Employee expense management - Key strategies

Employee business expenses can be a major hassle for most businesses. Not only do they involve a lot of analysis and policy formation by finance and compliance departments, but they also involve every department’s input on what an ideal budget should be.

From the largest promotional event to the smallest stationary item in a cubicle - employee expenses can add up to an unmanageable amount if they aren’t designed to be efficient.

Fortunately, a multitude of expense management systems has come into the market to help companies (of all sizes) manage expenses. Largely automated, they are easy to use and keep track of employee expenses.

How to manage employee expense?

It is important to understand the possibilities of employee expenses and where the budget needs to be allocated. Note that employee expenses are not the same as company expenses.

Employee expense management needs to take place separately from departmental expenses. Once you’ve isolated the possible employee-specific expenses, assess their frequency.

Things like travel and accommodation, food and beverages, and mileage reimbursements are all required by sales teams. Meanwhile, subscriptions, office supplies, and entertainment are recurring expenses for all employees. Budgets for company-sponsored activities, holidays, retreats need to be designated for every financial year.

Key strategies for managing employee expenses

Use corporate cards

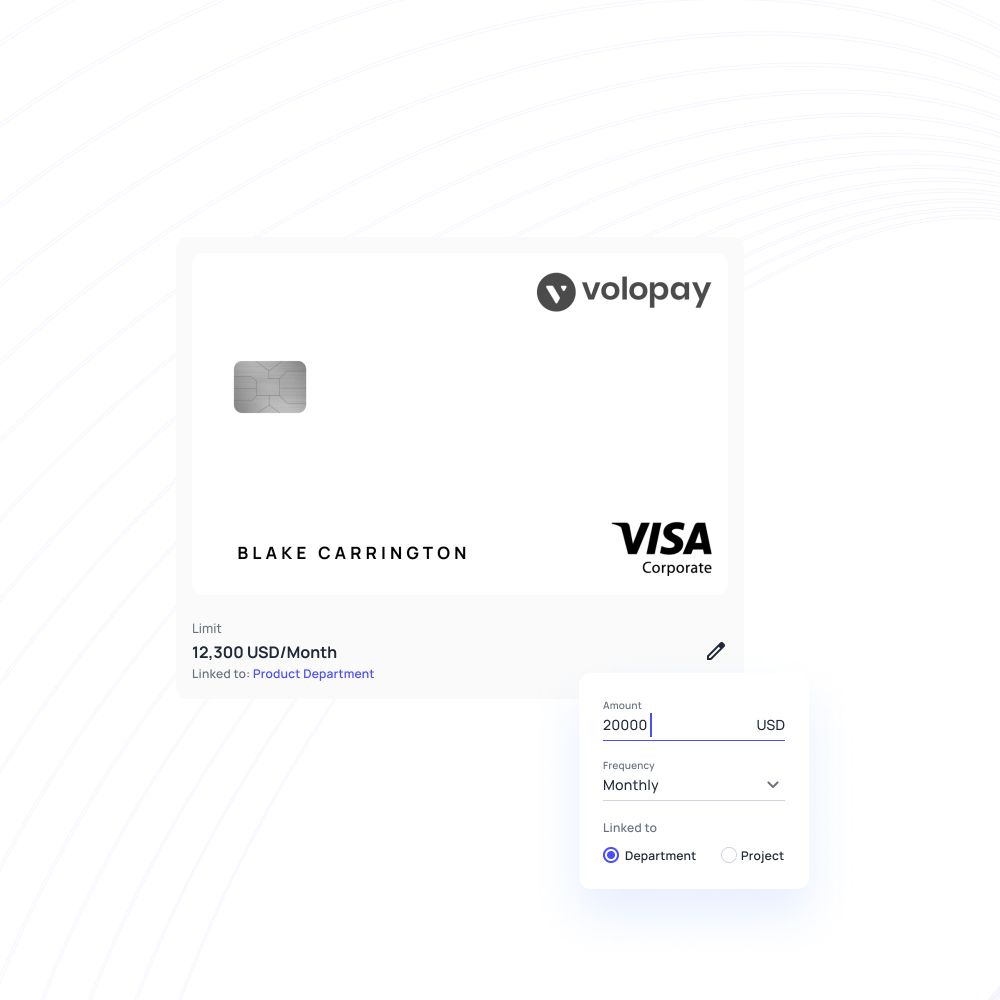

Corporate cards eliminate the need for money transference and only require approval and receipt for accounting. These days, virtual cards also make it so that only an approved amount of money is linked to a card. They also come with a long list of rewards, which can be beneficial for the finance team.

