9 ways to increase business finance and accounting efficiency

To become a well-established business, having financial efficiency is one of the key factors. Streamlined accounting operations and financial systems make the entire flow of the business smoother, helping these crucial arms of the business focus on strategy and company growth. Historically, finance departments and accounting have been branches of a company that works autonomously and in a disconnected fashion from other departments.

While this might’ve worked in the past, it is only cumbersome now. Basic financial operations suffer. Accounting and finance for the business are too important to not be automated in the same way as other processes. Scaling a business in the twenty-first century means investing in proper utilization of resources, including account and finance procedures.

Finance and accounting processes that benefit from increased efficiency

Basic financial operations take into account the management of purchase orders. But, a manual process is not easy to scale. It is also not easy to translate, nor fluid enough to make room for variety.

A bad purchase order management system can lead to crises since business orders make or break your pipeline. Increasing efficiency for purchase orders can help regulate these crises. This can include removing the manual aspect of P.O management or even automating certain processes.

Accounting processes often require the most efficiency boost. Given the extremely traditional approach they follow, they are disconnected from everyone except finance. As a result, creating policy, recognizing exceptions, and enforcing rules become very difficult.

Tax season becomes riddled with chasing information and mountains of erroneous information. Making your financial accounting process and reconciliation process more efficient can improve functionality and prevent redundancy.

Your vendors are one of your key contacts. They play a role in your inventory, material supply, services, as well as product delivery. But inefficient finance operations can cause this relationship to become strained.

Lost invoices, misplaced receipts, improper transactions - all of these can harm the relationship between a business and vendors. Vendor management has become a core area of financial accounting automation, and increased efficiency in that domain has only caused businesses to improve their output.

There is no reason for payment processing to be a difficult part of accounting and finance for business. Payments, ideally, should be processed within minutes.

Unfortunately, inefficiencies in the financial systems of businesses have caused payments to become days’ long processes, burdened with confusing approvals, missing documentation, and obsolete protocols. Streamlining your finance systems to support efficient payments can bring your business to a higher level of competence.

Invoice processing systems seem easy enough to manage when you start your business. But the more your company scales, the volume of invoices only increases, harming financial efficiency.

Accounts payable and receivable becomes a juggling act, and a badly managed invoice can create a domino effect of extra work and corrections. Efficiently managing your invoices can cause a major boost in productivity, and help with vendor management.

Common financial accounting problems

Inefficient process

An inefficient process is a bane to the working of any organization. Outdated financial accounting systems are no longer conducive to a healthy work environment, or a productive one. Financial and accounting data, on paper, presents a situation where data is highly secretive (not necessarily by intention), difficult to access, and even harder to process. Basic accounting operations can easily become one of the most cumbersome when the process behind them is unnecessarily complicated and obsolete.

Lack of visibility

When there are large volumes of data to process, accountants and financial managers have no way of keeping track of specific information. You could create the most elaborate tagging and sorting mechanism, but your employees will still find themselves wasting hours and effort into finding data that is needed at the drop of a hat. Accounting and finance for business take a serious hit.

Complicated approval processing

Approval processes - believe it or not - don’t have to be that difficult. But current systems have made them extremely difficult to streamline, even basic financial operations. Manually entered data requires manual storage. This means that approval also requires a manual flowchart - from one employee to another. Whether the approval comes or not becomes secondary to the aim. The entire process becomes focused on playing ‘hot potato’ with the paperwork, dragging out something that should, ideally, take minutes.

Compliance difficulties

With so many possible roadblocks and error-risks with manual entry, compliance for accounting hinders finance process optimization. The required information might not be available for audits or compliance assessments. If it is, then it might need to be converted into the proper format to meet compliance requirements. Policy enforcement becomes a mammoth task since there are thousands of transactions that need to be analyzed, line-by-line. On top of that, it ensures that there is a lot of stress and pressure on the compliance officers at the end of every month and/or taxable year.

