What is accounts payable days? - AP days formula

Tracking and analyzing company performance over a period of time is essential to the future growth of your organization.

Without vetting past performance you’ll never know where your business is lacking and what areas of improvement need to be addressed earliest. The same goes for your accounts payables.

The accounts payable days, creditor days, or days payable outstanding (DPO) is one such metric that can give you important insights into how fast your business is able to pay its creditors.

But, before you can move forward and make the best use of this metric you need to know how to calculate accounts payable days.

What are accounts payable days?

Days payable outstanding (DPO), accounts payable days ratio or creditor day is a financial ratio indicating, in days.

It is also the average time taken by a business organization to pay its invoices and bills to its trade creditors, and creditors may include vendors, suppliers, or financiers.

Accounts payable days calculation is typically on an annual or quarterly basis. It indicates the status of cash outflow in your company, i.e. how well it is being managed.

A higher value of accounts payable days of a company means that it takes longer time to pay bills.

This could mean that the company is able to hold funds for a longer period, which then allows the company to maximize the benefits it can gain via the utilization of these funds.

High accounts payable days, however, could also indicate that the company is unable to pay its bills on time, which could be construed as a red flag.

Why is it important to calculate accounts payable days?

Given below are some reasons why it is important to calculate accounts payable days.

1. Improve vendor relationships

Simply put, accounts payable days calculation gives you insight into how fast your company is being able to pay back its vendors, suppliers, or financiers. If your company is slow to pay its bills then obviously relationships with vendors will suffer.

By accounts payable days calculation you can catch these delays and address them before they can hamper your vendor relationships. In addition to this managing vendors through a vendor management system can also help drastically.

2. Optimize accounts payable workflows

Accounts payable days calculation can also give you insight into how well your accounting department is functioning and how efficient its workflows are.

If your AP days payable outstanding is too high it almost always means that something is wrong with your system and your workflow probably has something to do with it.

In case you face this situation the AP days calculation can help you detect shortcomings in company workflows and address them as the earliest.

3. Find early payment discounts

In addition to optimizing workflows and improving vendor relationships, accounts payable days calculation can also help you make the most out of early payment discounts.

If your AP days payable outstanding is too high then it’s likely that you are missing out on these discounts. It also indicates that you should look into these delays and fix them so that you can enjoy early payment discounts.

Which is the formula for calculating accounts payable turnover?

The accounts payable days formula looks something like this:

Total supplier purchases ÷ ((Beginning Accounts payable + Ending Accounts payable) ÷ 2)

Let’s understand this better with the help of an example:

The controller of company ‘A’ wants to calculate accounts payable days for the last year.

At the beginning of this time period, USD 500,000 was the beginning accounts payable balance, and USD 750,000 was the ending balance. Purchases were USD 50,00,000 over the last 12 months.

With this data accounts payable turnover can be calculated as:

Purchases USD 50,00,000 ÷ ((Beginning payables USD 500,000 + Ending payables USD 750,000) / 2)

= Purchases USD 50,00,000 ÷ average accounts payable USD 625,000

Therefore, accounts payable turnover = 8

*Note: Modify this calculation to exclude cash payments to vendors and only include purchases on credit. AP days will be too low if you include the cash payments.

How to calculate accounts payable days?

Following on from the example used above, we understand that the company ‘A’ in question had accounts payable that turned over the last year 8 times.

To convert this and get the accounts payable turnover days calculation we can divide the number by 365:

365 Days / 8 turns = 45.6 Days

What are the best ways to reduce your accounts payable days?

1. Balance cash outflow & inflow

To balance cash outflow and inflow you need to take a look at the payment terms both you and your vendors work on.

If there is an imbalance in the number of days try to change it so that there is more parity, this can help you improve the balance and therefore reduce AP days payable outstanding.

2. Cutting invoice processing time

By reducing the time taken by your AP department to process invoices there will be a direct impact on your accounts payable days. Faster processing will mean lesser days taken to pay bills.

