Small business finance management - Tips and essentials

Small businesses are equally complicated in comparison to Large scale businesses. Just establishing the business and working blindly is not the way to success. Your small business finance is the primary entity that helps you make a fortune. However, before using business financing as the central basis of your decisions, you need to have a “small business finance 101.”

Approximately 627,000 small businesses are established every year. But from this, only two-thirds of businesses are able to stand for three years, and only half survive more than five years. This failure is not because of a lack of customer base or degraded quality of products, the only major reason is the inadequacy of money.

Without proper small business finance management, any profitable business can collapse. Many small business finance decisions have to be taken on-spot. You need to be always prepared. But not every small business owner has a sound financial background or experience in handling a business.

This is the time when you need a guide to help you understand all the vital elements of business financing and manage your finances efficiently.

9 essential business financing terms that you should know

Before deliberating on any critical business financing decisions, you must know all the finance terms to make an informed decision and ask the right questions to obtain implementable and beneficial solutions.

1. Gross revenue

Gross revenue is the total money earned by your business, without adding the sum of money which would be or has been used for any expense. This implies gross revenue consists of money made from the sale of goods and services and from interest, sale of shares, exchange rates, and sales of property and equipment.

2. Profit

By subtracting all your expenses from the gross revenue, you get the amount of profit you have earned in a specific period. There may be circumstances where you have a great gross revenue but not an exceptional profit.

The words gross revenue and profit are often mixed up, which may cause chaos and confusion because these words show if your small business is doing worse or performing excellently. You, at no cost, can be ambiguous about these terms.

3. Cash accounting

This is an accounting procedure in which the payment receipts are documented as soon as they are received, and the expenses are recorded immediately, i.e., in the very instance, they are paid.

In short, income and expenses are registered as cash is obtained or paid.

4. Accrual accounting

This is another type of accounting method in which a transaction is registered in the accounting books as and when it occurs, even if the payment is yet to be done. This implies that accrual accounting records transactions without considering the cash flow.

You can plan your future business financing decision precisely with this type of accounting.

5. Working capital ratio

The difference between your company’s current assets and current liabilities is called working capital. The percentage of this difference is known as working capital ratio.

Your business’s health can be effectively measured by these metrics.

6. Internal controls

To maintain the accountability of a company’s financial team, ensure the coherence of the financial and accounting statements, and be secure from fraud, internal controls are executed by a company. Internal controls are techniques, rules, and procedures.

Apart from making sure that everyone obeys the laws and rules of the company and preventing fraudulent stealing, internal controls are beneficial for raising functional efficiency and accuracy of financial reporting.

7. Cash flow

The net amount of cash and cash equivalents transacted from a company (received or paid) in financial terms is called cash flow. When you receive cash, it is known as Inflow, and when you spend money, that is called outflow.

If your company receives more than it spends, then it has a positive cash flow. However, if your business’s outflow is more than its inflow, then it has a negative cash flow.

8. Break-even point

In terms of trade or investment, a break-even point is obtained by contrasting the prices of an asset, i.e., the market value and the original cost. When both these prices are equal, you get the break-even point.

In other corporate accounting terms, the break-even point is the level of production at which the total revenues earned are equal to the total expenses.

9. Business expenses

Business expenses are the costs that a company sustains. Some factors tend to have a direct impact on the cash flow, whereas some may not. Such as, payroll has a direct effect, while depreciation doesn’t.

You are allowed to claim some expense as deduction as per IRS, but only when they are important revenue-generating items and are constant throughout the same industry. For example- travel, office supplies, executive memberships, etc.

Necessary documents for small business finance

Now that you are adequately equipped with the basic terms of financing, here are some important documents that help in managing small business finances:

#1 - Balance sheet

A balance sheet is a document that contains the details about the assets and liabilities of a business and is a record of all the investments made in the company.

This helps in calculating the return rates and examining the gains entailing the funding sources.

#2 - Income tax return

Every different stratum of your business structure has a different kind of tax return attached to it. You must acquaint yourself thoroughly with the ones your business has to use; this will save your time during tax filing.

Many business owners already know about tax returns as they have filed for themselves, personally. While running a business, you need to be aware of all the business taxes as well as any personal tax you may have to incur at the side.

Your business entity type is the deciding factor of the type of tax form you have to file. Every business type has different income tax consequences.

