Accounts payable vs accounts receivable : Key differences

Accounts payable and accounts receivable are two opposite concepts of business accounting. Accounts receivable is the money a company is entitled to get from its customers for the goods or services it has provided them whereas accounts payable is the money a company owes to its suppliers or vendors.

For bookkeeping and accounting purposes, it is essential to differentiate between accounts payable and accounts receivable as the former is a liability and the latter is an asset of the company. These both are often confused with each other. This happens because both these types of accounts are recorded in closely similar ways in the general ledger.

What are accounts payable?

Accounts payable, often abbreviated as AP, represents the outstanding debts a business owes to its suppliers or creditors. In simpler terms, it's the money a company needs to pay for goods or services it has received but hasn't yet settled. This financial obligation is recorded as a liability on the balance sheet.

Every individual who is part of a company’s finance team or is closely related to its operations needs to understand the nuances between accounts payable and accounts receivable. These two concepts form the foundation of a business's financial operations and play a significant role in its success.

What are the steps associated with accounts payable process?

The accounts payable process has five major steps:

● Acquiring

After the purchase of the required goods and services a business receives an invoice for the payment.

● Record

The invoice received is then recorded in the accounts payable ledger. However, if your company uses accounting software this recording process is done automatically by scanning the invoice.

● PO matching

The invoice recorded is then matched with purchase order details, shipping receipts, and inspection reports.

● Approval

Before making the payment, the invoice has to go through a set of approvals to make sure payments are warranted.

● Payment

The last and final step is to see that the payment is made on time and the correct amount is paid.

How to record accounts payable?

Accounts payable are recorded on the basis of the receipt of an invoice that states the payment terms that both your company and the vendor have agreed upon.

When the team gets a bill payable for the goods and services the company has purchased, it is recorded as a journal entry and written under expense in the general ledger. The balance sheet will display the total bill payables and not individual transactions.

After the expense, if approved and the payment is initiated under the terms and conditions of the contract, such as net-30 days, the accounting team members record it as an expense paid.

What are the responsibilities of AP department?

The AP department members are entrusted with the responsibility to process expense reports and invoices, along with this they also have to ensure that all the payments are accurately made.

Maintaining a good supplier relationship by ensuring that all vendor information is correct and precise and all the bills are paid on time is also the job of the AP team members.

A firm and structured AP practice reap immense advantages for a business like a team can help the company enjoy all the benefits of favorable payment terms and payment discounts. They also ensure error-free cash forecasts, minimal mistakes, and take preventive measures to stay secure from any fraud.

To learn more about how these benefits are achieved, visit our blog on the Key functions of accounts payable department.

Enhance financial efficiency with AP automation

Why accounts payable is essential for businesses?

Invoice management

Any type of invoice that needs to be paid by an organization falls under the accounts payable department’s responsibility.

Efficient management of accounts payable helps in organizing and tracking incoming invoices, ensuring that payments are made promptly. This prevents disputes and late fees, contributing to a smoother business operation.

Cash flow management

Maintaining a positive cash flow is important for any business to stay nimble and make flexible decisions. Accounts payable plays a pivotal role in cash flow management.

It allows businesses to schedule payments strategically, ensuring that they have enough liquidity to meet their financial obligations without any further disruptions.

Vendor relationships

Timely payments foster trust and strong relationships with suppliers. Maintaining good vendor relationships can lead to better terms, discounts, and even priority in supply during high-demand periods.

When you have a consistent and steady payment cycle with vendors, it helps develop your relationship with them and improves the chances of better deals.

Compliance and reporting

Accurate accounts payable records are essential for regulatory compliance and financial reporting. They provide transparency and help businesses meet their tax obligations.

To have accurate and up-to-date information regarding a company’s accounts payables at all times, many people use automation software that streamlines payment, tracking, and controlling of such business expenses.

Audit preparedness

Well-organized accounts payable records simplify the auditing process. Being audit-ready at all times not only saves time and resources but also enhances the company's credibility.