Design a clear plan

Once you know how you’re going to manage money transfers, you can then decide how to manage a budget. For example, a reimbursement model with clear guidelines on accepted claims, approval processes, and accounting will help design an effective budgeting plan.

Set an expense reimbursement policy

Expense policies need to be designed in collaboration with your compliance team. Collectively decide how you are going to dole out money to employees and manage the budget. Compliance will also assess the security risks of your policies.

If you intend to work on a reimbursement, having a plan can prevent future roadblocks. Employee expense reimbursement software can help you manage quicker than manual intervention.

User-friendly expense reporting

Systems are efficient when they are complex in their management function but simple in their interface. A good expense management system can churn out a report that is understandable to both employees, and the accounting department.

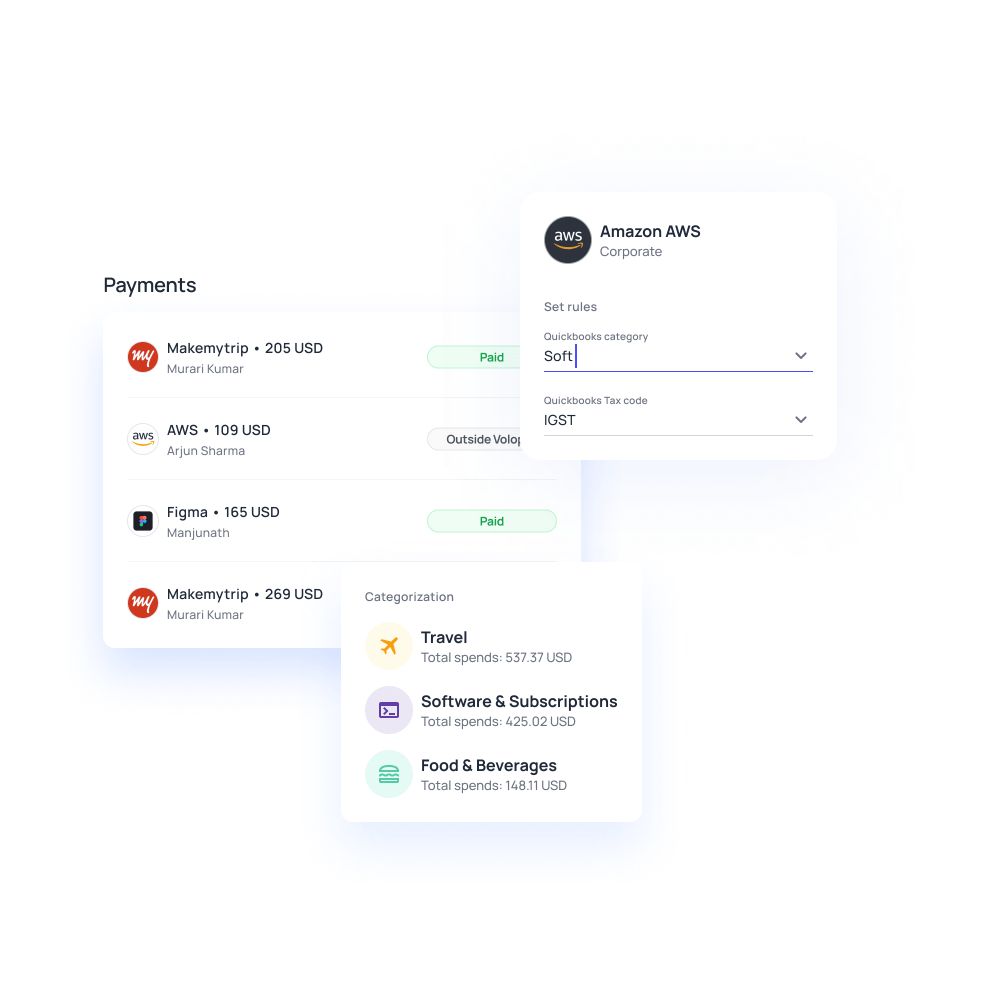

And, it should also be versatile enough to fit into any accounting software. Automated expense management systems can easily be integrated with accounting software for this purpose.

Simplify your financial processes with an expense management software

How to improve your spend management system?

Centralizing expenses for transparency

Transparency plays a crucial role in fostering a healthy spending culture, allowing all departments and employees to clearly understand and follow the ideal expense patterns.

By consolidating your subscriptions, recurring payments, and reimbursement history into a single, easily accessible database, you ensure that everyone in the company is aligned. This centralized approach makes it easier for teams to manage finances efficiently.

