What is accounts payable automation?

An accounts payable software helps you manage and pay all your vendors, suppliers, and creditors. The system can create payment automation to save time and make business operations more efficient.

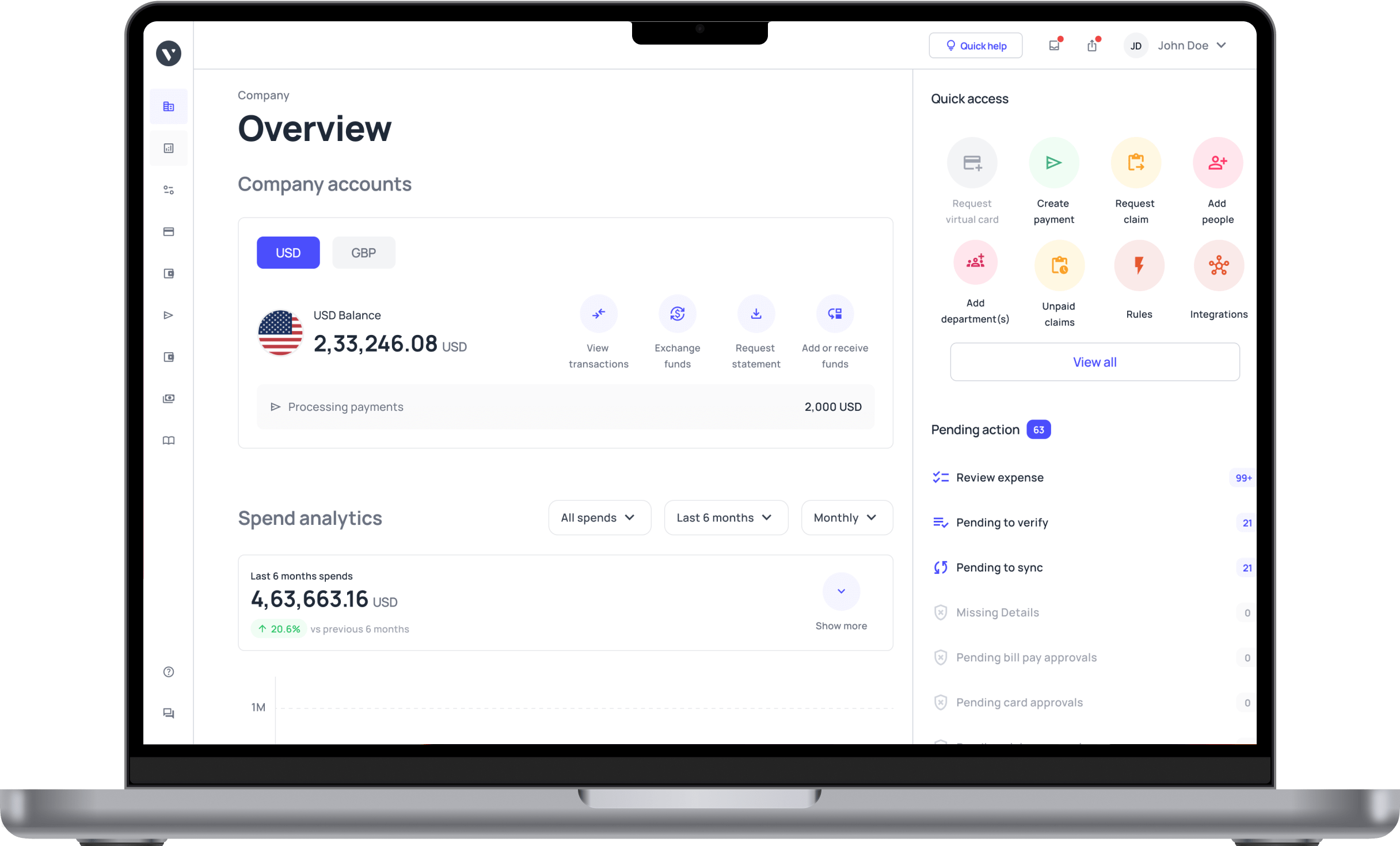

Volopay is an AP automation software that can transform the way your business carries out financial operations.

What is accounts payable?

Accounts payable refers to all the money that is owed by your business to other individuals or businesses. It is the responsibility of the finance department in a company to keep track of all transactions related to the accounts payable process and other tasks associated with it such as vendor invoice management.

A finance department manages the transactions from different vendors, suppliers, creditors, investors, etc. by creating subsidiary AP ledgers for them. Modern businesses use a vendor management system like Volopay to keep track of vendors, all their invoices, and ensure timely payment processing for each one of them.

Difference between accounts payable vs accounts receivable

While accounts payable deals with money going out of a business accounts receivable deals with money coming inside a business. Both are managed by the finance team in a company. Accounts receivable also entails creating invoices to be sent out to clients and following up with payment reminders.

To do this, finance professionals can use invoice processing software to send out invoices to their clients. Creating and maintaining both accounts payable and accounts receivable is important as it helps the accounting team to generate accurate financial statements and close the book of accounts on time.

To know more, check out our detailed guide - Accounts payable vs accounts receivable: Key differences

Example of accounts payable

Accounts payable automation, commonly referred to as AP Automation, is a technology-driven solution that streamlines and automates the entire accounts payable (AP) process, from invoice receipt to payment processing.

By automating the AP workflow, businesses can reduce manual effort, lower processing costs, improve accuracy, and shorten the payment cycle. AP Automation eliminates the need for traditional, labor-intensive processes by enabling digital invoicing, automated data capture, seamless approvals, and instant reconciliation.

This transformation in accounts payable operations supports faster, error-free financial processing and strengthens vendor relationships by ensuring timely payments.

How does the traditional accounts payable process work?

Receive paper invoices from vendors

In traditional AP workflows, businesses often receive paper invoices from suppliers via mail or in person. Handling paper invoices adds manual steps, as each document needs to be physically sorted, filed, and tracked.

