What is an audit trail and how to automate it?

What are audit trails?

An audit trail is a detailed and chronological collection of documents or files that can prove and validate the accuracy of your financial statements. An audit trail is used to verify all kinds of data– transactions, work processes, accounting details, anything that contributes to the financial records of your company.

Auditors start with the ultimate statement and then work in reverse, carefully analyzing not just every document but also analyzing updates and alterations made to the final records, as well as people who made them. Every approver and executor of each transaction must prepare you with documentary evidence for it all. You can think of an audit trail as a mandatory, full-body MRI, but for your business.

Auditors need to go through your financial records to verify that the business is utilizing money legally. They compare company ledgers against credit card statements and other financial data to ensure that every record is accounted for. You can do internal audits whenever you want, however mandatory auditing is done by either a government agency or a third-party auditor for legal or acquisition purposes. Audits are a way to prove your legitimacy to the government and also a way to build trust and raise funding from potential investors.

What is included in audit trail documents?

Now that we know what an audit trail is, it’s important to know what kind of documents collectively form the audit trail data. Here are some obvious and some not-so-obvious files and documents that are included in an accounting audit trail and logs:

1. Purchase orders (wherever applicable), invoices, and receipts for every transaction.

2. Documented approval for aforementioned transactions by concerned authorities.

3. Logged detailed history of alterations and customizations to any request or approval.

4. Valid reasons for any transaction or record whose documentation is not provided to the auditors.

Solely providing these documents will not work. These documents need to be attested with some form of validity or authenticity that can mark them as genuine documents, otherwise, any bit of paper can be called a document. All documents provided should ideally contain these details to be recognized as official files:

1. Date and time stamp.

2. Crystal clear mention of the specific transaction.

3. Any sort of identification for the approver (image, employee ID, official stamp, etc.)

4. A chronological record of any changes made in the document, with their respective date & time entry and approver’s ID

Even after following all these steps, auditing remains, for most businesses, a nerve-wracking process. Let’s look at traditional methods of managing an audit trail that has held businesses back for decades.

What makes audit trails complex process?

Paper records

In this day and age of hyper-digitization, relying on paper-based records is like starting a fire using stones when there is a perfectly good lighter right beside you. Paper-based records such as invoices, receipts, purchase orders, expense claims, etc are poor forms of audit trail data.

They are prone to human error and difficult to store properly with a high risk of getting lost. Even governments encourage digitizing your receipts, expense claims, and invoices. It is the most secure way to ensure that your audit trail is easily accessible and harder to lose, given that you store them properly and chronologically.

Tedious approval process

When employees make a substantial purchase using the company’s money and resources, they need their manager’s and even executive approval to carry it through. To get this kind of approval, employees commonly use email correspondence that although is digital and can be saved as documentary evidence, however, it is in itself a very tedious and time-consuming process.

Every single email has to be forwarded to the finance team to keep them in the communication loop. It is also extremely difficult to find them during an audit when you have to go through thousands of emails to find one specific correspondence. What you need is a form of approval workflow that’s weaved into your purchasing process to eliminate lengthy email chains.

Chaotic nature of company credit card

Among the numerous issues that plague company credit cards, one of the most notorious problems is the fact that company credit cards are not designed to be shared among employees. Since there is no way to keep a tab on who purchased what while using a business credit card, it becomes a bigger nightmare during auditing season, when you have to explain every single credit card transaction.

Conversely, if you limit credit card usage to only specific office managers and finance teams, that would require only a handful of people to make all the purchases for every department in your business. This is a clear wastage of time and your employees’ efforts. While these issues are troublesome, know that you can simply eliminate them all by adopting an audit trail software that can effortlessly automate audit data for you so you have everything you need to prove your financial records at a moment’s notice.

Importance of automating your audit trails

One of the scariest terms in financial accounting is audit. Ensuring your financial records are 100% accurate is the most important part of running a business. After all, one tiny miscalculation left unchecked can result in an avalanche of problems, and can very well be the end of your business.

From investors to shareholders and the government, everyone needs to be reassured that your business is functioning exactly how it claims to function, and audit trails are a surefire way to reflect the transparency of your business or bring minute yet glaring inaccuracies to light.

Needless to say, then, that audit time is a scary time for everyone involved, especially your finance team. However countless hours of chasing paperwork can be saved by simply digitizing all documents and automating processes before your audit. In this article, we’ll learn how you can lessen the terror of auditing by harnessing the power of automated accounting for audit trail data.

Why do you need to automate your audit trail reports?

