Beginner's guide to small business bookkeeping

Bookkeeping and accounting are important aspects of every business regardless of the size of the company. However, these aspects maybe a little lower on the priority list of a small business owner, majorly because they are balancing between numerous other responsibilities like the maintenance of daily business operations. Still, small business accounting and bookkeeping shouldn’t be treated lightly.

Updated and well-maintained books can help a company plan and forecast many months in advance, which gives it alerts for any future financial shortcomings. The reason why bookkeeping and accounting are put on the back burner for many small businesses is the tedious and daunting nature of the process. Numerous small business owners say that financial management is one of the most difficult processes of running a business. Even a minute mistake in the procedure can cause grave harm to the growth and development of the business.

What is bookkeeping?

Tracking every financial transaction made by a company from the time the company started to the end of the current financial year. Based on the type of small business accounting system, every financial transaction is recorded against its supporting documents. These documents can be receipts, purchase order slips, invoices, or any other similar kind of financial document that are proof of the transaction taking place. There are broadly two ways bookkeeping transactions are recorded: manually in a journal or by using Microsoft Excel spreadsheets.

The majority of businesses use innovative bookkeeping systems and software to keep their books updated. Bookkeepers employ a single-entry or double-entry bookkeeping accounting to record all financial transactions. The people maintaining the firm’s books must understand the chart of accounts and how to balance the debits and credits of the company.

What is accounting?

Accounting reports are prepared using the financial statement and data collected from bookkeeping. All the accounts are supposed to create financial reports, analyze costs and also take care of the business’s tax filing.

Along with this, they also assist in making budgets and give recommendations on what should be the business’s future investment plans. However, if you decide to manage your small business accounting yourself, there are ways you can automate the bookkeeping tasks or outsource accounting.

What is the difference between bookkeeping and accounting?

Bookkeeping is an important task of the business operations, however, it is preliminary to the actual accounting functions. A bookkeeper's job is to gather all documents related to every financial transaction, then record all the transactions into an accounting journal, classify each transaction as one or more debit and credit and finally organize all the data according to the business’s accounting chart.

Once all the financial transactions are recorded, they have to be summarized according to the end-time periods. Some companies make quarterly reports or some make yearly, depending on their requirement. Many small businesses only need reports at the end of the year for preparing taxes.

At the end of the time period, the account comes into the picture and takes over the tasks of analyzing, examining, interpreting, and report forming for all the financial information of the business. The accountant also has to prepare the year-end financial statements and up-to-date organized accounts for the business.

Basic accounting terms that you should know

Revenue or income

This is the money your business makes from the sale of goods and services or any other business activities.

Expenses or expenditures

These are the costs your business has to incur in order to generate revenue or income, for example, rent, office supplies, labor costs, etc.

Equity

After deducting the liabilities and assets of the company, the value remaining is called equity. This amount is the representation of ownership in the business.

General ledger

This is the entire record of all company transactions such as expenses, sales, debit, credit, etc. it is used to make financial statements.

Journal entry

To update the company’s general ledger, bookkeepers and accountants make journal entries. Each entry is made under a unique reference number, debit or credit amount, transaction date, and description.

Chart of accounts

This is a list of all the different accounts and transactions of your business organized categorically. These categories can be income, assets, expenditures, and liabilities.

Trial balance

This is an accounting report which documents the balance for all accounts in the general ledger, labeled as either debit or credit. It is basically used to check any calculation or mathematical errors.

Assets

These are things that bring in current, future, or potential economic advantages to the company. It can be liquid or non-liquid assets your business owns like accounts receivable, patents, stocks, land, etc.

Accounts receivable

This is the money your customers, clients, or anyone who does business with you, owes your business for the goods and services provided. These are assigned as ‘assets’ on a balance sheet.

Accounts payable

This is the money your business owes, could be the amount you owe to a lender, freelancer, merchant, etc. Accounts Payable are classified as ‘liabilities’ on a balance sheet as they are a form of debt taken by your business.

Liabilities

These are usually debts or obligations your business owes like loans, income taxes, accounts payable, etc.

Balance your books more efficiently using accounting software

Importance of accounting and bookkeeping for small business

While establishing your business one of the most important initial decisions you have to make is related to the setting up of your bookkeeping system, whether to employ a cash or an accrual accounting system. If your company is small, a one-person business, or a larger practice being held from a one-person office, you may prefer considering the cash accounting option.

Bookkeeping and accrual accounting

Using bookkeeping system, your small business accounting becomes much easier as every transaction is recorded as and when cash changes hands. However, if you decide to use accrual accounting, the purchases and sales made by your company are immediately recorded, even if the cash is not moved until later.

There are many businesses that start with the cash accounting system and then down the line switch to accrual accounting as the company grows. If you are planning to offer credit to your customers, or request credit from your vendors, then your best option is an accrual accounting system.

