Accounts payable process flow [Beginner's guide]

Efficiently managing your accounts payable process is essential for optimizing your business’s financial health. This comprehensive guide will walk you through every step of the accounts payable process, from receiving invoices to processing payments.

By implementing these strategies in your business, you’ll improve accuracy, streamline operations, and build stronger vendor relationships.

What are accounts payable?

Accounts payable refers to the entirety of your business’s expenses (except payroll!) For the duration of time wherein, the vendor sends you the invoice for the order which then gets approved and finally paid, you remain in a short-term debt known as accounts payable.

The true marker to ascertain your company’s financial wellbeing is its AP process. Whether you are a large corporation or a budding enterprise, a healthy and more importantly accurate balance of accounts payable reflects the cashflow status, credit rating, and your relationship with your suppliers.

What accounts payable looks like in a business?

Vendor payments

Your accounts payable majorly consists of payments due to your suppliers in exchange for goods or services you need to run your business.

Over time, you form consistent vendor relationships that provide you the materials you need on credit that will be paid later at a pre-decided time, therefore becoming a component of your accounts payable.

B2B transfers

As a business owner, you might be working with a variety of entities - from independent contractors to other businesses. When you work with other business entities, the mode of payment then becomes a business-to-business or a B2B transfer.

Since businesses thrive on a steady cash flow, accounts payable then becomes an essential part of all B2B transactions.

Multi-currency money transfers

With international vendors and businesses, you need to set up dedicated forex accounts to ensure timely and accurate payments, taking into consideration the exchange rate going at the present time.

Since the forex fees of banks and other money transfer companies are significantly high, it is prudent to send out all your invoices collectively at once, rather than one at a time. Therefore, multicurrency money transfers become a notable part of your accounts payable process.

Office supplies

Office supplies are considered to be a part of your accounts payable process. Usually, your office supplies are ordered in bulk and supplied in a consistent manner. Therefore their payments are often scheduled to ensure smooth cash flow.

Cleaning services

If you avail of third-party cleaning services to tidy up your office, then that can be added to your accounts payable section.

The cleaning company sends out regular invoices to you that can be scheduled to pay at a later date, leading to a duration of short-term debt and hence, accounts payable.

Terms every AP professional should know

Accounts payable is an essential part of your financial statements and therefore you must stay up-to-date with all the necessary terms that you might come across when optimizing your accounts payable management.

Invoice management

Scan, capture invoices, and automate processing for a seamless approval process. Validate invoices and reconcile faster.

Effortlessly integrate invoices into the accounts payable process and go paperless. With proper accounts payable document management, all invoices are organized and stored systematically, ensuring easy access and retrieval when needed.

Compare and validate supplier invoices against the purchase order issued and the goods delivery receipt. Automatically match invoices according to customized business requirements.

Purchase Order (PO)

A form of record generated from the buyer’s end that carries the proof of purchase transaction.

Upon approval by vendor, it becomes a legally binding contract between the supplier and the buyer that lays out the specifications mentioned regarding quantity, pricing, discounts (if any), shipment address, billing address, any specific instructions, and T&C.

Purchase orders are the origin of the accounts payable flow that ensures easy reconciliation, proper tracking of payments, and accurate financial records for your business.

Days Payable Outstanding

DPO is the average number of days that a business takes to pay the invoice in the accounts payable flow. It shows a company’s creditworthiness and overall money ethics.

A higher DPO implies that a company struggles to meet the invoices on time and therefore has a poor cashflow. A lower DPO shows the company’s ability to pay off its credit on time with a steady cashflow.

AP workflow

Collection and reconciliation of invoices, purchase orders, and receipts/approvals. Any invoice received must match with the PO issued and proof of payment to be successfully recorded.

AP automation streamlines reconciliation, eliminating cash flow bottlenecks. In the future of accounts payable, AI and automation will drive even greater efficiency and faster processing times.

Cash flow

Cash flow is the injection and withdrawal of cash and receipts that keep the day-to-day operations running.

Good cash flow occurs when the closing balance of cash for a specific time period is higher than the opening balance.

This implies that your customers receive their goods or services on time and that you efficiently process accounts payable promptly, enhancing business relationships and cash flow management.

Profit & loss (P&L)

A financial statement that shows a condensed view of all your expenses and revenues for a given time period such as a financial year or a quarter.

The P&L shows company’s financial position and helps to carefully audit to reduce costs wherever possible and increase profitability using varied tactics.

A well-managed AP process contributes to a positive P&L, ultimately supporting the company's long-term financial health.

Looking to automate accounts payable for your business?