This can create processing delays, especially if invoices are misplaced or require routing to different departments for review or additional approvals. Storing these documents can also consume physical space, making them harder to access when needed.

Manually verify invoice details

Upon receipt, the accounts payable team verifies each invoice by manually checking essential details, such as amounts, dates, and line items, to ensure accuracy. This verification process helps detect potential errors early on but requires close attention to detail, taking time and increasing the risk of oversight.

Any discrepancies often require further manual checks, slowing down processing time and potentially delaying payment approvals, especially during high-volume periods.

Match invoices with purchase orders and receipts

To prevent payment errors, the AP team performs a three-way match, aligning invoice details with corresponding purchase orders and delivery receipts. This step ensures that the goods or services billed were received as specified and that the prices align with the agreed terms.

However, manual matching can be tedious, particularly if the volume of invoices is high or if discrepancies require investigation. The process demands significant attention to detail, which can slow down the workflow, especially in organizations handling large purchase volumes daily.

Route invoices for manual approval

Invoices then need to be routed for manual approval, typically requiring physical signatures or email approvals from designated managers. This step helps validate and control expenses, but it can cause significant delays, as approval depends on manager availability and priority.

In multi-department organizations, the process may involve several individuals and require handoffs across departments, further slowing down approvals and creating bottlenecks, particularly during peak times or employee absences. This manual step also makes tracking approval status more challenging.

Record invoices in physical or basic digital systems

After approval, the AP team records invoices by hand in ledgers, spreadsheets, or simple digital accounting systems. This basic approach often limits data entry capabilities, making it difficult to track, analyze, or extract information effectively.

Consequently, the process becomes time-consuming, impacting financial reporting accuracy and slowing down decision-making. Lack of data integration also means any updates require multiple manual entries, increasing the risk of errors and inconsistencies that can affect cash flow forecasting.

Schedule payment dates manually

With invoices recorded, payment dates are scheduled manually, often by setting calendar reminders or managing a spreadsheet to monitor due dates. This process is time-consuming and prone to errors, as each invoice requires individual attention to ensure timely payment.

If not closely monitored, manual scheduling can lead to missed payments, incurring late fees, damaged vendor relationships, or missed early-payment discounts.

Additionally, any changes to payment terms necessitate adjustments across various tracking systems, increasing workload and the chance of oversight.

Issue checks or bank transfers

When the payment date arrives, the team issues payments, often by writing checks or arranging bank transfers. Preparing checks or initiating transfers manually involves repetitive tasks that demand precision to avoid payment errors. This process includes verifying account details, securing necessary approvals, and ensuring sufficient funds, all of which add more time and effort to the AP process.

Additionally, manually issued checks or transfers increase the risk of delays, especially if multiple approvers or signatories are involved, potentially impacting vendor relationships.

File physical documents for record-keeping

The AP team files each document in physical storage after payment, preserving records for audits or future reference. While this maintains a comprehensive paper trail, document storage becomes increasingly costly and space-consuming as records accumulate over time.

Retrieving specific records can become a slow, labor-intensive task, particularly during audits or compliance checks.

Moreover, physical storage carries risks, such as damage or loss of documents due to fire, flooding, or misplacement, which can hinder long-term accessibility and reliability of AP records.

Reconcile vendor statements manually

At the end of each period, the AP team must manually reconcile vendor statements with internal records to ensure all invoices are properly accounted for. This process involves a meticulous cross-checking of each line item, comparing quantities, prices, and payment terms against internal entries.

Manual reconciliation can be slow and labor-intensive, with frequent errors requiring additional time to investigate and correct, ultimately impacting the accuracy of financial reporting.

Review and resolve invoice disputes

Invoice discrepancies often result in disputes, requiring the AP team to communicate back and forth with vendors to clarify and resolve issues.

The team must review records, verify details, and make necessary adjustments, which can be a labor-intensive process.

If not managed effectively, these disputes can lead to delayed payments, strained relationships with vendors, and disruptions in supply chains. Prompt and accurate resolution is crucial to maintain vendor trust and efficient payment cycles.

What is accounts payable automation?

Put simply, accounts payable automation refers to the process of using technology to digitally handle your accounts payable (AP) processes.

Instead of manually documenting invoices, performing invoice matching, and chasing down approvers, you’ll be able to utilize a system designed specifically to automate these tasks.

These digital and automated workflows will streamline your accounts payable and improve efficiency and accuracy.

Related read: CFO's guide to AP automation

Automate your AP process for enhanced efficiency

How does accounts payable automation work?

You may already be familiar with the way the accounts payable process works, but there are some key differences between doing several components manually and using digital automation tools.

Here are some ways that AP automation can make the process easier at each step.

1. Invoice capture

● Manual process

With a manual process, your vendors will likely send you a paper invoice, which means you’ll have stacks on stacks of them to work through. Not to mention that they can be difficult to process without a standardized format. This is also true for PDF invoices.

● Automation

Accounts payable automation technology allows you to capture your invoices digitally, regardless of how an invoice is sent to you. Ideally, vendors will be able to send invoices electronically with a standardized digital format that AP platforms can recognize and capture.

2. Data extraction

● Manual process

When you get sent a paper invoice or an invoice through email, you’ll have to perform manual data entry and enter the invoice information into your accounting system. The more invoices you have to process, the more time-consuming this administrative process will be.

● Automation

Knowing how to automate accounts payable means knowing about optical character recognition (OCR) technology, which allows you to simply scan or take a photo of an invoice document to extract its data. All it takes is a few seconds and even fewer clicks.

3. Invoice approval workflow

● Manual process

Having a manual invoice approval workflow means that much of the work involves chasing approvers from desk to desk to get their physical signatures. It’s a slow process that could result in delays if you can’t find an approver to give you a signature.

