Business cash flow forecast - Types, challenges, and steps

Ask a finance expert to name one of the critical financial tasks. The answer will be cash flow forecasting. This factor is the key to keeping a business thriving.

Efficient financial management can happen only when they make accurate future cash flow forecasting.

In recent years, we have seen the advent of many innovative startups. Within a month or so, they were put out of business.

Upon digging further, it was found by the U.S. Bank that 82% of startups fail due to ineffective cash flow management, which often happens because of a common mistake that startups make— failing to prioritize and properly manage their cash flow forecast.

What is cash flow?

Cash flow is the total movement of cash and cash equivalents into and out of a business over a set time period. It includes three key components:

● Operating cash flow

Cash earned or spent through regular business operations, such as revenue and operating expenses.

● Investing cash flow

Cash related to buying or selling assets like equipment or real estate.

● Financing cash flow

Cash flow from borrowing, repaying debt, issuing shares, or paying dividends.

These elements combined provide insight into a company’s liquidity, financial stability, overall performance, and make up an integral part of the cash flow forecasting system.

What is business cash flow forecasting?

With so many options for business funding, it’s easier to secure finances if your product is unbeatable. But do all businesses have the knack for handling it well and multiplying given resources? Unfortunately, no.

With business cash flow forecasting, you can tackle this challenge. Cash flow denotes the money that comes in and goes out daily in your business. The cash flow statement captures this movement, summarizing inflows and outflows. When combined with analysis of the debt-to-equity ratio, cash flow forecasting helps predict future financial needs and challenges.

It will underline the instances when you will bring money into the business and the expenses you expect. To forecast this, all your expenses, incomes, rebates, and debt repayments will be considered.

Why is business cash flow forecasting important?

Cash flow forecasting is essential for businesses, offering a clear view of future financial conditions and enabling better decision-making. By anticipating cash inflows and outflows, businesses can plan effectively, manage uncertainties, and maintain financial health.

Below are four critical reasons why forecasting cash flow is vital for business success.

1. Predicts cash shortages and surpluses

The cash flow forecast allows businesses to foresee periods of cash shortages or surpluses. By predicting future cash movements, companies can identify potential shortfalls ahead of time and take preventive measures, such as arranging additional funding or cutting expenses.

On the flip side, forecasting surpluses helps in planning the optimal use of extra funds, whether it's reinvesting in growth or paying off debt. This proactive approach helps avoid unexpected financial challenges and ensures the business is always prepared to meet its financial obligations.

2. Improves financial management

Precise cash flow forecasting is vital for effective financial management. It enables decision-makers to optimize the management of financial resources by accurately timing cash inflows and outflows, scheduling payments, preparing for significant expenditures, and maintaining adequate operational funds.

Moreover, it bolsters negotiations with suppliers and creditors by demonstrating the company's fiscal reliability. In essence, accurate forecasting facilitates strategic financial decisions that enhance the company's financial stability.

3. Improves business stability

Cash flow forecasting is crucial for maintaining business stability. By regularly updating forecasts and comparing them with actual outcomes, businesses can quickly detect any discrepancies from their financial plans.

This allows them to take corrective action promptly, reducing risks and ensuring smooth business operations. Consistent monitoring and adjusting of cash flow forecasts help maintain a balanced financial position, which is essential for long-term stability and growth.

4. Drives profitability

Maintaining a robust cash flow forecast directly contributes to profitability. By identifying when and where cash is being used most effectively, businesses can channel resources into the most profitable areas.

It facilitates strategic planning in key areas such as pricing, cost control, and investment, leading to increased returns. Additionally, understanding cash flow trends helps in making decisions that maximize profits, such as timing investments during periods of surplus.

Elevate your cash flow management with Volopay

Direct forecasting vs indirect forecasting - Key differences

Direct and indirect cash flow forecasting are the primary methods used to predict a business's cash flow. Direct forecasting focuses on actual cash transactions, while indirect forecasting involves adjusting the net income to account for cash flow.

Understanding the differences between these techniques is vital for choosing the right one for financial planning.

