What is automation of accounting process?

Accounting one of the most crucial, yet most tedious aspects of running a business. No surprise, then, that automated accounting software is becoming popular (if not vital) to the business running tech stack. Having an automated accounting system has become an integral part of efficient financial planning.

Automated bookkeeping has eliminated the labor that goes into the accounting process. Accounting automation has also freed up many businesses from excess costs and time-wasting.

What is accounting automation?

Accounting automation tools essentially eliminate all manual aspects of an accountant’s job. The accounts teamwork is onboarded into a software that can perform functions ranging from simple to complex. The intention is to shift the accounting teams’ focus from redundant, time-consuming tasks to actual analytical and interpretative tasks. Instead of spending all their time doing data entry, accountants can instead work directly with compliance and finance to see the flow of transactions.

How to automate accounting process?

The idea of automation is to make sure the human eye is able to focus on drawbacks and fix mistakes rather than doing a repetitive task that a machine can take care of. The accounting software works in tandem with accountants to make their lives easier. Accounting tasks, once automated, are able to scan and assess data much faster than humans. The numbers are also updated much quicker since accounting software can plug into expense management systems.

Software like Xero is capable of integrating with your expense management platform, or even your company’s bank account. Every transaction, then, is automatically added to bookkeeping instead of a weekly, fortnightly, or even monthly dump.

Manual accounting system and challenges

A manual accounting system relies on paperwork and manual data entry. It’s not just that the process is hectic. The higher the volume of data, the higher the chances of mistakes being made. Taking a look at some of the challenges of manual accounting will better help you understand why it’s important to solve them.

The positive impact of automation on accounting becomes very apparent, then. You can check our article on 5 accounting tasks you should automate in your organization to know more.

Lack of accessibility

One of the biggest drawbacks of having manual copies of anything is that it is not as easily accessible to people who need to see it.

Consider a folio of paper accounting reports. It is near impossible to make copies for every employee, let alone for the same folio to be accessible to all managers and accountants at once. This is the same issue even with digital or cloud-based spreadsheets.

Even if it is easier to make copies and distribute an Excel sheet, it still requires certain permissions. This poses accessibility issues and creates a wall behind which important data is constantly hidden.

Error prone

Human error is impossible to avoid, particularly when there are stacks of opportunities for it. Even a mistake as small as one digit shift can impact the entire company’s financial predictions and compliance procedures.

In the same way that one misspelling in a vendor’s or client’s name can cause large losses of data. While there is no shame in human errors, the volume and possibility of it increase exponentially when the labor is done manually.

Add into that the same time-crunch and stress, and your manually written accounting records are likely not as accurate as you would like them to be.

Time consuming

Ledgers and paperwork are a mountain of work to process - and they take a lot of time. The largest part of a manual accounting system is, in fact, organization and line-by-line data entry.

Crosschecking those same entries is almost double, or triple the amount of time consumed in the entire process. That kind of workload can often cause accounting teams to become stressed and overworked.

Workers who are under deadlines to perform these accounting tasks end up frequently taking even longer than expected, simply due to the immense pressure of getting all done within a designated time frame.

Manual data loss

Security of data is not just threatened by people outside the company or those with ill intentions. Lack of security can also be present in the form of how easily your data can be lost.

Even with more than a single copy, it is possible that the most recently updated record could get erased with a lost file or accidental deletion. These losses can cause skewed predictions, and even entire months or years’ worth of ledgers’ irreplaceable data lost.

Lack of security

Even if you lock all your accounting records behind a metal safe, chances are that they are all prone to a security breach. Securing paper data has never been an easy task.

In the day and age of easy hacks, even cloud-based data is prone to be attacked by malware. This could cause important files to be corrupted, or even leaked to third-party entities. The confidentiality of these documents is difficult or even impossible to protect, especially if you deal with a high volume of data.

Importance of automating accounting process

Given the aforementioned challenges with manual accounting, it becomes quite evident that the automation of the accounting process is an important step into protecting and streamlining your accounting process. You might be wondering if you really do need it. After all, it’s quite possible that you’ve already considered the above problems. Perhaps you’ve faced them and found solutions - or you’ve already predicted them and have safeguards in place.