Providing a clear expense policy

Whatever expense policy you design will be a Bible for your compliance and finance teams to follow. Not only does it need to account for any possible loopholes, but it also needs to be enforceable.

Your expense policy should cover all the basics and every other relevant base that you can think of. This can include: what can be claimed/reimbursed, how to file for reimbursement, spend limits for reimbursement (or cards, if you opt for those).

Reduced risk of human error

Human error is the biggest hurdle for finance and compliance teams, especially when the volume of employees and/or transactions is high. Fortunately, human intervention can be removed altogether with the help of automated expense management systems.

Software like Volopay can organize your budgets, enforce policies, create quick approvals, and auto-decline over-the-budget payments. Data can also be sifted for errors, and for transfer to accounting.

Best practices to organize employees business expenses for your company

Create your employee expense management plan

Have a plan that accounts for all possible employee spending, and how you will manage expenses. The plan should be flexible to future needs, and scalable as the department and company expand. At the same time, some laws need to be universal to prevent snowballing of employee business expenses. There should also be a spending process outlined so everyone understands how to manage spending.

Set clear employee expense guidelines

Employee expense guidelines will allow departments to brief their employees about correct spending. This can be tracked, and enforced by individual managers alongside the finance department. Having the employee expense guidelines in the open will also allow employees to learn from one another on how to optimize their company spending.

