4 step solution to improve working capital through accounts payable

The market keeps on fluctuating, with business trends being the prime reason. However, money remains constant. Improving working capital is important for businesses to carry out their business operations effectively.

Accounts payable can help to improve working capital significantly. Accounts payable are frequently seen as the spend management information hub, the capability that controls a lot of business information that influences the CFO plan.

Therefore, the role of accounts payable in improving working capital should not be overlooked.

How working capital and accounts payable are related?

Accounts payable is the sum that an organization should pay out over a shorter period and is a vital part to improve working capital. Organizations try to offset payments with accounts receivables to keep up with their daily income.

Organizations might postpone payment for however long it is sensibly conceivable, fully intent on keeping up with positive credit scores while supporting great associations with providers and banks.

Expanding accounts payable or accrued liabilities as opposed to paying money won't change how much the organization's improving working capital.

Be that as it may, the organization will have more money available as a result of the postponement in paying out cash. The higher balance will briefly bring about extra liquidity.

Related read: What is net working capital and how to calculate it from balance sheet?

Steps to manage working capital of business through accounts payable

1. Centralize accounts payable processing and reporting

This approach ensures all staff individuals stick to normal guidelines and measure their exhibition against laid out business measurements — regardless of where they are getting the information from.

2. Automate handling and control correspondences with suppliers

Organizations that automate their records payable frameworks by empowering electronic correspondence with sellers to gain critical functionality benefits and investment funds through accessible rebates or discounts.

Contingent upon the objective degree of AP automation, solicitations can be checked; consequently, conveyance receipts followed and debates settled electronically instead of through manual development.

3. Capture the information correctly

EDI is just a single innovation that can give detailed accounts payable data and straightforward correspondences with suppliers.

However, the key isn't what innovation organizations use yet to ensure that the innovation involved can catch accurate data in the process on a detailed level and give fundamental spending visibility for improving working capital.

4. Leveraging the use of accounts payable automation solutions

The accounts payable (AP) process is the foundation of any association as it straightforwardly influences cash flow optimization, fraud prevention, and vendor connections.

Progressions in AP automation advances have made accounts payable a significant area of concentration for improving the working capital in SMEs.

Advancements like business process management (BPM), and artificial intelligence (AI) are being considered for their capacity to computerize manual, time-intensive activities that hinder the general proficiency of the AP cycles.

Improve working capital and free up the cash flow of businesses

1. Properly managing the invoicing process

Your accounting division needs to intently screen all past due records to keep up with cash inflow. Businesses should attempt to automate the invoicing process, so you're not burning through significant time managing invoices.

You could likewise consider boosting accounts receivables, with the goal that your clients pay on time or early. Hence properly managing or automating invoice processing can assist you in improving the working capital of your company.

2. Early payment discounts

Customers are motivated to make early payments when they receive discount offers. Discount promotes early payment, which in turn can the improve working capital of a business.

Late-paying clients can cause an income crunch; however, a little rebate can go far in getting the payments to come in. Furthermore, a late fee penalty is likewise successful at boosting clients to keep away from late payments.

3. Lease your resources

Innovation develops consistently. Many times, continuing to put resources into new equipment can be monetarily impulsive.

Renting is one method for abstaining from making huge, rehashed ventures to keep steady over mechanical advancements. It's likewise one of the most underrated practices to improve working capital.

You can likewise offer it to a renting organization to get one-time cash support. Afterward, you can rent it back from them just when you want it.

4. Develop stock management and try not to store

Each unsold thing in your warehouse is a heap of cash sitting on the rack, not being put to use. This diminished liquidity makes your business less flexible and less competitive.

To improve working capital, you need to time your provisions and items to show up precisely when you want them, and to try not to have an overabundant stock.

Stock management must be learned as it helps improve your business's working capital. You'll have less capital restricted by rapidly changing over stock into cash.

5. Focus on sales income

One of the best ways to improve the working capital is through the sales process. Focus on growing your sales team and exploring new advertising channels.

Base your evaluation on overall revenues and sales to guarantee your rates are sensible and useful. Your sales team should be competitive. They must contribute to improving the working capital by accelerating the sales process.

Improving working capital is important for every kind of business

Businesses must improve working capital to ensure the proper functioning of their business operations. Structuring accounts payable data can help in improving working capital.

The finance team must make strategic decisions that would lead to the optimization of working capital. The finance department should also check negotiations with vendors for longer payment terms.

