Understanding top line growth vs bottom line growth for businesses

In business performance, two fundamental metrics stand out: top-line and bottom-line growth. Understanding the distinction between these measures is crucial for navigating the complexities of financial management and strategic decision-making.

Top-line growth refers to the increase in a company's revenue or sales over a specified period, reflecting the organization's ability to expand its market reach, attract more customers, or command higher prices for its products or services.

Conversely, bottom-line growth pertains to the improvement in a company's net income or profit after accounting for all expenses, including operating costs, taxes, and interest.

While both metrics are indicative of a company's financial health and success, they serve distinct purposes and may require different strategies for optimization. This is why having a comprehensive understanding of what is top-line and bottom-line in business can help entrepreneurs develop a much better system.

What is top-line growth?

Top-line growth, or revenue growth, denotes the increase in a company's overall sales or income during a specified period.

This metric is crucial, indicating the firm's capability to extend its market share, showcasing increased market penetration or the acquisition of new clientele. Moreover, top-line growth is intricately tied to brand recognition, signifying that a company's offerings are gaining traction and visibility among consumers.

While both top-line and bottom-line growth assume paramount importance financially, top-line growth is responsible for laying the groundwork for lasting profitability and business triumph. It facilitates the coverage of operational costs, investment in research and development, and pursuit of avenues for expansion.

Ultimately, the sustained advancement in this metric serves as a pivotal indicator of a company's competitive prowess and enduring viability within its industry.

What is bottom-line growth?

Bottom-line growth, also referred to as net income or profit growth, represents the increase in a company's overall profitability after accounting for all expenses such as operating costs, taxes, and interest.

Among the top-line and bottom-line metrics, the bottom line holds significant implications for market share, brand awareness, and business finance. As bottom-line growth directly impacts a company's net profit, it influences the resources available for strategic initiatives, marketing efforts, and overall business development.

A strong bottom line contributes to enhanced market share by allowing a company to invest in competitive pricing, product innovation, and marketing campaigns. Additionally, it reinforces brand awareness, signaling financial stability and success.

From a financial standpoint, sustained bottom-line growth ensures a company's ability to meet debt obligations, fund expansion projects, and provide returns to shareholders, underscoring its overall fiscal health and resilience in the market.

Key indicators for top-line growth

In the understanding the top-line vs bottom-line distinction, one must know that top line is a pivotal measure for a company's overall success and sustainability. It encompasses various key indicators that provide insights into the company’s market performance and revenue generation.

Understanding these indicators is crucial for businesses seeking to optimize their strategies and foster consistent growth:

1. Revenue growth rate

The rate of revenue growth is a crucial measure that calculates the percentage rise in a company's overall revenue during a defined timeframe. A favorable growth rate signifies the company's capacity to draw in new customers, enlarge its market share, and potentially launch prosperous products or services.

Keeping a close eye on this metric empowers businesses to evaluate the efficacy of their sales and marketing strategies, enabling them to make well-informed decisions regarding resource allocation.

2. Customer acquisition rate

The customer acquisition rate measures how quickly a company can attract and onboard new customers. A high acquisition rate indicates effective marketing and sales efforts, demonstrating the company's ability to expand its customer base.

Businesses often leverage marketing channels, advertising campaigns, and promotions to boost their customer acquisition rates, understanding that a robust influx of new customers is essential for sustained revenue growth.

3. Customer retention rate

While obtaining new customers is essential, preserving existing ones is equally imperative for long-term expansion.

The customer retention rate gauges the proportion of customers a company sustains over a specific duration. A heightened retention rate indicates contented customers, loyalty, and the success of customer relationship management strategies.

Concentrating on customer retention not only ensures consistent revenue streams but also diminishes the necessity for continual customer acquisition endeavors.

4. Average Revenue Per User (ARPU)

ARPU assesses the average revenue produced by each customer or user over a designated period, offering insights into the contribution of individual customers to the business.

Augmenting ARPU can be achieved through upselling, cross-selling, or introducing premium offerings. Companies can bolster their revenue by comprehending and refining ARPU, thereby reducing the reliance on merely expanding their customer base.

5. Market share

Market share denotes the fraction of the overall market that a company commands in sales or revenue. This metric is pivotal for gauging a company's competitive standing in its industry.

Observing market share enables businesses to evaluate their performance in comparison to competitors and devise strategies for continued growth. An expanding market share frequently aligns with successful market penetration and high levels of customer satisfaction, a crucial indicator of top-line growth.

