Year end audit preparation - How to ace your year end audit?

What is a year-end audit?

In a year-end audit process, a third-party auditor assesses the authenticity and reliability of the financial statements. The external auditor examines the financial data and verifies them by matching its supporting documentation.

They try to comprehend the company’s adopted accounting techniques and practices and how well the financial records were aligned to these techniques.

Additionally, the auditors oversee the financial statements to gauge the financial health of the company and its performance against the organizational goals.

The auditors happen to be experienced financial professionals who understand the delicate nature of accounts preparation.

They provide valuable advice and insights on how the company can perform better to optimize its financial capabilities.

Auditing is an arduous task. But not anymore! Read our seven insightful tips to transform your year-end audit process.

Tips to ensure a successful audit year-end

Accounts preparation can be an exhausting and challenging task if not pre-planned.

It’s not the accounting team responsible for the internal auditing but other departments that must contribute by providing all the necessary documentation critical to financial reporting.

Here are the tips that businesses can adopt and improvise their auditing process:

1. Kick start early

Allowing you and your team ample time to maintain and collect documents avoids last-time commotion. The hastening of this process shoots up the possibilities of errors and misinterpretation.

Therefore, to prevent a situation like this, it’s advisable to start the preparation of accounts and financial statements as early as possible.

Companies can have a dedicated team for internal auditing purposes only. This ensures that employees don’t give their main work for auditing reasons.

2. Regular reconciliations

Do not wait for the year-end to start with the reconciliation process. Practice reconciling your books every month or quarter to ensure the financial reporting is as accurate as possible.

Also, time-to-time reconciliation helps identify the errors and mistakes and rectify them prior to the commencement of the auditing procedure.

Leaving the reconciliation at the year-end makes it difficult to occupy any omissions or changes of values. The whole process needs to be redone, demanding a lot of time.

3. Be ready with documentation

Accounting is all about bills, invoices, and receipts. Based on these, the whole accounting structure is framed. Maintaining these supporting documents is critical to validating data entries. Auditors need not be looking and waiting for papers.

4. Communicate the expectations

Only the account team knows what documents need to be filed for the audit. Therefore, it’s suggested to ensure other employees are on the same page as the accounts team.

They need to communicate with each other to know their expectations and how to fulfill them. Later, no one gets to push the blunders.

5. Learnings from the past

When companies keep repeating the auditing process year on year, they identify the loopholes in their systems, how well the employees contributed to the process, were there enough resources for the auditors, and answers to many more questions.

Companies strive hard not to repeat the mistakes and find an alternative ways to resolve the problems through these learnings.

6. PBC list preparation

Prepared-by-client (PBC) list is the set of documents required by the auditor while auditing a company’s financial statements.

Usually, the list includes reports, ratio analysis, profit and loss statements, balance sheets, and more, as stated by the auditor.

Having this list beforehand allows the accounts team to have sufficient time to grab all the documents and submit them before time to avoid any last-minute confusion. Any document they do not prepare can be created if made aware in time.

7. Go digital

Cloud-based software is increasingly emphasized for streamlining accounting processes, reaping the benefits of saving time and cost, and reducing the dependency on error-prone manual processes.

You can create, store and review accounting data in seconds through automation.

Your employees need not be required to safeguard invoices and bills for further processing. Everything just flows in automated accounting software.

Importance of audit for business

Audit accounting is a healthy practice as it helps understand the company's financial health after running for one year.

It provides insights into how the business operations functioned compared to set standards and how business processes were churned to earn revenue.

Though auditing is not compulsory for every business, public limited companies and sole proprietorships must file for auditing mandatorily.

Operational efficiency

Through auditing, companies can see how efficiently the business operations took place for the previous year and whether the strategies adopted helped achieve the organizational goals.

Errors and omissions

The external audit of company accounts reviews the documents right from the start. Therefore, any missing information and duplicate entries can be accounted for.

Verification of books

Auditing helps verify the financial records from time to time, ensuring they are highly reliable for further reference.

Independent opinion

Having an external or independent auditor gives you insights from a different perspective. These parties are not biased in any form; therefore, the points raised by them can be considered for implementation.

Legal compliance

Auditing is a part of the legal responsibility of a business entity. Through this, business owners can know what amount of their earnings will be deducted as income tax, wealth tax, property tax, and more.

How can technology make your audit right?

Automation is changing the way year-end audit processes take place.

With robust softwares capable of handling a terabytes of data and offering the highest level of security, companies are considering shifting to this newly marketed technology.

The audit automation helps keep all the financial reports in one place, which the auditors and top management can access at any time.

• Reduction in time and effort in auditing and preparing accounts.

• Improved quality of auditing reports.

• Ensures implementation of risk management policies.

• Easy identification of errors.

• On the top reconciliation.

• Widens visibility on business expenses and incomes.

• Data-driven insights into the company’s financial health.

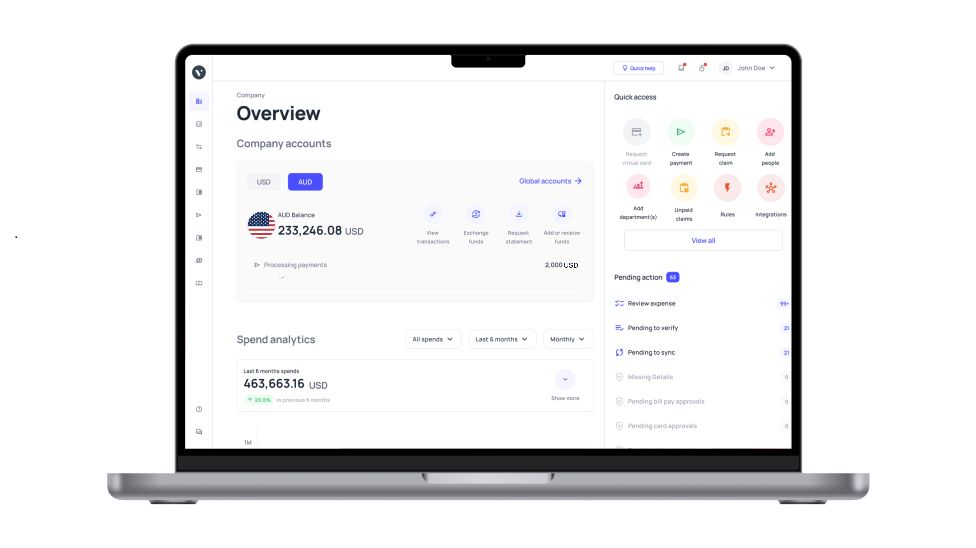

With Volopay's accounting automation capabilities, you can experience seamless financial management and audit preparation. The platform consolidates all your financial data in real-time, ensuring easy access, enhanced accuracy, and quicker reconciliation. Volopay not only saves time but also empowers your team with data-driven insights for better decision-making and financial oversight.

FAQs

There are 11 types of audits that your business needs to know.

• Internal

• External

• Performance

• Single

• Compliance

• Financial statement

• Information system

• Operational

• Payroll

• Forensic

• Employee benefit

Every company doesn’t need to do audits, though it is advisable. But for, companies registered under the Companies Act have to file for an audit mandatorily.

Yes, small businesses and companies need to audit yearly. This proves helpful in sanctioning loans and other credit options.