While we do applaud your ability to protect your manual accounting process, the fact remains that automated accounting software can still benefit you in major ways.

Just as paper replaced stone, and spreadsheets replaced paper - switching to accounting automation tools is simply a matter of keeping up with the times. Automated accounting is designed to improve your capabilities. Aside from being extremely time-saving, cost-saving, and efficient, it is also a chance for your team to focus on the bigger picture and become detail-oriented.

Instead of having employees slogging away at manual data entry, they can do a better job of validating the data and finding any errors that need attention. In the same way, accounting reports are more focused on analytics and predictions as opposed to factual inaccuracies.

Industries such as healthcare, retail, manufacturing, and professional services are particularly benefiting from accounting automation. In healthcare, for example, the complexity of billing, compliance requirements, and multiple payer systems make automation an essential tool for maintaining accuracy and efficiency, especially when integrated with robust management accounting practices.

You can also refer our blog on benefits of outsourcing accounting services to know whether you should consider outsourcing your accounting services over automation.

Accounting automation benefits for your business

Fast and accurate

This is probably the most immediate and obvious benefit to automating any process in your business. The amount of time saved by automation in accounting and finance can not only save money - it can also improve the efficiency of your work.

The accuracy with which software can comb data, at a fraction of the time it takes for a human to do it, is the biggest return on investing in automation. Additionally, the algorithms in the software can help pick up discrepancies that a human eye might easily overlook.

Faster data extraction and recovery

A machine will always be better at searching than a human could. When you’re dealing with years worth of data, and millions of transactions - no way could a human eye possibly manage to find one entry.

On the other hand, recovering or extracting data with the help of accounting software is much more accurate. Not only that - if you’re looking for groups of data, but accounting software can also filter and present entries on the basis of a specific time frame, vendor, department, etc.

Cloud access

Having cloud-based software taking care of your business means that you don’t need to head to a specific location or department to get the information you’re looking for. Rather, the provision of web-based and mobile applications enables you to access your data on any device, at any given time.

Whether you’re traveling and working, attending to an emergency during your commute, or even experiencing a power issue with one of your devices. You don’t need to rely on one device to be able to access information.

Real time synchronization across platforms

The positive impact of automation on accounting doesn’t end there. Another benefit of having cloud-based software is that it has data stored on the internet. This means that whatever information gets added to the pool of data, is updated on the cloud and is synchronized with all devices across various platforms.

An update that you do from a mobile app will automatically get reflected for everyone else using the account, on whatever device they choose to use. This makes accounting data a lot more accessible & makes remote teamwork much smoother.

Increased employee productivity

It is no surprise that menial accounting tasks and monotony can negatively impact the work environment. Employee productivity is greatly harmed when workers are expected to perform repetitive tasks. Automated accounting can create a space that is much more conducive to innovation and productivity.

The time and cost-saving benefit of accounting automation preserves employee work hours. These work hours can go towards creating better policies, smarter spending decisions, and improved sales strategies. Instead of simply feeding numbers, employees can take on the larger role of helping shape the business for the better.

Increased security

You never have to worry about data being lost or compromised ever again. Automated bookkeeping takes into consideration the integrity of your reports and data. All the systems are cloud-based - which means that hardware and software malfunctions will not cause your data to become corrupted.

The cloud-backed mechanism also means that data is encrypted. It is accessible through your account and a unique login, instead of requiring physical walls or secured locations. Additionally, all verified integrations make sure that data transfer between platforms is also secure and doesn’t run the risk of wrong hands exchanging information.

Reduced costs

You might be wondering, “How is investing in software going to help me save money? Isn’t it going to cost me?”. Yes, initially. But the demand for accounting software has made them incredibly affordable with a very high return on investment (ROI).

The money you put into automating your accounting will end up saving you thousands of dollars that might get wasted on increased work hours, data correction, redoing lost work or mistakes. An error in accounting always comes with a price - and automating it can help eliminate that loss.

