What is invoice reconciliation?

Invoice reconciliation is the process of matching the information on the invoice with another record such as a bank statement or company ledger. When you run a business that relies on goods and services from an external supplier, or your company itself is the one that provides products to other businesses, then a need to reconcile invoices may arise.

Businesses conduct a reconciliation process when they notice some errors or inconsistencies on an invoice. These need to be corrected to make sure that all your accounts reflect the correct transaction values and are matching up with each other.

When should you reconcile invoices?

Now there are various types of errors that you might notice on an invoice. Some of them may be legitimate mismatches while some may be fraudulent attempts.

● Amounts between a bank statement and an invoice may not match due to early payment discounts.

● If the transaction was international, there’s probably an unaccounted currency conversion fee.

● An invoice could have been lost or misplaced leading to different balance amounts.

● Late payment due to late delivery messes up with accounting.

● When only a certain percentage of the invoice was paid.

● Issues that are not in your control like the time taken for money deposited to reflect in bank statements.

These are some of the factors or situations where the need to reconcile invoices becomes necessary. This way you’ll be able to tell whether the mismatches in records were legitimate or not and take further action to solve the issue.

Such logistic requirements are usually fulfilled using corporate credit cards or some form of credit payment. So at the end of the day, even if the payment is not directly going to a supplier from you, you must reconcile invoices for payment to creditors that you eventually have to make.

Related read: Importance and best practices for accounts payable reconciliation

Invoice reconciliation steps

From sending a purchase order to invoice reconciliation there are many steps involved to make sure that matching and reconciliation go smoothly.

Organizing all documents

The first step in the invoice reconciliation process is to gather all the invoices for a particular vendor. Then reorder them according to the dates you received them in a way that matches the format of your bank statement. This will help in the easier matching of particulars. You can do this using physical documents or digital ones and software programs like Excel spreadsheets.

The matching process

Once you’ve organized all the invoices from a vendor, you must then start looking at each particular on the bank statement and see whether the same is reflected in the invoices. Apart from the invoices, you can also keep the goods receipts handy to make sure you’ve received all the products mentioned on the invoices.

Tallying the information

As you reconcile invoices, start marking off each particular that matches with the invoice. You could draw a straight line across them or add any form of mark next to it to indicate that that particular entry is legitimate and verified. Make sure to not only check the goods particular and amount, but also the date the transaction took place. Similar dealings might occur on multiple dates with the same particulars and could lead to reconciliation errors.

Mark the inconsistencies

Whenever you find an entry on the bank statement that you can’t find on your invoices, check your goods receipts. If you still can’t find it, chances are you either lost the invoice somehow, didn’t receive it, or the entry might be an error. Mark this in a distinct way so that you can get back to all such errors at the very end of the reconciliation.

Calculate the sum of invoices

Finally, add up all the invoice amounts for a vendor and see whether it matches your bank statement. If you don’t find any errors during the matching process but find the total amount that you get from the invoices differs from the total on your bank statement, then clearly something was missed out in the matching process. You’ll have no choice but to tally the records again and see which error slipped through.

5 tips for effective invoicing reconciliation

1. Systematically organize invoices as soon as you receive them.

2. Make different invoice folders for different vendors, be it physical or digital. Also refer our article on vendor reconciliation process in accounts payable for better idea.

3. Maintain a regular interval for conducting reconciliations.

4. Create systems to recognize paid, unpaid, and partially paid invoices.

5. Rectify reconciliation errors as soon as possible so that it doesn’t affect accounts and auditing.

Manual vs automated invoice reconciliation

Manual invoice reconciliation

You know that the invoice reconciliation process has traditionally been done manually. Now while it gets the job done, it isn’t the most efficient way to go about it.

As you can imagine, going through all the particulars on an invoice and then manually matching it with a bank statement or your company ledger to check whether the amount of money to be paid or received and the quantity of goods received or delivered matches up is an extremely time-intensive task. Add to that the chance of human error. A process meant to remove errors with the scope for more errors.