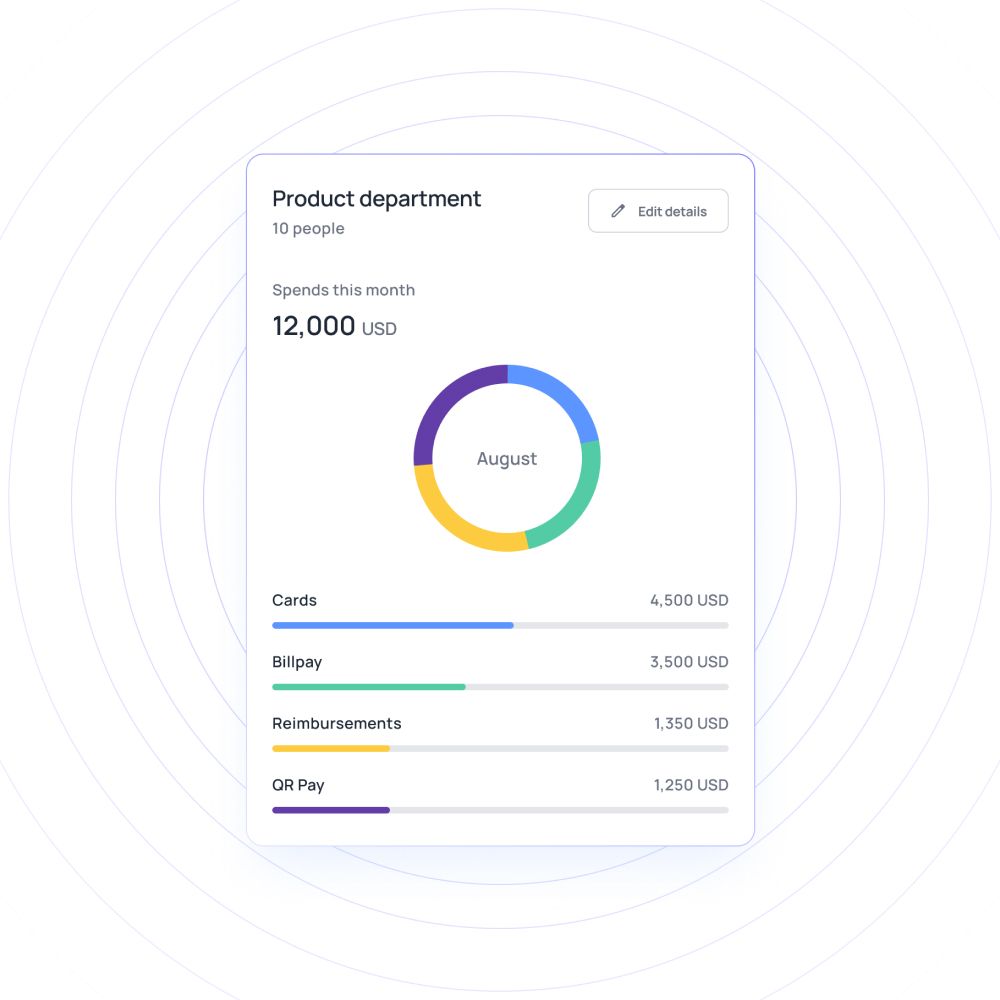

Real time visibility

Furthermore, along with deciding the accounting system, you also need to have a clear idea of which type of bookkeeping you want to use for your business; single-entry or double-entry. In the Single-entry bookkeeping system, you basically record all your transactions as and when you pay the bills and make the deposits in the company’s account.

It is only considered as an effective bookkeeping system if your company is relatively small with the transaction volume being low. Moreover, if your company is large, which means it naturally has more complex transactions, you will have to set up a double-entry bookkeeping system. This means that for every transaction there are at least two entries made, one on the debit side of accounting and at least one on the credit side.

Save your business time and money

To save time and money and speed up the process, many companies set up computerized accounting systems when they decide on a bookkeeping method for their businesses. This software is generally used to keep a check on all the accounting journals against the bookkeeping entries.

Many small businesses may choose to use spreadsheet software like Microsoft Excel, Google Sheets, etc. Large-scale businesses tend to employ more sophisticated systems to track their accounting journal. Ultimately, for your business you must have a chart of accounts, to track the changes and development of the business over time.

How to set up accounting for small businesses?

Open separate bank account

Your first step towards establishing a smart accounting and bookkeeping system for your business must be to open a separate bank account for your company. This will keep your personal expenses detached from the business expenses. Having a business savings and checking account, will assist you in efficiently organizing the revenue stream and planning for taxes at the end of the year.

Document all expenses and income

Being equipped with the knowledge of how to track and document all business transactions is the basis for a smart accounting and bookkeeping system. These documents bring ease to the whole procedure of identifying tax-deductible expenses, devising financial statements, and tax returns, and ultimately tracking the overall development of the business. It is essential to note here that only the expenses which directly impact your business should be recorded such as purchase orders, invoices & other business documents.

Choose accounting method

Before taking any step towards bookkeeping, you need to first set up an accounting method for your company. As mentioned above there are two methods of recording accounting transactions: cash accounting and accrual accounting. Based on your company size and requirements wisely choose which system you need to adopt for better business play.

Transactions to trial balance

In a double-entry accounting system, all the transactions are tracked as journal entries. These journal entries are listed chronologically and record everything, amount debited and credited, transaction dates, and explanations supporting the transactions. The balanced transactions are then used to make a general ledger. On the basis of the current balances and past transactions, amends are made in the ledger and a trial balance is assembled.

Prepare adjusted trial balance

If your business uses the accrual accounting method, the journal entries are adjusted according to the periodic income and expenses. For example, when you pay a vendor for all the yearly supplies, a monthly adjustment entry should be made to identify and record that expense. Once the adjusting entries are recorded, an adjusted trial balance is created to recheck all the debits and credits to match the adjusting entries.

