Accounting checklist - 8 tasks to consider

Tired of finding careless errors in your annual accounting reports? Wish your accountant had the eye of an eagle? Now you can, with automated accounting! Automated accounting takes away the long hours of manual accounting and does it almost effortlessly for you. Also known as computerized accounting, automated accounting tasks set certain wheels in motion for you, so that you don’t have to deal with crunching numbers and tracking receipts anymore.

Unlike what many think, automating your accounting process is not the “death of an accountant”, rather an evolution from carrying out long-drawn manual tasks and freeing your accounting team to formulate new strategies, data analysis, and more innovative ideas for your business.

What is accounting process automation?

Accounting process automation means utilizing accounting software and its tools to computerize certain financial tasks and duties, lessen the burden of manual accounting, reduce excess paper documentation, and eliminate the risk of human error, to name a few.

Gone are the days of depending on excel spreadsheets and running for days after busy execs for a simple signature; with accounting automation, your accounting tasks are preset to carry out certain duties, such as accounts reconciliation, creating annual records, and issuing financial statements with zero to minimal supervision whilst avoiding any possibility of human error. In this day and age of hyper-digitization, wherein automation has quickly been transformed from an option to a necessity, it is certain that the future of accounting is automation.

However, that does not mean that automation can ever completely replace the need of human entities in business: accountants shall always remain an integral part of any organization. What is more important for accountants today is to stay up-to-date with the new technological advancements in accounting automation tools so as to future-proof their careers and move in tandem with the evolving business world. Automation of your business’ accounting tasks can drastically improve your wealth and prestige, not to mention save your time and money too!

Accounting checklist: 8 tasks to consider

Sales order process

With nifty accounting automation tools, you can easily and conveniently automate your entire sales order processing, such as order and payment confirmation, shipping confirmation, order tracking, and lots more. This ensures that the sales team follows all the particulars of a purchase order and delivers on time, every time.

Purchasing

Purchasing goods and services from vendors results in a high volume of purchasing order paperwork that can really clog up the AP processes. Purchase order automation can help you avoid this pitfall completely. Digitizing your purchasing order can give you the safety of multi-level AP processes without manually reviewing every order and wasting valuable time and money.

Payroll

Putting things on autopilot can do wonders for your business, one of them being payroll. Instead of using huge resources such as a dedicated human resource manager for this particular task, you can simply automate payroll to ensure that all your employees receive their salaries on time. Using automated payroll makes more and more sense as your business continues to grow.

Monthly closes

Monthly closes are the onset of financial chaos in most companies that rely on the traditional manual form of accounting. Many accounting teams report being under extreme pressure to meet their monthly closes faster, leading to even more errors. Automating your monthly closes can produce reliable and accurate numbers that can be trusted for data analysis without your accountants sweating any month-end bullets!

Approval and task routing

When a company is on the path to success, the employees might find themselves doing more and more work as each year passes by. In order to lessen the workload and increase productivity, you can automate certain tasks and routines that can open up your employees’ schedules to do more meaningful work. With automation, each approval goes to the required authority including all the necessary information needed so as to eliminate any time wastage.

Travel and mileage reimbursement

Filing and processing travel and mileage reimbursements for employees is a minor task, but, if done manually, it can end up costing your business hundreds of billable hours! With travel and mileage reimbursement automation, your employees can go on work trips and simply file their receipts online for proper and timely reimbursement. This ensures transparency, accurate verification of said receipts, and no employee has to wait weeks to get reimbursed for out-of-pocket expenses.

Expense reports

Does your company still waste crucial hours preparing handwritten expense reports or print spreadsheets with stapled receipts here and there? If your answer to this question is yes, you need expense report automation immediately! With expense report automation, you can digitally file all your receipts and transactions from day one itself, so no single document gets lost. Moreover, these reports can be accessed from anywhere and exported easily, lifting the weight of routine administrative tasks from your accounting teams.

Accounts payable

If cash flow is the lifeblood of your business, then accounts payable is the oxygen that courses through it. If your AP processes are slow and jammed up with unnecessary paperwork and long approval processes, then it could sour your relationship with your vendors, increase the late payment fees, and may even terminate your contract with your suppliers. Automation can help you streamline your AP process and keep track of your purchasing order, invoices, and receipts, all in one convenient location. You can also automate the order and payment frequency to maintain a steady balance of your accounts payable and cash flow overall.

