11 common mistakes startups make and how to avoid them?

Of the numerous new startups that crop up almost every single day, only 10% are able to survive and bear fruit. There are many reasons why the rest fail.

What’s common among all is they didn’t pay heed to common startup mistakes committed by fellow aspiring entrepreneurs.

These mistakes certainly have a significant impact and decide if your startup will see the next dawn or not. How can an entrepreneur get past obstacles and make the cut?

What does it take to avoid the road most taken in the entrepreneurial journey that leads to startup failures?

Common mistakes to avoid making in a startup

The hunger to do something new and bring an impact is what pushes someone to have their own startup. They might have a kickass product or the best pilot team on board.

What they neglect on the way are a few business startup mistakes that slowly lead to doom.

1. Lack of planning

Procrastination is bad, but starting something without planning is worse. Every startup must have short-term and long-term plans containing objectives they want to achieve.

There must be quantifiable goals for each quarter or year of the business with which growth can be measured. If a business randomly takes the next steps without any aim, it will be hard to develop its own culture and establish steady growth.

Also, many crucial components of a business, like budgeting, cash flow forecasting, employee retention, inventory management, and vendor evaluation, don’t get attention.

A planned approach gives you a roadmap and sets your business in the desired direction where growth is measurable.

2. Product/service doesn’t solve pain points

In business terms, a pain point is something that deters an activity or stops customers from doing something. It’s universal and exists everywhere. A product or a service is intended to serve a group of people aimed at simplifying or fixing problems.

Most of the time, customers don’t even realize the pain points and have to be reminded of the fix. But when your product or service doesn’t speak them clearly, it will be unnoticed and eventually go out of business.

That’s one of the startup mistakes to avoid, as it can cut your revenue at the source. You must conduct a pain point analysis of your customers and find ways and use cases to communicate it effectively.

Your marketing efforts should underline this unique value proposition to capture the ideal customers’ attention.

Products that connect with customers have good success rates and stay longer despite competitor efforts. Because no matter what space you sell at, you ultimately sell to people.

3. Not being customer-centric

Customers generate revenue for your business. They must feel valued and appreciated. In the long term, satisfied customers can bring more value and wealth and spread the word to bring more customers for you.

However, startups constantly are on the battlefield addressing important product-related issues. And they have a very small team who are fully occupied. That’s why customer support takes a backseat.

Many startups have support lines for the sake of it and don’t provide dedicated support. If you are in a competitive space, your customer will be exiting at this point, choosing your competitor.

When you prioritize customer experience, they stay loyal to you and offer valuable suggestions to improve your product. That brings in a customer-centric approach to product development that leads to custom-built solutions.

Products that don’t create positive customer experiences produce a lesser impact on society.

4. Ignoring key metrics, KPIs

One can keep putting efforts into creating great, impactful products and offering the ultimate customer experience. But if they don’t have KPI to measure every team’s performance, they wouldn’t know how far they have progressed.

That’s one common startup mistake many new business owners commit. They are so focused on operations but lack when it comes to comprehending their effectiveness.

When potential growth indicators are ignored, goals to achieve further cannot be formed, nor strategies to achieve more milestones. Employees who are there with you in the race will feel unappreciated as metrics prove their hard work.

Such metrics also play a role in convincing investors to invest in the growth plans of your business. Startups that don’t have measurable and achievable metrics will have no access to actionable insights that can lead to higher performance.

Metrics like customer acquisition costs, lifetime value, churn rate, and average revenue per customer must be tapped into to unlock abundant growth potential hidden in them.

5. Bad execution skills in the team

Vision without execution is just a hallucination. Anyone can come up with groundbreaking ideas. Making strategies and setting goals is also easy. But to implement it practically takes a skillful team.

Many startups with cool, transformational ideas and who did great at funding rounds have faced collapse due to poor execution of plans. One good example is the failure of the new-age car buying-selling platform ‘Beepi.’

They had a great business plan and changed the way people buy and sell cars. But failed greatly when it came to execution, wasted all their capital within the short term, and finally ceased to exist.

6. Loans and debt consolidation

Financial assistance is necessary to scale up your business and turn your plans into reality. But too many loans and debt repayments when you don’t make profits to cover that will get you into trouble.

When startup owners don’t analyze their fund requirements and get more loans than they require, they end up spending it in unnecessary categories. Late payments to small businesses can further compound the problem, as late repayments lower your credit score, which further reduces the possibility of securing additional credit.

To repay one loan, the startup owner is forced to take up another loan, and that toxic cycle goes on. This only leads to a point where there is no incoming money but only debts, leading to a complete loss.

What they can actually do is accept debt consolidation that lets them club together all of their pending debts. This is a great option to pay off your loan in lower installments and save the money for other responsibilities.

7. Scaling up too soon

Every startup aim to grow and become a unicorn. But if they are too impatient and scale quicker before it’s time, they can face too many challenges and might not make out of it.

Startup Genome’s survey statistics point out that more than 70% of startups have failed because they did premature scaling. In haste to grow and serve millions of customers, founders, especially first-time entrepreneurs, take bold steps and make expensive mistakes.

They try to sell advanced versions of their products and services before even they begin selling the foundation. For this reason, they hire experienced teams, invest in cutting-edge solutions, and finally break the bank.

The first growth spurt doesn’t mean guaranteed progress thereafter. What the startup needs here is strategic and well-planned strategies and sustainable techniques. You must also understand your customer nature.

Numbers can lie and sometimes be very seductive. Without blindly trusting them, startup owners should dig deep and check if they are good enough to handle additional costs.