1. Encourages user accountability and compliance

Proving compliance is one of the most essential parts of the audit trail; it is also difficult to prove with traditional methods of bookkeeping. Due to its dynamic nature, satisfying compliance is undertaken as a separate task altogether.

However, by automating workflows through a centralized platform, you can not only capture information accurately but also know that it’s automatically audited in real-time since there is no room for error. Additionally, especially in approval workflows, since every approval carries full information about the approver along with the date and time of the approval, user accountability is also automatically enforced.

2. Clear insights on business transactions

When business processes are saturated with paper documents, it can make your accounting audit trail and logs less transparent and efficient. Automating the database into a centralized portal for all receipts, invoices, approvals, and other documents aids with visibility and allow business owners to gain valuable insights to review their processes and optimize them for maximum productivity.

3. Increases efficiency and protects against fraud

One of the biggest and most noticeable benefits of automating the audit process is the increased efficiency it brings to the organization. Manual, tedious activities are automated, freeing up thousands of working hours for your employees to delve into more meaningful high-value tasks.

This further decreases the need for additional employees to carry out mundane activities, thereby saving you time and money. Since every execution in an automated workflow is duly recorded along with the executor’s information, automation protects the business from fraudulent activities by notifying dubious activities in real-time, strengthening overall audit trail data security.

4. Integrates accurate information

One of the most labor-intensive tasks during an audit trail is to compile fragmented information from multiple sources. Imagine compiling every paper-based purchase order with its invoice, receipt, and the respective approval email buried under thousands of similar emails - a nightmare indeed!

Automation allows businesses to integrate this audit trail data by storing it in one centralized location and predefined workflows, thereby accelerating the time taken to complete the auditing process. When the time comes, it is presented as a single audit trail in accounting software, containing the necessary information for a smoother auditing process.

How to automate audit trails?

To automate audit trails, you need solutions that help you digitize documents necessary for auditing and capture information at the payment point itself. Let’s look at ways you can automate audit trail data to work smarter, not harder:

Transaction data

One of the key components of an accounting audit trail and logs is your transaction history. However, with multiple payment methods in effect, it gets difficult to avail your entire payment history whenever you require it. Instead of perusing through hundreds of credit card statements, invoices, and expense reports, you ideally require audit trail data capture at the source to be made available at one centralized database.

That is why having an all-in-one spend management solution is your best bet to have everything from invoice management to employee reimbursements, and physical plus virtual card payments, all in one central repository. Every transaction is recorded and source and automatically compiled so you don’t have to.

Requests and approval workflow

Requests and approval go hand-in-hand, both during purchases and claiming employee expense reimbursements. When a request is made, it has to be approved, either through e-mail or in written format. With automation, you can create approval workflows within the payment system itself.

Whenever an employee wants to access funds, either by creating virtual cards, corporate expense cards, or employee reimbursements, it must be approved by the designated authority, who is notified the moment funds are requested or a claim is made. By automating approval workflows you have a detailed report regarding the transactions, persons requesting and approving it, date, time, and purpose of spending all in one centralized location.

Digitize documents

The most frustrating portion of auditing for the finance team is the mind-numbing paper chasing, whether it is invoices or their corresponding receipts. Part of the problem is that employees do not submit these documents on time, since there is no hassle-free way for them. By automating invoice and expense reporting through a mobile or web application and submitting digitized invoices and receipts, whether it’s an image or a PDF, you can significantly lessen the length of trouble your employees have to go through to record these transactions.

When employees use easy-to-use tools, receipts and invoices are recorded on time, every time. When you have a platform that automatically captures all the records, requests, approvals, documents, and transaction history at the source, you are eliminating the excess burden on your finance team to enter any additional data from their side, ready for any surprise audit that comes your way.

How does Volopay make your audit trail easy?

