What is a chart of accounts in accounting and how to map one

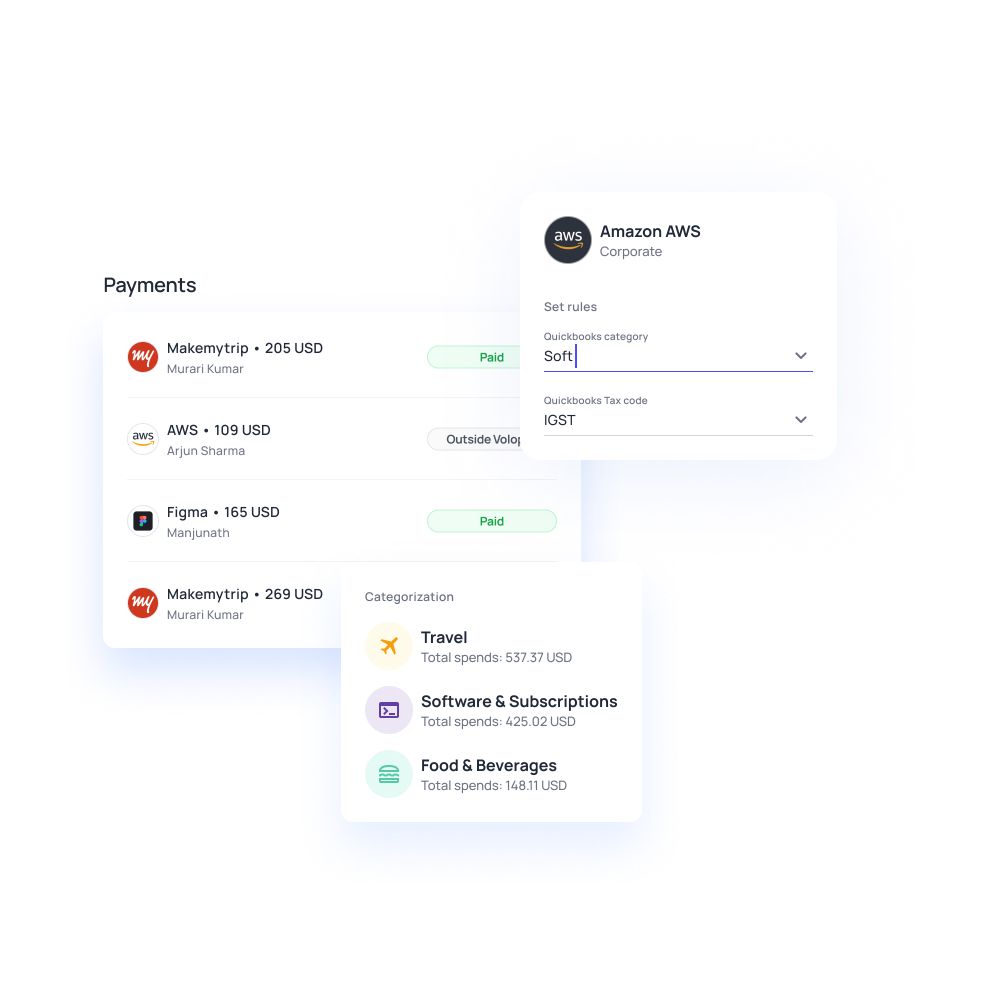

Everybody knows how important it is to accurately categorize business expenses. Every expense your company makes must be recorded and categorized as per its particulars. The role that chart of accounts mapping plays in financial management is this - it can help you categorize your business’s financial transactions, expenses, and payments that are made during a particular period of time.

Not sure about how a chart of accounts for small business works? We’ve got you covered. Read on to get a comprehensive understanding of what a chart of accounts is, its types, uses, and everything else you need to know to create the best chart of accounts mapping.

What is a chart of accounts?

A company’s chart of accounts is a comprehensive list of all the transactions that a company has undertaken during the course of a particular accounting period. It serves as an index where you can find all your company’s financial activity in one place. A chart of accounts helps businesses gain a bird's eye view over five primary account types - revenue, expenses, assets, liabilities, and equity.

These account types are also classified in the chart of accounts list under two financial statements - the balance sheet and income statement. Assets, liabilities, and equity is classified under the balance sheet while Revenue and expenses form a part of the income statement. Chart of accounts debits and credits and all other forms of business transactions you conduct will be divided into these categories.

Why is the chart of accounts important?

A chart of accounts helps provide a framework for categorizing information related to the accounts involved in business transactions. It helps companies get a comprehensive overview of every transaction the business is involved in. With a well-structured chart of accounts you can access any transaction you wish to and check its particulars.