Businesses should encourage early payment by offering invoice discounts to customers. These simple steps can help businesses to improve their working capital.

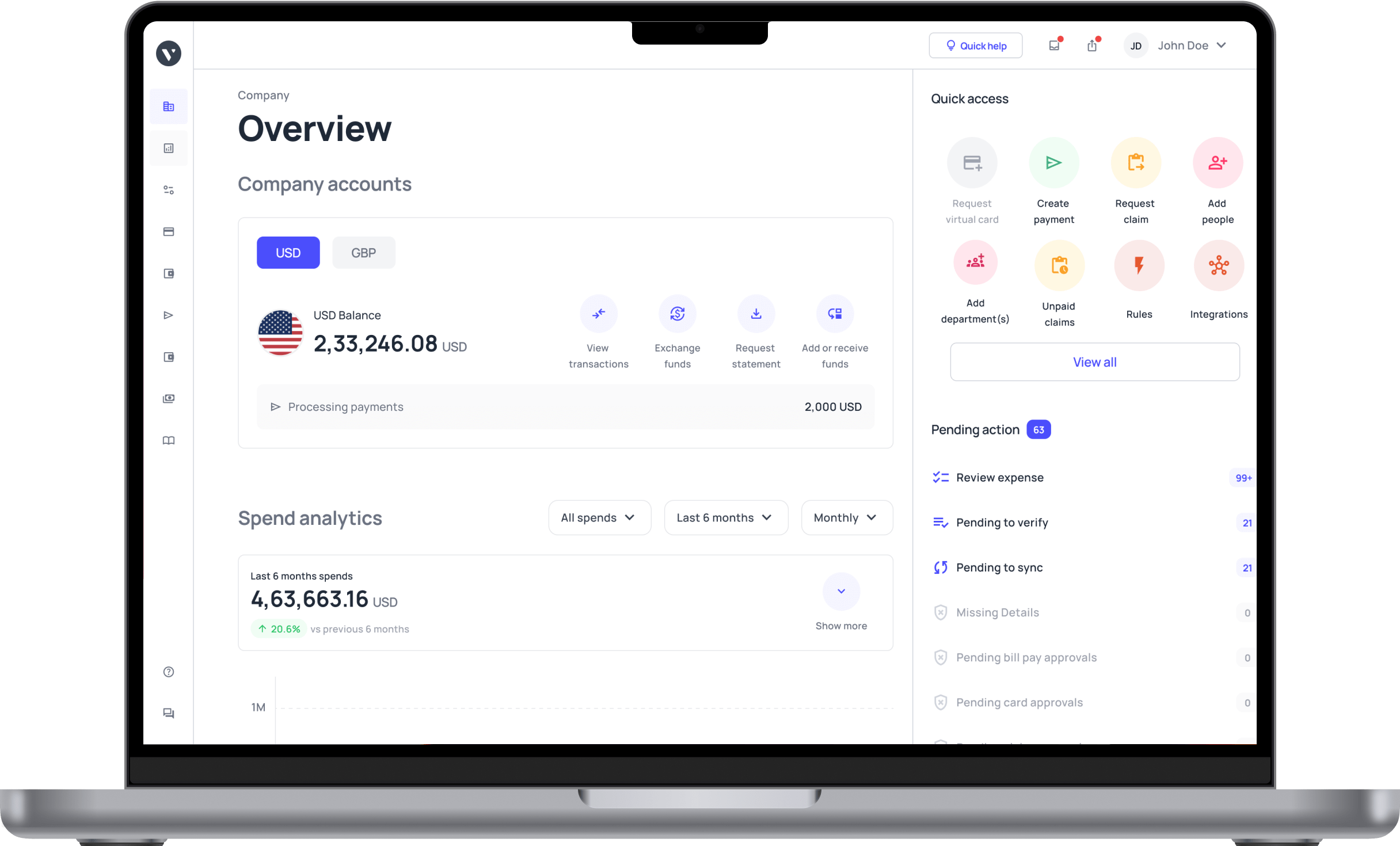

All these functions and tasks can easily be performed through intelligent accounts payable automation software like Volopay. Features like OCR scanning, multiple expense approval requirement, Individual vendor account maintenance facility. unlimited virtual cards, cheap international payment channels, and direct accounting integration.

All of these can help your business streamline AP processing. Get Volopay and unlock the possibility of taking your business a step further.