Automated invoice reconciliation

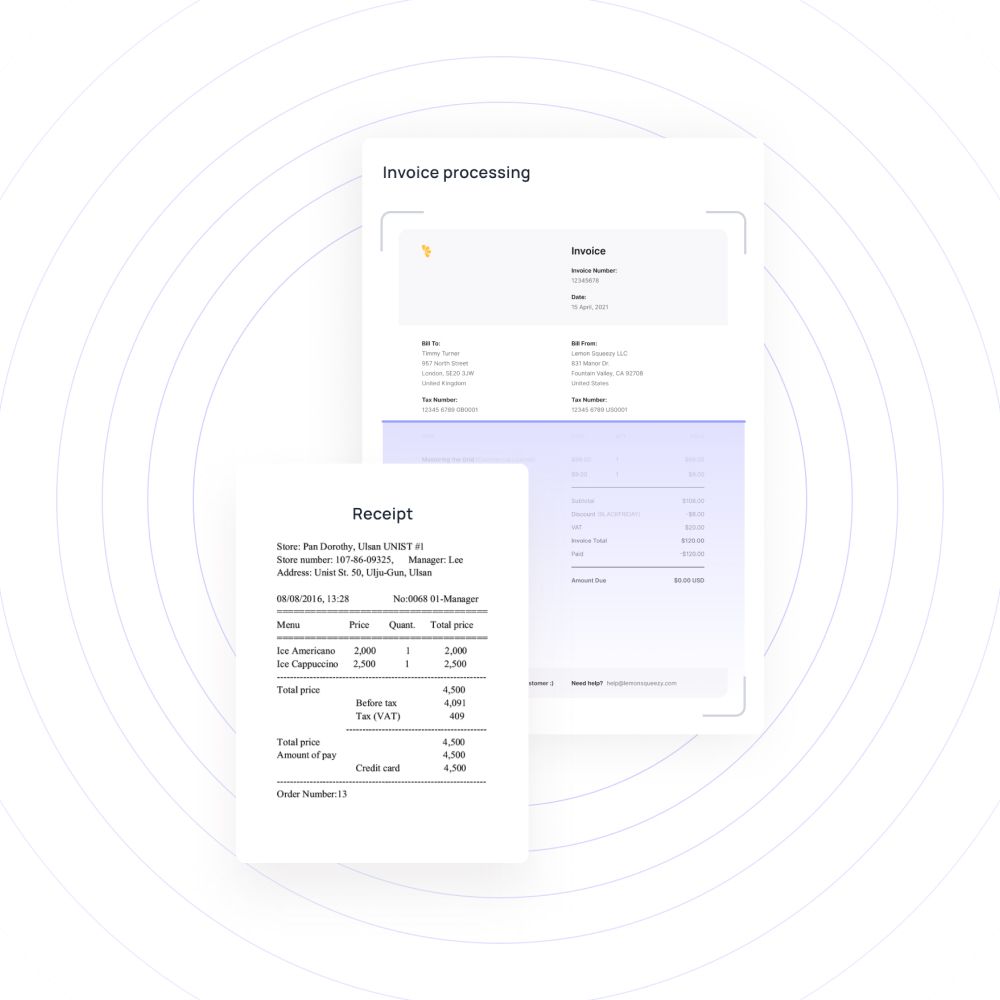

This is when businesses started choosing modern expense management software which can directly scan documents using OCR (Optical Character Recognition) technology. By doing this, you let the software match the particulars on different records and find errors.

Once the system detects a mismatch between your invoice particulars and the information on other statements, it will highlight these errors. In this manner, automatic invoice reconciliation saves the time you spend trying to find errors and instead helps you get to solve them immediately.

Related page: Guide to OCR invoice processing in accounts payable

How can Volopay help you with invoice reconciliation?