Ordinarily, companies hire CPAs or tax professionals to look over their tax return files, but we would suggest you personally analyze your tax file. This is recommended because knowing the business return would help you and your financial team in curating growth plans and profit-yielding solutions.

#3 - Bank statement

It is a suggested practice to spare some time at the end of every month to analyze your business’ bank statements just to make sure that all withdrawals and deposits are correct. This means ensuring that all your vendors have received their payments, and if not, you can look into the problem and solve it.

A proactive approach towards vendor payments runs long in maintaining strong business relationships. Also, looking personally over your statement would give you a clear idea of your actual transactions.

#4 - Cash flow or financial forecast

Cash flow documents, as the name suggests, determine the company's cash flow, help in future financial forecasting, and are essential for managing expenses for small businesses.

Determining and scheduling expensive purchases during positive cash flow and getting funds or credit in the negative cash flow period is facilitated by cash flow information.

#5 - Profit and loss statement

Profit and loss statements, also called Income statements, are documents used to assess the present financial position of the company and the opportunities for future growth. A profit and loss statement is an outline of the expense undertaken and revenues generated by your business over a particular period.

The amount left after deducting expenses from the total revenue is the profit earned. However, if your expenses are more than revenues, then your P&L statements would display losses.

Tips on how to manage business finances

For reaching a profitable output every year, you need to have some plans and strategies in place to help your company reach that target. These plans and strategies will come under an effective business financing system.

Here are some tips on how to manage your small business finances:

1. Have a financial business plan in place

Small business financial planning consists of accounting, budgeting, tax preparations, future forecasting, and risk administration. To have the advantage of curating the right financial targets for your business, you must examine the financial statements and accounting records every now and then.

Along with setting financial targets, this practice will also help you judge your business’ performance, according to which you can decide investment areas for expansion and saving mechanisms for security.

When it comes to taxes, there is no better way than being prepared and composed in advance. You can steer clear of any extra tax or common tax mistakes by having a systematically arranged financial record.

As a small business owner, besides understanding the tax deductions, with this practice, you can also reduce your tax burdens.

2. Create an operating budget

It is extremely important to have a plan for the positive growth of your business. Fabricating a budget can ace up your small business finance game and help you accomplish your profitable revenue goal well before the expected time.

Forecasting revenue levels and identifying uncalled-for expenses becomes easy if you have a budget in place.

An operating budget should be your first step. This will show you the expected levels of revenue for a financial year as it includes every important detail in regards to the different types of costs your company incurs in the process of production, i.e., the fixed cost, variable cost, and operating expenses. This operating budget is your tool to assess if your expenses fit your plan or not.

