations, regulations, or travel practices. Regular reviews ensure that policies remain relevant and effective.

Yes, T&E systems often allow for the generation of custom reports tailored to specific departments or projects. This feature helps in analyzing departmental spending and aligning expenses with project budgets.

T&E systems manage mileage reimbursement by allowing employees to log miles driven for business purposes, calculate reimbursements based on company rates or IRS guidelines, and integrate with expense reports for easy processing.