It is helpful to have a chart of accounts for small business since it helps gauge company value. A chart of accounts stores important information regarding company expense breakups. It can help you determine the exact amount of profit you owe to stakeholders.

Through the financial reports created from the chart of accounts, you can evaluate your company’s performance during a particular period of time. You can also conduct a comparative review of company performance with historical data during a different period of time. Helps streamline accounting for firms with various domains. Chart of accounts helps these companies consolidate and compile their financial records.

Chart of accounts types

The two main types of accounts included in a chart of accounts are the Balance sheet and the Income or Profit & Loss Statement.

When conducting chart of accounts mapping, within these main types of accounts you will also find subtypes of accounts. In the chart of accounts balance sheet, you have your Assets, Liabilities, and Equity while in your Income or P&L statement you have Income, cost of goods sold (COGS), expenses, etc. These sub-types will decide which account in the corresponding financial statement the transaction will be classified under.

Ways small businesses use the chart of accounts

Get an idea of what is owed

Chart of accounts not only helps track sales but also accounts payables. It provides valuable information on short-term and long-term bank loans, how much you pay employees on the payroll, and other such factors related to business liabilities.

Track spending

Alongside sales and dues, chart of accounts mapping also tracks where and what your money is being spent on. It provides information on recurring payments like rent, utilities. It can also help you streamline your expenses by highlighting key areas of improvement.

Keep a check on money

Your chart of accounts list is the best place to gain visibility over where your money is coming from and its particulars. It makes keeping track of sales easy and also helps determine how much of your assets are easily liquidatable.

Stay on top of taxes

Lastly, a well-structured and up-to-date chart of accounts can be your best friend during tax time. It can give you quick access to transaction details of all particulars that are taxable for your business.

Looking to upgrade to automated accounting?

How to create a chart of accounts?

Creating a chart of accounts for small business is not particularly difficult. While the intricacies of your chart of accounts will be dependent on the industry your business caters to, the general approach to a chart of accounts mapping is pretty universal. You’ll have to start by creating a blank chart and assigning the columns. These 3 columns given below are what the COA is most commonly broken down into:

Business account names: The first column in the COA will contain the business account names. These are the titles given to the business account you’re reporting on (i.e., bank fees, cash, taxes).

Account numbers associated with business accounts: Next is the column with account numbers. These are the numbers that you assign to account names to help categorize and identify them. Widely used sequences for these numbers include -

Assets: 1,000 to 1,999

Liabilities: 2,000 to 2,999

Income: 4,000 to 4,999

Operating expenses: 6,000 to 7,999

Account category types: Your third and final column should be dedicated to the chart of accounts expense categories. Every account name falls under a particular account type. There are 4 primary account types that these account names get assigned to. They are asset, liability, income, and expense.

Related page: How to do petty cash reconciliation?

Numbering a chart of accounts

The numbering of chart of accounts is key to its uses. Numbering your accounts helps finance personnel store and process data represented in the chart of accounts. It is an important reason why categorizing transactions is accurate in a chart of accounts. It involves structuring accounts and setting them up. Your chart of accounts accounting numbers should contain the following codes:

Division code

This part of the number identifies a specific division within a company. It is a two-digit code but can become three-digit if your company has more than 99 divisions. At the same time, if your company has only one division you don’t need this code.

Department code

This is also a two-digit code. It is responsible for indicating which department that account falls under (e.g. accounting, marketing, or production).

Account code

Account code is usually a three-digit code. It is responsible for identifying the account type. Account types are, for example, fixed assets, supplies expenses, or transportation expenses.

How does a chart of accounts work?

The order in which your accounts appear in your financial statements is the order in which they will be shown in your chart of accounts list. Therefore, assets, liabilities, and shareholders’ equity (balance sheet accounts) will appear first before being followed by revenue and expenses (income or P&L statement accounts).

Under these categories, again, the chart of accounts also has a list of subcategories. To begin with, here are the possible subcategories for assets:

-Accounts receivable

-Cash

-Prepaid expenses

-Inventory

-Fixed assets

-Petty cash

-Marketable securities

-Allowance for doubtful accounts

-Accumulated depreciation

Similarly, liabilities also contain subcategories for accounts. These are:

-Accounts payable

-Wages payable

-Notes payable

-Taxes payable

-Accrued Liabilities

Shareholders’ equity also has breakdowns. These generally appear in the form of:

-Preferred stock

-Retained earnings

-Common stock

Moreover, you can also structure your chart of accounts using the business function, line of item, division it belongs to, and so on, to show revenues and expenses.

