What is mileage reimbursement and how do you track it?

Do you find your employees spending more time behind the wheel for work-related trips rather than sitting at their desks?

If your employees are using their private automobiles for hopping between offices, meeting up clients, or bringing in office supplies, then they qualify for mileage reimbursement.

Mileage reimbursement benefits both the employer and the employee. While the employee receives payment for mileage expenses made on behalf of the company, it also provides business owners with tax-reduction incentives. But reporting business mileage is not an easy task.

What are mileage reimbursements?

Mileage reimbursement compensates your employees for using personal vehicles for work-related tasks.

It covers expenses such as fuel, maintenance, and insurance when they travel for business, attend client meetings, or run company errands.

By reimbursing mileage, you ensure that your employees are not financially burdened by these business-related costs, promoting fairness and motivation.

Recognizing and offsetting these expenses is crucial for businesses, as it directly impacts employee ability to perform their role efficiently and maintain business productivity.

Proper employee mileage reimbursement and having a grasp on what is mileage reimbursement helps your employees manage expenses effectively and focus on work without financial concerns.

1. Fuel costs

As an employer, covering fuel costs through employee mileage reimbursement is essential.

Employees using their personal vehicles for work incur additional fuel expenses. Reimbursing these costs ensures they are not financially burdened for business-related trips.

This support acknowledges their contribution and helps maintain fairness in compensation for work-related travel.

2. Wear and tear

When employees drive their personal vehicles for business, wear and tear on their cars increases. This includes tire wear, brake degradation, and overall vehicle aging.

Providing mileage reimbursement helps compensate for these costs, recognizing the additional strain placed on their vehicles due to business use and ensuring they are fairly reimbursed.

3. Vehicle maintenance and repairs

Employees who use their personal vehicles for work often face higher maintenance and repair costs. Routine services like oil changes and unexpected repairs can add up.

By offering employee mileage reimbursement, you help cover these extra expenses, ensuring that employees are compensated for the increased upkeep required due to business-related driving.

4. Vehicle insurance costs

Increased business travel can raise vehicle insurance premiums due to higher mileage and associated risks.

By including insurance costs in mileage reimbursement, you help employees manage these additional expenses.

This ensures they are not unfairly penalized financially for using their personal vehicles for work-related purposes and supports their overall financial well-being.

What does mileage reimbursement cover?

You have to take into consideration a variety of vehicle-related expenses when an employee’s private vehicle is being used. A standard business mileage cost exceeds current fuel prices and additionally covers wear and tear, new tires, oil change, insurance premiums, and registration fees.

Any other associated charges such as parking and toll charges are not considered part of their mileage pay. Mileage rates also vary according to the purpose a vehicle is driven for.

Moving and healthcare

Moving business assets and inventory from the factory to the warehouse? Going for a doctor’s appointment? All these purposes are reimbursable.

The cost of this mileage is less than that for direct business purposes but more than charitable reasons.

Charitable cause

If you are driving as a volunteer for a charitable cause, you qualify for mileage reimbursement.

These have the lowest mileage rates amongst all three groups.

But driving a kid volunteer to a charitable cause doesn’t qualify for compensation.

Business activities

From going out to acquire business resources to traveling between offices and client meetings, mileage covered while conducting direct business-related activities qualifies for mileage reimbursement.

This kind of business mileage receives the highest mileage rate.

How does mileage reimbursement work?

It is a compensation system where businesses like yours pay employees for using personal vehicles for work-related tasks.

Various methods calculate employee mileage reimbursement to cover costs like fuel, maintenance, and wear and tear.

Understanding what is mileage reimbursement helps ensure fair and accurate reimbursements for business travel expenses.

1. Mileage allowance

Providing a mileage allowance is a straightforward way to handle employee mileage reimbursement.

You receive a fixed amount per mile driven for work, which covers expenses like fuel, maintenance, and wear. This approach is easy to manage, requiring only distance tracking for reimbursement.

Offering a mileage allowance simplifies administrative tasks while ensuring that your employees are compensated fairly for their travel-related costs. It’s a cost-effective and transparent option for managing work-related vehicle expenses across the organization.

2. Reimbursement for actual expenses

Reimbursing employees for actual expenses offers a more accurate reflection of costs.

Employees track and submit receipts for items like fuel, maintenance, and repairs. Although this method provides detailed and precise reimbursement, it requires extensive record-keeping.

As an employer, this approach allows you to reimburse employees based on real expenses, ensuring that no one is over- or under-compensated. However, it demands careful documentation and processing to manage the detailed reports effectively.

