How to prepare for business audit?

Auditing is indispensable to ensure that your company’s financial records are flawless and the finance team follows compliant practices. Faulty and improper records can falter your company’s financial state. So the auditor's job is to verify and see if the company has paid taxes correctly.

Audit preparation is the process of getting ready for the year-end financial audit, getting prepared to gather documents and records of the company’s credit and debit history.

What are different types of audits?

When your employees perform auditing, that’s called internal auditing. No third party would be involved, and this audit report will be used for internal purposes.

Government audits involve the officials from the local and state bodies who review your financial documents to see if any taxable income has been ruled out while paying taxes.

Running a small business, you might have a low supply of staff. You can employ a third-party auditing company to get some peace of mind & get honest & unbiased auditing done. They will go through your financial statements and perform auditing on your company’s behalf.

When does your business need audit statement?

It is not just the year-end, but there are multiple other scenarios where you will need to conduct an audit report.

1. When you are buying or selling a business - If you consider selling your business, you will need to go through your income and expenses to put a price on it. This financial audit can help you while negotiating the prices. And if you buy another business, knowing your financial status can help you determine how much you can spend.

2. To find out fraudulent activity - When you sense something with your financial records or if it’s not adding up.

3. Getting government contracts - As a legal procedure, you are bound to submit your audit reports to show the entity that you can handle the project.

4. When you need funding for your business, especially a C-series funding.

5. When you plan to make your business public and let people buy your company’s stocks.

How to create audit plan for your company?

A smart spend management platform can contribute to smooth small business audit planning. Following is how Volopay untangles stress out of the otherwise cumbersome audit preparation and planning process.

Determine the ‘whos.’

There are exclusive auditing agencies that you can reach out to. If you are a small business with budgeting concerns, you can find independent auditors. Here is what you should keep in mind while hiring an audit firm or auditor.

- If they have experience in your industry.

- Whether they have the workforce and resources to pull off before the quoted time.

- Whether their firm is registered with any local or government panels.

- Fees and reputation of the firm.

- An assurance on quality and precisenes.

Discussing deliverables and deadlines

Find out the time needed and set out time for different phases.

Results from previous audits

Collection of documents and documentation from past audits, if you have conducted one.

To be updated on accounting standards

Accounting standards are protocols the auditing team should adhere to prepare a thorough auditing report. There are standards like GAAP, GAAS, and IFRS for delivering precise financial statements.

Document collection process

To be ready with a document checklist will avoid time wastage on document searching. Check the next section for the detailed checklist of prerequisite documents and controls.

Work on red flags

Auditors generally hunt through to find problematic areas in accounting like calculation errors, hard card transactions without proper proof, stock compensations, intellectual property capitalizations, etc. Steer clear of them or work on them before the audit begins. Have a discussion about this with the auditing team as well.

Time to work on financial audit plan

This will carry the step-by-step instructions on what’s going to happen during the actual business audit process. Try to add more detail to avoid confusion and roadblocks while executing. Go over the fifth step again and make sure that you have every necessary statement to do the audit. Once you get approval and inputs from the board members, set up meetings so that every internal member can become aware of their roles.

Ensuring smooth communication between the auditing group and your company

There are many instances when you both have to sit and discuss. Setting up the mode of communication and establishing the procedure to follow when your auditor needs to contact you is also called for.

Related page: What is accrual basis of accounting?

What is included in audit plan?

Along with this, your auditing client would also need a peek into your internal controls. Get ready to give the auditing group access to accounting systems, company-related policies, board meeting minutes, contingent liabilities, organizational charts, payroll IT control, and physical access control proof. An auditor needs to study the access control structure of your company too. Besides, if your auditor requests more proof, your company should tend to it.

Must have documents you need to have while doing a business audit.

1. Purchase slips, invoices, financial statements

2. Payroll documentations

3. Monthly and annual budgeting sheets

4. Bank loan documents, if any

5. General ledger

6. Transaction history

7. Tax returns

8. List of bank accounts

9. Legal documents

10. Fixed assets

11. Bank reconciliation

12. Revenue and sales-related documents

13. Trial balance

Streamline your audit process more efficiently

Why is it essential to plan audit for your business?

An audit is not only a complex task but a daunting and chaotic challenge. Even the most experienced and well-established strive and spare no effort. For starters, audit processes and procedures will take more time and effort than planned.

Auditing costs are massive

Making a well-detailed audit plan opens the door to a more efficient and prompt auditing process. There are no unexpected surprises or delays from both sides, and work gets finished on or before time.