Generate financial statements

After the adjusted trial balance is created, you can begin creating the financial statements of your company which include statements of income, retained earnings, cash flow, and balance sheet.

Reconcile and close your books

The final step in setting up accounting for your business is to make post-closing entries. This is the process where the balances of temporary accounts are reset and brought back to zero so that the accounting cycle can be commenced again. Income and expenses accounts are supposed to be closed in order to record the next period’s transactions.

Crucial accounting reports for your small business

In small business accounting, recording data is just the first step. All the data you have needs to be gathered and sorted in such a way that it can be of actual use. To make strategic business decisions, accounting reports are a vital element.

Balance sheet

A balance sheet functions as a financial picture of your business at a specific time or date. It is the major financial statement most small business owners use. Other financial statement reports show data for a timeframe, like a month or a year, but balance sheets display data for the company’s financial stance at a specific time. The following data is listed in a balance sheet:

1. Assets

2. Liabilities

3. Equity

Income statement (Profit & loss statement)

An income statement projects the performance of your business during a period of time. It is also called a Profit & Loss statement (P&L). An income statement lists:

1. Sales

2. Expenses

3. Profit or losses over time

4. Cost of sales

Cash flow statement

Cash flow reports are of two types, direct and indirect cash flow reporting. There are three sections in a cash flow statement to record different groups of activities- financing, operating, and investing.

The category of cash flow reporting which shows the direct or indirect cash flows is the operating activities one. Direct cash flow reporting shows the cash that has actually been transacted.

Statement of retained earnings

The total of all the profits and losses the company has incurred right from its establishment to the current time is called retained earnings. Similar to a cash flow statement, most businesses don’t ever have a requirement to use a retained earnings statement. To decide upon company valuations, dividends disbursements, etc., big publicly traded companies rely on this financial statement.

Related page: Benefits of continuous accounting model

Single entry bookkeeping vs double entry bookkeeping

How transactions are recorded

Financial bookkeeping which is done using the single-entry method records revenue when cash flows in and records expenses when cash is given out. So, businesses using the double-entry method record revenue when it's earned, not received & expenses when it’s due not paid.

Number of entries

In the single-entry bookkeeping system, there is one entry made for every transaction. Whereas, in the double-entry bookkeeping method, there are two entries made per transaction a debit and a credit. The debit entries are recorded in one account and the credit entries are recorded in another account, so in the single-entry bookkeeping system one account is used per transaction.

What is recorded

The single-entry bookkeeping method uses cash-basis accounting, which means that it records the cash incoming and cash outgoing. Cash can be physical cash, credit card payments, checks, or electronic fund transfers. In contrast to this, double-entry bookkeeping uses accrual accounting which consists of five accounts- revenue, expenses, equities, assets, and liabilities. Single-entry method only uses revenue and expenses accounts.

Importance of assets, liabilities, and equity while balancing books

To establish strong and effective financial bookkeeping for your business, you must have a basic understanding of the company’s accounts. The chart of accounts of any company is made from these accounts and their sub-accounts. A company's balance sheet is composed of accounts that include assets, liabilities, and equity.

Assets

The possessions of a company such as its accounts receivables and inventory are known as assets. Several fixed assets such as the plant, land, and equipment are also considered as assets. In a balance sheet, you will find that asset accounts are arranged in the order of their liquidity.

The cash account is the initial entry in an asset account because cash is perfectly liquid. The tangible assets such as fixed assets accounts, receivables, and inventory come next to the cash account in an asset account. Tangible assets can be touched. Intangible assets like customer goodwill are also a part of firms that may be mentioned on the balance sheet.

Liabilities

Liabilities consist of mortgages, bank and business loans, and other related debt on the books. Liabilities are what the organizations owe to their suppliers. Both current and long-term liabilities are a part of liability accounts on a balance sheet. Accruals and accounts payable are listed under the current liabilities.

Whatever the businesses owe to their suppliers, bank loans, and credit cards are referred to as accounts payable. Accruals will consist of Taxes owed such as medicare tax on the employees which is usually paid quarterly, social, state, and federal security comes under accruals. Long-term liabilities have a maturity of more than a year. Mortgage loans are a part of long-term liabilities.

Equity

An investment made by a business owner and any other investors in the business is known as Equity. All the claims the business holder has against the organization are included in the equity accounts. A business owner invests in a business, and it may be his only investment so far in the business. Other investors taken up by the firm are mentioned in the equity accounts.

Financial bookkeeping

Financial bookkeeping refers to balancing your books at the end of a financial year. The bookkeeper is supposed to maintain these items carefully and confirm the transactions dealing with assets, liabilities, and equity are mentioned accurately and in the right location. The bookkeeper can use a principal formula to balance his books every time. This formula is known as the accounting equation:

Assets = Liabilities + Equity

The accounting equation makes sure that everything the firm possesses (assets) is balanced against everything that it owes to its suppliers (liabilities and equity). Liabilities are what a firm owes to its lenders and vendors. The business owners have rights against the remaining assets (equity).

Related page: What is accrual basis of accounting?

How to do bookkeeping for small businesses?

Bookkeeping is the process of recording your day-to-day business transactions. Here, you’ll need to record the incomes and expenses incurred by your firm daily. All the money that goes out as well as the money that flows in is separately recorded in financial bookkeeping. Simple bookkeeping for small businesses requires getting organized as documentation is the prime lead. Maintain a record of the firm's receipts, canceled checks, and bills.