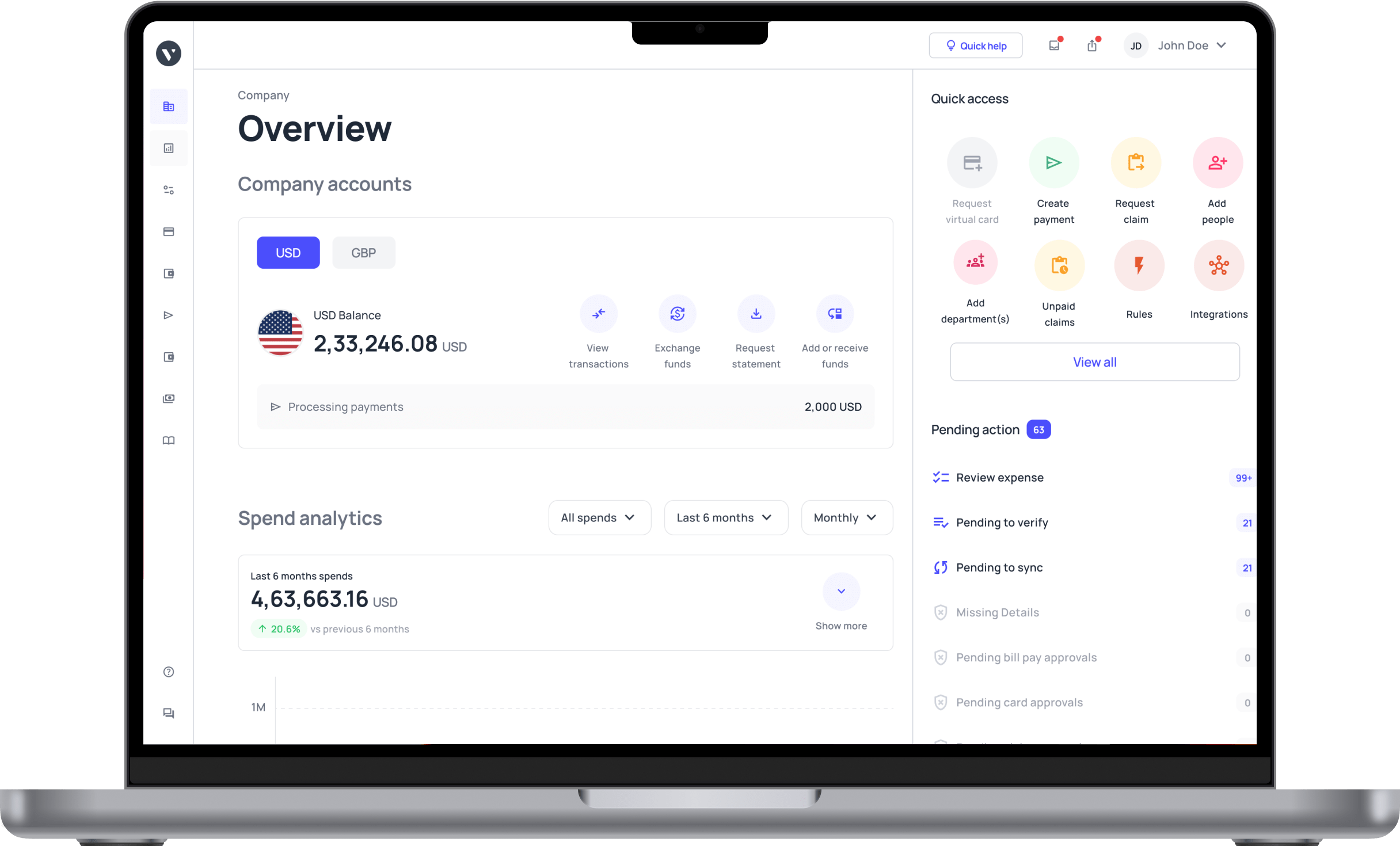

3. Shift to corporate cards

Corporate credit cards are the ultimate solution to a chaos-less digital spending way for your business. These help in raising the purchasing power of a company, earning benefits and rewards, untangle the analysis and tracking of business transactions, facilitating better control on spending by setting limits, and refining the cash conversion cycle at zero interest on short-term credit.

In comparison to personal cards, corporate credit cards have higher credit limits which facilitate managing all expenses for small businesses without having any impact on personal liability. Along with small business finance management, corporate credit cards provide an easier way of abidance and reporting for a progressing small business.

4. Business credit line

While managing small business finances, procuring small business credit or small-term financing is an effective tool for growing your business as it helps in many funding requirements like inventory maintenance, getting new orders, and salary payments.

Your business's cash flow can also be improved by having access to a line of credit.

5. Streamline employee payroll process

Employee payroll processes can be extremely complex and have hidden costs here and there. By discarding the complexity, you can save a lot of time and identify the hidden costs which make the whole thing unnecessarily expensive.

Here are some ways through which you can streamline your employee payroll process:

• Review your payroll policy now and then.

• Use automated systems instead of paper-based ones.

• Keep track of employee activity.

• Be quick in solving payroll problems.

6. Small business loans

While thinking of taking a loan, the first thought in your mind is the question of falling into a debt trap. But the loan is not just about debt traps.

Loans can prove to be a useful tool for expanding your small business. The majority of small businesses depend on loans of different types.

However, you always have to be aware of that thin line of difference between taking a loan your business can handle and loans that spiral out of control.

Good business financing is about taking care of even the tiniest details.

You have to keep a sharp eye on your business performance and the financial conditions to make the right decision while taking a loan.

However, don’t be afraid; small business loans can back you up when in an unforeseen problem.

Even if you are completely armed with an effective financial plan, even the smallest market disruption or change can affect your company and its revenue, and it is at these times when small business loans help you meet your working capital requirements.

Some other benefits of small business loans are- they have a minimal documentation requirement, easy eligibility, are collateral-free, and cheaper interest rates.

All these things make the application process easier and can be an aid for your business in difficult times.

7. Separate business and personal finances

While running a small business you need to be sure of separating your business and personal finances. This is an extremely crucial task because your company is the professional side of your life which is entirely different from the aspects of your personal life.