Detailed analytics and data insights

Redundancy doesn’t just exist with data collection. Certain operations and processing can also become redundant when it needs to be done often. For instance, spend statistics, SaaS information, sales forecasts. Some of these operations take more time in their actual execution instead of a focus on output.

Accounting automation tools perform all these tasks so that financial managers and accountants can focus on the importance of the data and what it means for the business. The insights that automated reporting provides can also introduce angles that a human mind might not necessarily be able to predict. The reporting is also always ready to be passed onto the auditing team.

Prevent cash-flow crisis

A cash flow crisis is a business nightmare. You never want to be in a situation where you don’t have a pipeline of funds to pay vendors or suppliers. But a cash flow crisis is avoidable when you know exactly when and how funds are moving in real-time. That’s where automation becomes your savior. Having a detailed record of every transaction, and predictive technology can protect you from any situation where you might find yourself in a dried well of money.

Maintain records and trials for tax audit

One of the goals of any kind of accounting is to maintain concrete records for compliance and auditing purposes. These records serve as a ledger to make sure everything in the business is running smoothly and in accordance with company & government regulations. This record maintenance is much quicker with automated accounting software. The accounting software can generate reports that cover all the bases required to fulfill auditing requirements. Additionally, the records are maintained such that a quick glance gives the auditor detailed information.

Related page: Benefits of accounting automation with Netsuite for businesses

Close your books faster with accounting automation

Essential areas of business that needs accounting automation

Reconciliation and bookkeeping of all uncategorized transactions

Reconciliation of records is the most long-drawn process for any accounting department. It can consist of improperly labeled transactions, missing information from vendors and buyers, or even a lack of reimbursement claim receipts from employees. Chasing down paper information from entities that can take weeks to comply is a major workload. Artificial intelligence has solved this problem by introducing automation in accounting and finance.

Accounting software can immediately recognize missing information and prompt users to fill it in. Some software even allows you to send a link to your clients and employees so they know exactly what supporting data or documentation needs to be provided. This eliminates the burden of scrambling for information and also creates a healthy culture of promoting efficient data entry on the very first go.

Related read: Beginner's guide to small business bookkeeping

General ledger (GL) & chart of accounts

Automating your general ledger is the key to automated bookkeeping. Your general ledger & chart of accounts is the central hub from where all other financial processes, transactions, and reporting take place. Automating it ensures that all information is accurate.

Additionally, if you intend to automate other aspects of your accounting system, then they can easily be plugged into this central hub. The automation of your general ledger eliminates the need for manually processing whatever data needs to be fed into other automated systems. It takes things into account right from the beginning.

Expense management

The goal of automation is to make everything easier in terms of expense management. Efficiently collecting, storing, and analyzing your financial data is the key to unlocking efficient expense management systems. This is true on both micro and macro levels. On a micro level, something as simple as your employees being able to scan receipts and upload them can ease the way you plan employee expenses.

On a macro level, having months of data readily available to filter can make quarterly predictions accurate. The focus shifts from raking fine details to making sound financial decisions, which is what productive expense management should be all about.

Accounts receivable

Similar to accounts payable, your accounts receivable is also a crucial element of your business. Accounting software like Xero allows you to create brand-specific invoices from within their portal. These invoices reflect the buyer’s information and are sent out in a timely manner by the software.

On top of that, the software can also keep track of incoming payments, or send reminders to customers about pending invoices to be cleared. The sales are linked to your inventory processing, so any information pertaining to your inventory is also automatically updated.

Payroll

Your company’s payroll is one of your biggest expenses. It is also most important to keep a correct record. A well-managed payroll system lets your employees receive their salaries on time including reimbursements and salary slips. It also makes sure that your records reflect every employee payment so that the investment in that department is never skewed or an unexpected number.

Automation in accounting and finance can help manage this far quicker than human intervention. Moreover, automated payroll systems also take into account all taxes and legislations related to the employee. These are calculated and reported automatically so that your compliance team doesn’t have to worry about the figures going haywire.