Devote specific attention to your petty cash and keep in mind to reconcile your accounts at least once a while. There is software available in the market that assists in the bookkeeping process. It may appear intimidating but financial bookkeeping for your firm is not so complicated when you follow the basic steps of accounting. To keep a check on your expenses and gather financial data for tax filing.

Transfer your receipts into a ledger. This is nothing but a summary of incomes, expenses, and whatever else you're maintaining track of. You can either create an electronic spreadsheet or a ledger on a sheet of paper.

Maintain the receipts of your firm’s purchases and sales. The receipts serve as proof of your business expenses. These receipts consist of the information related to the date, amount, and other necessary data to compose summaries of your transactions. Receipts are also beneficial during tax payments.

Compile financial reports by transferring entries from your ledgers. The financial reports consist of the profit and loss account, cash flow analysis, and the balance sheet. These reports help in understanding the financial position of your businesses. Once you have prepared your reports, take a step behind and start rationalizing systems. You may turn towards setting up realistic expectations with your buyers.

3 small business accounting tips to keep your books balanced

Devote close attention to receivables

When a client pays you, the amount should be transferred to their invoice, and it should be considered as paid. However, this task becomes time-consuming and complicated when you have to deal with a bulk of receivables. It results in a delay in the reconciliation of customer payments. It further creates a lot of confusion and chaos during the time of tax payment. The accountants find themselves stuck with a number of customer receivables in their revenue accounts and a lot of mismatched receivables.

As a repercussion, accountants spend hours making amendments and updating their accounts. It increases the possibility of paying extra on their tax return, and the firm slips into the risk of high debts. So, the accountants should try to maintain an on-the-spot record of all the transactions that happen. Maintaining your client’s receivables monthly can save a lot of time on invoicing and wealth in the long run.

Keep an eye on your cash flow

An accountant should primarily consider maintaining a cash flow statement while performing weekly and monthly financial reviews. These statements offer you a wider understanding of cash flow inside (and outside) of your firm.

A cash flow statement keeps a vivid track of income flow. It also consists of the element of time. It allows you to analyze seasonal expenses and payment cycles. Cash flow statements can provide you with the information you require to eliminate expenses and more accurately utilize income. They are also beneficial when designing financial bookkeeping.

Log expense receipts

What if you go through your bank statement and find an expense of a hundred dollars and have no knowledge about what it was? Well, this complication often exists due to poor record-keeping. Saving a receipt of every expense that your business incurs is the best solution to eliminate such problems. It may appear to be a hectic task but there are several accounting tips to guide you in making simple bookkeeping for your small businesses.

The first way is to keep a single credit card to pay for all business purchases and other expenses. Maintain track of your receipts by assigning a particular location for them, such as a spot on your desk, or in your vehicle. You can even click an instant picture of your receipt on your portable devices. These tricks aid your firm to pay its taxes on time.

