Accounts payable turnover ratio explained - Definition and formula

Tracking the performance of your company is paramount to its successful future. By analyzing the numbers behind the business performance. The numbers can get a concrete idea of where your business stands currently and where it is projected to be in the near future.

The accounts payable turnover ratio is one such liquidity metric that can help you track how fast your business is able to pay its suppliers back, over a specific period of time.

Before you can start using and making the best of this metric it would make sense to first understand what exactly it entails, how it is calculated, key areas, and how to analyze and improve the accounts payable turnover ratio.

Accounts payable turnover ratio definition

The accounts payable turnover ratio is a metric that is used to measure the rate at which a business is able to send out payments to suppliers and creditors that extend lines of credit. The ratio is quantified by accounting professionals by calculating, over a specific period of time, the average number of times a company pays its accounts payable balances.

The accounts payable turnover ratio is an important indicator of a company’s ability to manage cash flow and its liquidity on a balance sheet. Bookkeepers should be tracking the AP turnover ratio as an aspect of managing accounts payable to identify issues related to payment.

Similarly, the AP turnover ratio can be used by creditors as a way of evaluating the vendor payment history of a company.

Key areas of accounts payable turnover ratio

High accounts payable ratio

A higher accounts payable ratio signifies that the organization in question is taking a shorter amount of time to pay its bills than those with a lower ratio.

Low accounts payable ratio

While it is not always the case, Low accounts payable ratio could mean that the company might be struggling to pay its bills. A low AP ratio could also mean that the company is using its cash strategically.

Typically, a higher ratio is a benefit for businesses that rely on lines of credit because lenders and suppliers use this metric to determine the degree of risk that they are undertaking.

Accounts payable turnover ratio formula - How to calculate?

To calculate this metric you need to use the accounts payable turnover ratio formula, to do this follow the below steps:

1. Average accounts payable calculation

Start by adding the accounts payable balance at the end of the chosen period with the accounts payable balance at the beginning of the period. Divide the result you get by two to get the average accounts payable.

Average accounts payable = (Beginning accounts payable + Ending accounts payable) / 2

Example: Take a fictitious company’s accounts payable balances as follows:

Accounts payable balance as of January 1: USD 20,000

Accounts payable balance as of December 31: USD 40,000

The average accounts payable balance is calculated as follows:

(USD 20,000 + USD 40,000) / 2 = USD 30,000

2. Total supplier purchases identification

All purchases made on credit must be included here, such as products for resale, purchases of supplies, and payments for overhead items like utilities and rent. Monitoring these purchases is essential for calculating the AP turnover ratio formula, which helps determine how efficiently your business is managing its accounts payable.

In case you are using accounting software, you can run a vendor purchases report easily to get the total supplier purchases and use the AP turnover ratio formula to track your company’s performance in managing payables.

3. Divide total supplier purchases by accounts payable average

Once you have obtained your total supplier purchases and calculated the average accounts payable, you have all you need to calculate the AP turnover ratio formula. Take the total supplier purchases and divide it by the average accounts payable.

Accounts Payable Turnover Ratio = Total Supplier Purchases / Average Accounts Payable

Example: Let’s take USD 200,000 as a company’s total supplier purchases. We’ll use the average accounts payable balance of USD 40,000 which we calculated in the first step.

For this fictitious company, the accounts payable turnover ratio will be calculated as follows:

USD 200,000 / USD 40,000 = 5

Streamline AP tasks seamlessly with Volopay

Analyzing accounts payable turnover ratio

The number of times you paid off your accounts payable balance during a certain period, such as monthly, annually, or quarterly, is what is signified by the accounts payable turnover ratio. If you have an increasing or higher AP turnover ratio it probably indicates that, in comparison with previous periods, you have been paying your bills faster.

On the other hand, an account payable turnover ratio that is decreasing could mean that your payment of bills has been slower than in previous periods. The issue here is that the AP turnover ratio cannot be used on its own to determine a business’s ability to pay its suppliers and vendors. It can, however, serve as a signifier that you need to look into why your company has a low or a high ratio.

For instance, a high ratio doesn’t always mean a good thing because it could also be an indicator of the fact that because of negative payment history you have very short payment terms with vendors. You should also take into consideration the accounts payable turnover ratio industry average for the industry you work in.

Ratios that are good for a grocery retail chain might not have the same meaning for a fashion retail brand. Compare your ratio with the industry average to get a better idea of where you stand.

Lastly, you must also take into account the trends in AP turnover ratio over different periods of time. You must also keep an eye on whether there are times during the year when your turnover ratio is consistently high or consistently low. If they are, you must further investigate. These are all factors that lenders will take into account when considering you for a line of credit or loan.

What is a good accounts payable turnover ratio?

A good accounts payable turnover ratio in days (DPO) is determined by benchmarking with your industry and your business. Accounts payable turnover depends on your company’s payment timing policies and the average credit term days received from your vendors.

Policies must support good credit history, vendor relationships, and continuing inventory shipments from suppliers. Days payable outstanding (DPO) is basically the accounts payable turnover in days.

Based on the average number of days in the turnover period, DPO is a different view of the accounts payable turnover ratio formula. The DPO formula is calculated as the number of days in the measured period divided by the AP turnover ratio.

The Days payable outstanding should relate reasonably to average credit payment terms stated in the number of days until the payment is due and any early payment discount rate offered.

How to improve your accounts payable turnover ratio?

Given below are some strategies you can use to improve your AP turnover ratio:

1. Balancing the cash inflows and outflows

Balance your cash inflows and outflows to get a better understanding of how to improve the AP turnover ratio. It can help you with finding a way to keep sufficient cash on hand that may be required to support the goals of the business.