Companies using automation tools will be able to help the auditor finish the audit process even faster as they will have access to data instantaneously.

Spending patterns insights

Accounts payable data provides valuable insights into spending patterns. Automated software tools allow finance professionals to filter and analyze expense data efficiently.

This information can inform budgeting decisions, identify areas for improvement, and support long-term financial planning.

What are the challenges in managing accounts payable?

1. Invoice processing complexity

Managing a high volume of invoices, especially from various vendors, can be complex. Each invoice may have unique terms, formats, and payment schedules, making it challenging to ensure accuracy and consistency.

This is especially tough if the invoice processing is being done manually rather than through the use of software.

2. Data entry errors

Manual data entry is susceptible to errors, such as typos or incorrect amounts. These mistakes can lead to payment discrepancies, delays, and strained vendor relationships.

Even a small error in entering the payment amount can lead to a huge issue that takes a lot of time and effort to resolve.

3. Invoice approval bottlenecks

Obtaining approvals for payments within an organization can be slow and cumbersome. The managers or senior staff responsible for approving the invoice payments may miss out on the approval email.

Delays in approvals can result in late payments and, in some cases, missed early payment discounts.

4. Vendor disputes

Disagreements with vendors over invoices can be time-consuming and may require substantial effort to resolve. These disputes can strain relationships and disrupt the procurement process.

When a dispute is going on between a vendor and your company, all operations are halted which makes it inefficient for both the parties involved.

5. Resource constraints

Small businesses or those with limited resources may struggle to dedicate sufficient staff and technology to manage accounts payable effectively. This can lead to delays and compliance issues.

6. Manual workflows

Many businesses still rely on manual accounts payable processes, which are not only labor-intensive but also prone to errors and inefficiencies. This outdated approach can hinder productivity.

While certain processes such as approvals need to be done manually, other repetitive processes such as data entry and processing should be automated using technology.

What are the solutions and best practices for managing accounts payable?

1. Implement AP automation

Automation streamlines invoice processing, reduces errors, and accelerates approvals. It also provides real-time visibility into payment status and cash flow.

All in all, it makes each step in the accounts payable workflow much faster and easier to execute.

2. Set clear policies and procedures

Establishing well-defined accounts payable policies and procedures ensure consistency and compliance. Clear guidelines help employees understand their roles and responsibilities.

Whether it is how the approval system will work or how an invoice should be processed, each step should have a clearly defined procedure and a policy that outlines all the scenarios.

3. Invoice approval workflows

Implementing structured approval workflows ensures that invoices are routed to the right individuals for review and approval, reducing bottlenecks.

Having an approval workflow and multiple levels of approvers according to the volume of the payments is a great way to ensure the appropriate degree of authorization for each payment.

4. Invoice validation

Implement validation checks to identify discrepancies and errors in invoices before they are processed, ensuring accuracy. This can be done in the form of 2-way or 3-way invoice matching.

Supporting documents to an invoice such as the purchase order and goods delivered receipt should be documented and and kept for future reference.

5. Segregation of duties

Separate responsibilities in the accounts payable process to prevent fraud and errors. This includes different individuals handling invoice approval, payment authorization, and reconciliation.

Giving the entire invoice processing till payment responsibility to one person can be risky. Separating duties ensures that if one person is trying to commit fraud, it will be caught by the other person.

6. Payment scheduling

Using automation tools can help to schedule payments in advance. Create a payment schedule that aligns with your cash flow and takes advantage of early payment discounts while avoiding late fees.

Automate your accounts payable process

What are accounts receivable?

Accounts receivable, often referred to as AR, represents the money owed to a business by its customers or clients for goods or services provided. It's essentially the opposite of accounts payable.

Accounts receivable is recorded as an asset on the balance sheet, as it represents funds expected to be received in the future. Proper management of accounts receivable is essential for maintaining healthy cash flow and overall financial stability.

What are the steps associated with accounts receivable process?