1. Direct forecasting

Definition

This method involves projecting cash inflows and outflows based on actual cash transactions. It starts with expected cash receipts and payments, such as sales receipts, expenses, and other cash transactions. The direct method provides a straightforward view of how cash flows into and out of the business.

When to use

● Use when

You need a detailed and real-time view of cash movements. It’s particularly useful for businesses with complex cash transactions or those requiring precise cash flow management.

● Best for

Smaller businesses, startups, or companies with straightforward financial transactions and fewer non-cash items.

Pros

● Clarity and precision

Provides a clear, detailed view of actual cash flows, making it easier to track and manage cash on a day-to-day basis.

● Immediate feedback

Allows businesses to see the direct impact of cash transactions on their cash position, facilitating timely decision-making.

● Simple to understand

The direct method is often simpler for those who are less familiar with accounting principles, as it focuses directly on cash movements.

Cons

● Time-consuming

Requires detailed tracking of all cash transactions, which can be time-consuming and labor-intensive.

● Limited scope

May not account for non-cash transactions and changes in working capital, providing a potentially incomplete picture of financial health.

● Manual effort

Involves significant manual effort to record and forecast each cash transaction, which can be prone to errors if not managed carefully.

2. Indirect forecasting

Definition

The indirect method begins with net income from the income statement and adjusts it for non-cash transactions and changes in working capital to calculate cash flow. This approach reconciles net income with cash flow by adding back non-cash expenses (e.g., depreciation) and adjusting for changes in accounts receivable, accounts payable, and inventory.

When to use

● Use when

You need to reconcile cash flow with accounting profit and understand how adjustments for non-cash items impact cash flow. It’s beneficial for businesses with substantial non-cash transactions or those using accrual accounting.

● Best for

Larger businesses, or those with complex financial structures and significant non-cash items.

Pros

● Comprehensive view

Offers a wider perspective by aligning net income with cash flow, factoring in non-cash elements and variations in working capital.

● Alignment with accounting records

Ensures seamless integration with financial statements and accounting records, facilitating reconciliation with the income statement and balance sheet.

● Advantageous for larger companies

Particularly apt for larger enterprises or those with intricate financial activities, as it includes non-cash elements and adjustments in working capital.

Cons

● Complexity

More complex and may require a deeper understanding of accounting principles and adjustments for non-cash transactions.

● Less immediate

Provides a less immediate view of actual cash movements compared to the direct method, potentially delaying decision-making.

● Potential for misinterpretation

Adjustments for non-cash items and working capital changes can be challenging to interpret, leading to potential misunderstandings of cash flow health.

What should be included in business cash flow forecast?

A good and accurate forecast will act like a siren alerting you of major expenses on the way so that you can plan accordingly. As the first step, you will have to source the data required.

What you need for this can be easily found in your financial statements and accounting systems. While estimating your cash flow, you shouldn’t forget the following elements.

Cash balance

Cash balance is the reserve you have in stock before the forecast period begins. Cash balance is mainly seen as the source for all upcoming business expenses.

As this is a huge sum, this is mainly used for debt repayments, bill payments, or to pay dividends to shareholders. To effectively lay out future expenses and make precise business cash flow forecasting, it's crucial to account for the operating cash flow in addition to the current cash balance.

The cash balance you ended up with in the previous forecasting season will be your beginning cash balance for the upcoming forecast period.

Cash inflows

Cash inflows represent all the money expected to flow into the business during the forecast period. This includes revenues from sales, collections of accounts receivable, loans, investments, and any other sources of income.

Breaking down inflows into categories, such as recurring income (e.g., monthly sales) and one-time inflows (e.g., a loan or asset sale), provides a detailed view of expected cash. Accurate forecasting of cash inflows is essential to understanding the funds available to meet the business’s financial obligations.

Cash outflows

Cash outflows are all the payments the business expects to make during the forecasting period. This includes operating expenses like rent, utilities, payroll, and supplies, as well as debt repayments, taxes, and capital expenditures.

Like inflows, outflows should be categorized to provide a detailed view of where the money is going. Understanding and forecasting cash outflows accurately is vital for managing liquidity, ensuring the business has enough cash to cover its obligations without overextending itself.

