How to conduct an accounts payable risk assessment?

One of the crucial functions of the accounting department is accounts payable. They manage vendor payments and maintain relationships with them for smooth business operations.

As long as the payment goes uninterruptedly, nobody realizes the need for accounts payable risk assessment and management. But that doesn’t mean that our current payment systems are picture-perfect.

There are many inefficiencies in traditional accounting processes that lead to payment fraud. When fraud happens, you lose money and put your reputation at stake.

Hence, the goal must be to save vulnerable systems against internal and external fraud.

What is an accounts payable risk assessment?

Often confused with accounting audit, accounts payable risk assessment is a tool to conduct risk evaluation. This is a process carried out to ensure that there aren’t any underlying risks in payment systems.

If these risks are left unaddressed, it can turn the system vulnerable and attract security issues.

How is accounts payable audit different from accounts payable audit risk management?

An audit is an extensive process of checking a company’s financial records for a particular duration to ensure that the data is accurate.

Whereas, accounts payable risk assessment is mainly concerned with evaluating the strength and effectiveness of internal controls. It’s about determining what methods have been used to shore up the AP system’s weaknesses.

Related read - What is an audit trial and why you should automate it?

How to conduct accounts payable risk assessment for a business?

To prevent risks, you should know where the system is open and exposed. The following methods can be put into experimentation to identify the risk sources and prevent further damage.

1. Improve the risk assessment tool with AI

Accountants are already swamped with payment-related tasks. Implementing manual processes for risk assessment adds to their workload, creating unnecessary stress.

To avoid this, automation technologies and AI can be applied to produce accurate results at a reduced load. For starters, procurement processes can be automated and integrated with AI.

This way, it’s also possible to apply continuous improvement input at every stage of the purchase-payment cycle.

Cloud-based data systems can set up the infrastructure required to gather, analyze and process data centrally from one place and data analytics and ML can be used to identify bottlenecks, hindrances, and inefficiencies in the overall procurement-payment process.

2. Identify sources of potential risk

Like a financial audit, even risk assessment starts with collecting data from various accounting sources. This is done to measure which areas are overly exposed and might be a threat to an organization's health.

The sooner you find it, the quicker you can react to isolate the threat. Sources of risk that you can take into consideration are.

• Maverick spend:

These are expenses handled out of the payment system. They don’t have payment proof and might not even have a vendor contract.

Companies engage in this as they want to receive products in better terms and conditions. It can damage the cash flow predictions as they are not reported.

Due to incorrect expense predictions, you will be forced to allocate resources reserved for other important expenditures

To correct this, you will have to make automated reporting and vendor management mandatory and integrate them. Or use process mining methods to understand your uncontracted purchases.

• External fraud:

Over 80% of organizations have faced some kind of fraud during their existence. Regardless of how severe this is, it’s important to be vigilant and cut off such activities.

Remember that no external source can swindle you without any internal help (even if it’s unintentional, such as carelessness). Such fraud can happen in two ways.

1. Kickback - When a vendor collaborates with someone within the organization to gain preferential treatment or receive/sell products at an inflated cost. It’s more like an act of bribery and is considered unethical.

2. Collusion - The collaboration of an employee and an external vendor where the vendor sends fake bills to receive extra money. This gets split between both parties.

3. How to avoid external fraud - The use of automated payment systems with advanced approval methods and 2 or 3-way invoice matching systems. Every received and processed invoice must also be linked with the vendor management system. Vendors must be vetted.

• Internal fraud:

Forgery can happen without the help of a third party too. Employees who are directly involved in the payments department have many ways to steal company money.

They can be masked well under the label of cut-off payments too. Hence even the internal control doesn’t notice and prevent this risk.

These swindlers create fake bills with fake vendor details and get them processed. Or they indulge in check fraud where they redirect the company’s money to dummy accounts managed by similar fraudsters.

Only automated accounting management can prevent this by bringing transparency and control over fund disbursement. As expenses go through automated approvals and always appear in the system, no one will risk committing such crimes.

• Payment delays or duplicate payments

If you follow manual methods to organize bills, one or two things can easily slip through causing a ruckus. This includes missed bills, duplicate payments, payments sent to the wrong users, etc.

As there is no centralized place to manage them, these errors can go unnoticed for a long period. Unlike external and internal fraud, this doesn’t happen intentionally but is still a loss.

How to fix issues with payments? - Automating the entire billing cycle and monitoring from start to end is the only way out. It includes removing manual intervention as much as possible.

Rather than this, you set up a workflow to receive, guide and process every invoice in a streamlined way. Therefore, no invoice will go missing or get processed twice.

3. Document the assessments and findings

Once you are done with the evaluation process, list down the risks you have found along with the recommended solution.

Be clear and precise when you explain both. Don’t write only the solution but the workflow, rules, and tools involved and how they are interconnected to prevent risk.

If fake vendor bills created internally are the risk you found, document how it happens. And explain how the vendor management solution will solve this. Repeat this for every concern.

4. Implementing the improvements

Now get real with segregating the risk factor and applying accounts payable risks and controls measures.

Find vendors who can provide the required solutions for the above issues. Communicate with the teams the expected results. Follow up with involved teams to notice improvements.

Risk assessment is not a monthly checkup but a continuous process. If you make this a practice or find permanent solutions, there won’t be any big surprises during accounts payable risk assessment audits.

Automate to reduce your accounts payable risks

Key questions to answer in accounts payable risk assessment

By asking your AP team specific sets of questions, you can understand the anticipated risks.

1. How do they receive invoices?

What’s the format and method in which invoices get delivered to your office? Are they sent in hard copies through the mail? Or as PDF attachments through email? Or through invoice generator software?