Brings order

A small business audit is, as a matter of fact, a collaborative effort of different teams coming and working together. With a plan, auditors can utilize their resources well, and so does your company. Like a well-oiled machine, one happens after another, and you get to grab the audit report before you know it.

To evaluate risks in advance

A business should be aware of its troublesome and tricky areas in finance and accounting, which can blow up and become a topic of controversy when found out during the audit. But doing the audit planning gives you plenty of time to work on risk assessment through which you can subside the effects. It’s not going to be a shock anymore if they are found sooner rather than later.

How can Volopay simplify your audit process?

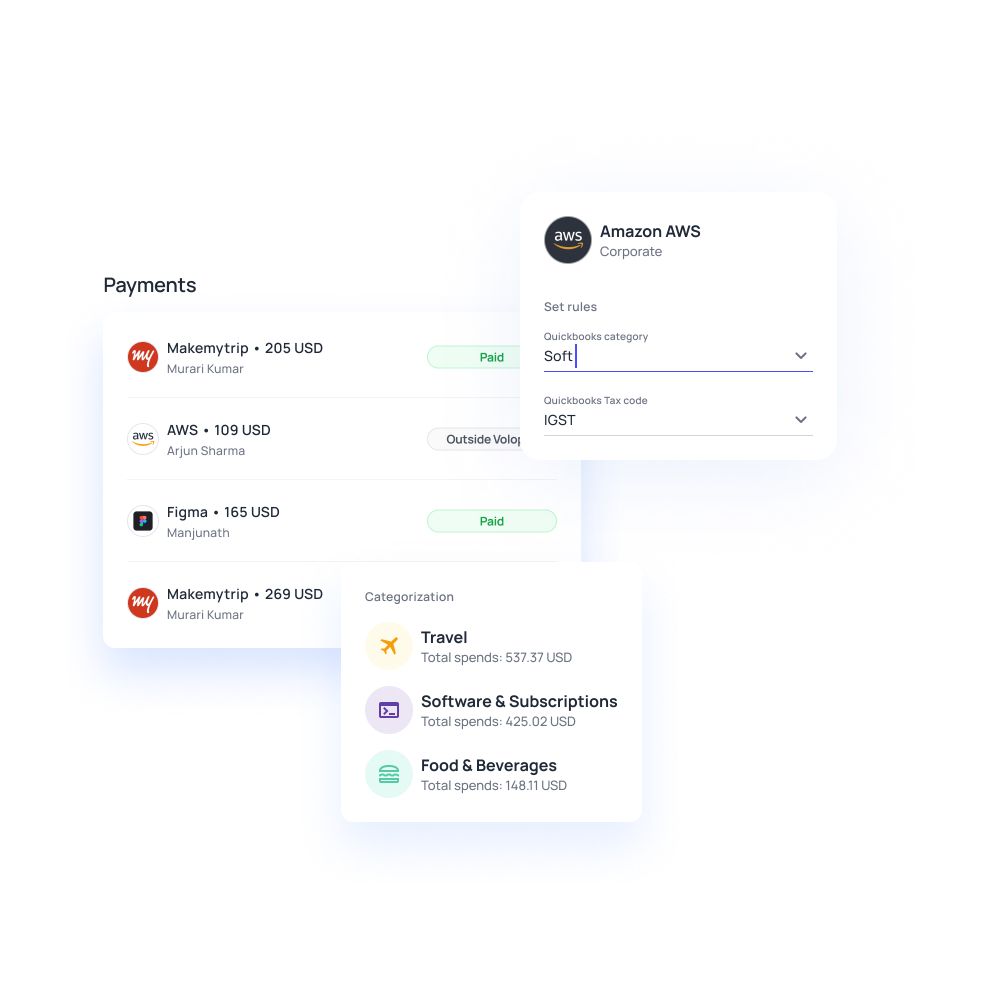

A smart spend management platform can contribute to smooth small business audit planning. Following is how Volopay untangles stress out of the otherwise cumbersome audit preparation and planning process.