Net cash flow

Net cash flow represents the difference between total cash inflows and outflows during the forecast period. It reveals whether the business will experience a cash surplus (positive net cash flow) or a cash shortfall (negative net cash flow).

This metric is essential for assessing the company’s financial health, indicating whether it is generating sufficient cash to maintain operations and support growth. Monitoring net cash flow regularly enables businesses to adjust spending and revenue strategies as needed.

Closing cash balance

The closing cash balance is the remaining cash at the end of the business cash flow forecasting period. It is determined by adding the net cash flow to the opening cash balance and serves as the opening balance for the next period.

A healthy closing balance ensures that the business has enough cash to cover future needs and provides a cushion against unexpected expenses or financial shortfalls. It is a critical measure of the company’s liquidity and overall financial stability.

Receipts

This line of entry denotes the cash inflow your business will receive during the forecast period. It can be the receipts/invoices you have distributed or from sales of assets, stocks, or any other revenue.

To predict this entry, you can look at the sales of your last quarter. Based on the previous season’s sales and other trends you observed, you can predict the revenue (including any price changes you have in the pipeline).

There are also certain complications you must consider before converting the sales into revenue, like payment terms, offers, and credit control. Enter the receipts in the same way you expect the payments to be reflected in your account.

Payments

After recording the cash inflow and reserves, it’s time to update the payments you must send out. You can split the expenses into fixed and variable based on their nature for easier entry.

Fixed expenses are usually consistent throughout the year (Eg. rent, subscription costs, license costs, etc.).

Variable expenses include the wages of your employees, manufacturing costs, major purchases, or expansion expenditures. Based on your past expenses and business plans for the coming year, you must input your expenses.

Optimize expenses and take control of your cash flow

Benefits of preparing a cash flow forecast

The cash flow forecast is a crucial instrument for businesses, offering critical insights into prospective cash transactions. It enables businesses to predict cash inflows and outflows accurately, facilitating informed decision-making, ensuring financial stability, and identifying potential areas for expansion.

Below are three principal advantages of compiling a cash flow forecast

1. Predict any future cash shortage

Despite being prepared, you can still encounter emergency spending situations. Getting into them can leave you in a cashless state. Even if it’s for a few days, going zero on cash flow is never advisable for stable financial health.

While preparing business cash flow forecasts, you can anticipate such shortage moments and take control of the situation before the damage happens.

For instance, holding a major equipment purchase on hold at the end of the month when payroll has to be processed.

In cases where the expenses cannot be put off, you could plan alternative financing in advance (credit or short-term loans) or receive customer payments in advance. Identifying the blocks earlier gives you time to deal with shortages better.

2. Monitor late payments

A major source of your income comes from your customers. Every company will have a group of customers who consistently pay late. Forecasting cash flow puts such customers under the spotlight.

You can follow different strategies to make them pay earlier or form new agreements. Late payers are often neglected, especially by small businesses, as they don’t want to lose a client by being rigid.

But establishing good payment habits and payment terms is important to a long-lasting vendor-client relationship. Cash flow forecasting can be your starting point.

Related read: What is the effect of late payments to small businesses?

3. Keep spending in check

Forecasting future cash flows indirectly curbs your expenses and prioritizes the necessary ones. It gives you an opportunity to rethink and decide if an expense is necessary or not and if your cash flow will take a hit.

You can compare your incoming money with outgoing and see if you can manage at any instance. As you can see all expenses together, you can pick out expensive ones and remove them from your budget.

4. Gain investors' confidence

Detailed business cash flow forecasting reassures investors and tells them that the business is profitable and going in the right direction.

Cash flow forecasting can be the financial indicator that they use to measure business performance. You seek investors' help when you plan to expand and are in additional need of funds.

Having cash flow forecasting planned can convince them and gain their confidence. This increases your chances of getting noticed and bags you the funding opportunities your business growth needs.

5. Improves relationship management

Customers are an integral part of your business as they are directly involved with revenue generation.

As seen already, you can’t upset them with rigid payment regulations. Rather you can have a strong and flexible partnership where both are mutually benefitted.