Bill Pay (Accounts payable)

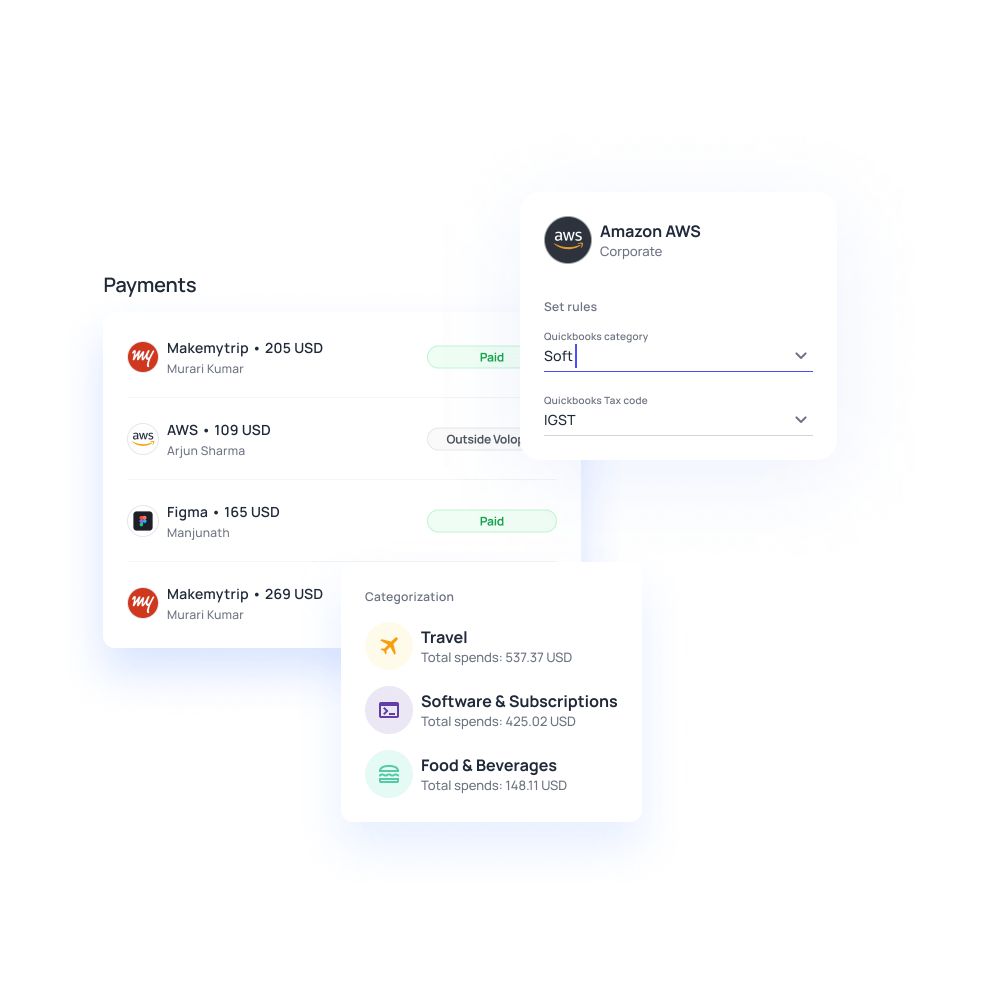

Volopay’s Bill Pay feature manages the automation of the accounting process - specifically accounts payable. This feature is one of our most beloved ones, and for good reason. A significant amount of time is wasted on collecting invoices, managing vendors, and setting up payments. There are also fees associated with these payments, particularly if your vendor happens to be overseas.

The manual labor of managing accounts payable can become expensive in both time and money. Automated features like Bill Pay let you handle all vendor payments from one location. Your invoices are automatically filled, and vendor payments are tracked through the system. Recurring payments can be set up for frequent, same-value payments (SaaS payments, for example). This can correct any instances of late payments or incorrectly filed invoices.

Expense reporting

Automation of expense reporting is equal parts using technology for transaction recording, and for accounting. Expense reports can be difficult to compile manually. They take time, and they’re prone to mistakes. It’s very easy to miss out on a transaction here or there or have to start over if the framework requirements change. Thankfully, AI can help you there.