6. Sales pipeline and conversion rates

The sales pipeline represents the progression of potential customers through the sales process. By analyzing the conversion rates at each stage of the pipeline, businesses can identify areas for improvement and optimize their sales strategies.

A healthy sales pipeline, coupled with high conversion rates, contributes to sustained revenue growth by ensuring a consistent flow of successful transactions.

7. Product/service expansion

Diversifying and expanding the product or service offerings is a strategic approach to drive top-line growth. Introducing complementary products or services can attract new customers, increase customer spending, and open up new revenue streams.

Successful expansion requires careful market research, understanding customer needs, and effective product development.

8. Geographic expansion

Venturing into new geographic markets is another avenue for top-line growth. Expanding into untapped regions allows companies to access new customer segments, respond to regional demands, and leverage opportunities in different markets.

However, successful geographic expansion requires thorough market analysis, compliance with local regulations, and effective adaptation to cultural nuances.

9. Partnerships and alliances

Collaborations with strategic partners and alliances can significantly contribute to top-line growth. Partnerships may involve joint ventures, distribution agreements, or co-marketing efforts.

By leveraging each other's strengths and resources, companies can access new markets, share customer bases, and enhance overall competitiveness.

10. Customer satisfaction and Net Promoter Score (NPS)

Customer satisfaction and Net Promoter Score (NPS) serve as pivotal measures of a company's proficiency in retaining and drawing in customers. Elevated levels of customer satisfaction and favorable NPS scores signify a robust brand image and unwavering customer allegiance.

Contented customers exhibit a heightened likelihood of engaging in repeat purchases, referring others to the company, and playing a constructive role in bolstering the company's overall top-line growth.

Key indicators for bottom-line growth

Bottom-line growth, epitomized by a company's net profit, is the ultimate financial yardstick of success.

An array of key indicators is instrumental in unraveling the intricacies of bottom-line growth, offering insights into the efficiency, financial health, and strategic management of a business.

1. Net profit margin

The net profit margin is a cornerstone indicator, representing the percentage of revenue that transforms into net profit after accounting for all expenses.

A healthy net profit margin implies effective cost management and revenue optimization, providing a clear measure of a company's profitability.

2. Gross profit margin

The gross profit margin is determined by dividing the gross profit by the total revenue.

This metric evaluates the profitability of a company's primary operations by measuring the percentage of revenue that surpasses the cost of goods sold. A strong gross profit margin signals effective production or service delivery.

3. Operating profit margin

The operating profit margin focuses on operational efficiency, revealing the percentage of revenue remaining after deducting operating expenses.

This metric highlights a company's ability to manage day-to-day activities effectively, excluding interest and taxes, providing a more refined view of operational profitability.

4. Return on Investment (ROI)

ROI measures the profitability of an investment, indicating the return relative to its cost. A positive ROI reflects a profitable investment, while a negative ROI suggests a potential loss.

Understanding ROI is crucial for evaluating the success of various business initiatives and investment decisions.

Related read- What is ROI in business and how to calculate ROI?

5. Cost of Goods Sold (COGS) efficiency

COGS efficiency assesses how effectively a company utilizes resources to produce goods or deliver services.

By managing and optimizing production costs, companies can enhance their gross profit margin, contributing to overall bottom-line growth.

6. Operating expenses ratio

The operating expenses ratio compares operating expenses to total revenue, indicating the proportion of revenue allocated to non-production costs.

A lower ratio suggests efficient cost management, while a higher ratio may indicate the need for operational optimization.

7. Cash flow from operations

Cash flow from operations provides a comprehensive view of a company's ability to generate cash through its core activities.

A positive cash flow indicates financial health, ensuring that the company can cover operating expenses, invest in growth, and meet financial obligations.

8. Debt-to-equity ratio

The debt-to-equity ratio evaluates a company's financial leverage through the comparison of its debt to shareholders' equity.

A reduced ratio suggests diminished financial risk and the possibility of increased bottom-line growth, as the company depends less on external borrowing for its operations or expansion.

Suggested read- How to calculate debt to equity ratio?

9. Working capital management

Efficient working capital management involves balancing short-term assets and liabilities to ensure smooth operations.

By optimizing inventory, accounts receivable, and accounts payable, companies can enhance liquidity, reduce financing costs, and bolster their bottom line.

10. Earnings before interest, taxes, depreciation, and amortization (EBITDA)

EBITDA represents a company's earnings before accounting for interest, taxes, depreciation, and amortization.