3. Standard mileage rate method

The standard mileage rate method is one of the most commonly used approaches for employee mileage reimbursement.

The IRS sets a standard rate per mile, covering fuel, maintenance, and depreciation. Employees calculate their reimbursement by multiplying the miles driven for work by this rate.

This method is easy to administer, providing a consistent and fair reimbursement system. It ensures all work-related trips are compensated uniformly, simplifying the process while adhering to tax guidelines.

4. FAVR (Fixed and Variable Rate) method

The FAVR method combines fixed and variable expenses for more tailored employee mileage reimbursement.

Employees receive a fixed payment covering costs like insurance, along with a variable rate for fuel and maintenance based on miles driven. This approach offers a personalized reimbursement plan that aligns with individual driving patterns and expenses.

The FAVR method provides greater accuracy in reimbursing employees, balancing fairness and precision while reflecting the true cost of work-related travel.

5. Methods for tracking mileage reimbursement

Accurate tracking is essential for ensuring fair employee mileage reimbursement.

Options include manual logs, GPS-based apps, or telematics systems. Digital tracking apps automatically log trips, simplifying the submission of mileage reports.

As an employer, offering technology-driven tools for tracking reduces errors and improves efficiency.

Whether through apps or traditional logs, proper tracking ensures employees are reimbursed accurately for every mile driven. Streamlining tracking methods also makes compliance easier and speeds up the reimbursement process.

Understanding what is mileage reimbursement helps you and your employees choose the most efficient and fair approach for handling mileage reimbursement in your organization.

Benefits of mileage reimbursement

Mileage reimbursement provides significant advantages for both your employees and your business.

By compensating employees fairly for using their personal vehicles for work, you enhance job satisfaction and foster loyalty. When employees feel their travel expenses are recognized and covered, they are more motivated, which positively impacts productivity.

For your business, employee mileage reimbursement simplifies financial management by offering a structured and predictable system for compensating travel expenses. Additionally, it helps you stay compliant with legal and tax regulations, avoiding potential fines or disputes.

Proper mileage tracking and reimbursement also ensure transparency, reducing the risk of overpayments or errors. By implementing a fair and efficient mileage reimbursement process, you maintain a positive work environment while optimizing your expense management.

Compensates employees for their costs

You ensure your employees are fairly compensated for the expenses they incur while driving for work, covering fuel, maintenance, and wear and tear.

Employee mileage reimbursement helps offset these costs, ensuring your employees aren’t financially burdened by out-of-pocket expenses when using their personal vehicles for business tasks.

By providing fair compensation, you foster a positive relationship between your business needs and your employees’ contributions, maintaining their satisfaction while fulfilling your goals.

Simplifies travel expense management

Employee mileage reimbursement simplifies travel expense management for you and your employees.

Implementing automated systems and clear reimbursement policies allows you to easily track and manage expenses without unnecessary administrative burdens.

Your employees benefit from a straightforward method for reporting travel and expense costs, while you maintain effective control over expenses.

A mileage reimbursement system enhances financial oversight and streamlines operations.

Boosts employee motivation

Fair and consistent employee mileage reimbursement directly boosts your employees' job satisfaction and motivation.

When you recognize and compensate them for business-related travel expenses, you contribute to a more positive work environment.

This acknowledgment of their efforts enhances morale, making employees feel valued and appreciated.

By covering their costs, you are not only supporting their financial well-being but also strengthening their loyalty and commitment to your company, ultimately leading to better employee productivity and job performance.

Ensures regulatory compliance

Properly managing employee mileage reimbursement helps you stay compliant with legal and policy requirements.

By following consistent procedures, you ensure adherence to labor laws, tax regulations, and company policies.

Corporate travel policy compliance protects you from legal risks and penalties while demonstrating fairness in compensating your employees.

Ensuring that reimbursements are handled correctly not only safeguards your business but also fosters trust and transparency with your employees, who see that their work-related expenses are being fairly addressed.

Avoids capital costs

You avoid the significant capital costs associated with maintaining a company fleet by reimbursing employees for using their personal vehicles for business purposes.

Employee mileage reimbursement eliminates the need for vehicle purchases, insurance, and ongoing maintenance, allowing you to focus resources on more critical aspects of your operations.

This cost-effective strategy supports your employees’ work-related travel needs without imposing unnecessary financial strain on your business, ultimately leading to more efficient budget management and long-term savings.