Spend management systems these days allow you to compile an expense report before plugging it into your automated accounting system. These reports can be filtered by budget, by employee basis, by quarter, or even department. Consequently, a comprehensive algorithm can generate a report in seconds depending on what you wish to analyze. These reports can also be generated by accounting software so that the report meets accounting standards.

Expense reporting

Automation of expense reporting is equal parts using technology for transaction recording, and for accounting. Expense reports can be difficult to compile manually. They take time, and they’re prone to mistakes. It’s very easy to miss out on a transaction here or there or have to start over if the framework requirements change. Thankfully, AI can help you there.

Spend management systems these days allow you to compile an expense report before plugging it into your automated accounting system. These reports can be filtered by budget, by employee basis, by quarter, or even department. Consequently, a comprehensive algorithm can generate a report in seconds depending on what you wish to analyze. These reports can also be generated by accounting software so that the report meets accounting standards.

Financial modeling & cash flow forecasting

Gone are the days when you need to rely on a spreadsheet to help you forecast the company’s cash flow. Accounting software is now fully capable of mapping out your expected payments, expected receivables, and accounting for a predicted cash flow. What could’ve been a shocker at the end of the month is now obsolete. Accounting software can predict cash flow for up to 3 months, allowing your financial managers to move things around for optimized spending.

Moreover, this also aids with financial modeling. With accounting being able to process data on vendors, stocks, sales, employee payroll, and more - your company’s financial model can be tweaked for the best possible performance with the help of forecasting technology.

Suggested read: 9 ways to increase business finance and accounting efficiency

Review books month end before closing

Reviewing books and verification of ledger entries is one of the most important jobs that accountants do. Collating all expense records at the end of the month is more convenient than scrambling during the last few weeks before tax filing season. However, depending on the volume of your transactions, even month-end reviews can become a tedious task for accountants.

Instead of putting this burden on your accounting team, automated bookkeeping can stop this work from piling up. AI can help manage all your invoices and expenses so that accountants need only focus on the more important accounting tasks analyzing the month’s spending and streamlining any expense flows.

Business banking & credit card reconciliation

A lot of transactional information is dependent on how efficiently the bank processes the data. Some accountants rely on monthly bank statements and credit card ledgers to be able to analyze and validate transactions. Unfortunately, this process can become further complicated if there are any errors or delayed spotting of suspicious transactions.

Accounting software allows you to plug in your credit card and bank information directly into the account. This means that transactions get recorded as they happen and you don’t need to wait for a bank statement to reconcile information. If you use an expense management system like Volopay, the information is passed on in real-time if you integrate your accounting software with it. That way your transactions & accounts are all synchronized & error-free on both ends.

Planning for taxes and audits

Nobody wants surprises during tax filing season. The advantage of using accounting automation is that it automatically prepares you for audit rules, in advance. The software follows the compliance requirements of taxes and auditing so that all your files are in order. In addition, it also ensures that any data that is being fed into it is already compliant - if not, it raises a red flag as and when the data is entered.

This makes preparing for year end audits and taxes much easier since nothing comes unexpectedly. All taxations, filing, and reports are in order throughout the year. You can also set up your account automation to ensure that everything follows both company and legal compliance - that way nothing that hurts the business happens either.

Risk management

Risk management comes not just with knowing where to recognize issues - it also comes with preventative measures. While a human eye might miss something suspicious, machine learning has allowed automated accounting software to understand what transactions are considered suspicious. Have you ever used a credit card for a transaction, and then received a message from your bank to approve it?

That’s machine learning in action - recognizing your spend patterns and spotting whenever you might step outside. AI-driven risk management works the same way. It recognizes a business’ spend patterns in order to be able to aid with financial modeling and to isolate transactions that pose a risk.

What is automated accounting system?

Okay, so you’ve learned why you need an automated accounting system and how it can help you. But what exactly does it do? What does it look like? What are its features?

The answers are diverse. Different accounting systems have their own unique offerings for your business. Choosing the right one is dependent on your specific needs, the volume of data you’re looking to process, and what you hope to achieve from automating your accounting.

In general, automated accounting software takes care of all tasks that can otherwise be considered redundant or menial. For instance, performing data collection, performing complex calculations, and compiling information for easier analytics. It takes care of collating all the data you need for seamless accounting and puts it together in an easy-to-consume format.