It offers a snapshot of operational profitability and cash generation, serving as a valuable metric for assessing a company's financial performance.

Streamline your business finances with Volopay

How to increase your top-line revenue growth?

Achieving sustained top-line revenue growth is a priority for businesses seeking to enhance their financial performance and competitiveness.

Implementing a strategic approach can unlock opportunities for expansion and increased market share. Some key strategies to boost top-line growth include:

1. Use best-performing marketing campaign

Employing effective marketing campaigns is integral to driving top-line revenue growth. Identify and replicate strategies from past campaigns that yielded the highest returns.

This may involve leveraging successful advertising channels, refining target audience segmentation, and crafting compelling messages that resonate with potential customers. Regularly analyze campaign performance metrics to optimize future efforts.

2. Expand into new markets

Venturing into new markets presents a powerful opportunity to enhance top-line revenue growth. Engage in comprehensive market analysis to pinpoint areas with unexplored potential or evolving customer demands.

Adapt your offerings to suit the specific needs of these markets and create focused marketing strategies. Expanding strategically into new territories will broaden revenue sources and decrease vulnerability tied to depending on a single market.

3. Increasing brand awareness

Boosting brand awareness plays a crucial role in drawing in new customers and extending market outreach. Allocate resources to branding endeavors that connect with your intended audience, utilizing social media, content marketing, and various channels to magnify your brand visibility.

A firmly established brand not only entices fresh customers but also nurtures customer loyalty, which in turn contributes to enduring revenue as well as both top-line and bottom-line growth.

4. Offering a wider range of products

Broadening your product or service portfolio has the potential to drive top-line revenue growth by appealing to a more extensive customer base and encouraging additional purchases from existing customers.

Conduct thorough market research to identify products or services that complement your brand and align with customer needs. This approach can elevate the overall value for customers, boost average transaction amounts, and cultivate long-lasting customer relationships.

5. Track and measure results

Implementing robust analytics and measurement systems is essential for tracking the effectiveness of your strategies and initiatives. Regularly assess key performance indicators (KPIs) related to sales, customer acquisition, and marketing campaigns.

By closely monitoring results, you can identify successful strategies, make data-driven decisions, and pivot when necessary to optimize top-line growth.

6. Customer retention programs

Formulate customer retention initiatives aimed at recognizing loyalty, fostering repeat business, and elevating the overall customer journey.

Implementing loyalty programs, personalized promotional offers, and delivering exceptional customer service collectively contribute to heightened customer satisfaction, thereby fostering enduring revenue growth in the long run.

How to increase your bottom line revenue growth?

Enhancing bottom-line growth is a paramount goal for businesses aiming to optimize profitability and financial sustainability.

Focused strategies that streamline costs, mitigate risks, and maximize efficiency are integral to achieving this objective. Here are key points on how to boost bottomline revenue growth:

1. Reduce marketing cost

Evaluating and optimizing marketing expenditures is crucial for enhancing the bottom line. Identify low-impact marketing channels and redirect resources towards high-performing ones.

Utilize data analytics to assess the return on investment (ROI) of marketing campaigns, allowing for informed decisions on budget allocation and the elimination of ineffective strategies.

2. Eliminate fraud

Engaging in fraudulent, deceptive activities can profoundly affect a company's financial standing and reputation, leading to monetary losses.

Establish strong measures for detecting and preventing fraud to shield against both internal and external threats. Conduct regular audits of financial transactions, deploy secure payment systems, and educate employees to identify, report and prevent potential fraudulent activities.

3. Maximize tax deductions

Leveraging available tax deductions is a strategic approach to increase bottom-line revenue growth.

Stay informed about tax regulations, work with tax professionals to identify eligible deductions, and explore tax-efficient strategies. This not only reduces the tax burden but also enhances overall financial performance.

4. Analyze spending patterns

A detailed assessment of spending patterns provides valuable insights for optimizing costs. Identify unnecessary expenses, potential areas of inefficiency, and set department budgets.

Implement measures to reduce costs without jeopardizing operational efficiency. This analytical approach ensures that resources are directed towards activities directly contributing to revenue growth.

5. Invest in high-ROI activities

Prioritize investments in activities with a high return on investment (ROI). Assess the profitability of various business initiatives and allocate resources to those that promise the greatest financial gains.

This might involve focusing on product lines with high margins, optimizing sales channels, or enhancing customer retention strategies; all of which contribute to both top-line and bottom-line growth.