● Automation

An accounts payable automation solution can digitize and centralize your approval workflows. Automatically route each invoice through its appropriate workflow and allow the system to send approvers alerts. Approvers can review and approve requests within minutes—no more delays involved.

4. Matching and validation

● Manual process

Before an invoice can be paid off, you’ll have to ensure it contains all the right information by manually comparing it to its corresponding purchase order. This means going through all your documents one by one and manually matching and validating all the information.

● Automation

There’s no need to go through each document manually and spend long periods of time performing invoice matching. Get an automated matching system that can read both invoices and purchase orders to match them.

You will automatically be notified of any discrepancies or irregularities.

5. Payment processing

● Manual process

After invoices have been matched and approved, you’ll still have to initiate and process payments. The traditional manual way to do this would be to use a payment method of your choosing and initiate the transaction separately. You’ll then reconcile it with the general ledger.

● Automation

An AP automation solution should be able to help you facilitate electronic payments without having to click out of the platform. Get different payment options such as bank transfers and card payments to settle your invoices. Recurring payments can also be set up automatically.

6. Reporting and analytics

● Manual process

Gone are the days of having to manually search through a lot of data to formulate and generate reports. While it is possible to create several reports in this manner, it gets harder to do the more reports you have.

● Automation

An AP automation solution can effectively solve this problem. By simply selecting the data you want to use and the report type or format, you can quickly generate the necessary reports. Moreover, this automation enhances accounts payable data analysis, providing you with valuable insights into your data patterns with minimal effort.

7. Audit trail

● Manual process

Audits are notoriously difficult to prepare for, but they’re even worse when you have to put together your audit trail manually. That will involve plenty of scrounging around for the right data and information, as well as organizing them into a cohesive audit trail by hand. Overall, it’s a time-consuming process.

● Automation

With accounts payable automation, it will take no time at all for you to compile an audit trail. All the information you need is easily accessible and already organized on your AP platform.

8. Document storage and retrieval

● Manual process

With a manual process, storing and organizing documents will take up a lot of your time. You will have to invest in either file cabinets or spend time categorizing your documents into different folders on your desktop.

● Automation

There’s no need for all that hassle with accounts payable automation technology. All your data can be stored in a server, with cloud-based platforms allowing you to store it on a remote server that is accessible from anywhere with an internet connection. Accounts payable document management ensures that all your documents are well-organized and easily retrievable, making the process quicker and more efficient.

9. Supplier collaboration

● Manual process

Instead of relying on long back-and-forth worth of text messages, collaborating with your suppliers is much easier to do with accounts payable automation. Your suppliers will be able to send invoices directly to your platform, eliminating delays in the invoice receipt step of the process.

● Automation

Once you’re ready to pay your invoice, you can also do it immediately through the AP automation platform. As soon as you get a notification that the transaction is successful, you can let suppliers know that the invoice has been settled.

Advantages of accounts payable automation

1. Time savings

The accounts payable process is notoriously complex and time-consuming, especially when performed manually.

You can cut the time taken to complete each step of the accounts payable cycle by half when you use tools that allow you to automate the process.

Matching your invoices with their corresponding purchase orders and delivery receipts, for example, can be automatic.

2. Faster approvals

Routing invoice approvals for payments can be done automatically on a single platform with accounts payable automation technology. By setting up custom approval workflows, you can make the approval cycle faster.

Each invoice will automatically be entered into the appropriate approval workflow, eliminating the need to chase approvals from desk to desk.

3. Improved visibility

Accounts payable automation guarantees that all your related data is updated in real-time. You’ll know the status of all your invoices at any time, which is easily accessible in just a few clicks.

You can also check how far into the approval workflow each invoice is and which payments have been made, ensuring better visibility.

4. Enhanced compliance

Manual accounts payable makes it difficult for you to maintain compliance within the entire organization.

With accounts payable automation technology, however, you can set up notifications and alerts for suspicious invoices or transactions, which will be automatically flagged.

The automated approval workflows also mean that all approvals will be trackable and controlled.

5. Data security

Most accounts payable automation technology and tools also offer additional security for your data. It’s easy to centralize your data and use just a single platform for every step in the process.

This way, you’re less likely to lose data. Not only that, but you also get to store your data in an encrypted cloud-based server.

6. Scalability

It may be easy to do the accounts payable process manually when you’re just starting with your business, but you’ll want to know how to automate accounts payable to scale better.

Accounts payable automation software allows you to scale your business hassle-free. You won’t have to worry about spending too much time on administrative work.

7. Accuracy and error reduction

One of the biggest problems you’ll run into with doing your accounts payable work manually is that it’s difficult to maintain accurate records. You’re bound to run into errors at some point, which are time-consuming to fix.

Automating your accounts payable is not only time-saving, but it also makes sure that your records are accurate.

Want to get started with AP automation?

Critical signs that tell it’s time to automate your AP process

Switching to accounts payable (AP) automation can significantly improve efficiency, accuracy, and control over financial operations. Here are key indicators that signal it may be time for your organization to consider AP automation.

1. High invoice volume

Organizations dealing with high invoice volumes often struggle with the inefficiency and risk of errors in manual processing. AP automation simplifies tasks such as data entry, validation, and invoice approvals, significantly speeding up workflows.

By eliminating manual intervention, automation allows AP departments to manage large volumes effortlessly, ensuring that invoices are processed accurately and on time. This scalability not only boosts efficiency but also improves accuracy, allowing businesses to expand without the need for additional resources.

2. Slow processing times

Slow processing times in AP can result in delayed payments, leading to strained supplier relationships and cash flow disruptions. By automating routine tasks such as invoice matching and approval, businesses can accelerate payment cycles and avoid late fees. This enhanced speed reduces administrative bottlenecks and ensures timely payments.

Moreover, faster processing allows employees to focus on strategic, value-added tasks rather than getting bogged down by routine manual processes, ultimately boosting overall business productivity and performance.