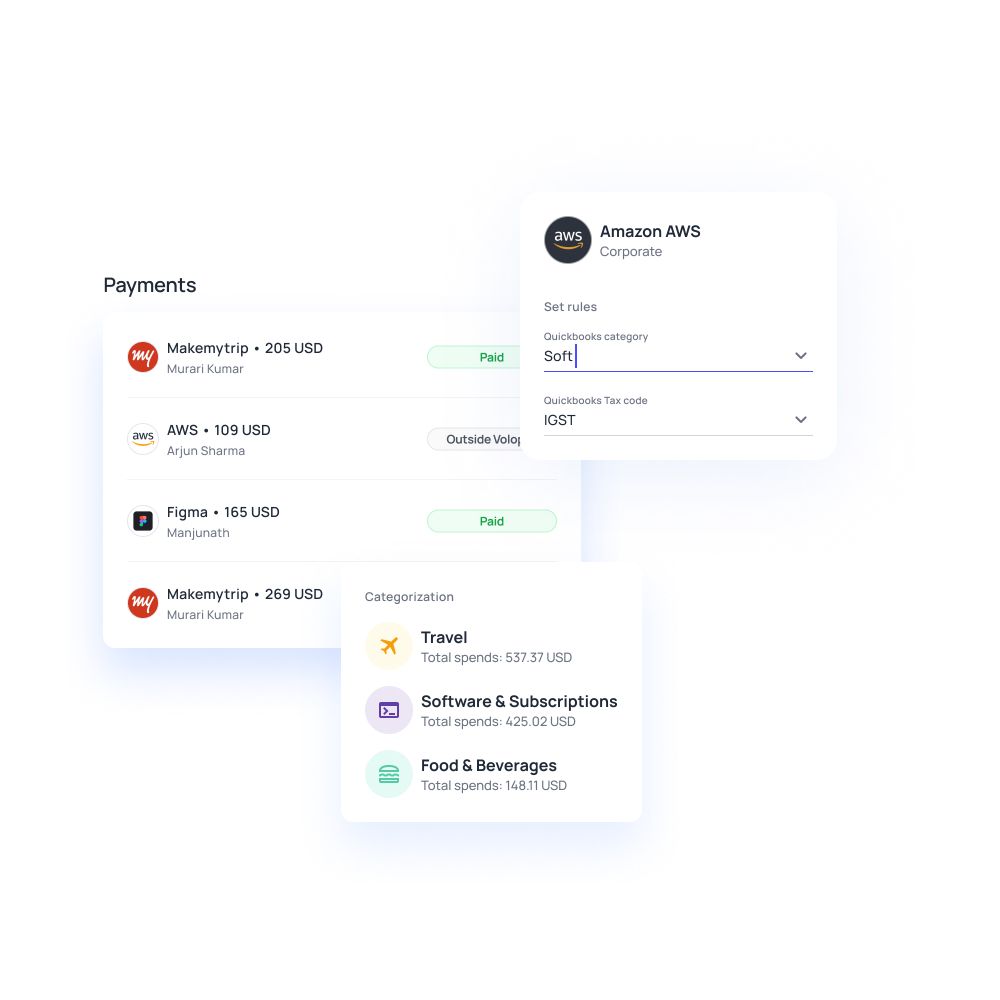

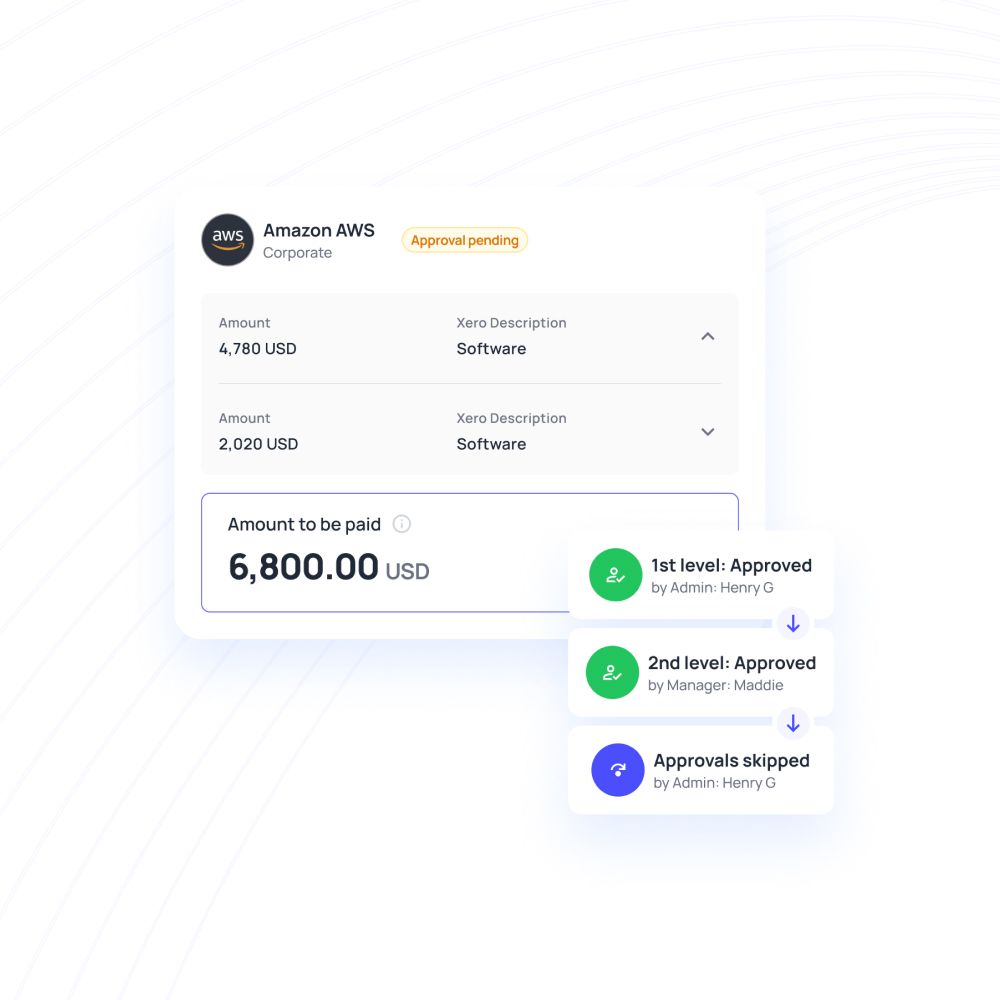

Automated platforms like Volopay help you reconcile invoices and identify discrepancies much faster than an individual accountant going through all the documents manually. With invoice reconciliation software like Volopay, you can manage and reconcile errors in real-time. The way this is possible is because of how invoice management works within our platform.