3. Saving on invoice processing costs

By reducing the costs incurred on invoice processing you also reduce the number of payables that are due on your behalf which, in turn, will also reduce your AP days.

4. Paying suppliers & vendors on time

Similar to faster invoice processing, fast vendor payments will also mean lesser time taken to pay bills and therefore lower your AP days payable outstanding.

5. Streamlining the overall AP process

The efficiency of your overall accounts payable process will, again, have a direct impact on how fast you are able to pay your invoices or bills. If your accounts payable process is slow then, consequently, your accounts payable days will be high.

To avoid this you can streamline your overall AP process or just get an AP automation system that drastically reduces the time and resources taken to process accounts payable.

How does Volopay help in reducing your accounts payable days?

The most direct route to reducing AP days payable outstanding is to streamline your overall accounts payable system.

Additionally, the best way to streamline your accounts payable system is to automate as much of it as possible. This is where Volopay comes in.

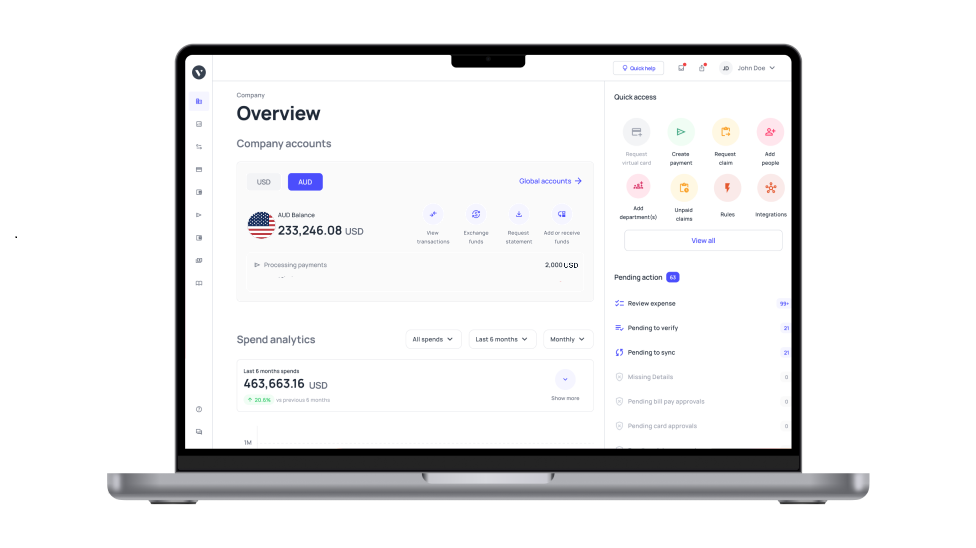

Volopay is an all-in-one accounts payable platform that is capable of automating and streamlining the entire accounts payable system end to end for a business.

You can use Volopay to automatically process invoices, pay vendors or suppliers, record expenses and reduce the amount of time and resources you spend on accounts payables.

In addition to the above features, Invoice approval workflows can also be automated via Volopay and you can also set up auto-payments to ensure your payments are always on time.

Enjoy the benefits of early payments, faster invoice processing, and an overall reduction in days required to process accounts payables.

Streamline your AP process with Volopay

FAQ's

Depending on your situation and requirement for the metric, a high accounts payable days could either mean that you are taking too long to pay your bills or it could mean that you are strategically using your cash flow.

A low DPO either means that you are paying bills in lesser time (which is good for creditors) or it could mean that you are not using your cash to its fullest potential.

Increasing accounts payable days could result in your company having a harder time getting loans or credit. But at the same time, it could also result in your company having more money to invest strategically.

It depends on your business requirements. If your company is looking to get a loan or credit then low DPO is good but if you’re looking to have cash in hand to invest in strategic areas high DPOis your best friend.