3. Frequent payment delays and penalties

Frequent payment delays and resulting penalties often point to inefficiencies in an organization’s AP process, which can harm vendor relationships. Automation streamlines the approval and payment cycles, ensuring that invoices are processed on time and payments made promptly.

With automated reminders and approval workflows, businesses can reduce the risk of missing deadlines. This leads to fewer late fees, better cash flow management, and improved supplier trust, fostering stronger, long-term business partnerships.

4. Difficulty in scaling

As a business grows, manual AP processes may struggle to handle increased transaction volumes, leading to errors and bottlenecks. AP automation addresses these scaling challenges by automating key processes like invoice validation and approval workflows, enabling businesses to manage higher volumes efficiently.

With automation, companies can easily integrate new suppliers and keep pace with growth without needing to overhaul their systems. This scalability ensures that businesses can expand operations smoothly while maintaining operational efficiency and accuracy.

5. Broken audit trails

A lack of clear audit trails in manual AP processes increases the risk of non-compliance and makes it difficult to trace financial transactions.

AP automation provides a complete and transparent audit trail by recording every action, from invoice receipt to payment processing, ensuring that each step is documented and easily accessible.

This improves internal controls, facilitates smoother audits, and helps businesses stay compliant with industry regulations, protecting against potential legal or financial risks.

6. Employee dissatisfaction

When employees are bogged down by repetitive and mundane AP tasks, their job satisfaction can suffer, leading to disengagement, burnout, and higher turnover rates. Automation alleviates this problem by handling time-consuming tasks such as invoice entry and approval routing, allowing employees to focus on more meaningful and strategic work.

By reducing monotonous duties, automation enhances employee morale, improves productivity, and helps businesses retain skilled talent, ultimately fostering a more positive and efficient workplace environment.

7. Increased frequency of errors

Manual data entry and invoice matching are highly susceptible to human error, such as duplicate payments or incorrect amounts, which can undermine financial accuracy. When error rates increase, it may signal inefficiencies within the process.

AP automation addresses these issues by automating tasks like data capture, invoice matching, and validation, significantly reducing the chances of mistakes. This not only helps prevent costly errors but also ensures financial data remains accurate, enabling more reliable financial reporting and strategic decisions.

8. Limited visibility & control

Traditional manual AP processes often lack real-time visibility, making it challenging for business leaders to track invoice statuses, monitor cash flow, or ensure spending aligns with budgets. When limited visibility becomes a problem, AP automation offers a comprehensive solution by providing real-time updates and centralized reporting.

With automation, managers gain instant access to dashboards that display processing times, pending invoices, and cash flow forecasts, empowering them to make informed decisions, reduce risk, and enhance overall financial control.

How to automate accounts payable process?

Assessment and planning

Before you even begin to implement accounts payable automation within your organization, it’s key that you understand where you are with your business.

Assess your current accounts payable processes and identify what some of your pain points are. This will help you when it’s time to choose an AP automation solution.

You also want to outline a rough plan for the implementation process.

Define the requirements

Once you have assessed your business needs, it’s important that you draft out what you’ll need to tackle the pain points you have.

Different AP automation solutions will have different features available, meaning that it’s necessary for you to know exactly what you need so that you can pick the right solution for your business.

If there are requirements, make sure you don’t skimp on them.

Choose the right provider

Do thorough research on all the different accounts payable automation technology providers.

The best platform for another business may not be the one that suits your business best, as every organization will have different needs. It’s important that you choose the right provider for you.

Make sure that the features they offer are in line with what you’re looking for.

Integration planning

When you get a chance to speak with a representative from a particular provider, you want to ask them about what integration the system supports.

It’s recommended that you work closely with your provider of choice to integrate your accounts payable automation software with other existing systems, such as your ERP and accounting software.

Make an integration plan and coordinate with your provider accordingly.

Employee training

Before you begin using your AP automation solution, you must first make sure that your employees have received sufficient training.

You want to create a training plan even before the system installation, but it’s even more crucial after the system has been installed.

Host multiple employee training sessions to ensure that you have explained the technology thoroughly and addressed any issues or queries.

Implementation

The last thing you want to do is overwhelm your accounts payable team by rushing the implementation process. The best way to do this stage is to plan it carefully before you get started and implement your accounts payable automation technology in phases.

This helps your employees get comfortable with a particular feature before learning about another feature, allowing them to use the system efficiently.

Monitoring and optimization

The process isn’t wrapped up just because you have finished implementing the software.

Once everything has been installed and your employees have started using the system for daily accounts payable activities, you want to make sure that you’re monitoring its usage.

Allow employees to give feedback on how the system runs. You should address issues and continuously optimize according to your business needs.

Security and compliance

Other than monitoring and reviewing for optimization, you should make sure that you do regular security and compliance checks.

Make sure that there are no password leaks and that every employee is adhering to the policies you have in place regarding logging into the accounts payable automation software.

Refer to your accounts payable policies to ensure that the automation implementation complies with them all.

Streamline your vendor payouts process now

How to choose the right accounts payable automation solution

The right accounts payable solution may differ from business to business, depending on what the needs of each business are.

However, there are some common key factors that every company should consider when selecting an AP automation solution. These can serve as your guidelines and are easily customizable according to your needs.

1. Integration capabilities with existing systems

You probably already have other systems in use to help you with your business processes.

To avoid data silos and mismatches between systems, it’s recommended that you pick an accounts payable automation solution that has integration capabilities with the systems you already have.

Most accounts payable technology will offer some form of integration, but you must consider integration with the specific systems you use.

2. Customization and scalability options

Each business will have slightly different accounts payable needs. To find the best way to automate your accounts payable, you want a solution that has customization options to suit your business.

The more customization options available, the better. Solutions that allow you to personalize the software according to your business needs will also make it easier for you to scale.

3. Ease of use

Alongside wanting the best features for your accounts payable automation solution, you also want these features to be easy to use.

