What is eCommerce working capital and how to manage it?

The outburst of the pandemic has paved the path for eCommerce working capital. What is required to deal with the dynamic competitive market?

Businesses require sufficient eCommerce cash flow. This is possible through a working capital line of credit. eCommerce working capital allows firms to focus on other significant aspects like marketing, logistics, and inventory.

What is working capital?

Working capital can be defined as a cash flow to meet daily business requirements such as maintenance of assets and payment of liabilities. eCommerce cash flow is necessary for the smooth flow of business operations.

eCommerce vendors need to manage recurring expenses before the generation of income from sales. eCommerce working capital helps businesses to cover costs like inventory, advertising, employee salaries, vendor payments, etc.

What issues does low working capital highlight?

Low working capital is a hurdle for every growing business. It becomes a cause of many unwanted troubles in the smooth functioning of organizations. The issues that businesses face due to low working capital are given below.

Inventory shortage

The market keeps fluctuating. It is essential to maintain inventory to meet the dead ends of market fluctuation. Businesses can smoothly deal with daily operations with sufficient levels of inventory.

Firms end up losing sales because of inventory shortages. Fewer sales lead to lesser profits for the firms. Therefore, businesses should ensure that the issue of inventory shortage does not arise.

It can be avoided by maintaining a positive level of working capital in the company. Another major concern is the excess inventory.

It should also be avoided because sometimes a larger portion of inventory remains unsold. It also leads to low working capital in the firm.

Payroll problems

With a shortage of working capital, businesses find it difficult to pay their employees. Late payments often diminish the morale of employees. They may even resign to look for better working opportunities.

Not only the employees but also business owners suffer because of low working capital. Sometimes they become bankrupt if the situation of low working capital persists for long.

Businesses are forced to shut down because of consistency in lesser profits. Therefore, it’s important to manage eCommerce's working capital.

Cash flow issues

The most important role of businesses is to ensure the availability of eCommerce cash flow. Low working capital results in lesser cash flow in the organization. Cash flow issues are dangerous to the health of businesses.

It may even result in losing suppliers because goods & services may not reach on time. Businesses face trouble with paying bills on time because of cash flow issues.

It becomes a cause of legal issues in your firm. A positive eCommerce cash flow is important to ensure the smooth functioning of business operations

.

Service quality issues

eCommerce working capital is required to maintain the quality of goods & services offered by the businesses. If a firm fails to maintain the quality of services, it ends up losing the most important clients.

A positive eCommerce cash flow depends on the premium quality of goods & services. Therefore, every business should ensure the quality of service they offer. Also, poor service quality creates a breach in the buyer-seller relationship.

How to manage eCommerce working capital?

As you already know, the repercussions of low eCommerce working capital. Following are the ways to accelerate eCommerce cash flow and manage the working capital of a business efficiently.

1. Inventory turnover should be optimized

The rate at which the stock is converted into liquid, i.e., cash, is called inventory turnover. Businesses should manage inventory properly because it plays a significant role in the management of working capital.

Inventory that is kept for too long in the warehouse adds nothing to the working capital. It is of no use to the eCommerce cash flow. It affects the sales of a business.

Therefore, businesses should ensure the optimization of inventory turnover. Inventory is useful during times of emergency such as market fluctuations. Inventory turnover can be accelerated by advertising for product sales.

2. Create inventory forecasts (based on historical data)

eCommerce working capital can be improved by easy access to historical data and analyzing insights. Businesses can check sales analytics to find out the areas where improvement can be made.

The risks associated with market fluctuations can be avoided by carefully examining the demand pattern of the customers. It is wise to create inventory forecasts before piling up a bulk of unwanted.

Businesses can use AI tools to analyze what goods & services will be in demand in the upcoming few months. Accordingly, they can decide what goods & services they require in their inventory.

Such hypotheses about the market demand helps businesses eliminate the issues related to eCommerce working capital.

3. Renegotiate vendor terms & conditions

An eCommerce cash flow mostly suffers because of vendor terms & conditions. Sometimes, businesses agree to pay their sellers within a month, but they need to clear their inventory and generate eCommerce working capital.

Other times, customers demand refunds which again affects eCommerce cash flow. Therefore, businesses should renegotiate terms & conditions with the vendor.

They should consider each factor that might affect their invoice payment agreement. It’s essential to consider how many days will be taken to clear the stock and receive payment from the customers.

4. Improve existing business model

eCommerce stores receive orders from the website. A collection of payments for the products follows it. And then, they ship the product to the customer’s location.

Sometimes it takes more than the expected number of days to reach the customer. This can be a threat to eCommerce working capital. Businesses can resolve this issue by improving their existing business model.

It can be done by analyzing which factors are affecting their eCommerce cash flow. A business model should be effective and efficient. It should be prepared to keep in mind the growth prospects of a business.

5. Leverage the use of technology

The goal of technological advancements is to make life easier or, at the very least, more convenient for everyone, including business owners.

eCommerce itself makes use of technology like the Internet to give business owners around the world more opportunities.

The difference between a company's success and failure is how well it manages eCommerce cash flow and eCommerce working capital.

Every entrepreneur needs to spend some time learning about eCommerce's cash flow and the amount of working capital available to them at any given time.