We understand that if you are the owner or the founder, keeping these two sides separate can be colossally difficult, but this is the best practice. By separating the two, you get an increased level of accuracy and transparency as your business accounts won’t be showing any personal expenses which in turn doesn't disturb your revenue plans.

Along with this, a proper differentiation between your business and personal finances will make the process of income tracking, tax filing simpler, and claim deduction simpler.

Also, someone who looks at your financial health (vendor, investors, credit bureaus) before making any business engagements would get a bad impression by looking at the chaos between the business and personal financing.

Here are some steps which can help you in at least starting the process of separation:

• Create a specific business bank account.

• Incorporate corporate credit cards.

• Pay yourself a salary.

• Know what is categorized between business expenses and what comes under personal expenses.

8. Inventory management

Inventory management has certain elements which look at your inventory from the starting order to restocking, storage, etc. To build an inventory, you need various kinds of information like sales volume, current stock levels, outdated stock levels.

Inventory management is done procuring all this data which in turn is helpful while demanding predictions and sales forecasting. The information gathered can only be useful if your inventory management practice is efficient and up-to-date.

Knowing your inventory and the process of its management is a tool for keeping up with the present needs of your customers and also meeting their future requirements.

Here are some small business tips for beginning with:

• Have a firm grasp on your supply chain.

• Settle minimum stock levels.

• Discard obsolete and slow-moving inventory.

• Minimize damage and loss (shrinkage).

• Be flexible with your fluctuating SKUs.

9. Automate with small business finance management software

The whole process of financial management can be automated with some small business finance software.

An automated system is beneficial as it helps in saving a lot of time, decreases the requirement of human effort, diminishes the vulnerability to human error, and gives you more control over the finances of your business, because of which you will be able to make better and practically achievable decisions.

These business finance tools also relieve the financial team members from repetitive tasks and give better insights into the cash flow and financial performance of the business.

Essentials of small business finance management and planning

When starting with your business and taking the first step into the market, you are all backed up with the money. But once you actually get into the business and your revenues start generating, your small business finances can multiply quickly, which then poses the requirement of small business financial planning.

As stated above, it is not only a good customer base and excellent product that keeps you strong in the market; most essentially, it is your ways of managing business finances that determine your present performance and future growth possibilities.

All the components discussed further are constant throughout all industries and specific to business financing.

1. Manage and track cash flow

What is cash flow?

Cash flow is defined as the growth or decline in the amount of cash a business or an organization or sometimes even an individual possesses. In business financing terms, cash flow is a term that describes the amount of money earned by a business in a given period of time.

Positive cash flow

Positive cash flow is when your company earns more than it spends on business expenses. This is an indicator that a company’s liquid assets are expanding through which it is able to fund its commitments, invest more in the business, pay all expenses easily and have a shield for any unforeseen future problems.

To gain an advantage from profitable investments, your company needs to have powerful financial flexibility.

Negative cash flow

Negative cash flow happens when a business’s expenditure is more than its income in a given period of time. This indicates a disparity in the revenue generation, but this does not certainly mean loss. It is a common small business financial situation that is temporary.

When you buy some new fixed assets or some payment is overdue, a negative cash flow situation may prevail. To cover the setback that comes with this, you can take a short-term loan or apply for a bank overdraft.

However, as long as your business is able to get back to a positive cash flow state, there won’t be any major problems arising for your company.

Importance of cash flow for small business

To sustain a profitable and healthy business, you have to be careful and analytical about your company’s cash flow and profit. Keeping your cash flow at the topmost priority is important because an accurate cash flow statement gives you a clear picture of your fund availability. This, in turn, helps you plan and make well-informed decisions for your business's magnification. Your business can be at a huge risk if you don’t manage your cash flow.

There are misconceptions about many businesses being in excellent positions, but you never know the cash flow statements may show that there isn’t much cash coming into the business in a particular period. This could be the case with your business as well.

So, to avoid being in an illusion about your company’s position, you should be well updated with your cash flow and evaluate it time and again. Cash flow statements also give you a better understanding of your current money spending which is not shown in a profit and loss statement.

Knowing where your money is being spent and why is crucial because expenses cannot always be categorized into a set group, and you may also be able to identify some hidden unnecessary costs and cut them down.

How to manage cash flow for your business?

1. Create a cash flow statement

Creating a cash flow statement is a simple financial document that records all the cash that comes in and goes out. Through these, you get a picture of your actual monthly cash flow.