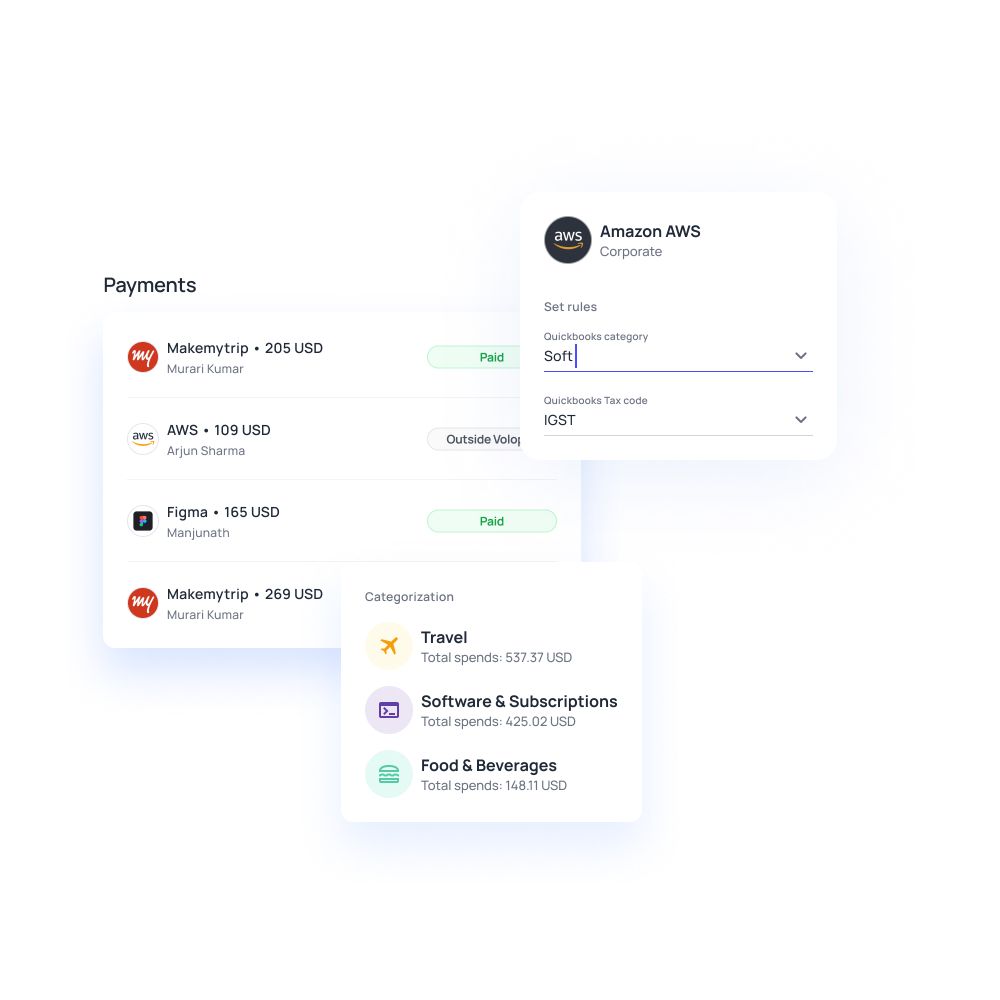

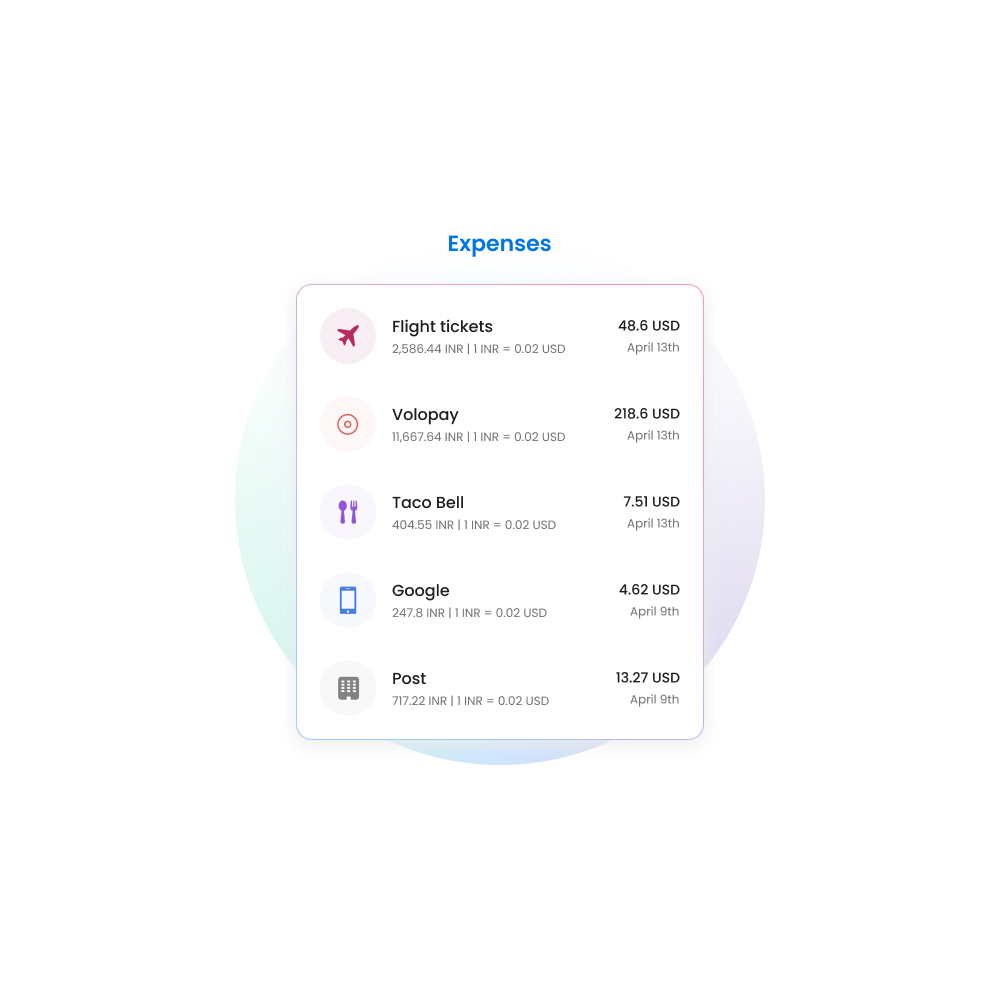

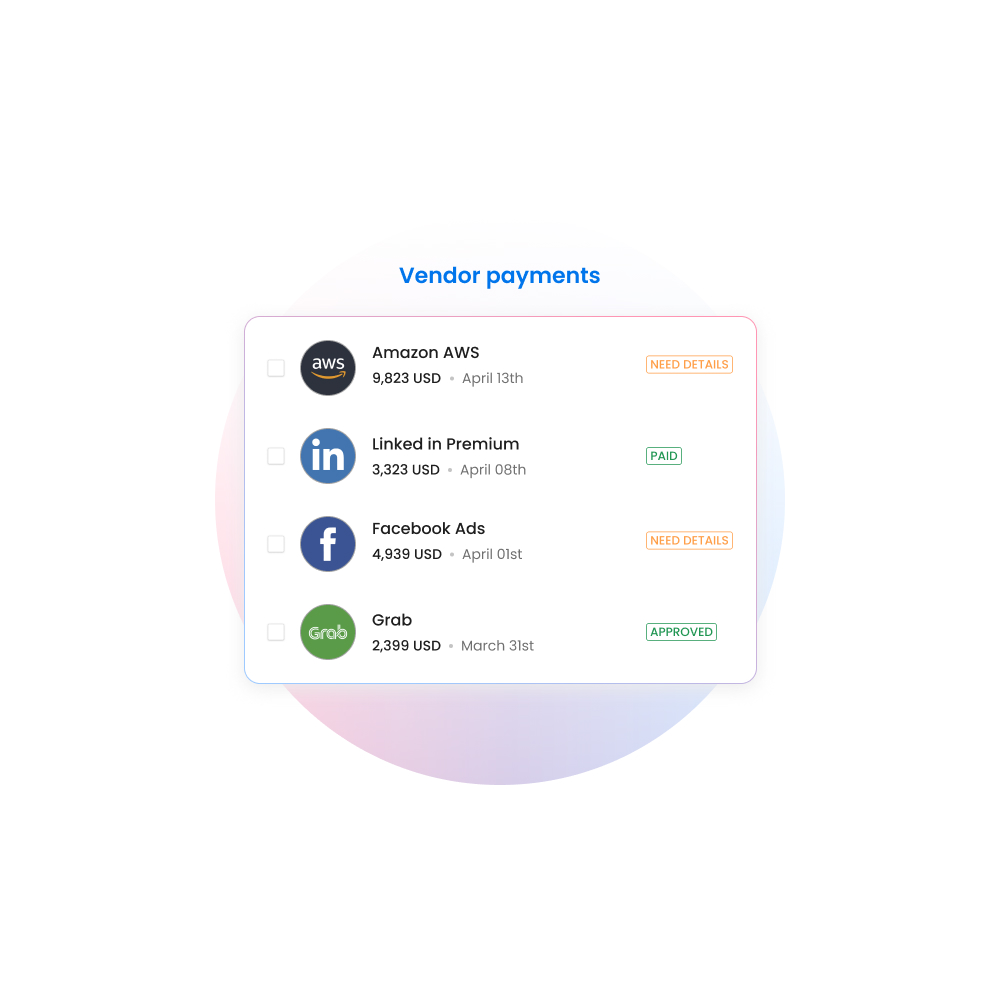

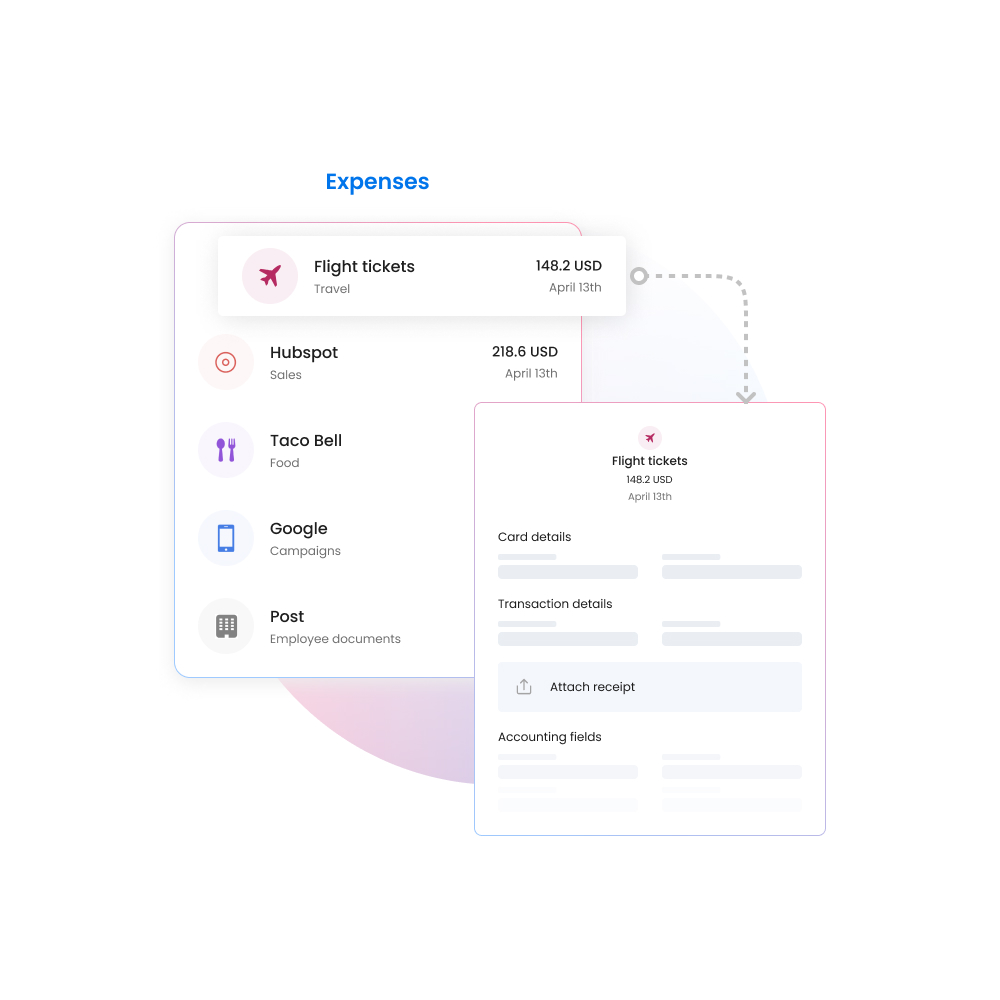

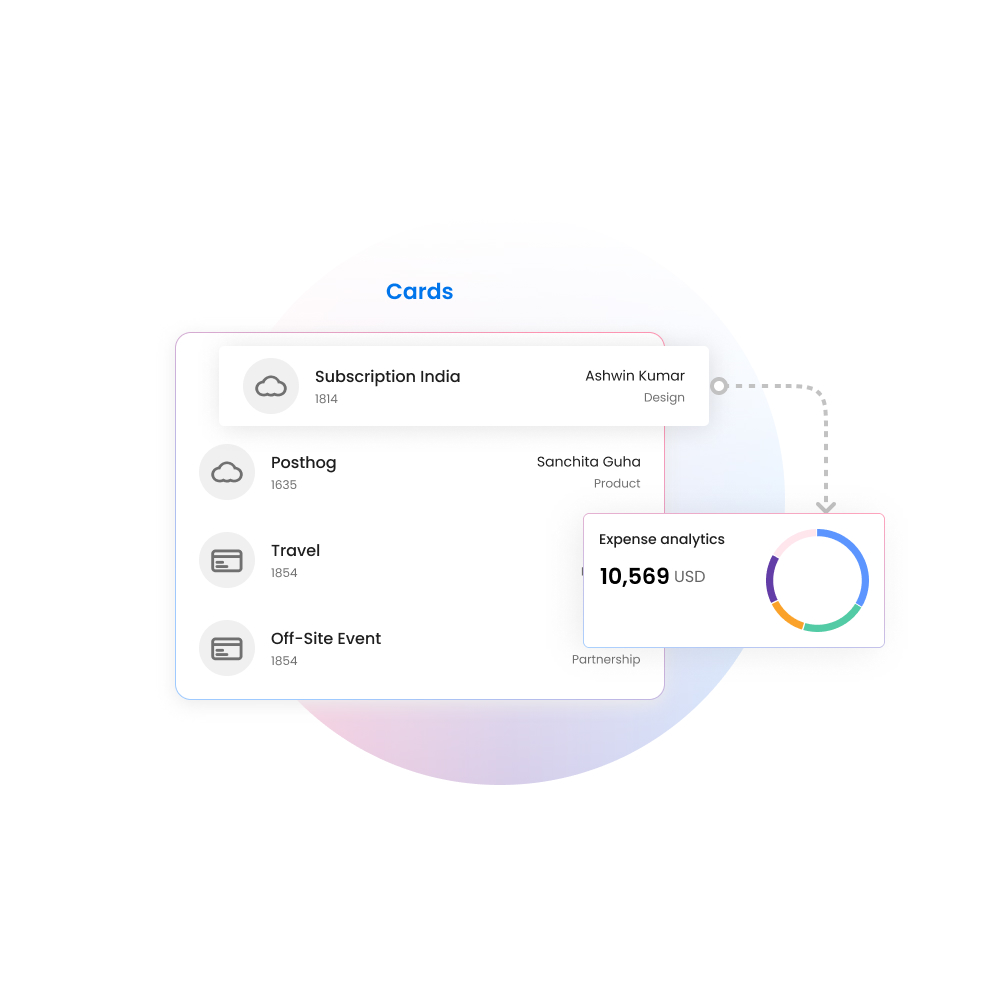

Get started with Volopay

Take your business to the next level with Volopay. Volopay is an all-in-one accounting automation and spend management platforms that offer you a variety of features to digitalize your business. It is your one-stop solution to automate complex accounting tasks like employee reimbursements, subscription management, invoice processing and payment, and lots more!