The proprietor can stay one step ahead of their rivals and the fluctuating market in which they operate by paying attention to these two factors.

6. Reduce expenses and debt

A significant portion of an eCommerce working capital is used for debt repayment and operating costs.

This is common because financing provides a significant portion of the startup company's working capital while operating expenses ensure the company's day-to-day survival.

Regularly, the company's expenses should be carefully examined to identify expenditures that are unnecessary for its day-to-day operations.

These include benefits for employees that do not help the business grow its revenue. These benefits can be delayed until the eCommerce cash flow is positive and its revenue sources are more diverse.

7. Encourage on-time payment (Offer discounts)

One of the best ways to manage eCommerce working capital is by encouraging on-time payment.

Timely payments from customers will resolve a significant portion of the issues associated with eCommerce cash flow. On-time payments can be encouraged by offering discounts to customers.

8. Contingency Plans should be created

The pandemic has reflected two separate sides of a business landscape. Businesses are volatile yet prone to disruption. Planning is the only way to prevent the business from being impacted by these market fluctuations.

Even though it is impossible to predict what will take place in the future accurately, business owners can identify potential risk factors and develop strategies for dealing with the issue when it arises.

How can working capital grow an eCommerce business?

eCommerce working capital is a significant factor in the growth of businesses. It is because of the following reasons.

• eCommerce cash flow helps in times of emergencies like market fluctuations. Cash flow is important for the smooth functioning of businesses. During the time of the pandemic, only those businesses survived which had sufficient cash flow.

• It helps businesses to reduce unwanted expenses and debts. Expenses and debts should be kept to control to ensure the growth of businesses in the right direction. Also, eCommerce working capital offers operational flexibility to businesses.

• Businesses can adopt better AI technologies for important operations if they have sufficient eCommerce working capital. Working capital is useful to leverage technology in businesses.

Technology can help eCommerce business owners to stand apart from the crowd.

• eCommerce working capital also results in the proper management of inventory. Excess inventory is a breach in the sales function of businesses.

Businesses can advertise their goods & services if they have enough working capital. Advertising and robust market campaigning requires funds. It can be done only when your eCommerce working capital is positive.

Related read: What is a cash flow statement and how to prepare it?

How to increase your working capital with Volopay?

eCommerce working capital should be accelerated to ensure that business operations run smoothly. To maximize eCommerce cash flow, the finance team must make fruitful decisions.

Additionally, negotiations with vendors for longer payment terms should be checked by the finance team. Discounts on invoices should be offered to customers by businesses to encourage on-time payment.

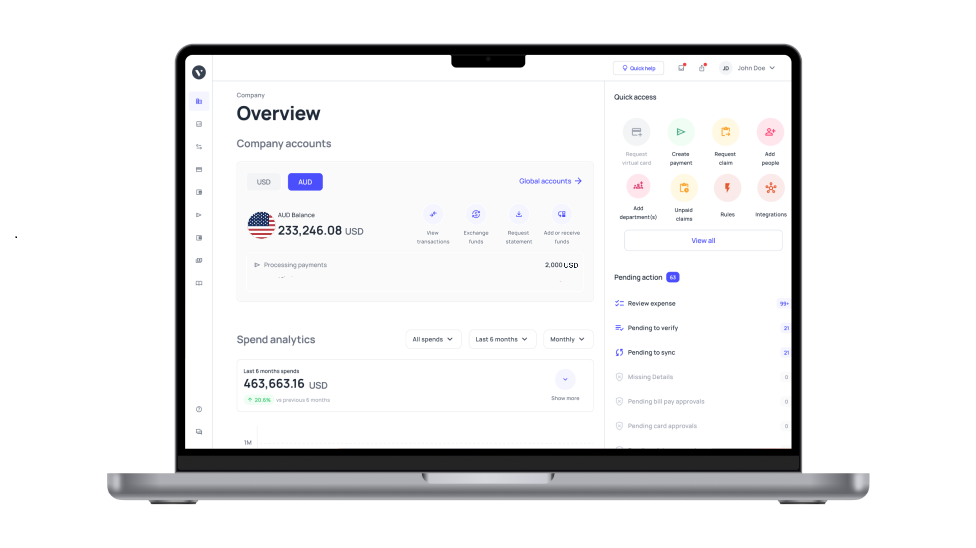

These straightforward advances can assist organizations with working on their functioning capital. Intelligent accounts payable automation software like Volopay makes it simple to complete all of these functions and tasks.

Volopay is the perfect solution for improving eCommerce working capital. An expense management software like Volopay can help you keep track of all your payments and complete your dues on time.

It can successfully set up reminders and alerts for payments, and close an invoice well before the due date. As the system would already be collecting and sorting data, your working capital accounting also happens at the same time.

Whenever your business is in a shortage of funds and requires a cheap solution to the problem, Volopay is the best option.

With just a few formalities and documentation, your business can be approved for a Volopay line of credit, which can then be used to boost the working capital of your business.

FAQs

Between 1.5 and 2 is the sound working capital ratio.

Yes, eCommerce working capital loans are taxable.

It is a financial metric that reflects how much financial resource is required to meet the ends of repayment of debts, operational expenses, and the costs of production.