Operating cash flow (OCF) - Definition, formula and examples

Operating cash flow (OCF) is a fundamental financial metric that reveals the cash a company generates from its regular business activities.

It is distinct from net income, as it excludes non-cash expenses and various accounting adjustments, offering a more precise reflection of a company's operational efficiency.

Given the importance of this metric, it is important to explore the concept of OCF, its calculation method, and various strategies to enhance it.

Whether you're a business owner, investor, or financial analyst, understanding OCF is crucial for making informed decisions, ensuring long-term financial health, evaluating a company's financial stability and operational success.

What is operating cash flow (OCF)?

Operating cash flow is basically the inflow and outflow of cash that a business generates during its regular operations. This metric is recorded in the cash flow statement of a company.

The operating cash flow of a business tells whether the company can generate enough liquid cash to continue operating its business and expand further.

What is the cash flow from operating activities?

• The total sale of goods and services in a given time period.

• The payments that are made to employees & vendors or suppliers.

• And other expenses in the production of goods or services are all aspects that account for the generation and calculation of operating cash flow.

Significance of operating cash flow for businesses

Operating cash flow (OCF) is a significant metric for a variety of reasons.

It aids in understanding financial performance, evaluating operating costs, assessing performance across locations, and reaping the benefits of positive cash flow, ensuring long-term sustainability and growth.

Understanding financial performance

Operating cash flow (OCF) represents the cash produced through a company's routine business operations and is key to assessing its ability to maintain and grow its primary activities.

OCF offers a clear picture of the real cash at the company's disposal, in contrast to net income, which can be influenced by non-cash items such as depreciation and amortization.

Focusing on OCF aligning it with cash flow forecasts enables companies to gauge their proficiency in generating cash through regular operations, which is vital for sustaining business functions, paying off debts, and fostering expansion. It also helps stakeholders like investors and creditors to evaluate the firm's true financial health and the efficiency of its operations.

Furthermore, understanding the difference between top line growth and bottom line growth is essential here. While top line growth reflects increased sales or revenue, bottom line growth showcases improved profitability, which directly impacts the sustainability of operating cash flow. Balancing both ensures operational success and financial stability.

Evaluating operating costs

Operating cash flow is instrumental in evaluating a company’s operating costs. It highlights the efficiency of a company in managing its working capital and operational expenses. By analyzing OCF, businesses can identify areas where they are spending excessively or inefficiently.

For instance, if a company has a high OCF but low net income, it may indicate high non-cash expenses, prompting a closer look at depreciation methods or asset write-downs.

Conversely, if OCF is low despite high sales, it may signal issues with inventory management, accounts receivable, or other working capital components of ecommerce working capital.

Regularly monitoring OCF allows businesses to make informed decisions to optimize operating costs, improve cash management, and enhance overall financial health.

Performance indicator across locations

For businesses operating across multiple locations, OCF serves as a vital performance indicator. It enables companies to compare the cash-generating capabilities of different branches or subsidiaries.

By examining OCF on a location-by-location basis, businesses can identify which locations are more efficient and profitable, and which ones may be underperforming.

This granular view helps in making strategic decisions about resource allocation, potential expansions, or closures of underperforming units.

Furthermore, it allows for benchmarking and setting realistic performance targets for different locations, fostering a culture of financial accountability and operational excellence across the entire organization.

Nature of cash flow

The nature of cash flow, particularly OCF, is fundamentally different from other financial metrics because it focuses solely on the cash transactions associated with the core operations of a business. This emphasis on cash provides a more immediate and tangible measure of a company’s operational success.

While accrual accounting can paint a broader picture of profitability over time, cash flow analysis reveals the liquidity position and immediate operational viability.

Understanding the nature of OCF helps businesses manage liquidity risk more effectively, ensuring that they have sufficient cash to meet short-term obligations, invest in growth opportunities, and withstand economic fluctuations.

Positive cash flow benefits

A positive operating cash flow is highly beneficial for a business. It signifies that a company is producing sufficient cash through its operations to meet its expenses, which is crucial for long-term viability.

With positive OCF, businesses can fund new projects, broaden their operations, and upgrade their infrastructure without depending heavily on outside funding. This also bolsters a company's creditworthiness, facilitating easier access to loans and the attraction of investors.

Moreover, robust OCF can result in increased returns for shareholders via dividends and stock repurchases.

Ultimately, a positive operating cash flow is indicative of a robust, efficiently managed business that is well-equipped to fulfill its strategic goals and navigate economic challenges.

Elevate your cash flow management with Volopay

Operating cash flow formula—direct method

When calculating the operating cash flow formula using the direct method it is required to report directly or explicitly all the cash transactions that are operating activities related.

This approach offers a clear perspective of cash inflows and outflows from such activities, without the need for adjustments due to non-cash items.

