How to simplify AP and AR management with automation?

Accounts payable(AP) refers to the money that your company owes. This can include many things from online subscriptions, creditors, suppliers or vendors, and other miscellaneous expenses. Accounts receivable management is the management of money that your customers owe you. When businesses and customers or two businesses transact with each other on a credit basis, then accounts payable and accounts receivable(AR) records are created in the ledger of the company.

Both AP and AR play a crucial role in business operations to give management clarity on how the finances of a business are being utilized. They help in making further financial decisions by gauging the inflow and outflow of funds. The task of maintaining AP and AR records can be tedious, often take a lot of time, and have the possibility of many errors occurring in the process. To solve this, many companies have started using AP and AR software that streamlines a lot of the work for finance teams.

What is AR automation?

AR automation is the use of a software program to automate many account receivable tasks that take a lot of time and are repetitive in nature. An example of this is AR invoice automation.

You might be a supplier or vendor who sends other businesses goods or raw materials for which you have to be paid. To receive this money, you have to send an invoice every month that falls under accounts receivable invoicing. Now instead of creating a new invoice each month, using an automated AR system can help you set certain invoices as recurring and send them automatically at particular dates.

What is AP automation?

AP automation refers to automating many of the tasks involved in paying other businesses. AP automation software can help with managing accounts payable invoices, expenses, reimbursements, and more. A simple example of an AP automation workflow is automated receipt fetching. Instead of making employees create expense reports at the end of every month and having your finance team sort through all expense receipts to match them, you can use a mobile app for this purpose from a provider like Volopay.

The app allows your employees to attach receipts directly to the relevant expenses. Using OCR(optical character recognition) technology our software is able to match and verify whether the receipt attached is legitimate or not. This cuts down your finance team’s work of manually collecting, sorting, and checking each receipt and simply reduces the work to approving the reimbursements instead.

Difference between accounts receivable and accounts payable

While accounts receivable is an asset for your company, accounts payable is a liability as you owe money to creditors. They can be considered as the two sides of a coin.

AR is considered to be a current asset in situations where the credit period you have provided your customers is less than one year. If you’ve provided a credit period that is more than a year, the money you receive can be considered a long-term asset.

AP vs AR is less of a versus conversation and more of an AP and AR conversation as they’re both interrelated to each other. Payables for one company are the receivables for another. Many businesses face the issue of being paid late causing cash flow problems and hindrances with regards to how the business functions.

This is why optimizing the AP and AR process is crucial to operations being carried out smoothly. And using AR and AP software to automate a major portion of those tasks can boost business efficiency.

To gain a more thorough understanding of how accounts payable and receivable function, and how they influence your business's financial management, explore our comprehensive guide on accounts payable vs accounts receivable.

What accounts payable tasks can you automate?

