8 Benefits of cloud accounting software for business

Accounts departments across companies use a lot of documentation - invoices, balance sheets, profit, and loss statements, tax reports the list goes on. Managing and processing so much paperwork has been the cause behind many headaches. However, thanks to accounting automation, there’s a shift in the industry that’s transforming our approach to accounting, eradicating the need for paperwork altogether.

Businesses all over the world are transitioning to smart, paperless and environment-friendly systems. Enabling this shift has been the introduction of cloud-based accounting. Modern accounting needs to function at a high level of efficiency and cloud accounting software is growing into the tool of choice for any business looking to adapt to this industry-wide modernization.

What is cloud-based accounting automation?

The practice of storing and processing data on physical servers or paper is no longer efficient enough for the finance world. As an upgrade to these traditional systems, we now have cloud-based accounting automation. With these platforms, you can store and process all your data on online ‘cloud’ servers that can be accessed anywhere anytime by anyone who has the correct login credentials.

Suggested read: What are benefits of accounting automation software?

Cloud accounting technology safely stores, processes and manages all of your company’s accounting data on one secure platform. The data is kept encrypted, like a bank, and can be accessed only by entering the correct login details. You can access the cloud servers of your business accounting software through the internet.

With cloud accounting technology, the need to set up and install software on individual desktops is no longer necessary. Anyone with the required credentials can use their own devices to access the cloud. This is especially useful now because also allows remote or out-of-office teams to use the same software to gain access to the same data and make changes in real-time.

Benefits of cloud accounting software

In-depth analytics

Cloud accounting software also comes with state-of-the-art analytical tools and resources that can give you nuanced insights and complete visibility over all your finances. This software can function as your personal financial advisor making your customized reports and giving valuable inputs.

Secure storage

In comparison with desktop-based software or paper-based systems, cloud-based accounting offers a much more secure option for storing financial information. SaaS providers routinely back up data to multiple servers spread across different locations, and the absence of any physical storage points means the risk of data being stolen is also cut down. This also ensures that data is also protected against natural disasters.

Hassle-free access

Having your data stored on a paperless accounting system means that there are no copies or limited physical books that can only be accessed by individual people at a time. When your data is stored on a cloud that means that that data can be accessed by any number of people at any given time from anywhere. Only by entering login credentials, all these people will be able to see the same data on the same software at the same time and collaborate on the data if necessary.