6. Improve inventory management

Efficient inventory management is pivotal in controlling costs and optimizing bottom-line revenue growth.

Avoid overstocking or understocking by implementing inventory control systems that align with demand forecasts. This prevents unnecessary carrying costs, reduces the risk of stockouts, and improves overall operational efficiency.

Top-line formula and example

Top-line growth, or revenue growth, is calculated using the following formula:

Top-line Growth Rate = [(Current revenue - Previous revenue) / Previous revenue] x 100

Here, the top-line growth rate is determined by subtracting the previous period's revenue from the current period's revenue, dividing it by the previous period's revenue, and then multiplying the result by 100 to express it as a percentage.

For example, if a company had $500,000 in revenue last year and $600,000 this year, the top-line growth rate would be:

Top-line Growth Rate = [($600,000 - $500,000) / $500,000] x 100 = 20%

This indicates a 20% increase in revenue from the previous year, demonstrating the company's top-line performance.

Bottom-line formula and example

Bottom-line growth, representing the increase in a company's net profit, is calculated using the formula:

Bottom-line Growth Rate = [(Current Net Profit - Previous Net Profit) / Previous revenue] x 100

This formula measures the percentage change in net profit over a specified period. By subtracting the previous period's net profit from the current period's net profit, dividing it by the previous net profit, and multiplying by 100, the bottom-line growth rate is expressed as a percentage.

For instance, if a company had a net profit of $200,000 last year and $250,000 this year, the bottom-line growth rate would be:

This indicates a 25% increase in net profit from the previous year, showcasing the company's bottom-line growth.

Streamline your business spending with Volopay

Which is more important: top-line or bottom-line?

Both top-line and bottom-line performance are essential for evaluating a company's financial health and overall success. The top line, representing revenue growth, is critical as it reflects a company's ability to attract customers, expand market share, and generate income. A robust top-line is a foundation for sustained profitability and provides resources for future investments and expansion.

On the other hand, the bottom line, indicating net profit, is equally crucial as it represents the company's ability to manage costs, achieve operational efficiency, and generate profits. It directly influences shareholder returns and long-term sustainability.

Ideally, a balanced approach is crucial. While a robust top-line fuels expansion, a proficient bottom line guarantees profitability and steadiness.

Achieving equilibrium between revenue growth and cost control enhances overall performance, nurturing a resilient and flourishing business. The interconnected nature of these facets underscores the necessity for a comprehensive strategy addressing both top-line and bottom-line goals.

When should you consider using the top and bottom lines in your analysis?

When choosing between the top-line vs bottom-line factors for analyzing business growth it is crucial to have clear reasoning behind the choice.

Particular situations will require management to make a choice between these two, depending on a variety of factors and positions such as:

1. Top-line

Utilize top-line analysis when concentrating on revenue-centric facets of a business. This method proves especially applicable in situations where the principal objective involves evaluating the company's market performance, customer acquisition strategies, and overall revenue generation.

Top-line analysis is beneficial for assessing the effectiveness of marketing campaigns, gauging market share, and comprehending the success of sales strategies. Its significance extends to evaluating the company's capacity to attract and retain customers, positioning it at the core of industries propelled by market expansion and revenue growth.

2. Bottom-line

Bottom-line analysis is pertinent when the primary concern is profitability and operational efficiency. This approach is most relevant in scenarios where the focus is on cost management, optimizing operational processes, and ensuring sustainable profitability.

It becomes especially crucial when assessing the impact of cost-cutting measures, evaluating the efficiency of resource allocation, and determining the overall financial health of the company. Bottom-line analysis is key for investors seeking insights into a company's net profitability, return on investment, and long-term financial viability.

How can expense management improve top and bottom-line growth?

1. Spend categorization and strategic cost reduction

Through the segmentation, and categorization of expenditures, businesses can acquire a comprehensive understanding of their financial outflows.This empowers them to pinpoint areas for cost reduction or optimization.

For example, identifying instances of excess spending on non-essential items or repetitive processes enables cost-cutting initiatives, thereby enhancing profitability in the long run.

2. Promote a culture of cost-consciousness

Fostering a culture of cost-consciousness among employees encourages prudent spending habits throughout the organization.

When every team member understands the importance of managing expenses wisely, it leads to reduced waste and increased efficiency.

This cultural shift has a positive impact on the bottom line by significantly reducing unnecessary expenditures and promoting more efficient spending practices.

3. Implement automation and technology solutions

Automation streamlines expense management processes, reducing manual errors and saving time.