For that to happen, preparing cash flow forecast can help you review your customers’ payment practices. Make your partners a part of this journey too to fully stick with forecasted cash flow.

6. Improves financial decision-making

A cash flow forecast improves financial decision-making by providing a clear picture of expected cash availability. It allows business owners and managers to plan for major expenses, time investments effectively, and ensure sufficient funds are on hand to meet obligations.

With a thorough understanding of future cash positions, businesses can avoid financial shortfalls, optimize spending, and allocate resources more efficiently. Additionally, by identifying patterns and trends, businesses can implement strategies to improve cash flow, ensuring smoother operations and better financial stability.

This foresight is particularly valuable when considering new investments or expansions, as it ensures the company can support these activities without jeopardizing its financial health.

7. Promotes business stability

Regularly preparing a forecast of cash flow fosters business stability by identifying potential cash shortages before they arise. This enables businesses to take preemptive actions, such as securing additional financing or adjusting payment schedules, to prevent liquidity crises.

By consistently monitoring cash flow forecasts and comparing them with actual outcomes, businesses can quickly detect discrepancies and make necessary adjustments.

This ongoing vigilance helps maintain a balanced financial position, reduces the risk of unexpected financial disruptions, and ensures the company stays on solid ground, even during challenging times.

8. Identifies opportunities

A carefully crafted cash flow forecast can uncover opportunities for growth. It enables decision-makers to identify times when the business may have excess cash, allowing for strategic investments in expanding operations, introducing new products, or venturing into new markets.

Moreover, it can pinpoint times suitable for negotiating more favorable terms with suppliers or creditors, thereby enhancing the company's financial standing. By incorporating departmental budgeting into the cash flow forecast, businesses can ensure that each department's financial needs and contributions are accurately reflected, leading to more precise and actionable insights.

Thus, a cash flow forecast serves as a tool for risk mitigation and a means to seize opportunities that bolster growth and profitability.

Challenges of business cash flow forecasting

While there are significant benefits of accurate cash flow forecasting, ensuring the level of accuracy and executing the forecast comes with its own hurdles and challenges.

Some of the commonly known challenges of cash flow forecasting include:

1. Data collection challenges

One of the main challenges in cash flow forecasting is the collection of accurate and comprehensive data. Businesses must gather information from various departments, such as sales, finance, and operations, to predict future cash inflows and outflows accurately.

The data collection process can be laborious and error-prone, particularly if departments use inconsistent methods or formats for financial tracking. Incomplete or incorrect data can result in faulty forecasts, complicating effective business planning. Moreover, the difficulty in collecting real-time data means that forecasts may not represent the latest financial status, leading to possible mismanagement of cash flow.

2. Lack of automation

A notable challenge in cash flow forecasting is the absence of automation. Many companies still depend on manual methods, like spreadsheets, for their forecasts. Manual forecasting is not just time-intensive but also heightens the risk of human error, resulting in imprecise predictions.

Without automation, regularly updating forecasts becomes increasingly difficult, especially as new data continuously emerges. Automated forecasting tools can simplify the process, enable more frequent updates, and significantly decrease error chances. Nonetheless, adopting these advanced tools necessitates investments in both technology and training, which some businesses may find financially prohibitive.

3. Dependence on historical data

Cash flow forecasts are often based on historical data to project future cash movements. While historical data provides valuable insights, it may not always predict future scenarios accurately, especially in a dynamic business climate.

Market volatility, shifts in consumer behavior, or unforeseen events like economic recessions can easily make historical data seem unreliable and less useful. Relying solely on past data can result in forecasts that are either too optimistic or too pessimistic, potentially leading to serious financial misjudgments and poor decision-making.

4. External market factors

External market factors present a significant challenge to precise cash flow forecasting. Economic conditions, industry trends, regulatory changes, and geopolitical events can all influence a business's cash flow in often unpredictable ways.

An unexpected downturn may reduce sales and affect cash inflows, while new regulations can raise expenses, impacting cash outflows. These factors create uncertainty, complicating accurate forecasts. Businesses must regularly monitor these changes and adjust forecasts, a resource-demanding task.