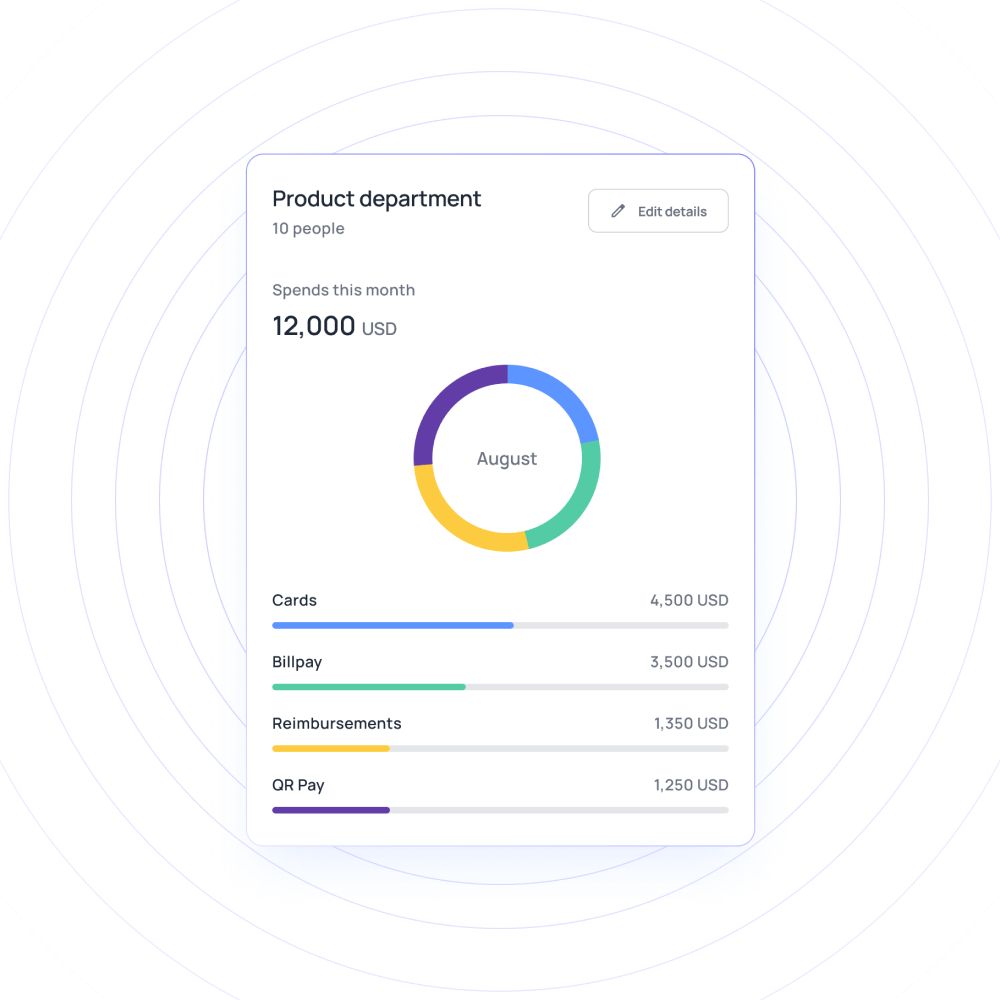

Set budget for each employee expense category

Budgets are a guideline for how your department or company is going to spend its money. Employee expense budgets are crucial - not just company-wide, but also specific to departments. Having clear limits, margins, and emergency buffers will prevent you from facing inexplicable losses, and make it easier to manage expenses.

Provide suitable payment methods

Diversifying payment methods is crucial in this day and age. Not only do employees expect to use cards, money transfer apps, and payment portals - vendors also provide some specific options of payment. Having your employee business expense policy account for, and accepting, multiple payment methods helps track a variety of expenditures.