Data entry

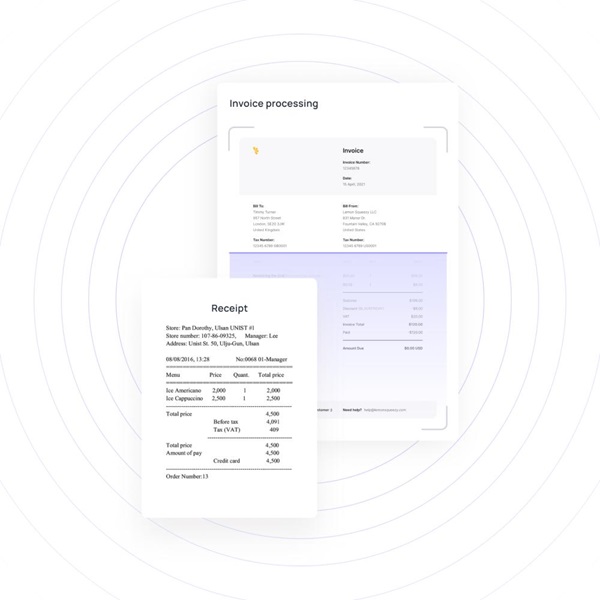

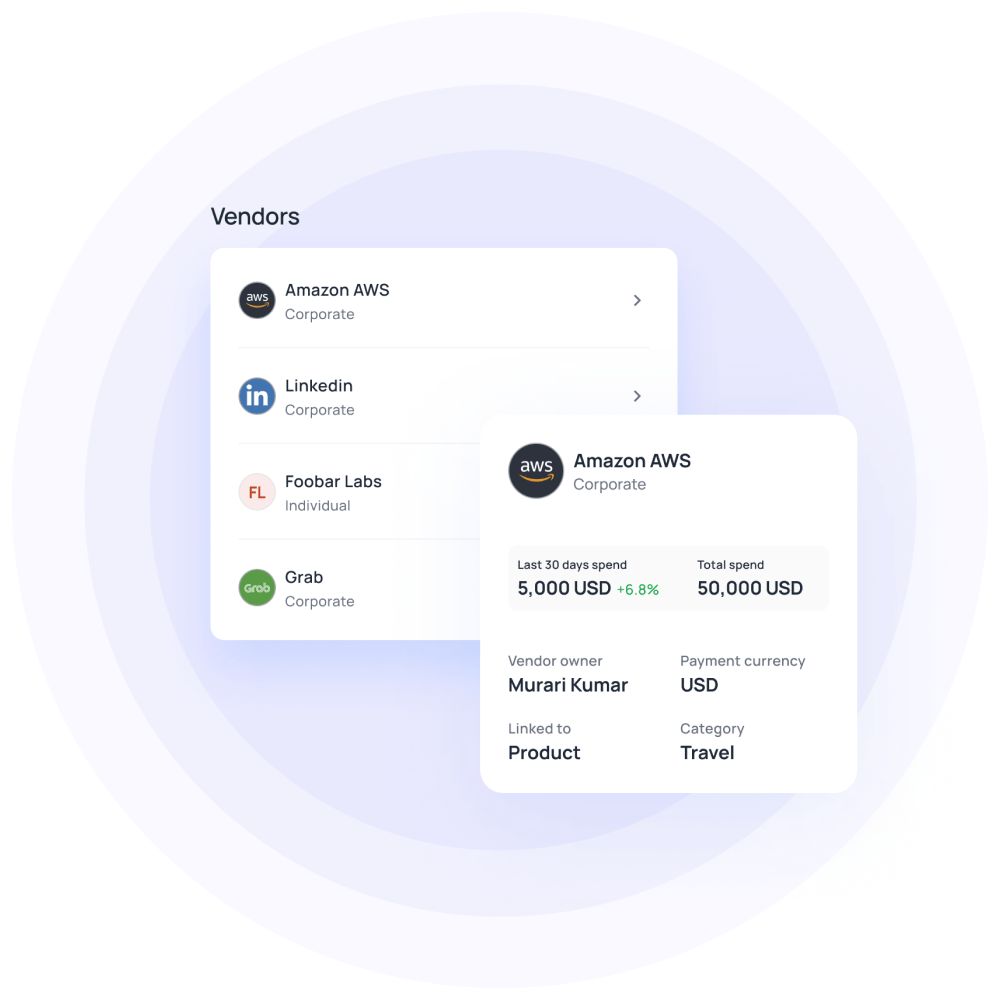

A business can have multiple vendors from whom they receive goods. All these vendors may not always send you an invoice by the same method. Some may send it by email, fax, or physical paper invoices. Entering the data of all these invoices is a time-consuming task.