Accounts payable vs accounts receivable

Meaning

Accounts receivable refers to the amount that the company is yet to receive from its customers/debtors. Whereas, the amount of money that the business is due to pay to its vendors/lenders is known as accounts payable.

Cause

In accounts receivable, your business is owed money by buyers for selling goods and services on credit. In accounts payable, your company owes money to lenders from whom you have purchased goods and services on credit.

Responsibility

In accounts receivable, the responsibility for paying the money lies with your debtors. On the contrary, the responsibility of paying the money to the lenders in case of accounts payable lies with you.

Cashflow

Accounts receivable are a source of money being injected into your company. Accounts payable results in a cash outflow from your business to your vendors.

Components

Key components in accounts receivables are your debtors and bills receivable whereas in accounts payable, your main components are lenders and bills payable.

Asset or liability

Accounts receivable are generally considered as an important asset to your business whereas accounts payable are classified as a financial liability.

Accounts payable process flow

A smoother AP process results in faster reconciliation and a consistent cash flow in your organization. This is crucial to raise the overall credibility of your business whilst reducing your liabilities in the long run. Let’s see what the accounts payable process steps look like in any business.

Setting up vendor details

First and foremost, we set up our vendor details to fully know the value and status of our outstanding payments yet to be made to the company.

Setting up vendor details can include any contract made with the vendor describing the terms and conditions of the credit cycle and credit amount, along with the frequency of goods and services received. This step is crucial as keeps both parties in the loop and the information is transparent for all.

Receive invoice and update records

When the invoice is received, the accounts team first validates the invoice with the purchasing order to ascertain that the invoice amount matches the one mentioned in the purchasing order.

Additionally, if any discount or special concession is offered by the supplier at the time of purchasing, it is important to make sure that it is promptly applied in the invoice. Once the match is confirmed, the invoice is updated in the records by the accounts team to be paid at the end of the credit cycle.

Invoice approval and payment

When the credit cycle ends and the payment goes through, the accounts team goes through another reconciliation process, wherein the purchasing order, invoice approval, and payment receipt are all reconciled to ensure that the amount owed is the amount paid and there are no discrepancies in the process.

A successful reconciliation means that the goods and services received are paid for to the correct account.

Repeating the process every week/month

A good AP process flow is one that occurs every week or month instead of every quarter or financial year.

One wrong invoice recorded can lead to your entire accounts payable being out of balance which can further jeopardize the reputation of your company. Therefore it’s necessary to catch these errors sooner rather than later.

Automate your accounts payable process with Volopay

Importance of accounts payable process management

Cash flow management

Managing your accounts payable process ensures that you keep a close eye on your cash flow and improve cash flow efficiency.

Timely processing of invoices and payments helps you maintain a balanced cash flow, preventing unnecessary liquidity issues and ensuring you have the funds available when needed.

It also creates a system of balance to effectively prevent any overspending.

Strong vendor relationships

A well-managed accounts payable process fosters strong relationships with your vendors and enhances operational efficiency.

By consistently making timely and accurate payments, you build a degree of trust and reliability, which leads to better terms and potential discounts, benefiting your business’s supply chain.

It can also create ease of renewals and future procurement processes.

Expense control

By tracking and analyzing your expenditures, you can identify cost-saving opportunities, prevent overpayments, and ensure that spending aligns with your budget and financial goals.

Expense control not only empowers employees but also creates an environment where careful, responsible spending can further company-wide expense management, helping with scalability.

Security and compliance

Proper management of the accounts payable process enhances security and ensures compliance with financial regulations.

Implementing robust controls and audit trails helps protect sensitive information and ensures adherence to legal and regulatory requirements. It also makes sure your teams stay on budget and don’t overspend company funds.

Accurate financial reporting

Accurate management contributes to precise financial reporting.

By keeping detailed records of all transactions and payments, you ensure that your financial statements reflect your true financial position, aiding in better analysis and reporting.

This level of detail also enhances AP data analysis, allowing for more informed decision-making based on accurate financial insights.

Reduced errors and fraud

Effective oversight of the payables process reduces the risk of errors and fraud.

Implementing controls and automated systems minimizes manual data entry mistakes and enhances the accuracy of your payments.

It also lets you enforce policies with actionable solutions. This goes a long way in protecting your business from financial discrepancies and fraudulent activities.

Improved efficiency

Streamlining your accounts payable process improves overall efficiency.

Automating repetitive tasks and centralizing invoice processing reduces the workload on your AP team and accelerates the payment cycle.

This reduction of workload also gives the team a chance to focus on strategic tasks, improving productivity and output within the teams.

Better decision-making

Improved decision-making ultimately drives more strategic business decisions. With accurate and timely information, your teams and executives can make informed choices about cash flow, budgeting, and financial planning.