For creating this document, there is no prior accounting experience needed. However, many accounting softwares have automated cash flow statement-making options which prove to be helpful.

2. Choose the right payment terms

Choosing the right terms of payment is another huge step in managing your business’ cash flow. Terms of payment mean deciding in what way you are ready to accept payments for your small business.

For example, many industries directly deal with customers and receive their payments immediately, like restaurants or general stores. Whereas businesses dealing with other businesses give an option of paying later. This means that the client can make the due payment within a span of some days, 7, 30, 60, or 90. These terms are set by your company, and this practice helps in attracting more customers as they are offered the convenient facility of buying now and paying later.

However, this raises a question, that till the time the payment is not made your company would face cashflow problems. To solve these, there are different techniques and strategies you can implement like discounts of early payments, interest or some penalty amount on late payments or some incentive on immediate payment, etc.

3. Be very selective about who you do business with

Before engaging in business with any prospect, you must be extra careful and sure about their credit score or credit records. You have to be selective with the clients you want to initiate a relationship with, and we understand that credit checking every time you get a potential client is a difficult task, but it is colossally important.

Imagine a situation where your company supplies raw material to a client and delivers according to their expectations, but in the end, they deny your payment; what would you do? Of course, legally recovering your money is a reliable option, but that would turn out to be very expensive.

Also, till the time you don’t get that money, what would you do without any cash flow? To not fall into any such trap, you must always credit-check every approaching client. There are many online credit tracking agencies like Creditsafe and Experian that give you the facility to check the credit score of any company online.

You might choose not to extend credit or just not work with companies having a bad or not such a good credit history.

4. Build good relationships with business partners to avoid payment delays

If you are offering your clients credit and the option to pay later, however, you still have to reduce the possibilities of delays in payments. To do so, it is always advised and is favorable to build a strong relationship with your business partners or clients. This makes the payment process easier; it also becomes simple to track if the invoice has reached the correct place and the right person.

The relationship also gives you the leverage to ask why the payment won’t be made on time? Or why is there any extra delay?

Suggested read: What is cash flow forecasting and how to forecast?

2. Take care of your business accounting

Operating a small business entails numerous inevitable yet time-consuming tasks like accounting, bookkeeping, tax filing, etc. Yes, these jobs are frustrating and require a lot of effort, but in the end, these things are important to generate valuable information and keep your business safe.

With these tasks set in a proper management system, you can run your business more effectively, which implies more profit.

Nowadays, the majority of businesses use cloud-based accounting software to reduce their daily accounting tasks burden, while some others still employ accountants who ensure filing commitments on their behalf.

Although, there are some steps crucial for managing small business finances.

Open a separate business bank account

It is a legal requirement for every limited company to have a separate business bank account. However, small businesses or sole proprietors are not legally bound to do so, but it is beneficial to have a separate business bank account.

This will majorly save your time and energy by keeping your personal finances separate from the business ones. There are advantages given to people having business bank accounts like introductory fees, admin fees, transaction fees, and customer support services.

A common mistake that startups make is mixing personal and business finances, which can lead to confusion during tax season and make it harder to track business performance. Keeping a separate account helps you maintain clear financial records and simplifies accounting and tax filing.

Automate your accounting and bookkeeping process

Investing in small business finance management software is a smart move. Cloud-based accounting software is the perfect way to save costs by not hiring accounting professionals because for any small business, saving costs wherever possible is essential.

Accounting software is used in connection with a small business accounting professional to ensure tax obligations and filing. Some cloud-based accounting softwares are - Xero and QuickBooks, which offer a 30-days free trial period so that you can choose which fits your business the best. These software automate your whole accounting and bookkeeping task and give you various benefits such as high productivity, data accuracy, secure file storage, real-time integrations, etc.

3. Business financial plan and forecast

What is financial forecasting?

Financial forecasting is simply a prediction of how your business will do in the future.Creating financial plans for your small business is a critical and important step.

For investors to be attracted enough to put money into your business, you will have to project some hard numbers, but we also know that forecasting your performance for the next few years. This becomes even more difficult when you are still new however short-term and long-term financial forecasting are requisite for alluring investor attention.

Elements of financial forecasting

Your business plan has different sections, from which financial forecasting is one. This part of the plan should have the following elements:

• Sales forecast

Being a small business, sales forecasting can be a hard task as you have no past data to analyze. However, if you have a strong understanding of the market and intrinsic knowledge of the industry trends.