Facilitates easy bookkeeping

Mileage reimbursement simplifies bookkeeping by providing clear, detailed records of travel expenses.

Streamlined expense reporting and tracking makes it easy for you to manage financial documentation and meet regulatory requirements.

Organized records reduce the risk of errors, ensuring smoother audits and compliance checks.

Straightforward knowledge of what is mileage reimbursement expense management, enhances control over your financial processes, leading to efficient operations and better oversight of your company’s expenses.

Lowers extra expenses

Relying on employee mileage reimbursement helps you avoid the extra expenses linked to managing a company fleet.

By compensating employees for using their own vehicles, you eliminate the costs of fleet maintenance, insurance, and fuel.

This approach keeps your travel-related expenses low while still meeting your operational needs.

Your employees also benefit from this arrangement, as it provides them with additional flexibility in managing their transportation needs, while simultaneously ensuring that they receive fair compensation for any business-related travel trips they undertake.

Reduces tax liability

Structuring your mileage reimbursement program effectively can reduce tax liability for both your business and your employees.

By treating employee mileage reimbursement as a tax-deductible expense, you reduce operational costs.

When reimbursements are handled correctly, they remain non-taxable income for your employees.

This dual benefit supports your financial strategy while ensuring your employees aren’t burdened with additional taxes.

It’s a win-win approach that balances cost management with employee satisfaction.

Mileage reimbursements made easier with Volopay

Challenges in mileage reimbursement

Employee mileage reimbursement presents challenges that can impact both you and your employees.

Common issues include inaccuracies in mileage reporting, disagreements over reimbursement rates, and the complexity of maintaining precise records. Inconsistent reporting about what is mileage reimbursement can lead to disputes and dissatisfaction, while differing interpretations of reimbursement rates may cause friction.

Additionally, tracking mileage accurately requires robust systems to avoid errors. Addressing these challenges requires clear policies, effective communication, and reliable tools to ensure that you fairly compensate your employees and maintain smooth, transparent reimbursement processes that align with your business goals.

Inaccurate mileage reporting issues

You might encounter challenges with inaccurate mileage reporting when your employees log their travel.

Mistakes or discrepancies in their mileage reports can lead to incorrect reimbursement, causing delays or disputes over compensation.

Inconsistent reporting also creates problems in verifying actual travel distances.

Implementing reliable tracking tools and clear guidelines helps you ensure that your employees provide accurate records, allowing you to fairly compensate them for their business-related travel and avoid unnecessary conflicts over employee mileage reimbursement.

Problems keeping mileage records accurate

Maintaining accurate mileage records is crucial, yet it’s easy for your employees to overlook or miscalculate their travel distances.

These errors can lead to inaccurate employee mileage reimbursement claims, affecting both your finances and employee satisfaction.

Ensuring accurate records requires clear tracking methods, whether through manual logs or automated apps.

By encouraging your employees to consistently log their miles and providing user-friendly tracking tools, you can reduce errors, streamline reimbursement, and ensure fair compensation for work-related driving.

Disagreements over reimbursement rates

Disagreements over reimbursement rates for employee mileage can cause friction.

You and your employees might have different perspectives on what rate fairly covers expenses like fuel, maintenance, and vehicle wear. Without clear, agreed-upon rates, these differences can lead to conflicts and dissatisfaction.

Establishing transparent policies and communicating those expectations upfront allows you to prevent misunderstandings and ensure that your employees feel valued and appropriately reimbursed for the costs they incur when using their personal vehicles for work.

Following legal and company rules

Navigating legal and company rules for employee mileage reimbursement can be challenging.

Compliance with labor laws, tax regulations, and company policies is essential to avoid legal issues and ensure that reimbursement processes are fair.

Failing to follow these rules could lead to disputes or penalties.

Staying updated on legal requirements and clearly defining your company’s reimbursement policies allows you to maintain compliance while ensuring that your employees are properly compensated for their business travel in line with fixed guidelines.

IRS standard mileage reimbursement rate

The IRS standard mileage reimbursement rate is a guideline set by the Internal Revenue Service (IRS) in the U.S. for reimbursing employees for business-related travel. This rate covers expenses related to fuel, maintenance, and vehicle depreciation.

For 2024, the standard rate is 65.5 cents per mile for business miles driven, a change from the previous year's rate. This rate is designed to fairly compensate you for the costs incurred while using your personal vehicle for work.

There are variations in the rate depending on the type of vehicle and specific situations. For instance, different rates may apply for business versus medical or charitable driving.