Formula:

Operating cash flow (OCF) = cash received from customers − cash paid to suppliers and employees − cash paid for operating expenses − cash paid for interest − cash paid for taxes

Breakdown of components:

● Cash received from customers: Total cash collected from sales or services.

● Cash paid to suppliers and employees: Payments made for raw materials, inventory, and employee wages.

● Cash paid for operating expenses: Expenditures for rent, utilities, and other operating costs.

● Cash paid for interest: Cash outflows for interest on borrowed funds.

● Cash paid for taxes: Cash payments for income and other taxes.

Example of calculating operating cash flow using the direct method

Consider a company with the following cash transactions for the year:

Cash received from customers: $500,000

Cash paid to suppliers: $200,000

Cash paid to employees: $100,000

Cash paid for rent and utilities: $50,000

Cash paid for interest: $20,000

Cash paid for taxes: $30,000

Calculation:

OCF = $500,000 − ($300,000 + $50,000 + $20,000 + $30,000)

OCF = $500,000 − $400,000 = $100,000

Thus, once we calculate operating cash flow here, the amount is $100,000.

Operating cash flow formula—indirect method

When you calculate operating cash flow (OCF) using the indirect method it is required to start with net income and adjust for changes in non-cash items and working capital.

This approach reconciles net income with actual cash flow from operating activities, providing insight into the differences between reported earnings and cash generated.

Formula:

OCF = net income + non-cash expenses + changes in working capital

Breakdown of components:

● Net income: The profit reported on the income statement.

● Non-cash expenses: Add back non-cash charges such as depreciation, amortization, and stock-based compensation. These expenses reduce net income but do not impact cash flow.

● Changes in working capital:

-Increase in current liabilities: Add increases in accounts payable and other short-term liabilities.

-Decrease in current assets: Add decreases in accounts receivable and inventory.

-Decrease in current liabilities: Subtract decreases in accounts payable and other short-term liabilities.

-Increase in current assets: Subtract increases in accounts receivable and inventory.

Example of calculating operating cash flow using the indirect method

Consider a company with the following information for the year:

Net income: $150,000

Depreciation expense: $20,000

Amortization expense: $5,000

Increase in accounts receivable: $10,000

Decrease in inventory: $8,000

Increase in accounts payable: $7,000

Calculation:

● Net income: $150,000

● Add non-cash expenses:

-Depreciation: $20,000

-Amortization: $5,000

Total non-cash expenses: $20,000 + $5,000 = $25,000

● Adjust for changes in working capital:

-Increase in accounts receivable: -$10,000

-Decrease in inventory: $8,000

-Increase in accounts payable: $7,000

Total changes in working capital: -$10,000 + $8,000 + $7,000 = $5,000

OCF = $150,000 + $25,000 + $5000 = $180,000

Thus, the operating cash flow is $180,000.

Optimize your business expenses with Volopay

How to improve your business cash flow

Cash flow is an important part of operating cash flow management, it is crucial for maintaining business stability and fostering growth.

Here are some strategies that can help boost cash flow:

1. Renting/leasing instead of buying

Renting or leasing equipment, vehicles, or office space instead of purchasing them outright can significantly improve cash flow. Buying assets requires a large upfront investment, which can strain cash reserves.

Leasing, on the other hand, allows businesses to spread out the cost over time, preserving cash for other needs. It also offers the flexibility to upgrade equipment more frequently, which can be crucial in industries with rapid technological advancements.

Additionally, lease payments are often considered operating expenses, which can be beneficial for tax purposes.

2. Better inventory management

Optimal inventory management is crucial for enhancing cash flow. Excessive inventory can immobilize capital and generate additional holding costs, whereas inadequate stock levels may result in lost sales.

Adopting strategies such as just-in-time (JIT) inventory can synchronize stock levels with actual demand. Consistently analyzing inventory turnover and employing data analytics for precise demand predictions can avert both overstocking and stock shortages.

Better inventory management practices ensure that capital is not unwisely locked in unsold inventory, thus enabling a more efficient allocation of resources.

3. Deals with vendors & suppliers

Securing advantageous terms with vendors and suppliers can have a positive effect on cash flow. Companies can strive for longer payment periods, which allow more time to pay invoices without exhausting cash reserves.

Additionally, securing discounts for prompt payments can result in significant savings. Establishing solid relationships with suppliers typically leads to improved credit terms and more adaptable payment arrangements.

Continuously assessing and renegotiating contracts is crucial to maintaining terms that are competitive and in sync with the business's cash flow needs.

4. Automate AR & AP

Automation of accounts payable and receivable processes can improve cash flow management. Systems that automate invoicing, reminders, and collections expedite cash inflows.

Similarly, automated accounts payable systems efficiently manage payment schedules, ensuring prompt payments and the ability to capitalize on early payment discounts.