Each of these accounts is identifiable by a number, name, and description that is assigned to it on the chart. Because charts of accounts can often become complicated, these descriptive parameters help index accounts. Indexing your chart of accounts in this manner makes it much easier for accounts personnel to locate the transactions they need. This is especially useful for multinational and big companies that go through a large number of transactions daily.

Chart of accounts best practices

It is best to wait until the end of the year before you delete old accounts. Getting rid of old accounts too soon may end up messing up your books. Accounts that have to be merged or renamed can cause significant headaches during tax filing.

While chart of accounts mapping does give important information on business transactions it should not, however, contain everything. Separate accounts for each item are unnecessary; try to club items wherever you can. Knowing what to record can help avoid a lot of confusion in the future.

Try to establish a chart of accounts structure that stays relevant and does not need to be constantly changed. This can help standardize your systems which then makes it easier for your accounts personnel to conduct historical performance comparisons.

Review your entire books at the end of the year to identify areas of possible consolidation. This can help make it easier to manage your accounts.

How can accounting software help you manage your chart of accounts?

While structuring and filling out a chart of accounts for small business might not be very hard, the difficulties will, however, pile up as you continue to grow. The chart of accounts is used as a tool for analyzing past performance to prepare for the future. Nonetheless, if it is not able to represent data error-free and without many hurdles, it is bound to fall short of its purpose.