Keeping up with the IRS updates ensures that you fairly compensate your employees according to the current standards.

By adhering to these rates, you provide clear and consistent employee mileage reimbursement for their work-related driving, simplifying financial compliance and corporate travel management.

How to calculate mileage reimbursement?

To calculate what is mileage reimbursement, use the following formula:

Multiply the number of business miles driven by the current standard mileage rate set by the IRS.

For example, if you drive 100 miles for work and the rate is 65.5 cents per mile, you would calculate your reimbursement as follows:

100 miles × $0.655 (rate) = $65.50.

Ensure you track your miles accurately and use the current rate to determine your total reimbursement amount. This method simplifies the reimbursement process and ensures you fairly compensate your employee for their business-related travel.

By using the standard mileage rate, you can maintain consistency and clarity in your reimbursement practices.

How to keep track of mileage for reimbursement?

Good record-keeping is an important part of reimbursement, as, without it, it would be impossible for your employees to qualify for compensation. That’s why it’s important to log every business trip and include these crucial details:

a) Date and time of the trip

b) Mileage covered (track using the readings provided on your vehicle’s odometer)

c) Destination of each drive

d) A brief description of the purpose of each drive

Three ways your employees can track their mileage expenses, ranging from traditional to digital & advanced versions.

Logbooks and excel spreadsheets

These are the low-cost mileage tracking options but are time-consuming and riddled with inaccuracies. Since these logbooks and spreadsheets are manually recorded, it leaves a lot of room for error.

Sometimes your employee might start a drive and not take note of the current number on their odometer, which leads them to record guesstimates.

Online mileage-tracking apps

These are the most accurate and efficient ways to track and report trip details.

Mileage tracking apps use GPS technology to accurately track the distance and mileage from the start to the end of the destination without having to do any manual entry.

These apps save time putting records, creating invoices, and reporting mileage expenses to receive tax benefits.