Automation also cuts down on administrative costs, reduces errors, and promotes consistent cash flow through the timely execution of transactions.

5. Perform credit assessments on customers

Performing credit assessments on customers prior to granting credit can mitigate the risk of defaults and enhance cash flow.

Assessing a potential customer's creditworthiness aids in making well-informed decisions regarding credit ceilings and payment conditions. Such assessments include the examination of financial reports, credit ratings, and past payment behaviors to determine a customer's fiscal reliability.

The implementation of definitive credit guidelines and the consistent surveillance of current customers' credit standings are crucial in reducing delinquent accounts and ensuring a steady cash flow.

6. Simplify payments and encourage timely customer payments

Making the payment process easier for customers can accelerate cash flow.

Offering various payment options, such as online payments, credit card payments, and electronic funds transfers, facilitates prompt payments. Providing incentives for early payments, like discounts or rewards, encourages timely invoice settlement.

Implementing clear payment terms and sending timely reminders reinforces the importance of on-time payments. Effective communication and flexible payment options lead to faster fund receipt and improved cash flow.

7. Actively manage cash flow projections

Regularly updating and actively managing cash flow projections helps anticipate and address potential cash shortfalls.

Detailed cash flow forecasts, including expected revenues, expenses, and capital requirements, enable businesses to plan for future cash needs.

Monitoring actual cash flow against projections allows for identifying variances and taking corrective actions, such as adjusting expenditures or securing additional financing.

Cash flow projections are essential for informed financial decision-making, managing working capital, and ensuring adequate liquidity to meet obligations.

8. Choose best business bank accounts

Selecting the appropriate business bank accounts can enhance cash flow management.

Business accounts offering high interest rates on deposits, low fees, and easy fund access optimize cash management.

Accounts with robust online banking features provide real-time visibility into cash balances and transactions, enabling better monitoring and management of cash flow.

Evaluating different banking options and choosing accounts that meet the business’s cash flow needs improves financial efficiency and reduces banking costs.

9. Strategically plan for growth and increase prices

Strategic planning for growth involves evaluating how expansion will impact cash flow.

This includes assessing the costs related to scaling operations, such as increased inventory, staffing, and capital expenditures. Ensuring that growth strategies align with cash flow projections helps avoid financial strain.

Additionally, periodically reviewing and adjusting pricing strategies to reflect cost changes or market conditions can maintain healthy margins and cash flow. Effective pricing strategies boost revenue and support sustainable growth, enhancing overall cash flow.

How does operating cash flow compare to free cash flow and net income?

Understanding how operating cash flow (OCF) compares to free cash flow (FCF) and net income is crucial for assessing a company’s financial health.

While OCF highlights cash from core operations, FCF accounts for capital expenditures, and net income reflects overall profitability. Each metric provides unique insights into financial performance.

Free cash flow

The cash that remains with a company after it has financed its capital expenditures necessary for maintaining or growing its asset base is referred to as Free Cash Flow (FCF).

It is determined by subtracting capital expenditures from operating cash flow.

FCF = operating cash flow − capital expenditures

In contrast, the cash produced by a company's fundamental business activities is quantified by the operating cash flow (OCF). It is calculated by reinstating non-cash expenses and modifying for variations in working capital within the net income.

OCF = net income + non-cash expenses + changes in working capital

The primary distinction between the two is that FCF subtracts capital expenditures from OCF, reflecting cash available for dividends, debt repayment, or reinvestment.

OCF, however, focuses solely on cash generated from operating activities. For instance, if a company has an OCF of $200,000 and capital expenditures of $50,000, its FCF would be $150,000.

Net income

Net income represents a company’s total profit after all expenses, taxes, and interest have been subtracted from total revenue.

It is calculated as:

Net income = total revenue − total expenses

In contrast, operating cash flow (OCF) measures the cash generated from core business operations and is determined by adjusting net income for non-cash expenses and changes in working capital:

OCF = net income + non-cash expenses + changes in working capital

The primary difference between the two is that net income includes all costs and revenues, reflecting overall profitability, while OCF focuses solely on cash flow from operations, adjusting for non-cash items.

For example, if net income is $100,000 and adjustments for non-cash expenses and working capital changes total $30,000, the OCF would be $130,000.