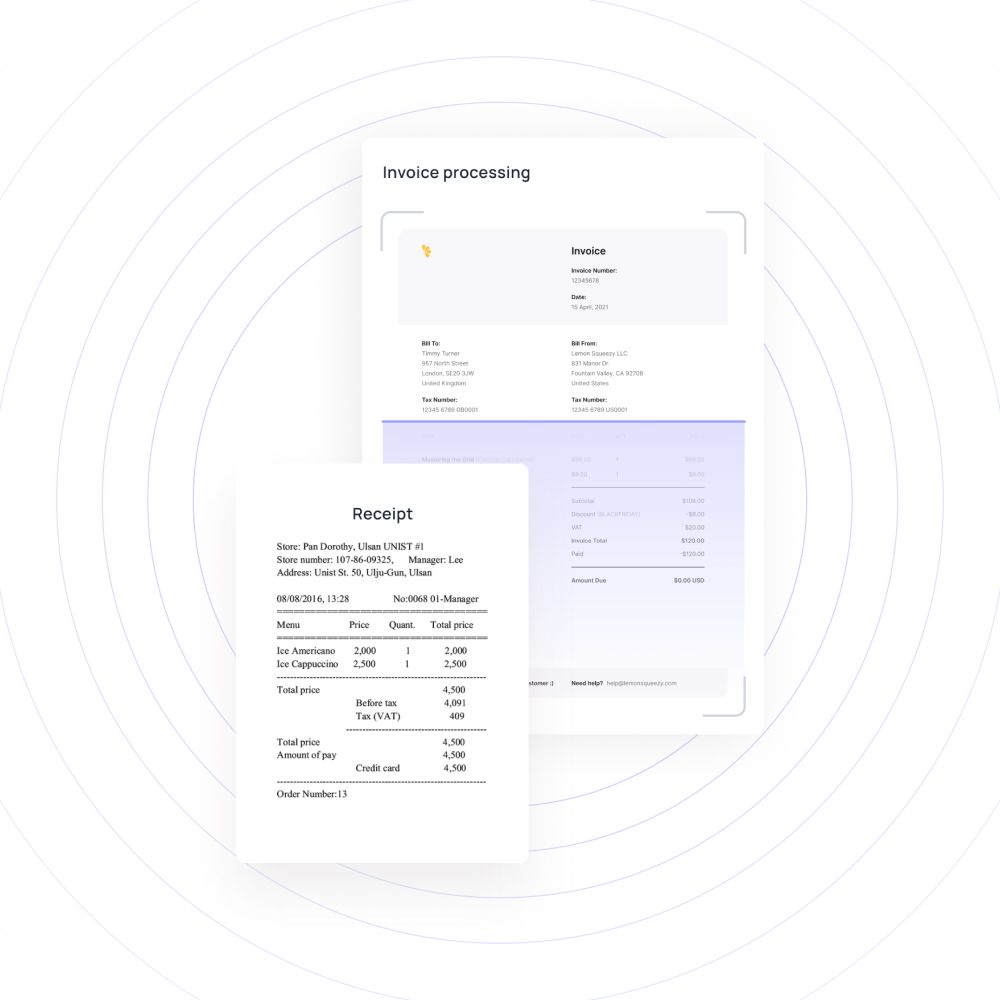

Receipt compliance

Out-of-pocket expenses are common in a small business. To get it reimbursed, they need to request their company along with bills and receipts. Volopay doesn’t let employees take their reimbursement requests to the next level without adding receipts.

There is no more chasing down from the employee or accounts team to pin the receipt and no need to hunt for it during the audit process. They add receipts while requesting, which the approver can see. Reimbursement gets processed, the receipt they added stays.

