Why should businesses have travel request approval workflow

Many businesses have financial policies in place for their employees in the form of a document. These outline the rules and guidelines that specify the usage of funds for different expenses like business travel, advertising, etc., and what they will and won’t be reimbursed for.

Organizations expect employees to adhere to this at all times. But there might be instances when a person has not completely gone through the rules, misunderstood a guideline, and accidentally made an expense that is not permitted by the company. In this case, there is not much the accounts team can do but reimburse the amount and inform the employee to not repeat such an error in the future.

A post expense approval isn’t an approval, but rather a verification or check of all expenses made. It doesn’t help in controlling expenses as they have already been made. This is where tech solutions with expense approval workflows come into the picture.

What is travel request approval workflow?

A travel request approval workflow is a function within expense management software. What this allows you to do is set an approval system before funds from your corporate credit program are given to your employees.

So now, instead of hoping that all your employees have read the financial company policy and are accustomed to them, you can make sure that no money is spent without financial controllers checking the transactions first. The best part is that all of this can be done remotely from wherever you are, using just the Volopay platform.

For example, if John is a sales employee at your company who requires funds to travel to a client location, he must first issue a request on the Volopay platform. Once the request is approved by the approvers your organization had set previously, only then will the funds be transferred to John’s Volopay corporate credit card.

Expense approval workflows: How to manage trips and advances?

Expense approval workflows give the finance team the ability to manage and control where the company funds are going. Be it a business trip that an employee is going on or an advance for one.

Advance fund requests on the Volopay platform can be made in the form of recurring funds. So for example, if John has to travel to client locations every month for sales purposes, he would have an idea of how much these visits cost on average. By estimating the amount, John can request a higher overall amount for the entire month's travel expenditure instead of requesting a smaller amount each time he has to visit a client.

This does two things:

- John doesn’t have to wait for approvals every time. He can simply have a conversation with the financial controller once and receive the funds on a recurring basis every month to flexibly make decisions on his own.

- The finance department also would not have to deal with constant requests for employees all the time and they’ll still know that only a certain amount can be spent by them every month.

Importance of having travel request approval workflow

Setting a pre-trip approval workflow is important for the finance department of your business as it helps them track and control how the budgets are being utilized. If employees had completely free access to funds above a certain limit, it would be very difficult to maintain compliance with financial policies.

Track

Knowing which employee is requesting money at what time and for what purpose gives clarity. It also helps track where the money is going instead of just a request for funds that might be an invalid expense.

Control

Once a fund request is made by the employee, it is up to the approvers to either accept, reject or ask for more information regarding the expense. This helps the finance department be in control of where the money goes and who it goes to.

Expense compliance

Using such a system for providing travel allowances to employees also gives the finance department peace of mind knowing that no unaccounted expenses are being made by employees. With time, even employees get used to the type of travel expenses that are permitted and won’t make requests that are not according to the company travel policy.

Streamline your approval workflow to manage your business expenses

How does approval process benefit employees while on business trip?

Flexibility

In case a situation arises where they need more than what was previously anticipated, your employees can always request more funds using the Volopay app. They get the flexibility to do this instantly and remotely simply with the availability of an internet connection. The financial controller or admins will then receive a notification alert on their system or mobile app, wherever they are, and be able to approve the request for instant money transfer.

Confidence

Business travel is a type of expense that can include several other types of expenses while you’re on the trip. When an employee has received funds through pre-trip approval software, they’ll know exactly how much they can spend and what they can spend it on. Rather than constantly guessing whether a purchase is legitimate and if it will be reimbursed or not, they can carry out their expenses without hesitation knowing that the funds were already approved.

Challenges of not having proper travel request and approval workflow

While your business might have a financial policy set in place, there’s no sure way to guarantee that all employees have read the entire document and whether they will follow it to a T. You are not controlling funds if the employees are making expenses on their own and you have to verify them later.

When companies rely on employees to adhere to the financial policy while making expenses on their own and getting them reimbursed later, the chances of making purchases that are not permitted according to the company policy are quite high. This uncertainty always leads to complications in the reimbursement process and it is not healthy for a work environment.

Without using corporate travel expense management software for a travel request approval workflow, getting funds from the finance department is a tedious and time-consuming task. The employee has to manually go and contact the financial controller and request funds. The financial controller then must verify this request from the employee’s team manager to see whether it is a legitimate request.

How to create business travel approval workflow?

Set goals

While it may seem obvious, it is important to note down the objective of a new policy for all stakeholders to gain clarity. Understanding the purpose of creating a new workflow gets everyone on the same page.

The goal of the new framework for travel approval requests could be anything from making the process simpler for everyone to overall making it more efficient. The reasons will depend highly on the drawbacks of your existing system.

By setting a clear goal, you’ll always have a north star to identify what steps the new process should follow so that you end up creating a better approval workflow.

Create travel and expense process flow

After setting your goals for this new business travel expense approval process, the next thing you must do is identify all the steps involved from an employee requesting funds all the way to receiving it.

- Where will the employee request funds?

- What information has to be provided to request funds?

- Who will be responsible to approve the funds?

- How long would it ideally take for funds to be transferred from the point of request?

- Where will the money be sent?

You must map out each step and see whether it makes sense and is better than what was being done previously.

Related page: What is travel and expense report and why automate it?