Technology solutions such as expense tracking software provide real-time visibility into expenditures, enabling better decision-making.

This efficiency improvement lowers administrative overheads, allowing resources to be redirected towards revenue-generating activities, thereby boosting top-line growth.

4. Leverage expense data for valuable insights

Analyzing expense data provides valuable insights into spending patterns, vendor relationships, and operational inefficiencies.

Leveraging this data helps businesses optimize expenses, negotiate better terms with suppliers, and identify innovation and growth opportunities.

Utilizing expense data effectively supports strategic planning, ultimately driving both top and bottom-line improvements.

How can Volopay help manage your business finances?

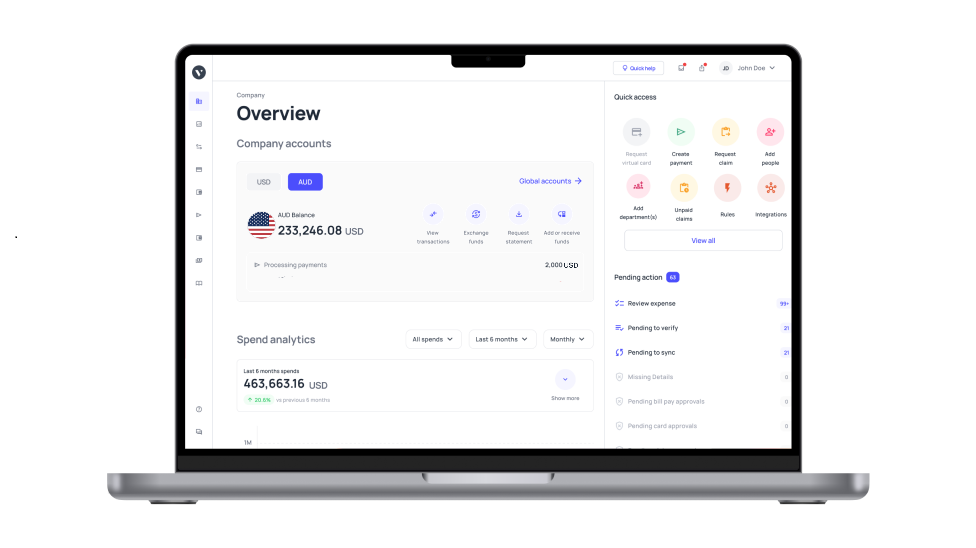

Volopay is a state-of-the-art expense management solution tailored to streamline financial processes for businesses of any scale.

Utilizing Volopay, organizations can seamlessly monitor, oversee, and enhance their expenditures instantaneously, fostering increased financial oversight, operational effectiveness, and positive overall impact on both the top-line and bottom-line.

Key features of Volopay include automated expense tracking, enabling users to capture and categorize expenses effortlessly.

The platform also offers virtual cards and physical corporate cards, facilitating secure payments and expense management.

Additionally, Volopay provides customizable spending limits and multi- level approval workflows, ensuring compliance and budget adherence.

With its intuitive dashboard and comprehensive reporting capabilities, Volopay empowers businesses to make informed financial decisions and drive growth.

What's better than a solution equipped for all your business needs?

FAQs

Top-line and bottom-line growth are crucial as they indicate revenue and profitability, respectively, reflecting a company's financial health and sustainability in the market.

Top-line growth is measured by revenue increase, while bottom-line growth is evaluated by profit margin improvement over time.

Companies can achieve balance by focusing on revenue generation strategies (top-line) while simultaneously controlling expenses and optimizing operations (bottom-line).

Yes, they can coexist when revenue growth is accompanied by efficient cost management, ensuring profitability and sustainable business growth in the long term.

The top line in a profit and loss statement signifies the total revenue or sales, while the bottom line denotes the net income, depicting profits after deducting all expenses and taxes.

Top of the line refers to the highest quality or most advanced product or service, while bottom of the line denotes the lowest quality or least expensive option.

No, the final figure on an income statement is called net income, not net revenue. Net revenue is the total revenue minus returns, discounts, and allowances.

The top line represents revenue, reflecting sales income before any deductions, while the bottom line represents net income, showing profits after all expenses and taxes.

The bottom line in business refers to the net profit or net income, indicating the company's overall financial performance after accounting for all expenses, taxes, and other costs.

A good bottom-line percentage varies by industry, but generally, a higher percentage indicates better profitability. For example, a bottom-line percentage of 10% or higher is often considered favourable.