3-way matching

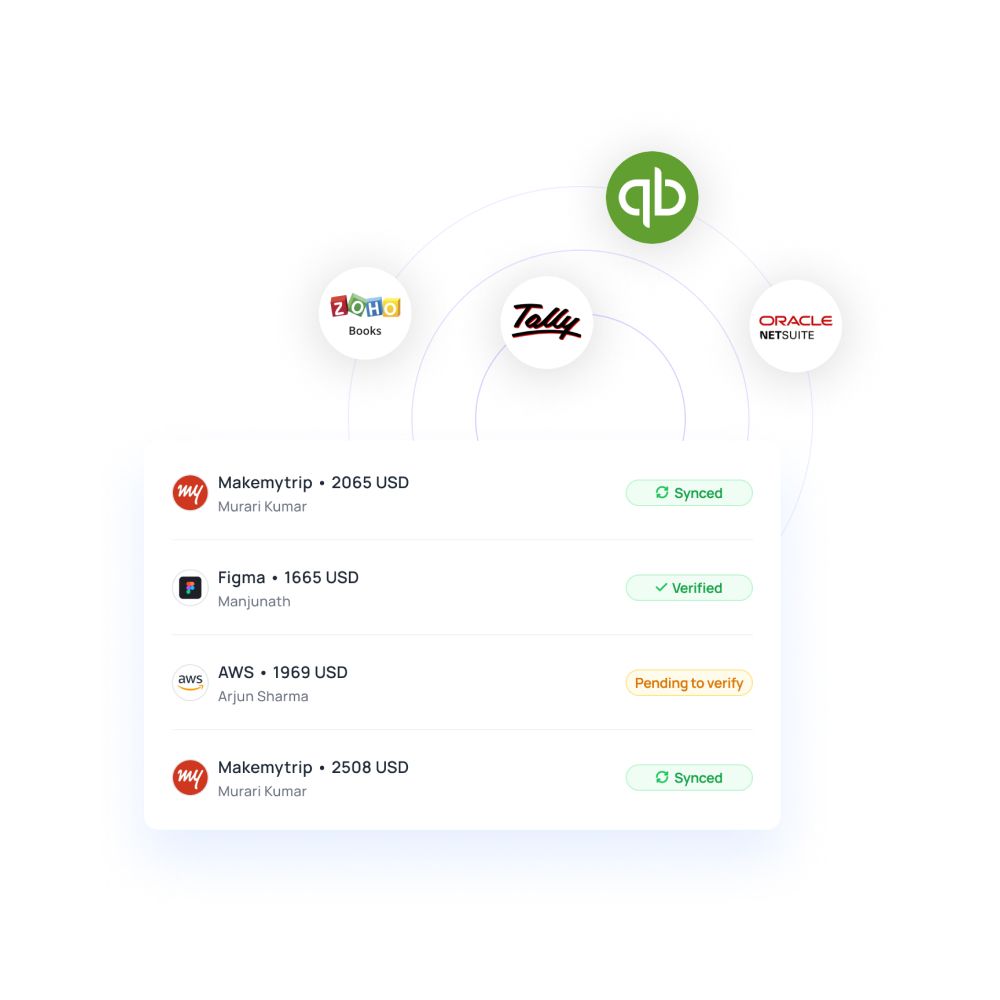

This includes emails, your accounting automation tools, and the platform itself. The best part is that the sync is two-way. So invoices can be pulled from emails and the accounting software onto the Volopay dashboard, and the accounting software can also extract transactions from our platform. This ensures that no bill goes unnoticed, unpaid, saving you from a late payment fee.

You can create individual vendor accounts and as and when you receive their invoices, they will be automatically mapped onto the platform under their account. This saves you the hassle of manually organizing invoices for each vendor. You’ll instantly be able to see at a glance which invoices have to be paid and which have been paid.

Document sourcing

The very first step is sourcing the invoices. A finance team member would collect and sort all invoices before beginning the matching process. This step is no more something that a person has to do manually as all the invoices are automatically mapped to their respective vendor accounts.

Data extraction

The way the automated mapping process works is that whenever the system receives a new invoice, the OCR (Optical Character Recognition) technology scans the document and extracts important information from it.

Structuring information and reconciliation

The software is built in such a way that it understands contextual and relevant information for invoice reconciliation. So once the data is extracted it matches it against the structures you have set within the platform and fills in the necessary information.

For example, a scan of the document will extract critical data to accounting such as the vendor name, invoice date, due date, item description, quantity, amount, and tax rate from the invoices and automatically sync it with accounting software for paid bills.

Rectifying errors

The three steps above all happen automatically and once the reconciliation process is done, you’ll be left with errors if any that will be flagged by the system to help navigate them quickly. So what used to take hours, now happens in seconds leaving you more time to rectify the errors.

FAQs

The major problem with managing invoices is all the different sources they can come from. So, Volopay gives you the option to directly upload an invoice on the platform as well as source them through email or an integration with your accounting software.

Yes, a category tag can be added to every invoice so that you can later see how much money was spent on what type of expense. You can also create vendor accounts to keep track of invoices from different vendors.

To know how Netsuite can be integrated with Volopay click on this link. If your business uses some other accounting software, check out our help section where you’ll find information regarding how our platform integrates with other accounting services.

Trusted by finance teams at startups to enterprises.