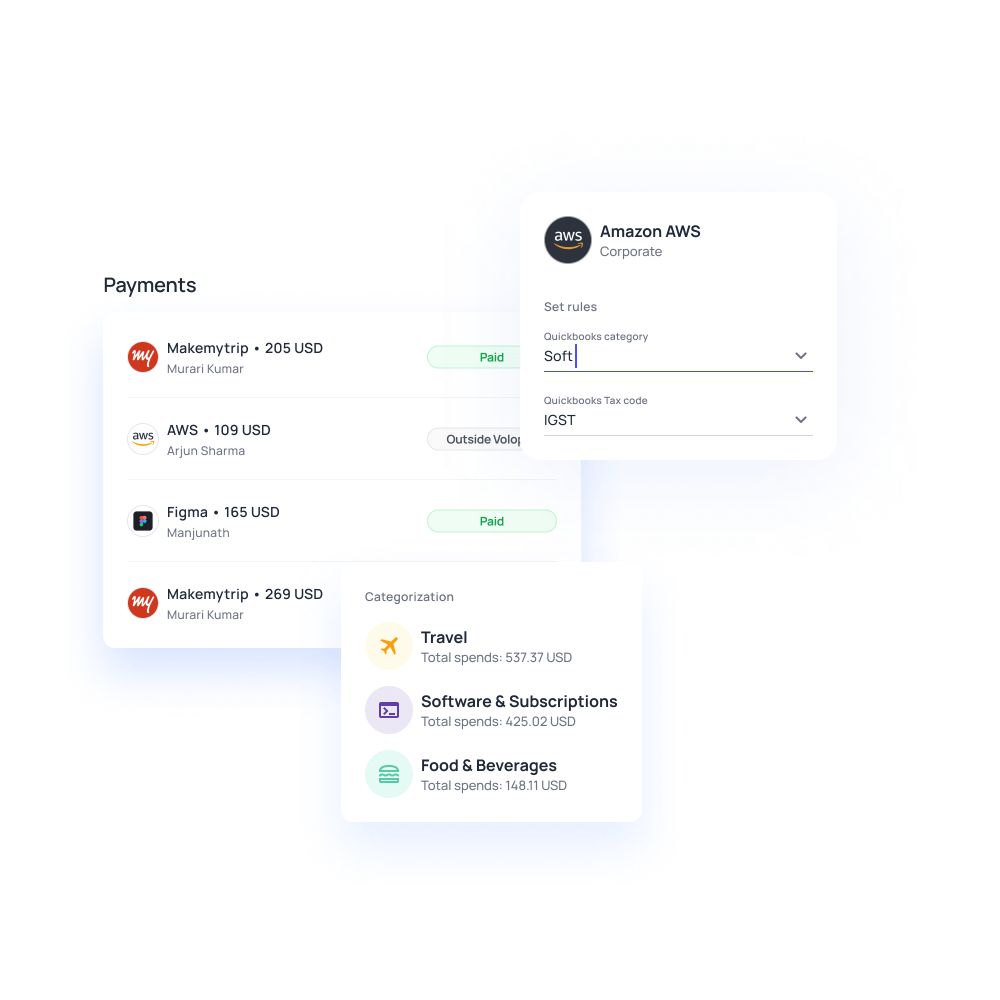

Real-time transactions

One of the best benefits of cloud accounting software is that you can enjoy the privilege of viewing your accounting transactions in real-time as and when they occur. Waiting for the end of a week, every other week, or a month before you can spot discrepancies in cashflow or finances can be detrimental to your visibility over your finances. Real-time transactions and reporting features of cloud accounting help you obtain financial snapshots of your accounts whenever and wherever you want or need them.