.

By tracking accounts payable KPIs, the data necessary to make these decisions becomes easier to process, especially if your business sees a large volume with an improved AP process.

Best practices for streamlining the accounts payable process

Establish control and limit access

Establish clear controls and limit access within your accounts payable process. Restricting access to sensitive financial information ensures that only authorized personnel handle critical tasks, reducing the risk of fraud and errors.

Custom user controls can create staggered levels of accessibility for strategists and decision-makers.

Prioritize invoice processing

Prioritize your invoice processing to ensure timely payments. Develop a system that categorizes invoices by urgency and importance, allowing you to manage your accounts payable efficiently and avoid late fees.

Incorporating a system of checks also eliminates the redundancy of processing duplicate invoices.

Leverage technology effectively

Leverage technology to enhance the overall process. Use accounting software and automation tools to streamline tasks, such as real-time invoice capture and payment processing, improving accuracy and efficiency.

OCR-powered accounting software can also streamline the digitizing of physical invoices, saving you time.

Related read - Best accounts payable software in the US in 2025

Organize vendor information

Keep your vendor information well-organized. Maintain an updated database with key details, such as payment terms and contact information, to ensure timely payments.

If your system allows it, add them to your software as recurring payees so you can streamline payment scheduling and consolidate all data.

Transition to paperless operations

Implement digital invoicing and electronic payments to reduce clutter, minimize errors, and speed up processing times.

Transitioning to paperless goes a long way in keeping a clear trail of information that does not get lost or become incomprehensible over time. It also cuts down on storage costs.

Automate processes where possible

Automate repetitive tasks in your accounts payable process. Utilize automated workflows for invoice approvals and payment scheduling to enhance efficiency.

Limiting human intervention in the data entry stage can also reduce manual errors, and free up your AP team for more strategic activities.

To discover how top-rated software can help automate your AP processes and improve efficiency, visit our page on the Best accounts payable automation software in the US for 2025.

Check for duplicate payments

Regularly check for duplicate payments, which can put a major drain on your business’s pocket.

Implement checks and controls to detect and prevent duplicate or erroneous payment these can happen at the invoice stage (if there are errors), delivery stage of goods/services, or even purchase order stage.

Regularly review and update data

Regularly review and update your accounts payable process data. Ensure that vendor information, payment terms, and other critical details are current to avoid delays and discrepancies in payments.

Also, ensure that the data is protected so that mismanaged information doesn’t create more chances for errors.

Monitor and resolve disputes promptly

Address discrepancies and vendor concerns quickly to maintain good relationships and ensure that your payment processes run smoothly.

Dispute resolution tactics should be in place with clear SOPs for your entire team so that any such issues can be resolved efficiently without creating unnecessary concerns for either party.

Reconcile accounts daily

Reconcile your accounts daily as part of your accounts payable process. Regular reconciliation helps you maintain accurate financial records, identify discrepancies early, and ensure that all transactions are properly accounted for.

It also makes sure that necessary transactional data is available for compliance purposes.

Approve invoices and automate payments with Volopay's all-in-one solution

What are the challenges faced by organizations with accounts payable?

Organizations often face several accounts payable challenges, from manual processes to duplicate invoices to communication gaps. Let's take a closer look at some of the key challenges that organizations face when managing accounts payable.

Manual data entry

Entering data manually significantly increases the time it takes to record an invoice, approve and pay it. Additionally, doing it all manually can make the entire AP process error-prone.

This can create a domino effect in your invoice calculations, payments, official records, and so on. To rectify these errors, you’ll have to find them in your spreadsheets, which is like finding a needle in a haystack. That’s the time your accounts team could have utilized doing something more important.

Extreme paperwork

The entire AP process involves reams and reams of paper. From issuing purchasing orders to receiving invoices, approvals, and getting payment receipts, the amount of paperwork required to carry out one vendor’s process is too high.

With so much paperwork, it is very easy to lose track of particulars and filing. One wrong record can set your financial statement back by a lot.

Vendor management issues

An irregular AP process impacts the cash flow of your and the vendor's business leading to a decrease in the vendor’s account receivable and cash inflow.

Jeopardizing their business can sour your reputation and your relationship, and can cost you essential goods and services you need to run your business. Vendors can even report your payment defaults to credit scoring companies which can plummet your business credit score.

Time-consuming and lengthy approval process

With so much paperwork and manual data entry, the entire accounts payable process becomes a long-winded approval process that can actually hinder your business’s smooth cashflow.

When the approval process is long, payment is delayed which can lead to dissatisfaction on the vendor’s part. This can further put your business credit score at risk.