Inaccessible data

When all your data is only present in a manual system, it becomes extremely difficult for other employees to access it. Even a spreadsheet is limited in its capabilities of viewing, editing, and analyzing. Moreover, this data is not accessible to employees who are remote and/or traveling. Accounting and financial data are relevant to multiple departments and frequently need to be accessed by them. Creating a wall between them and the financial metrics makes an important limb of the business completely inaccessible.

Leave your business accounting obstacles behind

9 Ways to Improve your finance and accounting operations

Strengthen credit management

Strengthening your business’ credit management system is the first step in improving financial efficiency. Your credit line(s) should always be immediately available for analysis. This means that your credit repayments should be visible throughout the period between bill payments, as should how the credit is being utilized.

If you have credit cards for your companies, their transactions should also be updated in real-time. Nothing on your credit statement should come as a surprise. A good way to manage this is to make sure your credit-providing institutions are digitized, and your bank statements are automated.

Collaborate and integrate

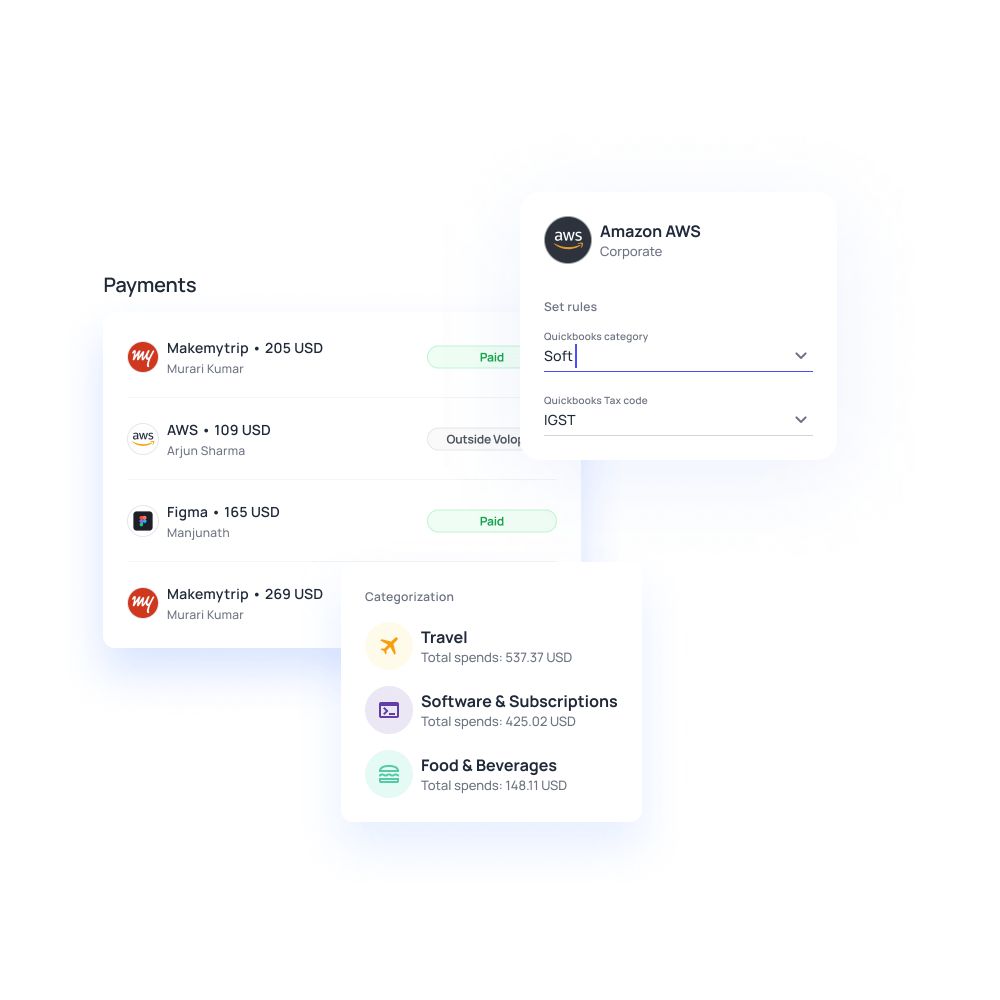

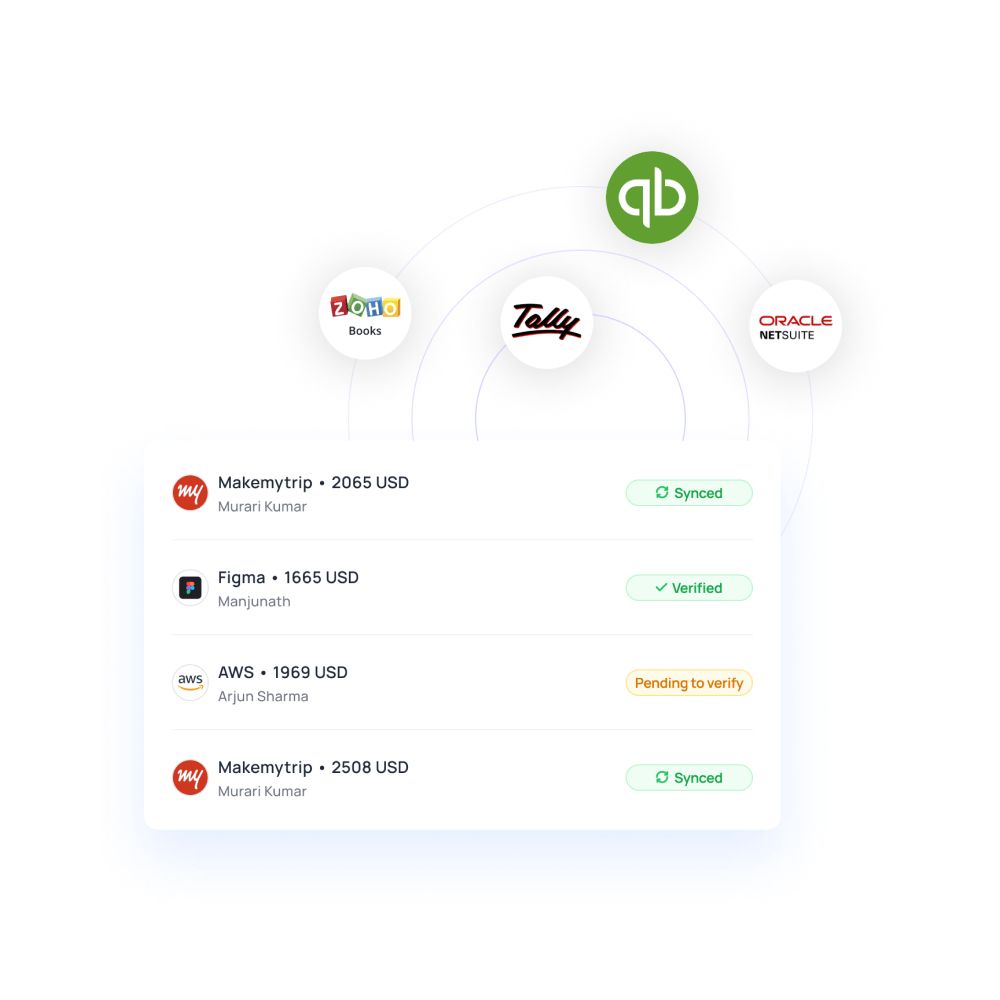

Collaboration and integration are better than outsourcing your operations. There are multiple ways to do this. Today, accounting and financial operations can work in tandem with each other, even if they are on different platforms. For instance, an accounting platform like Xero readily integrates with your banking platform. Expense management software like Volopay lets you plug your Xero account so that financial updates can run parallel to their accounting. Finance process optimization benefits both accounting and finance.