The AR process is easier than the AP process consisting of three main steps:

● Send

Once all the goods and services have been provided, the invoice must be sent immediately.

● Track

The invoices sent are regularly tracked. If the payment is not received, reminder emails are sent out and some additional measures are taken like phone calls.

● Receive

After the payment is received, the AR department makes sure that the correct amount has been received and is recorded in the ledger as “paid.”

How to record accounts receivable?

Accounts receivable are recorded when goods or services are provided to a customer on credit by entering the amount due into your accounting system as soon as you issue an invoice.

Log this entry in the accounts receivable ledger, noting the invoice date, customer name, invoice number, and the amount due. Subsequently, display accounts receivable on your balance sheet under current assets, indicating the total amount expected to be collected soon.

When considering accounts payable vs accounts receivable, remember that accounts receivable reflect money coming into your business, while accounts payable track amounts owed to vendors. Managing accounts receivable effectively ensures timely collection and supports cash flow.

What are the responsibilities of the AR department?

The accounts receivable (AR) department manages several key functions, like overseeing the invoicing process, and ensuring accurate and timely billing to customers.

The department further follows up on overdue invoices and handles collections to maintain your business’s cash flow. It also reconciles accounts to confirm that payments received align with invoices and addresses discrepancies promptly.

The main difference between accounts payable and accounts receivable is that accounts payable require you to manage outflows of cash to meet obligations, while accounts receivable represent future cash inflows, enhancing your liquidity.

Efficient AR management ensures that your business receives due payments on time and maintains healthy financial operations.

Boost efficiency and enhance control

Why accounts receivable is crucial for businesses?

Revenue generation

Accounts receivable directly contribute to a company's revenue stream. It represents sales that have been made but not yet collected.

Effective management of accounts receivable ensures that revenue is realized and can be reinvested into the business.

Cash inflow

AR provides a consistent source of cash inflow, which is essential for covering operating expenses, debt obligations, and growth initiatives.

Without proper management of accounts receivable, there will be a shortage in the cash inflow of the organization.

Working capital management

Efficient management of accounts receivable helps in optimizing working capital.

It ensures that the company has enough liquidity to meet its short-term financial obligations. This is directly linked to a company’s cash inflow.

Without an adequate inflow of cash, there won’t be enough working capital to manage operations.

Investor and lender confidence

Well-managed accounts receivable instill confidence in investors and lenders. It demonstrates the company's ability to generate revenue and manage its financial commitments.

A steady, organically growing accounts receivable increases the confidence of lenders and investors allowing the business to get more opportunities for capital and expansion.

Sales and growth

AR reflects a company's sales performance and growth potential. A healthy accounts receivable balance suggests a thriving business with a loyal customer base.

Seeing the accounts receivable pattern or trend over the past months gives a good idea about how the company is growing in terms of revenue.

Customer relationships

A transparent and efficient AR process enhances customer relationships. Clear billing and prompt follow-up on payments contribute to customer satisfaction and loyalty.

Making the payment process as seamless and user-friendly for your customers will directly impact your accounts receivables.

What are the challenges in managing accounts receivable?

1. Slow-paying customers

Slow or delayed payments by customers can strain cash flow, impacting the ability to meet financial obligations and invest in growth.

When there is a huge time gap between receiving payments, it hinders the daily operations of the business wherever there are immediate monetary requirements.

2. Bad debts

Unpaid invoices can lead to bad debts, which can be a financial burden. Managing and mitigating bad debts is crucial for maintaining profitability.

Customers not paying on time is a risk and can cause issues in managing the finances of the company.

3. Inaccurate invoicing

Inaccurate or unclear invoices can lead to disputes, payment delays, and strained customer relationships.

Even a small error on an invoice can lead to it being sent back for revision which causes a delay in payments being received on time.

4. Disputes and deductions

Customers may dispute charges or make deductions from payments, requiring time and effort to resolve. This will again cause dissonance in accounts and lead to more time spent rectifying accounting books.