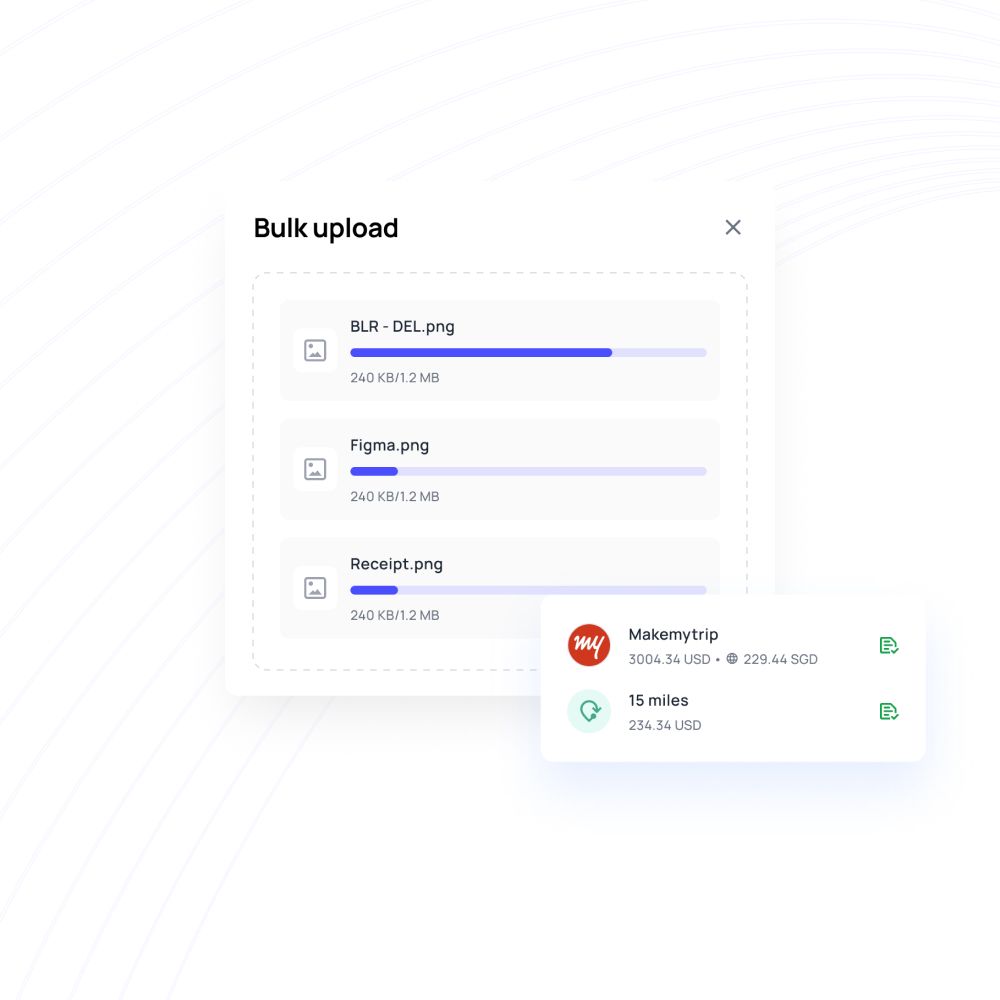

Receipt capture and storage

The actual value of every receipt is felt only during the time of auditing. It acts as a validation to show every transaction made through the employer's account. Storing receipts somewhere else when your business expenses and controls are handled in one place doesn’t make sense.

Volopay allows you to generate, manage and store receipts in the same place where bills are processed. You are free to download it or view it anytime. And that gives complete liberty for someone from outside doing an audit.

