Benefits of continuous accounting model

Record-to-report has been the most popular method of accounting for a significant part of the 20th century. However, various drawbacks and insufficiencies were pointed out with the move towards the 21st century and the immense growth in business technology. To compensate, a better and more progressive method of accounting has been adopted by modern companies, which is called continuous accounting.

Continuous accounting can be a game-changer for all business operations, not just the financial ones. It is much more than just providing real-time financial information to the heads of decision-makers from past readings.

What is continuous accounting?

Continuous accounting is a process that helps conduct accounting tasks in real-time or continuously so that all the transactions are immediately recorded, and the books are updated automatically.

This approach significantly reduces the month-end accounting workload, sparing finance teams from the stress of last-minute reconciliations and reporting. It aligns closely with management accounting goals by promoting efficiency, accuracy, and timely insights that support strategic decision-making.

The process is built on modern financial accounting practices and emphasizes three key principles:

● Automation of recurring accounting tasks to increase transparency and maintain the integrity of data

● Division of accounting tasks over fixed intervals (monthly, quarterly or yearly) to terminate the burden of last-minute business accounting and ensure that all the finances are handled at the prime time

● Establishing a continuous improvement culture in the accounting management cycle and setting new financial performance objectives.

Continuous close accounting is more than simple automation of financial operations. It builds a new foundation for better financial responsiveness and utilizing the best from modern accounting software. This is done to ensure the timely and efficient completion of all business operations performed throughout the year.

6 benefits of continuous accounting

Improved business agility

Through a regular check and analysis of the accounting reports, all the people working in the company will be riding the same boat and will be working with the same fresh data. This helps a company maintain a constant growth rate and achieve all the target goals in a shorter period than expected, as everyone works efficiently without any misinterpreted or inaccurate information.

More informed decisions

It seems like a dream when all your books are balanced and reconciled at any moment. However, a “soft close” is possible with regular reconciliations and little effort. When all your finances are updated in real-time, the decision-makers won’t have to invest time in making reports and adjustments to get the correct information to take any further action. Everyone in the company would be working with up-to-date financial data, which in turn streamlines all the business operations.

Improved data integrity

Even after accounting automation, there is a possibility of errors occurring, especially in the initial data entry stages. However, when someone reviews the data daily, the mistakes in the finances can be spotted before any massive destruction is caused. The case is the same when it comes to identifying fraudulent transactions. Once your accountants are in a routine to reviewing accounting data, the overall data integrity automatically increases.

Makes compliance and auditing easier

Being compliant with statutory and other requirements becomes much easier for a company if fewer people are involved in the financial accounting processes. The auditors will be able to analyze the data more precisely when all the data is stored in an automated system and not in manually created spreadsheets. This is because everything is accurately connected with relevant records and transactions. An open-book audit can be a beneficial practice for any organization. Here the auditor gets read-only access to the system.

Employee engagement

Automated information storing and accounting processes result in a balanced and manageable workload division that eliminates burnouts and prepares an excellent financial team.

More time for analysis

Instead of spending an immense amount of time creating data reports, Investing more time in the analysis and review of data is more critical to implement beneficial decisions. Continuous accounting significantly reduces the time of completing the standardization and automation of many accounting processes. Once the possible financial operations are automatized, the analysis process won’t consist of any extra time of creation. After standardization, the whole procedure is consistent, and error-identification becomes easier.

Volopay accounting: A modern solution for your accounting needs

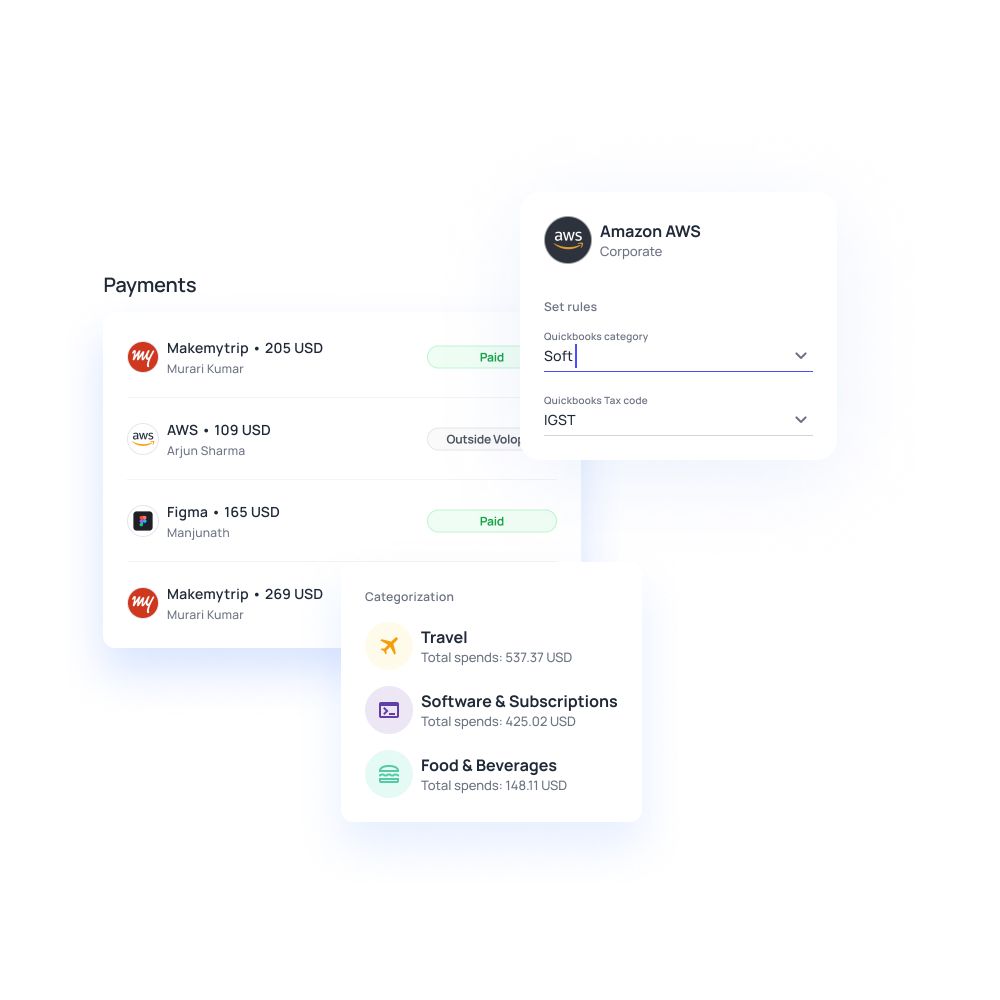

Volopay is the ultimate solution to all your accounting problems. It is an all-in-one accounting automation software that is specifically designed to relieve your financial team members of repetitive and cumbersome tasks and complete all your business operations in an unimaginably faster and more effective way.

All-in-one accounting

This software is the one-stop-shop to automate all your intricate and complex accounting tasks like subscription management, employee reimbursements, invoice reconciliation, vendor payments, etc. All your accounting is managed without paper, i.e., using digital invoices and receipts to streamline every transaction and record it in real-time. Along with this avail the amazing new feature of accounting triggers which immensely reduces your manual work. From expense policies regulation to using corporate cards with personalizable budgets to quicker closing of books with efficient accounts payable reconciliation and chaos-free accounting integration - do it all with Volopay!