5. Manual processes

Relying on manual processes for invoicing and collections is inefficient, prone to errors, and can result in delays.

Before automation, there was no other choice but to do all of this manually. But with the help of technology, a lot of the tasks can be automated.

6. Aging receivables

Overdue receivables can accumulate, creating financial stress and the need for extensive collection efforts. This puts stress on the finance team to not only get payments from customers but also make them lag on their current work that needs to be done.

What are the best practices for managing accounts receivable?

1. Timely invoicing

Send invoices promptly after providing goods or services to ensure customers are aware of their obligations and payment timelines.

Sending the invoice well in advance or even with the goods delivered will ensure that you can get paid on time and that there are no delays.

2. Invoice validation

Review invoices for accuracy and completeness before sending them to customers to reduce the risk of disputes and delays.

This will help you avoid invoices being sent back for corrections and the time spent making the necessary corrections and sending them back.

3. Clear policies

Establish and communicate clear payment policies, including due dates, late fees, and acceptable payment methods, to set expectations.

Make sure that the customer is aware of all these details so that there is no confusion later on while making payments.

4. Monitoring and reporting

Regularly monitor accounts receivable aging reports to identify overdue accounts and take proactive measures for collections. This part is a necessary periodic process to help recover bad debts and increase the cash inflow of the company.

5. Payment terms and options

Offer flexible payment terms and options to accommodate different customer needs, such as installment plans or discounts for early payments.

Doing this will help you cater to your customer’s varying needs and at the same time help you have a stable accounts receivable workflow.

6. Automation

Implement AR automation solutions to streamline invoicing, payment reminders, and collections, reducing manual effort and errors.

Simple automation like payment reminders can be the difference between not receiving a payment and having to deal with a sticky situation with customers.

7. Regular reconciliation

Reconcile accounts receivable records with customer payments and resolve discrepancies promptly to maintain accurate financial records.

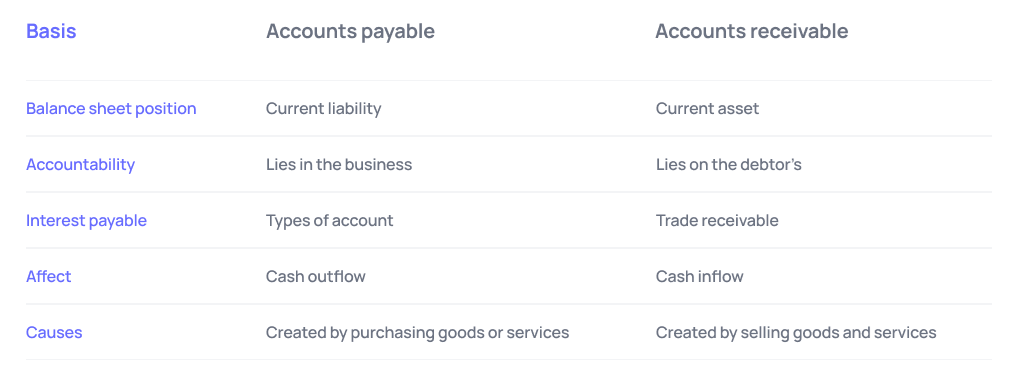

Accounts payable vs accounts receivable - What are the differences?

1. Definition

● Accounts payable

Money owed by a business to its suppliers is known as accounts payable in a business environment. These are also generally referred to as the payments or expenses that need to be made by an organization.

● Accounts receivable

Money owed to a business by its customers is known as accounts receivable. Any money that an organization is yet to receive for goods or services delivered falls under this category.

2. Nature

● Accounts payable (Liability account)

Accounts payable fall on the liability side of a balance sheet as these accounts are expenses yet to be made.

● Accounts receivable (Asset account)

Accounts receivable fall on the asset side of a balance sheet as these are sources of income that will be received by the business.

3. Direction of flow

● Accounts payable (Cash flows out)

Money flows out of the business in the case of accounts payable. A business pays to settle debts.