Depending on the software you opt for it, there can also be added features your automated accounting system may offer. It could help generate reports and predictions. It could provide you place to upload your receipts and invoices. It might even help you manage your payrolls, employee petty cash, or travel-related expenses.

Most accounting software also takes into consideration that you might need to directly plug-in bank statements. The most important feature they all have is that the software is secure and smart. It doesn’t just process your data - it also protects it.

Features to consider when choosing accounting automation tool for startups

Cloud based

In this day and age, any good software solution is cloud-based. Having your data on the cloud not only makes it more secure but also makes it more accessible. It is no longer prone to theft, or loss. If an accounting software doesn’t offer cloud-based services then it is likely to become obsolete soon - so opt for something that offers the ability to work on the cloud.

Seamless automation

If you’re opting to automate your accounting process, then obviously then the form of automation is crucial. There is little benefit in choosing to automate accounting but the software still requires heaps of manual work. Automation should make your life easier, not more complicated. When scanning the capabilities of the software, take care in ensuring that it has a viable solution to your main pain points.

Fundamental accounting modules

Good accounting software will cover all the basics of accounting. This means that it will have a method of streamlining the core accounting processes. These can include invoice processing, expense trackers, financial reporting capabilities, as well as a usable dashboard. It is also vital that the software provides hands-on customer service so that any issues you may have are addressed and solved quickly.

Scalability

Automation is one step that reflects how efficiently you are running your business. The need for automation comes with large volumes of data - which can only happen when your company is booming. So, opting for software that isn’t scalable will quickly bring you to a new dead-end. Look into getting an automation software that lets you compute larger data sets, can add a large number of users & also send or receive payments.

Intelligent software

Software ought to be intelligent if it has any chance of helping you. Intelligent accounting software is able to filter data, flag any errors, and make predictions based on whatever information is fed to it. Being able to compute the profit and loss is just a bare minimum. Based on machine learning and payment patterns, accounting software should be able to forecast into the coming months and also suggest ways to optimize your expenses.

User-friendly

Finally, before you go ahead and choose accounting software, ask yourself if this is something a child could use. It might seem odd, but good software is complex on the backend but really simple in its user interface. Every single employee should be able to use the software without needing to spend hours of learning or tutorials. This includes an easy-to-use dashboard tons of helpful prompts/links, as well as options of mobile applications for remote working.

Multi users with multiple permission and approval levels

Your accounting software is not just for the accountant. It is also for employees to be able to contribute to efficient accounting in a transparent manner. Moreover, having managers on the system makes approvals quicker. Choose accounting software that lets you add multiple users without breaking the bank. You should also be able to sort these users into different categories, which provide them with different permissions. For example, managers being able to access departmental budget information, sales being able to access inventory, etc.

Best accounting automation software for startups

1. Xero

Possibly one of the most well-known accounting automation options, Xero has a very comprehensive platform. Xero’s impact of automation on accounting is unparalleled. It offers a variety of operative options for accountants and financial admins to choose from. Doubling as a cloud-storage system, it offers a single place for you to store all your accounting data while also processing it.

The reporting and data recovery options are also wide. Xero prepares accounting reports for you, from simplistic conclusions to complex predictions. All of this happens simultaneously and allows for smoother teamwork. You can even use Xero to create invoices and send them to vendors, as required.

The interface is extremely user-friendly, making it easy for non-technical users to operate it easily. Over 2 million users trust Xero, and it also offers more than 800 application integrations!

2. QuickBooks

QuickBooks is the best friend to many small businesses. There’s a good reason why over 3 million people, worldwide, trust this software for their accounting. Easy to use, even easier to manage, it’s a great collaborative tool for financial managers and accountants.

One of the biggest advantages of using QuickBooks is its ability to integrate with payment gateways. Compatible with some of the largest portals - like PayPal and Stripe - it records transactions as they happen. Instead of relying on a delayed bank update, company transactions are recorded into QuickBooks in real-time.