When you’re exploring a particular provider, ask if you could see what the platform looks like or get a free trial. This will help you familiarize yourself with the system before you commit to it. You want a system that is intuitive and user-friendly.

4. Reporting and analytics

Other than features to help you automate the accounts payable process, you also want good reporting and analytics of the process. Look for a platform that allows you to automate AP reports.

You’ll save a lot of time by automatically generating reports using the data available. For instance, an accounts payable aging report can be easily created to track overdue invoices and assess payment patterns. Ideally, you also want customization options to create the exact reports you need.

5. Mobile accessibility

Knowing how to automate accounts payable using a desktop computer is useful, but the best solutions should be easily accessible from anywhere. Try to look for an AP automation solution that offers mobile accessibility.

This way, you and your accounts payable team can collaborate and complete work remotely. There will be no more delays in your processes when people can easily approve invoices.

6. Customer support and training

Setting up an AP automation solution and familiarizing your team with it takes some time and effort. Consider whether a software provider is well-known for its good customer support and service or not.

When you’re shopping around, ask representatives of different providers if they offer training sessions. Getting someone to train your staff will be helpful in the overall implementation process.

7. Reviews and references

No matter how good an AP automation solution sounds, you want to make sure that you know of its reputation before committing to any particular platform.

The best accounts payable automation technology will have a reputation of being trustworthy.

Make sure that you check out reviews and references from other customers to see how the system performs and whether or not it has issues.

Best AP automation software in the US

1. Volopay

● Overview

Volopay was founded in the year 2020. It is a premier accounts payable (AP) automation solution in the US, designed to streamline financial workflows for businesses of all sizes. It offers a comprehensive suite of tools that enhance efficiency, reduce errors, and improve overall financial management by integrating seamlessly with existing systems.

● Key features and benefits

Volopay boasts an intuitive user interface coupled with powerful features such as Optical Character Recognition (OCR) for accurate data extraction, automated invoice matching, and customizable approval workflows.

The platform supports systematic and scheduled vendor payments, automated alerts and reminders, and mobile accessibility, enabling AP teams to manage tasks on the go.

Additionally, Volopay provides robust document management, advanced analytics for strategic forecasting, and seamless integration with major accounting systems, ensuring a cohesive and efficient AP process.

● Advantages

Volopay offers a user-friendly interface and flexible customization options, making it easy to adapt to specific business needs. Its strong integration capabilities and automated features significantly reduce processing times and errors, enhancing overall AP efficiency and vendor satisfaction.

● Limitations

Despite its robust features, Volopay’s initial implementation can be complex for some businesses. Additionally, smaller companies might find certain advanced functionalities unnecessary, potentially leading to underutilization of the platform’s full capabilities.

● Target audience

Volopay is ideal for small to medium-sized businesses seeking to enhance their AP processes. It is particularly suited for organizations looking to improve efficiency, reduce manual errors, and gain better control over their financial operations through automation.

● Fees and charges

Volopay offers flexible pricing models tailored to the size and needs of your business. Costs typically include software usage fees, customization options, and ongoing support services, ensuring that businesses receive a scalable solution that fits within their budget.

● G2 rating

Volopay on g2.com has an average of 4.2 stars out of 5 from a total of 86 reviews.

2. Netsuite

● Overview

NetSuite was founded in the year 1998. It is a comprehensive enterprise resource planning (ERP) software that includes accounts payable automation as part of its robust financial suite. Designed by Oracle, NetSuite streamlines AP processes by integrating with broader business functions, making it ideal for businesses looking to automate AP within a full ERP system.

● Key features and benefits

NetSuite’s AP automation features include automated invoice capture, multi-level approval workflows, and real-time expense tracking. It supports vendor management and payment scheduling, enhancing control over the AP cycle. NetSuite’s cloud-based platform provides accessibility, advanced reporting, and analytics tools that improve decision-making by giving businesses full visibility into their accounts. Integration with NetSuite’s ERP system allows seamless data flow across finance, inventory, and procurement.

● Advantages

NetSuite is highly customizable and offers comprehensive AP features within a broader ERP system. Its advanced analytics and reporting tools help businesses gain insights, improve decision-making, and streamline AP processes across multiple departments.

● Limitations

NetSuite can be complex to implement, especially for small businesses with limited resources. Its extensive features may lead to higher costs and a steeper learning curve, and smaller businesses may not fully utilize its full ERP capabilities.

● Target audience

NetSuite is ideal for medium to large businesses that need an AP automation solution integrated into a full ERP system for cross-departmental visibility and control.

● Fees and charges

NetSuite offers various pricing plans that include AP automation features as part of its ERP suite. Fees depend on customization, modules selected, and support levels, with specific pricing available on request.

3. Sage Intacct

● Overview

Sage Intacct was founded in the year 1999. It is a cloud-based financial management solution that provides robust accounts payable automation. Known for its real-time financial insights, the platform is designed to improve efficiency in AP processing, making it a popular choice for finance teams in various industries.

● Key features and benefits

Sage Intacct’s AP automation includes features like automated workflows, digital invoice capture, and approval routing, which streamline the end-to-end AP process. The platform offers advanced reporting and real-time dashboards, providing insights into spending and cash flow. Sage Intacct’s seamless integration with existing financial systems further enhances efficiency, while compliance and audit tracking help maintain accuracy and control over AP functions.

● Advantages

Sage Intacct’s user-friendly design and real-time insights enable finance teams to make informed decisions quickly. Its strong reporting capabilities and easy integration make it an excellent choice for businesses looking to optimize financial management and gain deeper visibility.

● Limitations

Some users may find Sage Intacct’s customization options limited compared to other AP solutions. Additionally, businesses without strong tech support may face challenges during the initial setup and integration phases.

● Target audience

Sage Intacct is ideal for small to medium-sized businesses in need of a scalable AP automation solution with real-time financial reporting to enhance visibility and control over cash flow.