● Accounts receivable (Cash flow in)

Money flows into the business in the case of accounts receivable. A business expects payment from customers.

4. Parties involved

● Accounts payable

Business and its suppliers or creditors. These are the two parties involved in any accounts payable transaction. A supplier/vendor/creditor and your business who needs to pay them.

● Accounts receivable

Business and its customers or clients. In accounts receivable as well, there are two parties involved, except that, in this case, your business is termed as the vendor/supplier and your customer might be a business or an individual that needs to pay you.

5. Purpose

● Accounts payable

To settle outstanding invoices for goods/services. Payments are made outwardly by your business to its supplier/vendors/creditors to make sure there are no outstanding payments.

● Accounts receivable

To collect payments for goods/services provided. Payments are received by the accounts receivable team and they take measures to get them as soon as possible.

6. Impact on cash flow

● Accounts payable

Reduces cash when paid. A business’s cash in hand is generally reduced when payments are made. An exception is if you are using credit cards to make payments and using the cash you receive later to pay them off.

● Accounts receivable

Increases cash when received. When you receive payments from customers, it reflects an increase in cash inflow or a positive cash flow.

7. Collection vs. payment

● Accounts payable

Involves making payments to suppliers. The transaction on your business’s behalf is known as a payment.

● Accounts receivable

Involves collecting payments from customers. The transaction on your company’s behalf is known as a collection.

8. Impact on financial statements

● Accounts payable

Reduces equity (liability). Accounts payables of a company affect the short-term liability of a company and directly influence the balance sheet, income, cash flow statement, and financial ratios.

● Accounts receivable

Increases equity (asset). It will be reported in two separate assets, current assets and non-current assets. This happens because it could eventually become a liability if there were to be a default or it may mature into cash after time passes.

9. Risks

● Accounts payable

If payments are not made on time by your business, then you risk late payment fees or strained relationships with suppliers. It might be harder to get better deals from them later on knowing that your account had defaulted.

● Accounts receivable

Similarly, if payments are not received on time by your business, then there is the risk of bad debts and disputes with your customers.

10. Automation

● Accounts payable

Automation streamlines payment processes. Modern automation tools provide even more features to make the AP process smoother such as automating invoice processing, setting up approval workflows, and scheduling payments.

● Accounts receivable

Automation streamlines invoicing and collections. Software tools can help you automate invoice generation faster and with more accuracy. They also have additional features such as sending payment reminders and communicating with customers directly through the platform in case of any discrepancies.

Simplify your accounts payable process

What’s the relationship between accounts payable and accounts receivable?

The relationship between accounts payable vs accounts receivable is crucial for managing cash flow. Accounts payable tracks the money your business owes to suppliers, while accounts receivable monitors the money owed to you by customers.

The difference between accounts payable and accounts receivable further lies in the fact that accounts payable typically involve scheduled payments, whereas accounts receivable are based on credit terms extended to customers, affecting how quickly you can access the funds.

Efficient management of both ensures balanced cash flow. Aligning incoming payments from accounts receivable with outgoing payments from accounts payable helps maintain financial stability and avoid liquidity issues. Proper coordination between the two supports smooth business operations.

Tips to handle accounts payable and receivable

1. Implement a clear approval process

Establishing a clear and standardized approval process for both payables and receivables helps maintain consistency and ensures proper oversight of financial transactions.

Approval workflows should be set up in such a way that all payments are to be verified but at the same time should not disrupt the work and productivity of senior executives.

You can do this by using an expense management platform that is capable of creating multilevel approval workflows. This will let you set multiple approvals for a payment depending on the volume of payment.

2. Leverage automation and technology

Utilize accounting software and automation tools to streamline and expedite the accounts payable and receivable processes, reducing errors and improving efficiency.

Many tools have the ability to automatically source an invoice so that you don’t miss out on making a payment because you missed the invoice in your email.