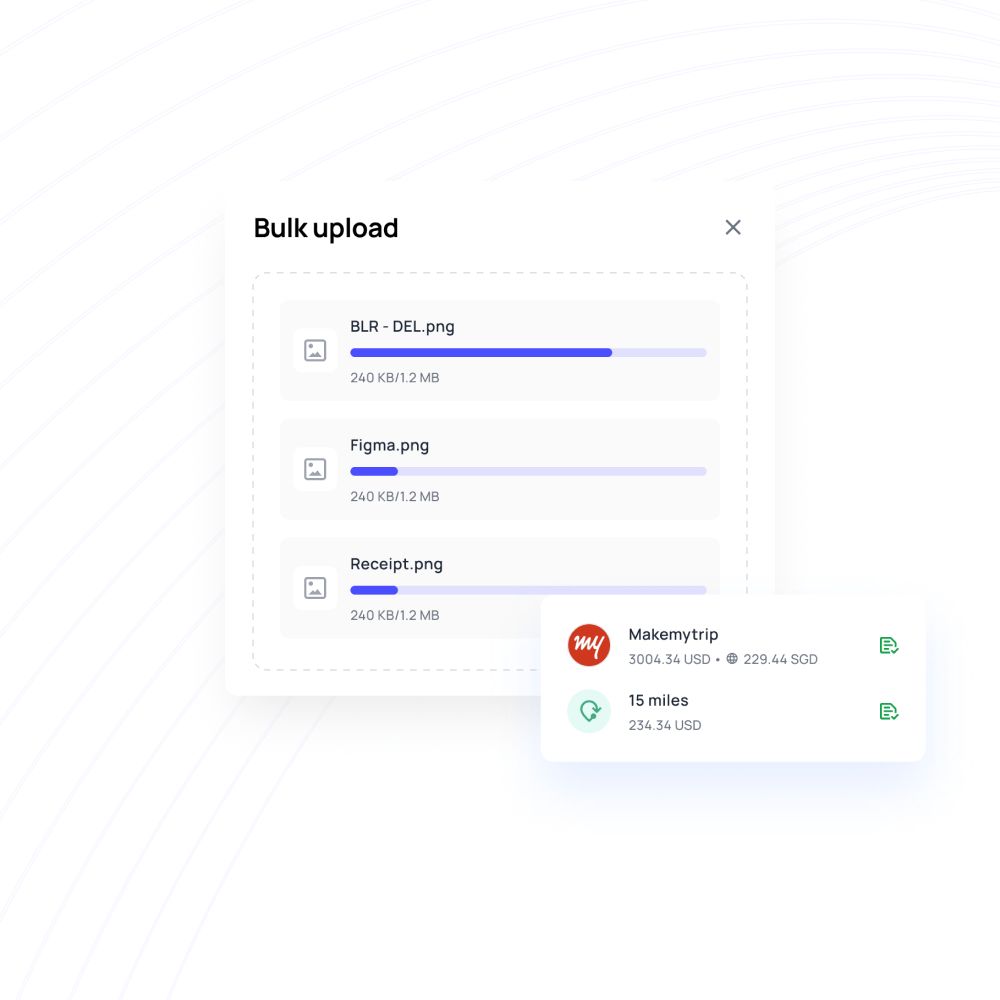

Expense management systems

Expense management systems are used for employee expense management and reimbursements and are a better option than paper-based recording when it comes to mileage reimbursement.

Although they are a medium-cost digital option that still relies on manual data entry by the employees, however, once the basic information has been entered, the system automatically fact-checks against odometer readings, receipts, and other such proofs for easy reimbursements.

Track and reimburse mileage effortlessly!

Reimbursing employees for mileage

To effectively manage employee mileage reimbursement, follow these steps:

● Establish a reimbursement policy

Define the reimbursement rates, acceptable mileage documentation, and procedures. Clearly communicate these guidelines to your employees to ensure consistency.

● Collect mileage records

Require employees to maintain accurate mileage logs, detailing the date, purpose, and distance of each trip. Use digital tools or manual logs to track this information.

● Review and approve

Verify the submitted mileage reports for accuracy and compliance with your policy. Approve the amounts for reimbursement once verified.

● Process payment

Use your accounting system to process the approved mileage reimbursements. Ensure that payments are made promptly, adhering to your company's payment schedule.

Documentation requirements

You need detailed mileage logs from employees, including trip dates, destinations, and distances traveled.

Depending on your policy, you may also require receipts for fuel and maintenance.

This documentation ensures accurate and fair employee mileage reimbursement and helps maintain transparency in the employee expense reimbursement process.

Submission process

Employees should submit their mileage logs and any required receipts through a designated platform or directly to your accounting department.

Ensure the submission process is clear, accessible, and straightforward to avoid delays and confusion in processing their reimbursements.

Timelines

Establish and communicate a timeline for submitting mileage reports and processing reimbursements.

Typically, employees should submit their mileage reports monthly, and you should process reimbursements within 10–15 business days.

Clear timelines help manage expectations and ensure timely compensation for your employees.

Tips to better mileage management

Consider an equitable mileage rate - not the standard one

There are multiple inaccuracies when the standard rate is being calculated. It takes into account last year’s average vehicle cost, average insurance premiums, and average depreciation based on a certain number of miles. However, unless your employees are experiencing all the above factors, reimbursing them on the standard mileage rate is highly incorrect.

This can prompt high-mileage drivers to add in a few extra miles to earn more out of reimbursement, leaving you unable to control your mileage expenses. That’s why you should consider adopting an equitable mileage rate that doesn’t reward employees for driving more.

This means that the rate is adjusted for each employee based on the kind of traveling they do and the prevalent gas prices. Having a different mileage for each employee is a cumbersome process, however, this will ensure that each employee is paid fairly.

Standardize the vehicle instead of the mileage rate

As we previously said, the best way to compensate employees fairly is to create an equitable mileage rate for them. The best way to calculate this is by using a standard vehicle that can be utilized to conduct business operations.

An employer cannot control the distance and geographically-sensitive fuel and other additional costs, therefore they can control the type of car to ascertain the appropriate mileage reimbursement rate for the employee. Since reimbursing bigger and more expensive vehicles is more costly, you as an employer can ensure that vehicles are used for business purposes.

For example, this means that one cannot use an SUV truck to do business tasks such as meeting a client. Once you have chosen an appropriate vehicle such as a mid-range sedan, you can easily calculate the mileage rate by taking fuel, insurance, and wear and tear of the specific car segment into consideration.

Choose mileage tracking apps over manual employee reporting

Even if you have adopted the previous tips, you could still incur a heavy mileage cost without having a good mileage tracker in place. While employee reporting is a traditional form of mileage tracking, it is extremely time-consuming and prone to human error.

Sometimes employees do not mark it correctly and are later filling in the details with estimates, which could fiscally harm your company in the long run. If the employees think they are being paid unfairly, they’ll try to receive the compensation they think is fair by inflating the number of miles driven.

Instead of scrutinizing their every move, automate mileage tracking by using applications that use GPS and digital data entry to precisely record any business trip and capture mileage in real-time to bring down overall reimbursement costs.