Difficulty with cash flow management

A lengthy, error-prone and manual AP process flow can create an obstacle in the cash flow management of your organization. It is important to remember that delaying payment to your accounts payable can increase the number of days of payment outstanding (DPO).

When cash flow becomes restricted, your accounts payable, or short-term liabilities, can become long-term liabilities, potentially harming your business in the long run. This can negatively impact your accounts payable turnover ratio, as delays in payment will result in a higher DPO and a slower payment cycle, ultimately affecting supplier relationships and overall financial health.

Duplicate payment and payment errors

When the accounts payable process flow is backlogged, it can build intense pressure on your accounts team to clear payments as fast as possible. Hasty procedures lead to forgotten transactions or even double payments.

If overlooked, these faulty payments can snowball into significant and in many cases, irreversible damage to your company’s cash flow, reputation, and creditworthiness.

How AP automation helps your business?

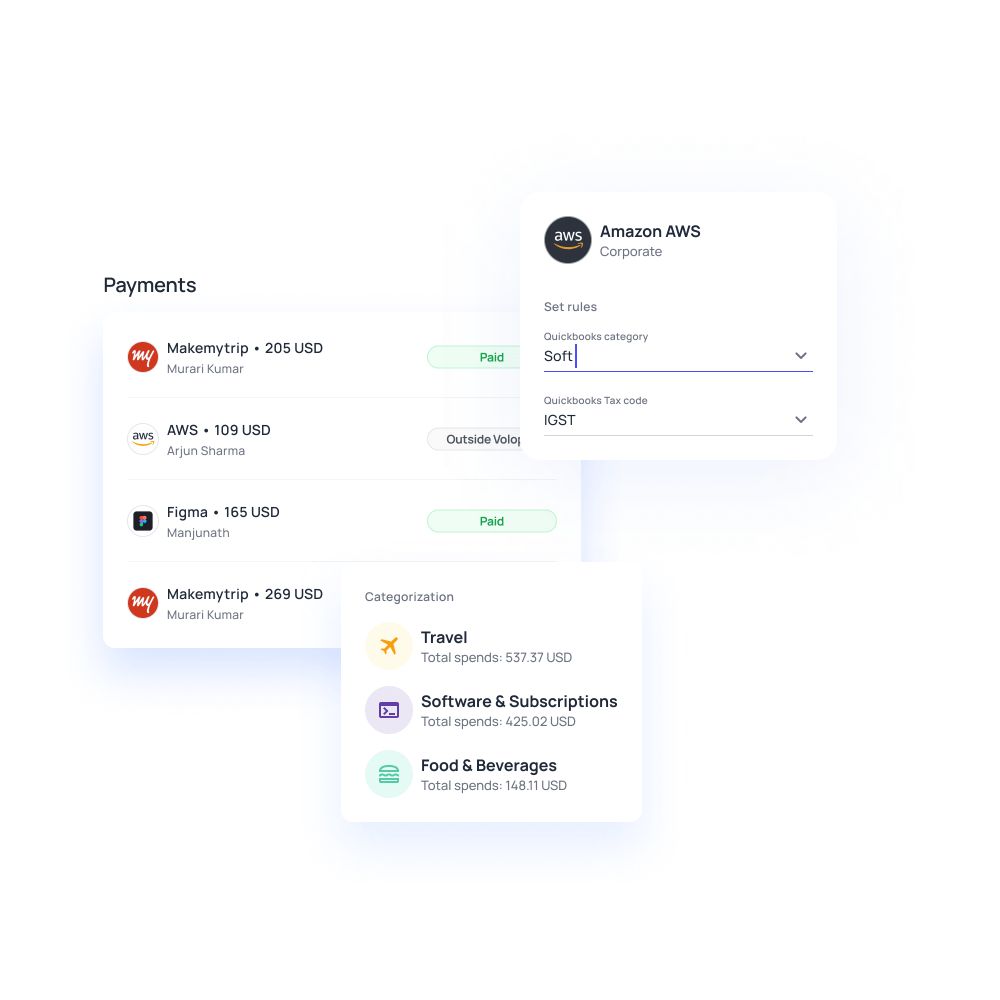

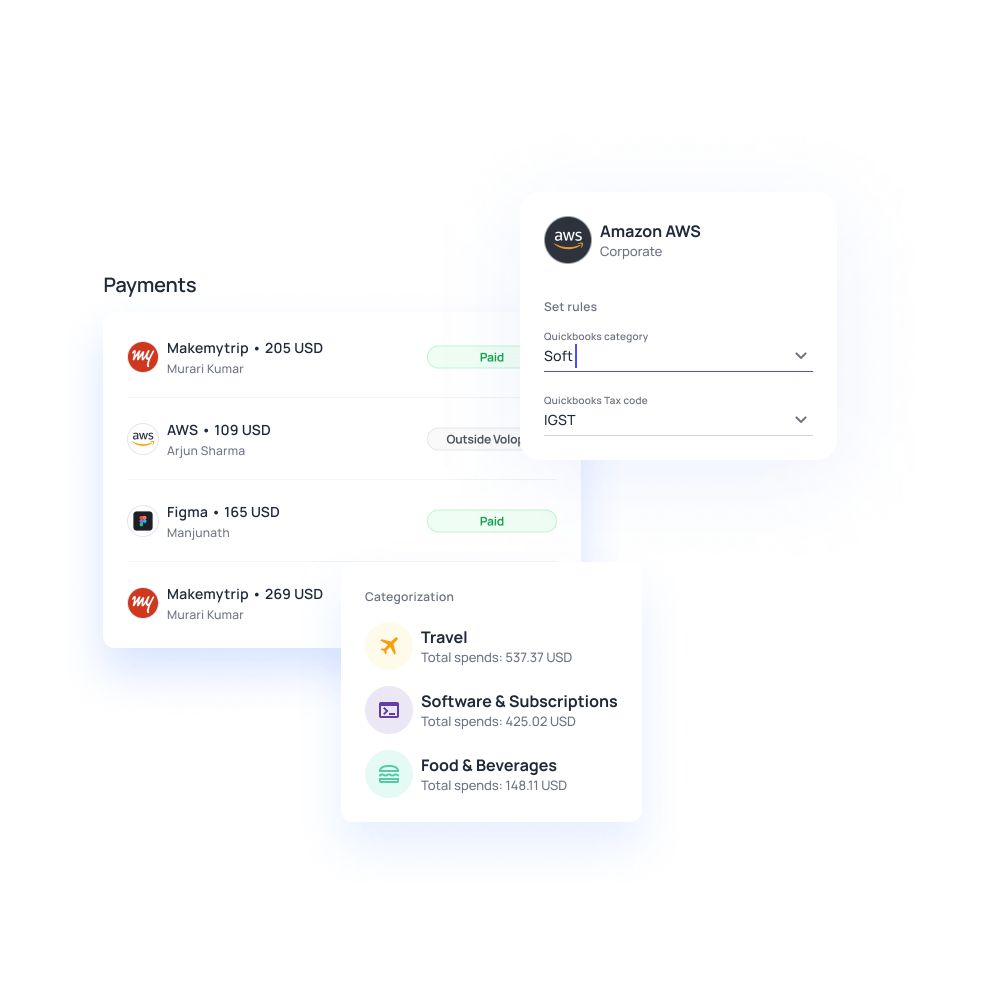

AP automation with invoice management ensures that your vendors can easily submit invoices and get paid on time. Allow vendors to send digital invoices and auto-categorize them.

With AP automation vendors get paid on time and nurture their association with your business which could mean extra discounts and timely delivery for you.

With reliable electronic accounts payable system, eliminate complex documentation. Link all the necessary documents such as PO, invoices, and receipts on one single transaction.

Auditing is simplified, as everything is available under one searchable transaction, allowing for efficient expense reporting.

Simplify and digitize the AP automation process for your accounts team, allowing them to focus on more important and impactful tasks.

This change allows them to focus on tasks such as analyzing data and building cost-effective strategies, thereby improving the company’s overall expense management system.

Automatically link your invoices to the respective vendors and avoid invoice duplication.

Decrease the risk of double payments and secure your financial statements by instantly identifying anomalies and notifying the accounts team.

Accounts payable (AP) software now comes with automated payment notifications that will prompt you to pay your vendors on time.

This means that there are no delayed or forgotten payments. When vendors are paid on time, proper cash flow in the business is maintained.