Select mandatory information to be conveyed

The finance department probably receives hundreds of fund requests daily. To sort through them quickly, accountants might miss out on crucial details regarding an expense which could determine whether it is a legitimate expense or not.

This makes it crucial to ensure that only the most important information about an expense should be provided when requesting funds so that approvers can quickly glance through it and know whether they should approve it or reject it. Some common line items of a travel expense that help an approver make quick decisions include:

1. The purpose of the trip.

2. How long will the trip be?

3. Which location is the employee traveling to?

4. A breakdown of the overall cost of the trip that includes transportation fees, rental cab service expenses, meals, accommodations, etc.

5. Whether any other employee will be joining the trip and their extra cost.

Experimentation and iteration

The last step is to execute the new travel request approval workflow and see whether things work out in a better way. If not, you could always go back and tweak the process wherever you notice inconsistencies and errors.

Things to consider while creating approval workflow for your business

Multi level approval workflows

In many cases, an expense might be of a nature that simply one approver cannot be responsible for. It needs a higher level of authority to further approve it. In such cases, you can create a pre-expense workflow with multiple approvers. A particular amount of expense can be set as a threshold to trigger a multi-level approval workflow.

Automation

Approvers can be preset into a workflow so that they get a notification each time there is an expense request rather than having the employee inform the financial controller about it. Once the approver approves the request, the funds will transferred to the staff's corporate card without having to tell another accountant to proceed with the money transfer.

Simplify travel approval workflow with Volopay

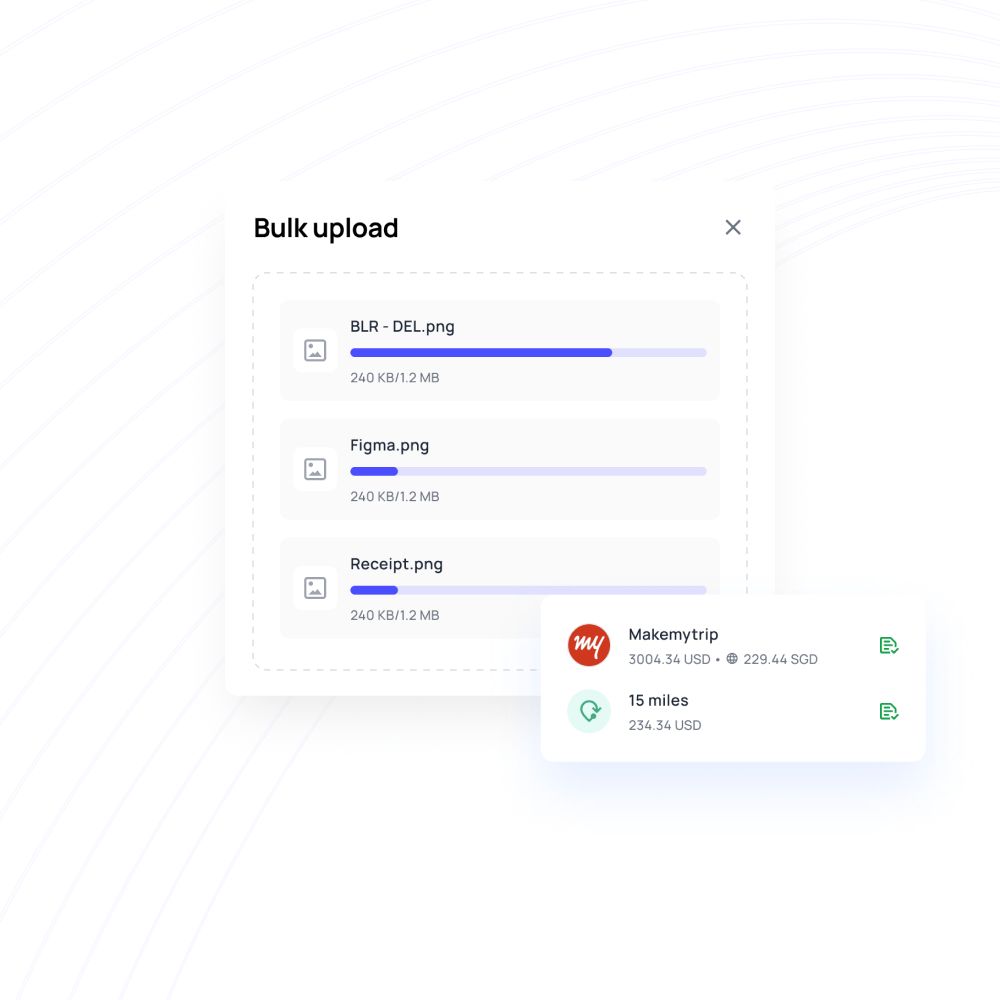

Using the Volopay platform, you can create and enforce expense approval workflows and policies within the system. An approval policy on our software allows the admins to set specific approvers based on the payment range. Approval workflows can be created for employees for both the payment methods available, namely corporate cards(physical and virtual) and Bill Pay.

Only the admins you choose to operate the platform from your company are allowed to create these approval policies and implement them. Once a pre-expense approval workflow is set, they can then be assigned to the different budgets that you create on Volopay.

For example, there might be a separate budget named ‘Travel’ for employees to request funds from. So now whenever a person requests funds from this budget, the approval policy that was assigned to it will be triggered and an alert will be sent to the respective approvers. Finally, you can always edit and tweak these policies to create simple yet robust workflows that give your complete control over your finances.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free