As the business that has to make a payment, you can also schedule or create recurring payments with the help of automation technology for your accounts payable.

3. Establish clear credit policies

Define credit terms and conditions for customers to mitigate the risk of late or non-payment. Conduct credit checks on new customers and set credit limits based on their creditworthiness.

4. Timely and accurate invoicing

Send invoices promptly and ensure accuracy to avoid delays in payments and confusion for customers. Include detailed information about products or services, payment terms, and contact details for inquiries.

You can also use automation software to match invoices with relevant documents to verify their legitimacy.

5. Monitor receivables closely

Regularly track and follow up on outstanding receivables to minimize the risk of bad debts. Implement aging reports to identify overdue accounts and take necessary actions for collection.

You can also use tools to automatically send your customers reminders to pay on time.

6. Offer convenient payment options

Provide multiple payment methods to customers, such as online payments, credit card options, and electronic fund transfers, to facilitate prompt payments and improve cash flow.

A rigid way of letting your customer make payments can delay and put stress on your company’s finances.

7. Regularly reconcile accounts

Perform regular reconciliations to ensure accounts payable and receivable records align with financial statements, uncover discrepancies, and maintain accurate financial records.

Related read: How to reconcile accounts payable transactions for your business?

8. Monitor cash flow

Maintaining a strong cash flow is crucial for the financial health of any business. Keep a close eye on cash flow patterns and projections to manage working capital effectively and make informed decisions.

Significance of maintaining a balance between AP and AR

Maintaining a balance between accounts payable and accounts receivable is vital for several reasons:

1. Cash flow management

Balancing payables and receivables helps ensure a steady inflow and outflow of cash, preventing liquidity issues and enabling the business to meet its financial obligations. If the volume of payments keeps increasing as compared to accounts receivable, then you might face a cash crunch.

On the other hand, if your receivables are more than payables by a certain margin consistently without significant growth, then you might be underutilizing your resources.

2. Working capital optimization

While you need to have a balance, having more accounts receivable as compared to your accounts payable is always a good sign.

By managing payables and receivables effectively, a company can optimize its working capital, ensuring it has sufficient funds for day-to-day operations, growth initiatives, and unforeseen expenses.

3. Supplier and customer relationships

Maintaining a balance fosters positive relationships with suppliers and customers. Timely payments to suppliers enhance trust while managing receivables well will strengthen customer relationships.

It is almost like a never-ending cycle where paying and receiving payments help in building your business relationships.

4. Financial stability and creditworthiness

Maintaining a healthy balance between payables and receivables demonstrates financial stability and improves the business's creditworthiness, enabling access to favorable financing options and terms.

In the future, if you ever plan to take a business loan, the institution offering you the loan or credit will look at your bank statements in order to determine your creditworthiness and the amount of loan that they can give you based on your financial activity.

5. Business performance analysis

It’s not only important to track all your accounts payables and accounts receivables but also to analyze this data. Monitoring the ratio between payables and receivables provides valuable insights into a company's financial performance, operational efficiency, and cash management practices.

Automate your accounts payable process with Volopay

Get startedHow can accounting software help track accounts payable and receivable?

Accounting software helps you track accounts payable and receivable cash flows more effectively.

It simplifies financial management by automating processes, providing clear visibility into your business finances, and improving accuracy.

These features enable you to manage your cash flows efficiently and stay on top of your finances.

Setting up invoices

Accounting software streamlines the creation and sending of invoices, ensuring accurate billing for accounts payable and receivable.

Customize invoice templates and automate delivery to enhance consistency and reduce manual effort.

This efficiency helps you maintain better control over your billing processes and ensures timely and accurate invoicing.

Reducing errors

Automated data entry and calculations in accounting software help minimize errors in managing accounts payable vs accounts receivable process.

The software minimizes mistakes in financial records, enhancing overall accuracy and reliability.

By relying on automation, you ensure that your financial data is precise and up-to-date, reducing the risk of errors.

