Year end accounting checklist to close the fiscal year

Holiday stress is real for businesses. End-of-the year is on the horizon, and they have to plan their finances and focus on closing activities. This means the finance team must put their nose to their grindstone to make a year end accounting checklist.

It takes extreme planning and 15 to 25 days of hard work from accountants and finance leaders. Organizations must put effort into reducing this overwhelming workload and do away with outdated accounting practices. A year end accounting checklist is to make this process easier instead of fumbling with data.

What is year-end accounting?

The term fiscal year can also mean the one-year’s period from when the business is started or the annual tax filing period. Yet, many companies prefer to do the year-end accounts closing before the new year (January) begins.

For businesses, year-end is the period when they review all of their accounting records of the current year and analyze every financial statement. The company's profitability is determined, and so as the values of its assets, debts, expenses, and liabilities.

This is conducted to ease the budget forecasting and tax filing for the upcoming year. Also, any discrepancies in accounts payable or receivable entries will be checked with the concerned team. To ensure everything is in order, following a year-end checklist for accountants is crucial for accurate financial reporting and a smooth year-end closing process.

Why closing for the fiscal year is a challenge for finance teams?

Delays in reconciliation

Reconciliation is the process of checking expenses entered in the general ledger and matching them with actual expenses spent. For companies with integrated expense apps, continuous closing is possible. Hence they won’t struggle a lot at the end of the year with reconciliation processes.

But companies that receive paper bills and process them manually or semi-automatically face problems with periodic closing. To reconcile an expense entry, they need supporting documents to understand that expense. But they can easily go missing, delaying the entire reconciliation process.

To prevent such delays and ensure a seamless year-end close, following an end of year accounting checklist is crucial. This checklist ensures that all documentation is accounted for, expenses are accurately reconciled, and every necessary step is completed on time. By staying organized and proactive, businesses can streamline their reconciliation process and avoid last-minute issues.

Manual entry errors

After all, accountants are human beings too, and errors can happen here and there. Accounting and documentation fully deal with numbers and amounts which can be swapped or replaced very easily. Manual accounting data entry is highly prone to errors as accountants enter numbers by themselves.

While doing the same data processing for the whole day, they can make untraceable mistakes. One small mistake can cause hours of delay and chaos which can be hard to detect and rectify.

Modern accounting and payment applications diminish this as it captures digital data in an automated fashion. Additionally, a year end checklist for accountants ensures that all financial data is thoroughly reviewed, accurate, and up to date, making year-end closing smoother and more reliable.

Back and forth to gather documents

Companies that follow manual or semi-automated accounting systems have folders and locations where they store files. This is highly unreliable, as tracing a file location can be tricky. Hence, the accountants are forced to follow up with concerned teams to locate a missing document.

This puts the reconciliation process on hold and initiates a never-ending chain of emails. Everyone’s work gets affected, yet there is no quick fix. If your employees work remotely with limited scope for communication, it can get even worse.

To prevent these issues, following a year end checklist for accountants can help ensure that all financial documents are properly organized, stored digitally, and easily accessible. By doing so, you can streamline the reconciliation process, reduce unnecessary follow-ups, and make the year-end closing much smoother.

Your year end accounting checklist to close your accounting books efficiently

It can be scary for new business owners as they are uninformed about how to approach year-end stress. To make it simple, we have broken down an easy-to-follow end of year accounts checklist.

It includes every mandatory step to be performed and is suitable for businesses of all sizes and industries. Your team can follow the year end checklist for accountants, ticking off tasks one by one as they finish, ensuring a smooth and stress-free annual financial review.

Create a calendar for closing

Before you start, establish a deadline for each important milestone. There are statements and reports to be prepared. Draw a timeline covering all these milestones and map it to the teams involved. At the end of this graph will be the final closing date.

This calendar makes reflecting on progress easy, and using an end of year accounts checklist ensures that each task is completed on time and nothing is overlooked before the year-end closing.

Compile financial statements

Analyze your accounting data and start preparing important financial statements. These documents, like cash flow statements, profit and loss, and income statements, are crucial to determining where your business stands financially. As you get a clear picture of your spending and income, you can make plans for the upcoming fiscal year.

To make budgets and expense forecasting, these documents are the primary needs. You will have many takeaways from the analysis of each document mentioned above. Some of the statements you need to work on are.

• Income statement

An income statement, also known as a profit and loss statement, is a financial document that shows the money you have gained and spent over the current financial period. By looking at this document, you can understand your revenue, expenses, taxes paid, depreciation, and many more.

The income statement underlines how much your business made this year. Compare it with previous years' income statements to learn your revenue progress and how the expenses have changed over the past.

• Cash flow statements

A cash flow statement is very similar to an income statement. The cash flow document demonstrates the inflows and outflows of cash in your business at different times. It only talks about the available cash, not the credit.

In general, cash flow is either positive or negative. Positive cash flow denotes that your earnings are more than your expenses. Negative cash flow denotes the opposite. You can find the time period when your business received more money and when it made less than its expenses.

A look at this, and you can tell when you can expect certain expenses and when you make more revenue. This is very useful in making the cash flow forecast which is essential for a positive cash flow.

• Balance sheet

A balance sheet is a financial statement that shows the available assets, liabilities, and stakeholders’ equity. As the name says, this document measures the balance between the above important factors (assets, liabilities, and equity).

It takes into account every asset you own, liabilities you owe, and equity that’s left after you have paid off your liabilities. The owned assets must be equal to the liabilities and equity put together.

Collect past due outstanding invoices

The year-end closing process also means getting the generated invoices settled. There might be invoices that you have distributed lately to your customers. There are also customers with pending invoices and term payments. Nudge your customers a bit through emails and start collecting the payments.