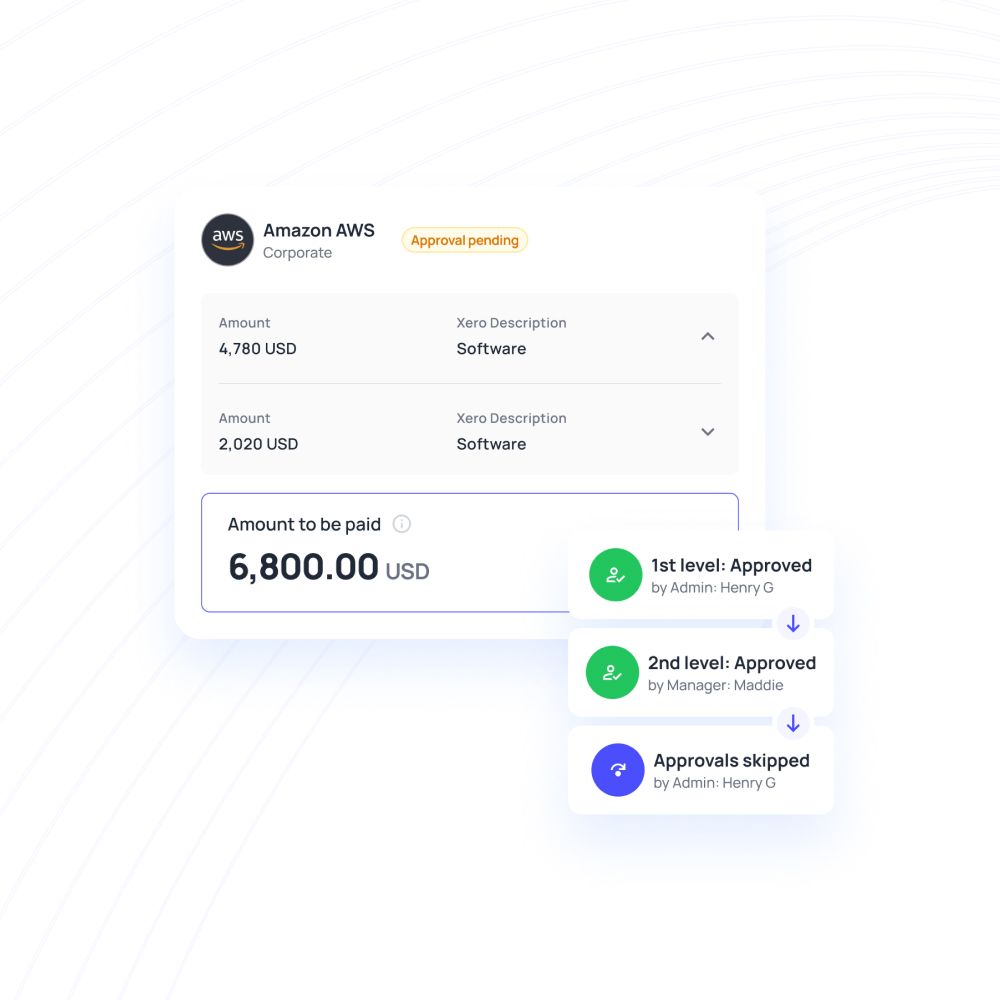

Access controls and approvals

As a part of the audit, the auditor needs to verify the approval process and type of control given to accounting systems. Volopay is an all-in-one finance management application suite.

Starting from invoice processing to multi-level approvals to spend records, one can view the whole records of your company’s expense and budgeting. This eases the most complex job of the auditor to travel from one system to another to interlink payments and assess controls and approvals.