You can very well create a solid sales forecast which will not only be beneficial for inventory decisions but also will leave an impression on the investors that you have put in thorough research into your product and business.

This is a great impression and will surely bring more investment into your business. For the initial stages, you can create a monthly sales report with basic information like units sold, price per unit, and expectations for the next month. Nonetheless, as years pass, you can shift the sales forecasting to a quarterly basis.

• Break even projection

After doing some basic analysis of your business data, you should be able to determine your business’s break-even point. This means you must know the date or the period in which your business would become profitable i.e., when your business earns more than it spends.

However, as a small business in the initial stages, this is not expected to happen immediately still having a break-even projection would show your investors or potential investors that you have a prudential plan and a set date in your mind backed with logistics and numbers.

• Expenses budget

Once you are in the market and have started selling, you should create a budget that projects all your expenses.This means recording all the costs your business is incurring for the units being sold, along with the overhead costs.

It is suggested to create an expense budget which is divided into fixed costs and variable costs, reasons being that some expenses are fixed for every month like rent whereas some costs change from month to month such as advertising.

1. As mentioned above, cash flow statement, profit and loss statement, and balance sheet are crucial parts of financial forecasting.

2. Create a five-year projection. You don’t have to include this in the official business plan, but this is a suggested practice in case any investor asks.

3. Prepare only two scenarios, “best-case scenario” and “worst-case scenario.” there should be no in-between when presenting before investors.

4. While creating the whole business plan and especially financial forecasting, be realistic and prudential.

Do not set unachievable goals, analyse your business’s data and the market trends carefully, and then create pragmatic targets.

Benefits of business financial forecasting

• Evaluate the output of the hard work and investment.

• Determine long-term value.

• Set target for future growth.

• Check your cash flow and accordingly lead the company.

• Be prepared for any downfall or unforeseen problem.

• Predict the outcomes of certain new steps and solutions implemented.

• Discover problematic areas and the causes.

• Reduce financial risk.

4. Manage debt of your business efficiently

The market scenario is forever volatile, and for small business owners surviving becomes even more complicated with different challenges kicking in at unexpected times, like unsold inventory slow receivables, which can have bad effects on your business’s cash flow. You can manage your debt more accurately by recognizing cost-cutting and revenue-generating areas.

Here are some measures to manage your small business debt efficiently:

Cost-cutting measures

When a simple loan starts turning into a big problem, cost-cutting measures are the safest way to deal with it, as your ability to continue selling is not affected much.

Cost-cutting measures can include reducing office supply expenses, canceling cleaning services, conducting meetings in coffee shops instead of hired meeting rooms, etc. Once your debt is under control, you will easily be able to go back to your normal ways of doing business.

Increase revenue

Another easy way to manage your debt is by adopting revenue-increasing measures you may not have explored yet. These could be offering incentives or discounts on early payments, subletting the used space in your business premises, or shifting to a place with lower rent.

In contrast, you could also look for ways to market your business though this would increase your expenses to some extent but will further lead to an increase in profitable sales.

Refinancing

There are some common things you must consider while analyzing your debt. Check the market rate of interest and if you are paying more interest than that market rate, consider refinancing by taking a loan with more feasible interest rates.

Another thing you could do is pay off debts with the highest interest rates first. Any loan which has your personal assets as collateral should be the foremost one to be paid off.

Negotiate more flexible or extended payment terms with suppliers

There is no shame in negotiating with your vendors or suppliers. You can ask them for discounts or incentives on placing bulk orders, or you can try lower rate suppliers, you can also use your timely payment or early payment history to show credibility for extending payment terms.

Improve business credit score

To be able to get any kind of business credit, your business’s credit score and history must be perfect. Business credit includes small business loans, credit cards, equipment, or property lease. It becomes easier to procure credit at lower rates if you have a good credit history.

Here are some small business tips to increase your credit score:

1. Get your business’s credit report checked by any credit reporting agency like Equifax and Experian so that you know your options for raising the credit score and also eliminate or fix the elements which are causing a bad effect on your accounting.

2. Establish more credit accounts with your suppliers to show more positive credit events.

3. Keep the ratio between the amount of credit utilized and the amount of credit available less than 15%.

4. Ensure that all the details on your credit files are accurate and up to date.

Raise funds - Investment and selling non-essential company assets

Looking from an investor’s perspective, non-indebted businesses are a better investment option in comparison to businesses already in debt. This makes the process of alluring investment very difficult.