Volopay for effortless mileage management

Enhance your mileage reimbursement with Volopay

Volopay revolutionizes what is mileage reimbursement for your business with its advanced expense management system, providing a seamless solution for both employees and employers. Its user-friendly interface simplifies the submission process, allowing employees to easily log their mileage and corporate travel related expenses.

Key features include real-time reporting and analytics, which offer instant insights into mileage expenses and reimbursement statuses. This capability ensures accurate tracking and timely adjustments, enhancing financial oversight.

Volopay also enforces policy compliance with built-in checks, ensuring that all submissions adhere to company guidelines and legal requirements, which helps mitigate errors and compliance issues.

The platform integrates smoothly with existing accounting systems, reducing manual data entry and improving accuracy. This integration allows for efficient reconciliation of mileage expenses and streamlines overall financial management.

1. Streamlined reimbursement process

Volopay transforms the mileage reimbursement process for your business by offering a streamlined employee expense reimbursement software.

Employees can easily submit mileage logs and related expenses through a user-friendly interface. This approach reduces the administrative burden, minimizes errors, and accelerates the reimbursement process.

By automating and simplifying submissions, Volopay ensures that you can handle mileage reimbursements efficiently, providing a smooth experience for both employees and employers.

2. Real-time reporting and analytics

Volopay’s expense management system features real-time reporting and analytics.

You and your employees can access up-to-date information on mileage expenses and reimbursement statuses. This feature allows for immediate tracking and adjustments, giving you insight into spending patterns and ensuring accurate and timely reimbursements.

Real-time visibility enhance financial oversight and help you manage your budget more effectively.

3. Policy compliance and checks

With Volopay, compliance with employee mileage reimbursement policies is easier to maintain. The system includes built-in checks to ensure that all submissions adhere to company policies and legal requirements.

This reduces the risk of errors and ensures that reimbursements are processed according to established guidelines. By automating policy enforcement, Volopay helps you stay compliant and avoids potential issues with reimbursement claims.

4. Seamless integration with accounting systems

Volopay integrates seamlessly with your existing accounting systems, providing a unified approach to managing expenses.

This integration streamlines the process of recording and reconciling mileage reimbursements, reducing manual data entry and improving accuracy.

By connecting expense data directly to your accounting system, Volopay simplifies financial management and enhances overall efficiency in handling reimbursements.

5. Speedy claims with centralized platform

Volopay’s centralized platform enables speedy claims processing for mileage reimbursement.

Employees can submit claims quickly, and you can review and approve them with ease.

The system consolidates all reimbursement requests in one place, allowing for faster processing and reduced turnaround times. This efficiency ensures that employees receive timely compensation, improving satisfaction and reducing administrative delays.

Trusted by finance teams at startups to enterprises.

FAQs on mileage reimbursement

There are better alternatives for the standard mileage rate. One approach is to separate the fixed costs (insurance, depreciation) from variable costs (gas, oil change, tires) and reimburse them accordingly. This is known as Fixed and Variable Rate Reimbursement (FAVR).

No, mileage reimbursement and reimbursing, in general, have nothing to do with income and refer to the compensation given to employees for carrying out business duties through out-of-pocket expenses.

Yes, an employer can refuse to pay mileage. However, this could lead to employee dissatisfaction. Therefore it’s recommended that business owners should offer mileage reimbursement as it also provides tax relief to the employees, wherever applicable.

Yes, mileage reimbursement can be used to negotiate a compensation package with an employee.

The Internal Revenue Service (IRS) issues a new standard mileage rate for employees using privately owned vehicles for business, medical, charitable, and moving purposes every year.

To ensure accurate mileage reporting, keep a detailed log of your trips, including dates, destinations, and distances. Use tracking tools or apps for precision in employee mileage reimbursement.

No, employee mileage reimbursement typically does not cover commuting miles to and from your regular workplace. It usually applies to travel that the business sends employees on or travel that makes up part of the business processes (client meetings, deliveries, conferences and conventions, etc).

If you have questions or disputes about employee mileage reimbursement, contact your HR or finance department for clarification. Review your mileage policy and provide detailed records.

No, employee mileage reimbursement covers only business-related travel. Personal errands during business trips are not eligible for reimbursement.

Mileage reimbursement is generally non-taxable if it follows IRS guidelines. Ensure compliance with tax regulations to avoid taxable income issues related to employee mileage reimbursement.

Bring Volopay to your business

Get started free