Accrual basis of accounting - Key principal, importance, and working

One of the most critical aspects while recording accounting entries is deciding which basis of accounting to follow. There are two types of accounting in accounting language based on the time transactions are recorded. Cash basis accounting and accrual basis of accounting.

What are key principals of accrual accounting?

In the accrual method of accounting, financial transactions are recognized and recorded at the time of occurrence, irrespective of whether the revenue is received or expense is paid. This means all the accounting entries are documented at the point of sale or purchase.

Under the Matching principle of accounting, companies are supposed to report related expenses and revenues in the same accounting period, i.e., month, quarter, or year. Following the same path in the Revenue recognition principle, revenues are recorded if they are realized or yet to be realized, no matter when the cash is received.

How does accrual accounting work?

Accrual accounting works on the ordinance of the Matching principle. The principle measures the business's present and anticipated revenues against the current and due expenses for a given period of time. Even if there are certain outstanding expenses unpaid and unreceived income, the accrual method of accounting takes into consideration every expected accounting transaction.

In accrual bookkeeping, the cash flow statement prepared at the end of the year is a combination of present and future cash flows, including those not received yet. This way, companies get a better understanding of cash management and cash cycles.

In the books of accounts, the accrued receivables are shown on the asset side of the balance sheet. And, the accrued expenses are reflected on the liabilities side.

Categories in accrual accounting

Accrued revenues

An accrued revenue is the amount that is yet to be received by the company. Often accrued revenue is classified as accrued receivables.

From the accounting perspective, accrued revenues are recorded in the current assets of the balance sheet.

Accrued expenses

An accrued expense is the liability of the company. It means the company owes money to its creditors or other parties.

Even if the company has not yet paid the accrued expenses under accrual bookkeeping, it will be reflected in the accounting ledgers.

5 importance of accrual accounting for businesses

The accruals in accounting provide a high grade of reliability and relevance to the current accounting position. Since it considers the accrued expenses as well as revenues, companies obtain an actual financial picture of the company health.

Strategic planning

The current strategies for cash flow and accounts receivables, and payables might need to be changed if they give alarming signs.

According to the data available in your accounting software, which happens to be updated after every transaction, you can create renewed short-term strategies.

Cash flow prediction

Due to the high accuracy of financial statements, companies can make predictions about the cash flow for a period of time, mainly monthly or quarterly.

Based on these assumptions, they can plan their future course of action. Additionally, you comprehend your average cash cycle.

GAAP compliant

The accrual basis is in accordance with the Generally Accepted Accounting Principles.

The GAAP recognizes only the accrual accounting method as this method provides a true to picture accounting trend.

Industry standard of accounting

Because the accrual basis of accounting is GAAP authorized, most companies around the world tend to follow it while preparing financial accounts.

A mismatch in the accounting techniques can be challenging to account for, especially if they happen to be closely working.

Accurate financial position

Contrary to the cash basis of accounting, where transactions are only recorded when realized, accrual accounting displays a current financial blueprint.

With the help of accurate numbers, companies estimate the accounts receivable and payables.

When are expenses and revenue recognized in accrual accounting?

On an accrual basis of accounting, revenue and expenses are recorded at the transaction time. If the company has accrued expense, it will be reflected on the liability side of the balance sheet; if it's an accrued income, it will be shown on the asset side.

Companies following this method of accounting need to look out for maintaining a proportion between expense and revenue. There should be an entry in the liabilities for every expense made and every income in the asset column.

So, if the company incurs the expense in the current month that is due in the month, the company is still liable to show the payment in the books. If it fails, the company is irrelevant to the basic principle of accrual accounting. This way of recording entries could be misleading to the companies who believe you follow the accrual method.

A misstep like this will be reflected in your income tax reporting. Without striking the proper balance, revenue-expense matching companies might end up paying disproportionate taxes every month. Also, due to the change in invoice dates, there can be discrepancies in the accuracy of data in the companies.

Manage your business cash flow more efficiently

Cash accounting vs accrual accounting

Recording entries in cash basis accounting is the complete opposite of accrual accounting. Under the cash method of accounting, companies record transactions only when the cash is received or paid to the party, not when incurred.