8. Solely focused on paid marketing instead of organic growth

Both organic and paid marketing have equal importance in getting your marketing message across. But the latter comes with additional advertising costs that can be spontaneous and sometimes expensive.

While organic marketing is slow, it’s less expensive and gradually brings more traffic, and aims at providing real value to prospective customers. Paid marketing is instantly effective and does bring in a lot of customers too.

Yet, you will be spending a lot and targeting a whole wide group of users where half of them don’t fit to be your ideal customer. To make paid marketing work for you, you need to know your customers and where they spend their time.

Your marketing team must have done full-fledged market research before investing big money in this.

9. Unnecessary spending

Both bootstrapped and funded startups have problems with controlling their spending. 29% of startups fail because of a lack of money. It’s valid that you must spend some to make some. But not all till you run out of resources.

It can be hard to tell which is an unnecessary expense and which is needed for long-term growth and profit. That’s why good financial decision-making must be there.

Here are the things that startups spend their money on that could be avoided or postponed to later stages.

• Large office spaces

• Fancy employee perks

• Unplanned taxes

• Hiring too many employees

• Expensive software

• Frequent office parties

It can be challenging even for experienced CEOs to draw the line and make a fit budget. But it’s necessary to strategize your available resources and multiply whatever capital you have.

Tip: if you are already making many business expenses, you can use expense management softwares to plan and send them out. You can enforce your budgets here and monitor and control them effectively.

10. Underestimating the competition

You can come up with out-of-box and unique ideas. But chances are you will have at least one competitor in that space or have one coming in the future. It’s never a one-man’s race. Even the best-rated product will have its flaws.

List your competitors products, identify their weaknesses and strengths, and turn that to your advantage. So, if you ever receive comments to ignore the competition and keep delivering what you can, ignore the comments not the competition.

If you don’t keep an eye out on them, they will outperform you and become dominant, pushing you out of the marketspace. Also your product must be a little different and better than your competitors to stand out in the market.

Offering a product of same value as that of your competitor at the same price won’t make a customer choose you over them. It only keeps you in a replaceable position.

11. Lack of Infrastructure

We are lucky to live in an era where the whole world can be accessed with just basic gadgets. Offices no longer need large machines, servers, and physical programs. Cloud apps do tasks with greater efficiency and at cheaper prices.

All you need is internet connectivity and desktops/laptops to access them. So when the right moment comes where you feel the need for automation, go for it.

This is particularly for jobs that are no longer performed in same scale and demands additional attention from employees. Rather than hiring more people, hire technology that can be operated by your small team and make them work faster.

Invest in the right infrastructure to empower your employees and help them do their job better. Startups that lack right infrastructure lose their best people or turn them into job haters who just do their job and not add any ‘value’.

How can good expense management software help with finances?

There are more than 50 to 70 common startups to avoid. No matter how careful you are, you will fall once, twice, or multiple times, while running a startup.

As long as you get up and manage to be in the race, you will move closer to good times and start making real profits. This is the right time to increase your profit margin and ensure strict management of your finances as a small business. How to do that?

By getting an expense management solution for your business. This is how you can monitor your spending bit by bit and control unnecessary expenses.

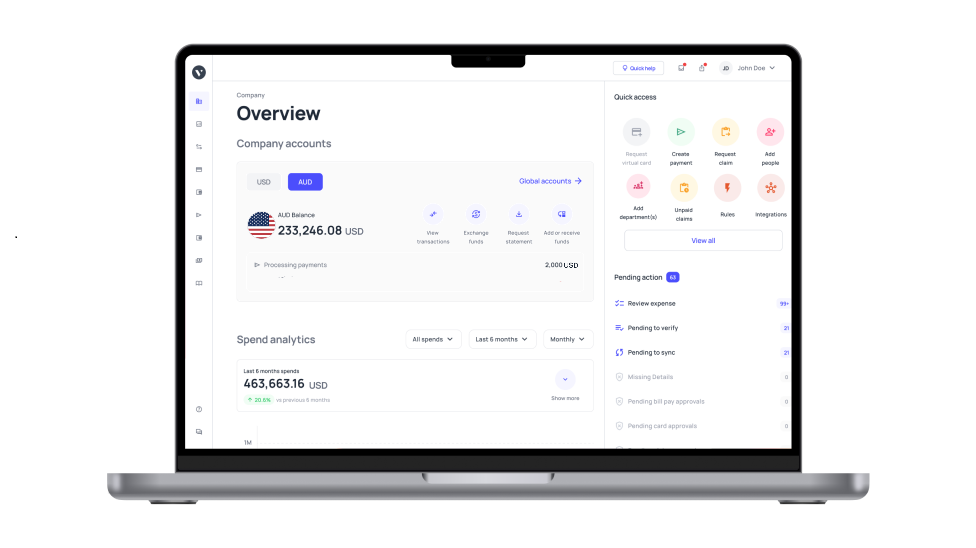

Here is what Volopay can to sort your startup expenses

• Expedite vendor payments and automate approval workflows

• Provide unlimited cards to simplify your online payments and help employees make travel bookings

• View your expenses as they happen in real-time within the dashboard

• Plan your budgets and execute them by setting expense limits. Compare your spending with budgets and cut down excessive expenses

• Step in when you have additional funding requirements and offer no-collateral credit

• Fully automate reimbursements and and make expense reporting easier.

• Integrate your expenses with other ERP and accounting systems to reduce manual workload of your employees.

• Bring extreme accuracy to your accounting data and set tax reporting straighter

Startups also fail when they don’t pay attention to their outgoing money and spend it all. Avoid unwanted expenses and business startup mistakes altogether by switching to Volopay.