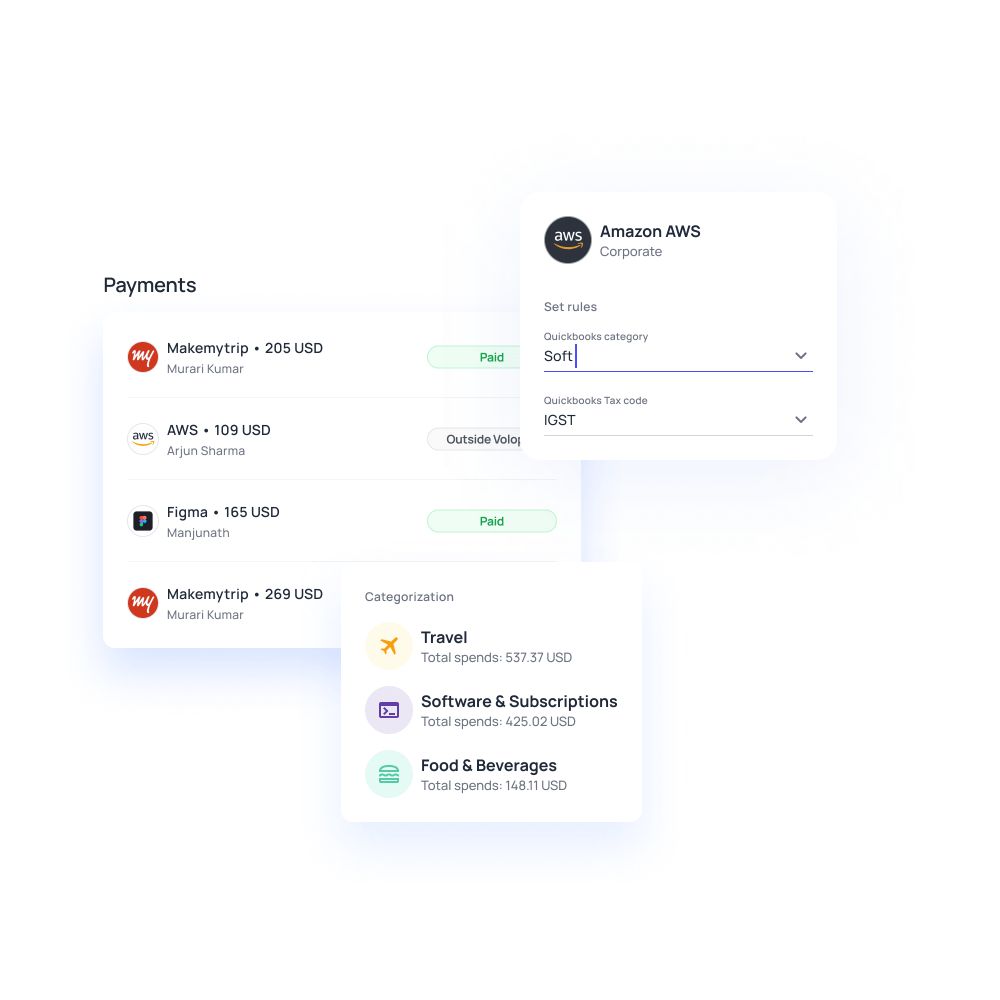

Using AP invoice automation software can drastically reduce this time by automatically scanning invoices and collecting all the data within one platform. Volopay also has 3-way invoice sourcing meaning that you’ll be able to collate all invoices, paid or unpaid, from different sources like email, your accounting software, and our platform directly onto one dashboard. This will make sure that you don’t miss out on any invoice and also decrease the time spent by finance teams manually entering data.

Invoice matching

Before your company pays any invoices, it is crucial for your finance team to ensure that all the invoices received are of legitimate purchases made by the company and not duplicates or false invoices. This process of checking and verifying the invoices is known as invoice matching.

AP automation software stores the purchase order receipts and helps in matching the relevant invoices with them. This is done through OCR technology combined with smart software computation.

Payment approvals

Another major part of processing invoice payments is the approval process. There are often many people involved in approving invoices before the final payment is made to your vendors. This can include team leads, managers, founders, and so on. Doing this without a tech system in place is quite a tedious and time-consuming process as not all the approvers may be available at the same time to approve the invoice, delaying the payment.

To solve this problem, AP automation brings the approval process to one single dashboard which can be accessed by all the relevant approvers at any time wherever they are. So the approval workflow is now seamless leading to faster payments to your suppliers and forging better business relationships.

Invoice coding

Invoice coding is a process that makes organizing and tracking expenses easier according to the GL(general ledger) of the company. In most businesses, it’s the responsibility of the accounts team to do so. The traditional or the manual way of doing this takes a lot of time as the accountant has to reach out and coordinate with the employee who has made the purchase. Using automation software, the invoices can be directly mapped to company GL codes.

Execution of vendor payments

There might be many vendor payments that recur every month with the same particulars. Instead of creating a new invoice and bill for it every month, you can use the AP automation system to mark it as a recurring payment. This will automate the payment to the vendor every month without you having to intervene in the process unless you are an approver.

Another great functionality that Volopay gives you is the ability to schedule a payment. Under this feature, you get three ways to schedule the payable amount:

1. Pay once approved - This means that the payment will be processed on the day the last approver approves the bill.

2. Pay as per scheduled date - Under this method, the payment to a vendor will be executed as per the date that has been selected.

3. Pay as per due date - This method allows a business to pay an invoice based on the due date that is mentioned on it. Businesses choose to opt for this method when they would like to keep cash in their bank account as it helps them earn more through interest rates as well as give more financial control.

To discover how top-rated AP automation solutions can simplify your vendor payment processes and help you manage recurring payments effortlessly, visit our page on the Best accounts payable automation software in the US for 2025.

What accounts receivable tasks can you automate?

Creating and sending invoices

If you’re sending goods to many businesses, creating and sending invoices to all of them is definitely a time-intensive task. The longer it takes for your business to send the invoices, the longer it will take for you to receive them. The way to streamline this process is by using AR invoice automation software that will let you generate invoices faster and create them on a recurring basis.

Support requests from customers

The communication between the customer and your team might not be very frequent other than when it comes time to send the invoice or receive the payment. Customers usually bring up issues at this point to avoid paying the invoices immediately and you’ll be stuck fixing the issue before you can receive the payment. With AR automation software, you can periodically communicate with customers and solve any support requests they might have.