Gain real-time insights into your cash flow

How to forecast cash flow?

In the process of cash flow forecasting, we will predict future spending and income. It’s a step-by-step process performed meticulously by collecting various forms of data.

Here is how it happens. Before you start forecasting cash flow, decide the period you want to forecast. It can be a month or three months or even a year. The lesser the period the more accurate the data be.

1. Forecast your income or sales revenue

After choosing a period, the first step is to predict your earnings for the specific period. You can start by analyzing how much sales you will be able to make during this stretch.

Rather than assuming numbers, you can rely on past years’ sale data and identify sale trends by noticing how it has changed over periods. (Certain businesses will sell more on certain seasons).

Now set a number based on your conclusion from the past sales data analysis. Also, remember that your sale value can change anytime depending on other factors.

There can be economic turbulences, inevitable natural accidents, recessions, or competitors' campaign outbreaks. If you are new to the business and have no data to run to, calculate your entire spending. Your revenue from sales should be able to cover this.

2. Estimate cash inflows

Any other incoming cash other than from sales counts under cash inflows. Your cash flow forecasting should include this too even if it’s negligible. This also gets added to your cash reserve and be used for managing expenses.

To estimate this, you must see if the forecasting period has any chance of receiving income from the following sources

• Any rented property owned by the business

• Additional funds invested by business owners

• Tax refunds

• Sale of assets or machinery owned by the business

• Interest from loans offered to other entities

Every incoming money in a business for the next forecast period is analyzed and added now.

3. Estimate cash outflows and expenses

Now, we will analyze the expenses that will be spent to produce goods or render services. This can change from one business to another, but the concept remains the same.

You will have to count every expense required to manufacture a product and do administrative tasks.

While deciding on manufacturing expenses, rely on the sale forecasting data. If you have assumed to sell 100 units of your product, estimate the cost required to produce that.

Compile the estimates into your cash flow forecast. Your cash outflow depends on inflow and vice versa. Hence, your values should be adjustable too. You might have made plans for selling 100 units but what if you need more than that?

• General expenses/outflows of a business

• Utility costs

• Maintenance fees

• Employee wages

• Loan repayments

• Marketing and advertising

• New machinery purchase

• License costs

• New branch establishment

4. Calculate net cash flow and closing balance

To begin, calculate the difference between total cash inflows and outflows during the forecast period. Project cash inflows from various sources, including sales revenue, collections of accounts receivable, and other forms of income.

Next, project cash outflows for operating expenses, debt repayments, and capital investments. Once the net cash flow is calculated, proceed to determine the closing cash balance. Take the opening cash balance, which is the cash on hand at the start of the period, and add the net cash flow to it.

The resulting figure is the closing cash balance, which will be carried forward as the opening balance for the next forecast period.

5. Use spreadsheets or cash flow forecasting software

Employ spreadsheets or specialized cash flow forecasting software for precision and efficiency. Tools like Microsoft Excel or Google Sheets allow customization to monitor inflows and outflows, execute calculations, and create forecasts, often facilitated by available templates.

Conversely, cash flow forecasting software provides advanced functionalities like automated data integration, real-time updates, and in-depth analytics, enhancing the cash flow forecasting system, minimizing errors, and offering granular cash flow insights.

6. Consistently monitor and revise your forecast

Cash flow forecasting is a continuous activity, not a singular task. Consistently review and update your forecast to mirror the actual financial performance and any shifts in business conditions.

Align your projected figures with the actual cash flows to spot variances and modify your forecasts as necessary. This routine evaluation enables you to track financial trends, manage cash proficiently, and implement strategic adjustments promptly.

7. Lastly, review your estimated cash flows against the actual cash flow

You have everything in hand now for preparing cash flow forecast. The last and most vital step is to put numbers across each other and tally. On one side you have your inflows and the opposite has outflowing money.

When you compare them with each other, you can identify if it’s possible to sustain the entire forecast period without running out of cash. If it’s not matching up and there is an expense surplus, you can plan on obtaining alternative finances.

What you can learn from this analysis?