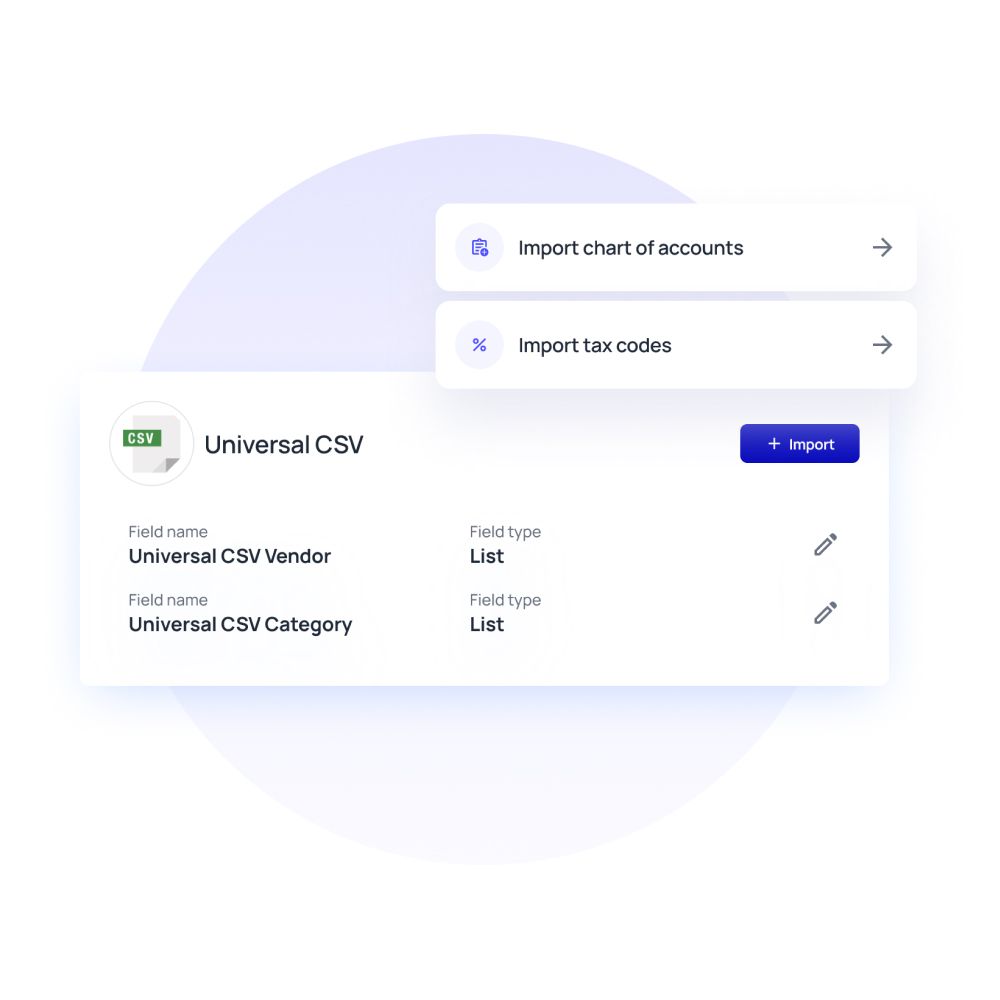

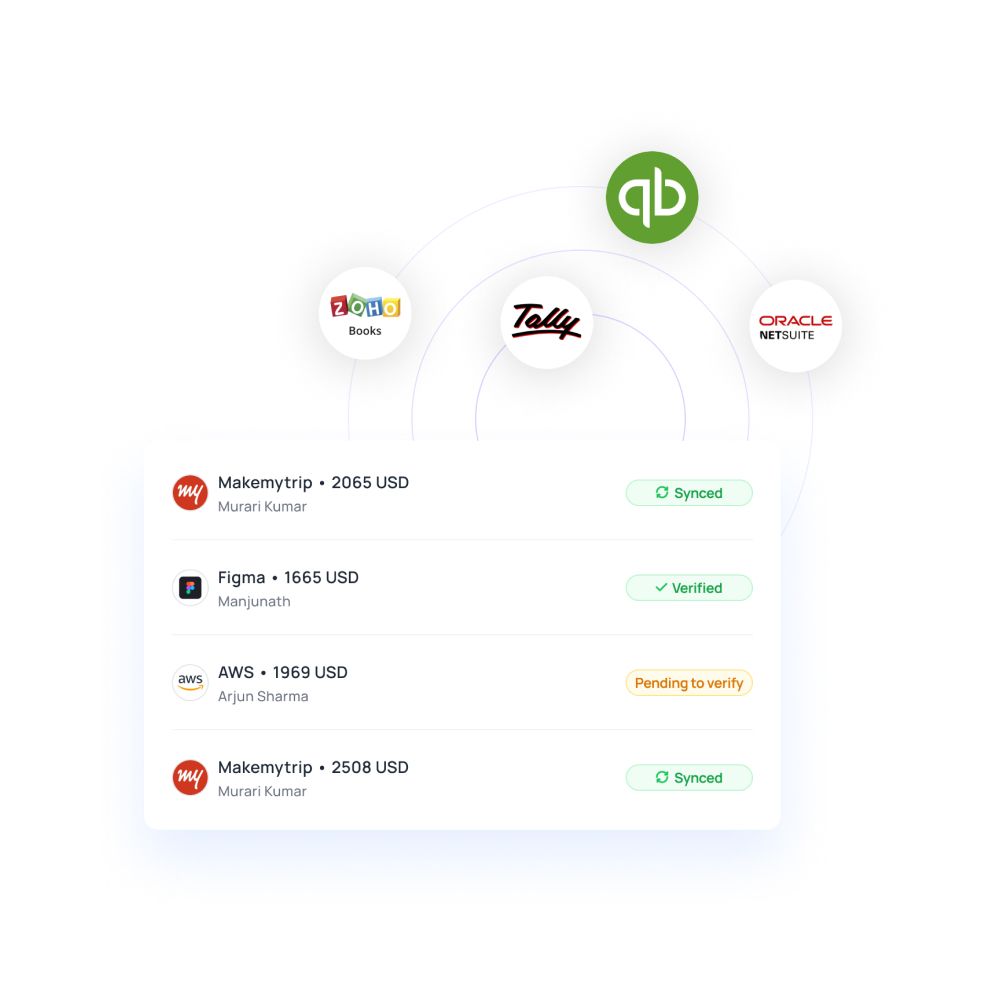

Easy accounting

Using automated accounting software to manage your chart of accounts mapping can do wonders for your bookkeeping system. Accounting software is capable of syncing with your pre-existing systems with ease. By doing this software are able to track and record all expenses you need to map your chart of accounts. Instead of manually sorting and categorizing these accounts you can just delegate the task to this accounting software automation. SaaS platforms, like Volopay, are able to complete such automatable tasks within minutes.

FAQs

No, the chart of accounts general ledger confusion is common but they are not the same. In the chart of accounts vs general ledger debate, the former is a compilation of all business transactions with a linked number and a description of what it has been used for. While the latter, General Ledger, is the actual book that contains the original entries for the company's financial records.

Adjusting a chart of accounts is pretty simple and straightforward. Accounts can be added throughout the year. However, you must wait for the end of the year to come around before you delete old accounts. Deleting old accounts in the middle of the year can harm your bookkeeping process.

Charts of accounts expense categories can be divided into two main categories and their subcategories. These are:

-Balance Sheet categories - Asset, liabilities, and shareholders’ equity.

-Income Statement categories - Revenue and expenses.