• If your customer still doesn’t respond, you can,

• Change your payment terms and agreements with customers

• Ask them for a date when they will be comfortable with making a payment.

• Contact your customer with plans and set clear expectations.

While closing the accounts is important, it’s equally necessary to give time to your customers and understand their perspective. If making a large payment at once is difficult for them, provide a payment plan where they can split in installments and pay. If there are many customers with unpaid balances, you can contact a collection agency.

Organize your receipts

If your business still relies on manual document copies and bills, you should tidy them up and organize them in order. This also suits digital copies that are stored in a particular location or cloud. You can go over them, see if you have all receipts and invoices present, and arrange it chronologically.

Organize it based on vendors, date, month, or any other factor with neat labels. Doing this can help you when you need them in the future or for reconciliation purposes. This is also the best time to take copies of paper bills and transfer them into digital format. When you are already using accounting software, tag bills and receipts with respective payments and move to the reconciliation step.

Related read - What are digital receipts & why should businesses embrace it?

Reconcile all accounts and spend transactions

You have collected all the pending payments. Now, it’s time to reconcile your expenses by comparing payment data from different sources. Compare bank statements with invoices, bills, and receipts and review every payment made that year.

If you notice anything odd or discrepant, check with your accountant or the relevant team that made the spending. If you keep it a habit to reconcile frequently, you can catch any internal fraudulent activity as quickly as it happens.

Review and close your accounts payable & receivables

Close your accounts payable and receivable by making and receiving pending payments. In accounts payable, if you have any unsettled invoices, make the payments in whole or parts and clear short-term debts.

In accounts receivable, if any customers have unpaid bills, contact them in the above-suggested ways and review your accounts receivable activities of the year.

This way, your accounting team will have a fresh start in the new year, leaving the past in the past.

Examine your business' financial state

You have enough information to value the financial state of your business. With this data, estimate the current ratio, debt ratio, and profitability of the current financial year. Also, go through the income, cash flow, and balance sheets prepared by the finance teams. These numbers can throw light on the financial condition of your business. With this in hand, you can set new goals to achieve in the coming year.

Assess your inventory

If your business also has an inventory where you store produced goods or raw materials, investigate that before the year-end. This is essential to not end up with expired goods or inventory shrinkage.

Calculate the amount of inventory stock and check if it balances with the balance sheet. Make adjustments if you find disconnection in the reported numbers. Inventory accounting is also necessary to evaluate how much is spent on stocks and supply items.

Evaluate this year's goals and plan for the next year!

As the current fiscal year is sorted, step into the next year by creating new business and financial goals to achieve. Check your current statements and decide if the same goals get carried forward to the next year.

Use your year end checklist for accountants to ensure all necessary financial documents and statements are finalized, reviewed, and accurate before setting new goals. Talk to the respective teams and create new goals and budgets that are,

• Realistic

• Specific

• Quantifiable

• Time-bound

• Achievable

How could your team benefit from accounting automation software?

Even with a well-built year end accounting checklist, year-end closing activities can sound scary. It’s because of the toilsome manual work it comes with. Not when you are partnered with a digital accounting management system.

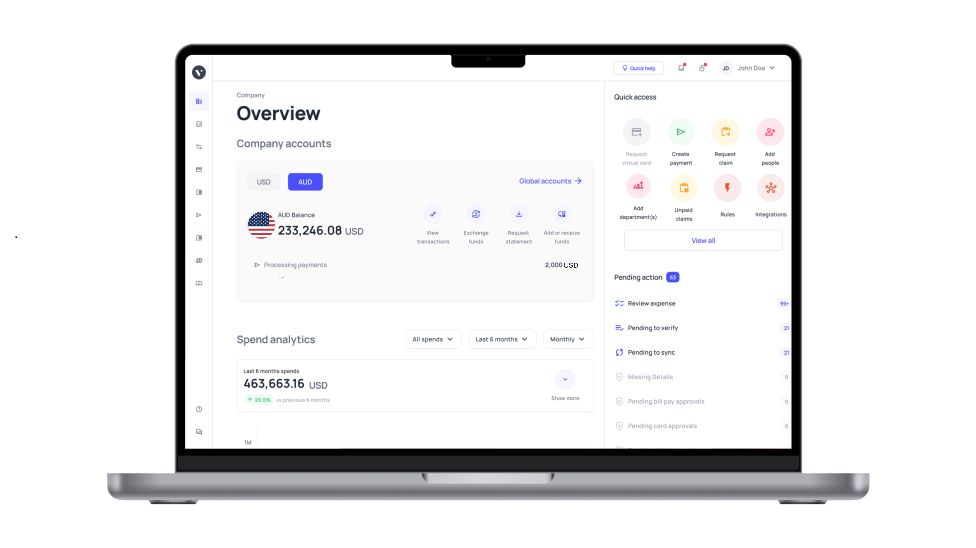

If you are tired of processing delayed invoices and organizing paper bills, it’s time to swap with a smart payment application like Volopay. Volopay's accounting automation solution can automate your accounts payable fully and stay handy for year-end plans. Manage all your invoices, payment receipts, and other supporting documents in one place, making it easier to follow your year end checklist for accountants and close your books on time.

Access corporate cards and other payment tools to speed up your vendor payments, expense reports, and business-related online transactions. Reconciliation is no longer a multi-step process. Volopay integrates with most ERP software and automatically syncs your expense data with other connected applications.

You can generate reports instantly that offer more insights into your company’s financial state. Not just at the end of the year but throughout it, your accountants must feel stress-free and relieved. By following an end of year accounting checklist, you can ensure that all necessary steps are covered and the closing process runs smoothly. Accounting automation is the perfect solution to reduce year-end stress and keep your financial management on track.