• If your income is higher than expenses, you have a strong, positive cash flow. Instead of keeping the excess money idle, you can work on your growth plans like expanding the business, hiring more staff, or investing in advanced technology.

• If your expenses are higher than your income, your cash flow is poor and you will have to reduce your expenses or find additional funding assistance.

What is the cash flow forecast formula?

The formula for calculating cash flow forecast involves three main steps:

● Estimate cash inflows

Include all sources of cash, such as sales revenue, collections from receivables, and any other income.

● Estimate cash outflows

Account for all cash payments, including operating expenses, debt repayments, and capital expenditures.

● Calculate net cash flow

Subtract total cash outflows from total cash inflows.

● Example calculation

● Cash inflows

$50,000 (sales revenue) + $5,000 (collections) = $55,000

● Cash outflows

$30,000 (operating expenses) + $10,000 (debt repayment) = $40,000

● Net cash flow

$55,000 (inflows) - $40,000 (outflows) = $15,000

The forecasted net cash flow is $15,000.

Track and manage your cash outflows seamlessly with Volopay

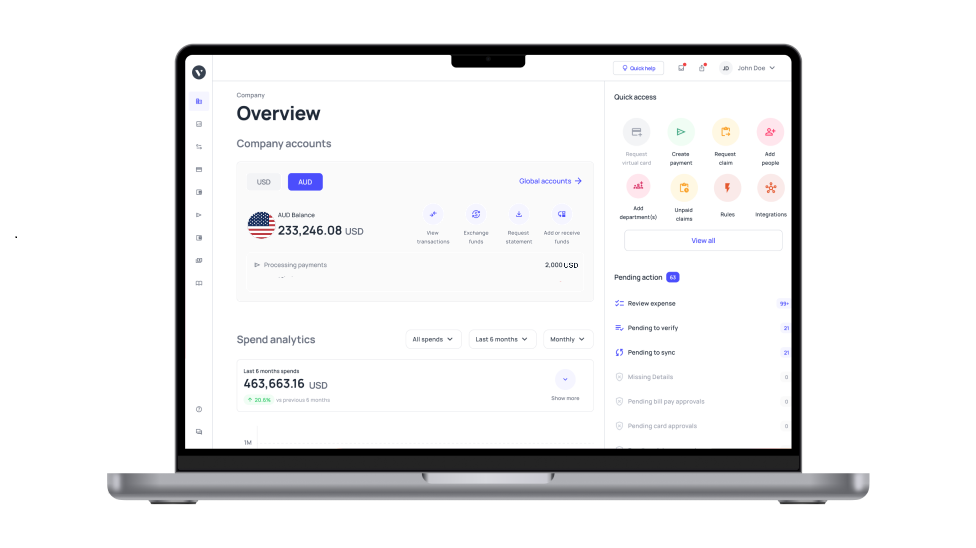

Before you can go ahead with cash flow forecasting, the first step is management. Managing cash outflows is essential for maintaining a stable cash flow and ensuring smooth business operations. Volopay offers a comprehensive platform that simplifies this process, enabling businesses to effectively track and manage expenses.

Here’s how Volopay can help you streamline cash outflow management through automated expense management, real-time data, efficient payment processing, customizable reports, real-time alerts, and seamless integration with accounting systems.

Automated expense management

Volopay's automated expense management feature stands out as a significant benefit. It empowers businesses to streamline everyday financial operations, including the tracking and categorization of expenses, payment approvals, and account reconciliations.

With reduced reliance on manual data entry and supervision, Volopay allows finance teams to dedicate their efforts to more strategic tasks. Moreover, automation diminishes the likelihood of human error, guaranteeing precise recording and categorization of expenses.

Consequently, this leads to more accurate financial reports and a better insight into the company's financial expenditures.

Real-time expense data

Volopay offers real-time expense data, giving businesses immediate access to current financial information. This instant visibility allows finance teams to monitor expenses as they occur, rather than relying on end-of-month reports.

Having real-time data is crucial for making informed decisions, such as adjusting payment schedules or modifying budgets. It also helps in quickly identifying potential overspending or unusual transactions, enabling prompt corrective actions.