Digitize invoice retrieval

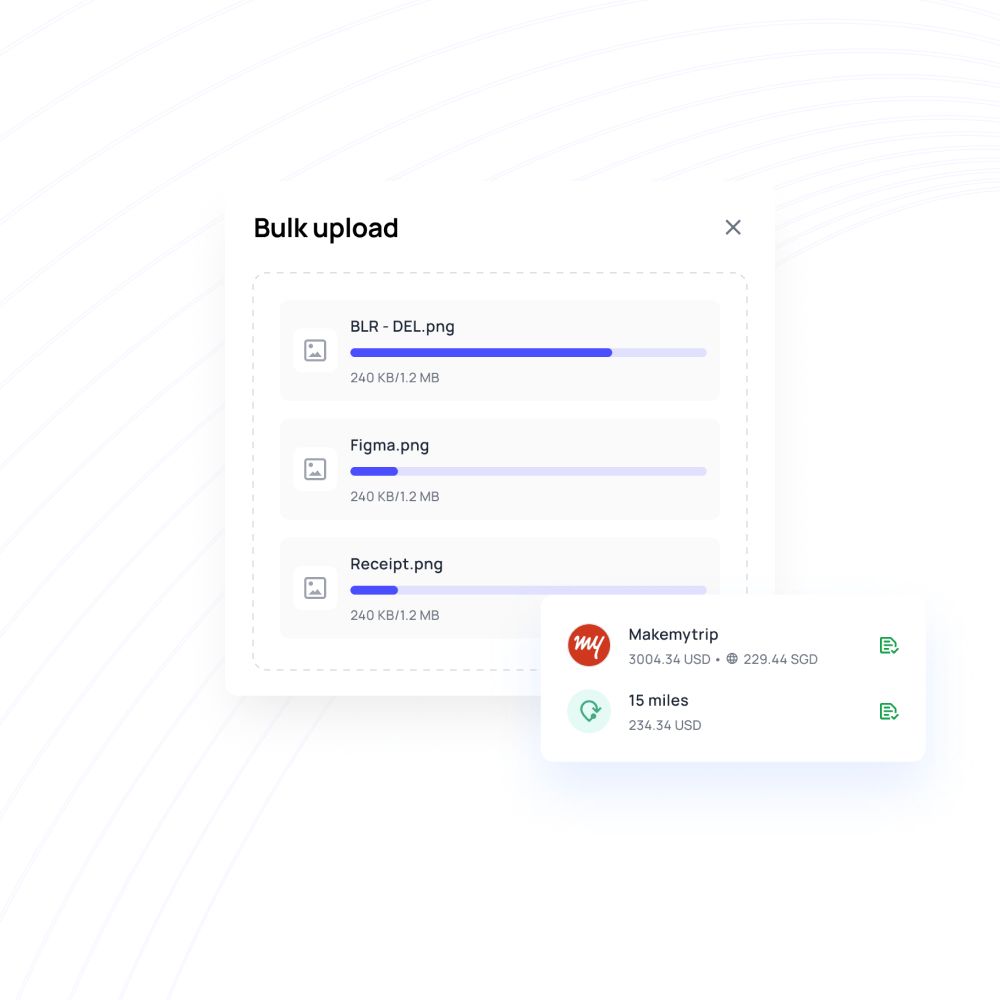

Bulks of invoices are easy to lose or accidentally duplicate. A digitized invoice retrieval system can collate all invoices in a single place for ease of verification and approval. Digitally available invoices can also later be scrutinized if there is a need.

Centralize subscription monitoring

Subscription monitoring and history should be centralized so that relevant managers and departments have access to the transaction data associated with them. Since subscriptions are recurring payments, and often relevant to all employees, they need to have a transparent record. Moreover, any issue with them can be easily pointed out before the payment has taken place multiple times.

Design employee expense reimbursement policy

Reimbursement policies need to be decided before any employee claims any kind of reimbursement. They need to cover all allowances, what counts as a company expense, how a claim needs to be filed, and what the process of employee expense reimbursement will be. These policies also need to highlight any windows within which reimbursements must be filed, what supplementary material is required along with the claim, and what the limit of claim is.

Track expense report fraud

Centralizing data makes it a lot easier for employees and legal teams to spot fraudulent activity. The transparency of it also discourages employees from partaking in fraud. Expense reports in an efficient expense management system can be easily filtered for specific data and analyzed for incorrect information.

Digitize and automate your processes

Lastly, manage employee business expenses with the help of expense management software. Digitization can create a safety net, while automation can collect data without any manual error. Digitized systems can detect discrepancies, fraud, and secure transactional data in a way that manual systems cannot.

How can Volopay help your business manage employee expenses?

Volopay’s unique expense management system is designed to try and reduce reimbursements altogether. Funds are allocated to virtual cards, which can be issued to a single employee. Equipped with expiry dates, and linked to budgets, they can eliminate the hassle of reimbursements altogether.