The second one is the most common, but there are still some who send paper invoices. Your team has to receive and scan it into your system to process it.

There lies a risk of missing or damaging them. PDF attachments are the potential sources of trojan viruses or ransomware putting your computers at virus attack risk.

Automated invoice processing software is the way to cut down these risks at source.

2. How often do invoices go missing?

Manual invoices have a higher tendency to go missing. If it goes untrackable before its due date, the chances of disappointing your vendors are higher.

An automated and centralized invoice-capturing system is the smartest option to tackle this.

3. How do they input invoice data into the system?

After receiving an invoice, they have to capture its details to send payment. How do accountants do that in your organization? Do they manually type in information?

They can easily mistype or missing characters, causing wrong payments. It’s also too much manual work.

However, there are organizations that have skipped this by adapting touchless technologies. Without doing anything, the data from the invoice can be captured in the payment systems. This creates the 100% accuracy that we aim for.

4. How much time it takes to get necessary approvals for payments?

If your accountants are spending more than 5 hours a week, then they are simply wasting their time. It should take less than an hour per week to chase down invoices.

Automated workflows will free up accountants from this task and route invoices on their own.

5. How much time they take to process an invoice?

What’s the average time your team takes to clear an invoice? Ideally, it must be lesser than a week.

But given the lagging process and delays from approvers, it takes 15 to 20 days. Automation cuts it short and processes the invoice within 2 to 3 days.

6. How often invoices go misplaced

Storing invoices before and after processing them is important. If you lose them, your records will be incomplete, and tracking down a processed payment becomes difficult.

If your vendor follows up on a paid invoice, you will have no proof and pay what’s asked. Avoid duplicate payments by maintaining invoices and payments under one system.

7. How are the outstanding payments being displayed to the management?

Only when the pending liabilities are communicated openly can the finance team allocate resources to clear them on time.

Prolonging them only increases the complication around it. Accountants take extra time to report them and there is no way to readily access this data in real-time.

Why Volopay is the best solution for your accounting automation needs?

It’s better to be late than never. Bypassing risks works the same way too. Instead of performing risk assessments and rectifying them later, you can strengthen your AP network. To do that, you need accounting automation software.

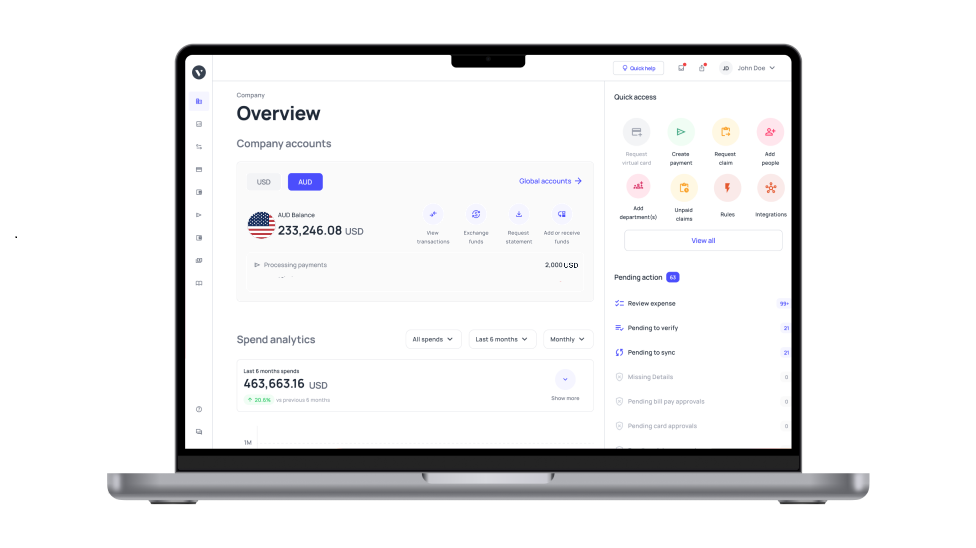

Volopay is a cloud-based accounts payable software that can be used to automate the entire accounts payable process such as your bills and business payments. It’s safe to use as the data stays safely in the cloud and travels in an encrypted format.

It has custom invoice approval workflows where you can set multi-level approvals for every payment. Thus, it gives no chance to perpetrators to falsify bills or duplicate payments.

It also has a reimbursement platform for expense reporting. It accepts receipts, routes through multi-level approvals, and takes them for clearance.

It prevents unauthorized expense categories by cross-checking with your expense policies. You can also distribute corporate cards to minimize the workload further.

It also has other tools to support safe and quick domestic and international transactions. By managing all vendors and their invoices in one place, you prevent vendor-related forgery.

Department managers and finance teams get the transparency they want. They can always view current, past, and ongoing payments on the dashboard.

So, there is automatic risk prevention. Volopay not only helps with mitigating risks but quickening payments too.

FAQ’s

Taking too long can cause disputes with vendors as they expect your money to fund their operations and development plans. If any banking issues arise, it can further delay the payment causing your vendor to impose a fine for that. This is not good practice to develop long-lasting vendor relationships.

You can mitigate risks in accounts payable by practicing the following tips

1. Streamlining outgoing payments and bills using automated and trackable software.

2. Working on internal controls and design workflows that are strong, incessant, and cover the right points.

3. By conducting accounts payable audit risk assessments frequently to ensure that everything functions properly.

Conducting risk assessments in accounts payable will take less than a week only.

After the accounts payable risk assessment process, you discover the problematic areas in AP and find viable solutions for them. Then, you observe how the solution works and focus on continuous improvement.