So when you sell goods and services, you don't enter them into the books until you receive the payment against them. A company cannot follow accrual accounting and cash accounting together. They need to adopt one method and stick to it till the dissolution of the company.

Benefits of moving from cash to accrual accounting

The cash method fails to deliver detailed financial analysis and reporting information.

On the other hand, the accrual accounting method provides granular and extensive information about the costs of operations and goods sold, allowing the management to adopt better resources to optimize these key areas.

Owing to the insightful availability of financial information, there's an increase in cash inflow and outflow transparency. Since the accrual method of accounting requires full disclosure of assets and liabilities, companies know the estimated value of the capital gains derived from them. Also, any changes in one aspect of the accounting framework can be witnessed in other elements.

In cash accounting, employees or management had an increased chance of getting away with fraud entries, as they don't record it immediately and can quickly settle it outside the organization. But, with the transition from cash to accrual accounting, the workforce can be held accountable for their actions. They need to disclose the reason for every entry made in the books. Any mismatch in the ledger statement will be immediately flagged.

Challenges businesses face in moving from cash to accrual accounting

Companies shifting from cash to accrual accounting walk through a series of challenges. Right from changing the accounting techniques to preparing the financial statements.

While shifting from cash to accrual accounting, you don't necessarily have to substitute your existing cash accounting principles. From a broader outlook, cash accounting is the setting stone of accrual accounting. Although some internal processes like accounts receivable and payables need to be completely renewed.

GAAP recognizes the cash accounting method as an unembellished and accurate basis of accounting. Moving from one method to another also means your accounting standards will get revised. The GAAP accounting principles will guide journals, ledgers, trial balances, cash flow statements, income statements, profit and loss statements, and balance sheets.

As cash accounting tracks cash-based transactions, managing them becomes relatively more straightforward and effortless. However, accrual accounting is an integrated set of various accounting principles closely tied in a cobweb. So, while shifting from cash to accrual method, companies must change their entire framework from their fundamental accounting principles.

What is Accrual Accounting Rate of Return

The Accounting Rate of Return (ARR) is a capital budgeting metric for long-term investments. It is used to determine how well long-term investments like stocks, mutual funds, bonds, real estate, and more have performed over a period of time. In the accrual accounting rate of return, the returns generated by the investments are recognized when they are earned and not received.

Calculating the accounting rate of return is a simple task with no complexities involved. In the ARR formula, companies divide the average investment return by the initial sum of investment and multiply it by 100 to derive a percentage. One thing to be noted while calculating the ARR is that it does not consider the time value of money. The time value of money indicates that the current value is more valuable than the sum of the money in the future.

Additionally, the ARR is unaffected by the risks and uncertainties of the investment. This means the rate derived does not take into account the fluctuations of the investment. However, depreciation is bound to change the ARR. Being a direct cost, depreciation will diminish the asset's useful life, making it less valuable.

How to calculate Accounting Rate of Return?

Businesses can apply the Accounting Rate of Return formula to know the returns yielded by an investment.

Below are the steps to calculate the ARR:

● Calculate the estimated net profit from the investment after deducting annual maintenance costs, taxes, costs of implementing the project, or any other expenses incurred.

● If the investment is a physical property like machinery, plant, and equipment, you will need to subtract the depreciation from the revenue generated.

● Next, after you derive a net annual revenue, divide it by the initial investment amount.

● To determine the percentage rate of return, multiply the amount by 100.

Two types of accrual based accounting principles

Two accounting principles guide the accruals in accounting under the Generally Accepted Accounting Principles (GAAP). Based on these principles, the entire accrual accounting framework is structured.

Matching principle

The matching states that the expenses are the cost of doing business or generating revenue. The principle requires the company to record the expenses as well as income generated from all sources. The matching principle works on the basis of cause and effect relationship.

So, to earn a profit, a business must incur expenses, and you need to mention the cost of running a business in the books.

Revenue recognition principle

Revenue is the monetary income of the company generated through the sale of goods and services. The revenue recognition principle states that a business must recognize the revenue generated at the time of the sales period, even though it may receive the actual payment in a separate period.

Due to this, the revenue report at the end of the financial year is different from actual cash outflow & inflow.