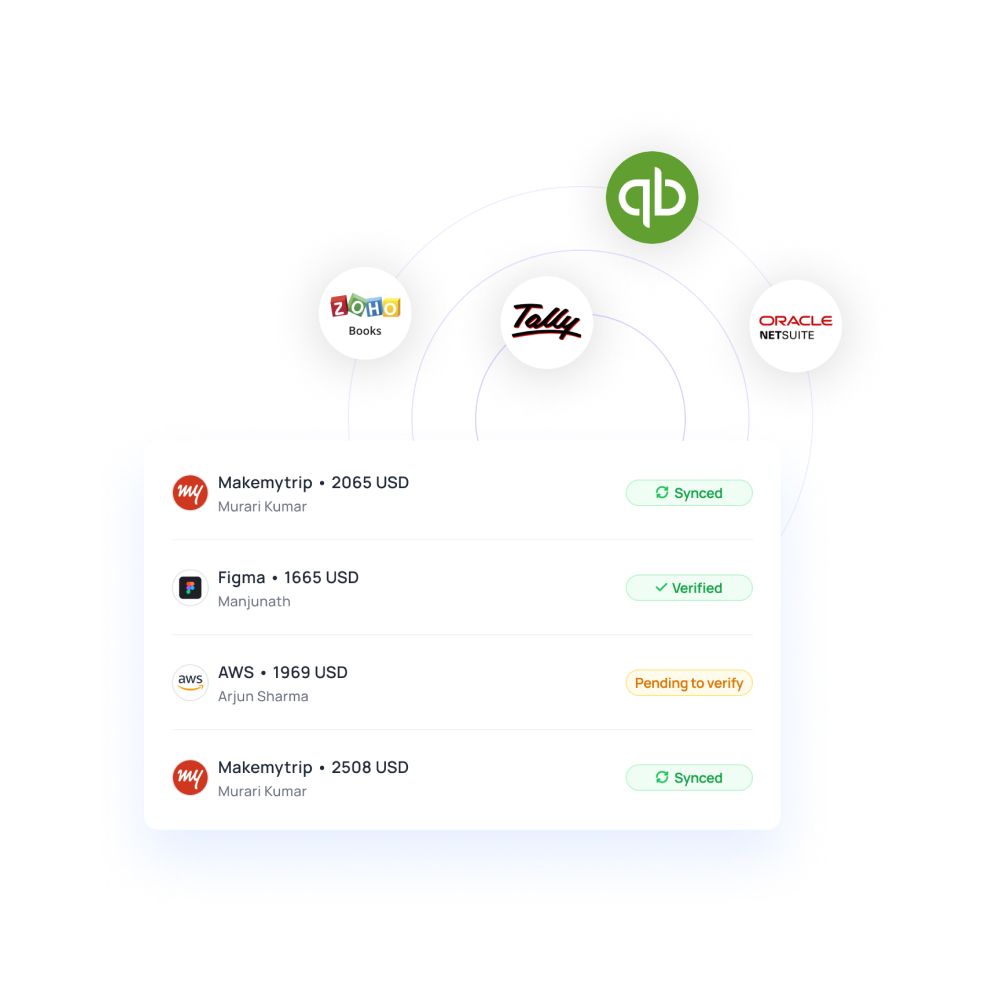

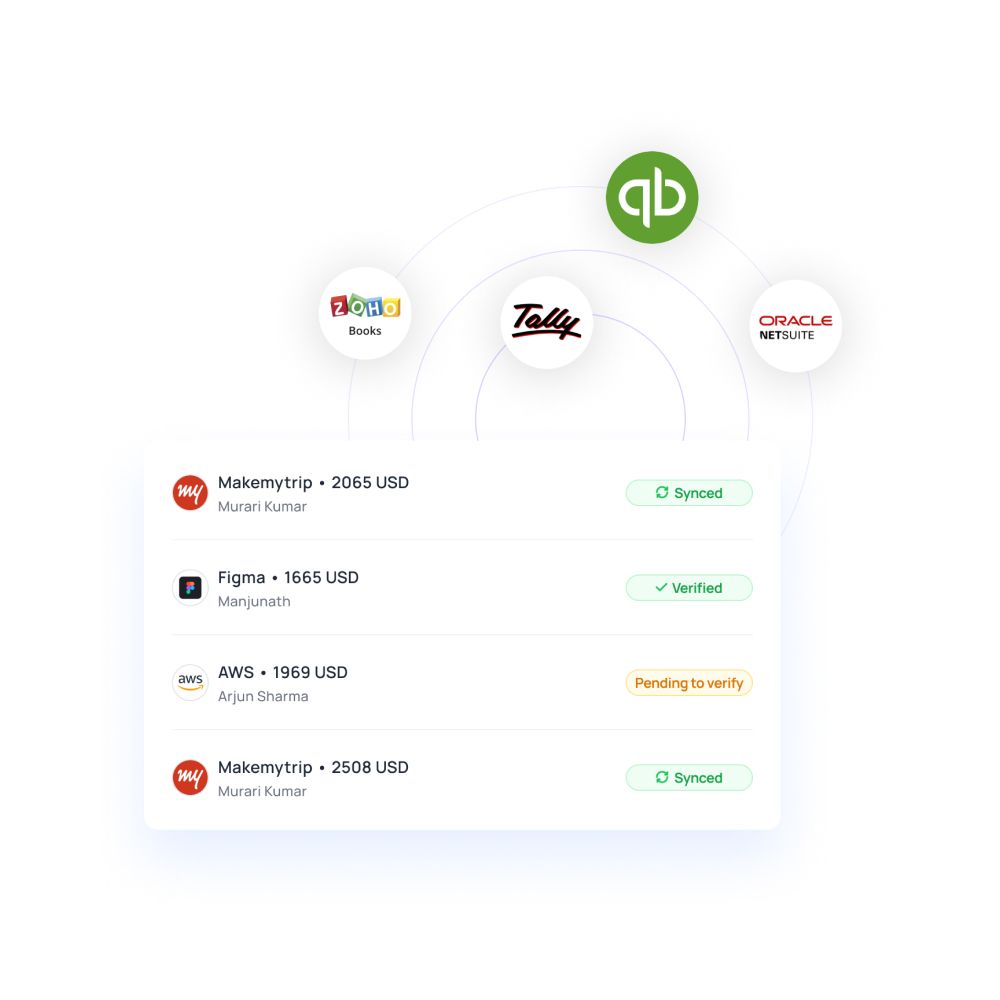

We offer various accounting software integrations with platforms like Xero, QuickBooks, and NetSuite, and these integrations automatically account for every transaction under the correct field and you can easily download the reports. We safeguard all your accounting structures with digital receipts and invoices, that help you streamline all your transactions.

FAQs

Outsource accounting and bookkeeping are considered a good idea because they aid in saving a lot of time, resources, and energy on planning the business strategies. Further, they add to the generation of revenue, as well as networking and developing relationships with your clients.

The 2 basic business bookkeeping principles include:

Revenue principle - A point of time when a bookkeeper records a transaction as ‘revenue’ in the accounting books.

Expense principle - A point of time when a bookkeeper records a transaction as ‘expense’ in the accounting books.

The business bookkeeping process consists of 4 essential activities. They are as follows:

- Analyzing financial transactions and posting them to their specific accounts.

- Maintaining original journal entries that debit and credit the appropriate accounts.

- Posting records to ledger accounts.

- Balancing entries at the end of an accounting year.

Trusted by finance teams at startups to enterprises.