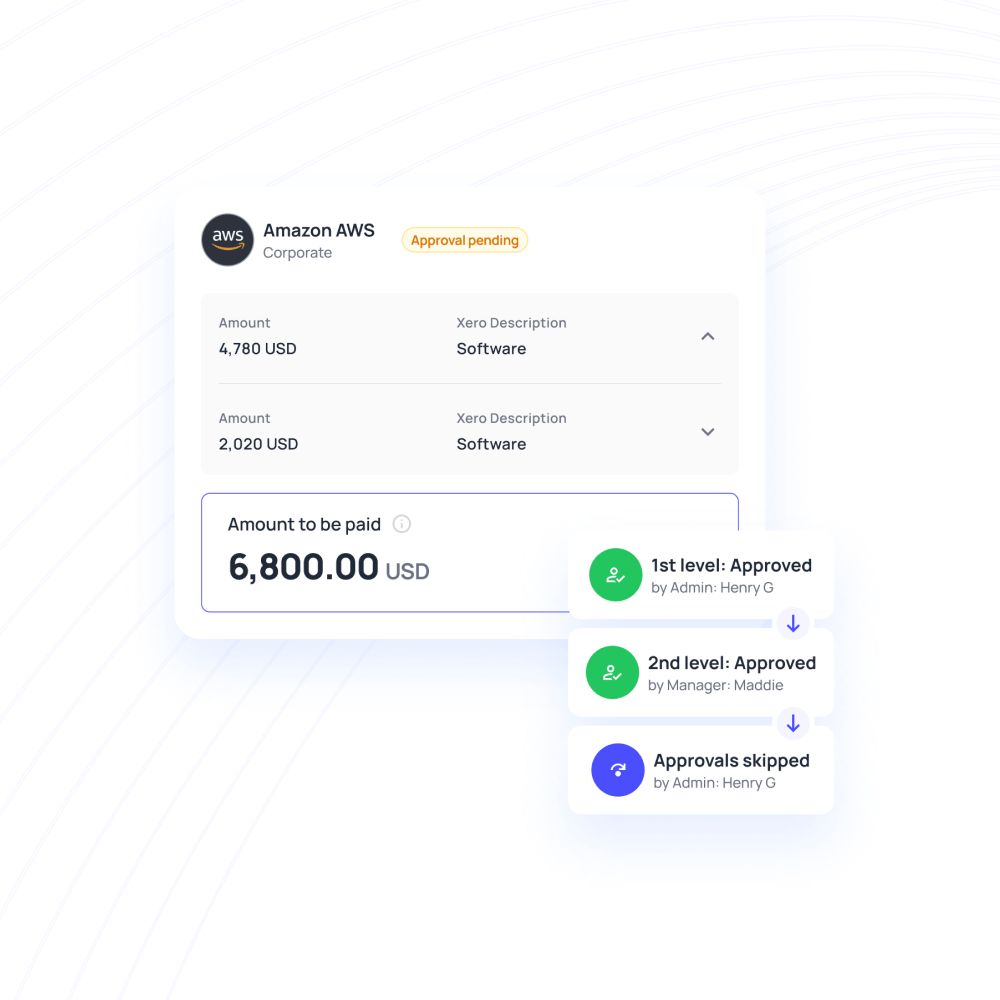

No more chasing authorities to analyze and approve invoices. Easily reconcile and gain approval at the click of the button.

The software notifies the approvers to approve invoices on the go, making the process fully automated and hassle-free.

How can Volopay help in accounts payable management?