It is also a great tool for those looking to handle all their financial needs from one platform. It allows users to create invoices and receipts within the account, for uniformity and ease of allocation. If you’re on the path to scaling, then QuickBooks might just be the best solution for you.

3. NetSuite

Got a much larger business, and a higher volume of accounting data? That’s where NetSuite comes into the picture. As the name suggests, it is quite literally a comprehensive suite of accounting needs - not just for accountants, but right up to senior executives.

Aside from the regular offerings of inventory management and invoicing, it has a wide array of capabilities that cater to operative and resource management functions. That’s why it’s considered an ERP software - enterprise resource planning! Administration, human resources, logistics, supply chain management - you name it, NetSuite streamlines it.

It has become a localized, centralized place for all employees to manage their tasks, and remove complexity from manual responsibility.

4. Microsoft Dynamics

Microsoft Dynamics is similar in its functionality to NetSuite, although the user interface is vastly different. It’s another popular ERP solution for large organizations looking to automate a majority of their complex administrative tasks.

Dynamics does the task of making all these tasks follow a similar flow so that one transaction can trigger every kind of follow-up required without someone having to manually start the process.

The only “drawback” of Dynamics would be its ease of use. Its vast possibilities make it hard to gain understanding. If you’re dedicated to making it work, then a little extra time and effort are needed to oil this machine’s engine.

5. Deskera

Deskera offers a unique, scalable solution for your business. An ERP solution by nature, it can handle the needs of small, medium, and large businesses alike. Its interface is something that can be handled by technically-learned folks, as well as users who are looking to simplify a couple of business operations.

One of its abilities is to centralize a lot of administrative processes associated with money-saving and smoother operations. Stock management, quality control, sales forecasting, and delivery management are some of the features it offers above and beyond accounting functions.

It also has a very robust reporting system that financial managers adore. The reports it generates are always updated with the latest data, and the analytics are beyond helpful. These reports are always ready to move to the auditing stage immediately.

6. MYOB

If your focus is on compliance, then MYOB is possibly your best bet. Its time-saving features make it beloved to those who are looking for acute financial insights and compliance-friendly reporting. MYOB is also quite popular for its cloud-based storage system, which it offers web and mobile applications, as well as a SaaS option.

According to Capterra reviewers, it is a great option for sole traders and growing operations who want to finesse their audit and accounting operations. If you’re wading into the business and automated accounting world at once, then it is a great place to start.

MYOB covers all your bases on how to automate accounting so that you can get into the flow of automating most of your operations.