● Fees and charges

Sage Intacct follows a subscription-based pricing model with fees depending on the modules selected, level of customization, and support services. Specific pricing details are available upon request, and tailored to a business’s requirements.

4. Ramp

● Overview

Ramp was founded in the year 2019. It is an innovative financial automation platform primarily focused on expense management, offering a streamlined accounts payable automation solution. Known for its cost-saving focus, Ramp helps businesses optimize their AP processes, control expenses, and improve financial efficiency through advanced automation.

● Key features and benefits

Ramp’s AP features include automatic expense categorization, real-time invoice processing, and vendor management. It allows businesses to track spending, set spending limits, and automate approval workflows, minimizing manual intervention. Ramp’s intuitive dashboard provides detailed financial insights and analytics, enabling better expense tracking and control. The platform also includes a rewards program, where users earn cashback on certain transactions, helping businesses reduce costs.

● Advantages

Ramp’s simplicity, automation focus, and cost control tools make it ideal for businesses looking to manage expenses efficiently. Its unique cashback program provides an added financial benefit, making it more than just an AP tool.

● Limitations

Ramp is heavily focused on expense and spend management, which might limit its capabilities for businesses needing comprehensive AP solutions. It may also lack some advanced reporting features present in dedicated AP software.

● Target audience

Ramp is ideal for small to medium-sized businesses seeking an easy-to-use AP automation and expense management solution with a focus on cost control and efficiency.

● Fees and charges

Ramp offers competitive pricing, often with a no-fee structure for its basic services, making it budget-friendly. Premium features and additional services may incur extra costs based on business needs. Specific pricing details are available upon request.

5. Airbase

● Overview

Airbase was founded in the year 2016. It is a comprehensive spend management platform that offers robust accounts payable automation features, designed to streamline financial processes from invoice capture to payment. The platform integrates AP, expense management, and corporate card solutions, providing a unified approach to managing business finances.

● Key features and benefits

Airbase’s AP automation includes features like automated invoice capture, multi-level approval workflows, and payment scheduling. Its integration with accounting software allows for seamless data sync and real-time reporting, providing insights into spending and cash flow. Airbase’s unique corporate card feature, along with virtual cards, helps businesses manage and control expenses across teams, all from a single platform.

● Advantages

Airbase combines AP automation with expense and spend management, creating an all-in-one financial solution. Its flexibility in managing both invoices and corporate card expenses makes it suitable for businesses looking to streamline multiple finance functions.

● Limitations

Airbase’s comprehensive features may be more than some businesses need, potentially leading to underutilization. Additionally, it can be costly for small businesses with limited AP requirements, as pricing is typically based on usage.

● Target audience

Airbase is well-suited for growing mid-sized businesses and startups that need an all-in-one solution for AP, expense, and spend management with advanced control over corporate spending.

● Fees and charges

Airbase follows a usage-based pricing model, with fees determined by the number of users, transaction volume, and feature requirements. Pricing is flexible but varies based on the extent of platform use, with specific quotes provided upon request.

6. Brex

● Overview

Brex was founded in the year 2017. It is a financial platform designed to streamline accounts payable and expense management with a focus on startups and growing businesses. Known for its corporate credit card and cash management solutions, Brex offers AP automation to improve financial control and optimize cash flow.

● Key features and benefits

Brex’s AP automation includes features like automated bill payment, vendor management, and real-time expense tracking. The platform integrates seamlessly with accounting systems, allowing for automated syncing of transactions and real-time visibility into financial data. Additionally, Brex offers a rewards program, providing cashback and points on certain transactions, helping companies save on spending while managing AP processes.

● Advantages

Brex combines AP automation with corporate credit and cash management in a single platform, making it highly versatile for fast-growing businesses. Its rewards program adds value by offering financial benefits that support cost savings.

● Limitations

Brex is tailored to U.S.-based businesses and may have limited functionality for international transactions. Its focus on startups means it may lack some advanced features that larger organizations need in a comprehensive AP automation system.

● Target audience

Brex is ideal for startups and fast-growing companies seeking a streamlined AP solution with integrated expense management and rewards benefits, particularly in the U.S. market.

● Fees and charges

Brex’s pricing is based on a mix of usage and subscription, with no annual fees for its corporate cards. Additional costs may apply based on the scale of AP automation needs, with details available upon request.

What are the costs associated with implementing AP automation?

The accounts payable automation process can streamline tedious tasks and enhance efficiency, but it also requires a financial investment. Here’s a breakdown of some of the general costs associated with setting up an automated AP system for your business.

1. Research team’s labor costs

Selecting the right AP automation solution requires a dedicated research team that includes professionals from finance, IT, and other departments. The time invested by these team members in conducting market research, evaluating different software options, and understanding specific business requirements can be considered a significant labor cost.

While this initial investment may seem high, it is vital to ensure that the chosen solution aligns with the company’s goals and can be successfully implemented without future complications or hidden costs.

2. Software license fee

Most AP automation solutions require businesses to pay a software license fee, which may be one-time or subscription-based. The fee structure varies by vendor, depending on factors such as the number of users, the complexity of features, and the size of the business.

Although software license fees can be significant, they typically cover essential functionalities like invoice processing, automated data entry, and vendor management. These features are crucial for enhancing efficiency and streamlining the AP process, justifying the initial expense for long-term benefits.

3. Software installation costs

In addition to the software license fees, businesses may incur installation costs for onsite setup or technical customization to ensure the AP automation software aligns with their specific needs. These costs cover tasks such as system deployment across devices, configuration to integrate with existing workflows, and ensuring compatibility with the company’s infrastructure.

A well-executed installation minimizes the risk of errors, reduces long-term maintenance issues, and ensures the software performs optimally within the business environment, ultimately supporting smoother operations.

4. Additional hardware & infrastructure costs

In some cases, implementing AP automation requires new hardware or upgrades to existing infrastructure to ensure the system performs at peak efficiency. This could include investing in servers, high-speed scanners, or secure storage solutions, particularly for large-scale organizations. These infrastructure costs are necessary to enhance the system’s speed, reliability, and security.