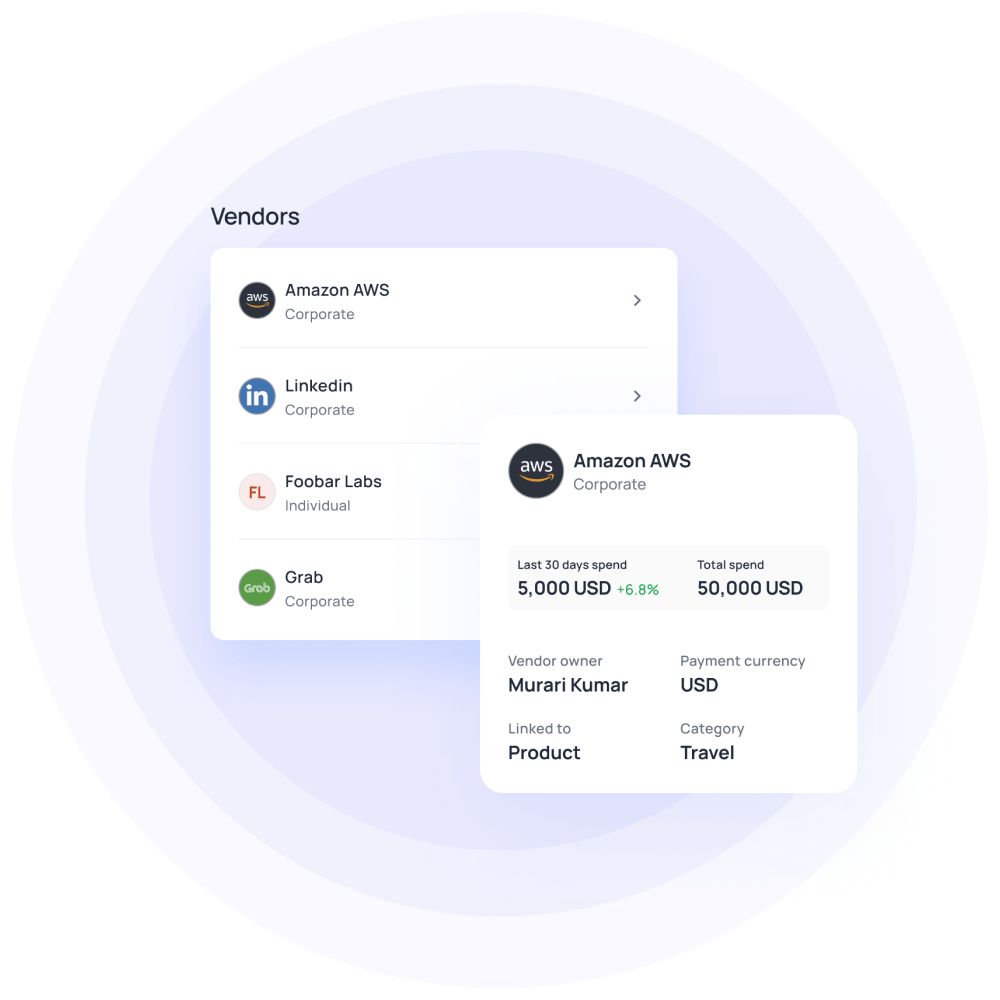

Centralize tasks

Cloud-based accounting software comes fitted with a whole array of features that, when put together, function as a one-stop solution for all your accounting woes. These platforms offer services like expense reimbursement, invoice processing, forex transactions, and automated approval workflows that work together to help you centralize and consolidate all your accounting processes on one comprehensive platform.

Improved accuracy

Accounting automation takes a lot of the guesswork, manual labor, and need for verification out of accounting processes. Technology is far less susceptible to errors than human beings. When you delegate your accounts to a cloud-based business accounting software you are not only reducing your finance teams’ workload but also ensuring that tasks are performed by a system that is designed to be error-free, accurate, and airtight.

Faster processing speed

Paper-based accounting comes with manual processes that take time and can be error-prone. Not only does automation improve your accounting systems’ accuracy, but it also makes them so much more efficient and, most importantly, faster. The sooner your systems are able to process and manage your accounting data the sooner you can take action on them.