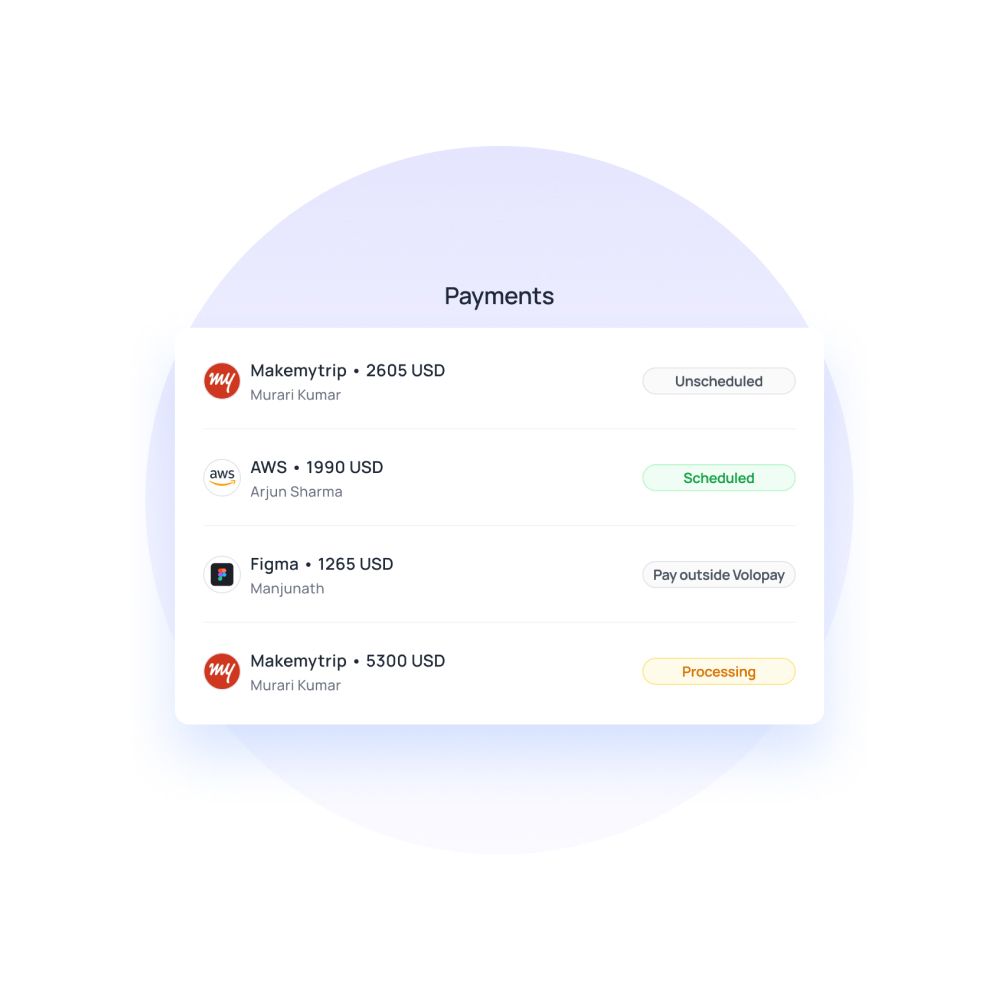

Invoice and payments

Volopay also equips you with the best invoice management system. It classifies invoices based on their payment status and arranges them based on the payment date.

An auditor can view the invoice details, vendor information, amount, mode of payment, and payment date. All these features are cut out to make the auditing quicker.

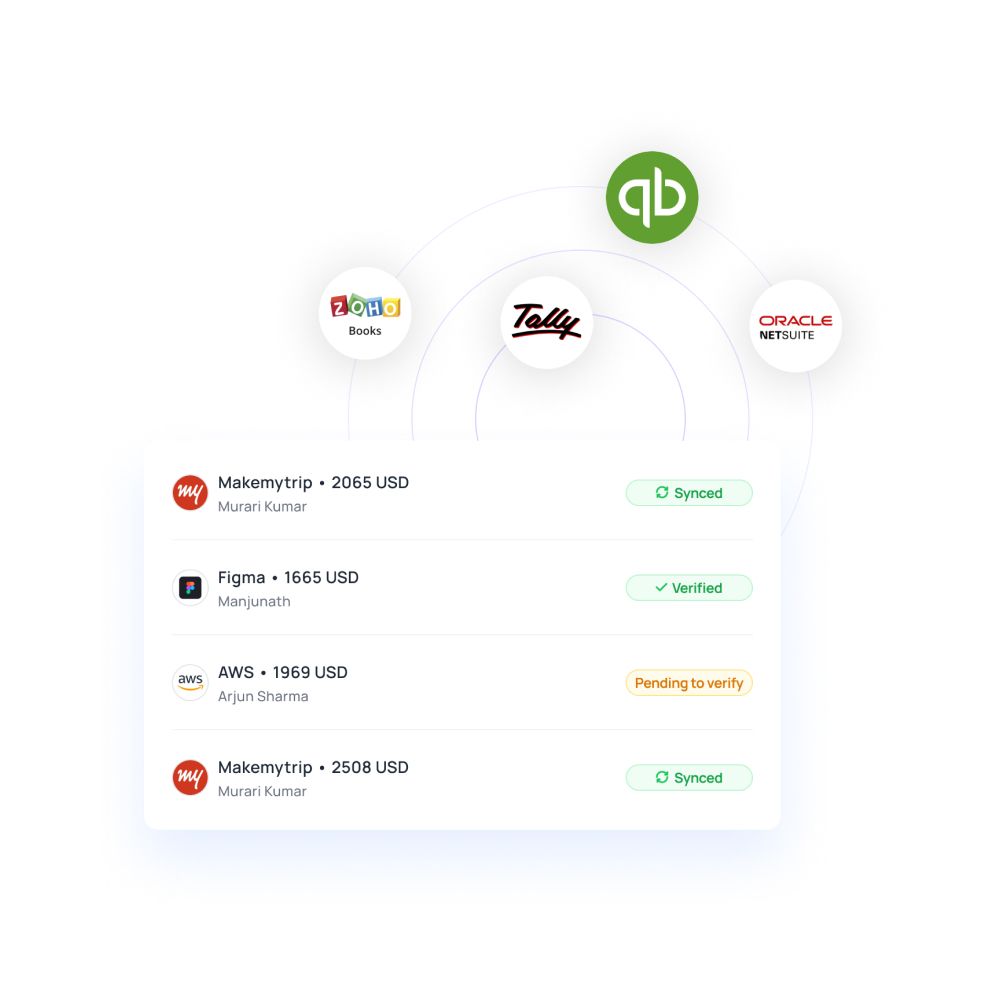

Instant integration with other applications

Volopay works well with other accounting software and automatically syncs its data. All these applications get scrutinized when a business audit happens. So, it’s mandatory to have them up to date.

With Volopay in the picture, you won’t miss a beat even if you haven't updated transactions processed through it. It supports cross-application sync and updates altogether.

Trusted by finance teams at startups to enterprises.