For businesses with outdated or insufficient hardware, this upfront investment ensures smooth integration with the automation software and supports optimal functionality for long-term operational success.

5. Customization costs

Customization costs can be incurred when the AP automation solution needs to be adjusted to match the unique workflows, reporting structures, or business-specific requirements of an organization. This might involve adding custom features, modifying existing workflows, or creating specialized reports, which may require the software provider’s involvement in development.

While these customizations enhance the system’s ability to meet specific needs and improve operational efficiency, they increase the overall investment, making it essential to balance functionality with cost.

6. Employee training program costs

Employee training is crucial for successful AP automation implementation. The cost of training programs includes resources such as workshops, onboarding sessions, instructional materials, and follow-up support to ensure employees can efficiently use the system.

Proper training accelerates user adoption, reduces the risk of operational errors during the transition, and ensures that the team fully understands the system’s features.

In the long run, these training costs help maximize the value of the automation solution by improving overall productivity and accuracy.

7. Periodic subscription or renewal fees

Many AP automation platforms charge periodic subscription or renewal fees to ensure continuous access to the software, regular updates, and ongoing customer support. These fees typically cover improvements, bug fixes, and new features that help businesses stay up-to-date with the latest technology.

By maintaining a subscription, organizations can benefit from enhanced security, compatibility with evolving systems, and efficient support, which helps maximize the long-term value of the solution and reduce the risk of operational disruptions.

8. Additional user license costs

As the company grows and adds more employees who require access to the AP automation system, additional user licenses may be necessary. These licenses come with additional costs that scale based on the number of users who need the system.

While this can increase overall costs, it allows the business to expand the number of people involved in the AP process, promoting better collaboration and efficiency within the team. Additionally, it ensures that new staff can be integrated into the workflow seamlessly.

9. System integration costs

Integrating AP automation with existing systems like ERP, CRM, or accounting software may require specialized resources and considerable setup time, impacting the overall implementation budget. Effective integration allows data to flow seamlessly between systems, reducing manual data entry, improving reporting accuracy, and enhancing financial visibility.

By connecting AP automation to other critical platforms, businesses can create a unified system that streamlines workflows, strengthens data integrity, and provides a comprehensive view of financial operations.

10. Expanded cloud storage fees

High invoice volumes and extensive document retention requirements may necessitate expanded cloud storage for AP automation solutions, with added costs for increased capacity. These fees support the secure storage of transaction records, vendor documents, and payment histories, essential for meeting regulatory and compliance standards.

Cloud storage offers scalability and ease of access, allowing businesses to manage growing data needs without investing in physical infrastructure, while ensuring data is readily available for audits, reporting, and analysis.

11. Departmental restructuring costs

Implementing AP automation can reshape traditional workflows, necessitating restructuring within the finance department.

These changes may involve reassigning responsibilities, redefining job roles, or creating specialized positions focused on system oversight and strategic analysis rather than manual tasks. This restructuring may come with associated costs, such as training or salary adjustments, but it fosters a more efficient and proactive AP team.

By aligning roles with the automation framework, companies can optimize team productivity, focus on higher-level financial strategy, and fully leverage the benefits of an automated AP system.

Boost financial efficiency with AP automation

Measuring success and key performance indicators (KPIs)

Given that there are a lot of factors to consider when choosing and implementing an electronic accounts payable system, it’s important that you understand how to assess the effectiveness of the system.

Make sure that you have key performance indicators (KPIs) to refer to. Here are some common KPIs to measure the success of your AP automation solution.

1. Processing time

Make note of how long it takes you to process an invoice, from the receipt to the payment. When you implement an accounts payable automation solution, you should be able to reduce the processing time of an invoice.

You want to reduce the processing time by at least 20%, but the higher the reduction, the better.

2. Invoice accuracy

Keep a close eye on what your invoice accuracy looks like before and after you implement accounts payable automation technology.

While you may run into errors during the training period as your employees are getting used to your AP system, you want there to be fewer errors in the long run.

3. Invoice approval cycle time

There’s a lot of emphasis on more efficient approval workflows when it comes to AP automation.

Other than a shorter overall processing time, you want to specifically measure the invoice approval cycle time after you know how to automate accounts payable. You should see faster cycles by eliminating manual approval processes.

4. Supplier satisfaction

When you add up different factors such as shorter invoice processing time and improved accuracy, your suppliers are bound to be more satisfied.

It may be a bit difficult to measure supplier satisfaction without other metrics, so make sure you specify how to measure this particular KPI when assessing the effectiveness of your accounts payable automation technology.

5. Compliance adherence

One advantage of AP automation software is that you’ll be able to improve compliance adherence, with suspicious reports being automatically flagged.

With approvals easily tracked as well, employees should be more conscious about complying with policies.

You want to regularly review if compliance adherence within your organization has improved after implementing automation.

6. Error resolution time

You naturally will reduce the amount of errors during the AP process when you improve your accuracy by using accounts payable automation software.

Another important metric that you want to keep in mind is the error resolution time, which should be reduced thanks to features that help you flag discrepancies.

How to calculate ROI from AP automation in your business

Calculating the return on investment (ROI) from accounts payable (AP) automation helps companies understand the financial gains of transitioning to automated processes. When a management team understands this process, they are much more likely to continue using it and optimize it so as to get better returns.

Here’s a step-by-step guide to evaluating ROI accurately for your business.

1. Identify the costs associated with implementation of AP automation

Start by thoroughly listing all implementation costs, such as software licensing fees, installation charges, employee training programs, and any additional hardware or customization expenses needed to adapt the system to your specific requirements. Having a detailed understanding of these upfront costs enables you to establish a clear baseline for measuring ROI effectively.

The accuracy of this initial cost assessment is crucial, as it not only impacts the credibility of your ROI calculation but also sets realistic expectations for stakeholders regarding the potential financial benefits.

