6 ways to improve cash flow in a business

One way to measure the stability of a small business is to look at its cash flow. Are you able to pay bills and manage expenses without breaking the bank? Are you making more than you spend? Then you are doing a good job in maintaining the cash flow.

But the financial state of businesses is never constant. You need to constantly work to keep the revenue and expenses balanced.

That’s where cash flow management comes into the picture. When you aim at reducing unnecessary business costs, you are instantly giving a boost to your cash flow.

Why is cash flow important for businesses?

Cash flow denotes the liquid cash a business maintains to manage expenses and pay bills. As much as businesses strive to make profits, the same effort goes into keeping a positive cash flow too.

Cash flow is the financial source that keeps a business running. A company can show its profitability yet still go out of business if they don’t focus on operating costs and manage them poorly.

This is why creating a balance sheet is essential—it offers a snapshot of a company’s financial health, helping businesses monitor their assets, liabilities, and equity, which, when coupled with effective cash flow management, can prevent financial missteps and keep the company in the green.

How does cashflow help small businesses when kicking off?

Let’s see how cash flow lends hand to make a new business sustain and grow.

New businesses like consulting firms, law firms, regular startups, and other small ventures that just start out tend to make a lot of expenses.

The expense management challenges for such consulting firms and small businesses in general can become more pronounced as they begin to scale, especially when facing higher operational costs while their revenue will still be on the lower side due to the low number of clients.

This is where they need the assistance of the cash flow to gain goodwill among the vendors.

Paying bills and invoices on time and investing in new equipment/technology is the right way to embark on the journey to growth.

Understanding where the money is going

A cash flow statement can clearly depict where your expenses are coming from and what accounts the most.

Understanding this as a small business owner is essential to spend money for the right reasons and develop impressive spending habits.

Expand at a steady pace

Dreams to grow big should happen at the right moment when you are ready to face it with a strong cash flow backup.

Business expansion, new hires, new offices, etc needs money and if done wrong, they can severely backfire.

Regular cashflow maintenance can tell you when you are ready to take the next step.

What are the best ways to reduce business costs?

Cost-cutting isn’t only for tragically dying businesses. Even a stable and growing business can adopt them to save more and improve the cash flow.

Small businesses are constantly looking for measures to reduce company spending. Here is how it can be done practically.

1. Leverage technology

Technology has a solution to everything. The same job that you do with a given amount of labor for a certain amount of time can be done instantly with the least amount of workers. And the magic word is automation.

Technology can be your best friend when you want to save time and turn your work more efficient.

You can do detailed research and discover amazing solutions in the form of mobile applications, desktop software, or suites that can simplify your work.

To take your business to the next step, reach out to clients outside your target locations, finish complex works on time, and automate repetitive tasks, leverage the presence of technology.

2. Switch to modern payment methods

Regardless of the crowd, if you are not using modern payment methods, you will be out of business soon.

People are rarely going to the bank or have ready cash nowadays and they rely more on online payment solutions that take a few minutes to a few hours.

Switching to online banking features can save you time both while clearing out bills and receiving payments from customers.

These methods are also safe which should be your major priority as you deal with the private information of your customers and vendors.

3. Cut down on production costs

This is one of the major expenses and it can be hard to say how much of this is dispensable.

Production costs on an average amount to 70% of business expenses. This includes material costs, utilities, supplies, labor, and overhead costs.

It’s not simple to cut down these costs as they can have a direct impact on your production. Understand the breakdown of your production expenses and identify where you can save a bit.

You can use less labor or increase labor efficiency, buy materials in bulk or at discounted prices, find and incorporate the right tools, or even alter the design/manufacturing process.

4. Limit overhead costs

Next to production costs, overhead costs can be really bothersome to estimate but you can pinpoint what you need and what you don’t. The majority of the company bills you incur come under this category.

To begin with, you need to look into the expenses list and understand how they serve. Make some tough decisions and see which you can do away with.

One of the best techniques is to embrace a remote work environment. This way you can save costs on amenities, travel, rent, internet, and electricity bills.

Look into programs and applications your employees use. If you don’t need something, cut it down or consider downgrading.

Adapting green policies like going paperless, using emails instead of mailing letters can also foster substantial effect.

5. Outsource your business tasks

Hiring full-time employees for every business task makes you pay them whether or not you have a need.

There are certain tasks that have momentary workloads like auditing, taxation, etc. This presents you with an opportunity to outsource to agents when a need arises.

Your work gets done efficiently too and you manage to save a considerable amount in outsourcing/freelancing rather than paying a full-time employee 24/7.

You are also saving money spent on employee benefits and taxes here.

6. Audit your supplier agreements

Supplier agreements are made when you start a business relationship with your vendors. By auditing the agreements from the past, you get a chance to review the terms, conditions, and promises made by the supplier at the beginning.

By diving deep into these audits, you can tell if the supplier has managed to deliver exactly as promised at the predetermined cost or if there are any anomalies.

This is your chance to reiterate the contract and get the best out of supply chain management thereby saving tons of money. Think of it as an opportunity to obtain the best value for your money rather than an ambush on buyer-supplier relationships.

How to improve cash flow in a business?

We have seen how cash flow can help you sustain and move your business forward. With these measures you can improve your cash flow and thereby increase stability.

1. Cash flow forecasting

By making a projection of your near future’s expenses and incoming revenue, you can create cash flow forecasting.