Payment reminders

Receiving late payments is an issue for many businesses. To decrease the chances of late payments, you can set up payment reminders for all the invoices you sent. Based on the due date of the invoice reminders can be sent before, on the due date, and after the due date has been crossed if the payment is not made.

Invoice reconciliation

Automated invoice reconciliation for AR accounts is crucial to figure out whether what a debtor owes you matches your ledger or bank statement. This will help you keep track of every account and if the payments being received are as per the invoices or not.

Looking to automate your payables and receivables?

Benefits of AR automation for business

Save precious time

When it comes to business, there’s no denying that time is money. And an automated AR system decreases the amount of time spent by your finance team on small repetitive tasks by a huge margin.

All that time spent in preparing and sending out recurring invoices manually can now simply be reallocated to making sure that the invoices have been sent. It’s not just the time of your accountants but also other employees who often have to collaborate with them to prepare invoices who save time.

Decrease the cost of processing payments

Once a business receives a payment, there are still quite a lot of steps to process them. This includes reviewing the amount you received, any transfers that need to be made to different accounts, and maintaining the records of these transactions in the company ledger. Thanks to AR software, you can easily automate these steps. Not only will this save your employees hours of work time but also reduce the cost of processing each payment.

Reduction in errors

While some people would say that automation of tasks takes away someone’s job, the truth is that it actually helps an employee do their job better. Preparing, processing, and reconciling the accounts receivable is a tedious task for any finance member especially if there are heaps of invoices and payments to be dealt with. Whenever manual work is involved, the chances of error also increase.

Humans might miss out or overlook an error due to work fatigue. Automation reduces the chance of errors, giving employees their focus, time, and energy to be utilized in rectifying errors if there are any.

Receive faster payments

One major account receivable automation benefit is the ability to receive faster payments. Since you can send invoices much faster, you also receive the payments for them quicker. Having the ability to send automated payment reminders does play a significant part in reducing defaulters.

This truly helps the company’s financial well-being as it improves the inflow of cash. A positive cash flow gives your company the ability to do more things such as buy stock, hire employees, improve work processes, etc.

Enhanced customer service

The better your relationship is with your customers, the better your business will be. Giving your clients the ability to pay easily is part of the customer service experience that businesses appreciate. Automating such elements can aid in the long-term relationship between you and your customers.

Benefits of AP automation for business

Efficient processes

There are many AP automation benefits, but the most prominent one is probably that it makes the entire accounts payable process extremely efficient. Since you’re automating 90% of the process, there’s very little scope for error or something being missed out.

Thanks to the software, all the time-consuming tasks like checking and verifying the legitimacy of each invoice are taken care of. This simply leaves the accountant with the task of rectifying any error when the system spots them. The best part is that the faster process does not trade off security. Your finance members will still be able to review any invoice or expense manually if they want to.

Increased productivity for employees

AP invoice automation means work being done faster, leaving more time for employees to conduct other work. The amount of work that finance teams took days and weeks to do now takes only minutes and hours to complete. Spending less time on repetitive tasks gives them more time to focus on meaningful planning and forecasting fund requirements and organizing budgets. And productivity is not just limited to time. Automation also improves the accuracy of work. This reduces time and effort spent in redoing faulty payments processing.

Organized collaboration

Traditionally, an accountant would have to manually coordinate with another employee who was responsible for a particular expense and ensure that the invoice was correct as per the purchase order. This was no doubt a hectic process as the accountant would have to do this with many employees.

With AP automation software, all of this can be done on one single platform. This makes the collaboration between your teams much simpler and faster to execute. Complete transparency within one dashboard allows for fewer disputes and an overall better working environment.

Better accuracy of invoices

An accountant who has to go through a huge pile of invoices is bound to miss out on an error. Letting invoice automation software do the job will reduce the time and effort required to spot errors.

Complete digitization

Paperwork might be essential for legal requirements. But it is highly susceptible to issues like fraud, storage problems, and is much more difficult to navigate through for finance teams. Digitization of AP records will bring great control, visibility, and transparency to the process. Without it, the chances of security issues and a lack of coordination are much higher.

Volopay’s automation solution

AP automation software like Volopay is made to help companies and finance teams create accounting processes that are much more efficient and lead to faster business growth. From data entry, invoice matching, payment approvals, invoice coding, execution of vendor payments, and more, Volopay is the only platform you’ll need to automate all your financial transactions.

Related pages

Explore how technology is reshaping accounts payable processes and stay ahead of the trends and innovations!

Discover key factors to evaluate when selecting the right accounts receivable software for your business needs.

Learn the steps to efficiently reconcile accounts payable transactions and maintain financial accuracy. Check out our blog for expert guidance and tips.