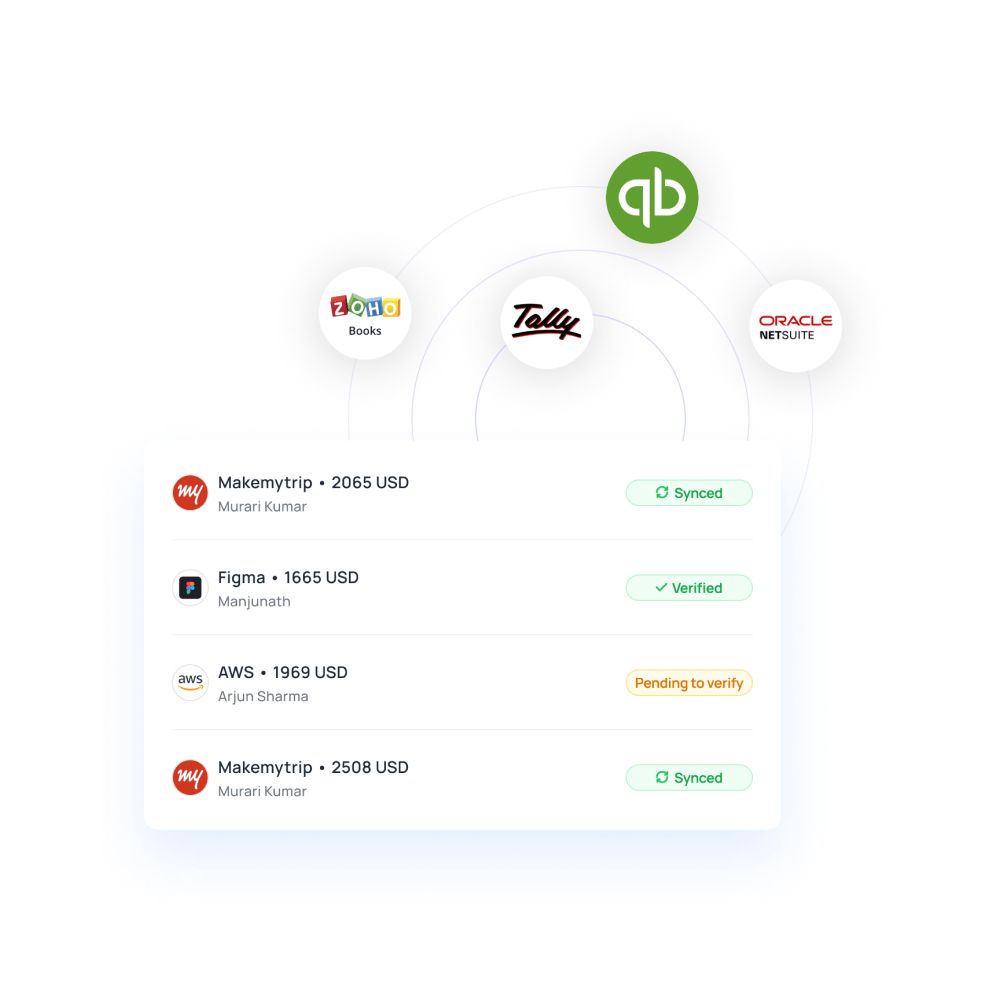

Integrate automated accounting tool with smart spend management software

Smart expense management systems are designed keeping in mind accounting needs. That’s how Volopay is designed, too. The automation of your expense management is just one step closer to more efficient automation of the accounting process. Volopay has the ability to integrate with top-of-the-line accounting software like Xero, QuickBooks, and NetSuite. What does this mean exactly?

Volopay is a platform for you to manage your business expenses much smarter. Your Bill Pay, vendor management, and invoice processing happen from this singular, cohesive platform. As does the management of any employee credit cards. Accounting automation tools is great at processing receipts and bank statements, no doubt. Volopay, in real-time, records every single transaction that your business makes. These transactions are automatically coded to be plugged directly into your accounting software. And you don’t even need to do anything! No need to download or reupload, no need to do any kind of manual labor.

Integrating with Volopay makes it even quicker

The integration means that once both accounts are connected, all transactional and invoice data is fed into your accounting software as it happens! Here’s the best part. This transactional data comes with information about the vendor, the invoice associated with it, as well as any receipts!

Not only is your data being fed directly into your accounting software, but it also comes with all the necessary information already in place! You never have to worry about chasing down an employee for an errant paper receipt or twiddle your thumbs wondering when your bank is ready to provide their statement. Everything is a touch of a button.

FAQs

Accounting, finance, expense management, compliance - these are all processes that are fundamentally streamlined with the help of accounting automation tools. Since they have a larger effect on strategy, growth, and operations, all your core business processes can benefit from accounting automation.

It’s important to create a process that actually benefits you and targets the problem area you are trying to address. With automating approvals, be sure to keep the approval process accessible, quick, and fool-proof. This could mean setting the correct policies that fulfill this framework, as well as choosing the correct people who can efficiently handle the software and approve in time.

This depends on the DMS you use. Volopay is an expense management system that integrates with other data management systems that have an impact on expense management. For example, integration with Xero, Netsuite, and Quickbooks is to ease accounting. Similarly, Volopay also connects to HR data management systems like Talenox, which handles payrolls and paid leaves.

With accounting automation, every manager and delegated approver has access to the transactions and ledger. So, they can immediately approve or decline any kind of data entry as soon as it is made. This is aided by real-time notifications from the automation systems.

Volopay links to your automated accounting software by means of integration. This means that when you “integrate” with the accounting system of your choice (be it NetSuite, QuickBooks, or Xero), there is data being transferred between the apps in real-time. Hence, any transaction done through Volopay’s Bill Pay or cards will be automatically synced to your accounting ledger.