Automating workflows

Accounting software automates repetitive tasks such as invoice generation and payment reminders.

This automation keeps you organized with both accounts payable and receivable, allowing you to focus on strategic tasks.

By automating workflows, you improve efficiency and reduce manual effort in managing your financial operations.

Tracking vendor payments

With accounting software, you can efficiently monitor and manage payments to suppliers.

Tracking accounts payable ensures that all vendor payments are timely and accurately recorded.

This functionality helps you maintain good relationships with suppliers and manage your business’s outgoing payments effectively.

Integrated financial reporting

Accounting software offers integrated reporting features that provide comprehensive insights into your financial status.

You gain a clear view of the difference between accounts payable and accounts receivable, which helps you understand cash flow and make informed financial decisions based on detailed reports.

Improved visibility and control

The software provides enhanced visibility into your financial transactions, allowing you to manage accounts payable and receivable more effectively.

Increased control helps you avoid discrepancies, monitor your finances closely, and maintain overall financial stability, ensuring accurate and efficient management of your business’s financial operations.

Streamlined payments

Automated payment processing features in accounting software help you manage outgoing payments and receipts seamlessly.

You can schedule and execute payments, making it easier to handle both accounts payable and receivables.

This streamlining ensures timely and organized payment management, improving your financial operations.

Analytics and report generation

Advanced analytics tools and report generation capabilities in accounting software offer valuable insights into your accounts payable vs accounts receivable payments.

Analyze trends, assess performance, and identify areas for improvement. These insights help you make data-driven decisions and optimize your financial management strategies.

Reconciled payments

Accounting software assists in reconciling payments by matching invoices with received payments.

This reconciliation process ensures that your accounts payable and receivable records are accurate and up-to-date.

Accurate reconciliation helps you maintain financial integrity and manage your cash flow effectively.

Tracking outstanding balances

The software tracks outstanding balances for both accounts payable and receivable, giving you a clear view of what you owe and what is owed to you.

This tracking helps you manage cash flow, prioritize payments, and stay on top of your financial obligations.

Accounting software simplifies tracking accounts payable and receivable with automation and accuracy. Explore the Best Accounts Payable Software in the US to enhance your invoicing, reduce errors, and gain better financial control.

How does Volopay simplify AP and AR management with automation?

Managing accounts payable vs accounts receivable can be complex, but Volopay’s automated solutions make it seamless.

With end-to-end automation of payments, simplified invoice processing, and real-time tracking, you can maintain tighter control over your finances.

Volopay’s system offers everything from multi-level approvals to automated bookkeeping, ensuring you manage accounts payable vs accounts receivable efficiently.

Its intuitive platform also integrates effortlessly with your existing accounting systems, streamlining your processes and boosting overall accuracy.

Automation of payments

Volopay’s automation takes care of everything from processing invoices to executing payments.

You can schedule payments, set up recurring payments, and control the cash flow with minimal manual intervention.

This end-to-end automation of payments allows you to focus on strategic decisions rather than getting caught up in administrative tasks.

You’re essentially putting your payment processes on autopilot, saving time, minimizing human errors and enhancing financial management.

Simplified invoice processing

Efficient invoice processing is crucial for maintaining the difference between accounts payable and accounts receivable smoothly.

Volopay enables you to digitize and centralize your invoices, allowing easy uploads and automated data entry.

Invoices are processed faster, with automated categorization and approval workflows, reducing delays and avoiding bottlenecks.

This simplification ensures that you always stay on top of due dates and avoid late payment penalties.

Multi-level approvals for enhanced controls

Managing approvals is often a tedious process, but Volopay’s multi-level approval system provides you with more precise control and reduced risks.

You can set custom approval workflows to ensure proper checks for payments and invoices.

This strengthens your control over financial processes and ensures compliance with company policies.

The automation of multi-tiered approvals minimizes delays and errors, offering a smoother and more secure financial operation.

Real-time visibility and tracking of expenses

Real-time visibility is key to keeping your financial operations smooth.