A comprehensive cost overview ensures informed decision-making and aligns all parties with the anticipated investment value.

2. Identify the benefits received from implementation of AP automation

Outline the direct and indirect benefits of AP automation, including reduced labor costs from minimized manual processing, faster invoice approval times, fewer duplicate payments, and the ability to capture early payment discounts. This analysis should quantify each benefit in financial terms, as these factors contribute directly to your cost savings and efficiency gains.

Additionally, consider intangible benefits, like improved supplier relationships and enhanced compliance, which add long-term value. A clear, quantified identification of these benefits provides a strong foundation for assessing the financial impact of automation, creating a comprehensive view of its ROI potential and strategic advantages for the organization.

3. Calculate your net annual savings in the first year

● Description

Net annual savings are the total monetary gains achieved after deducting all implementation costs from the annual financial benefits of AP automation. Calculating this helps clarify the cost-effectiveness of automation within the first year of use.

● Formula

Net Annual Savings = Total Annual Benefits−Total Implementation Costs

● Example

If AP automation generates $100,000 in annual benefits and costs $50,000 to implement, your net annual savings for the first year would be $100,000 - $50,000 = $50,000.

4. Calculate ROI from AP automation in the first year

● Description

The ROI calculation reveals the percentage of return relative to the initial investment. A higher ROI indicates a more favorable investment. Calculating ROI in the first year shows whether the benefits justify the upfront costs.

● Formula

ROI = ( Net Annual Savings/Total Implementation Costs) × 100

● Example

With net annual savings of $50,000 and initial implementation costs of $50,000, the ROI would be (50,000/50,000) × 100 = 100%.

5. Calculate ROI from AP automation progressively using KPIs in the future

Progressively measure ROI by tracking relevant KPIs such as processing time reduction, cost savings per invoice, and percentage of early payment discounts over multiple years. This long-term approach accounts for operational efficiencies that continue to deliver value.

Tracking KPIs enables businesses to adjust processes for enhanced productivity, making the ROI more accurate over time and reflecting evolving business gains.

How Volopay’s AP automation helps your business

1. Optical character recognition (OCR)

Every time your business receives an invoice from a supplier or vendor, using the OCR(optical character recognition) technology, our invoice management software scans and reads the invoice to automatically generate a bill within the system.

This saves your finance team a lot of time spent on manual data entry when the invoices need to be paid.

2. Alerts and payment history

A smart accounts payable software will be able to tell the difference between an unpaid invoice and a duplicate invoice. Volopay’s alert function notifies you when you are close to the due date of an invoice.

The payment history feature will reduce incidents of late payments and help you avoid duplicate payments by letting you see your payment history.

3. Three-way invoice sourcing

A major reason why companies face late payment fees is that their invoice sourcing is not organized in one place. They are scattered making it tough to keep track of every invoice.

With Volopay’s 3-way invoice sourcing, invoices are automatically synced from your email, accounting software, and can directly be uploaded to the platform. This way you won’t miss out on any payments.

4. Two-way sync of bills

We know that the details of any expense are important for accounting and auditing purposes. This is why Volopay has enabled two-way sync of bills between our platform and the accounting software that you use.

Minute details like a vendor’s name, invoice date, due date, item description, quantity, amount, tax code, are all automatically scanned and synced to your accounting tool.

5. Different payment methods

The Volopay platform provides you with two major payment methods to choose from for domestic and international payments.

You can send money via SWIFT, which is a vast messaging network used by banks and other financial institutions to keep track of exactly where your payment is.

You can also send money to 40+ countries in their local currencies through a Non-SWIFT method which is more economic, faster, and money received by the receiver is in full.

6. Schedule payments as per convenience

Accounts payable automation software also gives you the ability to schedule payments. Using Volopay, you get to schedule invoice payments in three ways.

Firstly, you can select a custom date and schedule the payment for that day. Secondly, you can schedule a payment as soon as the approver on the platform approves it.

And lastly, you can also schedule invoice payments right before the due date so you get to hold money for as long as possible in your account and earn interest on it.

7. Multi-currency wallet

Volopay allows you to create multi-currency wallets and store money in different currencies. This lets you pay international vendors or suppliers in their local currency, and save on FX charges.

Additionally, the receiver gets the money in full without you having to pay extra in the first place to ensure that vendors receive the amount that they’re supposed to.

8. Create recurring payments

Paying invoices is a task that your finance team will do every month. There will be vendors you will have to pay every month.

With Volopay you can create recurring payments to these suppliers. Set a particular date and payments for an invoice will go out every month without the need for manual interference.

9. International payments

Sending international payments with Volopay is a breeze. Our platform allows you to transfer money to 100+ countries in 65+ currencies.

This is possible through our integration with Rapyd, which is the world’s largest local payments network.

Want to automate your accounts payable process?

FAQs

A great way to prevent duplicate invoices is to use an invoice management system like Volopay which is equipped with an OCR feature.

The optical character recognition technology scans invoices and matches them against relevant documents such as bank statements or purchase orders to verify whether such payment has already been made or not.

Extremely identical invoices will be flagged and you will manually be able to check and verify whether the invoice is new or just a duplicate.

By automating the accounts payable process, you’re essentially speeding up payments to your vendors, suppliers, etc. It also reduces the number of unplanned expenses which in turn helps to maintain a balance of cash flow from one month to the next.

Multi-currency wallets on Volopay let you maintain separate wallets on the platform with a currency of your choice from the ones that are available. You can use these to send payments to a country without having to bear any FX charges.

Once an invoice is sourced onto the Volopay platform, it is scanned and a bill is generated for it. The bill is then notified to the approver to check and verify whether the payment is good to be made.

Once the approver approves the request, the payment will be made with money being transferred from your bill pay balance. In case you had scheduled the payment, it will be executed accordingly - as per the due date/once the approver approves the request/ a custom date set by you.