For small purchases and employee travel, use a corporate card.

Corporate cards have been misunderstood to be difficult, scary, and complex. They can make your financial operations much smoother. Having a dedicated card for certain employees and/or vendors can make it easier to track every transaction, and to obtain the data for accounting. You don’t even need to issue physical cards for every employee. Today, it is entirely possible to generate virtual cards within minutes and use them for use for all online payments. They also remove the need for reimbursements, which can make your accounting department more efficient.

Maintain accurate accounting records

To achieve financial efficiency, your accounting process needs to be immaculate. There can be very little room for error - which is something automation can solve. Automation makes sure that all your invoices and records are up-to-date and flags any inconsistencies. It also sets up alerts for upcoming payments so that there are no delays in processing invoices for vendors. An automated financial accounting process can also set up reminders for receivables, so you are not left without payments incoming.

Process your data in batches

Financial data should be processed in batches. If every single receipt and invoice is processed as it arrives, then it can cause a diversion of resources, and a waste of time. On the other hand, processing large amounts of data over many months (or even years) can be a gargantuan task that takes up every second of finance and accounts’ time. Instead, there should be designated periods at the end of which that periods’ data is processed. It should be regular enough to remain an updated database, but not so regular that it becomes repetitive.

Utilize analytics and reports

You would be surprised at how underrated analytical tools and reporting features are, despite aiding finance process optimization. Oftentimes, finance and accounting are so swamped with menial tasks that there is little time to use these tools for better future work. When you automate your tasks, you also have the option to then analyze the data. Reporting features let you create reports formatted to emphasize specific details, and projections can become much more accurate.

Ensure that policies and procedures are followed

Having a robust system can only go so far. Unless employees are enforcing policies and procedures, the system cannot function the way it is designed to. It is important to design policies, and then find a foolproof way to enforce them. Having discipline in tasks (particularly hygiene work) can oil the machine for smooth functioning. Make sure your employees are aware of these policies, and how to meet the steps of all the procedures. Create workable deadlines for different tasks, and ensure that employees meet them to make your accounting department more efficient.

Automate employee expense reimbursement process

Reimbursement can be difficult to keep track of, for employees and the finance team. It can also become an obstacle for accounting. To prevent this, automating your reimbursement process can cut down the trouble it causes your entire business. Automating reimbursement means that finance knows immediately when a claim is made when it is approved, and when it is fulfilled. Additionally, accounting has all the details related to it for easier processing. Cutting down the time associated with it also makes employees’ lives easier.

Enhance team communication

You can automate your processes as much as possible, but team communication is the cornerstone of efficient financial and accounting processes. You must set expectations with all your departments, as well as with employees that directly deal with finance and accounting officials. To enforce policies, they must be communicated. Gathering opinions and subject matter experts can help you customize your decisions for your specific needs.

Related page: What are accounting checklist for businesses?

Is outsourcing finance operations the answer to business accounting challenges?

Whether you outsource any of your operations is entirely dependent on your business model, how large it is, and what its intent is. For many companies, especially those starting or the ones who have limited resources, it is better to outsource operations like finance and accounting.

Deciding which operations you will outsource includes analyzing which operations are core to your business. However, it is important to realize that finance is an integral part of growing your business. It is a vital cog in the machinery of scaling your company operations. Outsourcing your entire financial system might become detrimental further down the road.

Finance informs how the rest of your business maps out. It decides sales, inventory, payroll, investments, profit. Consequently, these things also inform how the finance department will run. Instead of outsourcing everything related to finance, you can outsource certain specialized tasks and roles that come under finance.

Boost your finance and accounting operations with Volopay's expense management tool

All how your finance and accounting department can become efficient are features that Volopay possesses. An all-in-one expense management system, it has the capabilities to streamline your entire financial workflow and benefit accounting and finance for business.