Volopay provides instant access to data on payments, invoices, and overall cash flow.

The real-time tracking feature allows you to monitor expenses as they happen, providing clear insights and enabling faster decisions.

With this transparency, you can better manage the difference between accounts payable and accounts receivable tasks, ensuring that you are fully aware of your financial position at any moment.

Vendor management with simplified vendor payouts

Dealing with multiple vendors can get complicated, but Volopay simplifies this through its integrated vendor management feature.

You can store vendor details, manage multiple payment methods, and schedule payouts directly from the platform. With automated workflows, vendor payments are quicker and more accurate, reducing potential friction.

The platform’s easy interface allows you to onboard new vendors, process payments, and handle any discrepancies efficiently, ensuring smooth vendor relationships and simplified accounts payable vs accounts receivable processes.

Easy expense preparation, export, and reconciliation

Volopay optimizes the entire expense cycle, from preparation to reconciliation.

You can easily categorize expenses, attach receipts, and automate reports, which are then ready for export.

The platform’s automated reconciliation feature ensures that all transactions are accurately matched against bank statements, minimizing errors.

This smooth and automated approach to expense preparation and reconciliation saves your time and enhances your business’ financial accuracy.

Automated bookkeeping for accuracy and efficiency

Volopay’s automated bookkeeping feature significantly reduces manual errors and boosts accuracy.

Transactions are automatically categorized and logged, ensuring your books are always up to date.

The system’s automation capabilities allow you to avoid time-consuming manual data entry while providing accurate financial records.

This automation is critical in ensuring both your accounts payable vs accounts receivable tasks are handled efficiently.

Automated bookkeeping handles routine tasks, allowing you to save time and energy to focus on more strategic aspects of your business.

Seamless integration with accounting systems

Integration is key when managing financial data across different platforms.

Volopay integrates seamlessly with your existing accounting systems, ensuring a smooth flow of information.

Whether you use QuickBooks, Xero, Netsuite, or other software, the platform’s easy connectivity keeps your financial data synchronized.

This seamless integration reduces duplication, ensuring that the difference between accounts payable and accounts receivable processes are unified and accurate.

You’ll have all your financial data in one place, enhancing both efficiency and control.

Related pages

Faster payments, employee retention, and improved cash flow, are some of the benefits of automating your accounts receivable.

Explore how technology is reshaping accounts payable processes and stay ahead of the trends and innovations!

Streamline your AP and AR processes with automation to enhance efficiency and accuracy in financial management.

Streamline your financial management

FAQs

No, accounts payable are recorded as a liability on the balance sheet whereas expenses are written in the company’s income statement.

In general it is suggested to keep accounts payable and accounts receivable teams different because there are high chances of confusion and mistakes.

Accounts payable refers to all the short-term debts or commitments which include trade payables. Whereas, trade payables are the money your company owes to its vendors for inventory-related goods like business inventory or supplies.

Examples of accounts payable include invoices from suppliers, utility bills, rent payments, and loan repayments.

The complexity of accounts payable and accounts receivable may vary depending on the specific circumstances and the size of the business. Both require attention to detail and proper management.

Accounts Payable is recorded as a credit in the company's books. It represents a liability, indicating an amount owed to creditors.

Accounts Payable is typically represented as a negative amount in financial statements, indicating an obligation or debt owed by the company.

Accounts receivable is considered an asset since it represents the amount of money that the company is owed to its customers.

The controller plays a crucial role in managing accounts payable vs accounts receivable cash by monitoring cash flow, implementing policies, preparing financial reports, conducting audits, and ensuring compliance with accounting standards.

Reconciling accounts payable and accounts receivable is essential to identify errors, prevent fraud, and maintain accurate financial reporting, and supporting overall financial health.

Technology streamlines managing the difference between accounts payable and accounts receivable by automating invoicing, payment processing, and reconciliation. Automated reminders, detailed reports, and real-time tracking help manage cash flow and maintain accurate records.