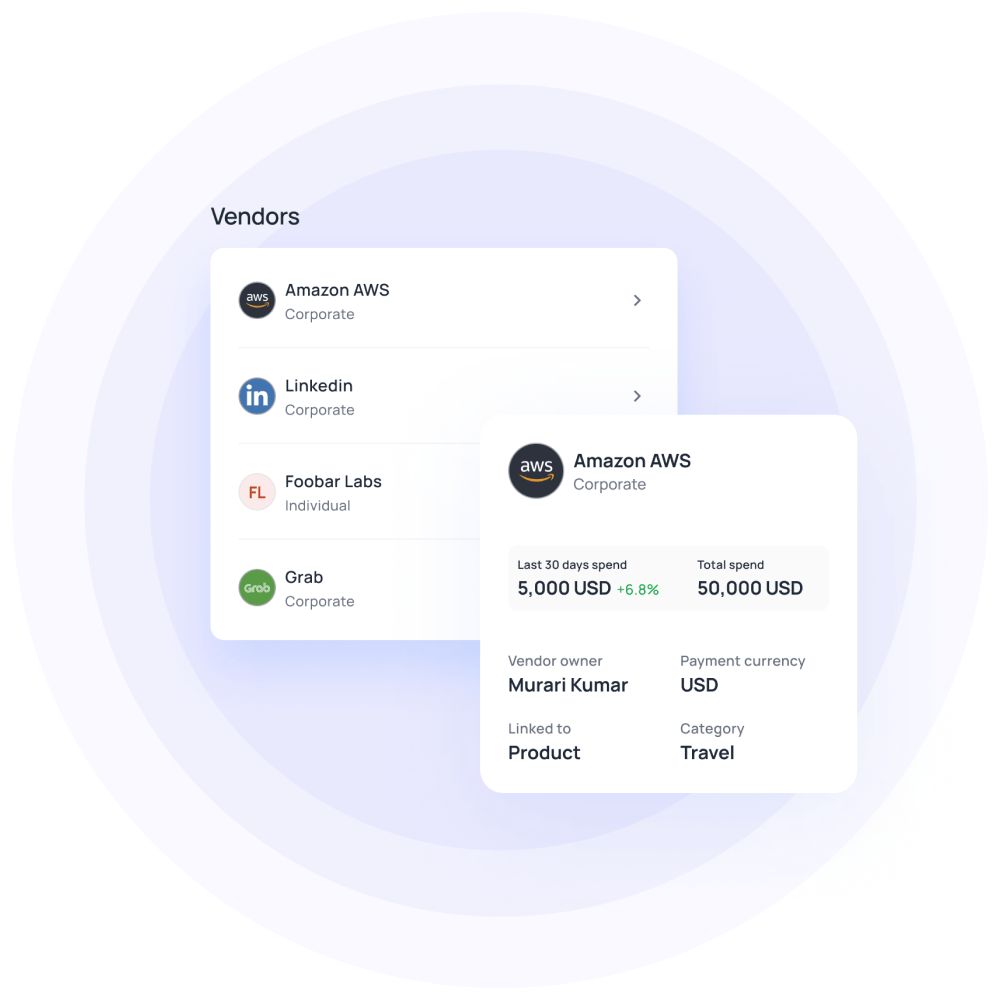

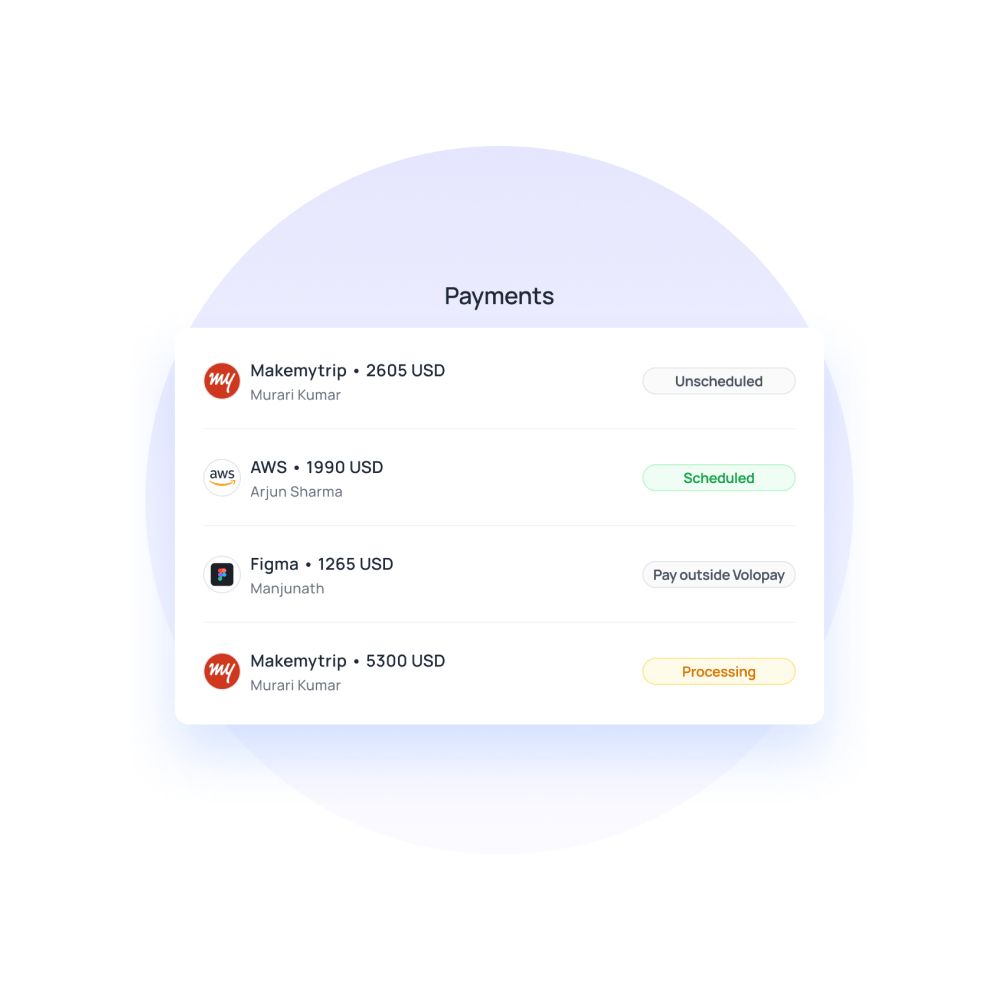

Volopay is an advanced expense management platform that helps you manage all your vendors and process invoices automatically, all from a single dashboard, without ever missing any receipt. With Volopay's accounts payable software, you can create payments and add or remove vendors from your list at any given time.