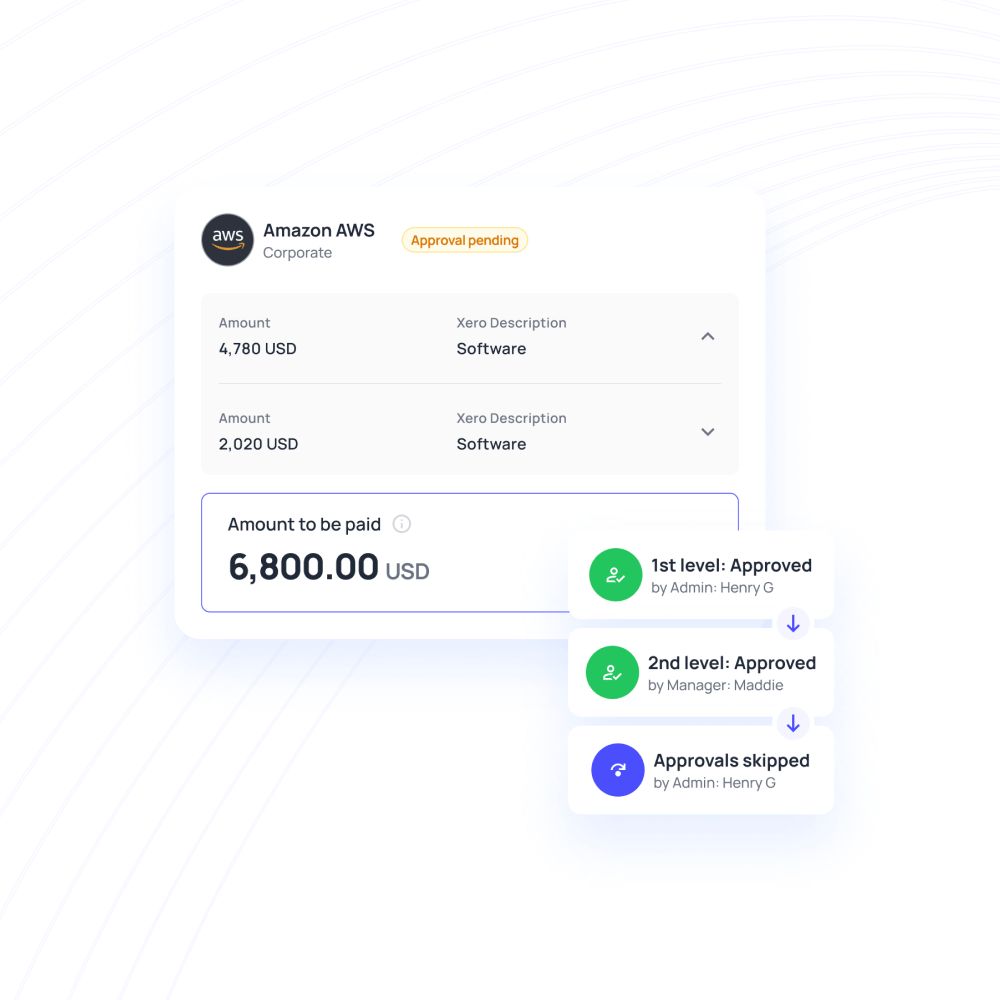

Nonetheless, being completely reimbursement-free is implausible. For this reason, Volopay also contains an expense reimbursement feature. Employees can file claims, and approvers have space to request additional data before authorizing a reimbursement.

Admins can design spend controls and limits. These are combined with company-wide, as well as budget-specific policies. Spend policies can be automatically enforced by the system. The entire process is made compliant by delegating multi-level approvers to oversee employees and budgets. All transactions and invoices are monitored in a single place.

Volopay’s expense management software streamlines and automates an otherwise tedious process. The automation also removes susceptibility to credit card fraud, theft, or misuse. Moreover, the ability to integrate with accounting software like Quickbooks, Netsuite, and Xero makes all these transactions transferable and ready-to-audit. Everything is centralized, easy to access, and incredibly user-friendly.

FAQs

Learning how to control expenses in a business is a data-driven task. It can be managed if there is a clear pattern to harmful transactions. Centralizing spending encourages employees to spend wisely, and also to show how budgets are maintained across departments. A shared database can also prevent redundant spending, and help find vendors that offer discounts for large orders, or timely payments.

With an automated system like Volopay, employee purchases can be tracked and organized in a central database. Transactions can be linked to budgets, with auto-declines on those against policy. Receipts can be attached, and subscriptions tracked by scheduling recurring payments. Virtual card limits are set in advance, and any changes need to go through multi-level approvers, with a history of which the manager approved it. All of this can be exported for data analysis, or filtered on the system.

Employee business expenses can be tracked by two methods. One is to clearly outline the reimbursement rules and to attach each reimbursement claim to a verifiable invoice and/or receipt. The second is to obtain a corporate card for the employee. The card’s limit is decided by the company, and all spending is automatically tracked.

Trusted by finance teams at startups to enterprises.