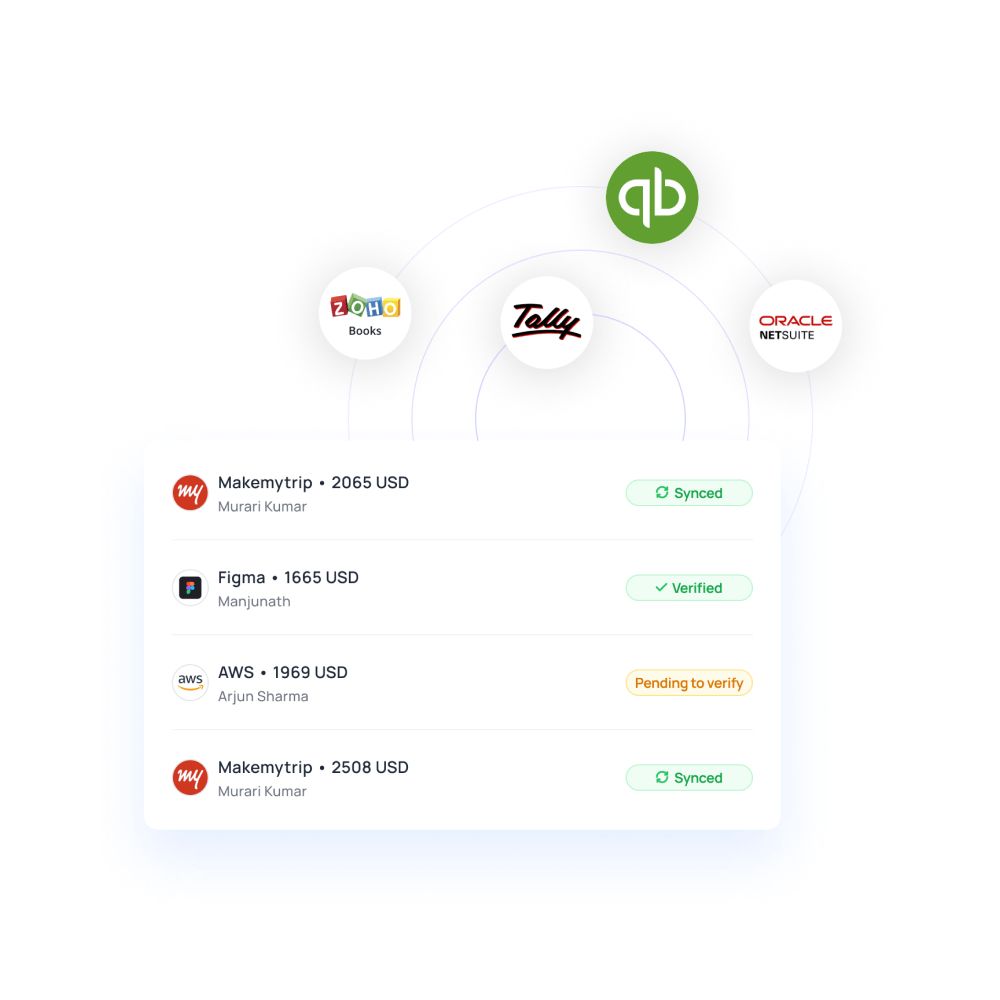

Seamless integration

Everybody knows how confusing and tedious handling multiple software to manage the same process can be. Accounting software (e.g. Xero, Quickbooks, etc.) that you have been using previously must hold data that you cannot lose. Why should you when you can employ a cloud accounting software that can integrate itself with your pre-existing systems? These platforms can seamlessly merge themselves with your accounting software to help you not lose out on historical data and at the same time use this data to make better decisions in the future.

Why going for paperless accounting makes sense

Cloud accounting software takes seconds to retrieve information from databases. Consequently, they can drastically reduce the time your accounts team might take to respond to inquiries made by vendors, suppliers, or other external sources. Earlier you would have to dig out information related to an inquiry manually but now this task can be fully automated.

When you are going paperless with cloud-based technology you make inter and intra-departmental collaborations much easier. Your accountants and CPAs should ideally be working together to serve both your clients’ and your company’s finances. Cloud-based business accounting software facilitates real-time collaboration so that your teams can analyze numbers, discuss strategies and make changes together, without any obstacles.

With paperless accounting, your accounting staff will be able to gain access to any information they need within a few clicks. The need to get up, locate necessary folders and search through them can be highly tedious and inefficient. By going paperless, you can make it easy for all your employees to expedite document procurement and move forward with tasks that need said documents with minimum obstacles.

All paper-based systems require supply and storage facilities. Any such service costs a good amount of money to set up and maintain, e.g. file cabinets, manila folders, warehouses, etc., all require you to allocate at least some percentage of funds towards upkeep. Moving to a paperless accounting system means moving to a whole new form of storage. With a paperless accounting system, physical resources and space needed to store documents are eradicated and replaced by cheaper, digital forms of storage.

Traditional or paper-based accounting requires every single document to be processed in a particular manner. When an employee raises a purchase request, for example, that request document will have to be received, manually reviewed and the information has to be stored after which your finance team will have to raise a purchase order, receive goods, send invoices, enter it into books, etc. With cloud-based accounting, this entire process can be rendered paperless. Each of these manual processes can be replaced by a few mouse clicks.

Processing invoices is both tedious as well as a process that your finance team probably has to carry out fairly regularly. It is also a task that has been heavily paper and, or, manual labor dependent. Luckily, invoice processing is one of the fundamental features of a paperless accounting system. These platforms have replaced data entry with e-invoices or OCR processing and scanning. All the information is already stored in your accounting system before you even start, cutting down on time taken and significantly reducing errors.

The future of business accounting is paperless

How to make your accounting paperless and cloud-based?

Step 1: Identify opportunities to go paperless

The best approach to going paperless is to first identify the processes that are relatively easier and use a lot of paper. Even if you plan on eventually adopting complete digitalization, these are the systems you should target first. Your first step should be conducting an overall review of your business processes and highlighting which are the most paper-intensive, need to be streamlined, and which can be digitized easily.

Electronic billing and invoicing, for instance, are a good place to start. They are easy to set up and help you to cut down on recurring paper usage.

Step 2: Choose software

Your plans to digitize processes will grow as and when your business grows. Keeping the scale, scope, and future potential of business in mind is important when determining which software to go for to get the best out of cloud-based accounting.