Volopay comes with all the essential accounts payable software features that any business would need. With seamless online money transferring capabilities, you can send all your payments to your vendors on time, every time. Tracking your outstanding payments has never been easier, with our transparent, real-time tracking dashboard for all your vendors.

You can create multi-level approval for the fastest invoice approval. With Volopay's accounts payable automation by your side, you can experience the seamless integration of invoice management with automated accounting of your choice so that you can export all your payments into accounting software with just a few clicks.

Streamlined invoice processing

Volopay streamlines your accounts payable process by automating invoice capture and approval. This reduces manual handling, speeds up processing times, and ensures that invoices are accurately tracked and processed efficiently.

It also empowers teams with its OCR-powered invoice processing feature called Magic Scan to digitize physical invoices.

Effective vendor management

Manage your vendors effectively with Volopay’s centralized platform. By keeping all vendor information in one place, you enhance communication and maintain strong relationships, making the process more organized and reliable.

The vendor portal allows you to add, edit, and maintain vendor payment and contact information to schedule payments.

Low FX charges

Take advantage of Volopay’s low foreign exchange (FX) charges for international transactions. This feature minimizes additional costs associated with cross-border payments, making your accounts payable process more cost-effective.

The competitive rates combined with transparent cost structures prevent cash wastage on international transactions.

Multi-level approval settings

Implement multi-level approval settings with Volopay to enhance control over your accounts payable. Customize approval workflows to match your business’s needs, ensuring that invoices are reviewed and approved by the appropriate team members.

The maker-checker system lets you add custom approval tiers for streamlined payment processing.

Real-time spend tracking

Manage your multi-entity finances with a consolidated dashboard in real time. Real-time spend tracking allows you to monitor your accounts payable process, stay on top of payments, and manage cash flow.

Instant notifications on card spends and money transfers keep you up-to-date while they get automatically recorded in your general ledger.

Simplified vendor payouts

Simplify vendor payouts with Volopay’s efficient payment solutions. Automate payments and manage disbursements easily, ensuring that your vendors are paid promptly and accurately.

Multi-currency wallets let you make payments in different locations with local currencies, speeding up transaction processing.

Automated accounting solutions

Leverage Volopay’s accounting automation and native integrations to automate data entry, reconciliation, and financial reporting.

Advanced mapping rules let data get auto-classified and transferred to your accounting software (through a two-way sync), reducing manual errors and improving overall efficiency.

Supported by

We are proud to be supported by world's leading investors, founders and senior leadership of world's leading companies.

Get started with Volopay's accounts payable automation software

FAQs

Optimizing cash flow through efficient accounts payable practices involves managing payment timings and taking advantage of early payment discounts.

By prioritizing and scheduling payments strategically, you can maintain a healthy cash balance and improve liquidity.

You should reconcile your accounts payable at least once a month. Regular reconciliation ensures that all transactions are accurately recorded, helps identify discrepancies early, and maintains the integrity of your financial records.

Daily or weekly reconciliations can be beneficial for businesses with high transaction volumes to ensure accuracy and timely financial reporting.

Manual accounts payable processes pose risks such as errors, fraud, and inefficiencies. Mistakes in data entry can lead to incorrect payments, while lack of oversight increases the risk of fraud.

Mitigate these risks by implementing automated solutions to reduce manual intervention, enhancing controls and approval workflows, and regularly auditing your AP processes to ensure accuracy and security.

3-way matching is a critical control process in accounts payable that involves verifying three documents before processing a payment: the purchase order (PO), the goods receipt note (GRN), and the supplier invoice.

This ensures that the details match across all documents, helping to prevent errors and fraudulent payments in your accounts payable process.

Late payments in your accounts payable process can lead to several consequences, including late fees, strained vendor relationships, and potential disruptions in your supply chain.

Persistent delays may also harm your business’s credit rating and hinder your ability to negotiate favorable terms with vendors. Ensuring timely payments helps maintain good vendor relationships and protects your business’s financial reputation.

Automation improves accounts payable processes by simplifying tasks such as invoice capture, approval workflows, and payment scheduling.

Automated systems reduce manual data entry errors, speed up processing times, and enhance visibility into your financial transactions. This results in more accurate financial records, better compliance, and increased efficiency.

Integrating accounts payable with other financial systems offers several advantages, including improved accuracy and efficiency. It enables seamless data transfer between systems, reduces manual entry errors, and provides a unified view of financial information.

Integration also enhances reporting capabilities, streamlines workflows, and ensures consistency across your financial operations, supporting better decision-making and financial management.