Say goodbye to your spreadsheets

7 advantages of accounting automation

Saves lot of time

One of the most apparent advantages of automating your accounting tasks list is the amount of time you’ll save. We aren’t talking about minutes and hours here — with automated accounting, you can save more than hundreds of hours worth of time every financial year!

The biggest chunk of your accounts team’s time is wasted during financial closing, more precisely, the reconciliation phase. When using a complete financial management platform, all your transactions, reimbursements, and receipts are promptly documented in their respective entries, making reconciliation a matter of minutes!

Increased productivity

When your employees are not encumbered in time-consuming manual tasks, they are doing more important work, work that’s propelling your business further towards success.

Automating your accounting process doesn’t put your employees’ jobs at risk, instead, it opens their schedule to work on more crucial tasks, such as brainstorming new ideas, expanding the business, analyzing areas of improvement and avoiding pitfalls, etc. These areas can never be fully automated and therefore require the perspective of your accounting team the most!

Avoid errors

Humans are prone to errors, and even though accountants go through rigorous training to be as eagle-eyed as possible, mistakes can still be made. It takes a couple of missing cents or a misplaced decimal point to turn your balance sheet into a big mess!

Automated accounting tools on the other hand are extremely accurate and are able to create tens of thousands of data entries with zero risk of errors. This means no data gets mishandled. Of course, an accountant is required to verify the accuracy of the data at the reconciliation stage and how to utilize this data in furthering the organization.

Recover data faster

From storing physical data in the form of thick files, we came as far as Excel sheets, yet the storage process of Excel isn’t centralized and advanced enough for us to access what we want to, whenever and wherever we want to.

Automated accounting software takes care of all these pesky problems in a smooth, all-in-one spend management system. With an automated accounting checklist, you can categorize and store all your vendor, client, and employee data in one centrally located platform.

Store data with the utmost security

If there’s one thing we’ve learned in this fast-paced world, it is the importance of reducing our reliance on paper-based documentation. For accountants everywhere, the convenience of e-receipts has made all the difference in the world!

With the help of automated accounting software, you can now attach processing orders, invoices, and receipts onto the entry from the very beginning, ensuring that you never lose the “paper” trail, whilst enjoying the paperless convenience.

Ease of cloud storage and access

The impact of automation on accounting can be felt with the advent of cloud storage. What started with cumbersome floppy disks and USBs ended in the extremely convenient access of cloud storage offered by accounting software. Whatever you need is available online, simply log in, file the receipt, and process the payment on the go. Cloud storage has revolutionized the world of accounting automation and streamlined the storage conundrum for your organization.

Integrate solutions in real time

One of the greatest benefits of accounting automation is the elimination of repetitive data entries from one platform to another, thanks to the seamlessly integrated solutions between your choice of accounting software and your complete expense management system.

Integrate your payroll with your accounting software, along with your vendor and invoice management, making reconciliation a piece of cake. This results in high-quality, accurate data accessible to you across all platforms. With the added feature of cloud storage, you can easily access it from absolutely anywhere!

Related page: Year end accounting checklist to close the fiscal year

How to automate accounting tasks with Volopay?

With an AI-powered, all-in-one spend management system like Volopay, you can tick off your accounting tasks checklist faster than ever, with the power of automation.