If you don’t have enough cash available your ability to pay bills will definitely suffer.

Suggested read: Automated invoice processing to better manage cash flow

2. Effective management of supplier relationships

Supplier relationships are integral to the accounts payable processes of your business. Effectively managing them can get you deals, offers, and discounts on accounts payables which in turn can help improve your AP turnover ratio.

3. Automating tools to eliminate human error

Errors in processing accounts payables can be another reason why your business may not have a good accounts payable turnover ratio.

Invoice processing errors and other discrepancies could lead to duplicate payments, delayed or even missed payments. Such errors could increase the costs you incur from accounts payables and in turn negatively affect the AP turnover ratio.

Related read - Accounts payable automation to streamline vendor payouts

4. Integrating with vendor data systems

Vendor data systems are a boon for accounting departments that struggle with huge amounts of vendor or supplier information.

Integrating with a vendor data system can help you consolidate, update and manage vendor data in real-time, this can help you streamline your accounts payables and therefore also the AP ratio.

5. Getting full transparency into the company’s spend

Knowing where your money goes and what it is being used for is a must-do for efficient business management.

Having full transparency into your company’s spending behavior can give you great insights into the areas where accounts payable turnover can be improved.

Transparency and visibility can help you catch cases of overpayment, redundant expenditures, obsolete purchases, and other such AP shortcomings.

6. Auditing how an organization is managing its cash flow

It goes without saying that managing cash flow is an important part of business management. Auditing how you manage your cash flow can help you identify the impact reducing days payable outstanding might have.

7. Evaluate the accounts receivable turnover ratio

Your accounts receivable turnover ratio is also an element that will have an impact on your company’s accounts payable turnover ratio.

Evaluating the AR turnover ratio can help you determine if delays in collections are having an impact on your ability to cover expenses.

8. Pay vendor supplier bills on time

Proactively paying supplier or vendor bills on time will not only help you build a better relationship with them but also improve your AP turnover ratio.

Paying bills on time faster will give you a higher AP turnover ratio which in turn will help you get better loans and lines of credit.

9. Leveraging early payment discounts

Leveraging early payment discounts can help you save a lot of money from account payables. To promote timely payments vendors and suppliers often offer discounts and deals that can help you save money.

Not only can this help reduce the costs you incur as a result of accounts payables but it can also help improve your AP turnover ratio by reducing the amount of credit you have to process.

Related read: How to negotiate with vendors to optimize costs?

Seamlessly maintain your accounts payable turnover ratio with Volopay

Need a solution that can both maintain and help you streamline your accounts payable turnover ratio? Look no further. Volopay is the answer to all the accounts payable needs your business has.

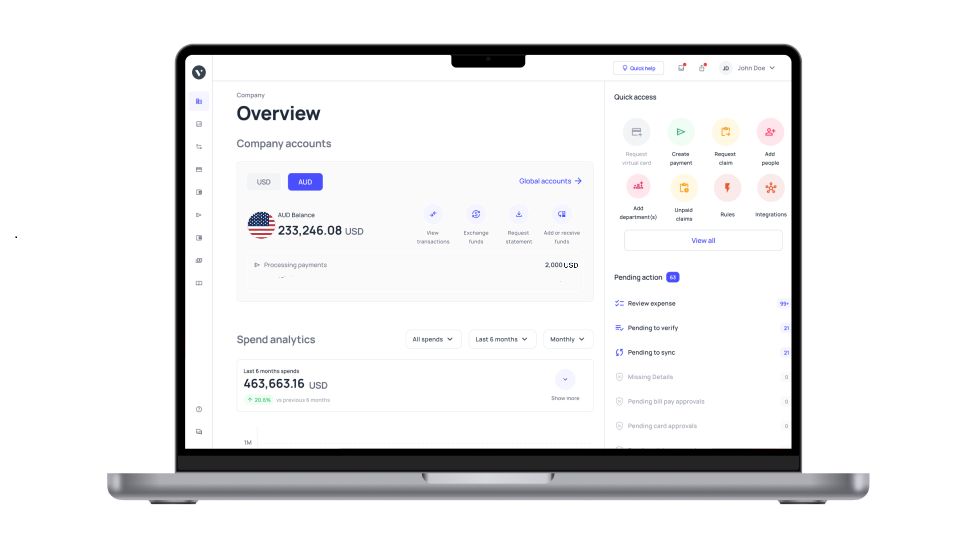

With Volopay's accounts payable solution, you get a comprehensive consolidated dashboard that is capable of managing accounts payable process completely.

Invoice processing, expense reporting, subscription payments, approval workflows, and even accounting integrations, all of these can be handled simultaneously by using Volopay.

The best part is that tasks happen in real-time and in an automated fashion. This means there’s little manual labor involved and you get constant visibility over cash flow.

By tracking your cash flow in real-time you can also make adjustments to accounts payables in real-time, therefore giving you the opportunity to improve the accounts payable turnover ratio quicker than you would otherwise be able to.

In conclusion, you can use Volopay to not only maintain your AP turnover ratio seamlessly but also a host of other processes associated with accounts payable.

FAQ’s

Generally speaking, a good accounts payable turnover ratio indicates that the payment of accounts payable obligations is done more quickly.

If the number of days increases from one period to the next, this indicates that the company is paying its suppliers more slowly, and may be an indicator of worsening financial condition.

You can reduce accounts payable days by paying your vendor or supplier bills faster.

It depends. If your business relies on maintaining a line of credit, lenders will provide more favorable terms with a higher ratio. But if the ratio is too high, some analysts might question whether your company is using its cash flow in the most strategic manner for business growth.

A decreasing turnover ratio indicates that a company is taking longer to pay off its suppliers than in previous periods.