Stay on top of your business operating costs with Volopay

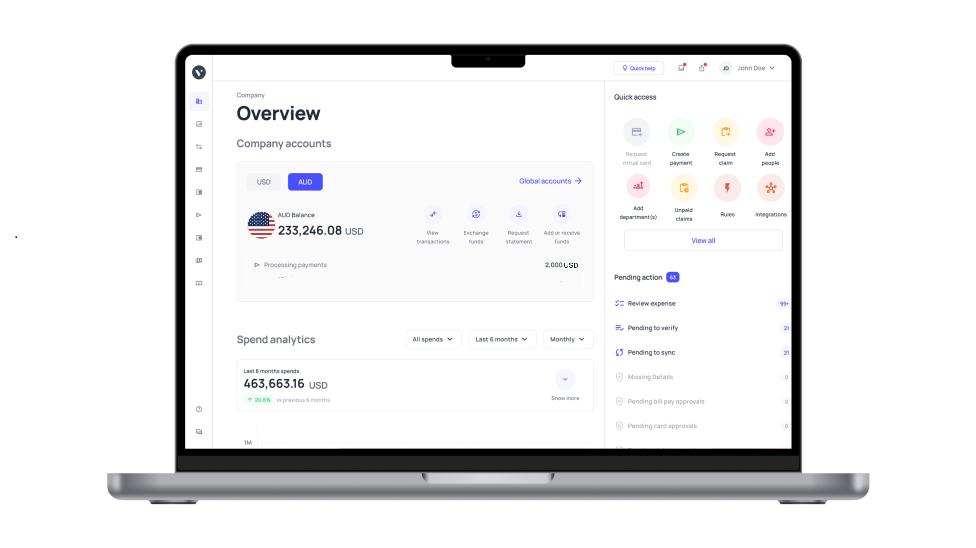

Volopay provides an all-in-one expense management ecosystem that helps you track, control, and manage all expenses and payments through a single platform.

Our software includes a centralized system for finance and accounting teams to distribute budgets to each department and individual.

1. Budget distribution & management

All employees who are onboarded onto Volopay will be able to use their assigned budgets to make business expenses via their physical corporate card, virtual corporate card, or the money transfer function in Volopay.

In order to control the amount that is spent, admins get to create custom approval workflows for payments through the money transfer function and set spending limits for each corporate card.

2. The reimbursement module

If the company does not want to issue corporate cards, they can also use our reimbursement module where employees can easily submit their claims via our mobile app.

3. Volopay corporate cards

Issuing corporate cards is optional but a wise move as it helps your business control the amount of money that can be spent by employees. You get to set a custom spending limit for each card that is issued, whether that is a physical or virtual card.

With Volopay, you can provide employees with one of the best prepaid business cards, giving you full control over employee spendings ensuring a firmer hold over your cash flow.

This is a much better solution to control and manage operating cash flow rather than processing reimbursements and dealing with out-of-policy expenses.

4. Automating AP

Volopay also lets you create a vendor database within the system and process their invoices easily to make faster payments.

You can schedule payments and create recurring payments for suppliers that you have a contract with so that you don’t miss out on payments and end up having to deal with late payment fees.

These efficiencies that automation helps you create ultimately affect your cash flow in a positive way.

5. Operating cost management

The best part is that no matter how you choose to create the expense system within your company, all the expenses are accessible on a single platform.

Whether it is card expenses, wire transfers to vendors, payroll, or reimbursements, each and every expense can be tracked in real-time on Volopay.

You also get access to analytics tools where you can see how the teams and employees are spending their budgets. You can compare the current month’s spend with the previous month's.

And you can also filter down deeper to see through which payment method expenses are being made. All of this helps you stay on top of the operating costs and financial performance of your business.

FAQs

The main components of operating cash flow include cash payments to suppliers and employees, cash receipts from customers, cash paid for interest, cash paid for operating expenses, and cash paid for taxes. These elements reflect the cash generated or used by core business activities.

Operating cash flow is often seen as a better indicator of financial health because it focuses on cash generated from core operations, excluding non-cash items and accounting adjustments. This provides a clearer picture of a company’s ability to generate actual cash for sustaining and growing its business.

Operating cash flow helps businesses make strategic decisions by providing insight into the actual cash generated from core operations. It aids in assessing the ability to fund new projects, manage debt, and invest in growth opportunities, thereby guiding financial planning and operational strategies.

Poor operating cash flow management can lead to liquidity issues, making it difficult to meet short-term obligations like payroll and supplier payments. It can also restrict the ability to invest in growth opportunities, increase reliance on external financing, and negatively impact overall business stability.

Changes in inventory levels impact operating cash flow as higher inventory levels tie up cash, reducing available cash flow. Conversely, lower inventory levels can improve cash flow by freeing up cash previously used for stock. Efficient inventory management is crucial for optimizing cash flow.

Growth in sales can positively impact operating cash flow by increasing cash receipts from customers. However, it may also require higher working capital for inventory and receivables. Effective management ensures that the additional cash generated from sales translates into improved operating cash flow.

Taxes affect operating cash flow as they represent cash outflows related to income tax payments. In cash flow calculations, tax payments are subtracted from cash generated by operations, reflecting the actual cash impact of tax obligations on the company’s operating activities.