Accrual accounting entries

Accrual accounting entries are simply the journal entries the accounts team pass to update the ledger balances. Because of the accrued expenses and revenues, the accounts team must make necessary adjustments to record them.

Companies follow the GAAP rules and principles to record accrual basis accounting journal entries. The accrued income should appear on the asset side of the balance sheet. The double-entry system of accounts needs to be followed while recording transactions. The recording process must begin with passing journal entries and end with balancing the accrual accounting balance sheet.

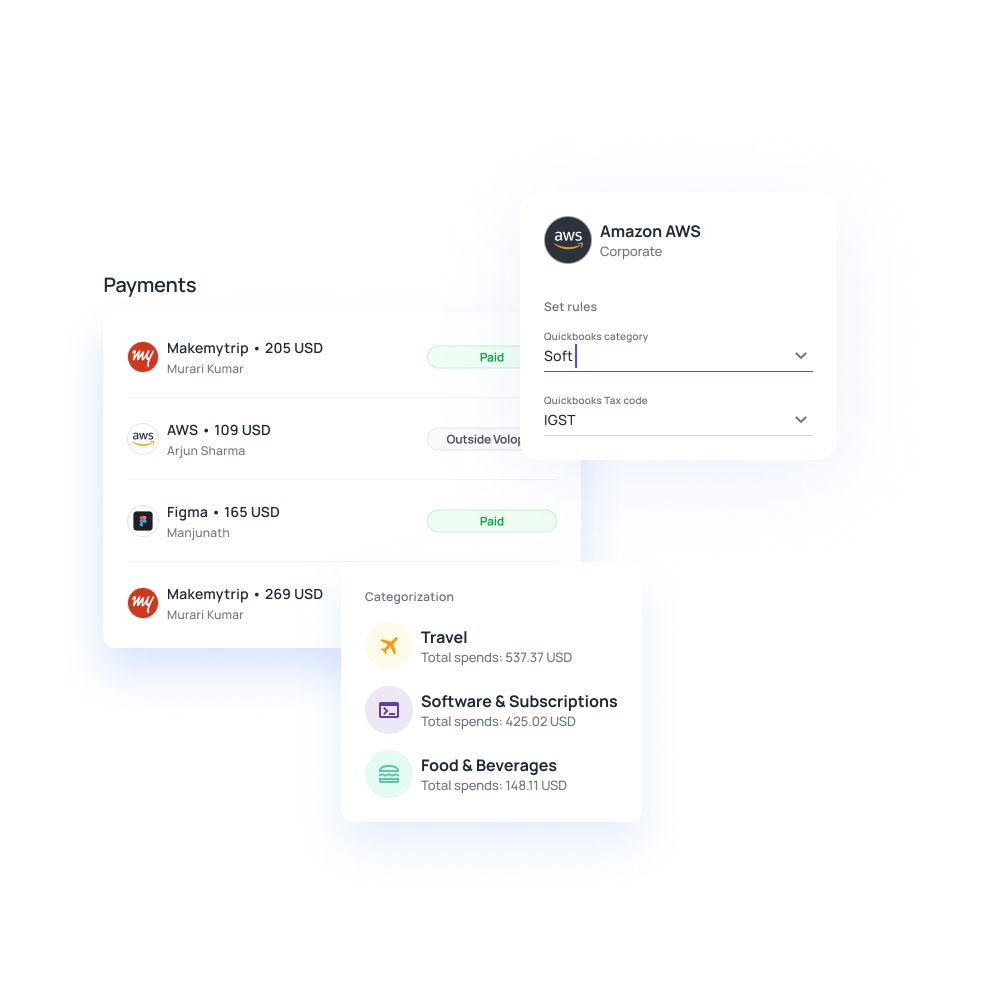

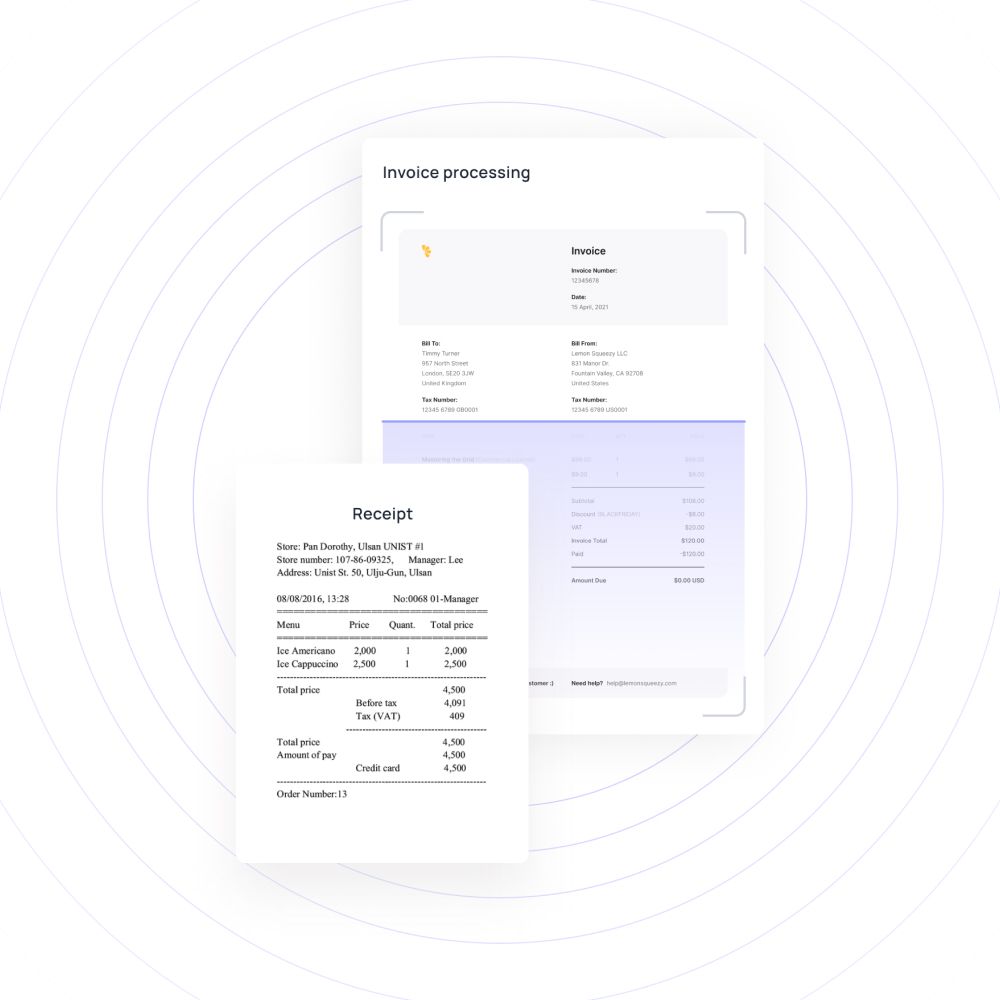

The accounts receivables and payables are shown on the asset and liability side of the balance sheet, respectively. So, every invoice in and out of business directly impacts multiple ledgers and balance sheets. In large companies, especially, a system should be established wherein the employees can easily submit the invoices. And after that, the accounts team can process and enter them into the books. So that they can keep the books balanced.

Accrual accounting best practices

Before entering any invoice into the system, validating the authenticity is always advisable. This prevents the accounts team from last-minute verification and modification of the books of accounts.

Don't stop after creating a budget. Keep on analyzing its effectiveness and relevancy to the organizational goals. If you feel one area needs more funds to deliver more efficiently, make the changes accordingly.

At the month-end, create a sheet of accounts receivables and payables due next month. According to the sheet, you can make provisions for the payment dues & begin with follow up with the customers.

A regular and thorough internal auditing by the accounts department can help understand the performance of strategies and action plans. They can uncover the bottlenecks in the processes, examine the company's overall financial health, and come up with ways to optimize the accounting workflow.

A budget keeps your money flowing in the right direction. You cannot gain visibility over your expenses and income without a budget. Under budgeting, you can estimate the amount required for accrued expenses, know your cash cycles, calculate your turnover ratios, create provisions for bad debts, and much more.

Get started with Volopay

Accounting professionals have discarded the manual method of accounting. They are shifting towards automated accounting software that provides high efficiency and resilience and can handle multiple tasks without blinkering the visibility. Nothing better than Volopay, we say!