However, there are some other ways to raise funds, such as borrowing from family or friends, because here, the fund availability would be at a more reasonable rate. Another option is to sell non-essential company assets and repay some debt.

5. Understand your business funding options

To grow and have at least a consistent progression rate, you will have to explore the business funding option available for your company. This is because there are times when there are some temporary cash flow problems or solutions that need to be implemented immediately for long-term benefits etc.

According to the type of your small business, the specific issues in the company, or the areas you want to market, you will have to choose the ones best from the numerous business funding options available. This may seem like an easy process, but it isn’t.

Securing funds and how you go about it can have major impacts on your business’s success and profitability.

Here are some basics to begin your research with:

What is the difference between equity financing and debt financing?

Equity financing means selling some part of your company’s equity for capital. The major advantage of equity financing is that you don’t have to worry about repaying the money. For a company’s owner, this is a convenient option as the common goal for both the equity investors and the owner is to earn a good return without any interest charges.

However, the biggest downside to equity financing is that you will have to share a part of your company with investors.

Debt financing as the name suggests means when you borrow some amount of money at a particular rate of interest and are obligated to pay the principal amount back. This comes with some added restrictions on the company’s activities which in turn stops the company from utilizing all the opportunities available.

For more debt financing for the future, it is a benefit for the company that creditors favor a low debt-to-equity ratio.

Pros and cons of debt funding

Pros:

Reserve control - When you take money from a lender or a lending institution, you are not answerable to them. You are in control of all the decisions made for the company with the money borrowed.

Tax advantage - Your net obligations can effectively be reduced by paying the rate of interest as it is tax deductible.

Simpler budget and finance planning - As you know the exact amount you have to pay, both as interest and principal amount, planning your budget and finance becomes simpler.

Cons:

Qualification requirements - To secure debt financing, you need to have an excellent credit score and history.

Collateral requirements - You have put some of your business assets at risk in the form of collateral, in order to get a loan.

Discipline - Repaying the principal amount or paying interests every month needs discipline. You will have to exercise some restraint measures and logical financial planning.

Pros and cons of equity funding

Pros:

Reduced burden - If you choose equity financing you are not obligated to repay any money. Your business will not have to pay monthly installments which is a great advantage if the business isn’t able to earn profit.

No credit issues - If your business doesn’t have a good credit score or good credit history, or lack of any financial track record, equity financing is a suitable option.

Learn and gain from partners - Equity financing gives you the opportunity to form relations with more experienced and knowledgeable people. This allows your business to form networks and work on the experience of others.

Cons:

Share profit - As you will be sharing a part of your business’s equity with the investors, you are obligated to even share the profits.

Loss of control - You get all the equity financing advantages at the price of losing some control over your business, as the investors will also have a say in the business decisions.

Conflict possibilities - Everyone has a different vision, different style of management, and different ways of running a business. These can be potential causes of conflicts between you and the other investors because both have ownership of the business.

Different types of small business financing options to consider

1. Traditional bank loans

While thinking of securing funds, the first option that comes to our mind is bank loans. It is the most popular form of debt financing for small businesses. This is a preferable option if you have good terms with the bank and perfect credit history.

Before taking a loan, research the different types of bank loans available for managing small business finances and choose the most appropriate one.

2. Invoice financing

To get cash immediately, you can sell your unpaid invoices at discounted rates.

This means that instead of waiting for a customer to pay, you can free the cash related to the invoice immediately.

This is a good option for businesses with not such a good credit history.

3. Business credit line

It is a risky option to use credit cards to fund your small business. There is always the tension of repayment and maintaining a good credit score.

However, if you use a credit card responsibly and only in times of dire need, it can be a good source of injection in your cash flow for the short term.

4. Small business and startup grants

The best thing about small business grants is that there is no commitment to repayment. Small business grants are like rewards for innovative companies, rewards mean offering direct cash or some type of discounts on essential resources.

The grant usually has terms of utility and some criteria your business has to meet.

Manage your company finances for smoother business operations

Managing your small business finances should be your topmost priority.

If you want your business to survive in the long run, make financial planning a part of your success strategy.

Once you have a firm understanding of the market and your business position in the marketplace, decision-making won’t be so difficult, and you will be able to take the right steps for the progress of your small business.