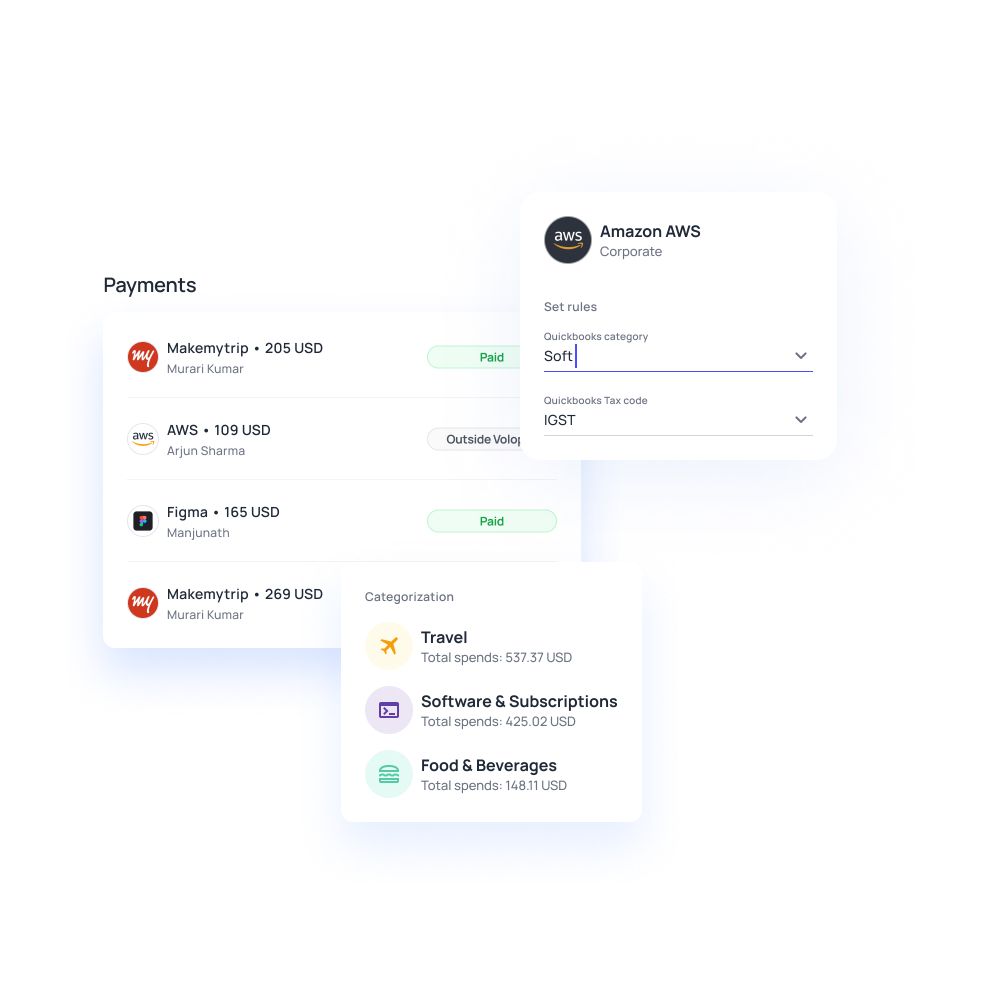

Volopay is your one-stop solution to streamline complex accounting tasks such as employee reimbursements, subscription management, invoice processing and payment, and lots more! Volopay safeguards your accounting structure with paperless ease, using digital receipts and invoicing to streamline every single transaction. Our triggers feature helps you autofill accounting fields for any user, card, vendor, or department.

All you have to do is set it only once, and our software will do the rest! Whether it’s using corporate cards with in-built and fully customizable departmental budgets and expense policies for proper regulation, to closing books faster with seamless accounts payable reconciliation and hassle-free integration with the accounting software of your choice you can do it all with Volopay!

FAQs

Common accounting tasks can be split into 4 categories:

Daily accounting tasks: Reconcile cash and receipts, review and reconcile transactions, record and categorize expenses and inventory.

Weekly accounting tasks: Record payments you receive, invoice your clients, review employee timesheets, and deposit cash and checks.

Monthly accounting tasks: Pay vendors or schedule bills to be paid, track budgets and discrepancies and back up your data.

Annual accounting tasks: Prepare year-end financial statements and complete an audit and year-end tax returns.

Robotic Process Automation (RPA) is a prominent technology used in business automation processes. RPA is generally used to replace low-level and repetitive accounting tasks such as data entry which requires a fixed number of steps to perform the task. On the other hand, we have more and more emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Natural Processing Language (NLP) which can be used to automate high-level accounting tasks list that is not always predefined and may require decision-making as well.

One of the most obvious benefits of automated accounting is the hundreds of billable hours you save every financial year from indulging in rote administrative activities. Another benefit is the cost-effectiveness of automated accounting. Every year, accounting software and spend management software such as Volopay cost your business way less than the average yearly salary of an accountant hired for the same manual task. That’s why every year, more and more companies are choosing automation for a more productive work environment.

Trusted by finance teams at startups to enterprises.