Comprehensive accounting

A dedicated Bill Pay portal handles all your accounts payables. Data is automatically updated on a real-time basis. Volopay also integrates with accounting software like Xero, Netsuite, and QuickBooks so that all the financial records are transferred to your accounting records without manual data entry.

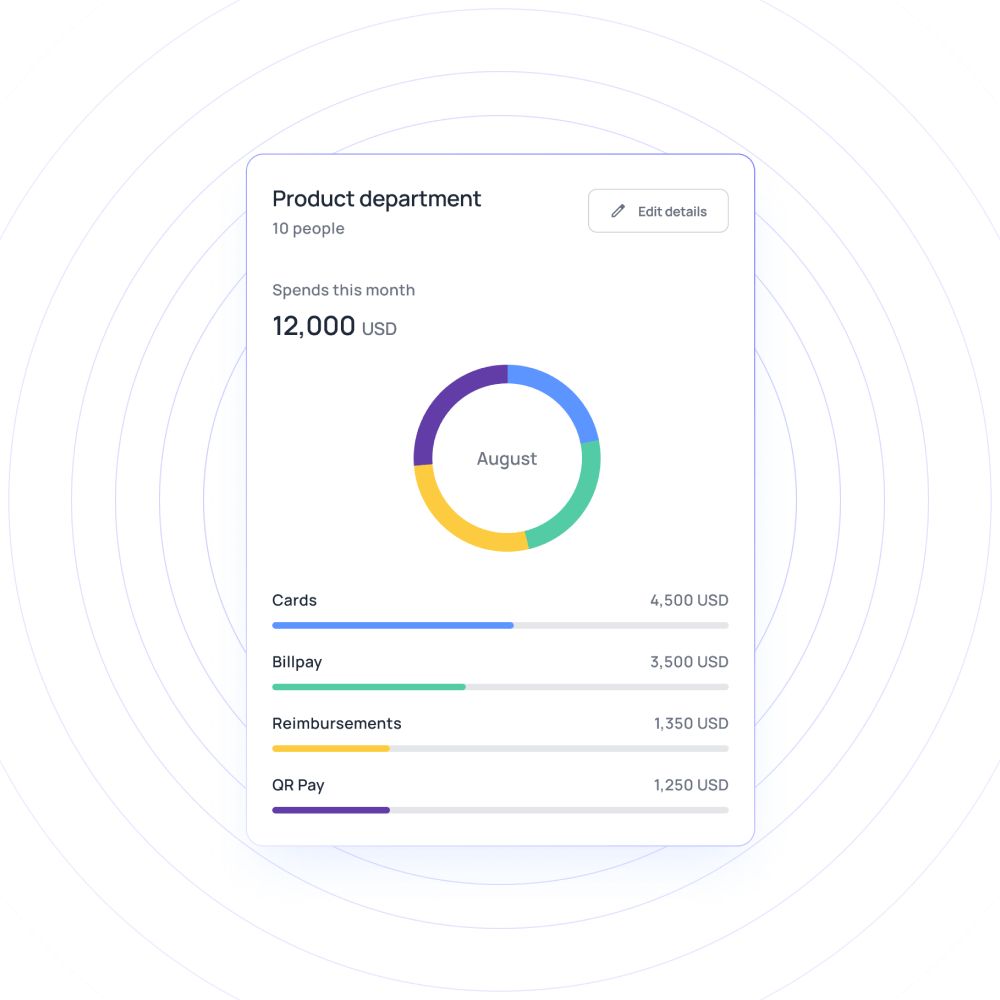

End-to-end spend management

Reimbursements and corporate cards can also be managed from the same portal. Every employee has access to their account to keep track of their spending, and managers have an all-rounded view of the department’s budgets and finances. Automating your expense management with a system like Volopay can help by improving accounting processes, saving you time, as well as money.