With real-time expense data and a consolidated dashboard to manage multi-entity finances, businesses can remain agile and responsive to financial changes.

Efficient payment processing

Volopay simplifies payment processing by offering a streamlined, centralized platform for managing all outgoing payments. Whether it’s paying suppliers, reimbursing employees, or settling bills, Volopay ensures that payments are processed quickly and efficiently.

The platform supports multiple payment methods, including bank transfers, credit cards, and virtual cards, providing flexibility in how payments are made. Additionally, Volopay’s efficient payment processing reduces the risk of late payments, which can damage supplier relationships and lead to penalties.

By ensuring that all payments are handled smoothly, Volopay helps maintain strong, reliable financial operations.

Customizable reports

Gaining insights into your business’s financial health requires access to detailed and relevant data. Volopay offers customizable reports that can be tailored to the specific needs of your business.

Whether you need to analyze spending by department, vendor, or category, Volopay’s reporting tools allow you to generate the precise insights you need. Customizable reports can be scheduled automatically or created on demand, offering flexibility and control over financial data.

These reports support better budgeting, more accurate forecasting, and improved financial decision-making, all of which contribute to more effective cash flow management.

Real-time alerts

In addition to real-time data, Volopay offers real-time alerts to keep you updated on crucial financial activities. You can tailor these alerts to inform you about particular events, like impending large payments, expenses surpassing set limits, or overdue payments.

Real-time alerts act as a safeguard against financial shocks by keeping you informed about your cash outflows. With this knowledge, you can promptly take corrective measures, such as deferring payment or modifying spending thresholds, to prevent adverse impacts on your cash flow.

Integration with accounting system

Volopay offers seamless integration with prominent accounting systems, streamlining the synchronization of financial data across platforms. This integration dispenses with manual data entry, diminishing the likelihood of errors and guaranteeing the precision and currency of your accounting records.

Volopay's automatic syncing of expense data with your accounting system eases the reconciliation process and certifies that your financial statements faithfully represent your business's financial health. Such integration conserves time and resources, freeing your finance team to concentrate on strategic initiatives.

Make use of Volopay's seamless expense management solution

FAQs

In this cash flow forecasting method, you will combine three financial statements (P&L statements, balance sheets, and cash flow forecast sheets) for preparing a cash flow forecast.

Three types of cash flow forecast that businesses track and record are cash flow from operating expenses, cash flow from investing activities, and cash flow from financing activities.

The most common formula used to determine cash flow from operations is

Cash Flow from Operating Activities = Net Income + non-cash items + Changes in Working Capital

It is advisable to update your cash flow forecast regularly, preferably on a monthly or quarterly basis, to account for changes in financial conditions and maintain accuracy. Regular updates are beneficial for predicting cash requirements and modifying strategies according to the latest financial information.

Cash flow forecasting helps manage seasonal fluctuations by predicting periods of high and low cash flow. This foresight allows businesses to plan for peaks and troughs, ensuring adequate cash reserves or securing financing to cover lower cash flow periods.

Automation streamlines cash flow forecasting by integrating real-time data, reducing manual errors, and saving time. Automated tools can update forecasts instantly, generate accurate projections, and offer detailed insights, making it easier to manage and adjust financial plans.

Yes, cash flow forecasting can attract investors or secure financing by demonstrating a clear understanding of cash needs and management. Detailed forecasts show financial health, future profitability, and risk management, which can build confidence among potential investors or lenders.

Inadequate cash flow management can result in a lack of funds to meet expenses, failure to fulfill financial commitments, and higher borrowing expenses. Additionally, it can cause operational interruptions, missed opportunities, and could lead to business collapse if not managed in a timely manner.

Industry trends impact cash flow forecasting by influencing sales patterns, costs, and investment needs. Changes in market demand, regulatory shifts, or technological advancements can alter cash flow dynamics, requiring adjustments to forecasts to maintain accuracy and relevance.

Cash flow forecasts can aid in negotiating terms with suppliers by providing a clear picture of cash availability and timing. This allows businesses to request better payment terms, discounts, or extended credit, improving their financial flexibility and supplier relationships.