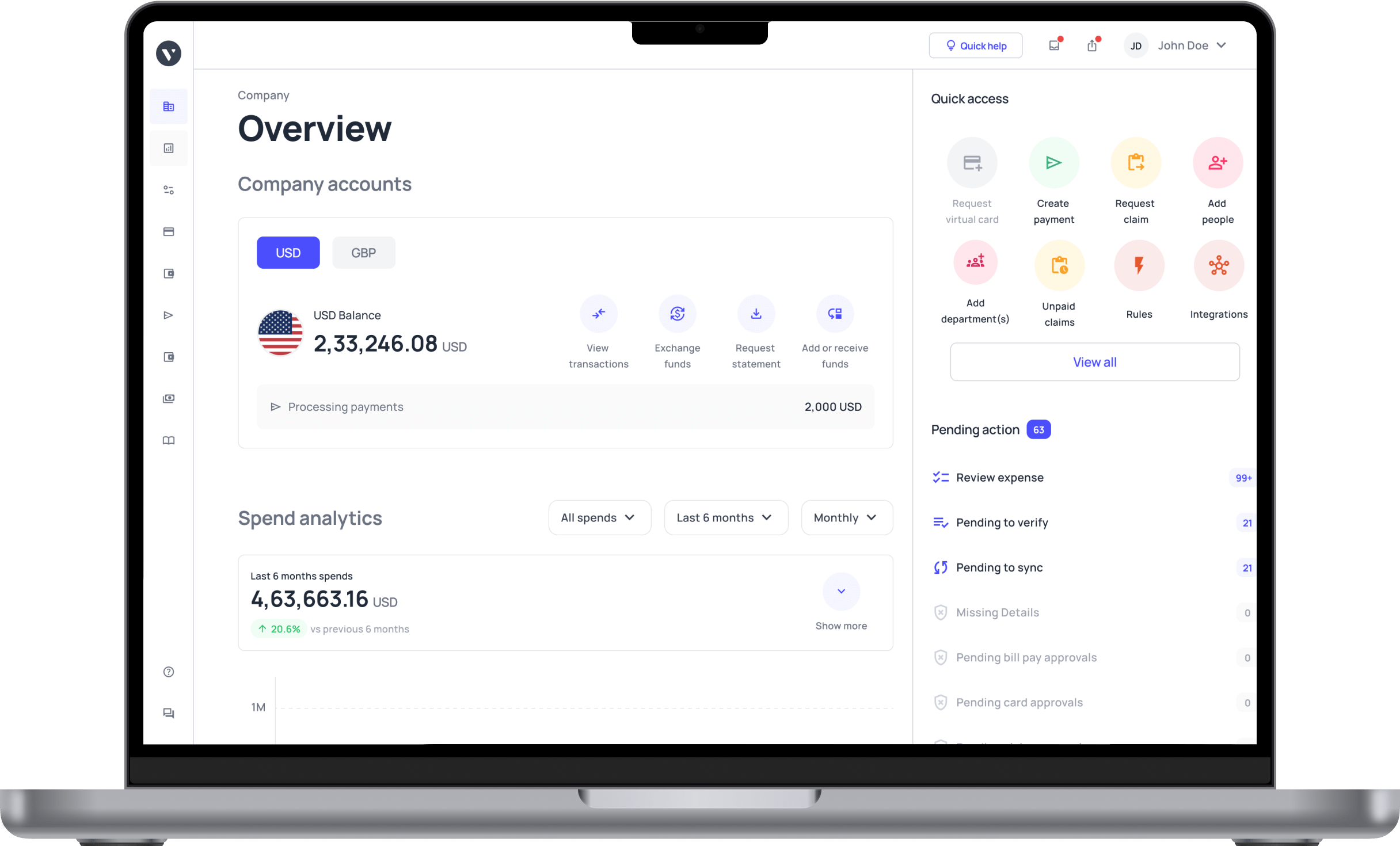

Volopay is a purpose-built spend management platform that helps organizations reduce time-consuming admin work, gain control, and achieve visibility, especially during auditing season. It combines all business payments on one central platform - ranging from software subscriptions to petty cash, business travel to online advertising, and employee reimbursements to vendor payouts.

Volopay provides a complete financial stack for businesses. Our software helps auditors retrace every single transaction back to its source, with a clear mention of not just who made the purchase, but also the approver, the value of the purchase, exact date and time, along with any invoices and receipts attached. Even with multiple users accessing the platform, Volopay keeps a strict record of any modification, creation, or deletion of transactions, with the timestamp of each transaction and its executor’s details.

Volopay diligently complies with audit trails rules and regulations and provides utmost transparency in its record-keeping. With Volopay, auditors can view the entire modification history of a particular transaction from the date of creation to the present day along with who made those specific changes, thereby eliminating the risk of fraud and protecting your business from going under.

Eliminate the risk of fraud and increases the efficiency of spending

FAQs

Generally speaking, audit trails should be stored for at least 90 days in an easily accessible location such as your cloud storage or computer system, and 365 days in a long-term backup.

There are three kinds of audit trails:

1. External audits - performed by CPA firms hired by a business to opine on that business’s financial standing.

2. Internal audit - performed within departments to analyze compliance, operations, finance, and IT processes.

3. Government audit - performed by government agencies when they suspect fraudulent activities or tax evasion activities.

Yes, an audit trail is discoverable provided it contains relevant information sought by the auditors.

Audit logs should be reviewed regularly, with critical systems reviewed daily to identify any violation or suspicious activity.