This prediction can be done accurately if your accounts payables and receivables team can precisely comment on the numbers they anticipate.

Knowing the situation with cash flow and expenses to make, a company can readily make informed financial decisions.

Forecasting is only going to make your cash flow position stronger for the coming months. You can make them with the help of sheets or use online applications.

2. Credit card policies that are more stringent

When there are no limitations or restrictions on how much we can spend, one wouldn’t stop spending. The same goes for business credit cards.

When you are given unlimited credit and benefits and you don’t have to worry about cash flow at the moment, you invest in a lot more than you should.

This is surely going to affect the cash flow of the coming months when you have the bills due. It breaks the cash flow as you have other expenses too.

Stringent credit card policies, as part of effective corporate credit card management, bring order to your spending habits. These policies ensure that you think carefully before using the card for payments.

3. Access to a line of credit

This is almost similar to credit card services where you will be provided with the credits of your choice. You can spend as much within the given limits and repay when you start making better money along with the interest.

This is better than term loan solutions because, in the case of a loan, you will have to pay back the entire amount given along with the interest.

Once you have used up the entire credits, a new line of credits will be auto-added after you have paid back.

4. Speed up receiving payments

Out of courtesy, the receivables department hesitate to reach out to clients to remind them of the pending payments. But if there is someone who gets affected here, it’s only your company and it’s teetering cash flow.

Your receivables department should come up with ways to clear out pending payments soon. It can be through phone calls or gentle email reminders. Proper departmental budgeting can also help by ensuring each department has the resources to effectively manage their tasks, including follow-ups on overdue payments.

Once the payment starts coming in, your cash flow will become steady and you can focus on the next orders. Small businesses should always enforce a clear due date for every client and every invoice sent.

5. Standardize billing

When you offer your products/services to someone, the end process of it from your end is sending an invoice.

As many businesses still rely on old-school invoicing methods, this gets delayed and by the time it reaches your client, they almost forget you.

To fix this, you need an automated invoice processing system, which after a few inputs, generates and sends the invoice instantly.

6. Increase prices

Even after you have done everything, and you still cannot see an improvement in cash flow, it’s time you ask questions about your charging.

Firstly, you could be charging less or way less to survive in a competitive market. Secondly, your services/products might have improved but the charges are still the same.

Either way, it’s going to affect your cash flow and profitability in the long run. Gear up to analyze overhead costs of your product and check if you can increase the pricing.

How Volopay can help improve cash flow?

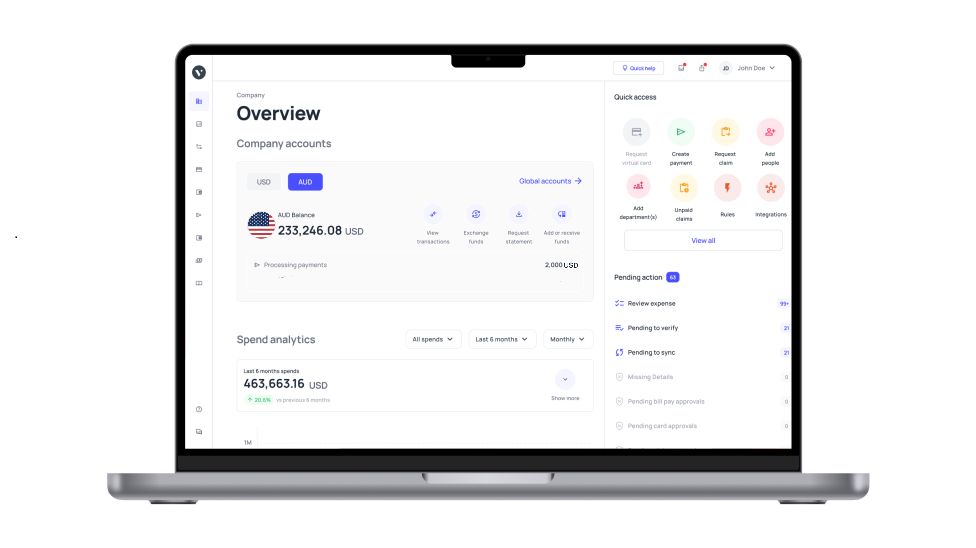

Every business deserves a technologically strong financial partner to manage spending and expenses automatically. To improve cash flow, you need a modern payment system that does quick billing and automates payment processes.

Volopay’s expense management does the same and many other accounting functions along with it. Reducing business expenses requires careful budget planning and resource allocation. Volopay allows you to plan your budget wisely and allocate resources and if there is an overspend, you know it before that happens.

With a custom approver system, you can have an eye over outgoing expenses and prevent unnecessary ones just like that. Get a peek into your overall past expenses and thereby helps in predicting the future expense and cash flow. Forecasting makes way for smart expense management and thus improves cash flow.

In a nutshell, this finance management suite is all you need to have control over your cash flow and never run out of money for business expenditures.

FAQs

It can be when your expenses are more than the revenue you generate. Consistently hitting negative cash flows can stop you from making profits and shake up the financial stability of your company.

Cash flow boost is non-assessable and non-taxable income and you will not be paying any additional taxes if you see a boost.

Financially speaking, cash flow is different from profit. Cash flow is the average amount of money left aside to manage the running costs of a business whereas profit is what you take home after you are done with every company-related expense.

Cash flow can be calculated over any period of time in the future. As a rule, companies do this monthly to see how much cash they are left with to manage the operating costs of the business.