Cloud accounting technology has really grown into a powerful tool. Platforms like Volopay come fitted with features that help you expedite employee reimbursements, invoice reconciliation, transfer funds, provide analytical insights all within a few seconds of you clicking some buttons. If you’re going paperless you should definitely look for these services at least. You should also opt for software that can extract key data from documents and integrate them with your pre-existing software to enable one-click reconciliation and audit proofing.

Step 3: Educate employees

Adopting cloud accounting software will be of no use if your employees are not informed and onboard regarding the same. Your employees are the ones who will have to interact with these systems most of the time and, therefore, must be well versed with the workings of this technology. You need to train them, preferably via dedicated workshops, on the systems you have established on your cloud-based accounting system, filing conventions, back-end processes, and so on.

Step 4: Implement organizational change

Once you’re finished choosing the right software, training your employees, etc. you then have to implement your new cloud accounting system across the organization. You should ideally roll out this transition in a gradual manner. Start by conducting small-scale test runs using a small team working on two or three processes that consume a lot of paper. Once these test runs show fruitful results you can then move on to implementing the new systems across the organization.

Step 5: Dispose of old paper copies

Storing and managing old copies of data is both tedious and unnecessary. With cloud accounting software this data is already stored safely on a cloud. Moreover, these copies are likely also racking up storage costs.

You can either partner with a shredding service to have your documents disposed of by a mobile shred truck or use the industrial shredders they might have at a separate shredding facility. You must also obtain a formal certificate of destruction after the shredding is completed. This certificate contains details like the time and location of shredding and can also come to use as proof of compliance in case of legal disputes.

Step 6: Ensure compliance and eliminate risks

Last, but definitely not least, your focus should be on ensuring that the guidelines you have laid out and those required by your government are both followed and at the same time risks are kept at a minimum. To protect your systems against accidental deletion or corruption, system-wide crashes, or other unforeseen emergencies you must ensure that all your data is regularly backed up into your clouds. When you back up data it helps you to quickly restore normalcy.

Maintain total visibility over transactions and changes by choosing a cloud-based accounting system that records document interaction history. This helps you establish audit trails that ensure accountability and compliance. Also, you should ensure proper storage and file retention policies are in place to protect you against lawsuits and liability claims.

Related page: What is a chart of accounts in accounting and how to map one

How to choose a cloud-based accounting platform?

Your policies won’t work unless you have a platform that can support them. When you’re formulating your approach towards going paperless, keep in mind the kinds of tools you’ll have to be equipped with to tackle the challenges you might face.

The benefits of cloud accounting software and accounting automation can only be enjoyed when you have accounting software that is adept at handling documents. Features like index and search, email management, and OCR or optical character recognition should be at the top of your priority list so that you can keep your documents categorized regardless of the file format.

You should also choose a platform that is highly rated for its security features, flexibility, and customer service. These aspects of the platform will help you ensure smooth accounting operations in the long run. By flexibility, here, we mean a platform whose services can be customized to your company’s scale, scope, and needs.

Why Volopay is the right choice to go paperless

Choosing the right tool will make a huge difference in how well you are able to execute a task. The same goes for cloud accounting tools. This is why at Volopay we have strived to build an all-in-one platform that can handle all your cloud accounting needs.

Comprehensive accounting system

Volopay comes equipped with one of the most advanced cloud accounting systems out there. The software is able to store, process, and manage large amounts of financial data with ease. Features like OCR, index and search and analytical tools help you easily sort your data and gain valuable insights from them. On Volopay your data is also extremely secure, protected under multiple layers of security, much like a bank.

Cloud accounting does drastically reduce the amount of paper your company will go through on a daily basis. However, it does not completely eradicate the use of paper because few processes, like collecting and scanning receipts, will use some amount of paper.

Yes, one of the best benefits of cloud accounting software on Volopay is that you can get instant access to your finances and accounts on your smartphones.

The occurrence of errors in cloud-based accounting is non-existent. Your financial data is processed by airtight systems that are capable of handling large amounts of data with ease. Moreover, if there are any errors they are usually resolved with ease.

Yes, Volopay’s services are well equipped to handle multi-currency transactions as well as balances.

The maintenance required for cloud-accounting platforms is minimal. Moreover, any maintenance or updates that do have to be performed will be handled by your SaaS provider.